2 Beaten Down Quality Stocks To Buy

+ Market Update

Market Latest

The S&P 500 had a mixed performance last week with investors closely monitoring inflation data and central bank policy.

As we can see above, the S&P 500 showed slight declines over the week, falling by about 0.5% overall.

However, it remains up significantly for the year, with a year-to-date gain of 28%.

Key Drivers:

Inflation report showing slower consumer price growth, which initially boosted market sentiment.

Later in the week, concerns over the Federal Reserve’s potential hawkish tone curbed some enthusiasm.

Technology stocks, which have been major drivers of 2024’s rally, saw a pause, contributing to the modest weekly decline.

Overall, the S&P 500 remains on track for one of its strongest years since 2021, despite some short-term volatility.

Biggest losers last week included:

Adobe (ADBE) down 16%

Oracle (ORCL) down 10%

Uber (UBER) down 9%

Advanced Micro Devices (AMD) down 9%

Comcast (CMCSA) down 8%

Bristol-Myers Squibb (BMY) down 6%

Nvidia (NVDA) down 6%

and many, many others.

Notable News

Broadcom (AVGO) Earnings

As the headline gives away, the market loved their earnings report which saw the stock rocket up 26% on the week, passing a $1T market cap for the first time.

Whilst it was a beat on EPS and a miss on Revenue, the CEO said that they are developing their own custom AI chips with three large cloud customers.

They are also seeing soaring demand from the boom in generative AI infrastructure. For the year, the company said AI revenue jumped 220% to $12.2bn.

Bull Market Continues?

The November CPI report, a key indicator before the Fed meeting, showed core inflation rising by 0.3%, maintaining an annual rate of 3.3% for the third consecutive month, signaling progress in reducing inflation from its 2022 peak (6.6%) but still above the Fed's 2% target, easing concerns of a major reversal.

Headline CPI rose to 2.7% year-over-year, driven by food, gasoline, and increased prices for cars, furniture, hotels, and airfare, with inflation expected to rise slightly in the short term due to base effects, though leading indicators suggest no resurgence in broader inflation trends

Interest Rate Cuts

Last week’s data is unlikely to stop the Fed from lowering its policy rate this week, as inflation reports aligned with expectations, unemployment trends support a cooling labor market, and bond markets are pricing a 95% likelihood of a December quarter-point rate cut, following the Fed's prior guidance for two cuts this year.

Earnings This Week

Even though it is coming towards the end of 2024 and into the holiday period, we still see some notable Companies reporting this week, including General Mills, Micron, Nike and others.

As always, we will cover this on our YouTube channel, and for those that aren’t subscribed, we would love to have you in our community which is heading over 66,000:

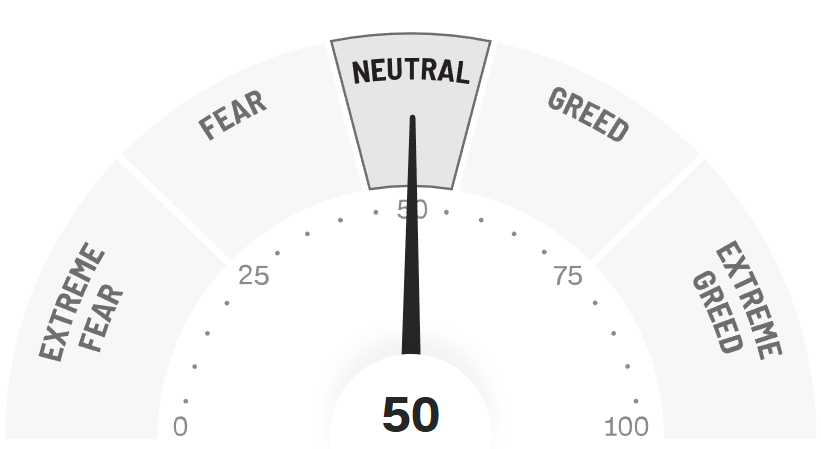

Fear and Greed Index

The market sentiment has shifted to Neutral and sits right now in the middle with a score of 50.

Remember last month we were in Greed with a score of 65.

Now whilst these numbers don’t tell us much it is interesting to note the shift we have seen since the post-election bullish movement.

How will December and 2024 close out?

2 Quality Stocks

I have used the following criteria to help identify these stocks:

Dividend Safety 60+ (Safe)

ROIC > 10%

Net Debt to EBITDA below 1 (Strong Balance Sheet)

Upside > 20%

Novo Nordisk (NVO)

Novo Nordisk is a global healthcare company headquartered in Denmark, specializing in diabetes care and obesity treatments, including widely known drugs like Ozempic and Wegovy.

Founded in 1923, it also focuses on growth hormone therapy and rare diseases, with a strong emphasis on innovation and sustainability.

Novo Nordisk's revenue streams are primarily divided into three segments:

Diabetes Care: This is the largest segment, driven by their leadership in insulin and GLP-1 receptor agonists for diabetes management. Products in this category include NovoLog, NovoRapid, and Ozempic, accounting for over half of the company’s revenue.

Obesity Care: A rapidly growing segment fueled by demand for products like Wegovy and Saxenda, which are part of their GLP-1 obesity treatments. Sales in this segment have seen significant increases in recent years.

Rare Disease Treatments: This includes therapies for hemophilia, growth disorders, and other rare conditions, although it contributes a smaller share compared to diabetes and obesity care.

The company is also investing in emerging areas like cardiovascular diseases to diversify its portfolio.

They anticipate that the next 2 quarters will bring in double digit growth to the EPS on a YoY comparison, with their next full accounting year (Dec 2025) lowering the forward P/E to 27.7x.

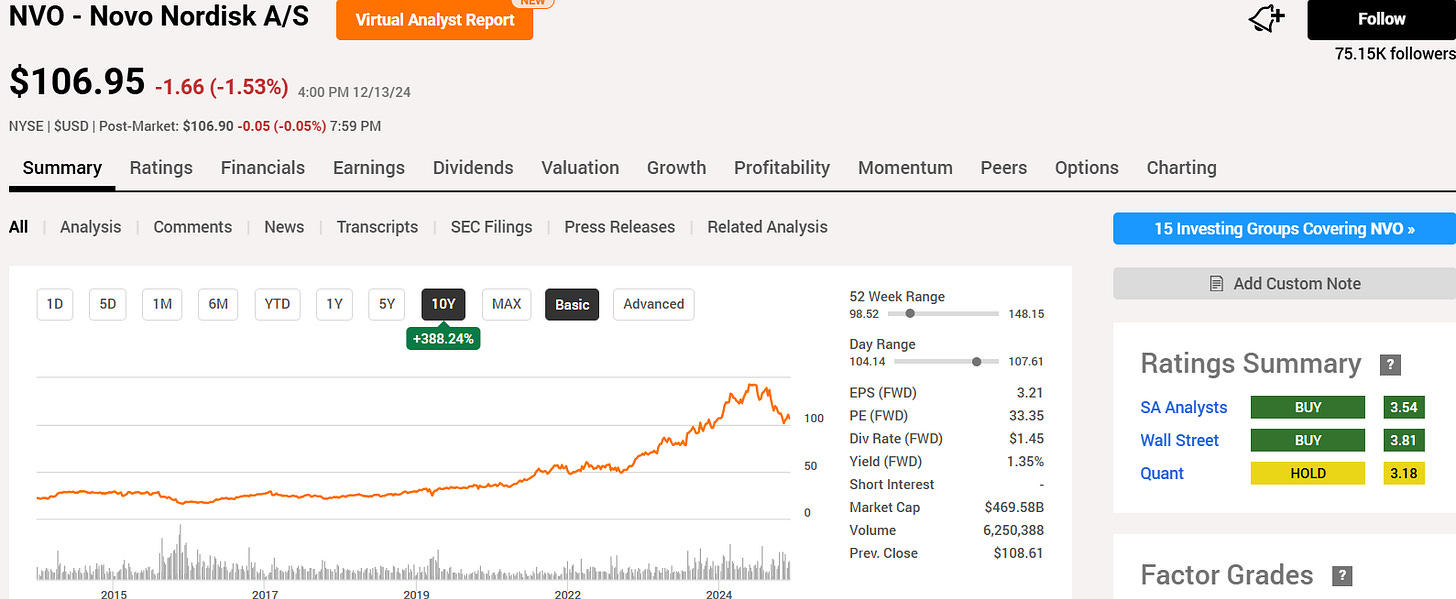

Over the last 10Y NVO has massively outperformed the S&P 500.

As per below, we get a reasonable signal on the yield, as the current yield is around the 5Y average (1.35% v 1.41%) with an undervaluation signal on the Forward P/E as it is lower than the 5Y (28.3x v 30.4x).

We also note a very safe dividend score of 99.

We want to see consistent increases with the free cash flow, and we get that near enough. It has grown by more around 3x over the last 10 years.

It is also expected to have a large jump over the next 12 months too.

Sales growth has been a little inconsistent, however we note the last 3 years, including the trailing twelve-month has grown by a double-digit rate.

ROIC for NVO is one of the best we have ever seen when reviewing stocks. 72% in 2023 is incredible and gives us faith that management are able to effectively allocate their capital.

Excellent Balance Sheet, it wouldn’t even take them 1 day to pay off all of their debt, net of cash on hand.

Net Debt to EBITDA has consistently been around 0.

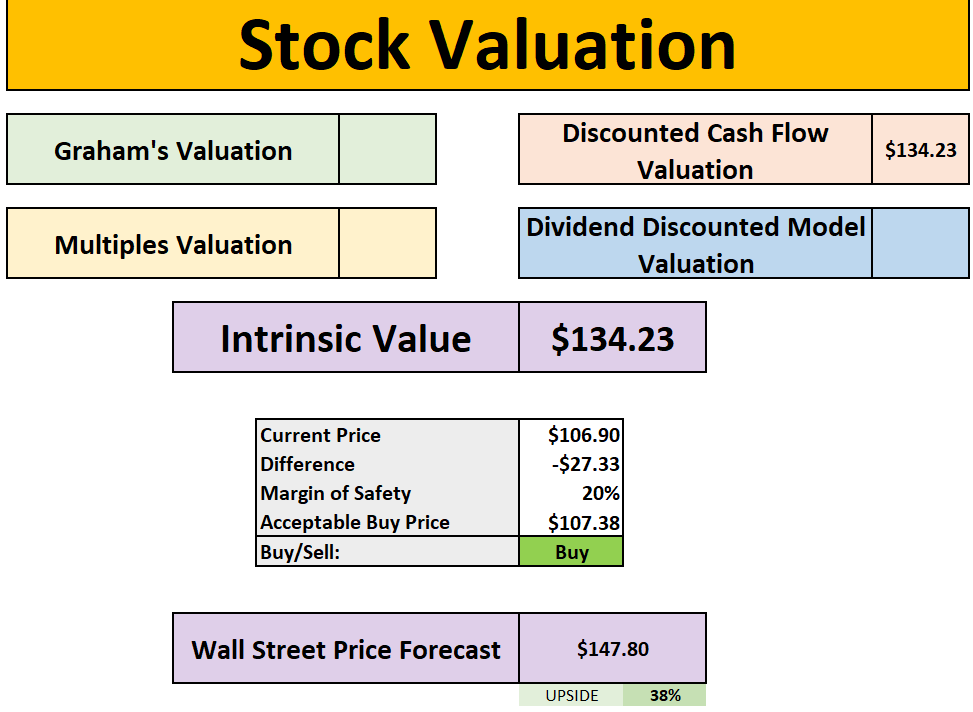

As per below, Wall Street see 38% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $134:

So, in conclusion for NVO, we see around a 20% margin of safety around the $107 mark with Wall Street indicating 38% upside.

KLA Corporation (KLAC)

KLAC is a leading provider of semiconductor process control and yield management solutions, specializing in inspection and metrology equipment for chip manufacturers.

The company plays a key role in the semiconductor industry, benefiting from growing demand in areas like AI, 5G, and autonomous vehicles

KLA Corporation's revenue streams:

Major Segments:

Semiconductor Process Control: The primary revenue driver, offering tools for inspecting and measuring semiconductor wafers.

PCB, Display, and Component Inspection: Also contributes significantly, though with more variability in growth.

Services Revenue: Reflecting growth in support services like maintenance and upgrades for semiconductor manufacturing equipment.

Geographically, KLA sees strong sales in China and Taiwan, where semiconductor manufacturing is robust

As above, they anticipate double digit growth to the EPS for the next 3 quarters and for their next full year accounts (Jan 2026) the Forward P/E based on this sits at 20x.

Over the last 10Y KLAC has massively outperformed the S&P 500.

As per below, we get a double reasonable valuation signal, as the current yield is around the 5Y average (1.04% v 1.20%) and the Forward P/E is near the 5Y, (21.4x v 19.4x).

We also note a safe dividend score of 71.

Nice growth in the free cash flow, up around 7x from the last 10Y.

The semiconductor industry is fairly cyclical as a whole, however we note that overall growth has been strong.

Sales is up more than 3x over the last 10Y.

Like NVO above, the ROIC on KLAC is also very strong and above the minimum 12% we want to see in the semiconductor space.

Net Debt to EBITDA also looking very strong, sitting at 0.54 in 2024.

As per below, Wall Street see 23% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $840:

So, in conclusion for KLAC, we see around a 20% margin of safety around the $672 mark with Wall Street indicating 23% upside.

Stock Resources

Stock Valuation Model

If you are interested in valuing stocks yourself, we have created a valuation model below which you can pick up, this is the same version we use in our YouTube analysis:

Seeking Alpha

They are one of the main stock analysis websites I use in my videos and you can get a discount below.

Patreon

Join our community in the Patreon where we discuss weekly buy and sells.

Snowball Portfolio Tracker

Snowball is a great portfolio tracker which allows you to have all of your investments in one place, with a ton of amazing features.

You can also get a 14-day free trial to check it out:

Conclusion

We have just gone through 2 quality stocks trading at a discount.

However as always do your own due diligence and let us know your thoughts about today’s newsletter in the comments.

I hope you all have a great week ahead!

Thanks For Reading!

If you’d like to support this work feel free to buy me a coffee. The proceeds will contribute to the running costs of the newsletter.

Join the community of investors - subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today’s newsletter helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Note:

I am not a financial advisor or licensed professional. Nothing I say or produce anywhere, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk.