2 Beaten Down Quality Stocks To Buy

+ Market Update

Market Latest

A lot has already gone on in 2025, and we’re only in February!

Over the last week the S&P 500 is up 1.47% and this is largely attributed to the strong performances in the Financials, Communication Services and Health Care Industries, as shown below:

Surprisingly perhaps, Information technology has been the worst performing sector, down 2.1% year-to-date.

With regards to this week, we see a fairly red market with lots of Companies down double digit.

We also had a lot of them report earnings which only added to the volatility in the market.

Biggest losers included:

PayPal (PYPL) down 13%

Merck & Co (MRK) down 12%

Nike (NKE) down 11%

Tesla (TSLA) down 11%

Google (GOOGL) down 9%

Advanced Micro Devices (AMD) down 7%

Notable News

Earnings

A key factor influencing stock market performance is the trajectory of corporate earnings.

The fourth-quarter 2024 earnings season is in progress, with corporate earnings consistently outperforming expectations.

So far, around 60% of S&P 500 companies have reported, and 77% have surpassed forecasts—exceeding the 10-year average of 75% and matching the five-year average of 77%.

While some notable misses and concerns over capital spending, especially among mega-cap tech stocks, have drawn attention, the broader trend continues to support earnings momentum moving into 2025.

Healthy Labor Market

The latest U.S. jobs report for January highlights a labor market that remains resilient.

When people feel secure in their jobs, they are more likely to spend, supporting economic growth.

Job creation totaled 143,000, slightly below the expected 175,000, but upward revisions to the previous two months pushed the three-month average to a strong 241,000—well above the 12-month average of 165,000.

The unemployment rate dropped to 4.0%, beating expectations of 4.1% and staying well below the long-term U.S. average of 5.7%.

A key metric to watch is wage growth, which rose to 4.1% year-over-year, exceeding forecasts of 3.8%.

While higher wages could add pressure to services inflation and delay Federal Reserve rate cuts, they also support household spending. Since mid-2023, wage growth has outpaced inflation, boosting real incomes and consumer confidence.

Tariffs

One of the most significant near-term uncertainties for markets and risks to economic growth is tariff policy.

While tariffs on Mexico and Canada are currently on hold, the future remains uncertain.

Meanwhile, a 10% tariff on China is now in effect and has the potential to increase.

Collectively, these three economies represent approximately 42% of total U.S. trade, amounting to over $2 trillion.

An escalation in tariffs—whether on these economies or more broadly—could strain consumers, dampen market sentiment, and drive up prices across various goods and services, ultimately slowing economic growth.

Federal Reserve research indicated that U.S. tariffs imposed in 2018-2019 contributed to a 0.1%-0.3% rise in inflation and reduced economic growth by 0.3%-0.5%.

This time, the impact could be even greater, given the potential for a wider range of trade actions.

BIG Earnings Drop

Elf Beauty

AMD

Earnings This Week

Earnings season is now in full swing:

As always, we will cover earnings week on our YouTube channel.

We would love to have you in our community which is over 78,000 on YouTube where we cover in depth analysis of undervalued quality stocks and their earnings:

Fear and Greed Index

Investor sentiment has only gotten worse over the last week, currently sitting at 39 from the previous week close of 46.

Note: The Fear and Greed Index is a tool used to measure investor sentiment in the stock market.

It ranges from 0 (Extreme Fear) to 100 (Extreme Greed) and helps indicate whether the market is overly bearish (fearful) or bullish (greedy).

2 Beaten Down Quality Stocks To Buy

Let us dive into these 2 Stocks:

I have used the following criteria to help identify these stocks:

ROIC 20%+

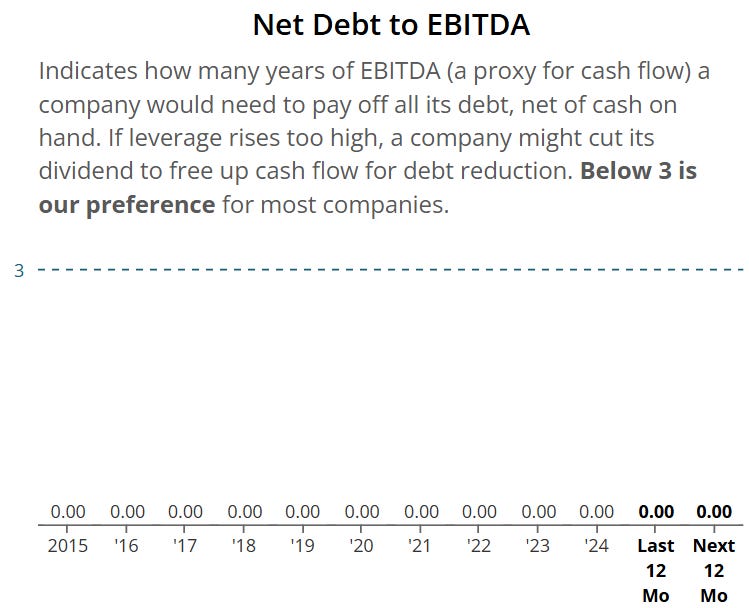

Net Debt to EBITDA below 1 (Strong Balance Sheet)

Upside > 15%

Microsoft (MSFT)

Microsoft is a global technology company specializing in software, hardware, and cloud services.

It is best known for Windows, Office, Azure cloud computing, and LinkedIn.

Microsoft's income streams come from several key areas:

Productivity & Business Processes – Includes Microsoft 365 (Office, Outlook), LinkedIn, and Dynamics 365 (enterprise solutions).

Intelligent Cloud – Azure cloud services, enterprise software, and server products.

More Personal Computing – Windows licensing, Xbox gaming (hardware, content, and services), and Surface devices.

AI & Emerging Technologies – Monetization of AI tools like Copilot, OpenAI partnerships, and cloud-based AI services.

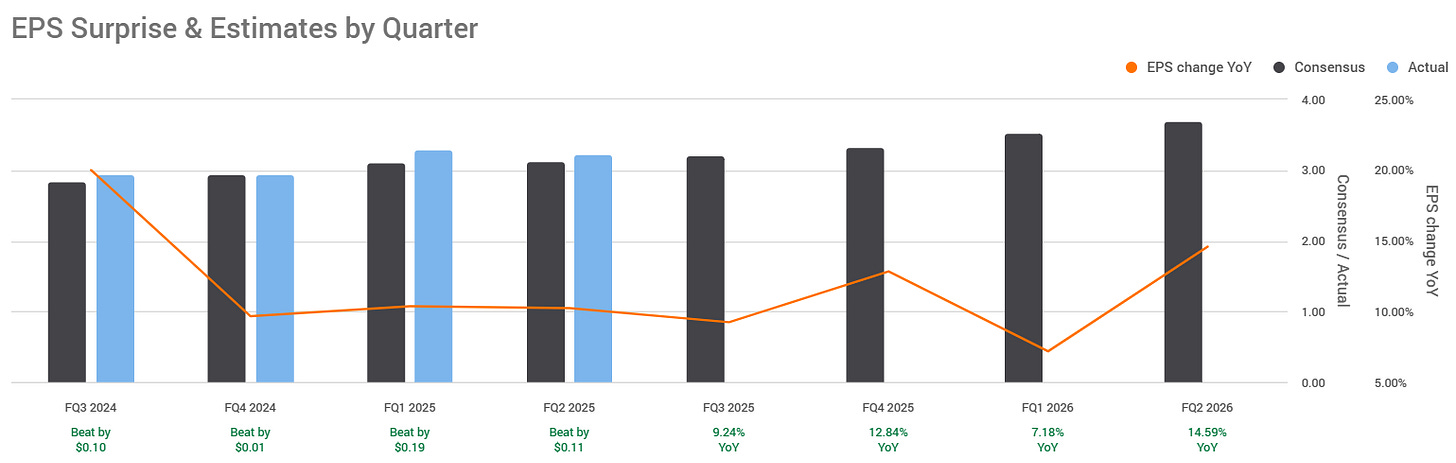

They have outperformed in their last 4 quarters (vs analyst expectations) and anticipate growth against the year-on-year EPS comparative for the next 4 quarters.

They have massively outperformed against the S&P 500 over the last 10Y.

We have a double reasonable signal, as yield 0.81% is near the 5Y average of 0.87%, as well as the Forward P/E of 29.8x being near the 5Y 31.7x.

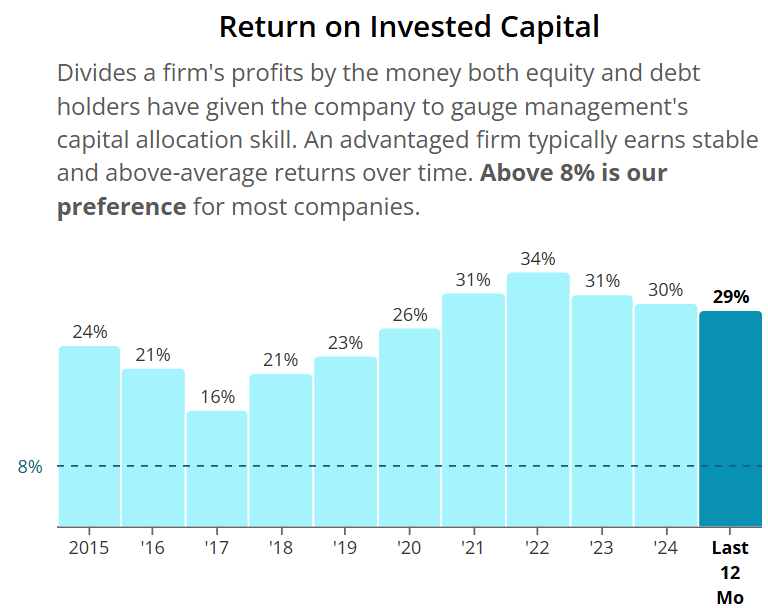

ROIC looks very very good and has been increasing over time, currently sitting at 29%.

Both operating and free cash flow margin have been consistently healthy above the minimum levels, and we also note efficiencies as the operating margin has increased over time.

Net Debt to EBITDA sits near 0 over the last 10Y consistently, meaning it will not take them long to pay off all of their debt, net of cash on hand.

Excellent balance sheet.

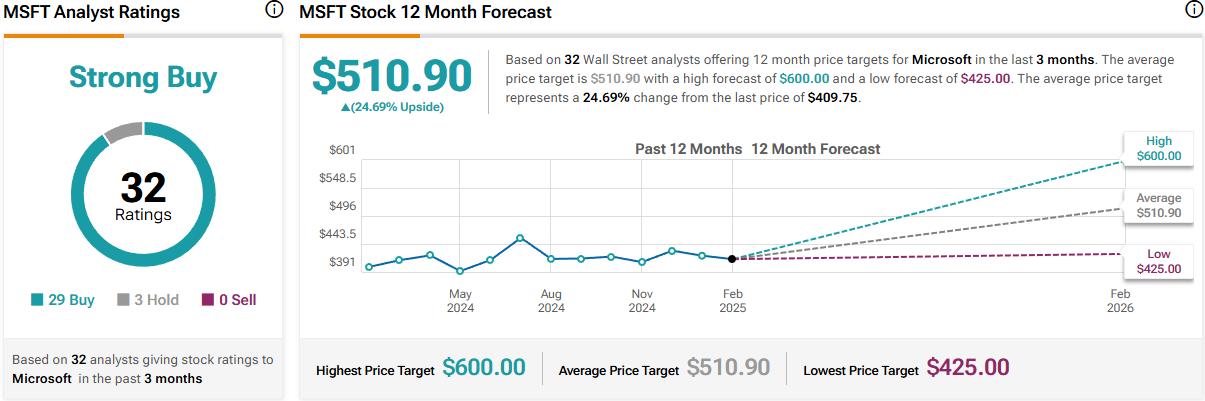

As per below, Wall Street see 25% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $494:

So, in conclusion for MSFT, we see around a 15% margin of safety around the $420 mark with Wall Street indicating 25% upside.

We would consider this a strong buying opportunity at the 20% margin of safety mark at $395.

Alphabet (GOOGL)

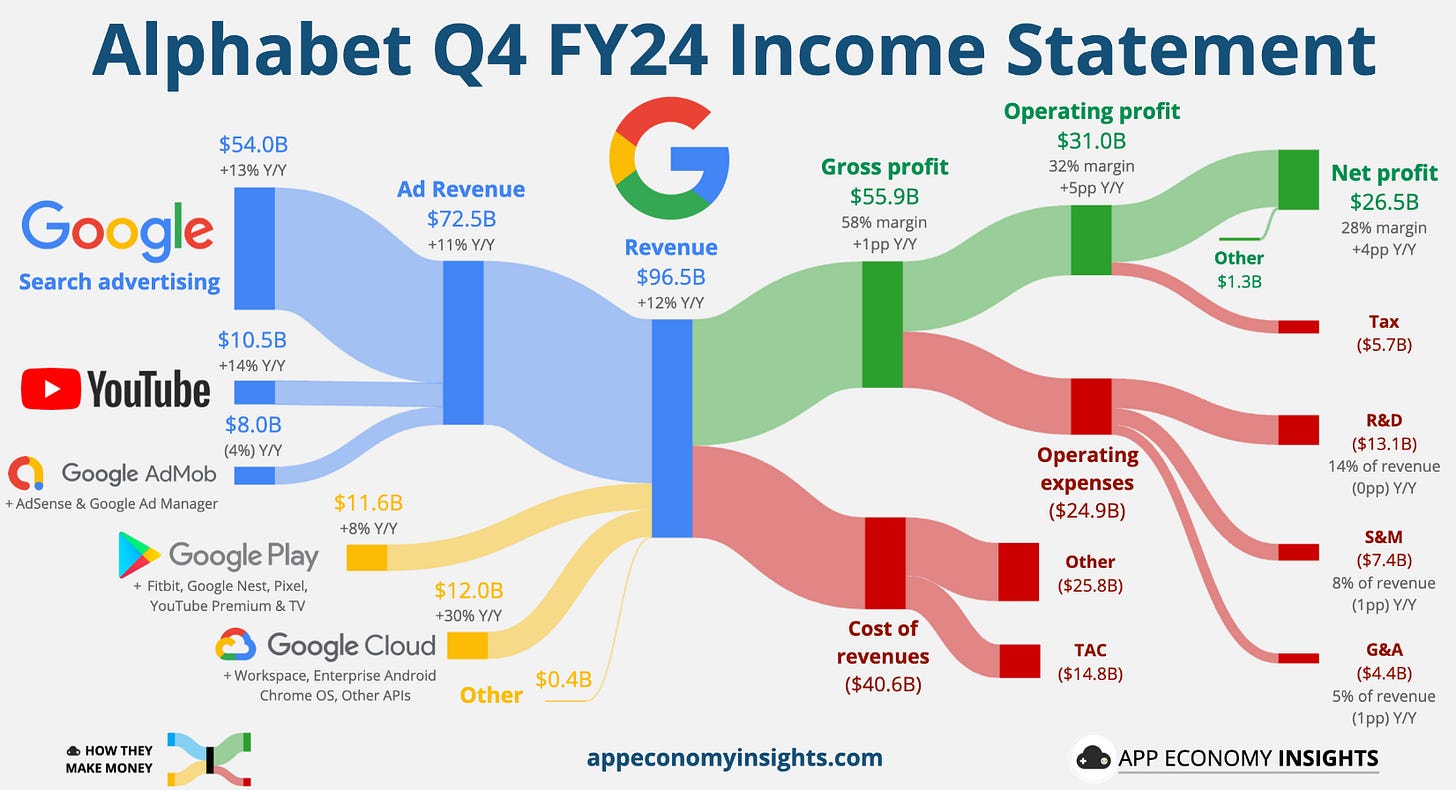

Google specializes in internet services, software, and AI.

It is best known for its search engine, Google Ads, YouTube, and Android.

The company also offers cloud computing, hardware (Pixel, Nest), and AI-driven products like Google Assistant.

Google’s income streams primarily include:

Advertising – Google Ads, YouTube ads, and other digital advertising platforms generate the majority of revenue.

Cloud Services – Google Cloud, including infrastructure, platform services, and G Suite (Google Workspace).

Hardware – Sales of devices like Pixel phones, Nest products, and Fitbit.

Other Bets – Income from ventures like Waymo (autonomous vehicles) and Verily (healthcare).

They have outperformed in their last 4 quarters (vs analyst expectations) and anticipate growth against the year-on-year EPS comparative for the next 4 quarters.

They have massively outperformed against the S&P 500 over the last 10Y.

They currently trade at a Forward P/E of 20.7x below the 5Y average of 20.7x.

ROIC looks good and has been increasing over time, currently sitting at 32%.

Both operating and free cash flow margin look very strong and are consistent.

Net Debt to EBITDA sits at 0 over the last 10Y and expected over the next 12 months, meaning it won’t even take them 1 day to pay off all of their debt, net of cash on hand. Excellent balance sheet.

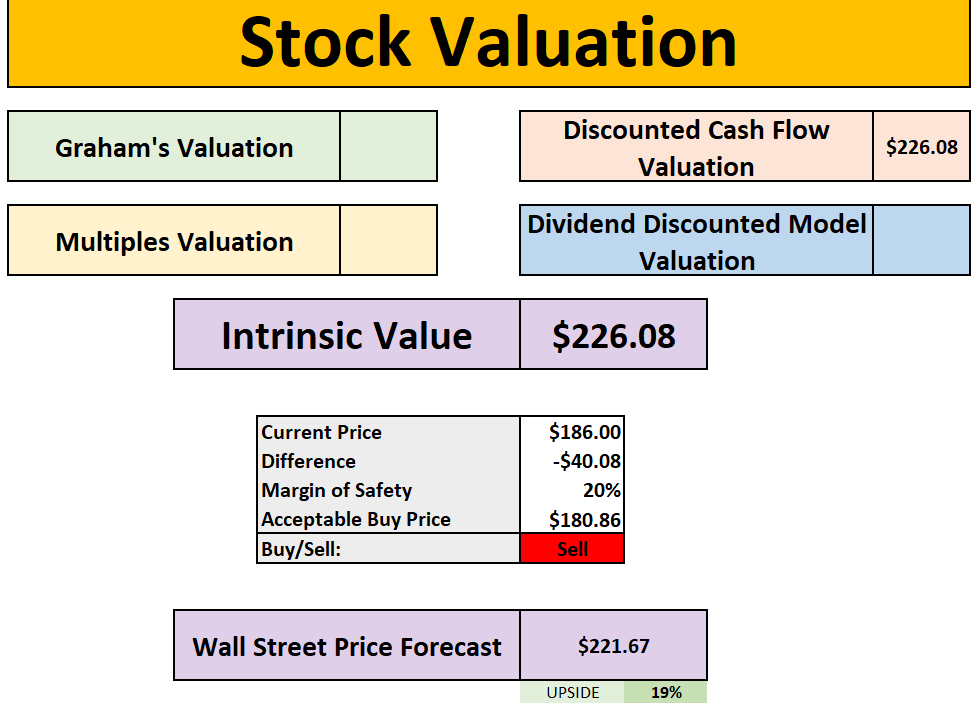

As per below, Wall Street see 19% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $226:

So, in conclusion for GOOGL, we see around a 20% margin of safety around the $181 mark with Wall Street indicating 19% upside.

Stock Resources

Stock Valuation Model

If you are interested in valuing stocks yourself, we have created a valuation model below which you can pick up, this is the same version we use in our YouTube analysis:

Seeking Alpha

They are one of the main stock analysis websites I use in my videos and you can get $30 OFF discount below.

TipRanks

To find the predicted upside of stocks, I typically use TipRanks, for example, using their system for Novo Nordisk (NVO) we get the below:

They currently have a 50% offer below.

50% OFF TipRanks:

Patreon

Join our community in the Patreon where we discuss weekly buy and sells.

Snowball Portfolio Tracker

Snowball is a great portfolio tracker which allows you to have all of your investments in one place, with a ton of amazing features.

You can also get a 14-day free trial to check it out.

Conclusion

We have just gone through 2 beaten down quality stocks to buy.

However as always do your own due diligence and let us know your thoughts about today’s newsletter in the comments.

I hope you all have a great week ahead!

Thanks For Reading!

If you’d like to support this work feel free to buy me a coffee. The proceeds will contribute to the running costs of the newsletter.

Join the community of investors - subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today’s newsletter helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Note:

I am not a financial advisor or licensed professional. Nothing I say or produce anywhere, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk.