2 Dirt Cheap Stocks to Buy ASAP

Hidden gems trading below intrinsic value — Wall Street is sleeping, but you shouldn’t be.

Market Update

The S&P 500 ended the week marginally higher, gaining 0.2% as investors weighed steady interest rates, progress on trade talks, and resilient economic data.

Despite ongoing tariff concerns, equities remained supported by solid corporate earnings and a stable labour market.

On a more granular level, we had some strong performers but also some stocks that were down significantly.

Biggest winners included:

Disney (DIS) up 15%

Delta Airlines (DAL) up 9%

Micron (MU) up 6%

Boeing (BA) up 5%

NextEra Energy (NEE) up 5%

Biggest losers included:

Eli Lilly (LLY) down 11%

Merck & Co (MRK) down 9%

Pfizer (PFE) down 8%

Fortinet (FTNT) down 8%

Google (GOOGL) down 7%

Notable News

Fed Holds Rates

The Federal Reserve kept its benchmark interest rate unchanged at 4.25%–4.5% for the third straight meeting, citing concerns over the economic impact of tariffs. In its latest statement, the Fed noted rising risks to both inflation and employment.

The updated "dot plot" shows officials anticipate two rate cuts this year, while bond markets are pricing in three, possibly starting in July. With unemployment at a low 4.2%, the Fed has room to stay cautious and assess inflation trends.

UK + US Trade Agreement

The U.S. and U.K. announced a new trade agreement this week - Washington’s first since implementing new tariffs on April 2. While limited in scope, the deal signals progress and lays the groundwork for further negotiations.

Key terms include:

A 10% tariff remains on most U.K. imports.

The first 100,000 U.K. vehicles face a 10% tariff; a 25% rate applies beyond that.

The U.K. will reduce or eliminate tariffs on select U.S. goods, including beef and ethanol.

U.S. tariffs on U.K. steel and aluminum will be removed.

Although the economic impact may be modest - the U.K. accounts for just 4% of U.S. exports and 2% of imports - the agreement reflects positive momentum. It could serve as a model for deals with other countries, though negotiations may be tougher with nations where the U.S. runs a trade deficit.

Earnings This week

Join 92,000+ investors on YouTube! 🎥

We dive deeper into earnings (and more) on our channel. Don't miss out - click below to watch now!👇

YouTube Channel 🔔

Click here to subscribe and stay updated!

2 Dirt Cheap Stocks

Let us dive into these 2 Stocks.

I have used the following criteria to help identify these stocks:

Margin of Safety 30%+

Upside 30%+

ROIC 20%+

Net Debt to EBITDA <1

Google (GOOGL)

Google is a global technology company specializing in internet services and products.

It dominates online search with its Google Search engine and generates most of its revenue through digital advertising via Google Ads.

The company also offers a wide range of products, including YouTube, Android, Google Cloud, and hardware like Pixel devices.

Additionally, Google invests in AI, self-driving technology (Waymo), and other innovative projects.

Google's income streams include:

Advertising Revenue: The largest source, generated from Google Ads on Search, YouTube, and partner websites.

Cloud Computing: Revenue from Google Cloud services, including storage, AI, and enterprise solutions.

Hardware Sales: Income from Pixel phones, Nest smart devices, and other hardware.

Google Play Store: Revenue from app sales, in-app purchases, and subscriptions.

YouTube Subscriptions & Services: Income from YouTube Premium, YouTube Music, and YouTube TV.

Other Bets: Revenue from experimental projects like Waymo (self-driving cars) and Verily (health tech).

They recently announced their largest acquisition ever of Wiz Security for $32bn.

Their fastest revenue stream has been growing strongly over the last few years, with growth in the latest quarter sitting at 28%.

They hope that this acquisition can help propel them even further as they are not the current market leader.

They also continue to spend significantly and for FY25 their CAPEX estimate is $75bn.

They have outperformed in all of their last 4 quarters (vs analyst expectations), and expect EPS growth in 3 of the next 4.

They have also massively outperformed against the S&P 500 over the last 10Y.

We get an undervaluation signal as the current Forward P/E of 16.6x sits below the 5Y average of 22.2x.

ROIC is consistently very high and increasing.

Margins look very strong, with operating showing signs of efficiencies, going from 26% 10Y ago to 33% now.

They also have a very strong balance sheet as Net Debt to EBITDA sits at 0 consistently for the last 10Y.

As per below, Wall Street see 32% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $226:

So, in conclusion for GOOGL, we see around a 30% margin of safety around the $158 mark with Wall Street indicating 32% upside.

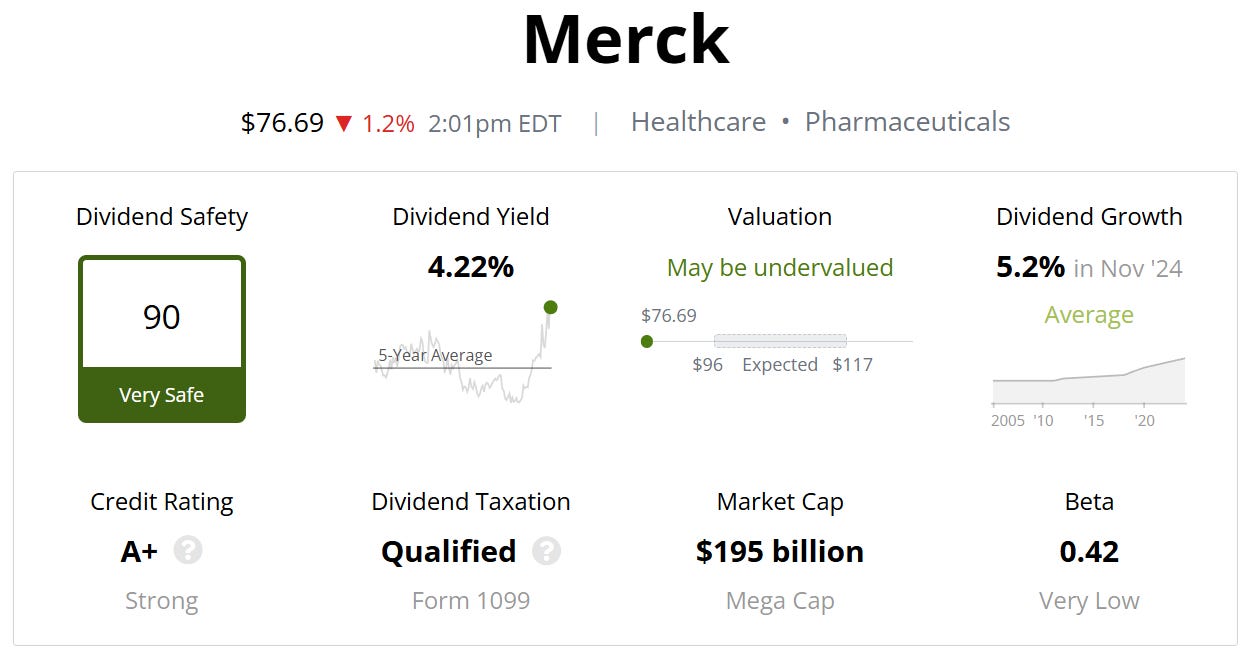

Merck & Co (MRK)

Merck & Co. is a global pharmaceutical company that develops, manufactures, and markets a wide range of medications, vaccines, and animal health products.

It is known for its contributions to oncology, immunology, infectious diseases, and other therapeutic areas.

Their income streams are as follows:

Pharmaceuticals: Revenue from prescription medications, including oncology treatments (Keytruda), vaccines (Gardasil), and other therapeutic areas.

Animal Health: Sales of veterinary products for livestock and pets.

Research and Development: Income from collaborations, licensing agreements, and partnerships in drug development.

They have outperformed/in-line in the last 4 quarters (vs analyst expectations) and anticipate growth against the year-on-year EPS comparative for 3 of the next 4.

They have underperformed against the S&P 500 over the last 10Y, however they currently trade at their 52 week low.

We currently get a double undervaluation signal with both yield above the 5Y average (4.22% v 3.04%) and the forward P/E below the 5Y average (8.5x v 13.4x).

Dividend safety looks good, with a score of 90.

ROIC looking very good at 23% on a trailing twelve-month.

0.94 for the Net Debt to EBITDA looking good based on the trailing twelve-month.

As per below, Wall Street see 35% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $108:

So, in conclusion for MRK, we see around a 30% margin of safety around the $76 mark with Wall Street indicating 35% upside.

Stock Resources

Stock Valuation Model 📊 (Unlock my stock valuation model as seen on YouTube)

Seeking Alpha 💵 ($30 off stock research tools I use daily.)

TipRanks 📈 (50% off expert stock research tools)

YouTube 🎥 (Join 92,000+ investors on YouTube!)

Patreon 👥 (Join my community for exclusive content)

Snowball Analytic (30% off portfolio tracker)

Thanks For Reading!

☕ Buy Me A Coffee – Your support helps cover the costs of running the newsletter.

📬 Join the community – Subscribe now to get weekly investment insights delivered straight to your inbox.

💬 Found this helpful? Share it with friends and colleagues! Your support keeps this newsletter FREE.

I hope you all have a great week ahead! 🌟

Dividend Talks💰

Note:

I’m not a financial advisor. All content is for educational purposes only. Invest and trade at your own risk—I'm not responsible for any financial outcomes.