2 Cheap Stocks Under The Radar

+ Market Update (Inflated?)

Market Latest

The S&P 500 is over the 6,000 mark once again!

Whilst the market is near all time highs, we do note some stocks that were down over the last week.

Biggest losers last week included:

Dell (DELL) down 8%

Nvidia (NVDA) down 6%

Intuit (INTU) down 5%

Micron (MU) down 5%

Oracle (ORCL) down 4%

and others.

Notable News

2024 - Hall of Fame

2024 is on course to be one of the best years over the last 24 in terms of S&P 500 Index performance.

S&P 500 Overvalued?

The S&P 500 P/E on a TTM (trailing twelve-month basis) currently sits at 30.69x, the modern era average is 20.4x.

Does this matter?

P/E ratios have a natural limit. For the U.S. stock market to sustain a P/E ratio consistently above its historical average over an extended period, it would not only need to maintain growth but also achieve an ever-accelerating rate of growth.

Earnings This Week

As we mentioned last week, earnings season is drawing to a close, although we do note some interesting companies reporting next week:

As always, we will cover this on our YouTube channel, and for those that aren’t subscribed, we would love to have you in our community which is over 61,000:

Fear and Greed Index

We are slowly moving further into Greed with a score of 66 (last week we sat at 61).

What is the CNN Business Fear & Greed Index?

The Fear & Greed Index is a way to gauge stock market movements and whether stocks are fairly priced. The theory is based on the logic that excessive fear tends to drive down share prices, and too much greed tends to have the opposite effect.

2 Cheap Stocks Under The Radar

Let’s dive into 2 stocks that have gone under the radar that look like they have a nice margin of safety and upside:

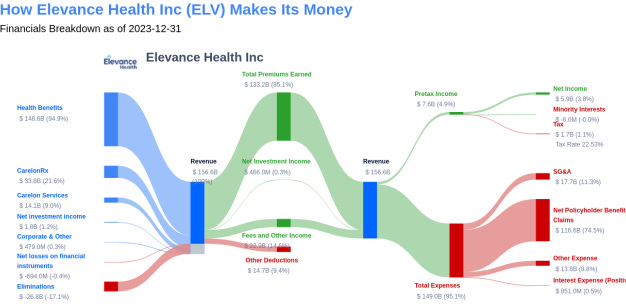

Elevance Health (ELV)

Elevance Health is a leading health benefits provider that offers medical, pharmaceutical, and healthcare services to improve individual and community health.

Elevance Health's income streams primarily include:

Health Insurance Premiums: Revenue from selling health insurance plans to individuals, employers, Medicare, and Medicaid beneficiaries.

Pharmacy Benefit Management (PBM): Income from managing prescription drug benefits for clients and members.

Healthcare Services: Earnings from value-added services, such as health management programs, wellness initiatives, and provider network arrangements.

Government Contracts: Revenue from contracts with federal and state programs, especially for Medicaid and Medicare.

Administrative Fees: Fees for managing self-funded insurance plans for employers.

Over the last 10Y ELV has outperformed the S&P 500.

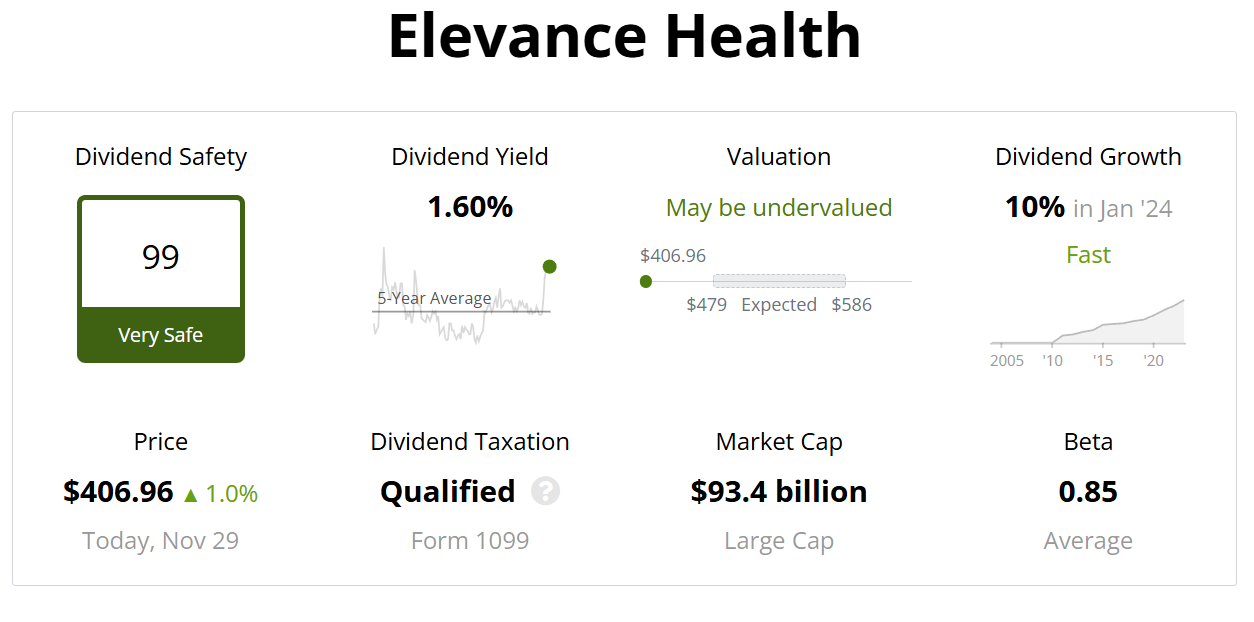

Elevance Health is also trading near its 52-week low.

As per below, we get a double undervaluation signal as the current yield is higher than the 5Y average (1.60% v 1.22%) and the Forward P/E is lower than the 5Y (12.4x v 13.9x).

Dividend safety score of 99 indicates safety.

Love to see double digit dividend growth on a consistent basis.

ROIC below is good to note, currently at 15% on a trailing twelve-month basis.

Gives us faith that management are able to effectively allocate their capital.

We would like to see higher margins; however, these are comparable to others in the same sector.

Net Debt to EBITDA is 0 on a trailing twelve-month basis.

Remember numbers below show us the number of years it would take management to pay off all of their debt net of cash on hand.

Thereby meaning it wouldn’t even take ELV 1 day to pay off all of their debt, net of cash on hand.

Excellent balance sheet.

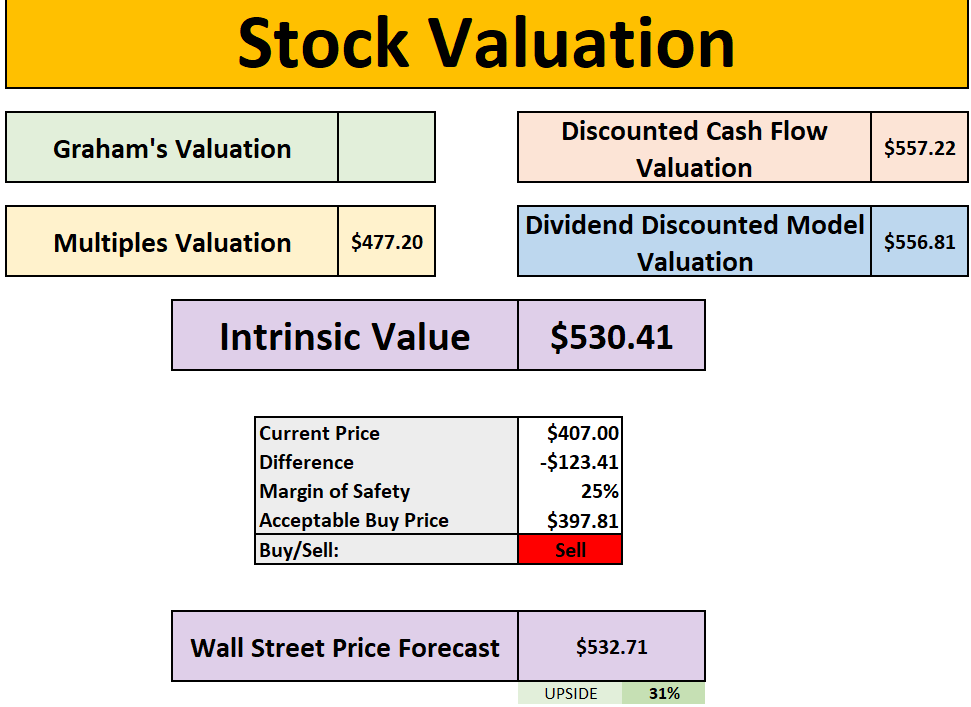

As per below, Wall Street see 31% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $530:

So, in conclusion for ELV, we see around a 25% margin of safety around the $398 mark with Wall Street indicating 31% upside.

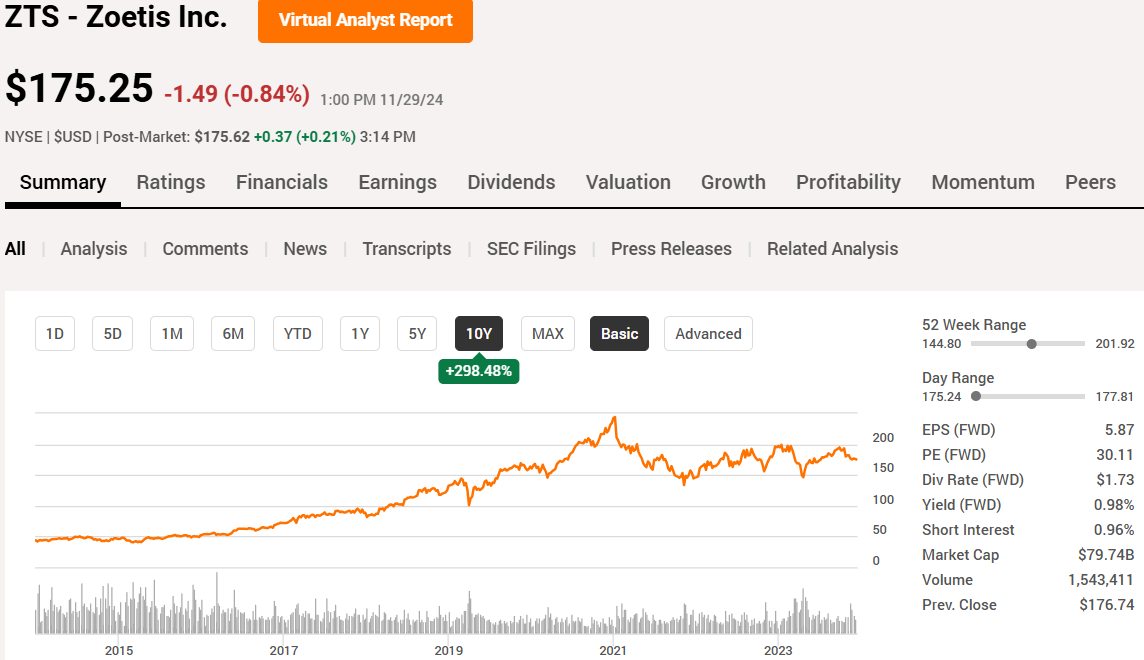

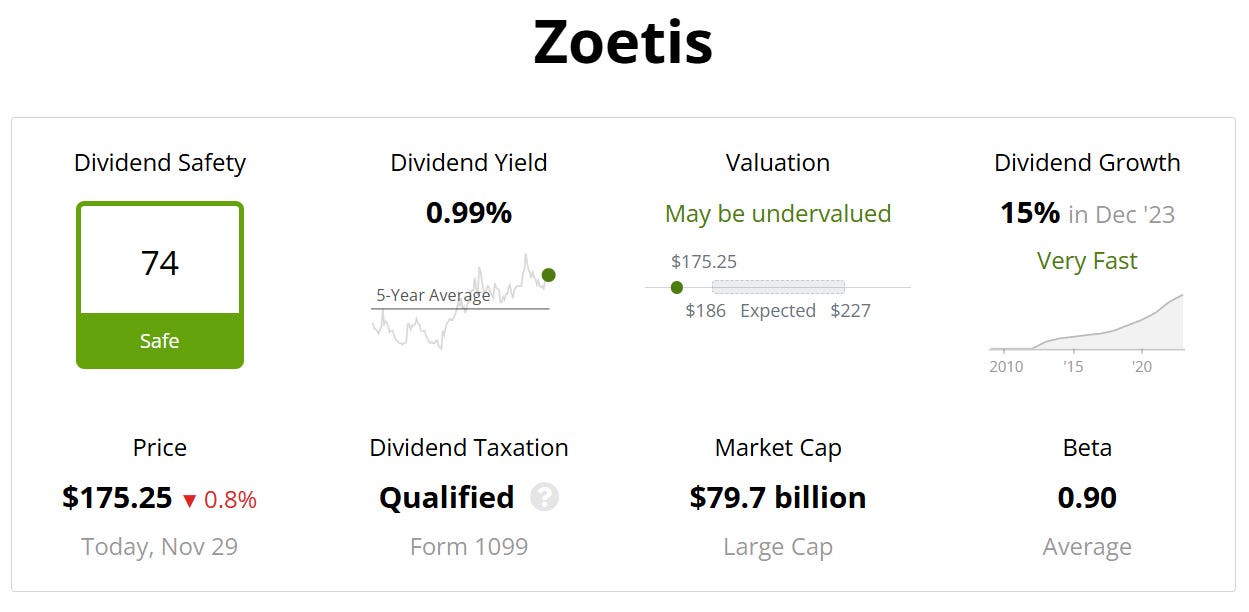

Zoetis (ZTS)

Zoetis is a leading animal health company that develops, manufactures, and markets medicines, vaccines, and diagnostic products for pets and livestock.

Zoetis' income streams primarily include:

Pharmaceuticals: Revenue from medicines for treating and preventing diseases in pets and livestock.

Vaccines: Sales of vaccines for disease prevention in animals.

Diagnostics: Income from diagnostic tools and services for animal health monitoring.

Biodevices: Revenue from veterinary medical devices and digital health solutions.

Genetics: Earnings from animal genetics products and services, particularly for livestock improvement.

Other Services: Income from consulting, training, and other veterinary-related services.

Over the last 10Y ZTS has outperformed the S&P 500.

Zoetis currently trades in the mid-point of the 52-week range.

As per below, we get a double undervaluation signal as the current yield is higher than the 5Y average (0.99% v 0.75%) and the Forward P/E is lower than the 5Y (28.5x v 33.6x).

Dividend safety score of 74 indicates safety.

Again, love to see double digit dividend growth on a consistent basis.

ROIC looks very good and has been increasing over time. Currently at 27% on a trailing twelve-month basis.

Great margins, in fact we note operating efficiencies as the operating margin has been increasing over time, something we see in high quality Companies.

Net Debt to EBITDA has been reducing over time which is a great sign and sits low at 1.38 on a TTM.

As per below, Wall Street see 20% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $226:

So, in conclusion for ZTS, we see around a 25% margin of safety around the $170 mark with Wall Street indicating 21% upside.

Stock Resources

Stock Valuation Model

If you are interested in valuing stocks yourself, we have created a valuation model below which you can pick up, this is the same version we use in our YouTube analysis:

Seeking Alpha

MASSIVE BLACK FRIDAY SALE:

Seeking Alpha (the stock analysis website I use in my videos) have just released a huge price drop:

Seeking Alpha Premium: WAS $299, NOW $209/Year (7-day free trial for new paid subscribers, $90 discount).

Alpha Picks: WAS $499, NOW $359/Year ($140 discount, +170.39% return since July 2022 vs. S&P 500’s +55.20%).

Alpha Picks + Premium Bundle: WAS $798, NOW $509/Year ($289 discount, no free trial included). Take advantage by signing up below:

Patreon

Join our community in the Patreon where we discuss weekly buy and sells.

Snowball Portfolio Tracker

Snowball is a great portfolio tracker which allows you to have all of your investments in one place, with a ton of amazing features.

You can also get a 14-day free trial to check it out:

Conclusion

We have just gone through 2 under the radar stocks with a nice margin of safety and upside over the next 12 months.

However as always do your own due diligence and let us know your thoughts about today’s newsletter in the comments.

I hope you all have a great week ahead!

Thanks For Reading!

If you’d like to support this work feel free to buy me a coffee. The proceeds will contribute to the running costs of the newsletter.

Join the community of investors - subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today’s newsletter helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Note:

I am not a financial advisor or licensed professional. Nothing I say or produce anywhere, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk.