2 Must Buy Growth Stocks

+Market Update

Market Latest

Stocks saw a small uptick this week, bouncing back from correction territory, though they are still down year-to-date.

Market leadership has shifted toward bonds and international stocks, offering support for diversified portfolios.

On a more granular level, some stocks were in the red this week.

Biggest losers included:

Lockheed Martin (LMT) down 6%

Micron (MU) down 6%

Nike (NKE) down 5%

FedEx (FDX) down 5%

NextEra Energy (NEE) down 4%

Nvidia (NVDA) down 3%

Notable News

No Rate Cuts

The Federal Open Market Committee (FOMC) wrapped up its March meeting this week, keeping the federal funds rate target range at 4.25%–4.5% for the second consecutive meeting, as anticipated.

The Fed is adopting a more patient stance on easing monetary policy in light of slowing economic growth and ongoing policy uncertainty.

Nike Faces Challenges Amid Tariffs and Consumer Uncertainty

Nike warned on Thursday that it expects a significant drop in sales for the current quarter, with projections pointing to a decline in the "low teens" range.

This comes as the company navigates the impact of new tariffs, sliding consumer confidence, and a slower-than-expected recovery.

Despite these challenges, Nike beat Wall Street expectations for its fiscal third-quarter earnings, posting a 54-cent per share profit, well above the 29 cents estimated.

However, its gross margin slipped by 3.3 percentage points due to higher discounts and increased product costs.

With the added pressure of tariffs and weaker consumer spending, Nike’s turnaround may take longer than anticipated.

Earnings This Week

Join 85,000+ investors on YouTube! 🎥

We dive deeper into earnings (and more) on our channel. Don't miss out—click below to watch now!👇

YouTube Channel 🔔

Click here to subscribe and stay updated!

Fear & Greed Index

2 Must Buy Growth Stocks

Let us dive into these 2 Stocks:

I have used the following criteria to help identify these cheap stocks:

Margin of Safety 15%+

Upside 25%+

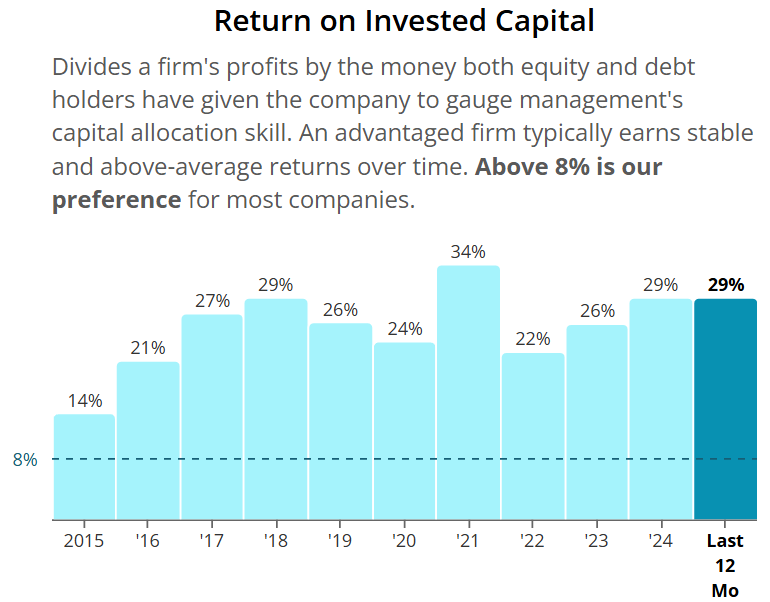

ROIC 25%+

Net Debt to EBITDA <1

Meta Platforms (META)

Meta Platforms, is a global technology company that owns and operates social media platforms like Facebook, Instagram, and WhatsApp.

It focuses on connecting people through its social networks, advertising services, and virtual reality products.

The company generates most of its revenue through targeted advertising on its platforms.

Meta Platforms' income streams include:

Advertising Revenue: The largest source, generated from ads on Facebook, Instagram, WhatsApp, and Messenger.

Virtual Reality (VR): Revenue from the sale of VR hardware like Oculus headsets and related content.

Marketplace: Revenue from e-commerce activities on platforms like Facebook Marketplace.

Subscription Services: Income from services such as Facebook’s subscription-based features or Instagram’s shop functionalities.

Payments & Other Fees: Fees from payment processing on its platforms and other related services.

Active users on their platforms are only increasing every single quarter.

On top of that so is the average revenue that is being generated from each user.

They have also outperformed in all of their last 4 quarters (vs analyst expectations), and expect growth in 3 of their next 4.

They have massively outperformed against the S&P 500 over the last 10Y.

We get a reasonable valuation signal as the current Forward P/E of 23.5x sits around the 5Y average of 23.2x.

ROIC is consistently very high in the mid 20’s.

Margins whilst inconsistent do look very strong and above the minimum we want to see.

They also have a very strong balance sheet as Net Debt to EBITDA sits at 0 consistently for the last 10Y.

Remember this is the number of years it would take them to pay off all of their debt, net of cash on hand.

As per below, Wall Street see 28% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $699:

So, in conclusion for META, we see around a 15% margin of safety around the $595 mark with Wall Street indicating 28% upside.

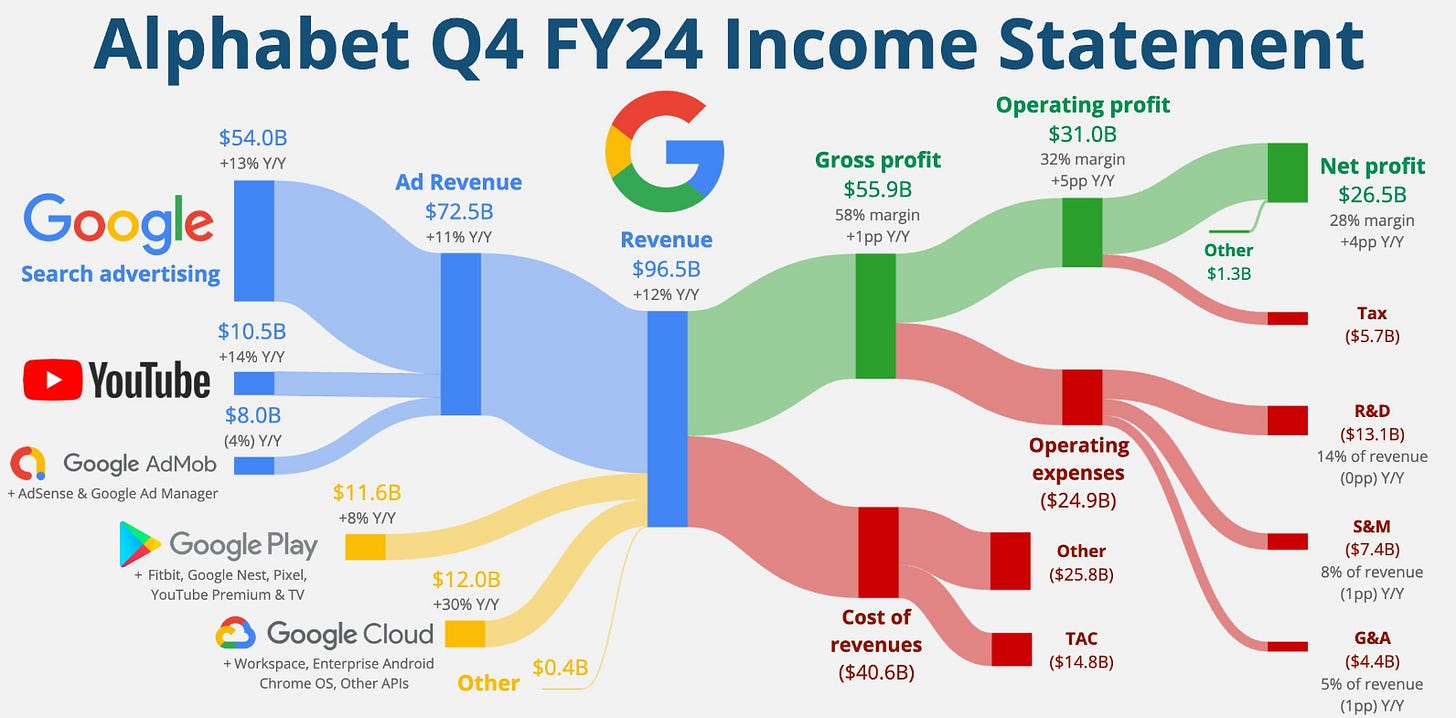

Google (GOOGL)

Google is a global technology company specializing in internet services and products.

It dominates online search with its Google Search engine and generates most of its revenue through digital advertising via Google Ads.

The company also offers a wide range of products, including YouTube, Android, Google Cloud, and hardware like Pixel devices.

Additionally, Google invests in AI, self-driving technology (Waymo), and other innovative projects.

Google's income streams include:

Advertising Revenue: The largest source, generated from Google Ads on Search, YouTube, and partner websites.

Cloud Computing: Revenue from Google Cloud services, including storage, AI, and enterprise solutions.

Hardware Sales: Income from Pixel phones, Nest smart devices, and other hardware.

Google Play Store: Revenue from app sales, in-app purchases, and subscriptions.

YouTube Subscriptions & Services: Income from YouTube Premium, YouTube Music, and YouTube TV.

Other Bets: Revenue from experimental projects like Waymo (self-driving cars) and Verily (health tech).

They recently announced their largest acquisition ever of Wiz Security for $32bn.

Their fastest revenue stream has been growing strongly over the last few years, with growth in 2024 in the 30% region. They hope that this acquisition can help propel them even further as they are not the market leader.

They also continue to spend significantly and for FY25 their estimate came in significantly above analysts which led to the share price falling in the most recent earnings quarter.

They have outperformed in all of their last 4 quarters (vs analyst expectations), and expect EPS growth in the next 4.

They have massively outperformed against the S&P 500 over the last 10Y.

We get an undervaluation signal as the current Forward P/E of 18.3x sits below the 5Y average of 22.3x.

ROIC is consistently very high and increasing.

Margins look very strong, with operating showing signs of efficiencies, going from 26% 10Y ago to 33% now.

They also have a very strong balance sheet as Net Debt to EBITDA sits at 0 consistently for the last 10Y.

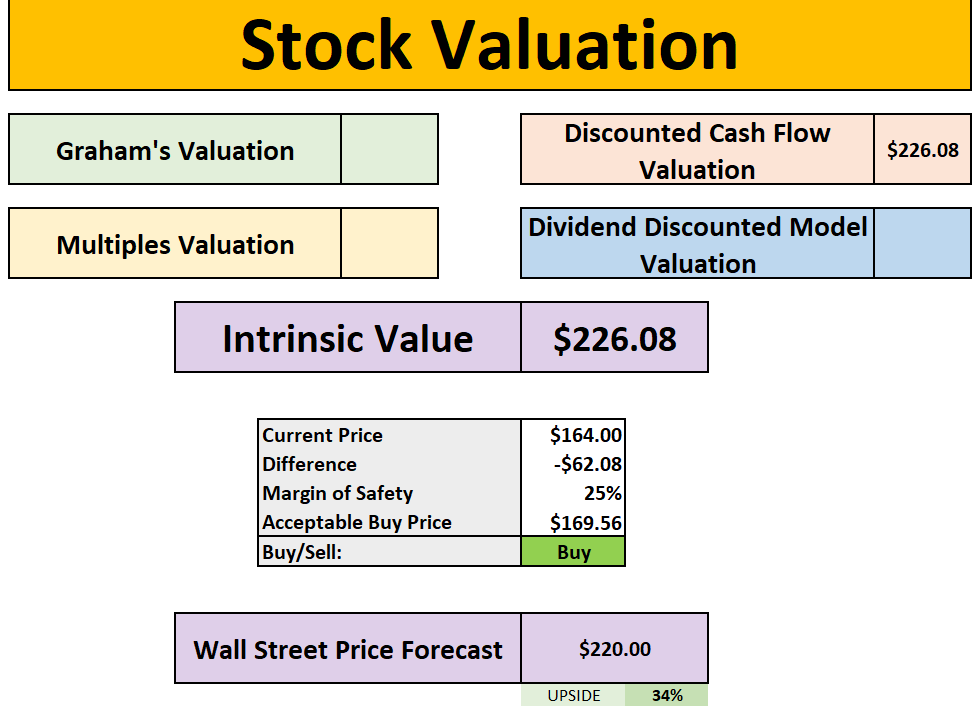

As per below, Wall Street see 32% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $226:

So, in conclusion for GOOGL, we see around a 25% margin of safety around the $170 mark with Wall Street indicating 32% upside.

Stock Resources

Stock Valuation Model 📊 (Unlock my stock valuation model as seen on YouTube)

Seeking Alpha 💵 ($30 off stock research tools I use daily.)

TipRanks 📈 (30% off expert stock research tools)

YouTube 🎥 (Join 85,000+ investors on YouTube!)

Patreon 👥 (Join my community for exclusive content)

Thanks For Reading!

☕ Buy Me A Coffee – Your support helps cover the costs of running the newsletter.

📬 Join the community – Subscribe now to get weekly investment insights delivered straight to your inbox.

💬 Found this helpful? Share it with friends and colleagues! Your support keeps this newsletter FREE.

I hope you all have a great week ahead! 🌟

Dividend Talks💰

Note:

I’m not a financial advisor. All content is for educational purposes only. Invest and trade at your own risk—I'm not responsible for any financial outcomes.

Really nice! Thank you! I shared this with a friend ☺️