2 Quality Stocks You Must Watch!

+ Market Update

Market Latest

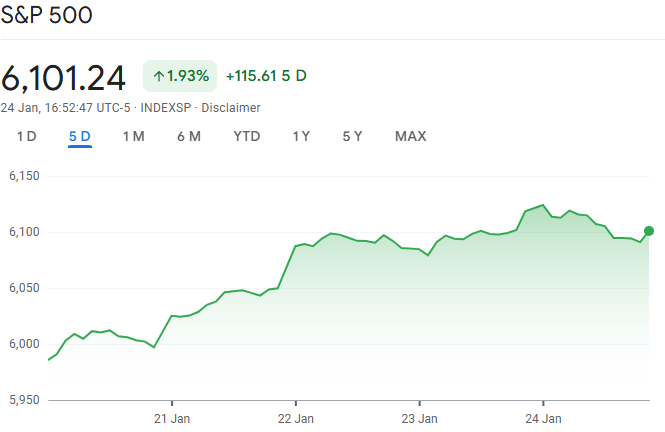

Last week, the S&P 500 saw a 1.9% gain, marking its first record close of 2025.

This performance reflects growing optimism among investors, fueled by expectations surrounding the new administration's policies, including deregulation and potential support for dealmaking.

The technology sector was a major driver of the market's growth, with companies like Nvidia, Oracle, and Arm benefiting from increased focus on artificial intelligence investments.

Additionally, a recent executive order on digital assets contributed to a boost in the cryptocurrency market, with Bitcoin maintaining strong momentum around $105,000.

Despite a slight pullback on Friday, market sentiment remains positive, bolstered by declining inflation and robust labor market data.

Investors are keeping an eye on potential risks from proposed tariffs and fiscal challenges as they await the Federal Reserve's upcoming meeting.

Overall, the S&P 500’s strong start to the year highlights investor confidence, particularly in technology-driven advancements and supportive economic trends.

Another week where we get to see a lot of green, however some notable stocks are down.

Biggest losers included:

Fair Isaac (FICO) down 8%

Occidental Petroleum (OXY) down 6%

Merck & Co (MRK) down 5%

Airbnb (ABNB) down 4%

Notable News

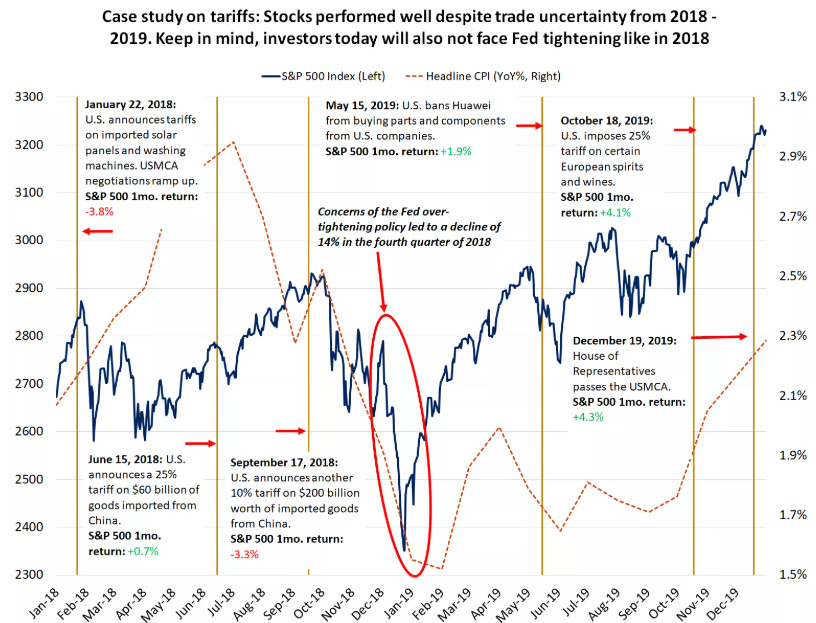

Potential Tariffs

Heading into Inauguration Day, tariffs were a significant concern for the markets.

However, the new administration has so far only hinted at tariff policies without taking any action.

President Trump has mentioned potential specifics, including a 25% tariff on Mexico and Canada starting February 1, citing unauthorized immigration and drug trafficking as primary reasons.

He has also discussed the possibility of imposing 10% tariffs on China and additional tariffs on the European Union, but no steps have been taken on these fronts yet.

Earnings This Week

This might be one of the biggest weeks in the market with many large and important Companies reporting:

As always, we will cover earnings week on our YouTube channel.

We would love to have you in our community which is over 75,000 on YouTube where we cover in depth analysis of undervalued quality stocks and their earnings:

Fear and Greed Index

Investors are getting more bullish as we move away from Extreme Fear/Fear to firmly in neutral.

2 Quality Stocks You Must Watch!

Let us dive into the 2 Quality Stocks to watch.

I have used the following criteria to help identify these stocks:

ROIC 15%+

Net Debt to EBITDA below 3 (Strong Balance Sheet)

Upside > 20%

Fair Isaac Corporation (FICO)

FICO develops analytics and software to assess credit risk, most notably through its FICO Score, which measures an individual's creditworthiness.

It helps businesses make data-driven decisions about lending and risk management.

FICO generates revenue through:

Software licensing: Revenue from licensing its analytics and decision management software.

Subscriptions: Ongoing revenue from subscriptions to credit scoring and risk management services.

Consulting services: Fees for providing consulting on data analytics and decision-making processes.

Royalties: Earnings from financial institutions using its FICO Score in credit decisions.

They have outperformed in 2 of their last 4 quarters (vs analyst expectations) and anticipate double digit growth against the year-on-year EPS comparative for the next year.

They have massively outperformed against the S&P 500 over the last 10Y.

It is worth noting that it trades higher than the sector and its 5Y average.

ROIC looks very very good and has been increasing over time, currently sitting at 53%.

Free cash flow has been increasing consistently over time and is expected to continue over the next 12 months.

The company also does share buybacks, returning excess cash to investors pockets.

Both operating and free cash flow margin looks very good and we get to see efficiencies too, with operating margin increasing over time.

Balance sheet looks good as Net Debt to EBITDA sits at 2.27, and expected to decrease to 1.88 over the next 12 months.

As per below, Wall Street see 27% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $2,129:

So, in conclusion for FICO, we see around a 15% margin of safety around the $1,810 mark with Wall Street indicating 27% upside.

Ideally we would like to add this at a 20% MoS level at $1,700 and we could see this perhaps with earnings coming up on 4th February.

Intuit (INTU)

Intuit is a financial software company that develops products like TurboTax, QuickBooks, and Mint to help individuals and businesses manage finances, taxes, and accounting.

It offers cloud-based services for personal finance, small business, and enterprise solutions.

They generate revenue from the following sources:

Software subscriptions: Revenue from subscriptions to products like QuickBooks, TurboTax, and Mint.

Product sales: Earnings from one-time purchases of software and add-ons.

Advertising: Income from ads placed within its financial platforms, particularly for its free services.

Professional services: Fees for services like tax preparation and bookkeeping provided through its platforms.

They have outperformed in their last 4 quarters (vs analyst expectations) and anticipate growth against the year-on-year EPS comparative for 3 of the next 4 quarters.

They have massively outperformed against the S&P 500 over the last 10Y.

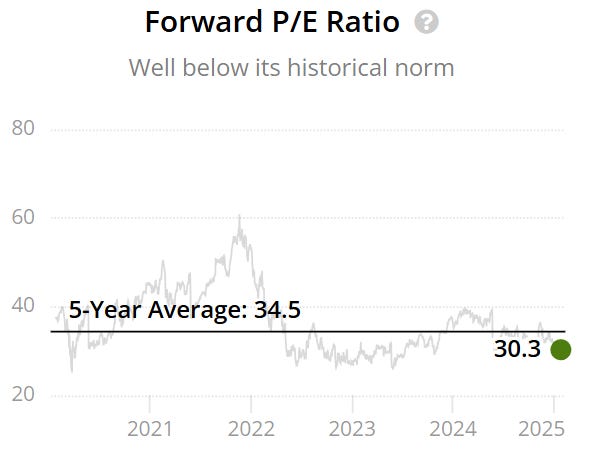

It currently trades lower than its 5Y average (30.3x v 34.5x).

ROIC looks good at 15% even after decreasing over the last 10Y.

Free cash flow growth also looks good and consistent over the last 10Y.

Very impressive as the Net Debt to EBITDA sits at 0.51, meaning a strong and healthy balance sheet.

As per below, Wall Street see 22% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $734:

So, in conclusion for INTU, we see around a 20% margin of safety around the $587 mark with Wall Street indicating 22% upside.

Stock Resources

Stock Valuation Model

If you are interested in valuing stocks yourself, we have created a valuation model below which you can pick up, this is the same version we use in our YouTube analysis:

Seeking Alpha

They are one of the main stock analysis websites I use in my videos and you can get $30 OFF discount below.

TipRanks

To find the predicted upside of stocks, I typically use TipRanks, for example, using their system for Johnson & Johnson (JNJ) we get the below:

They currently have a 50% offer below.

50% OFF TipRanks:

Patreon

Join our community in the Patreon where we discuss weekly buy and sells.

Snowball Portfolio Tracker

Snowball is a great portfolio tracker which allows you to have all of your investments in one place, with a ton of amazing features.

You can also get a 14-day free trial to check it out.

Conclusion

We have just gone through 2 quality stocks to watch.

However as always do your own due diligence and let us know your thoughts about today’s newsletter in the comments.

I hope you all have a great week ahead!

Thanks For Reading!

If you’d like to support this work feel free to buy me a coffee. The proceeds will contribute to the running costs of the newsletter.

Join the community of investors - subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today’s newsletter helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Note:

I am not a financial advisor or licensed professional. Nothing I say or produce anywhere, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk.