2 Stocks I Just Bought!

+ Market Update

Market Update

Stock markets slipped last week, with the S&P 500 continuing the downtrend this year - down 10% YTD:

Semiconductor stocks, including NVIDIA, were hit by new U.S. export restrictions to China:

While Fed Chair Powell signaled patience on rate cuts as tariffs complicate inflation and growth.

Notable News

Mag7 Down Last Week

Meta down 8%

Nvidia down 6%

Amazon down 5%

Microsoft down 4%

Tesla down 4%

Google down 1%

Apple up 3%

Earnings Season Is Back!

Join 89,000+ investors on YouTube! 🎥

We dive deeper into earnings (and more) on our channel. Don't miss out—click below to watch now!👇

YouTube Channel 🔔

Click here to subscribe and stay updated!

Fear & Greed Index

2 Stocks I Bought

Let us dive into these 2 Stocks.

I have used the following criteria to help identify these stocks:

Margin of Safety 20%+

Upside 40%+

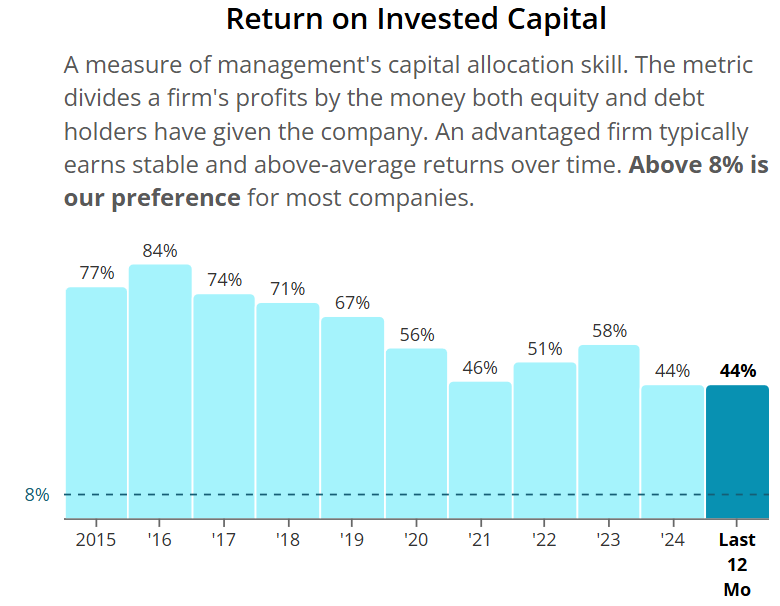

ROIC 10%+

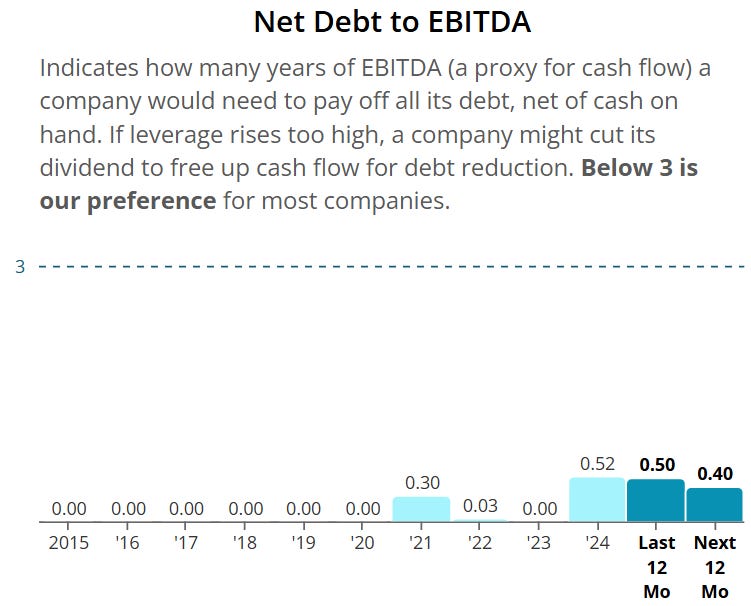

Net Debt to EBITDA <1.5

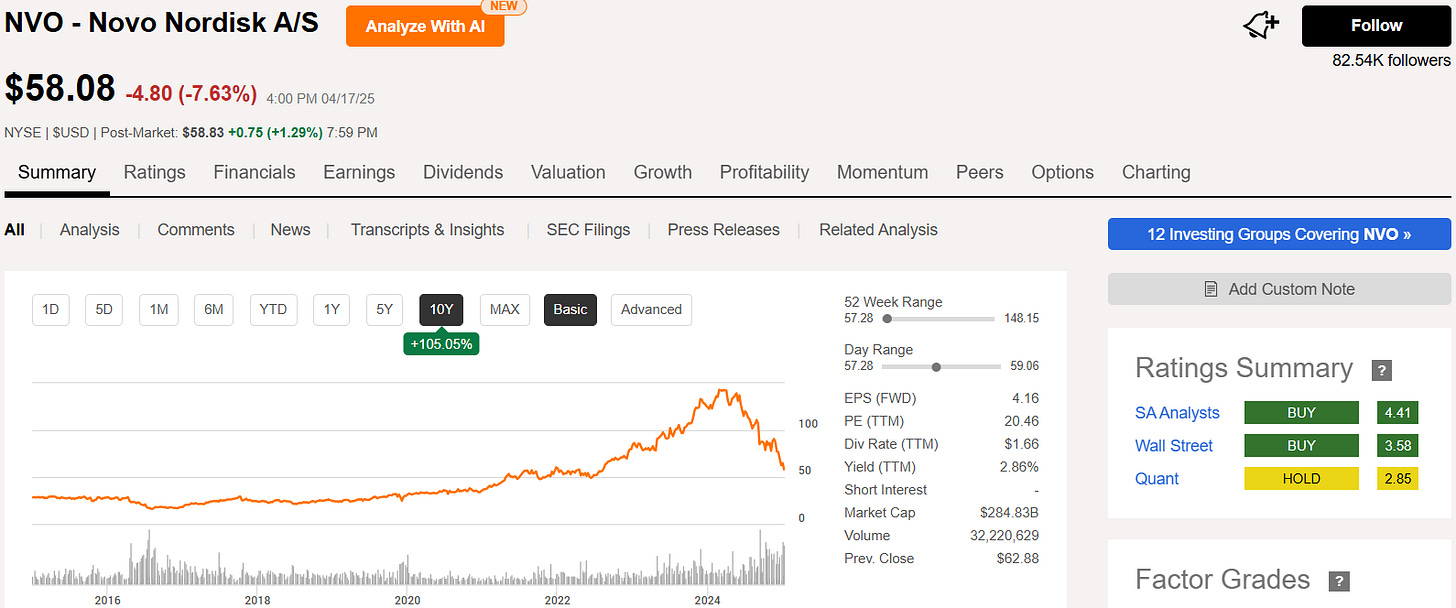

Novo Nordisk (NVO)

Novo Nordisk is a global healthcare company specializing in diabetes care, obesity treatment, and other serious chronic diseases like rare blood and endocrine disorders.

They produce insulin, GLP-1 receptor agonists like Ozempic and Wegovy, and hormone replacement therapies.

The company also invests heavily in biotech research, focusing on metabolic and cardiovascular diseases. Headquartered in Denmark, it operates in over 80 countries.

Their income stream is as follows:

Diabetes Care: Insulin products, GLP-1 receptor agonists (like Ozempic, Rybelsus), and other diabetes treatments

Obesity Care: Prescription weight-loss drugs (notably Wegovy)

Rare Disease Treatments: Products for rare blood disorders (like hemophilia) and growth hormone deficiencies

Cardiovascular & Other Chronic Diseases: Emerging treatments in metabolic and cardiovascular health

They have outperformed in 3 of their last 4 quarters (vs analyst expectations), and expect growth in all 4 upcoming quarters.

They have outperformed against the S&P 500 over the last 10Y.

We have a double undervaluation signal, as yield 2.76% is above the 5Y average of 1.41%, as well as the Forward P/E of 14.5x being below the 5Y 30.4x.

ROIC looks very very good and currently sits at 44%.

Free cash flow growth has been increasing at a fairly consistent rate over time.

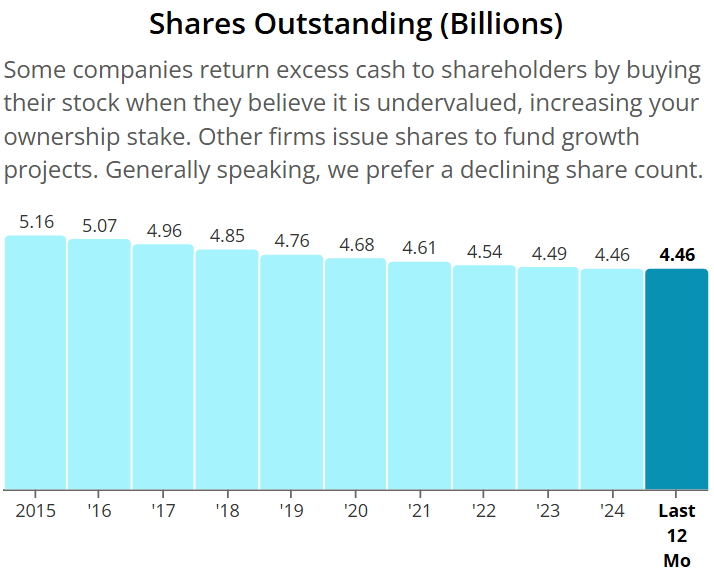

They have also been buying back shares over the last 10Y.

Whilst growing the dividend at a double-digit rate over the last 10Y.

Both operating and free cash flow margin have been consistently healthy above the minimum levels and we note operating efficiency.

Net Debt to EBITDA sits at 0.50 and expected over the next 12 months to reduce to 0.40, meaning it won’t take them long to pay off all of their debt, net of cash on hand.

Excellent balance sheet.

As per below, Wall Street see 46% upside over the next 12 months.

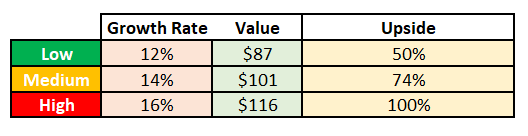

When we last ran it through our valuation model our intrinsic value came to $87 on a conservative growth rate:

As you can see below, the medium rate would yield $101, which is where we see this intrinsically worth.

So, in conclusion for NVO, we see around a 35% margin of safety around the $57 mark with Wall Street indicating 46% upside - based on the conservative growth rate of 12%.

UnitedHealth Group (UNH)

UNH is a diversified healthcare and insurance company.

It operates through two main businesses: UnitedHealthcare, which provides health insurance plans to individuals, employers, and governments, and Optum, which offers healthcare services like pharmacy benefits, data analytics, and care delivery.

Together, they manage healthcare costs, improve patient outcomes, and provide coverage to millions globally.

UNH is one of the largest and most influential players in the U.S. healthcare system.

Their income stream is as follows:

UnitedHealthcare (Insurance)

Employer & Individual insurance plans

Medicare Advantage, Medicare Supplement, and Medicaid plans

Global insurance offerings

Optum Health

In-person and virtual healthcare services

Primary care, urgent care, and specialty clinics

Optum Insight

Healthcare data analytics, consulting, and technology solutions for hospitals, insurers, and governments

Optum Rx

Pharmacy benefit management (PBM) services

Prescription drug plans and home delivery pharmacy services

These combined streams fuel UNH’s revenue, with insurance premiums being the largest contributor.

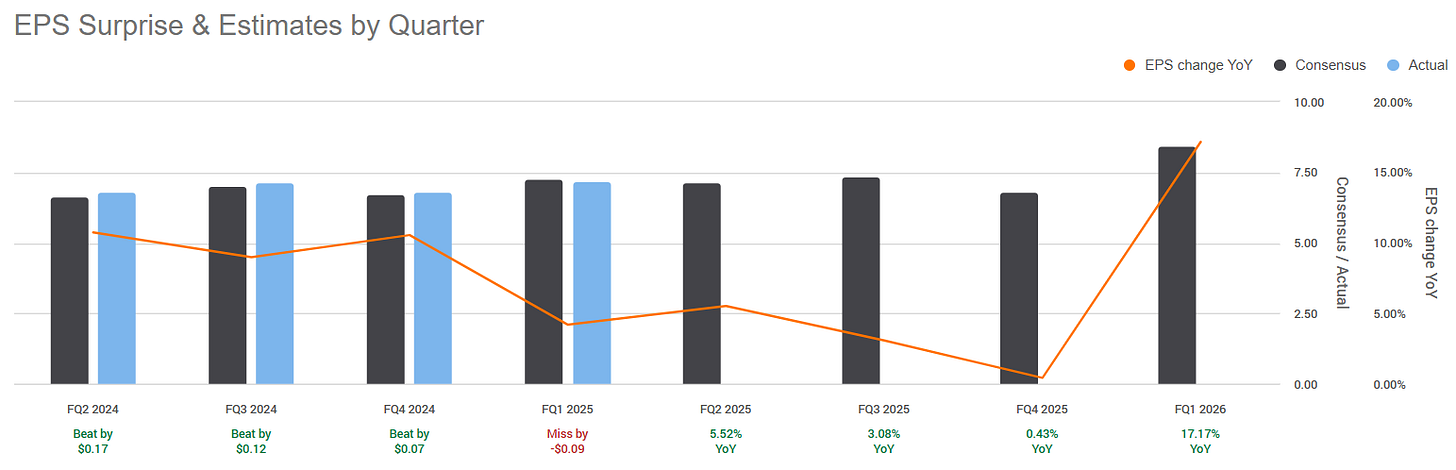

They have outperformed in 3 of their last 4 quarters (vs analyst expectations), and expect growth in all 4 upcoming quarters.

They have outperformed against the S&P 500 over the last 10Y.

We have a double undervaluation signal, as yield 1.85% is above the 5Y average of 1.42%, as well as the Forward P/E of 15.3x being below the 5Y 20.2x.

ROIC is very consistent in the mid-teens.

Free cash flow growth is very impressive too and fairly consistent, increasing nearly 3x over the last 10Y, with growth expected into the next 12 months.

Excellent dividend growth!

Margins have been consistent and whilst the operating margin is lower than we would like, it is in line with the industry norms.

Net Debt to EBITDA sits at 1.20 and expected over the next 12 months to reduce to 1.04.

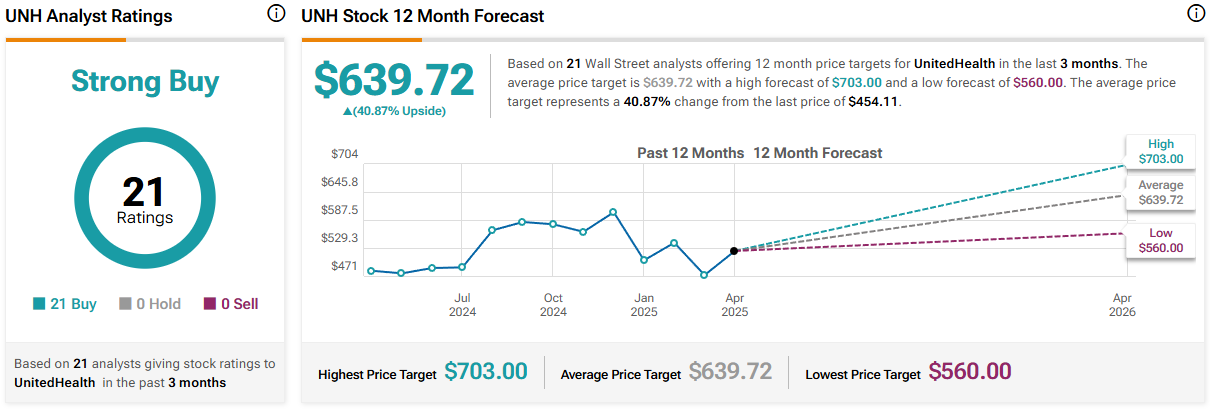

As per below, Wall Street see 41% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $553:

So, in conclusion for UNH, we see around a 20% margin of safety around the $442 mark with Wall Street indicating 41% upside.

Stock Resources

Stock Valuation Model 📊 (Unlock my stock valuation model as seen on YouTube)

Seeking Alpha 💵 ($30 off stock research tools I use daily.)

TipRanks 📈 (50% off expert stock research tools)

YouTube 🎥 (Join 89,000+ investors on YouTube!)

Patreon 👥 (Join my community for exclusive content)

Thanks For Reading!

☕ Buy Me A Coffee – Your support helps cover the costs of running the newsletter.

📬 Join the community – Subscribe now to get weekly investment insights delivered straight to your inbox.

💬 Found this helpful? Share it with friends and colleagues! Your support keeps this newsletter FREE.

I hope you all have a great week ahead! 🌟

Dividend Talks💰

Note:

I’m not a financial advisor. All content is for educational purposes only. Invest and trade at your own risk—I'm not responsible for any financial outcomes.