2 MASSIVE Upside Stocks

+Market Update

Market Latest

Last week, the S&P 500 experienced a decline of approximately 1.76%, closing at 6,013.

This marked its most significant single-day percentage drop since December 18, 2024 and was influenced by several factors:

Economic Data: Reports indicated a deceleration in U.S. business activity and a decline in consumer sentiment.

Policy Concerns: Investors reacted to President Donald Trump's announcement of new tariffs on imports such as lumber, cars, semiconductors, and pharmaceuticals.

Corporate Earnings: Companies like UnitedHealth Group saw stock declines due to investigations into their practices, while others like Akamai Technologies faced sell-offs after issuing disappointing revenue forecasts.

Having said that, the S&P 500 maintained a year-to-date gain of approximately 2.24%.

On a granular level we can see a lot of red right across the board.

Biggest losers included:

Palantir (PLTR) down 14%

UnitedHealth Group (UNH) down 12%

Chipotle Mexican Grill (CMG) down 11%

Walmart (WMT) down 10%

Lululemon (LULU) (down 8%)

Broadcom (AVGO) down 7%

Notable News

Mega cap stocks are underperforming the broader market.

Mega cap technology stocks led the broader market, especially in the first half of the year in 2024.

However, in 2025, their performance has been mixed, with only two of the seven outperforming the S&P 500, while the group as a whole lags behind most other asset classes.

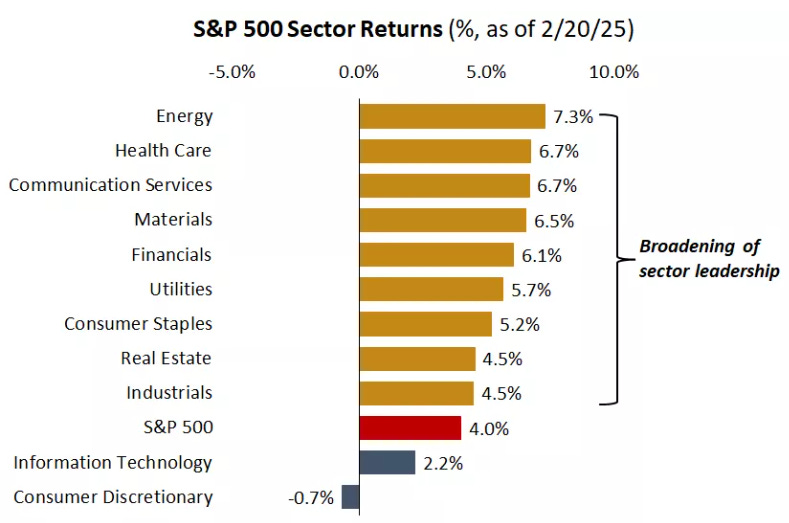

Energy has been leading the S&P 500 returns so far in 2025.

Earnings This Week

Earnings Season: It’s the big one after market close on Wednesday! - Nvidia are reporting.

As always, we will cover earnings week on our YouTube channel.

We would love to have you in our community which is near the 82,000 mark on YouTube where we cover in depth analysis of undervalued quality stocks and their earnings:

Fear and Greed Index

After the end of the week there are no surprises as to why investor sentiment now sits in the Fear bucket at 35.

2 Massive Upside Stocks

Let us dive into these 2 Stocks:

I have used the following criteria to help identify these cheap stocks:

Margin of Safety 25%+

Upside 35%+

Nu Holdings (NU)

Nu Holdings Ltd. is a Brazilian fintech company that operates as a digital bank under the brand Nubank.

It offers financial services like credit cards, personal loans, and digital banking with no fees, focusing on a mobile-first experience.

The company aims to disrupt traditional banking by providing user-friendly, low-cost financial solutions in Latin America. It has expanded beyond Brazil into Mexico and Colombia.

Nu Holdings generates income through:

Interest on credit card balances

Interest on personal loans

Fees from financial products (e.g., insurance, investments)

Commissions from third-party services offered through the platform

Their business model focuses on low operational costs and a high volume of users.

They have outperformed in 2 of their last 4 quarters (vs analyst expectations), however the other 2 quarters were in line with expectations.

They anticipate double digit growth against the year-on-year EPS comparative for the next 4 quarters.

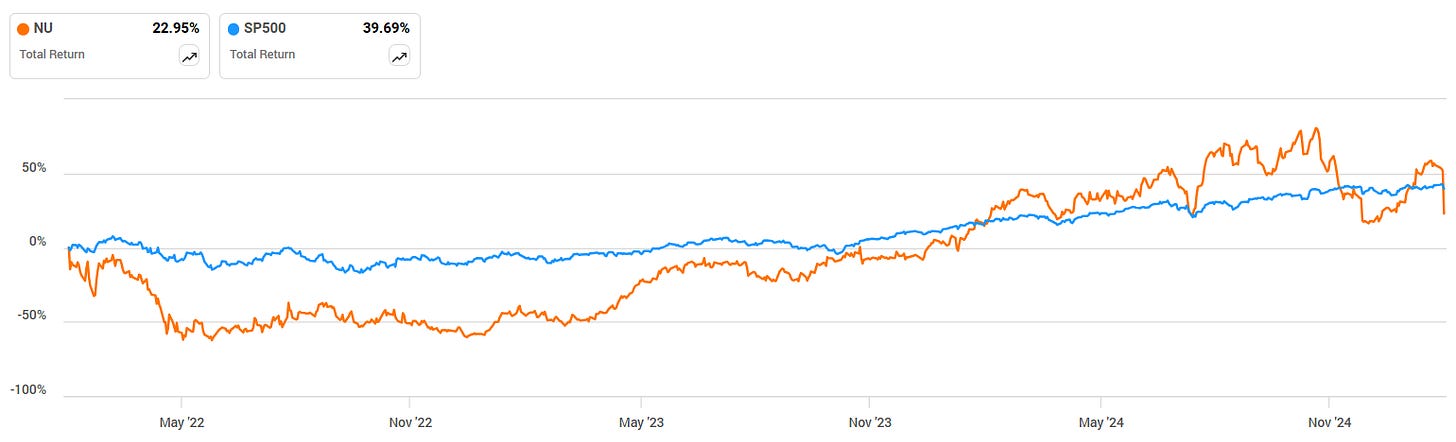

They have underperformed against the S&P 500 over the last 3Y.

They continue to grow their customer base on a q/q basis as well as over the years.

Revenue is also up 58% from the previous year, with margins also improving from 43% to 46%.

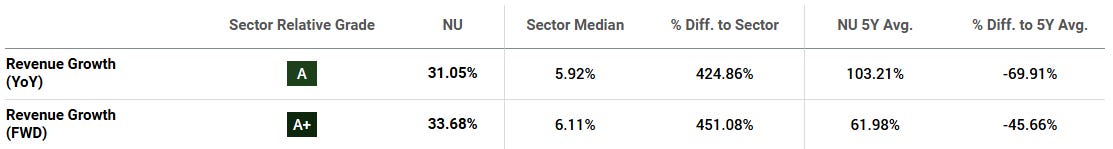

Their revenue growth is above the sector median by quite some way, however it is lower than their own 5Y average.

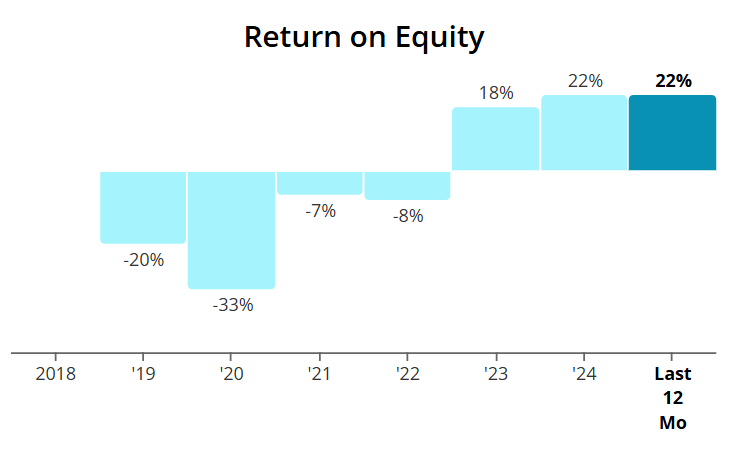

ROE has improved significantly over time, now sitting at 22%.

As per below, Wall Street see 51% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $15.20:

So, in conclusion for NU, we see around a 30% margin of safety around the $10.64 mark with Wall Street indicating 51% upside.

Interesting fact, Warren Buffett holds NU in his portfolio, however he did reduce it last quarter and it only encompasses 0.16% of his overall portfolio.

Constellation Brands (STZ)

Constellation Brands is a leading international producer and marketer of alcoholic beverages, including beer, wine, and spirits.

It owns popular beer brands like Corona, Modelo, and Pacifico, and a portfolio of wines and spirits.

The company focuses on premium products and has a significant presence in the U.S. market.

It also invests in cannabis-related businesses to diversify its portfolio.

They generate revenue through the following streams:

Revenue from beer sales (e.g., Corona, Modelo, Pacifico)

Revenue from wine and spirits sales

Revenue from cannabis-related investments

Partnerships and distribution agreements

Licensing and royalties from brand and product licenses

It is also the new stock that Warren Buffett added to his portfolio in the latest quarter.

It now makes up 0.47% of his portfolio and he spent around $1.2bn on the position.

They have outperformed in 3 of their last 4 quarters (vs analyst expectations).

They anticipate mid single digit growth against the year-on-year EPS comparative for the next 4 quarters.

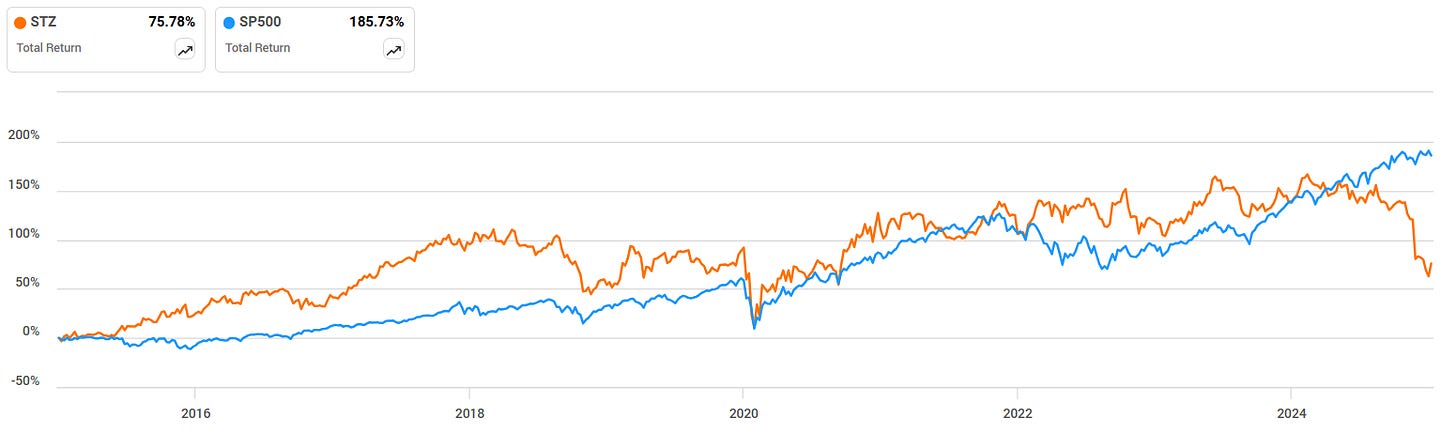

They have underperformed against the S&P 500 over the last 10Y.

We have a double undervaluation signal, as yield 2.30% is above the 5Y average of 1.43%, as well as the Forward P/E of 12.5x being below the 5Y 20.2x.

Free cash flow per share has been growing over the last 10Y, in fact rising 4x.

ROIC also sits above the minimum for the sector at 17%.

Margins are looking very strong and showing signs of efficiencies.

Net Debt to EBITDA is in a downward trend which is great to see and below the maximum we want at 4, currently sitting at 2.75.

As per below, Wall Street see 38% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $225:

So, in conclusion for STZ, we see around a 25% margin of safety around the $169 mark with Wall Street indicating 38% upside.

Stock Resources

Stock Valuation Model

If you are interested in valuing stocks yourself, we have created a valuation model below which you can pick up, this is the same version we use in our YouTube analysis:

Seeking Alpha

They are one of the main stock analysis websites I use in my videos and you can get $30 OFF discount below.

TipRanks

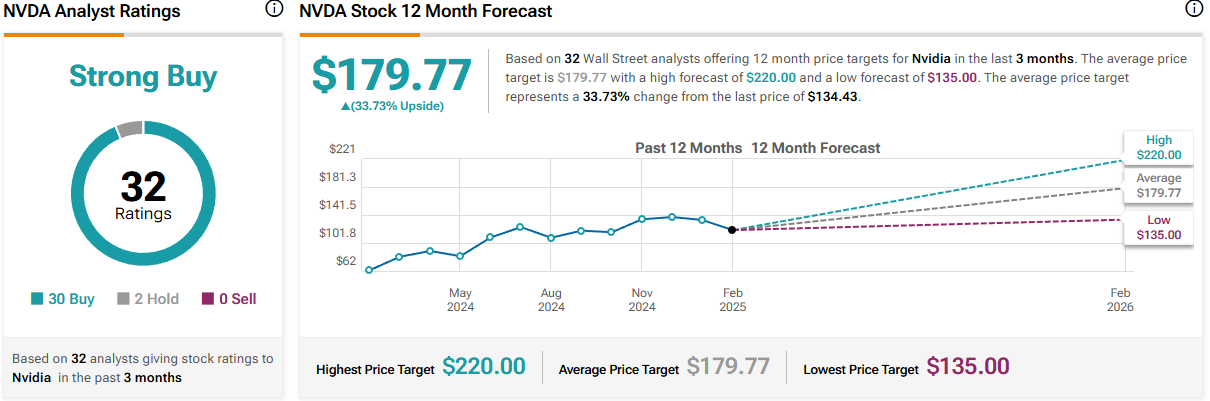

To find the predicted upside of stocks, I typically use TipRanks, for example, using their system for Micron (MU) we get the below:

They currently have a 50% offer below.

50% OFF TipRanks:

Patreon

Join our community in the Patreon where we discuss weekly buy and sells.

Snowball Portfolio Tracker

Snowball is a great portfolio tracker which allows you to have all of your investments in one place, with a ton of amazing features.

You can also get a 14-day free trial to check it out.

Conclusion

We have just gone through 2 stocks with massive upside.

However as always do your own due diligence and let us know your thoughts about today’s newsletter in the comments.

I hope you all have a great week ahead!

Thanks For Reading!

If you’d like to support this work feel free to buy me a coffee. The proceeds will contribute to the running costs of the newsletter.

Join the community of investors - subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today’s newsletter helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Note:

I am not a financial advisor or licensed professional. Nothing I say or produce anywhere, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk.