2 Must Buy Stocks

+ Market Update

Market Latest

The S&P 500 closed the week with a 0.56% gain, continuing its upward momentum as investors reacted to a mix of corporate earnings and economic data.

Strong results from major tech companies helped drive the index higher, while the Fed’s decision to maintain interest rates provided further stability.

Despite some volatility, market sentiment remained optimistic, with investors focusing on growth prospects and a potential shift in monetary policy later this year.

Mixed week in the markets, although notable companies like Nvidia have been hit hard.

Biggest losers included:

Nvidia (NVDA) down 16%

United Parcel Service (UPS) down 14%

Micron (MU) down 12%

Broadcom (AVGO) down 10%

Caterpillar (CAT) down 9%

ServiceNow (NOW) down 9%

Notable News

DeepSeek

DeepSeek is a Chinese AI startup that has made headlines by developing highly efficient AI models, positioning itself as a potential challenger to U.S. tech giants like OpenAI and Google.

Its latest breakthrough—an advanced language model with capabilities rivaling or surpassing those of Western AI leaders—has sent shockwaves through the AI industry.

The panic stems from concerns that DeepSeek's rapid progress could disrupt the global AI race, threaten the dominance of U.S. firms, and accelerate geopolitical tensions over AI supremacy.

Investors were particularly alarmed as this development triggered sell-offs in major tech stocks, reflecting fears of increased competition and shifting market dynamics.

Nvidia had the biggest single-day stock decline following this news:

A side-by-side comparison of DeepSeek R1 and OpenAI:

After the DeepSeek news on Monday which shocked the market, we then saw Alibaba come out and say their new model Qwen 2.5 Max surpasses DeepSeek.

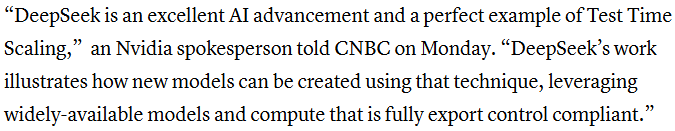

Nvidia responded by calling this an excellent AI advancement:

The question is, will this affect Nvidia, and how.

Microsoft shares were down after they had a double beat but guidance was lower than analysts expectations:

We have talked below about the implications of this for Nvidia below:

UPS Down After Amazon News

Earnings Has Started

Corporate earnings surged this week as four of the "Magnificent 7" companies reported their results.

Apple, Microsoft, and Meta exceeded expectations for both earnings per share and revenue, while Tesla fell short on both fronts.

Despite the weak performance, Tesla's stock gained traction, driven by optimism surrounding a favorable regulatory landscape, upcoming affordable models, and advancements in autonomous vehicles, including the Robotaxi.

No Interest Rate Cut

The Federal Open Market Committee (FOMC) wrapped up its January meeting this week, keeping the federal funds rate steady at 4.25%-4.5%.

The Fed is adopting a cautious stance on easing monetary policy, citing strong economic growth, a resilient labor market, moderating disinflation, and ongoing policy uncertainty.

Earnings This Week

Another HUGE week in the market:

As always, we will cover earnings week on our YouTube channel.

We would love to have you in our community which is over 76,000 on YouTube where we cover in depth analysis of undervalued quality stocks and their earnings:

Fear and Greed Index

Given the events of this week, it is no surprise that we are on the cusp of Fear with a 46 score.

Remember:

The Fear and Greed Index is a tool used to measure investor sentiment in the stock market.

It ranges from 0 (Extreme Fear) to 100 (Extreme Greed) and helps indicate whether the market is overly bearish (fearful) or bullish (greedy).

2 Must Buy Stocks

Let us dive into the 2 Must Buy Stocks:

I have used the following criteria to help identify these stocks:

ROIC 20%+ (exception made for stock#2)

Net Debt to EBITDA below 1 (Strong Balance Sheet)

Upside > 25%

ASML (ASML)

ASML is a Dutch company that designs and manufactures advanced photolithography machines used in semiconductor chip production.

Their extreme ultraviolet (EUV) lithography technology is essential for producing smaller, more powerful, and energy-efficient microchips.

ASML's main income streams come from selling photolithography machines (including EUV and deep ultraviolet systems), maintenance and service contracts, and software solutions for chip manufacturing optimization.

They also generate revenue from upgrades and enhancements to existing machines.

Photolithography Machine Sales – Revenue from selling EUV and DUV lithography systems to semiconductor manufacturers.

Service & Maintenance Contracts – Ongoing support, repairs, and maintenance for installed machines.

Software Solutions – Revenue from software tools that optimize chip manufacturing and machine performance.

Upgrades & Enhancements – Selling hardware and software upgrades to improve the efficiency of existing machines.

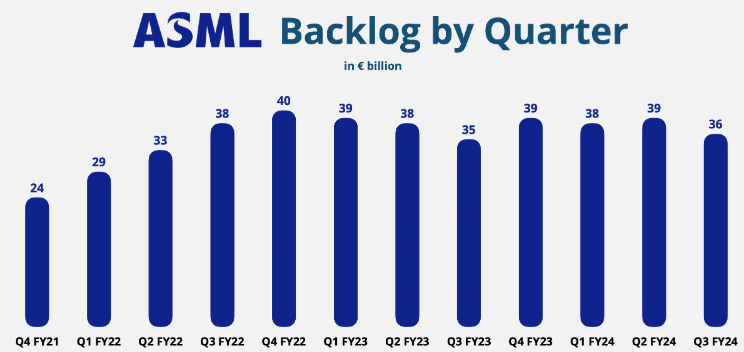

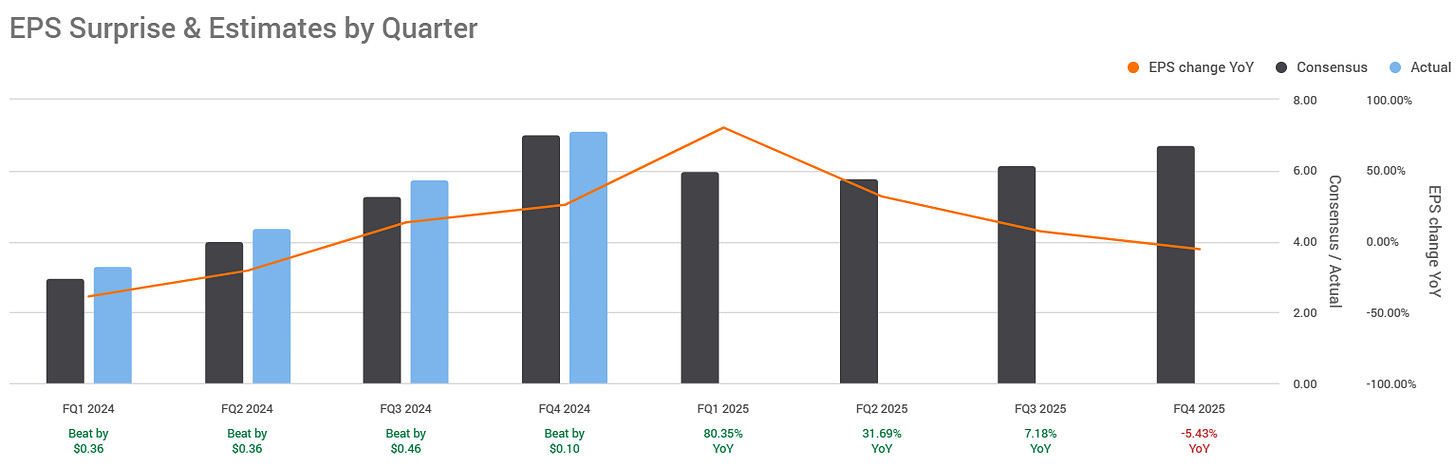

They have outperformed in their last 4 quarters (vs analyst expectations) and anticipate growth against the year-on-year EPS comparative for 3 of the next 4 quarters.

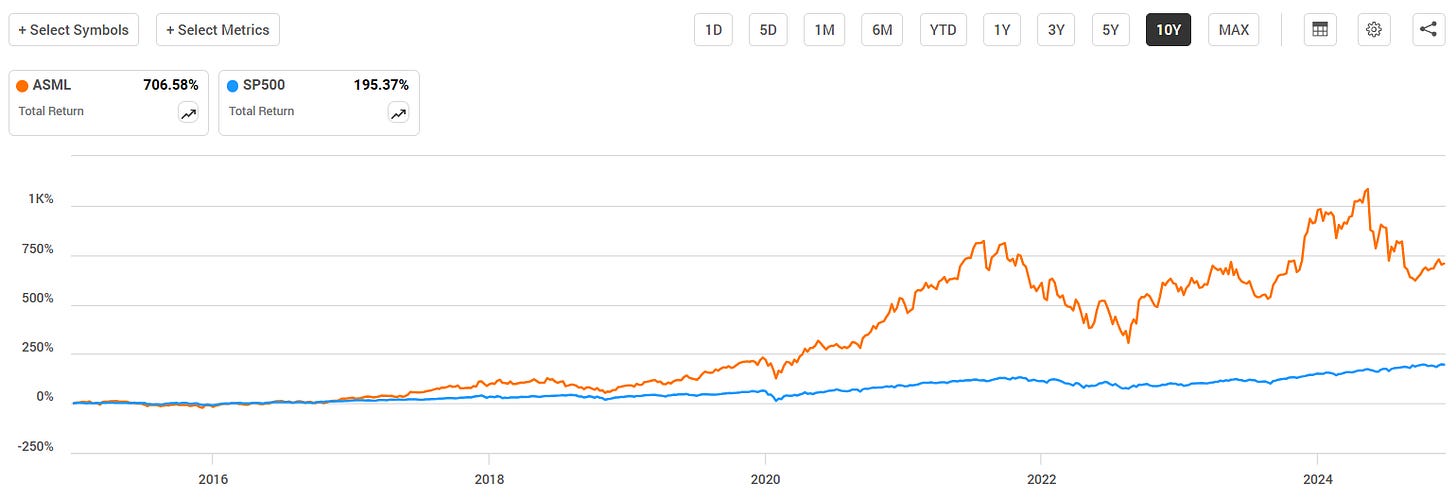

They have massively outperformed against the S&P 500 over the last 10Y.

We have a double undervaluation signal, as yield 0.89% is above the 5Y average of 0.84%, as well as the Forward P/E of 29.7x being below the 5Y 34.1x.

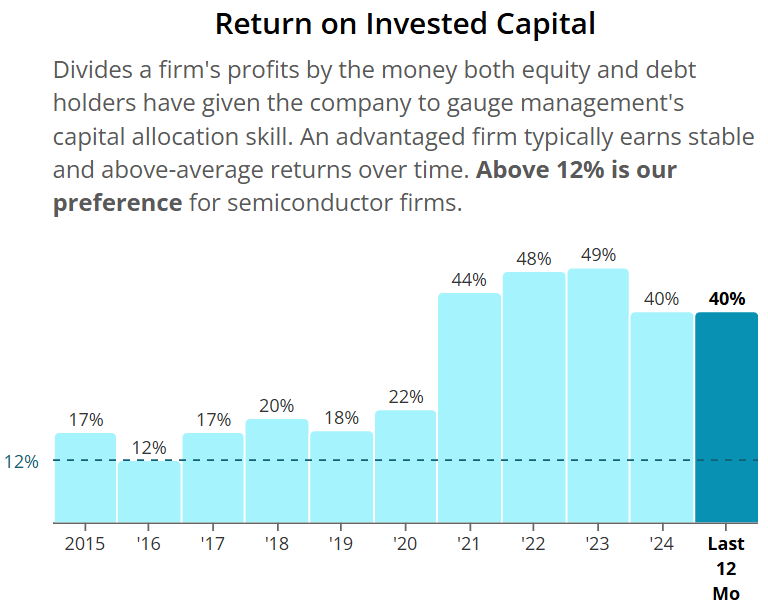

ROIC looks very very good and has been increasing over time, currently sitting at 40%.

Both operating and free cash flow margin have been consistently healthy above the minimum levels.

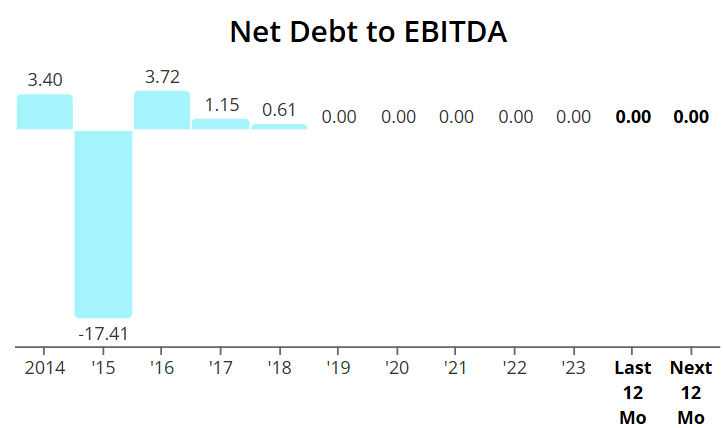

Net Debt to EBITDA sits at 0 over the last 10Y and expected over the next 12 months, meaning it won’t even take them 1 day to pay off all of their debt, net of cash on hand. Excellent balance sheet.

As per below, Wall Street see 27% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $1,032:

So, in conclusion for ASML, we see around a 30% margin of safety around the $722 mark with Wall Street indicating 27% upside.

Advanced Micro Devices (AMD)

AMD designs and manufactures semiconductor products, including CPUs, GPUs, and custom chips for gaming, data centers, and embedded systems.

They compete with Intel and NVIDIA in high-performance computing and graphics processing.

AMD generates revenue from:

Computing & Graphics – Revenue from CPUs, GPUs, and APUs for consumer and professional use.

Enterprise, Embedded & Semi-Custom – Sales of server processors, embedded chips, and custom solutions for gaming consoles and specialized hardware.

Data Center Solutions – Income from high-performance processors and accelerators for cloud computing and AI workloads.

Licensing & Royalties – Revenue from intellectual property licensing agreements.

They have outperformed/in-line in all of their last 4 quarters (vs analyst expectations) and anticipate double digit growth against the year-on-year EPS comparative for the next year.

They have massively outperformed against the S&P 500 over the last 10Y.

Their current 2025 Forward P/E sits at 24x

This is lower than the sector median:

and lower than their 5Y average:

Given the industry is cyclical we can see this through the ROIC, some years very good, others we do see it lacking, for example on a trailing twelve-month it sits at 2%.

Net Debt to EBITDA is as impressive as ASML’s that we discussed earlier.

As per below, Wall Street see 39% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $189:

So, in conclusion for AMD, we see around a 35% margin of safety around the $123 mark with Wall Street indicating 39% upside.

Stock Resources

Stock Valuation Model

If you are interested in valuing stocks yourself, we have created a valuation model below which you can pick up, this is the same version we use in our YouTube analysis:

Seeking Alpha

They are one of the main stock analysis websites I use in my videos and you can get $30 OFF discount below.

TipRanks

To find the predicted upside of stocks, I typically use TipRanks, for example, using their system for Microsoft (MSFT) we get the below:

They currently have a 50% offer below.

50% OFF TipRanks:

Patreon

Join our community in the Patreon where we discuss weekly buy and sells.

Snowball Portfolio Tracker

Snowball is a great portfolio tracker which allows you to have all of your investments in one place, with a ton of amazing features.

You can also get a 14-day free trial to check it out.

Conclusion

We have just gone through 2 must buy stocks.

However as always do your own due diligence and let us know your thoughts about today’s newsletter in the comments.

I hope you all have a great week ahead!

Thanks For Reading!

If you’d like to support this work feel free to buy me a coffee. The proceeds will contribute to the running costs of the newsletter.

Join the community of investors - subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today’s newsletter helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Note:

I am not a financial advisor or licensed professional. Nothing I say or produce anywhere, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk.