18 Undervalued Dividend Kings!

50+ Years Of Increasing Dividends!

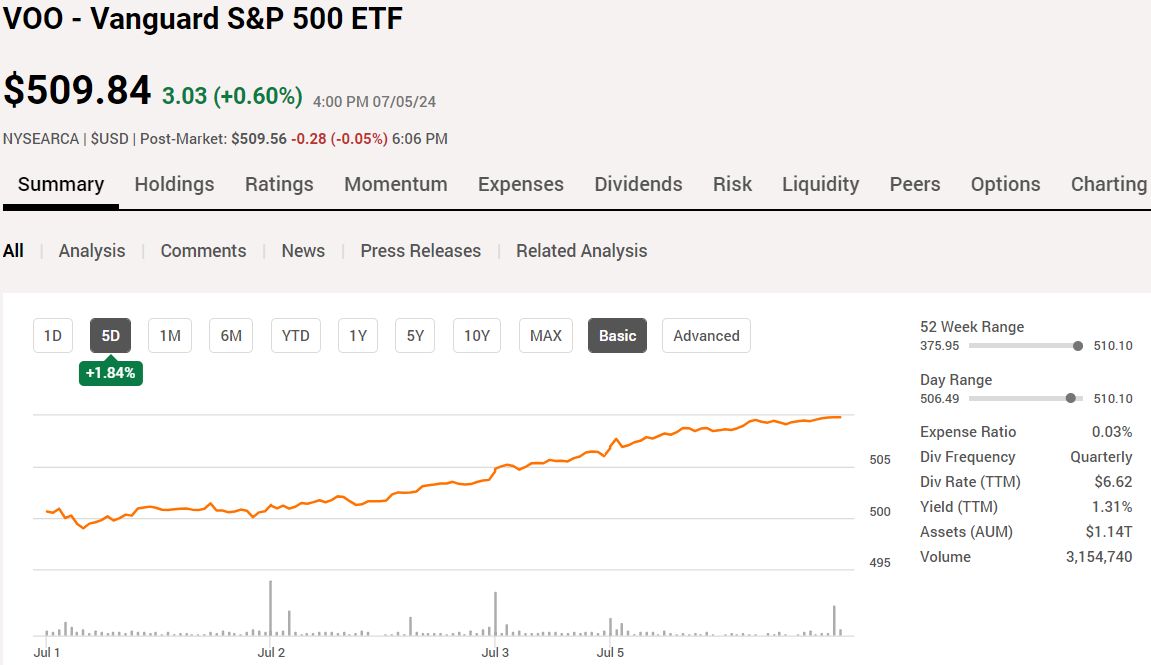

Market Latest

The first week of Q3 has finished although we only saw 3.5 days of trading in the US market due to Independence day, nonetheless that didn’t stop the S&P moving higher and ended the week up 1.84%.

As we can see from the S&P 500 heat map for the last week the pattern to spot is that technology and semiconductors are pulling the market higher whilst healthcare, industrials, utilities and energies continue to fall for the most part.

As we mentioned in last weeks article July has historically been the best month of the year on average stretching all the way back to 1928, and that trend doesn’t look like changing (but as we know, things can change very quickly in the stock market).

A notable mention about earnings season as it is fast approaching. As always we will cover this on our YouTube channel, and for those that aren’t subscribed, we would love to have you in our growing 45k community:

PepsiCo and JP Morgan are some of the big names reporting next week:

What Is A Dividend King?

The special status of being called a Dividend King is only given to those companies that have raised their dividend for 50 or more consecutive years.

What makes this an incredible accomplishment is that they have survived everything ranging from economic recessions to major technological advancements.

One of the reasons we like to focus on dividends is down to the fact that when you look at the S&P 500 below, dividend income makes up a massive portion of the total return.

In fact from 1930-2020 the total return of the S&P 500 was made up 40% by dividend income.

Again below we can see this importance:

As always it is very important to understand that past performance does not indicate how the future will go but it is clear that those who pay dividends and increase them year on year do outperform the others:

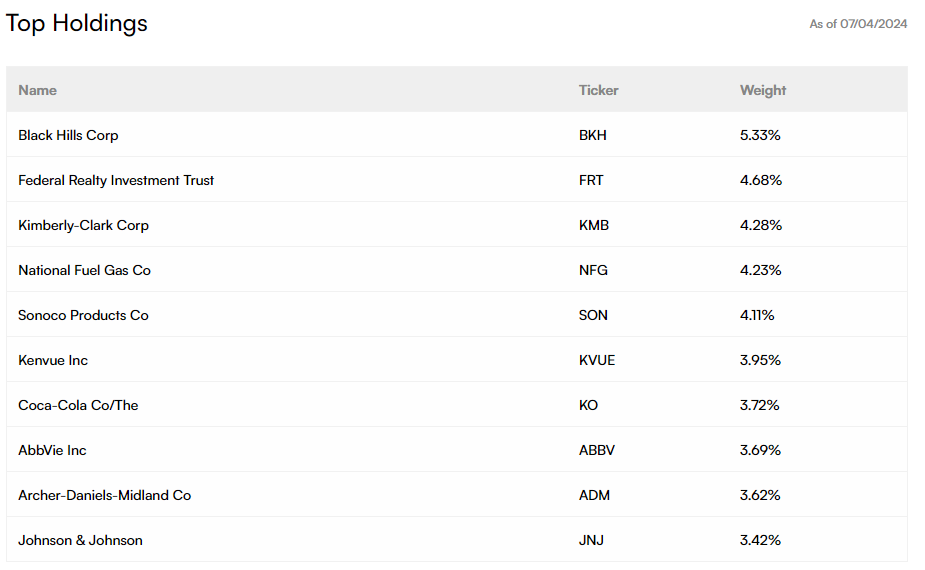

KNGS Dividend King ETF

Now before we look at individual kings, it is important to understand that some investors would rather have exposure through an ETF.

Recently this has been made possible with a new ETF, ticker symbol KNGS.

This was created in November 2023 which holds an elite group of 38 companies with 50+ years of increasing the dividend.

The top holdings consist of the below:

Please note this has an expense ratio of 0.35% and the performance since inception is +9.83%.

Undervalued Dividend Kings

FULL 49 DIVIDEND KINGS BREAKDOWN ON THE EXCEL DOCUMENT BELOW:

Attached above we have a breakdown of 49 Dividend Kings which has a lot of useful information and can be used as a good starting point for analysis.

Now let us dive into those that we believe to be Undervalued Dividend Kings.

To select those that we believe to be undervalued and worth a deep dive we have used the following criteria:

P/E below or equal to 25

Dividend Safety to be a minimum safe level (60+)

Upside 15%+

And if they don’t meet any one of these we have highlighted them in red and we ignore them.

Out of the 49, this leaves us with 18 to consider further. You can see those in the above spreadsheet in detail, however not to make this newsletter too long, we will select the top 5 that show the most upside.

Tennant Company (TNC)

For those that haven’t heard of this company they design, manufacture, and market floor cleaning equipment globally.

Sector: Industrials

Years of Increase: 52

Yield : 1.15%

Free Cash Flow Positive: 9 out of the last 10 years

Payment Schedule: Mar, Jun, Sep, Dec

As per above, dividend yield theory would note this as reasonably valued/overvalued (see previous articles for in depth discussion on DYT).

However the forward P/E is lower than the 5 year average and lower than the sector P/E of 18.5

Wall Street Upside = 49%

Genuine Parts Company (GPC)

GPC distributes automotive replacement parts, and industrial parts and materials. It operates in two segments: Automotive Parts Group and Industrial Parts Group segments.

Sector: Consumer Discretionary

Years of Increase: 67

Yield : 3.02%

Free Cash Flow Positive: 10 out of the last 10 years

Payment Schedule: Jan, Apr, Jul, Oct

As per above, dividend yield theory would note this as a double undervaluation signal.

Wall Street Upside = 27%

National Fuel Gas (NFG)

NFG is a vertically integrated natural gas company with operations in upstream exploration and production, midstream pipelines and storage, and downstream regulated utilities in Pennsylvania and New York.

Sector: Utilities

Years of Increase: 53

Yield : 3.8%

Payment Schedule: Jan, Apr, Jul, Oct

As per above, dividend yield theory would note this as a double undervaluation signal.

Wall Street Upside = 26%

Stepan Company (SCL)

SCL produces and sells specialty and intermediate chemicals to other manufacturers for use in various end products worldwide.

Sector: Materials

Years of Increase: 57

Yield : 1.82%

Free Cash Flow Positive: 6 out of the last 10 years

Payment Schedule: Mar, Jun, Sep, Dec

Undervaluation per DYT, although we note the forward P/E is higher than the 5Y average and sector P/E.

Wall Street Upside = 26%

PPG Industries (PPG)

PPG manufactures and distributes paints, coatings, and specialty materials globally.

Sector: Materials

Years of Increase: 52

Yield : 2.08%

Free Cash Flow Positive: 10 out of the last 10 years

Payment Schedule: Mar, Jun, Sep, Dec

Double undervaluation signal as well as being significantly lower than the sector P/E.

Wall Street Upside = 26%

Latest YouTube Videos!

Some of the videos we have covered below on the YouTube channel:

5 Undervalued Dividend Kings To Buy For The Long Term:

Time To Buy These 8 Beaten Down Dividend Kings:

10 Undervalued Dividend Stocks At 52 Week Lows:

8 Stocks Politicians Are Buying Now:

Stock Valuation Model

If you are interested in valuing stocks yourself, we have created a valuation model below which you can pick up, this is the same version we use in our YouTube analysis:

Seeking Alpha

Seeking Alpha, one of the websites that I use when I review stocks on YouTube has a 20% off discount for your first year. This also includes a 7-day free trial for new users too!

Conclusion

We have just gone through 5 Undervalued Dividend Kings.

However as always do your own due diligence and let us know your thoughts about today’s newsletter in the comments.

I hope you all have a great week ahead!

Thanks For Reading!

If you’d like to support this work feel free to buy me a coffee. The proceeds will contribute to the running costs of the newsletter.

Join the community of investors - subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today’s newsletter helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Note

I am not a financial advisor or licensed professional. Nothing I say or produce anywhere, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk.