2 Buy Now AI Stocks

+ FREE DIVIDEND KINGS SPREADSHEET

Market Update

Newly announced tariffs and persistent inflation concerns are fueling market volatility as the first quarter draws to a close, with the S&P 500 experiencing a decline of 3% this week.

A 25% tariff on all non-U.S. made autos was revealed, foreshadowing a larger set of reciprocal tariffs scheduled to begin on April 2.

On a more granular level, some stocks were in the red quite significantly.

Biggest losers included:

Super Micro (SMCI) down 19%

Broadcom (AVGO) down 12%

Nvidia (NVDA) down 7%

Nike (NKE) down 7%

Oracle (ORCL) down 7%

PayPal (PYPL) down 7%

Micron (MU) down 7%

Alphabet (GOOGL) down 6%

Palantir (PLTR) down 6%

Notable News

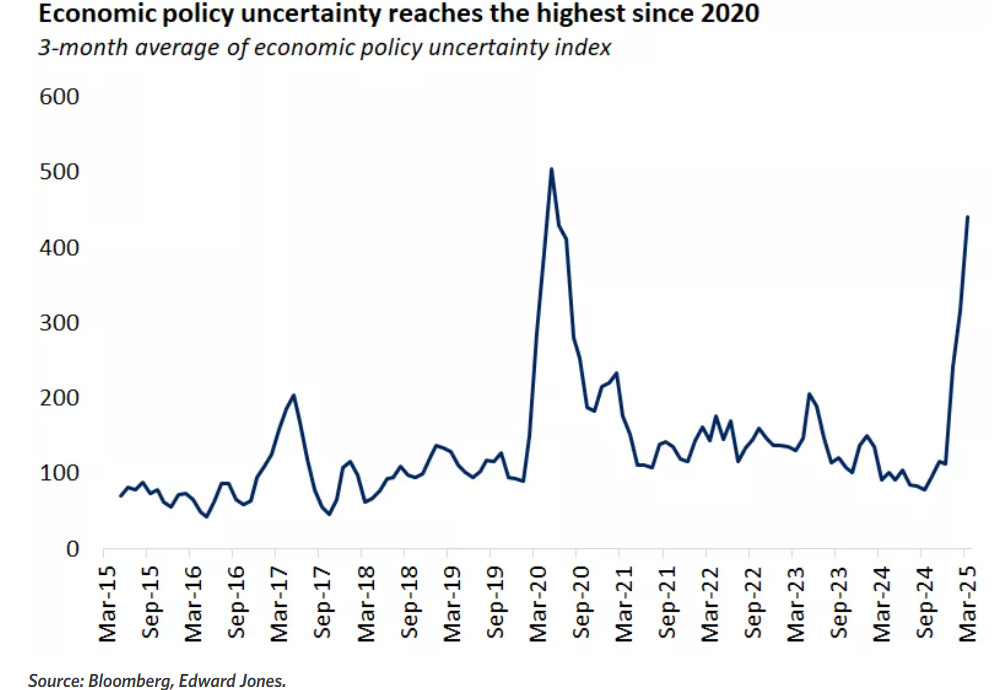

Economic Policy Uncertainty

As the old saying goes, uncertainty is the bane of markets, and currently, there's an abundance of it.

The Economic Policy Uncertainty Index, which monitors the frequency of "economic uncertainty" mentions in financial articles and evaluates disparities in economic predictions, has soared to levels unseen since the pandemic's onset.

Against this backdrop, it's hardly shocking that investors are struggling to gauge the effects of constantly shifting trade news.

The announcement slated for April 2 should shed some light on the administration's strategy, offering a degree of clarity and openness, though it might not address every concern investors have.

In reaction to the mutual tariffs, certain nations might opt for retaliation, whereas others could pursue negotiations, a scenario that might unfold over months.

Nevertheless, progress in the second quarter could dispel some of the haze and conjecture surrounding tariffs.

Rising Profits

Instead of fixating on fleeting headlines, investors can turn their attention to the certainties: The core factors influencing market performance continue to be more beneficial than detrimental.

Corporate earnings are on the upswing, a trend that typically doesn’t signal an impending recession.

Although S&P 500 earnings projections for the year have been adjusted downward in recent months, they still indicate growth exceeding 10%, outpacing the long-term historical average of 6%–7%.

Earnings This Week

Join 86,000+ investors on YouTube! 🎥

We dive deeper into earnings (and more) on our channel. Don't miss out—click below to watch now!👇

YouTube Channel 🔔

Click here to subscribe and stay updated!

Fear & Greed Index

Dividend King Spreadsheet

See below for a free spreadsheet looking at all Dividend Kings (50Y+ of consecutively increasing the dividend) including:

✅ Dividend Yield 📊

✅ Valuation Insights 📉

✅ Dividend Safety Scores 🔥

2 AI Stocks

Let us dive into these 2 Stocks:

I have used the following criteria to help identify these cheap stocks:

Margin of Safety 20%+

Upside 40%+

ROIC 10%+

Net Debt to EBITDA <2

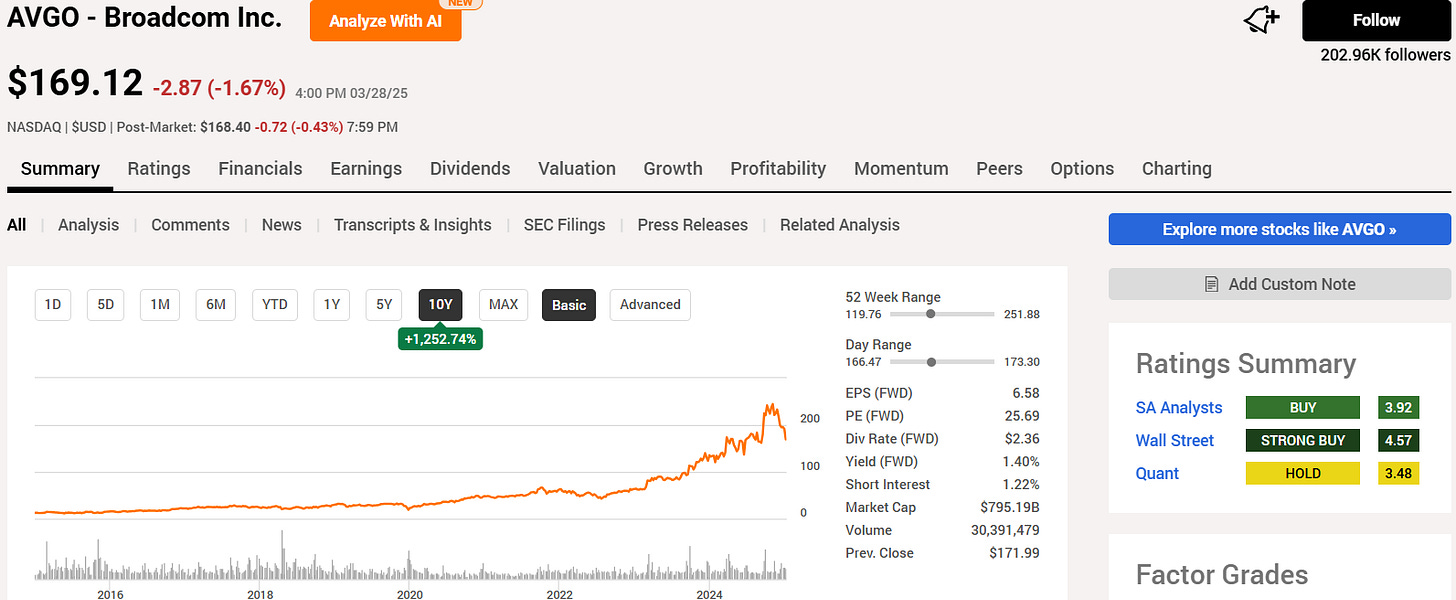

Broadcom (AVGO)

Broadcom is a global technology company that designs, develops, and supplies a wide range of semiconductor and infrastructure software solutions.

Its products are used in various industries, including data centers, networking, telecommunications, and consumer electronics.

The company is known for its expertise in creating chips for wireless communication, storage, and broadband applications.

Broadcom also provides software for managing enterprise systems and cybersecurity.

Broadcom’s income streams are:

Semiconductor Solutions: Revenue from designing and selling chips for data centers, networking, telecommunications, wireless communication, storage, and consumer electronics.

Infrastructure Software: Income from enterprise software products, including cybersecurity, mainframe, and data center virtualization solutions, boosted by the VMware acquisition.

Broadband and Connectivity: Earnings from chips enabling broadband access, Wi-Fi, Bluetooth, and mobile device connectivity.

AI and Networking: Growing revenue from AI-specific semiconductor products and Ethernet networking solutions for hyperscalers and enterprises.

They have also outperformed in all of their last 4 quarters (vs analyst expectations), and expect double-digit growth in the next 4 quarters.

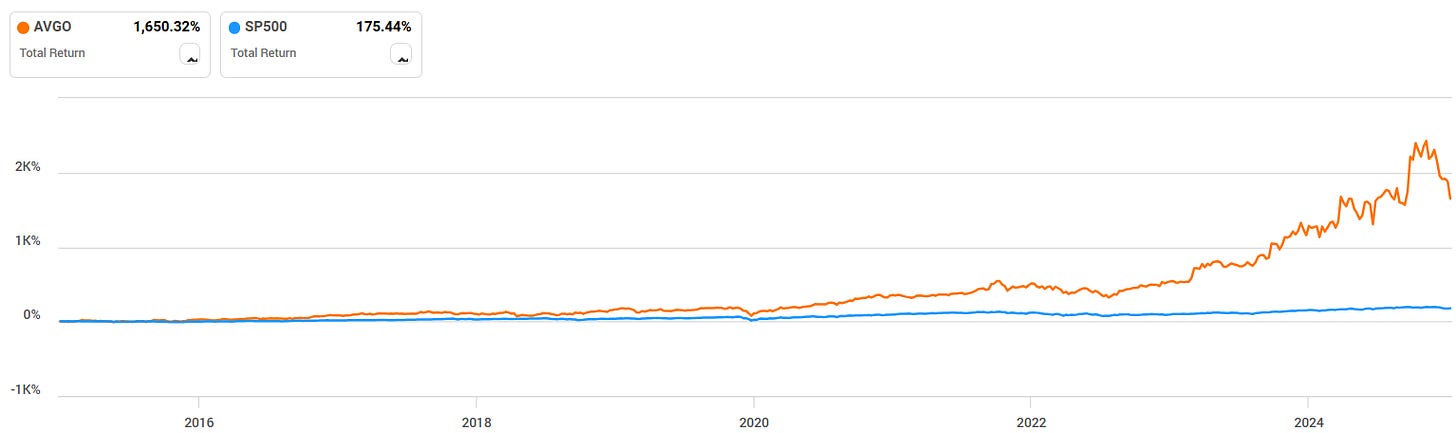

They have massively outperformed against the S&P 500 over the last 10Y.

We get a potential overvaluation signal solely based on Forward P/E being higher than the 5Y (24.6x v 17x) and the Dividend Yield being lower than the 5Y (1.40% v 2.89%) however we don’t look at these in pure isolation and will run it through our own DCF model below.

ROIC has been a little inconsistent, however on a trailing twelve-month it sits at 14% which is above the minimum 12% we want to see for this industry.

Margins whilst inconsistent do look very strong and well above the minimum we want to see.

They also have a strong balance sheet as Net Debt to EBITDA sits at 1.64 as per the latest quarter.

Remember this is the number of years it would take them to pay off all of their debt, net of cash on hand.

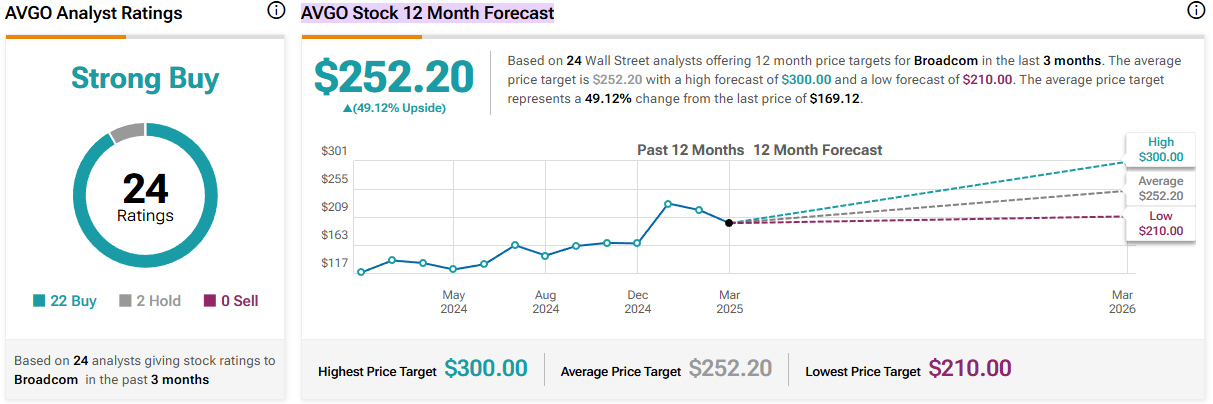

As per below, Wall Street see 49% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $223:

So, in conclusion for AVGO, we see around a 25% margin of safety around the $167 mark with Wall Street indicating 49% upside.

Micron Technology (MU)

Micron is a leading semiconductor company specializing in memory and storage solutions, including DRAM, NAND, and NOR flash.

Their products power everything from data centers and AI applications to consumer electronics and automotive systems.

Micron competes with companies like Samsung and SK Hynix in the global memory market.

They focus on innovation in high-performance, energy-efficient memory for emerging technologies like AI, 5G, and autonomous vehicles.

Micron Technology's income streams include:

DRAM (Dynamic Random-Access Memory) – Used in data centers, PCs, smartphones, and AI applications.

NAND Flash Memory – Essential for SSDs, mobile storage, and cloud computing.

NOR Flash Memory – Used in automotive, industrial, and embedded applications.

Enterprise & Data Center Solutions – Memory and storage products for AI, cloud computing, and hyperscale infrastructure.

Automotive & Industrial Solutions – Memory solutions for autonomous vehicles, infotainment systems, and industrial IoT.

Consumer Electronics – Memory chips for smartphones, laptops, and gaming devices.

Licensing & IP Revenue – Earnings from patents and technology licensing agreements.

They have also outperformed in all of their last 4 quarters (vs analyst expectations), and expect at least double-digit growth in the next 4 quarters.

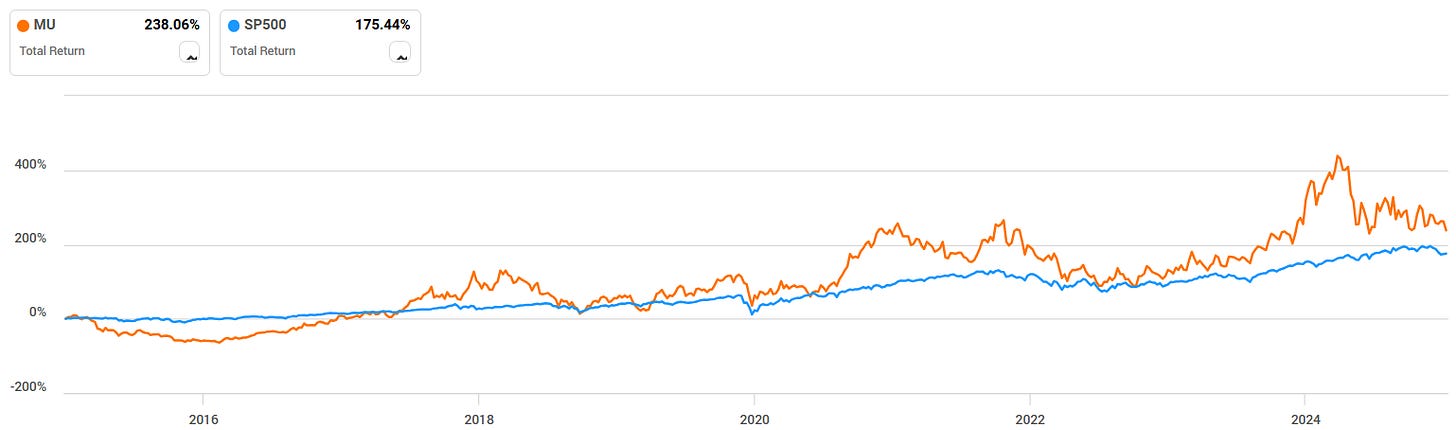

They have outperformed against the S&P 500 over the last 10Y.

We get an undervaluation signal as the current Forward P/E of 10.3x sits below the 5Y average of 12.4x.

ROIC is inconsistent, however it is 10% on a trailing twelve-month basis.

They also have a very strong balance sheet as Net Debt to EBITDA sits at 0.47.

As per below, Wall Street see 47% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $124:

So, in conclusion for MU, we see around a 30% margin of safety around the $87 mark with Wall Street indicating 47% upside.

Stock Resources

Stock Valuation Model 📊 (Unlock my stock valuation model as seen on YouTube)

Seeking Alpha 💵 ($30 off stock research tools I use daily.)

TipRanks 📈 (50% off expert stock research tools)

YouTube 🎥 (Join 85,000+ investors on YouTube!)

Patreon 👥 (Join my community for exclusive content)

Thanks For Reading!

☕ Buy Me A Coffee – Your support helps cover the costs of running the newsletter.

📬 Join the community – Subscribe now to get weekly investment insights delivered straight to your inbox.

💬 Found this helpful? Share it with friends and colleagues! Your support keeps this newsletter FREE.

I hope you all have a great week ahead! 🌟

Dividend Talks💰

Note:

I’m not a financial advisor. All content is for educational purposes only. Invest and trade at your own risk—I'm not responsible for any financial outcomes.