2 Cheap Stocks Under The Radar

+ Market Update

Market Latest

This week, the S&P 500 experienced a 1% increase, closing at 6,114.63.:

The index reached near-record levels during the week, reflecting resilience despite concerns over rising inflation and political uncertainties.

Notably, the Nasdaq rose by 2.6%, while the Dow Jones saw a 0.5% gain over the same period.

The market's performance was influenced by mixed corporate earnings reports and economic data.

This upwards movement indicates investor optimism, though analysts caution about potential overvaluation and the need for the index to break its current pattern to avoid a decline.

On a granular level, we had a very varied week in the market with the continuation of earnings season.

Biggest losers included:

Lululemon (LULU) down 8%

Zoetis ZTS (down 8%)

Humana (HUM) down 7%

Thermo Fischer (TMO) down 7%

Merck & Co (MRK) down 5%

Lockheed Martin (LMT) down 5%

Earnings This Week

Earnings season is still in full swing:

As always, we will cover earnings week on our YouTube channel.

We would love to have you in our community which is near the 80,000 mark on YouTube where we cover in depth analysis of undervalued quality stocks and their earnings:

Fear and Greed Index

Market confidence is starting to pick back up slowly as we enter into Neutral (45) from last week’s Fear (39).

2 Cheap Stocks Under The Radar

Let us dive into these 2 Stocks:

I have used the following criteria to help identify these cheap stocks:

Margin of Safety 15%+

Upside 20%+

Global Payments (GPN)

Global Payments is a financial technology company that provides payment processing solutions for businesses worldwide.

It offers merchant services, point-of-sale systems, digital and mobile payment solutions, and software for various industries.

The company enables secure and efficient transactions for businesses of all sizes.

Global Payments generates revenue through:

Merchant Solutions – Transaction processing fees from businesses for accepting payments (credit, debit, digital wallets).

Issuer Solutions – Services for banks and financial institutions, including card issuing, fraud management, and payment processing.

Business & Consumer Solutions – Subscription-based software, analytics, and value-added financial services for businesses.

Partnerships & Integrations – Revenue from collaborations with financial institutions, fintech companies, and technology providers.

They have outperformed in 2 of their last 4 quarters (vs analyst expectations), however the 2 misses were very marginal by $0.02 and $0.01.

They anticipate mid to high single digit growth against the year-on-year EPS comparative for the next 4 quarters.

They have marginally underperformed against the S&P 500 over the last 10Y.

We have a double undervaluation signal, as yield 0.96% is above the 5Y average of 0.78%, as well as the Forward P/E of 8.4x being below the 5Y 12.1x.

Free cash flow per share has been growing over the last 10Y, in fact rising 3x.

Sales has also more than tripled over the last 10Y.

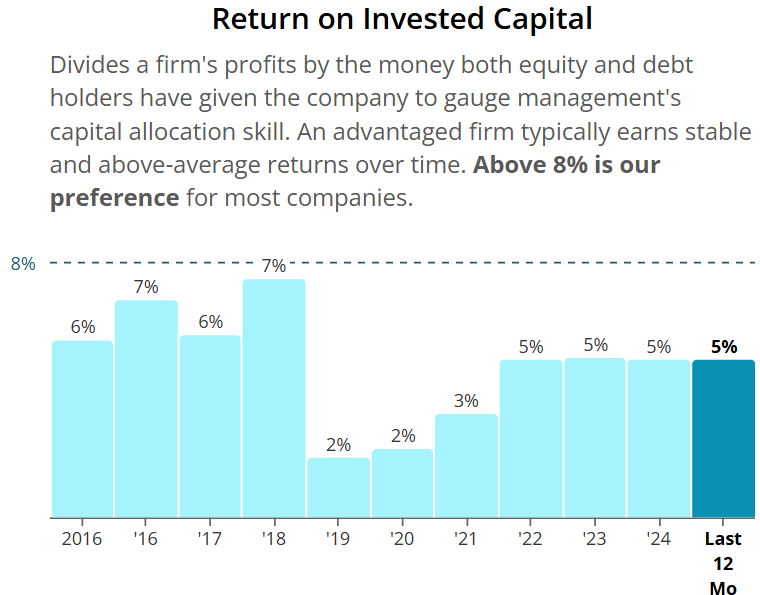

ROIC does leave a little to be desired for, given it is below the 10% we typically like to see.

Margins are looking very strong however a little inconsistent.

Net Debt to EBITDA sits around the maximum we want to see at the 3 level.

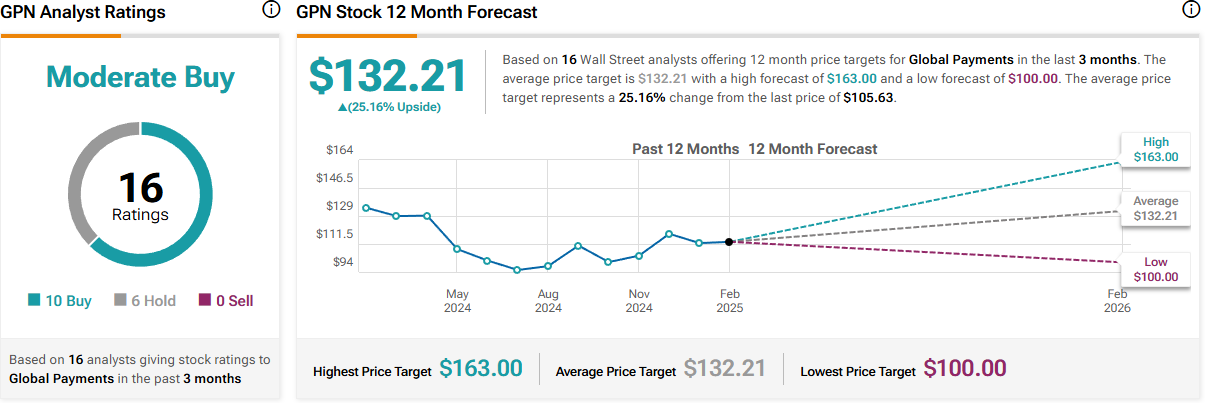

As per below, Wall Street see 25% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $139:

So, in conclusion for GPN, we see around a 25% margin of safety around the $105 mark with Wall Street indicating 25% upside.

AstraZeneca (AZN)

AstraZeneca is a global biopharmaceutical company that researches, develops, and manufactures prescription medicines.

It focuses on treatments for oncology, cardiovascular, respiratory, renal, and rare diseases.

The company generates revenue through drug sales, licensing agreements, and collaborations with other healthcare organizations.

They generate revenue through:

Prescription Drug Sales – Revenue from selling medicines across oncology, cardiovascular, respiratory, renal, and rare diseases.

Collaborations & Licensing – Income from partnerships, co-developments, and licensing agreements with other pharmaceutical companies.

Royalties & Milestone Payments – Earnings from royalties on licensed drugs and milestone payments tied to drug development progress.

Vaccine & Biologics Sales – Revenue from vaccines, antibody therapies, and biologic treatments.

They have outperformed/in-line in their last 4 quarters (vs analyst expectations) and anticipate growth against the year-on-year EPS comparative for the next 4 quarters.

They have outperformed against the S&P 500 over the last 10Y.

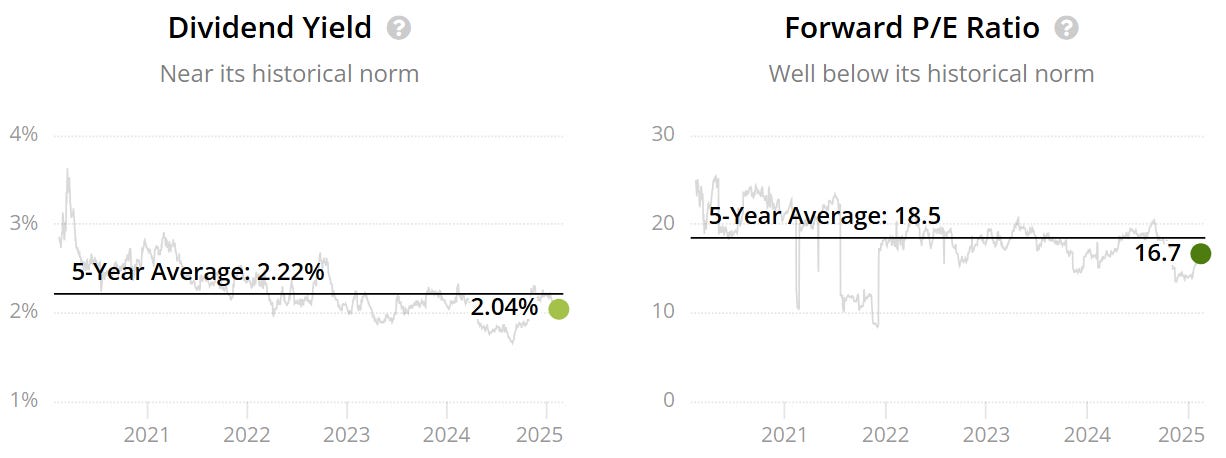

We have a double reasonable signal, as yield 2.04% is near the 5Y average of 2.22%, as well as the Forward P/E of 16.7x being near the 5Y 18.5x.

Free cash flow per share has been growing over the last 10Y, in fact rising over 3x.

Sales has also more than doubled over the last 10Y.

ROIC looks good at 17% and has been increasing from 2021, however we do note some inconsistencies.

Margins are looking very strong however a little inconsistent.

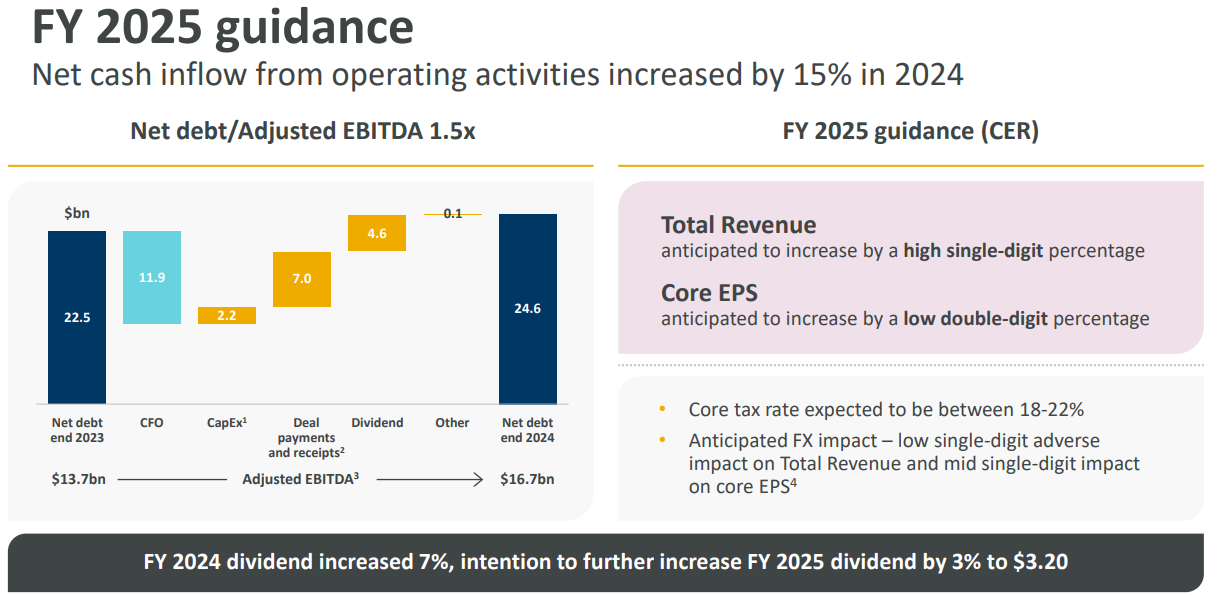

Net Debt to EBITDA looks good at 1.56, significantly lower than the maximum of 3.

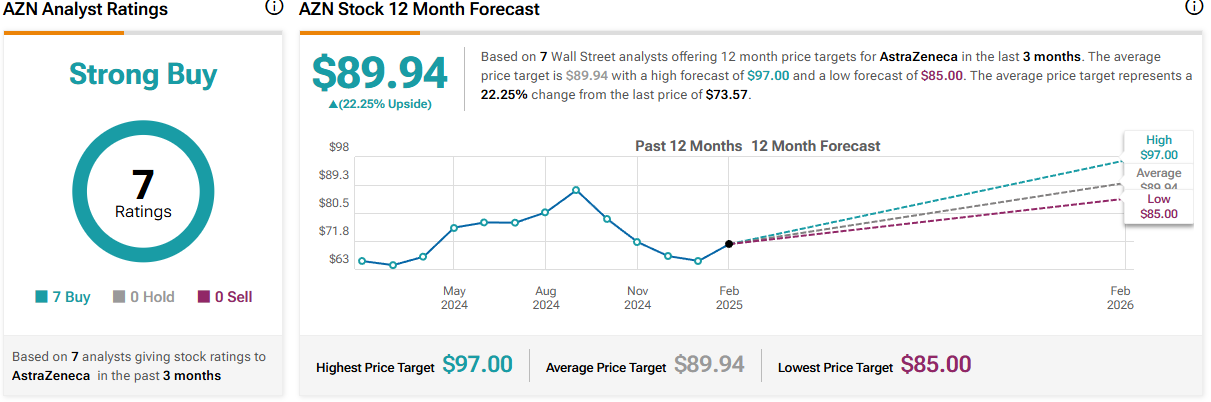

As per below, Wall Street see 22% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $87:

So, in conclusion for AZN, we see around a 15% margin of safety around the $74 mark with Wall Street indicating 22% upside.

Stock Resources

Stock Valuation Model

If you are interested in valuing stocks yourself, we have created a valuation model below which you can pick up, this is the same version we use in our YouTube analysis:

Seeking Alpha

They are one of the main stock analysis websites I use in my videos and you can get $30 OFF discount below.

TipRanks

To find the predicted upside of stocks, I typically use TipRanks, for example, using their system for Micron (MU) we get the below:

They currently have a 50% offer below.

50% OFF TipRanks:

Patreon

Join our community in the Patreon where we discuss weekly buy and sells.

Snowball Portfolio Tracker

Snowball is a great portfolio tracker which allows you to have all of your investments in one place, with a ton of amazing features.

You can also get a 14-day free trial to check it out.

Conclusion

We have just gone through 2 cheap stocks under the radar.

However as always do your own due diligence and let us know your thoughts about today’s newsletter in the comments.

I hope you all have a great week ahead!

Thanks For Reading!

If you’d like to support this work feel free to buy me a coffee. The proceeds will contribute to the running costs of the newsletter.

Join the community of investors - subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today’s newsletter helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Note:

I am not a financial advisor or licensed professional. Nothing I say or produce anywhere, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk.