10 Stocks With Massive Upside!

Don't Miss Out!

Wall Street Analysts

Analysts in Wall Street will come up with forecasts for stocks estimating where they believe they will be in the next 12 months.

How they exactly come up with these numbers is anyone’s guess and the fact that they tend to change these figures constantly, especially if the share price moves rapidly in one direction shows that it isn’t something to focus on when you research your own stocks.

However, having said that, it can be a good place to start when considering adding stocks to your watchlist.

In today’s newsletter we will take a look at 10 Dividend Stocks that not only have some strong upside from Wall Street Analysts but also have a decent margin of safety from when we last reviewed these stocks on our YouTube channel.

10 Dividend Stocks

Apple (AAPL)

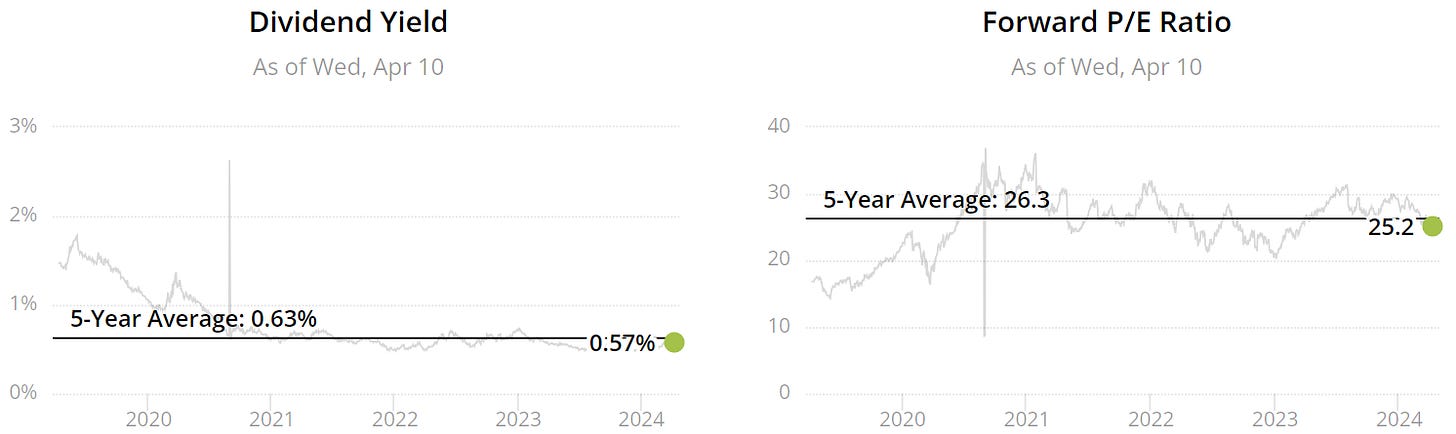

If you read last week’s article (or regularly watch our YouTube episodes) then you will understand what we mean by Dividend Yield Theory.

From the above we can see that Apple is currently trading on a forward PE basis slightly below the 5-year average with the yield slightly lower than the 5-year average too. Based purely on this model we see a sign of reasonable valuation.

When looking at Wall Street forecasts below we can see over 20% upside for this Tech Giant!

Price = $167.78

Target Price = $202.95

Upside = 20.96%

In our latest deep dive below we estimated that the margin of safety sits around 15-20%.

Broadcom (AVGO)

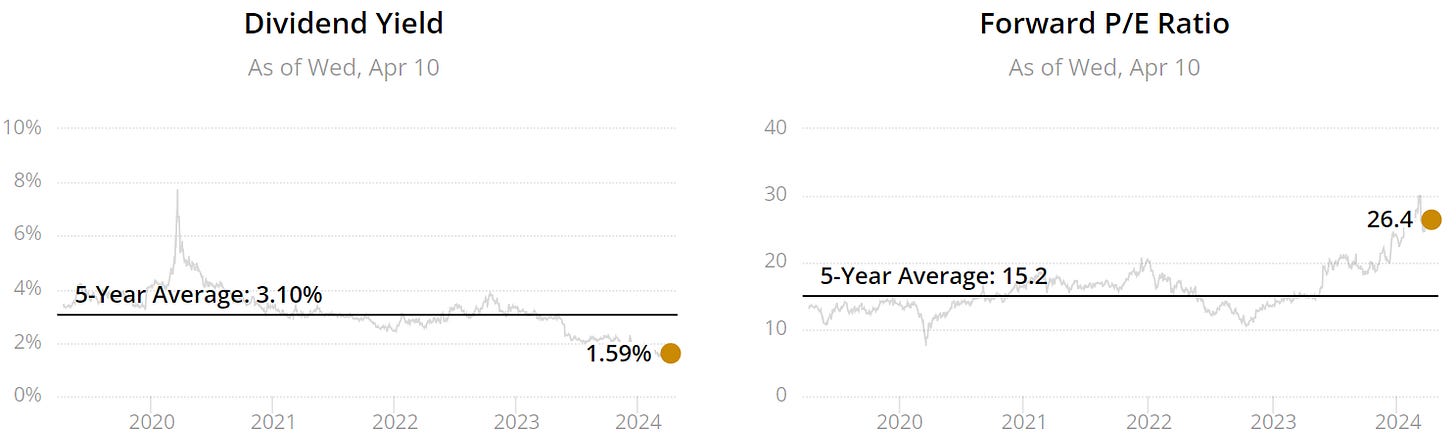

From the above we can see that Broadcom is currently trading on a forward PE basis higher than the 5-year average with the yield lower than the 5-year average. Based purely on this model we see a sign of overvaluation.

However, when looking at Wall Street forecasts below we can see approximately 19% upside for this strong semiconductor company.

Price = $1,322.37

Target Price = $1,573.10

Upside = 18.96%

Our last review of Broadcom below showed between 15-20% for the margin of safety.

UnitedHealth Group (UNH)

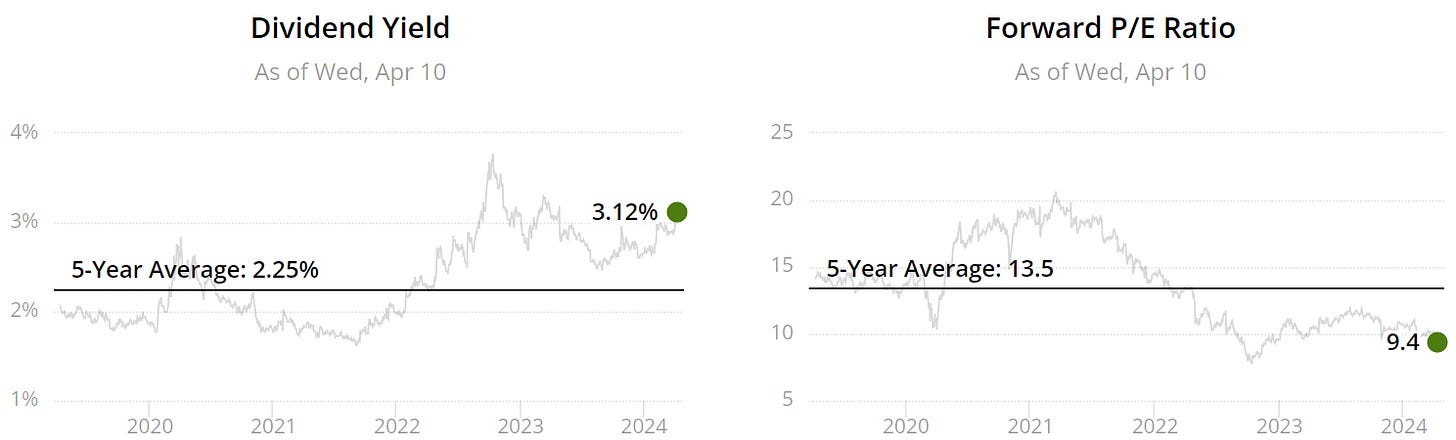

From the above we can see a strong double undervaluation signal for UNH with the forward PE lower than the 5-year average and the current yield higher than the 5-year average.

Wall Street also see a strong 29% upside for UnitedHealth Group over the next 12 months.

Price = $450.05

Target Price = $578.69

Upside = 28.58%

In our recent deep dive below we saw a massive margin of safety of between 20-25%.

Johnson & Johnson (JNJ)

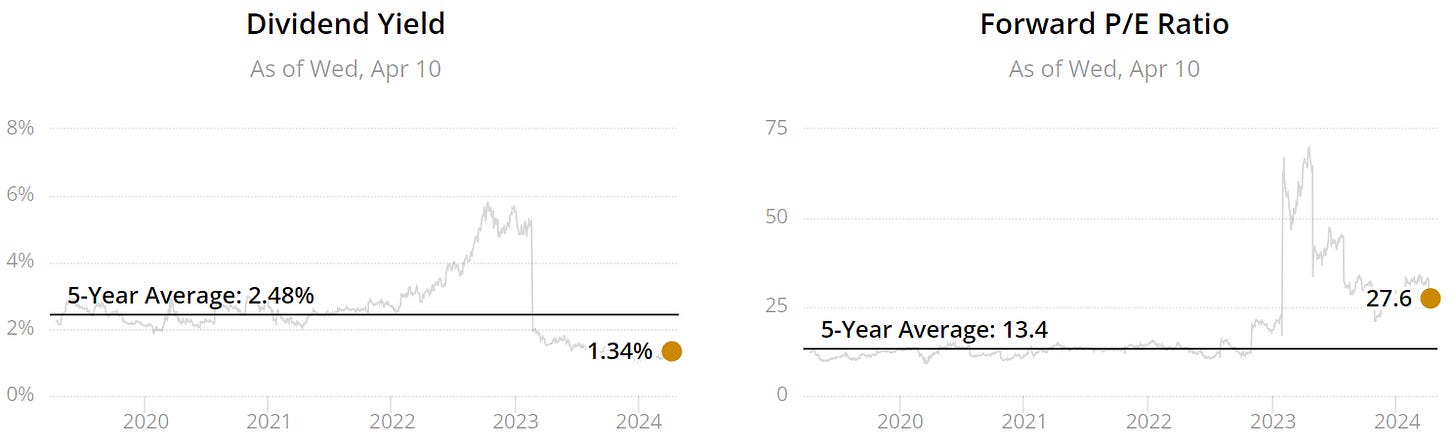

From the above we can see a strong double undervaluation signal for Johnson & Johnson with the forward PE lower than the 5-year average and the current yield higher than the 5-year average.

Wall Street also see an attractive 19% upside for JNJ over the next 12 months.

Price = $150.20

Target Price = $178.82

Upside = 19.05%

Our review of JNJ this week indicated it had a margin of safety sitting at 15-20%.

FYI - If you are interested in valuing stocks yourself we have created a valuation model below which you can pick up:

McDonald’s (MCD)

From the above we can see a strong double undervaluation signal for MCD with the forward PE lower than the 5-year average and the current yield higher than the 5-year average.

Wall Street also see a nice 20% upside for McDonald’s over the next 12 months.

Price = $268.67

Target Price = $323.30

Upside = 20.33%

In our review yesterday we saw a nice 15-20% margin of safety based on our estimates and judgements.

Comcast (CMCSA)

From the above we can see a massive double undervaluation signal for Comcast with the forward PE lower than the 5-year average and the current yield higher than the 5-year average.

Wall Street also see a massive 28% upside for CMCSA over the next 12 months.

Price = $39.72

Target Price = $50.80

Upside = 27.90%

Intel (INTC)

Dividend yield theory gives us a sign of overvaluation however we need to incorporate the fact that Intel did have a dividend cut last year so the data will be slightly skewed. The forward PE is also trading substantially higher than the 5-year average.

Wall Street do see strong upside at 21% over the next 12 months.

Price = $37.20

Target Price = $44.88

Upside = 20.65%

Interestingly in our Intel episode above we believed it was trading at near fair value around $41, given the share price has dropped to $37 in today’s market the margin of safety sits around 10-15%.

Pfizer (PFE)

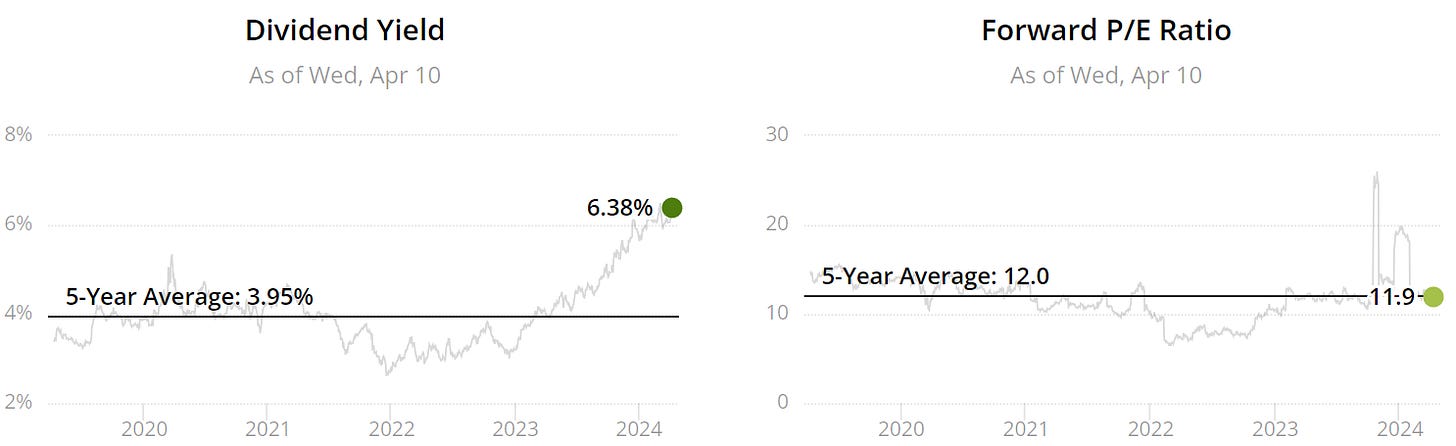

From the above we can see a massive sign of undervaluation based on dividend yield theory, although we note that the forward PE sits in line with the 5-year average.

Wall Street also see an attractive 20% upside for Pfizer over the next 12 months whilst also raking in that nice yield over 6%.

Price = $26.32

Target Price = $31.57

Upside = 19.95%

In our episode above from last week we saw a 15% margin of safety level.

S&P Global (SPGI)

SPGI looks reasonably valued based on both dividend yield theory and analysing the forward PE.

Wall Street also see a nice 17% upside for this high quality company.

Price = $424.04

Target Price = $497.60

Upside = 17.35%

Our latest review indicated SPGI had around a 10% margin of safety.

Nike (NKE)

From the above we can see a massive double undervaluation signal for Nike with the forward PE lower than the 5-year average and the current yield higher than the 5-year average.

Wall Street also see a massive 25% upside for NKE over the next 12 months.

Price = $89.00

Target Price = $111.32

Upside = 25.08%

We reviewed Nike as part of 6 other stocks near their 52 week lows and it came out with a 15% margin of safety level.

Conclusion

So there you have it, 10 undervalued dividend stocks with strong upside over the next 12 months for you to consider.

Let me know your thoughts and if you have been adding any of these to your portfolios!

Support

If you’d like to support this work feel free to buy me a coffee. The proceeds will contribute to the running costs of the newsletter.

Join the community of investors - subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today’s newsletter helpful please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Note: I am not a financial advisor or licensed professional. Nothing I say or produce anywhere, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk.