2 Beaten Stocks Ready To Soar

+ Market Update

Market Latest

The S&P 500 experienced a robust performance last week, posting a 3.40% gain—the best since November.

This upward movement was largely driven by lower-than-expected inflation data, which led to a decline in Treasury yields and bolstered equities.

Additionally, a strong start to the fourth-quarter earnings season contributed to investor optimism.

As of January 17, 2025, the S&P 500 is up 2% year-to-date.

Last week we saw a LOT of green, with only a few stocks down.

Biggest losers included:

Moderna (MRNA) down 19%

Eli Lilly (LLY) down 9%

Target (TGT) down 6%

Lululemon (LULU) down 6%

Super Micro (SMCI) down 6%

Dell (DELL) down 5%

Apple (AAPL) down 3%

Notable News

TSMC Earnings

Taiwan Semiconductor Manufacturing Company (TSMC) reported a 57% year-over-year increase in net profit for the fourth quarter of 2024, reaching NT$374.68 billion (approximately $11.37 billion), surpassing analysts' expectations.

This robust performance was driven by strong demand for their advanced 3nm and 5nm technologies, particularly in artificial intelligence (AI) applications.

TSMC projects first-quarter 2025 revenue between $25 billion and $25.8 billion, with gross profit margins between 57% and 59%, indicating continued confidence in AI-related demand.

Interest Rates

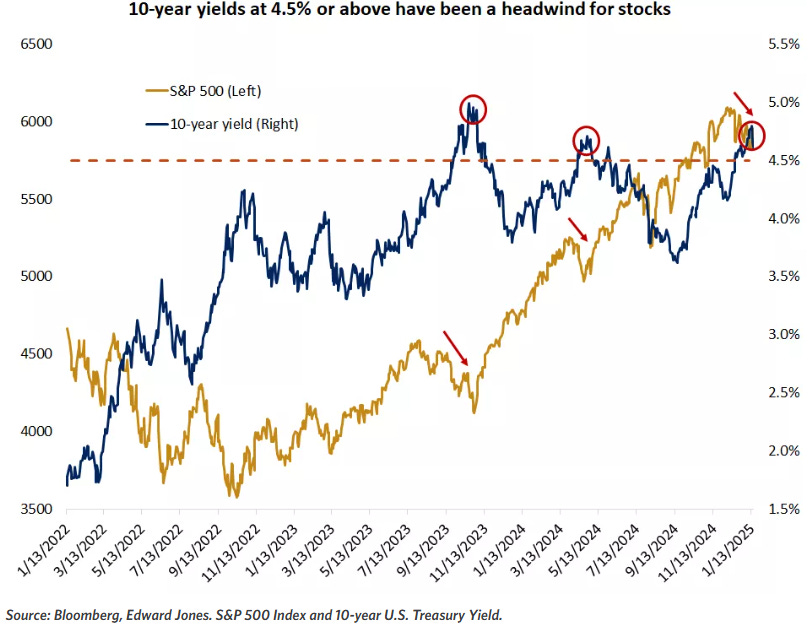

Last week, the benchmark 10-year Treasury yield briefly reached a 14-month high of 4.8% before retreating on positive inflation data.

This was the third instance since the bull market began in October 2022 where the yield exceeded 4.5%—a level that has historically caused turbulence for equities.

In the summer of 2023, it led to a 10% pullback in the S&P 500, and in April 2024, it triggered a 5% decline.

Despite these challenges, the bull market has remained resilient, supported by strong fundamentals.

Amid strong economic growth, a uneven disinflation process, and ongoing policy uncertainty, the Fed appears in no rush to lower interest rates further.

Consequently, investors have significantly reduced their expectations for rate cuts this year.

Earnings This Week

Massive week for Companies as we have many big names reporting:

As always, we will cover earnings week on our YouTube channel.

We would love to have you in our community which is climbing over 73,000 on YouTube where we cover in depth analysis of undervalued quality stocks and their earnings:

Fear and Greed Index

The Fear and Greed Index, a widely watched indicator of market sentiment, is currently at around 38, signaling "fear."

This suggests that investors are leaning toward caution, likely due to concerns about economic uncertainty, potential interest rate hikes, or geopolitical tensions.

Historically, fear-driven markets can lead to pullbacks and volatility, but they also create potential opportunities for savvy investors to buy undervalued assets.

It's important to remember that markets often fluctuate between fear and greed, and extreme fear can sometimes indicate that a bottom is near.

Conversely, it’s a reminder to approach investments with a balanced perspective, as emotional decision-making can lead to missed opportunities or unnecessary losses.

Keeping an eye on this index can provide insights into the broader sentiment, but it should always be used in conjunction with thorough research and a clear investment strategy.

2 Beaten Stocks Ready To Soar

Let us dive into the 2 High Quality Stocks Beaten Down Stocks we like.

I have used the following criteria to help identify these stocks:

ROIC 30%+

Net Debt to EBITDA below 1 (Strong Balance Sheet)

Upside > 30%

Adobe (ADBE)

Adobe develops software solutions for creative, marketing, and document management, including industry-leading products like Photoshop, Illustrator, and Acrobat.

The company also offers tools for digital experiences, such as Adobe Experience Cloud, empowering businesses with analytics, content creation, and customer engagement.

Adobe's income streams primarily come from three segments:

Digital Media: This includes subscription-based revenue from products like Photoshop, Illustrator, Acrobat, and the Creative Cloud suite.

Digital Experience: Revenue from Adobe Experience Cloud, which provides enterprise solutions for data-driven marketing, customer analytics, and content management.

Publishing and Advertising: This includes niche products for digital publishing, technical documentation, and legacy services, as well as advertising-related offerings.

Subscription models dominate their revenue, providing predictable and recurring income.

They have outperformed in their last 4 quarters (vs analyst expectations) and anticipate double digit growth against the year-on-year EPS comparative for the next year.

They have massively outperformed against the S&P 500 over the last 10Y.

Adobe currently trades lower than the sector median on both a trailing twelve-month and on a forward looking basis.

It also, on both accounts trades lower than it’s 5Y average.

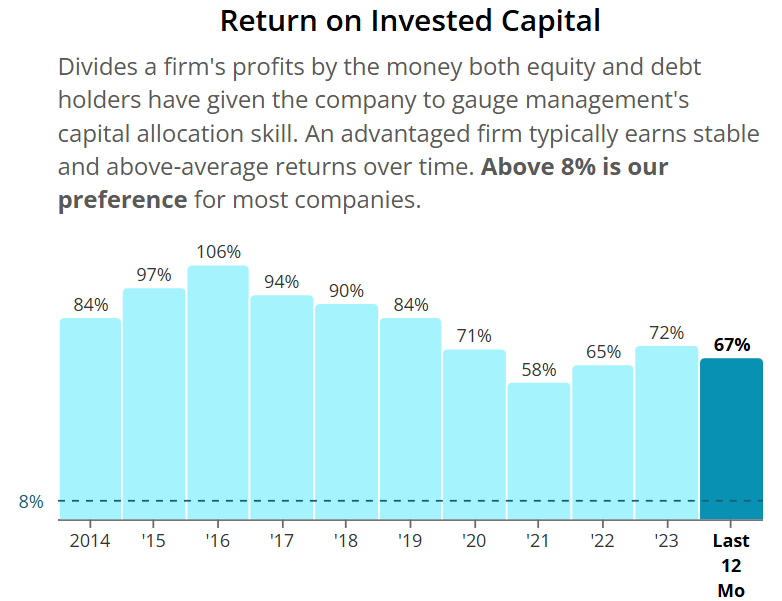

ROIC looks very very good and has been increasing over time, currently sitting at 39%.

Balance sheet looks very good as Net Debt to EBITDA sits at 0, and has done for a while, meaning it won’t even take them 1 day to pay off all of their debt, net of cash on hand.

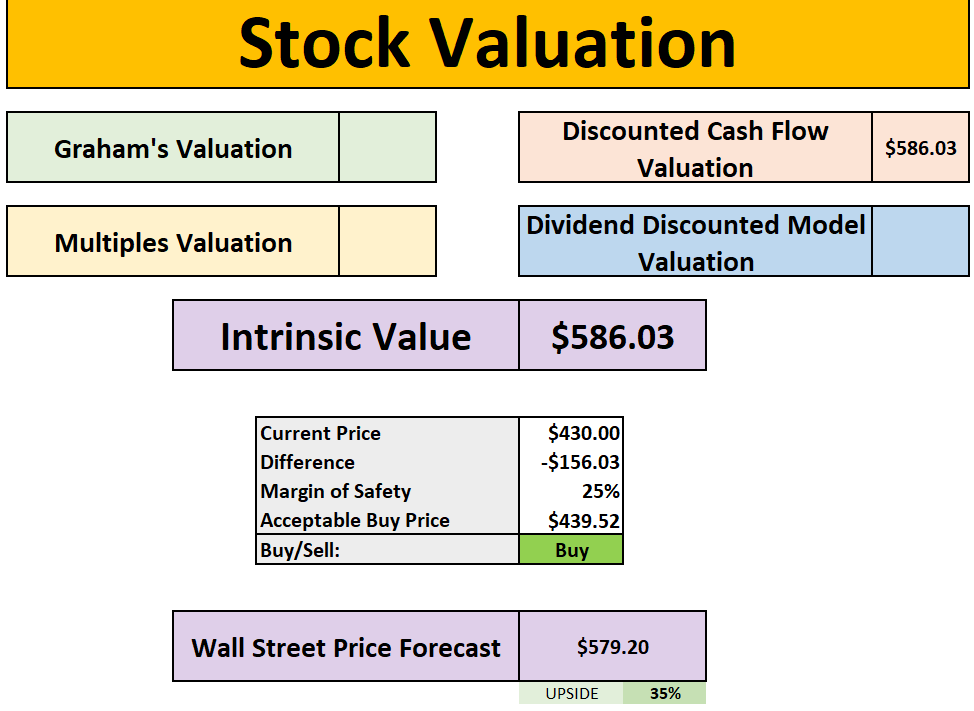

As per below, Wall Street see 35% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $586:

So, in conclusion for ADBE, we see around a 25% margin of safety around the $440 mark with Wall Street indicating 35% upside.

Novo Nordisk (NVO)

Novo Nordisk (NVO) is a global healthcare company specializing in the development, production, and marketing of pharmaceuticals, particularly for diabetes care, obesity, and rare endocrine disorders.

Its product portfolio includes insulin, GLP-1 receptor agonists like Ozempic, and other treatments aimed at improving chronic disease management.

Novo Nordisk's income streams primarily come from two segments:

Diabetes and Obesity Care: This includes insulin, GLP-1 receptor agonists (e.g., Ozempic, Wegovy), and other diabetes-related treatments.

Rare Disease Treatments: Revenue from therapies for rare blood and endocrine disorders, including hemophilia and growth hormone-related conditions.

The diabetes and obesity care segment generates the majority of their revenue.

They have outperformed in 3 of their last 4 quarters (beats vs analyst expectations) and anticipate growth against the year-on-year EPS comparative for next quarter by 28%.

They have massively outperformed against the S&P 500 over the last 10Y.

We currently get a double undervaluation signal with yield above the 5Y average (1.83% v 1.41%) and the forward P/E below the 5Y average (21.1x v 30.4x).

Dividend safety looks good, with a score of 99.

Dividend growth is also very impressive.

ROIC looks absolutely incredible too.

Balance sheet looks very good as Net Debt to EBITDA sits at 0.

As per below, Wall Street see 47% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $117:

So, in conclusion for NVO, we see around a 30% margin of safety around the $82 mark with Wall Street indicating 47% upside.

Stock Resources

Stock Valuation Model

If you are interested in valuing stocks yourself, we have created a valuation model below which you can pick up, this is the same version we use in our YouTube analysis:

Seeking Alpha

They are one of the main stock analysis websites I use in my videos and you can get $30 OFF discount below.

Patreon

Join our community in the Patreon where we discuss weekly buy and sells.

Snowball Portfolio Tracker

Snowball is a great portfolio tracker which allows you to have all of your investments in one place, with a ton of amazing features.

You can also get a 14-day free trial to check it out.

Conclusion

We have just gone through 2 beaten stocks to consider.

However as always do your own due diligence and let us know your thoughts about today’s newsletter in the comments.

I hope you all have a great week ahead!

Thanks For Reading!

If you’d like to support this work feel free to buy me a coffee. The proceeds will contribute to the running costs of the newsletter.

Join the community of investors - subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today’s newsletter helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Note:

I am not a financial advisor or licensed professional. Nothing I say or produce anywhere, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk.