2 Cheap Stocks To Buy This Month

+ Market Update

Market Latest

Although 2024 ended on a subdued note, it was an exceptional year for investors.

The S&P 500 reached 57 record highs and delivered its second straight year of 20%-plus gains, a feat last achieved in 1998.

Mega-cap tech stocks led the charge, but gains were broad-based across sectors, styles, and market caps.

With 2024’s impressive performance now behind us, it’s only natural for investors to wonder if the momentum can persist.

Last week, and the beginning of 2025 saw the majority of stocks down in the red as shown above:

Biggest losers included:

Tesla (TSLA) down 10%

Apple (AAPL) down 6%

Broadcom (AVGO) down 5%

Netflix (NFLX) down 5%

Adobe (ADBE) down 4%

and many others.

Notable News

US Growth Slowdown

Contrary to predictions of a more pronounced slowdown, the U.S. economy is estimated to have grown at a 2.7% pace in 2024 (including Q4 projections). This marks only a slight decline from 2023's 2.9% growth rate and remains above the estimated long-term average of roughly 2%.

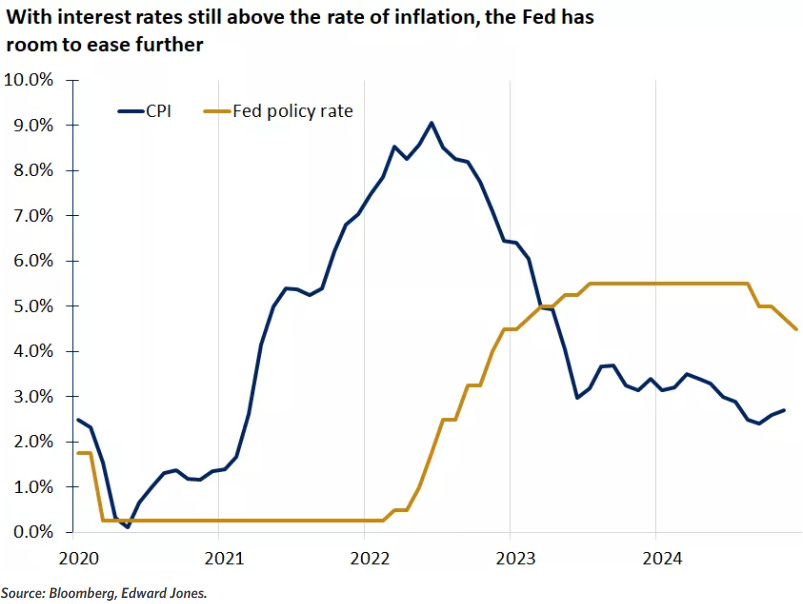

Interest Rate Cuts

The Fed’s 0.25% rate cut in December, along with updated projections, raised expectations for higher interest rates, as policymakers now anticipate fewer cuts in 2025.

With the economy performing well and uncertainty lingering over the pace of inflation’s return to target, the Fed remains cautious about lowering rates further.

Bull Market Again?

Overall, fundamentals remain strong, indicating that investors can take advantage of any volatility that arises.

Historically, bull markets tend to end due to a recession, Fed rate hikes, or an external shock.

While the latter is difficult to predict, there are no clear signs of an economic downturn or a return to Fed tightening in the near future.

Earnings This Week

Earnings season for 2025 has kicked off:

We would love to have you in our community which is over 70,000 on YouTube where we cover in depth analysis of undervalued quality stocks and their earnings:

Fear and Greed Index

At the beginning of 2025, investor sentiment is steeped in fear, driven by lingering economic uncertainties and concerns over interest rates.

Market volatility and cautious earnings outlooks have further eroded confidence, prompting many to adopt defensive investment strategies.

2 Cheap Stocks

I have used the following criteria to help identify these stocks:

Dividend Safety 60+ (Safe)

ROIC > 10%

Net Debt to EBITDA below 3 (Strong Balance Sheet)

Upside > 20%

PepsiCo (PEP)

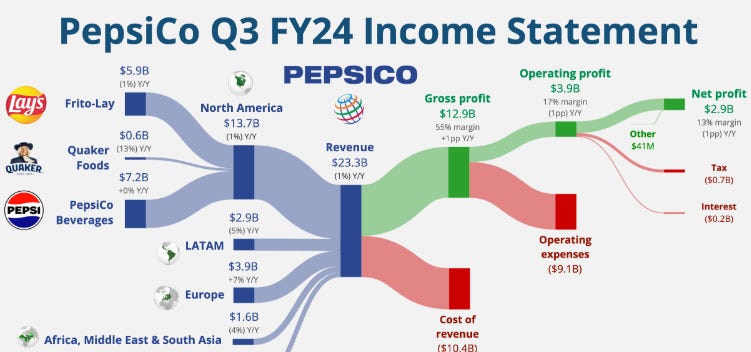

PepsiCo is a global food and beverage company known for brands like Pepsi, Mountain Dew, Gatorade, Lay's, Tropicana, and Quaker.

It operates in over 200 countries, offering a wide range of snacks, beverages, and nutrition products.

PepsiCo generates income from two main segments: beverages and snacks.

The beverage segment includes products like Pepsi, Mountain Dew, Gatorade, and Tropicana, while the snacks segment covers brands such as Lay's, Doritos, Cheetos, and Quaker products.

Additionally, PepsiCo earns revenue through sales in both developed and emerging markets, with a mix of direct-to-consumer and retail distribution channels.

Beverages: Pepsi, Mountain Dew, Gatorade, Tropicana, 7UP, and other soft drinks.

Snacks: Lay's, Doritos, Cheetos, Fritos, and Quaker products (such as oatmeal and granola bars).

Nutrition products: Including Quaker Oats and other health-focused foods.

Convenience foods: Such as baked goods and packaged meals.

Retail and direct-to-consumer sales: Through supermarkets, convenience stores, vending machines, and online platforms.

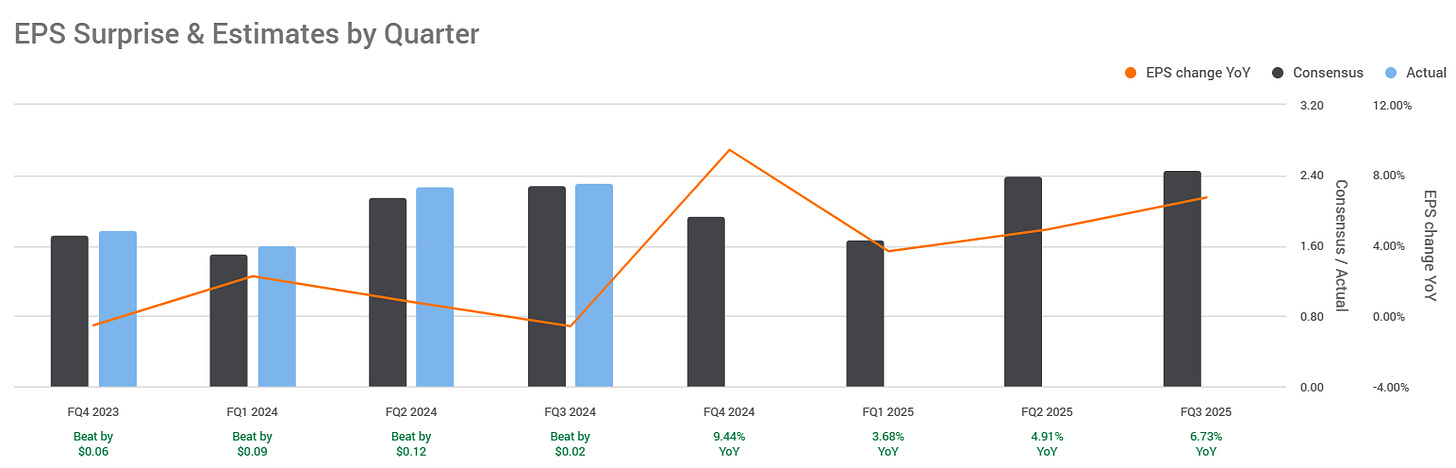

They have outperformed in the last 4 quarters (all beats vs analyst expectations) and anticipate growth against the year-on-year EPS comparative.

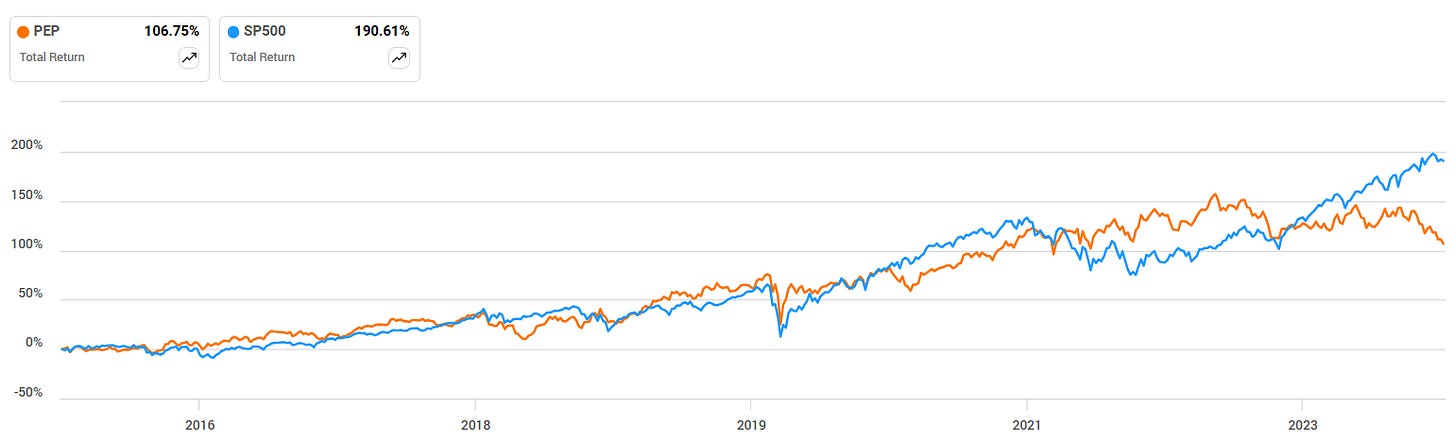

They have underperformed against the S&P 500 over the last 10Y, however, they currently trade at their 52 week low with all 3 analysts considering this a buy.

We currently get a double undervaluation signal with both yield above the 5Y average (3.62% v 2.85%) and the forward P/E below the 5Y average (17.6x v 24x).

Dividend safety looks good, with a score of 93.

They are also a Dividend King with 50+ years of consecutively increasing the dividend.

Dividend growth is also attractive.

No issues with ROIC as it sits consistently around 19-20% YoY.

Balance sheet also looks good with Net Debt to EBITDA sitting at 1.95 on a trailing twelve-month basis.

As per below, Wall Street see 24% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $173:

So, in conclusion for PEP, we see around a 15% margin of safety around the $147 mark with Wall Street indicating 24% upside.

Merck & Co (MRK)

Merck & Co. is a global pharmaceutical company that develops, manufactures, and markets a wide range of medications, vaccines, and animal health products.

It is known for its contributions to oncology, immunology, infectious diseases, and other therapeutic areas.

Their income streams are as follows:

Pharmaceuticals: Revenue from prescription medications, including oncology treatments (Keytruda), vaccines (Gardasil), and other therapeutic areas.

Animal Health: Sales of veterinary products for livestock and pets.

Research and Development: Income from collaborations, licensing agreements, and partnerships in drug development.

They have outperformed/in-line in the last 4 quarters (vs analyst expectations) and anticipate growth against the year-on-year EPS comparative.

They have underperformed against the S&P 500 over the last 10Y, however they currently trade at their 52 week low.

We currently get a double undervaluation signal with both yield above the 5Y average (3.27% v 2.99%) and the forward P/E below the 5Y average (11x v 13.6x).

Dividend safety looks good, with a score of 90.

ROIC looking very good at 23% on a trailing twelve-month.

1.13 for the Net Debt to EBITDA looking good based on the trailing twelve-month.

As per below, Wall Street see 29% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $126:

So, in conclusion for MRK, we see around a 20% margin of safety around the $100 mark with Wall Street indicating 29% upside.

Stock Resources

Stock Valuation Model

If you are interested in valuing stocks yourself, we have created a valuation model below which you can pick up, this is the same version we use in our YouTube analysis:

Seeking Alpha

They are one of the main stock analysis websites I use in my videos and you can get $30 OFF discount below.

Patreon

Join our community in the Patreon where we discuss weekly buy and sells.

Snowball Portfolio Tracker

Snowball is a great portfolio tracker which allows you to have all of your investments in one place, with a ton of amazing features.

You can also get a 14-day free trial to check it out.

Conclusion

We have just gone through 2 cheap stocks to consider.

However as always do your own due diligence and let us know your thoughts about today’s newsletter in the comments.

I hope you all have a great week ahead!

Thanks For Reading!

If you’d like to support this work feel free to buy me a coffee. The proceeds will contribute to the running costs of the newsletter.

Join the community of investors - subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today’s newsletter helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Note:

I am not a financial advisor or licensed professional. Nothing I say or produce anywhere, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk.

The paid subscription includs the stock valuation model?