2 Stocks I'll Buy In November

+ Market Update

Market Latest

The S&P 500 fell for the second week in a row, however when we look over the last 12 months it is still up over 35%.

Just last week the S&P 500 was down 1.85% and with some significant events taking place next week, we are in for a lot of volatility.

We also had the employment data which showed that the economy added 12,000 jobs in the month of October which was lower than what the economists had expected.

The majority of stocks last week were down, some more significant than others.

Biggest losers last week included:

Super Micro Computer (SMCI) down 45%

Estee Lauder (EL) down 24%

Advanced Micro Devices (AMD) down 10%

Eli Lilly (LLY) down 9%

Micron Technology (MU) down 8%

Tesla (TSLA) down 8%

Palantir (PLTR) down 7%

PayPal (PYPL) down 6%

Uber (UBER) down 6%

Microsoft (MSFT) down 5%

There were many more too.

Notable News

First, we will start off with 2 HUGE events taking place next week:

Election Week

The US Presidential Election takes place on 5 November and analysts are expecting to see a lot of volatility and even more so as there is no clear winner between Kamala Harris and Donald Trump

Interest Rate Cuts

Jerome Powell is expected to speak this week with the market expecting 2 cuts, one this month and one in December, however CEO of Blackrock that has over $10T in assets under management, believes we will only see one cut (whether that is 25 or 50bps).

Warren Continues To Sell Apple

In this recent quarter Warren Buffett sold approximately 300 million shares of Apple, which is a 67.2% reduction of the position in comparison to the same quarter last year.

Berkshire cash position also now sits at an all-time high at $325billion.

Super Micro Computer

SMCI'‘s auditors Ernst & Young (EY) disclosed last week that they had resigned and this sent the shares of the Company tumbling even further as it already had dropped from the short position taken by Hindenburg and the DoJ probe, which were all centred around the allegations that they had fraudulent accounting practices and internal controls.

Mag7 Earnings

We had some of the Mag7 report some strong earnings:

Amazon

Google

Microsoft

Meta

Nvidia Entering Dow Jones

This change will be effective from the market open on Friday 8th November.

Earnings This Week

Whilst we had some of the biggest names report last week, earning seasons continues this week with lots to watch out for:

As always, we will cover this on our YouTube channel, and for those that aren’t subscribed, we would love to have you in our community which is over 57,000:

Fear and Greed Index

2 weeks ago, we were at Extreme Greed, last week we were at Greed and now we are sitting in Neutral.

Just as we’ve said over the last few weeks, the market moves very quickly alongside sentiment and with the election taking place this week, more volatility is likely.

2 Stocks I’m Buying

Let us dive into the 2 High Quality Stocks I’m looking to buy in November.

I have used the following criteria to help identify these stocks:

Dividend Safety 60+ (Safe)

ROIC > 10%

Net Debt to EBITDA below 3 (Strong Balance Sheet)

Upside > 20%

ASML (ASML)

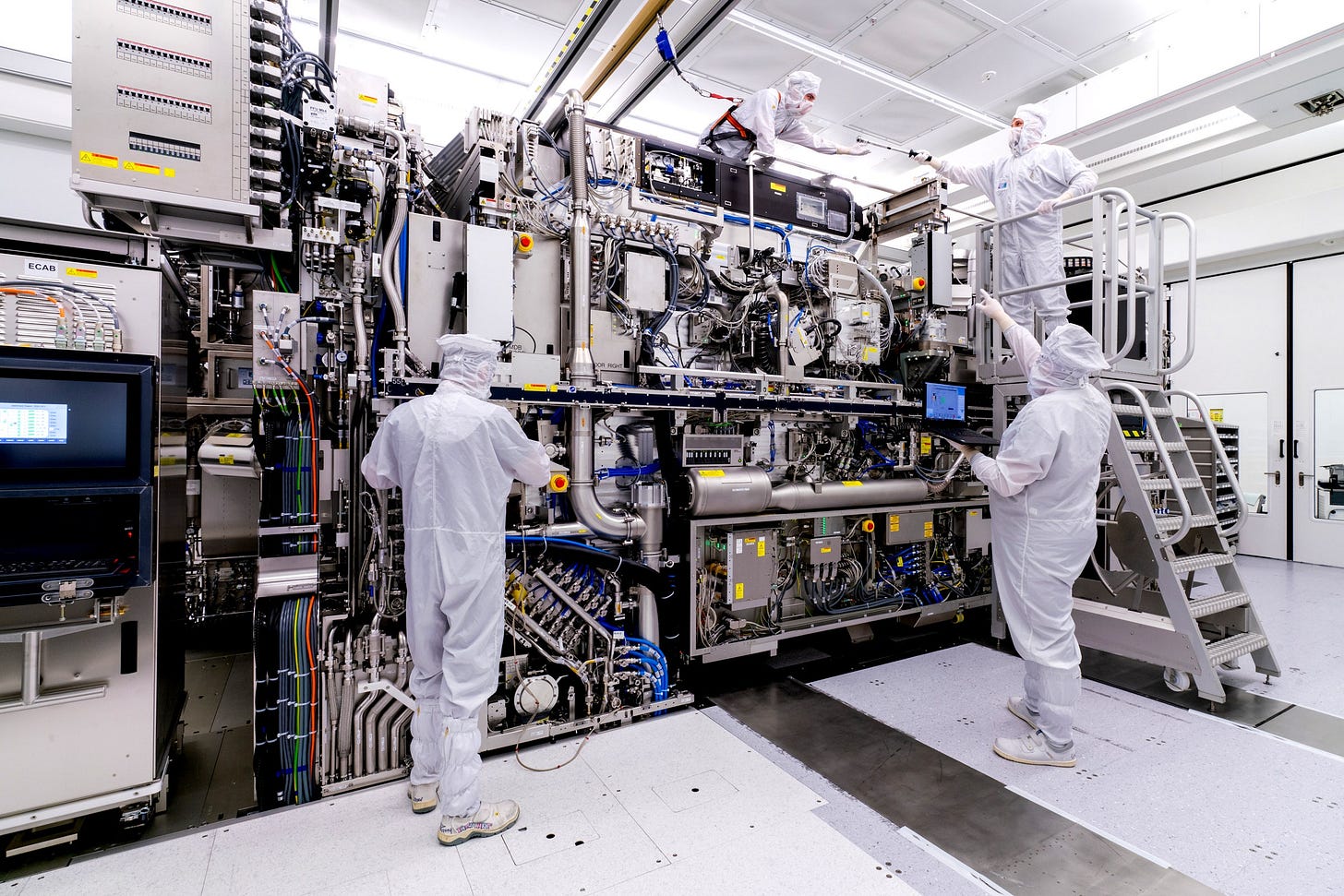

ASML designs and manufactures advanced lithography machines used in semiconductor production, enabling the creation of smaller, more powerful microchips.

ASML’s revenue primarily comes from selling and servicing its lithography systems, including extreme ultraviolet (EUV) and deep ultraviolet (DUV) machines. Their revenue streams include:

Equipment Sales: Selling new lithography machines, particularly EUV and DUV systems, to semiconductor manufacturers.

Service and Maintenance: Ongoing support and maintenance contracts for installed systems, ensuring optimal operation.

Upgrades and Enhancements: Offering upgrades to extend the functionality and life of existing systems.

Software Solutions: Licensing software for process optimization, control, and diagnostics to improve chip production efficiency.

Their EUV machines are especially lucrative due to their high demand and limited competition in advanced semiconductor manufacturing.

Over the last 10Y ASML has significantly outperformed the S&P 500 and is up 574%!

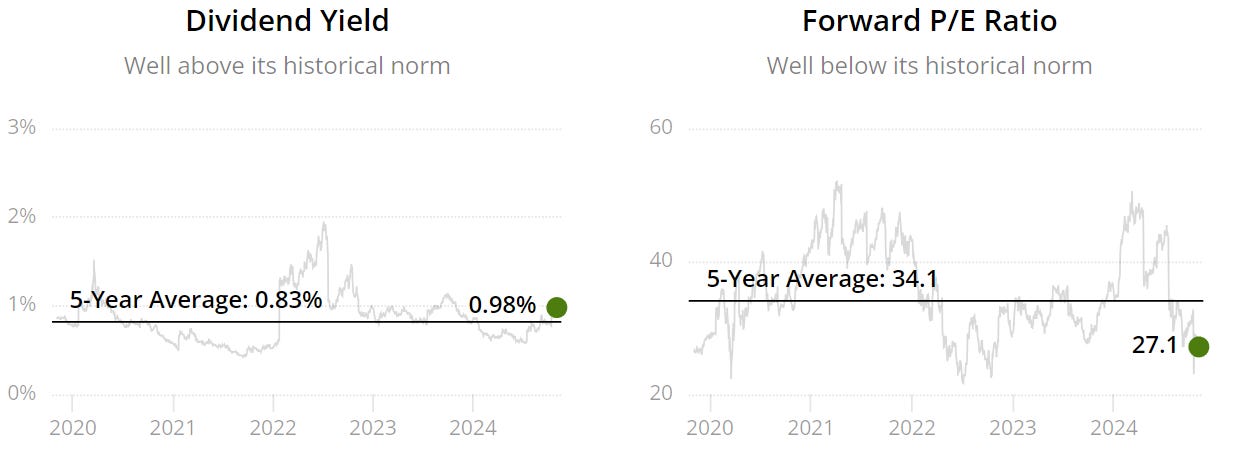

As per below, we get a double undervaluation signal as the current yield is higher than the 5Y average (0.98% v 0.83%) and the Forward P/E is lower than the 5Y (27.1x v 34.1x).

Dividend Safety score of 82 indicates safety.

The dividend growth of this Company is great to see, although this year’s increase was poor.

ROIC is very good to note.

Extremely impressive and gives us faith that management are able to effectively allocate their capital.

Net Debt to EBITDA is 0 across the board meaning it wouldn’t even take them 1 day to pay off all of their debt net of cash on hand.

Excellent balance sheet.

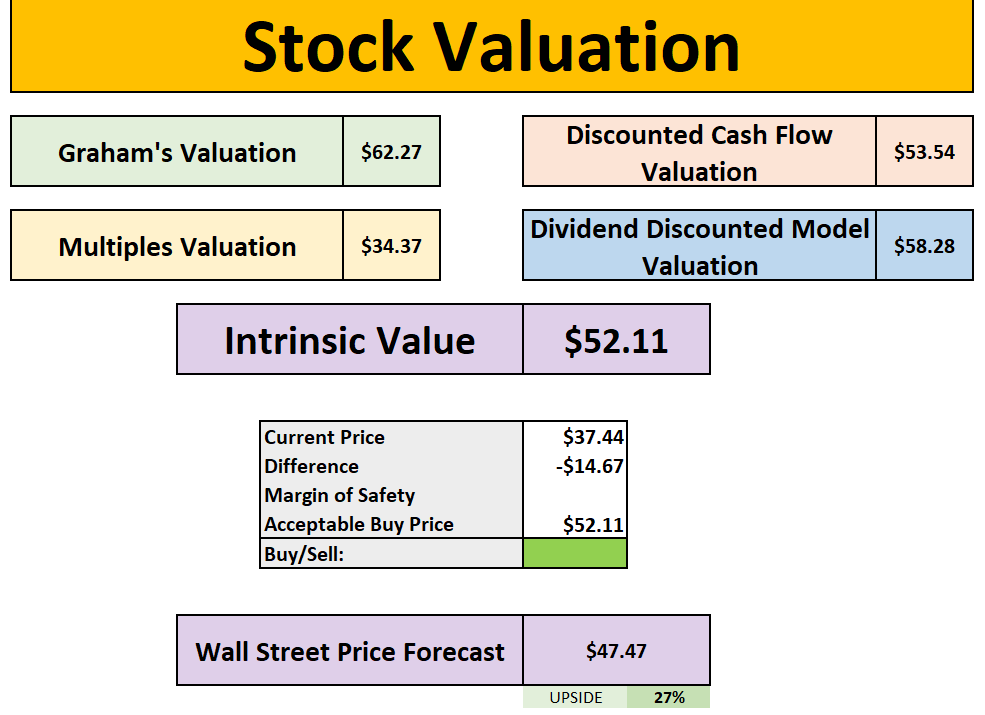

As per below, Wall Street see 36% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $1,129.

So, in conclusion for ASML, we see around a 40% margin of safety around the $677 mark with Wall Street indicating 36% upside.

Alphabet (GOOGL)

Google’s income streams primarily come from the following sources:

Advertising (Google Ads): The largest portion of Google's revenue comes from advertising through its platforms, such as Google Search, YouTube, and Google Display Network. Advertisers pay to display ads based on user searches, demographics, and behaviors.

YouTube Ads and Premium Services: Google earns from ads shown on YouTube videos as well as subscriptions to YouTube Premium and YouTube TV, which provide ad-free content and additional services.

Cloud Computing (Google Cloud): Google Cloud, which includes Google Cloud Platform (GCP) and Google Workspace, generates revenue by offering businesses infrastructure, data analytics, AI tools, and collaboration software like Gmail and Google Drive.

Google Play Store: Google earns commissions from app purchases, in-app purchases, and subscription services offered through the Google Play Store for Android devices.

Hardware: Google generates income from hardware sales, such as Pixel smartphones, Google Nest smart home products, Chromecast devices, and other accessories.

Other Bets: Through Alphabet’s "Other Bets," Google invests in various ventures like Waymo (self-driving cars), Verily (healthcare technology), and others, though these currently generate smaller revenues compared to its core businesses.

They have also just reported an excellent quarter!

Google is up 521% over the last 10Y and has massively outperformed the S&P 500 in this period.

As per below, the Forward P/E, Google trades lower than it’s 5Y average:

Forward P/E = 19.9x

5Y Average = 22.9x

ROIC has historically been very strong for this Google, however over the last 3Y it has stepped up another level around the high 20’s, with the trailing twelve-month metric showing 32%.

Excellent Balance Sheet, it wouldn’t even take them 1 day to pay off all of their debt, net of cash on hand.

Net Debt to EBITDA has consistently been 0.

As per below, Wall Street see 23% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $215

So, in conclusion for Alphabet, we see around a 20% margin of safety around the $172 mark with Wall Street indicating 23-26% upside.

One thing to remember with Alphabet is that they own Waymo, which is a self-driving technology company.

It was initially formed as part of Google's self-driving car project, which began in 2009, before becoming its own entity in 2016. Waymo develops autonomous driving technology designed to operate vehicles without human input.

In August it was announced that they are doing more than 100,000 paid robotaxi rides every week across LA, San Francisco and Phoenix. That was double what they had disclosed a few months prior.

Something to think about when considering adding this Company to the portfolio.

Stock Resources

Stock Valuation Model

If you are interested in valuing stocks yourself, we have created a valuation model below which you can pick up, this is the same version we use in our YouTube analysis:

Seeking Alpha

Seeking Alpha, one of the websites that I use when I review stocks on YouTube has a $30 off discount for your first year. This also includes a 7-day free trial for new users too!

Patreon

Join our community in the Patreon where we discuss weekly buy and sells.

Conclusion

We have just gone through 2 Stocks I’m buying in November.

However as always do your own due diligence and let us know your thoughts about today’s newsletter in the comments.

I hope you all have a great week ahead!

Thanks For Reading!

If you’d like to support this work feel free to buy me a coffee. The proceeds will contribute to the running costs of the newsletter.

Join the community of investors - subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today’s newsletter helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Note

I am not a financial advisor or licensed professional. Nothing I say or produce anywhere, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk.