2 Buy Now AI Stocks

+ Market Update

Market Latest

Whilst the market was not open for the full week, we can see the S&P 500 is up 2.14% and ends 2024 up 25.9%.

Whilst the majority of stocks were in the green, we did get a few stocks that were down.

Biggest losers last week included:

Brown-Forman (BF-B) down 6%

Accenture (ACN) down 4%

Old Dominion Freight Line (ODFL) down 4%

and a few others.

Notable News

Slowdown of interest rate cuts

Only two rate cuts are expected in 2025, compared to the four projected during the September Fed meeting.

S&P 500 2025 Predictions

Many analysts are predicting approximately 10% gain to the S&P 500 by the end of 2025.

Earnings This Week

Given the festive period continues this week, there will be no Companies reporting their earnings.

However, be sure to subscribe to our YouTube channel where we will be looking forward to 2025 and the opportunities that we can find in the Stock Market.

We would love to have you in our community which is heading over 70,000:

Fear and Greed Index

Last week the sentiment across investors was at Fear, with a score of 34, with November (not even long ago, sitting in Greed with a score of 63).

As we enter 2025, there are a lot of catalysts that could see the market swing in either direction, but as always, we should block out the noise and follow our own investment thesis and strategy.

2 Buy Now AI Stocks

I have used the following criteria to help identify these stocks:

Net Debt to EBITDA below 1 (Strong Balance Sheet)

Upside > 30%

Micron Technology (MU)

Micron Technology is a leading producer of memory and storage solutions, including DRAM, NAND, and NOR flash memory, used in various electronic devices and data center applications.

Micron Technology's income streams primarily include:

DRAM (Dynamic Random Access Memory): Revenue from DRAM products, which are widely used in PCs, servers, mobile devices, and data centers.

NAND Flash Memory: Income from NAND flash products used in solid-state drives (SSDs), smartphones, and other consumer electronics.

Embedded Storage Solutions: Revenue from memory and storage solutions for automotive, industrial, and IoT applications.

Mobile and Consumer Solutions: Earnings from memory solutions for smartphones, tablets, and other personal devices.

Enterprise and Cloud Solutions: Income from high-performance memory solutions for data centers and cloud computing.

Licensing and Intellectual Property: Revenue from licensing its technologies and patents.

They have outperformed in the last 4 quarters (all beats vs analyst expectations) and anticipate growth against the year-on-year EPS comparative.

Over the last 10Y MU has marginally underperformed against the S&P 500, and currently trades near its 52 week low.

It also currently trades below its 5Y Forward P/E average, 11.3x vs 12.8x, which is an undervaluation signal.

Excellent balance sheet with the Net Debt to EBITDA sitting at 0.65 in 2024 and expected to come down to 0.34 over the next 12 months.

As per below, Wall Street see 55% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $138:

So, in conclusion for MU, we see around a 35% margin of safety around the $90 mark with Wall Street indicating 55% upside.

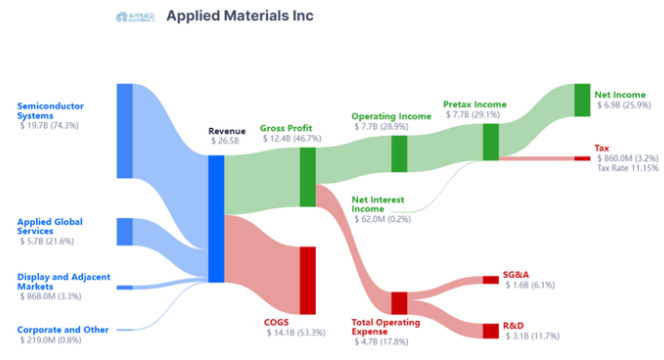

Applied Materials (AMAT)

Applied Materials is a leading provider of manufacturing equipment, services, and software for the semiconductor, display, and solar industries.

Applied Materials income streams primarily include:

Semiconductor Systems: Revenue from equipment used in wafer fabrication, including deposition, etching, inspection, and ion implantation.

Applied Global Services: Income from maintenance, spare parts, and optimization services for semiconductor and display manufacturing equipment.

Display and Adjacent Markets: Revenue from manufacturing equipment for advanced displays (e.g., OLED, LCD) and other technologies like flexible and large-area screens.

Energy and Environmental Solutions: Earnings from equipment and solutions for renewable energy applications, such as solar panel manufacturing.

They have outperformed in the last 4 quarters (all beats vs analyst expectations) and anticipate growth against the year-on-year EPS comparative.

Over the last 10Y AMAT has massively outperformed the S&P 500.

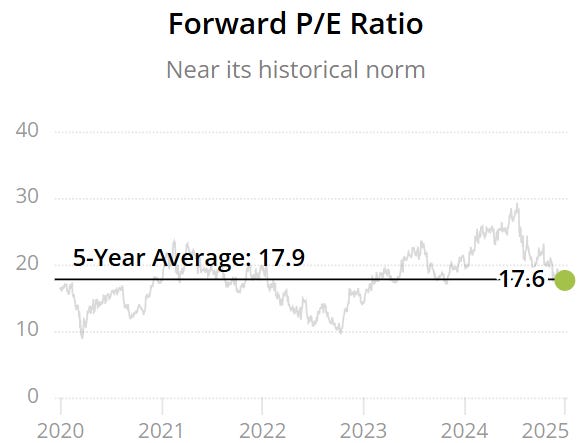

It currently trades around it’s 5Y average P/E which would indicate reasonable valuation.

Excellent Balance Sheet with a 0 Net Debt to EBITDA metric, meaning it would not even take them 1 day to pay off all of their debt, net of cash on hand.

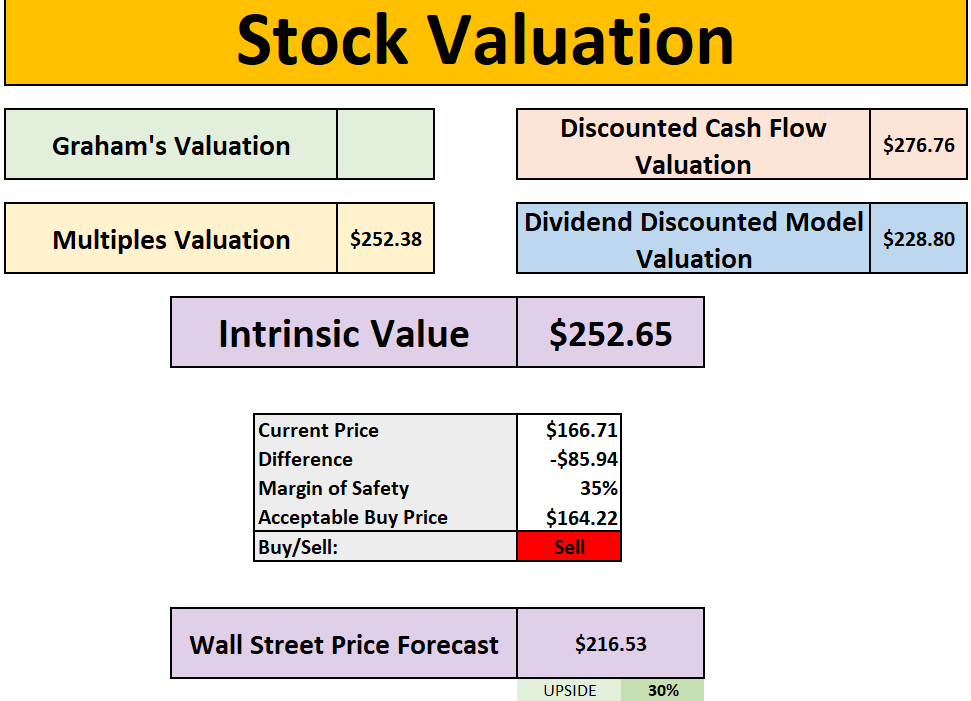

As per below, Wall Street see 30% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $253:

So, in conclusion for AMAT, we see around a 35% margin of safety around the $165 mark with Wall Street indicating 30% upside.

Stock Resources

Stock Valuation Model

If you are interested in valuing stocks yourself, we have created a valuation model below which you can pick up, this is the same version we use in our YouTube analysis:

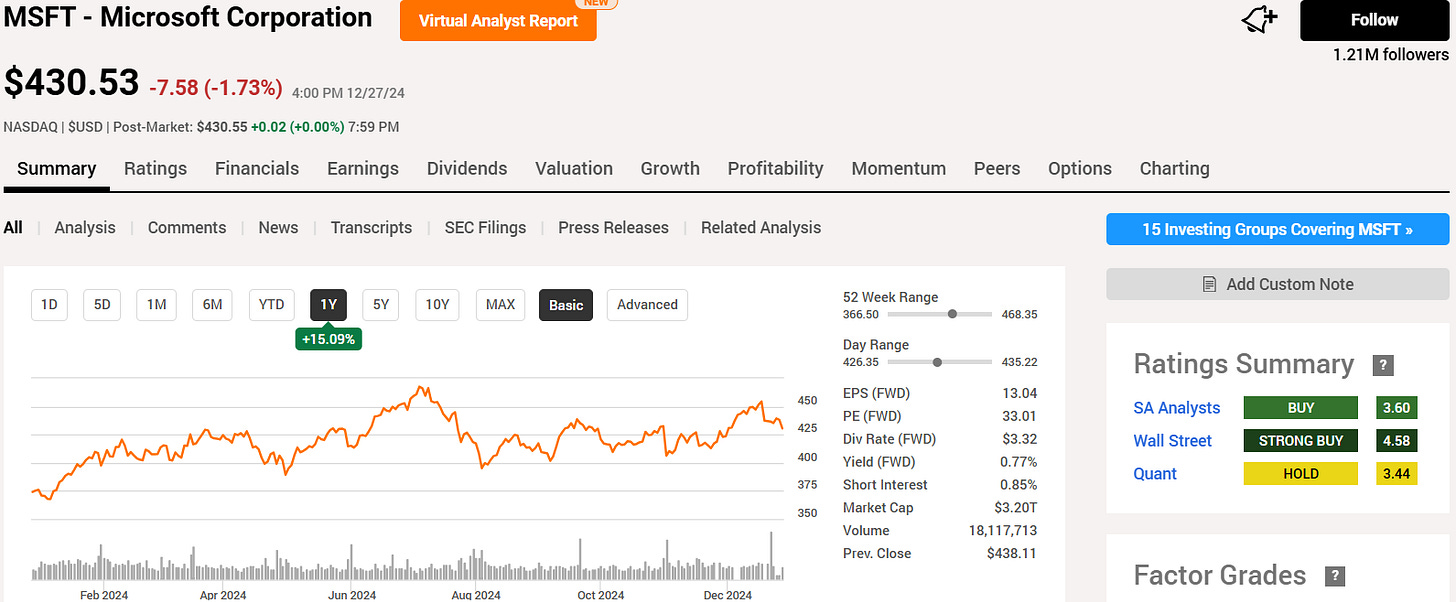

Seeking Alpha

They are one of the main stock analysis websites I use in my videos and you can get a discount below.

Patreon

Join our community in the Patreon where we discuss weekly buy and sells.

Snowball Portfolio Tracker

Snowball is a great portfolio tracker which allows you to have all of your investments in one place, with a ton of amazing features.

You can also get a 14-day free trial to check it out and right now they have an incredible 30% off discount:

Conclusion

We have just gone through 2 AI stocks to consider.

However as always do your own due diligence and let us know your thoughts about today’s newsletter in the comments.

I hope you all have a great week ahead!

Thanks For Reading!

If you’d like to support this work feel free to buy me a coffee. The proceeds will contribute to the running costs of the newsletter.

Join the community of investors - subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today’s newsletter helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Note:

I am not a financial advisor or licensed professional. Nothing I say or produce anywhere, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk.