2 Cheap Dividend Stocks!

+ Market Update

Market Latest

Although we closed at 5,995, last week was a historical moment in the S&P 500 as we saw it break through to 6,000 for the first time ever!

The S&P 500 was also up 5% in what was the best week of 2024 and in fact the best performance in more than one year.

Although we can see that the majority of stocks had a phenomenal week, this did not apply to every single one.

Biggest losers last week included:

Moderna (MRNA) down 15%

Dollar Tree (DLTR) down 8%

Dollar General (DG) down 6%

Archer-Midlands-Daniel (ADM) down 5%

Pfizer (PFE) down 5%

General Mills (GIS) down 4%

Walgreens (WBA) down 4%

and others.

Notable News

US Presidential Election

Probably the biggest news of the week came in the US election as Donald Trump was voted in for a second term as president.

Whether or not this was the choice you wanted, the market clearly seemed to love this as it shot to record highs.

This political shift caused optimism among investors, especially those favoring sectors like energy and defense, which are seen as potentially benefiting from Trump’s policies.

There is now an increased confidence in corporate tax cuts and deregulation which has helped the markets strong performance this week.

Interest Rate Cuts

We saw 25bps cuts in the interest rate in both US and UK:

Why is this bullish?

Primarily, lower interest rates reduce borrowing costs for both consumers and businesses, potentially increasing spending and investment.

This, in turn, can stimulate economic growth, which is typically positive for stock markets.

Investors often shift more money into stocks rather than bonds in a lower-rate environment since bond yields decrease, making stocks relatively more attractive

However, rate cuts can signal deeper concerns about economic growth or inflation, it can also introduce caution among investors who worry about potential economic slowdown risks.

Earnings This Week

Whilst the majority of the more glamourous names have already reported, earnings season still continues with Companies such as Home Depot (HD), Disney (DIS) and Cisco (CSCO) reporting this week.

As always, we will cover this on our YouTube channel, and for those that aren’t subscribed, we would love to have you in our community which is over 57,000:

Fear and Greed Index

What a difference one week makes to the overall market sentiment!

Last week we sat in Fear (score of 44) and now we are in Greed.

Do remember as quickly as things can go positive, they can go as quickly negative.

2 Cheap Dividend Stocks

Let us dive into the 2 Cheap Dividend Stocks.

I have used the following criteria to help identify these stocks:

Dividend Safety 60+ (Safe)

ROIC > 10%

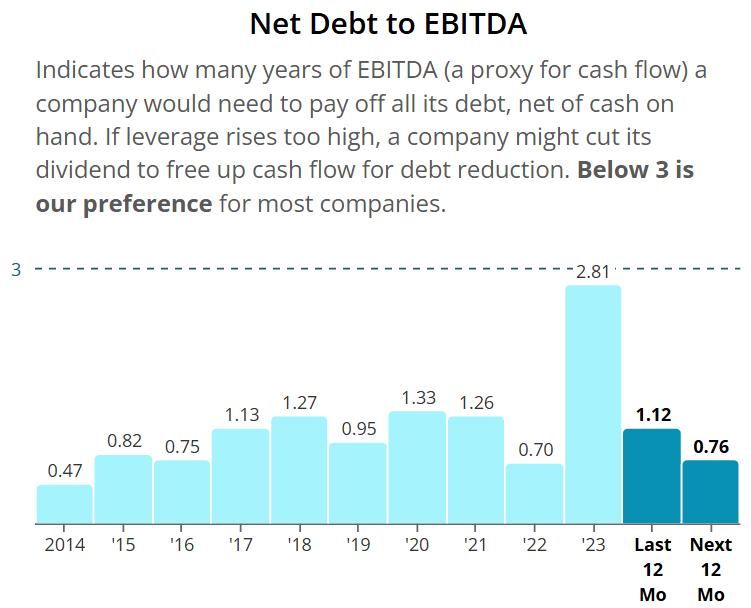

Net Debt to EBITDA below 3 (Strong Balance Sheet)

Upside > 20%

Merck & Co. (MRK)

Merck & Co. is a global healthcare company founded in 1891, focuses on developing innovative treatments and vaccines for a variety of diseases.

The company operates primarily in two segments: Pharmaceuticals and Animal Health.

Pharmaceuticals: Merck is widely recognized for its research and development in areas such as oncology, vaccines, infectious diseases, and cardiovascular health. Its products include well-known drugs like Keytruda (for cancer), Gardasil (an HPV vaccine), and Januvia (for diabetes). Keytruda, in particular, has become one of Merck's most successful products, known for its effectiveness in treating multiple cancer types by enhancing the body's immune response.

Animal Health: This segment offers products and services to prevent and treat diseases in livestock, pets, and aquatic animals. Merck provides vaccines, antibiotics, and other health solutions for animals, supporting the veterinary industry and livestock production globally.

Merck is also heavily involved in vaccine development and has made notable advancements in immunology and infectious disease treatment. The company prioritizes innovation, investing in research to address unmet medical needs and improve global health outcomes.

Over the last 10Y MRK has slightly underperformed the S&P 500.

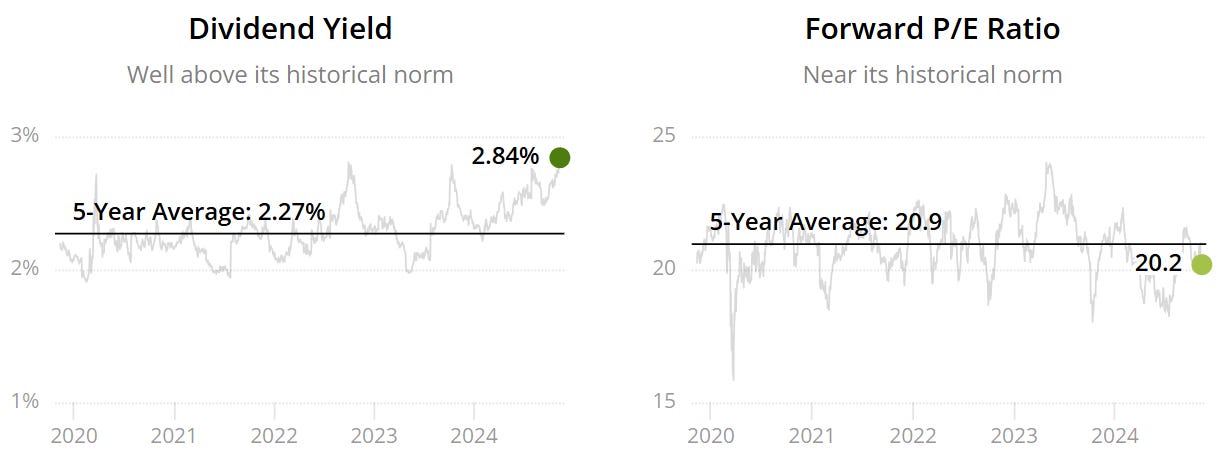

As per below, we get a double undervaluation signal as the current yield is marginally higher than the 5Y average (2.99% v 2.96%) and the Forward P/E is lower than the 5Y (11.4x v 13.8x).

Dividend Safety score of 90 indicates safety.

ROIC below is good to note.

Extremely impressive and gives us faith that management are able to effectively allocate their capital.

Net Debt to EBITDA is 1.12 on a trailing twelve-month basis which is significantly lower than the 3 maximum we want to see.

Remember numbers below show us the number of years it would take management to pay off all of their debt net of cash on hand.

Good balance sheet.

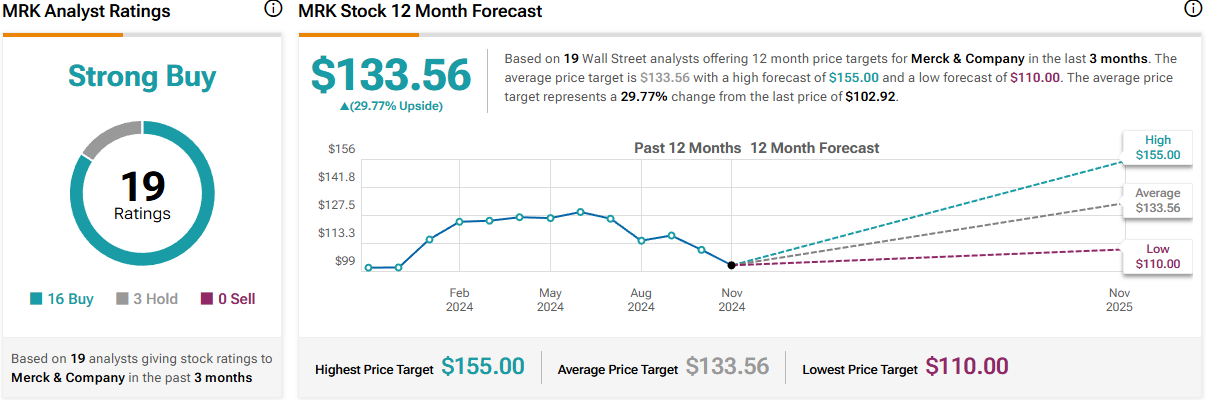

As per below, Wall Street see 30% upside over the next 12 months.

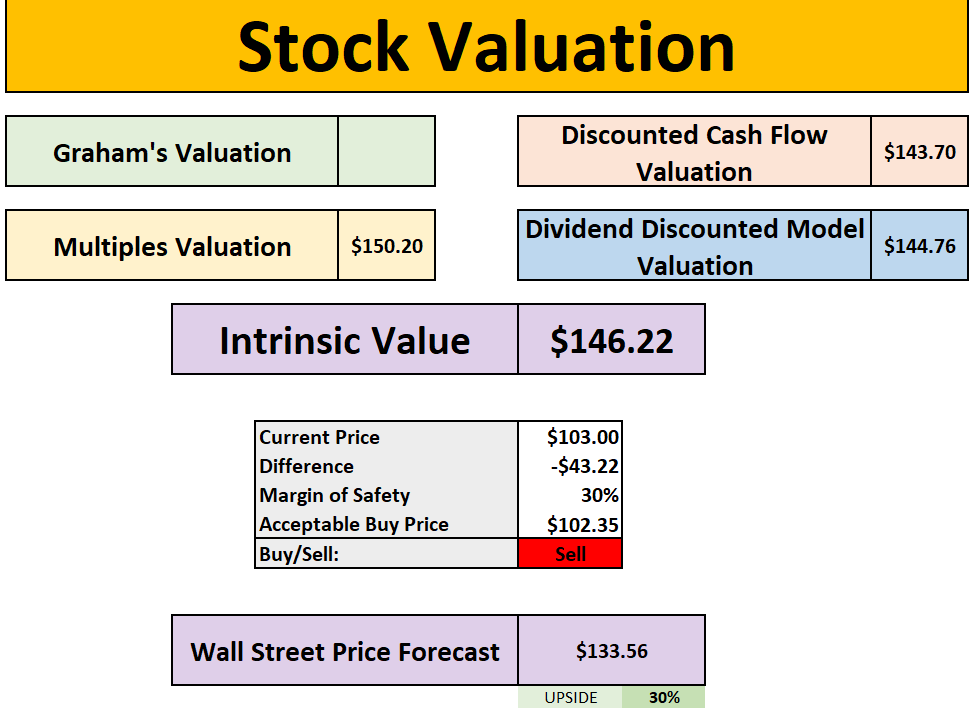

When we last ran it through our valuation model our intrinsic value came to $146

So, in conclusion for MRK, we see around a 30% margin of safety around the $102 mark with Wall Street indicating 30% upside.

Mondelez (MDLZ)

Mondelez International, headquartered in Chicago, Illinois, is a global snack food and beverage company that produces well-known brands across categories like biscuits, chocolates, gum, candy, and powdered beverages.

Founded in 2012 after a spin-off from Kraft Foods, Mondelez operates in over 150 countries and is known for popular brands including Oreo, Cadbury, Toblerone, Ritz, Trident, and belVita.

Key Areas of Mondelez's Business:

Biscuits: Mondelez is one of the world's largest biscuit manufacturers, with Oreo and Chips Ahoy! among its top brands. These products are sold globally and represent a significant portion of the company's sales.

Chocolate and Confectionery: Mondelez owns iconic chocolate brands such as Cadbury, Toblerone, and Milka, positioning it as a leader in the chocolate market, especially in Europe and Asia.

Gum and Candy: The company also produces gum and candy, including Trident gum and Halls cough drops, catering to diverse consumer tastes and preferences worldwide.

Beverages: Mondelez sells powdered beverages like Tang and various other drink mixes, particularly in emerging markets where these products are widely popular.

The company focuses on snacking trends, sustainable sourcing, and health-conscious options, reflecting growing consumer interest in healthier and responsibly produced food options.

Over the last 10Y MDLZ has underperformed the S&P 500.

As per below, we get a double undervaluation signal as the current yield is higher than the 5Y average (2.84% v 2.27%) and the Forward P/E is lower than the 5Y (20.2x v 20.9x).

Dividend Safety score of 66 indicates safety.

Dividend growth in the more recent period has been very attractive at 11% year on year over the last 5Y.

ROIC is around the minimum levels we want to see.

Net Debt to EBITDA has been decreasing over time which is a good sign, and on a TTM it sits at 2.19 which is far lower than the 4 for the consumer staples industry.

As per below, Wall Street see 22% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $81

So, in conclusion for MDLZ, we see around a 20% margin of safety around the $65 mark with Wall Street indicating 22% upside.

Stock Resources

Stock Valuation Model

If you are interested in valuing stocks yourself, we have created a valuation model below which you can pick up, this is the same version we use in our YouTube analysis:

Seeking Alpha

Seeking Alpha, one of the websites that I use when I review stocks on YouTube has a $30 off discount for your first year. This also includes a 7-day free trial for new users too!

Patreon

Join our community in the Patreon where we discuss weekly buy and sells.

Conclusion

We have just gone through 2 Cheap Dividend Stocks.

However as always do your own due diligence and let us know your thoughts about today’s newsletter in the comments.

I hope you all have a great week ahead!

Thanks For Reading!

If you’d like to support this work feel free to buy me a coffee. The proceeds will contribute to the running costs of the newsletter.

Join the community of investors - subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today’s newsletter helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Note

I am not a financial advisor or licensed professional. Nothing I say or produce anywhere, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk.