2 Beaten Down Stocks With Over 30% Upside!

+ Market Update

Market Latest

The S&P 500 is up for the sixth straight week hitting all-time highs.

The majority of earnings growth is expected to come from the Magnificent 7, with the market anticipating an 18% increase to Q3 profits in comparison to 1.8% growth from the rest of the market.

One of the best investing strategies is to simply index and chill, and for those who have done exactly this, they would be up 36% over the last year.

To put this in to context if you had invested 1Y ago:

$10,000 in $VOO, an ETF that tracks the S&P 500, you’d currently have $13,596.

$100,000 in $VOO, you’d have $135,960.

On a granular level below, we can see that the week was not great for all:

Biggest losers included:

KLA Corp (KLAC) down 16%

Elevance Health (ELV) down 14%

Lam Research (LRCX) down 12%

CVS Health (CVS) down 10%

Uber (UBER) down 8%

Advanced Micro Devices (AMD) down 7%

United Health (UNH) down 5%

Notable News

ASML Earnings

One of the biggest news this week was that ASML (in error) released their earnings one day earlier to the market, and it was terrible.

Net bookings for the September quarter were 2.6bnEuros v 5.6bnEuros expected.

To get the full picture and our view on this, check out our post earnings episode:

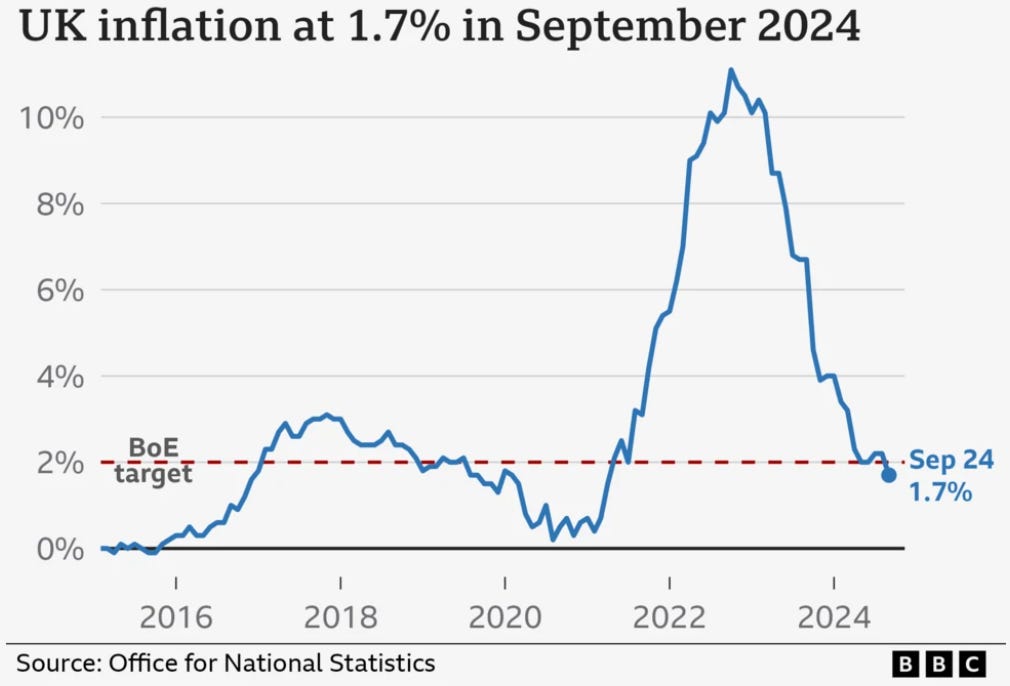

UK Inflation

UK inflation fell to 1.7% in the year to September which was a surprise as analysts expected this to be higher, meaning there is a very strong chance we see interest rate cuts next month. This is the lowest rate in 3 and a half years.

CVS CEO Change

This led the share price to drop more than 5% today, making this stock trade near its 52-week low.

We took a look at the company in detail below on Friday:

Earnings This Week

Massive earnings taking place next week with so many Companies reporting:

As always, we will cover this on our YouTube channel, and for those that aren’t subscribed, we would love to have you in our community which is over 55,000.

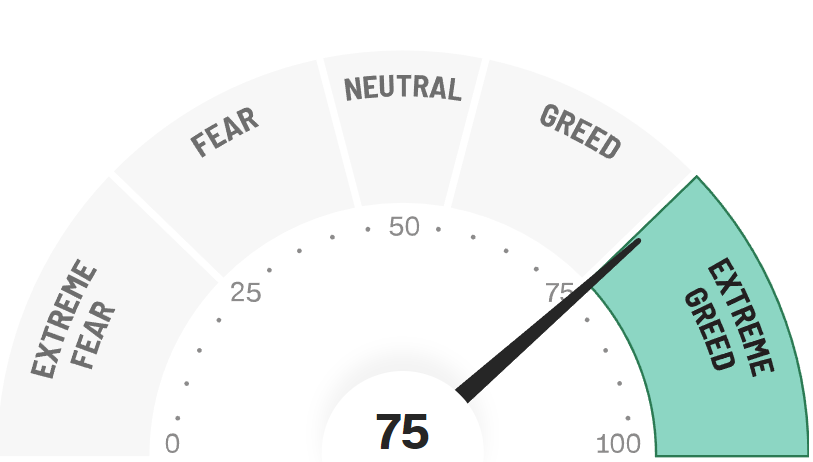

Fear and Greed Index

We have now officially entered Extreme Greed territory, and there is no surprise in this as we see the S&P 500 continue to make all-time highs week after week.

As always, the market can change quickly, and with numerous large corporations reporting this week may change sentiment once we see how they’ve performed in the more recent quarter as well as future guidance announced.

2 Beaten Down Stocks With Over 30% Upside

Let’s dive into 2 stocks we like that have been beaten down recently and have more than 30% upside over the next 12 months according to Wall Street analysts:

Novo Nordisk (NVO)

Novo Nordisk is a Danish multinational pharmaceutical company primarily focused on diabetes care, but it has diversified its business into other therapeutic areas. The company's revenue streams come from several key areas:

1. Diabetes Care

Insulin Products: Novo Nordisk is a global leader in insulin production, offering a wide range of insulin treatments including short-acting, intermediate-acting, and long-acting insulins. This is their largest revenue stream.

GLP-1 Receptor Agonists: These are a newer class of diabetes drugs that stimulate insulin production in a glucose-dependent manner. Novo Nordisk has been a leader in this space as well.

Obesity Treatments: Obesity treatments often overlap with diabetes, and Novo Nordisk has expanded its product portfolio to include medications specifically for weight management.

2. Obesity Care

With the increasing recognition of obesity as a major health challenge, Novo Nordisk has expanded into obesity treatments. Its leading product is Wegovy, which has seen rapid uptake due to its efficacy in weight loss.

3. Biopharmaceuticals

Hemophilia and Blood Disorders: Novo Nordisk develops products for hemophilia, a rare blood disorder, and other related conditions. These products are primarily based on recombinant (genetically engineered) clotting factors.

Growth Hormone Therapy: The company also markets products for growth disorders.

4. Hormone Replacement Therapy (HRT)

Novo Nordisk has a smaller, but established market in hormone replacement therapies for treating symptoms related to menopause.

5. Rare Endocrine Disorders

The company is involved in treatments for other rare endocrine disorders, such as growth hormone deficiencies and certain types of endocrine-related cancers.

6. New Initiatives and R&D

Novo Nordisk invests heavily in research and development, with an emphasis on chronic disease areas. The company is exploring new treatments for conditions like cardiovascular disease, non-alcoholic steatohepatitis (NASH), and kidney disease, all of which have close links to diabetes and obesity.

NVO is up 417% over the last 10Y and has massively outperformed the S&P 500 in this period.

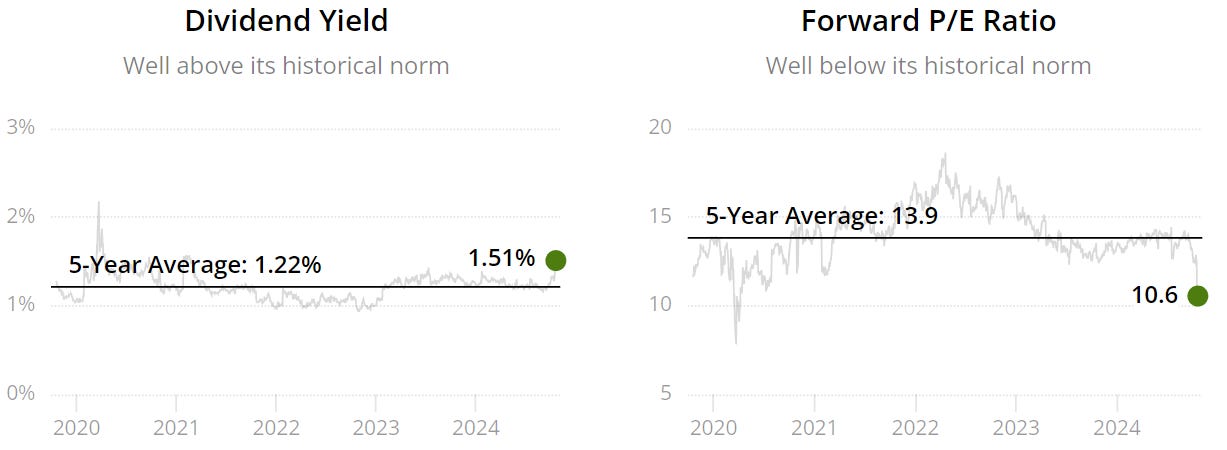

Based on Dividend Yield Theory and the Forward P/E we can see that these values are trading near the 5Y averages so we could say purely based on this it is trading at a reasonable valuation.

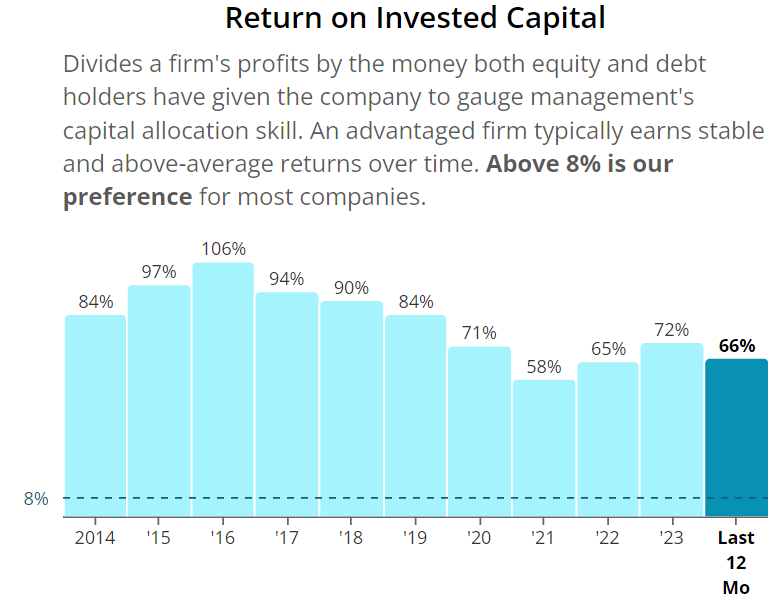

ROIC is incredibly strong and consistently, 72% in 2023 and 66% on a trailing twelve-month basis is something investors and potential investors love to see.

Operating margin also shows efficiency as it has increased over time, and the FCF margin shows how much of a machine this company is.

Excellent Balance Sheet, it wouldn’t take them much more than a few days/weeks to pay off all of their debt, net of cash on hand.

Net Debt to EBITDA has consistently been near 0.

As per below, Wall Street see 31% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $134

So, in conclusion for Novo Nordisk (NVO), we see around a 15% margin of safety around the $114 mark with Wall Street indicating 31% upside.

Elevance Health (ELV)

Elevance Health, formerly known as Anthem, Inc., is one of the largest healthcare insurance companies in the United States. The company's revenue streams come primarily from health insurance services, although it has expanded its operations into health-related services through its subsidiaries. Here are the key revenue streams for Elevance Health:

1. Commercial & Specialty Business

Employer-Sponsored Health Plans: This is the largest revenue source for Elevance Health. It involves providing group health insurance plans for employers, both large and small, who offer health coverage to their employees. This includes fully insured plans where Elevance assumes the risk, and administrative services for self-insured employers who manage their own risk.

Individual Health Insurance Plans: Elevance offers health insurance plans for individuals, including those who purchase coverage through the Affordable Care Act (ACA) exchanges.

Specialty Products: These include dental, vision, life, and disability insurance products, as well as other ancillary health services.

2. Government Business

Elevance Health generates a significant portion of its revenue from government-sponsored health programs.

Medicare: Elevance offers Medicare Advantage (MA) plans, which are privately run alternatives to traditional Medicare, as well as Medicare Supplement plans. The company also participates in Medicare Part D, which covers prescription drugs.

Medicaid: Elevance operates Medicaid managed care plans in several states. Medicaid provides health coverage for low-income individuals and families, and the company contracts with states to manage care for Medicaid beneficiaries.

Dual-Eligible Programs: These are plans designed for people eligible for both Medicare and Medicaid, often covering the elderly or disabled with low incomes.

Federal Employee Health Benefits (FEHB): Elevance provides health insurance plans to federal employees and retirees through the FEHB Program.

3. Pharmacy Benefits Management (PBM)

Through its pharmacy benefit manager, IngenioRx, Elevance Health manages prescription drug benefits for its members. The PBM provides services such as drug plan design, formulary management, and mail-order pharmacy services. This stream allows Elevance to control costs related to medications while improving access to prescription drugs.

4. Carelon (Health Services)

Carelon, a subsidiary of Elevance, focuses on providing a wide range of healthcare services beyond traditional insurance.

CarelonRx: Focuses on pharmacy services.

Carelon Behavioral Health: Provides mental health and substance use disorder services.

Carelon Medical Benefits Management: Offers healthcare management services such as diagnostic imaging, oncology care, and specialty benefits.

Carelon Post-Acute Care: Provides services focused on transitions of care after a hospital stay.

Carelon Whole Health: Focuses on holistic and integrated care management, addressing both physical and behavioral health.

5. Value-Based Care and Healthcare Innovation

Elevance Health is increasingly moving towards value-based care models. These models focus on paying for healthcare services based on outcomes and the quality of care delivered, rather than the traditional fee-for-service model. The company's efforts include partnerships with providers and healthcare systems to improve patient outcomes while reducing costs.

6. Other Services

Digital Health Solutions: Elevance offers digital tools, telemedicine, and online health management platforms to provide members with easier access to healthcare services and better self-management of their health.

Health Management Programs: These are wellness and disease management programs that help members manage chronic conditions such as diabetes, asthma, and heart disease.

Elevance Health is up 265% over the last 10Y and has outperformed the S&P 500 in this period.

We get a double undervaluation signal as the yield is currently above the 5Y average and the Forward P/E sits below the 5Y rolling.

ROIC is consistent and above 10%, something we always like to see, and 15% in 2023 as well as on the trailing twelve-month is a good sign.

Excellent Balance Sheet, it wouldn’t even take them 1 day to pay off all of their debt, net of cash on hand.

Net Debt to EBITDA has consistently been 0.

As per below, Wall Street see 36% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $567

So, in conclusion for Elevance Health (ELV), we see around a 25% margin of safety around the $425 mark with Wall Street indicating 36% upside.

Stock Resources

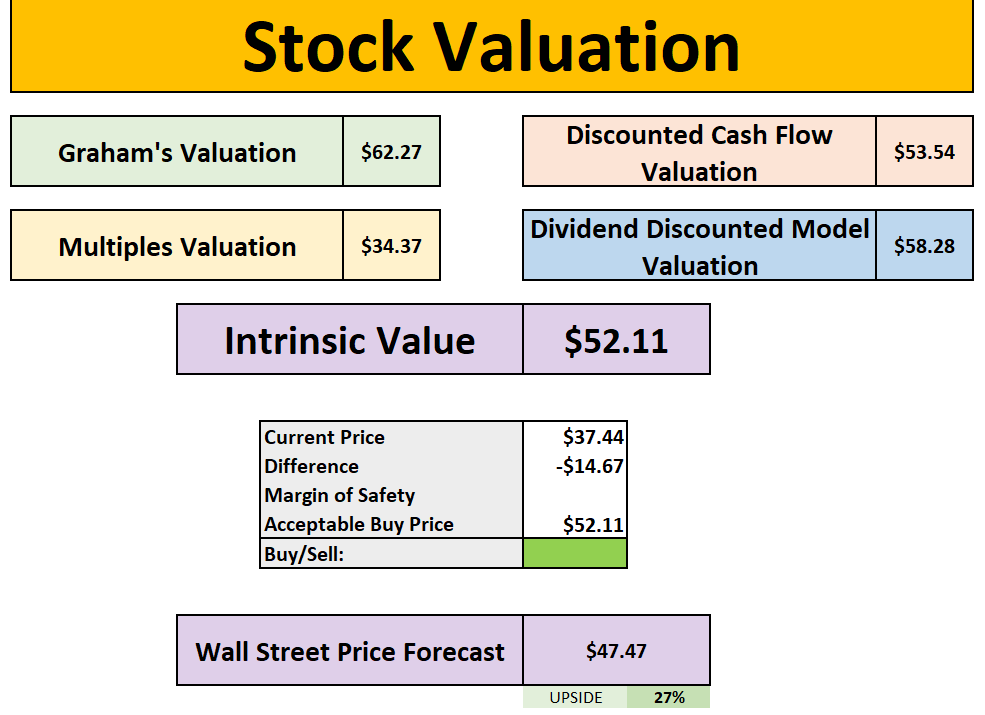

Stock Valuation Model

If you are interested in valuing stocks yourself, we have created a valuation model below which you can pick up, this is the same version we use in our YouTube analysis:

Seeking Alpha

Seeking Alpha, one of the websites that I use when I review stocks on YouTube has a $30 off discount for your first year. This also includes a 7-day free trial for new users too!

Patreon

Join our community in the Patreon where we discuss weekly buy and sells.

Snowball Portfolio Tracker

Snowball is a great portfolio tracker which allows you to have all of your investments in one place, with a ton of amazing features.

You can also get a 14-day free trial to check it out:

Conclusion

We have just gone through 2 beaten down stocks with over 30% upside that we believe could be considered as undervalued stocks in the market right now to consider in the portfolio.

However as always do your own due diligence and let us know your thoughts about today’s newsletter in the comments.

I hope you all have a great week ahead!

Thanks For Reading!

If you’d like to support this work feel free to buy me a coffee. The proceeds will contribute to the running costs of the newsletter.

Join the community of investors - subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today’s newsletter helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Note

I am not a financial advisor or licensed professional. Nothing I say or produce anywhere, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk.