2 Stocks to Buy After Crashing to Decade Lows

In a market where almost everything looks overpriced, these two beaten-down stocks stand out as true value plays.

Market Update

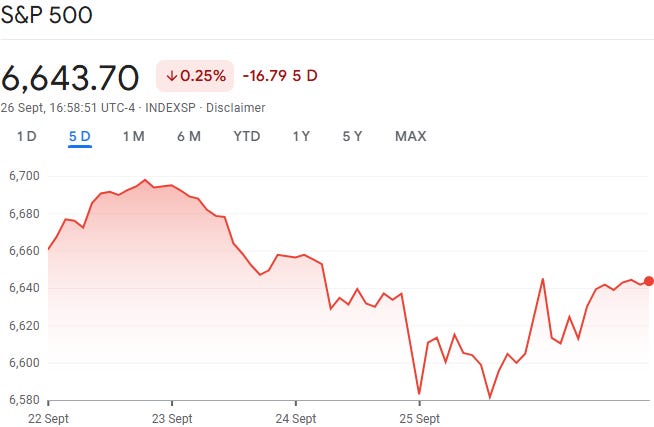

Stocks finished the week in the red, weighed down by cautious words from the Federal Reserve. The Nasdaq led the drop, slipping 0.65%, with small-caps and mid-caps also giving back ground. Only the Dow managed to hold steady.

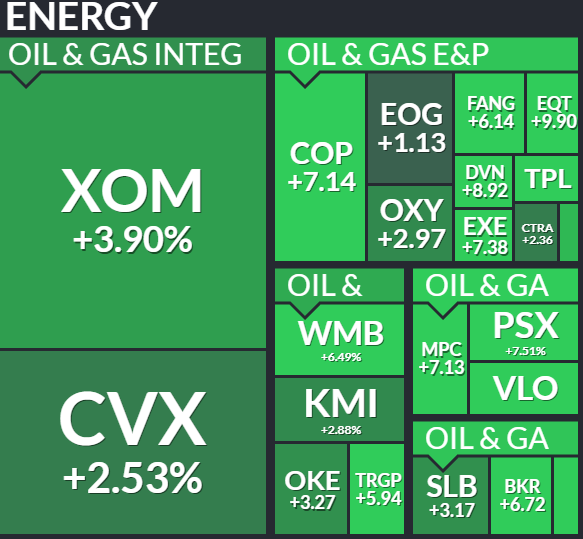

Energy was the standout. Oil prices jumped after President Trump urged Europe to cut Russian energy purchases, giving the sector a lift while most others fell.

The real drag came from the Fed. Jerome Powell warned of a “challenging situation”—inflation risks on one side, a cooling labor market on the other—while adding that stock prices look “fairly highly valued.” Other Fed officials echoed the same caution, signaling that rate cuts may not come as quickly as Wall Street hopes.

That tempered outlook was enough to cool investor sentiment and push markets lower for the week.

Top performers:

Intel (+20%)

Union Pacific (+7%)

Applied Materials (+7%)

IBM (+7%)

Ulta Beauty (+6%)

Biggest drops:

Kenvue (-10%)

Oracle (-8%)

Deckers (-7%)

Keurig Dr Pepper (-6%)

Amazon (-5%)

Notable News

Potential Market Risks

With the economy holding up and inflation settling, it’s fair to ask: where could trouble come from next? Two risks stand out.

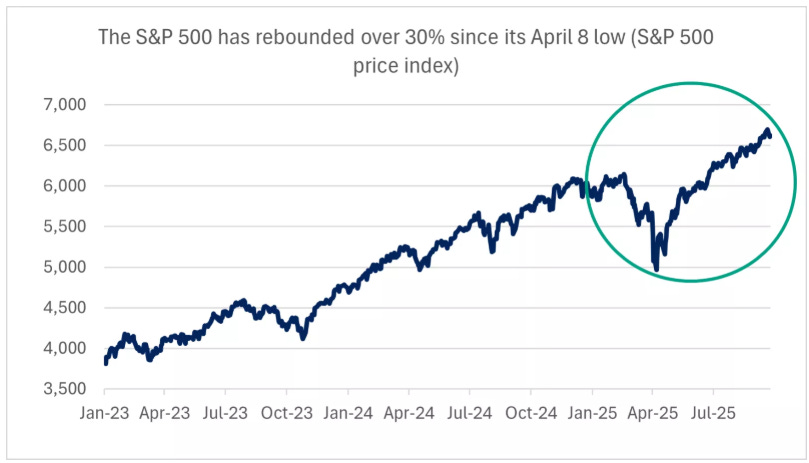

1. A market that’s run too far, too fast.

Since the April lows, the S&P 500 has surged more than 30% without even a modest pullback. History tells us corrections of 5–10% are normal, and October is often a choppier month. With earnings season still weeks away and little fresh data in the meantime, investors may decide to lock in profits. A dip wouldn’t necessarily signal deeper problems, but some turbulence ahead wouldn’t be surprising.

2. A potential U.S. government shutdown.

If Congress can’t agree on funding by October 1, parts of the federal government could shut down. That would mean furloughed workers, stalled services, and plenty of headlines. While past shutdowns have only caused short-term slowdowns, they’ve also rattled markets. Even if the economic impact is limited, political uncertainty could cool the momentum we’ve seen recently.

In short: the backdrop is still strong, but don’t be surprised if volatility creeps back in.

US Economy Data

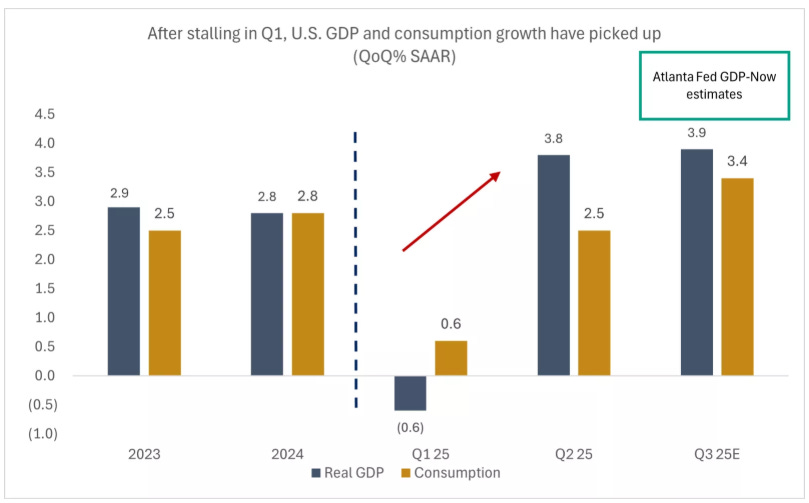

The latest data shows the U.S. economy is holding up better than most expected.

Second-quarter GDP was revised higher to 3.8%—well above the long-term trend of 1.5%–2%. The real driver? Consumers. Spending grew 2.5%, beating forecasts, and the strength continued into August with both incomes and inflation-adjusted spending rising faster than expected.

Looking ahead, the Atlanta Fed’s GDP-Now model points to nearly 4% growth in the third quarter, again powered by resilient household spending. Even the Bloomberg Economic Surprise Index, which tracks how data stacks up against forecasts, has been ticking higher.

Bottom line: U.S. growth is running above trend, and for now the consumer is keeping the momentum alive.

Labor Market + Inflation

Whether the U.S. economy can keep its momentum will come down to two things: jobs and inflation—the same data the Fed is watching ahead of its October 30 meeting.

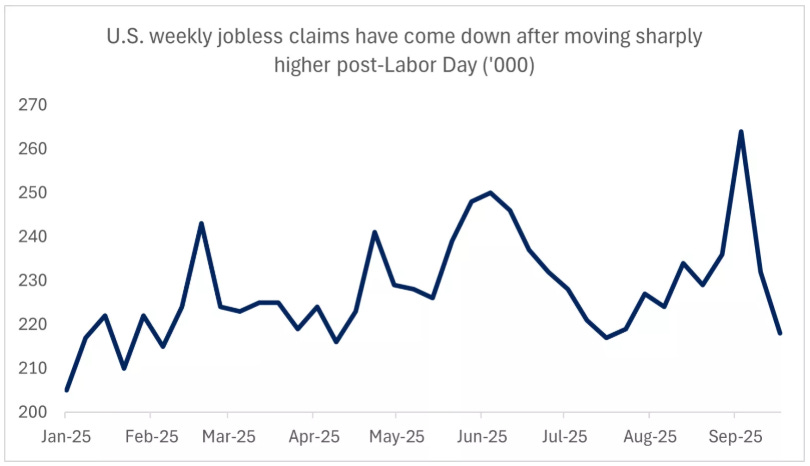

On the jobs side, things look steadier than they did a few weeks ago. Weekly jobless claims have dropped back below expectations, suggesting the spike after Labor Day was likely a blip rather than the start of a trend. The October 3 jobs report will be the next big test.

On inflation, the Fed’s preferred gauge—the PCE index—came in at 2.7% headline and 2.9% core in August, right in line with forecasts. That’s still above the Fed’s 2% target but a touch below its own projections for 2025. Goods prices could see upward pressure from tariffs, though that may be offset by cooling service costs, which make up most of the inflation basket.

For now, the story is one of stability: a labor market that’s holding up, and inflation that’s elevated but not spiraling.

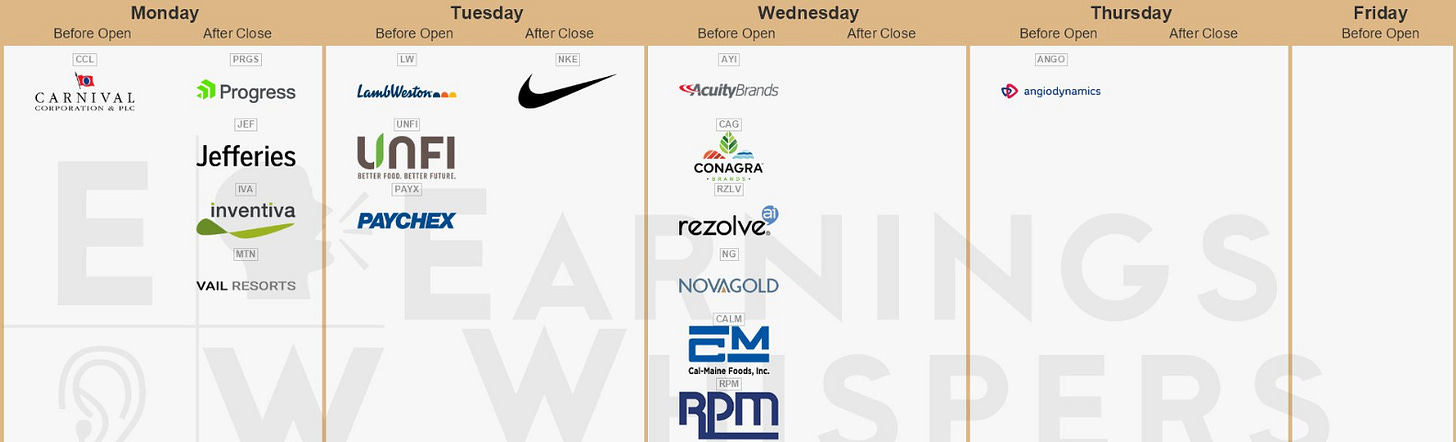

Earnings This Week

Join 111,000+ investors on YouTube! 🎥

We break down earnings, market moves, and exclusive insights you won’t find anywhere else.

Don’t miss out — hit the button below to watch and subscribe now! 👇

YouTube Channel 🔔

Subscribe today and stay ahead of the market!

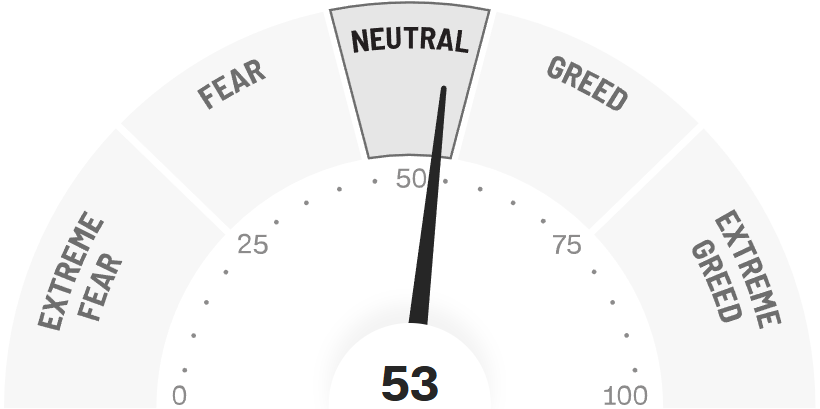

Fear & Greed Index

2 Stocks to Buy After Crashing to Decade Lows

While the market overall looks stretched, not every stock is sharing in the rally.

A handful of quality names have quietly fallen back to decade lows—levels we don’t often get to see.

These are the rare spots where long-term investors can find real value. Let’s take a closer look at three of them.

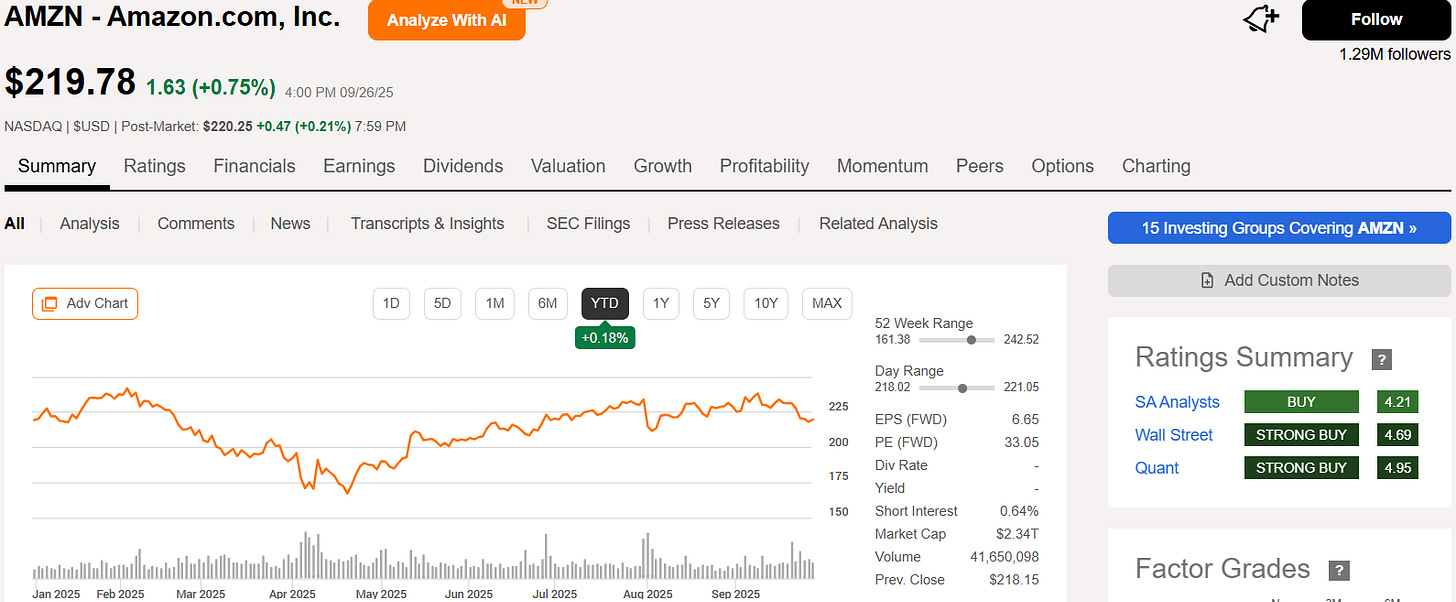

Amazon (AMZN)

EV/EBIT 31x

10Y High 185x

Amazon Web Services (AWS) is still a beast, but Wall Street has lost patience.

Amazon has been the laggard of the “Magnificent Seven” this year—while its peers raced ahead, the stock is essentially flat year-to-date. Investors have been hesitant, weighing slowing growth in its retail arm against the longer-term promise of AWS and AI.

The reality is that Amazon is in a transition phase. The company has spent heavily on logistics, cloud infrastructure, and AI capabilities, which has muted short-term profitability. But those investments are designed to pay off in scale and efficiency over the next few years.

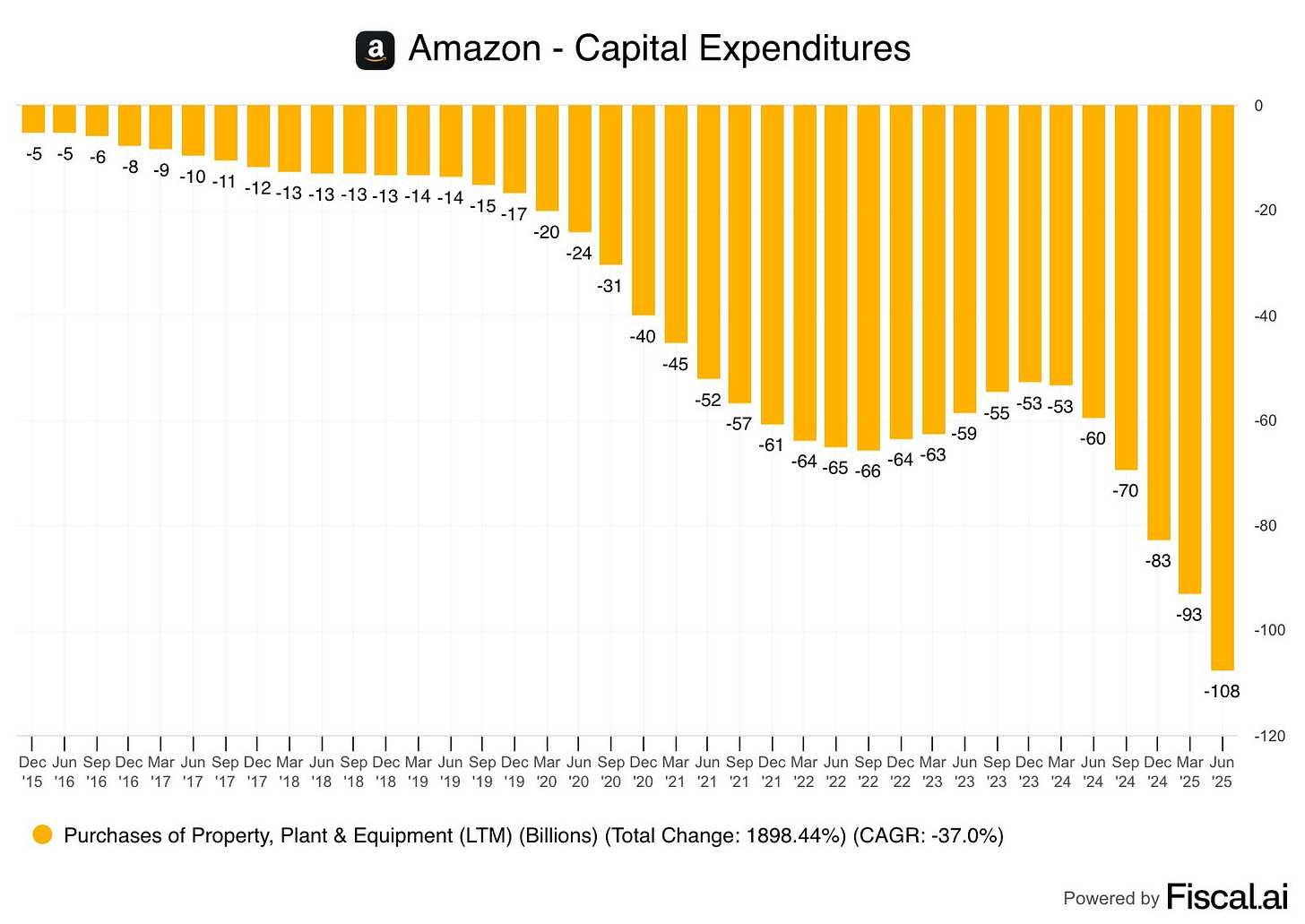

They have spent $108bn over the last 12 months.

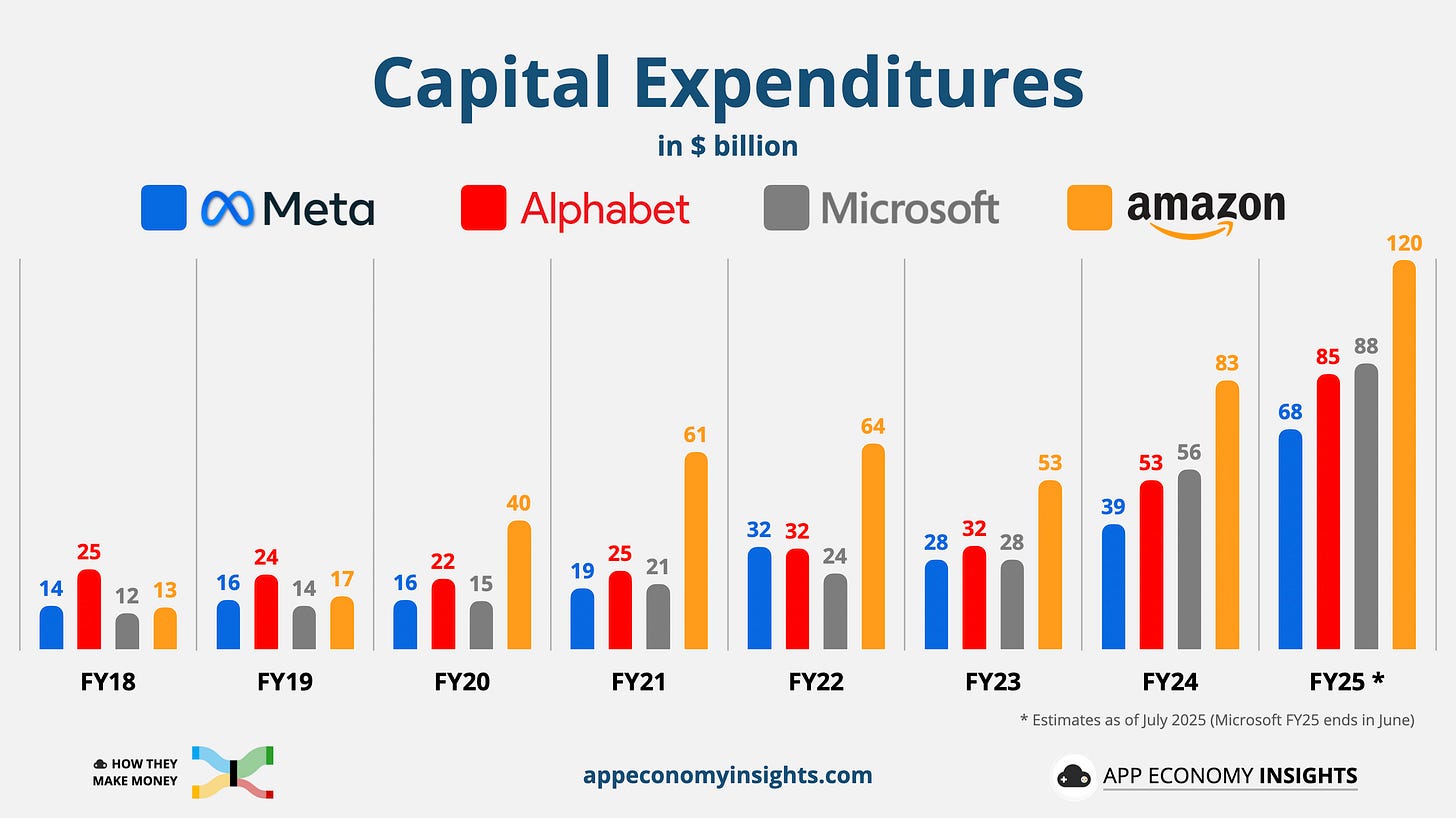

This is expected to total $120bn for FY25, the largest spending out of the Mag7.

For long-term investors, Amazon trading sideways while the rest of Big Tech stretches valuations could be a gift—an opportunity to buy one of the strongest platforms in the world before momentum catches up again.

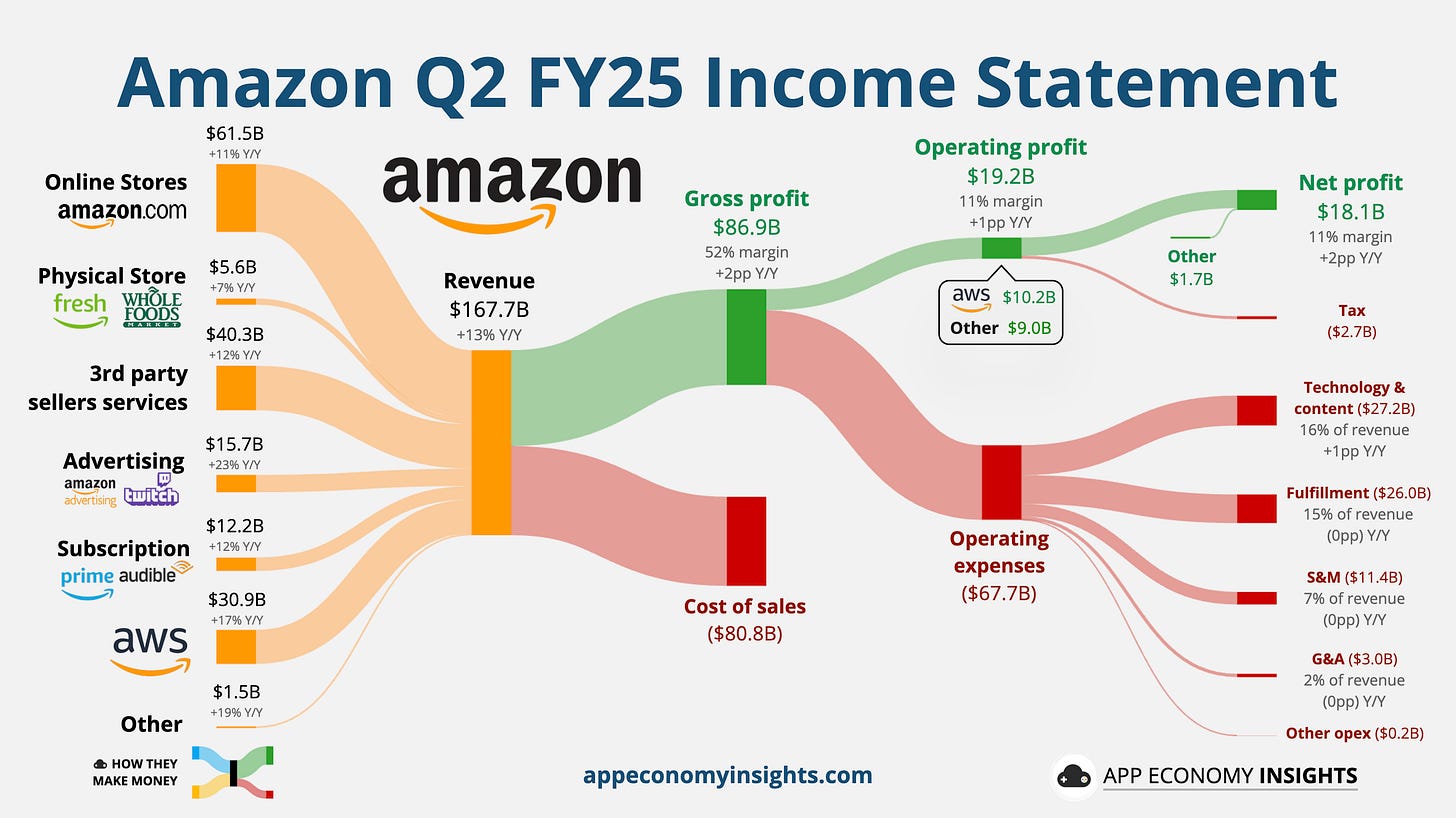

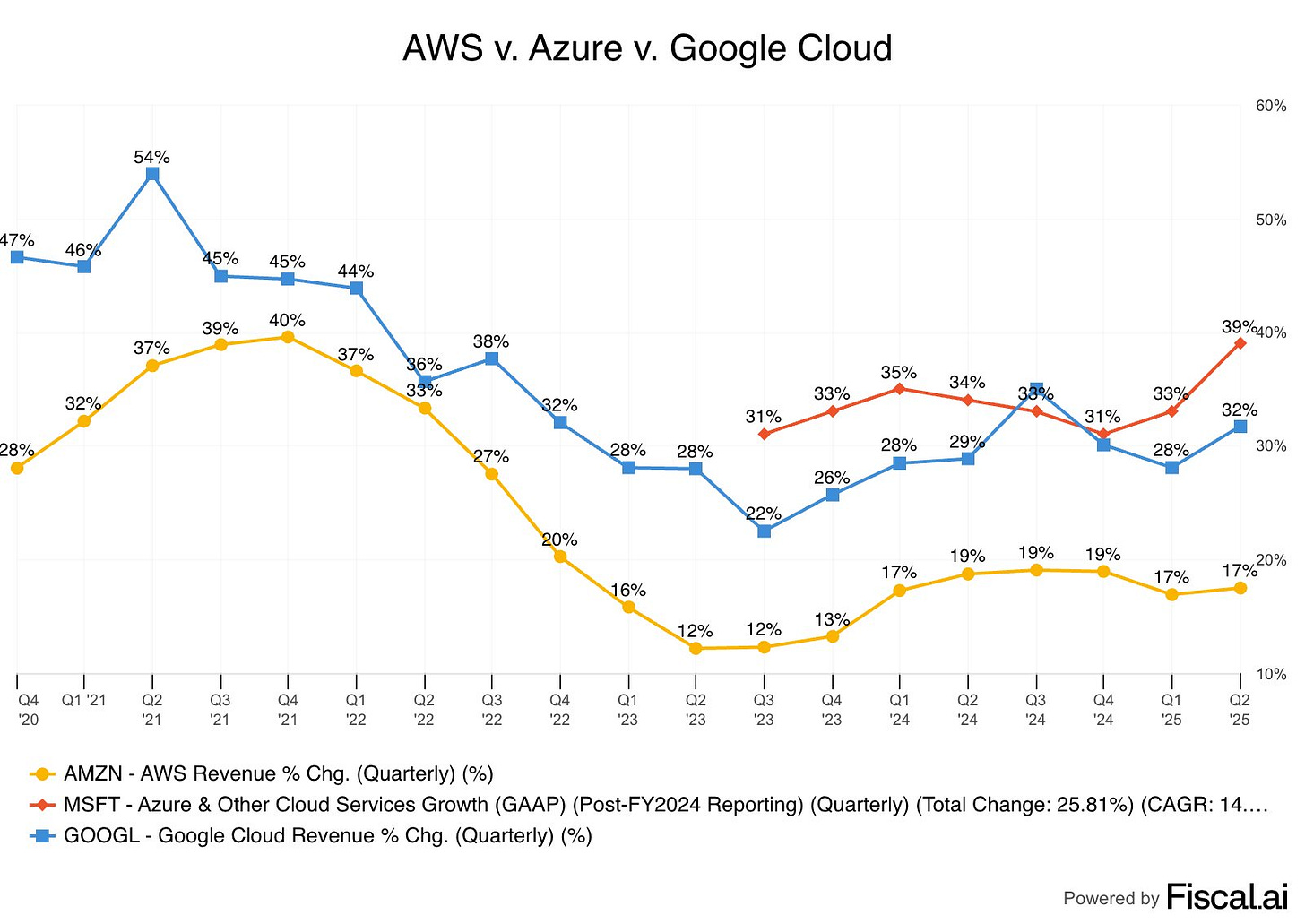

Their latest earnings was strong with double digit increases across the board and efficiencies noted in their margins, but AWS grew 17% Y/Y - Wall Street wanted to see higher.

They grew slower and by quite some distance in comparison to both MSFT and GOOGL.

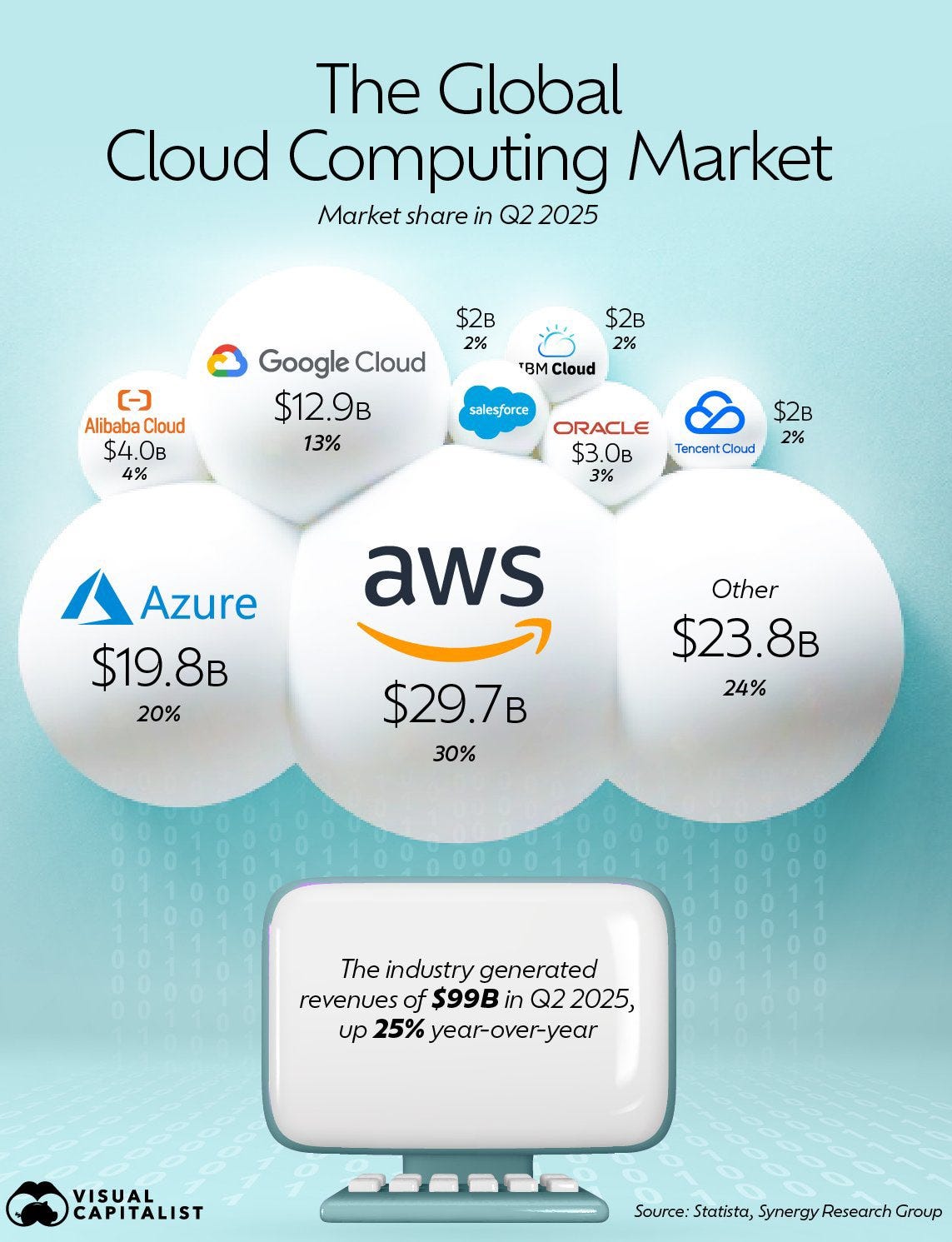

Although they do hold the largest market share at 30% with Azure in second place at 20% and Google Cloud third with 13%.

Amazon’s story today is less about what’s happening this quarter and more about the foundation it has been laying. Its retail network is now faster and leaner than ever, giving it an edge in same-day and next-day delivery that competitors can’t easily match. On the cloud side, AWS growth has slowed, but it remains the backbone of the internet—and Amazon is doubling down on AI to reaccelerate that business.

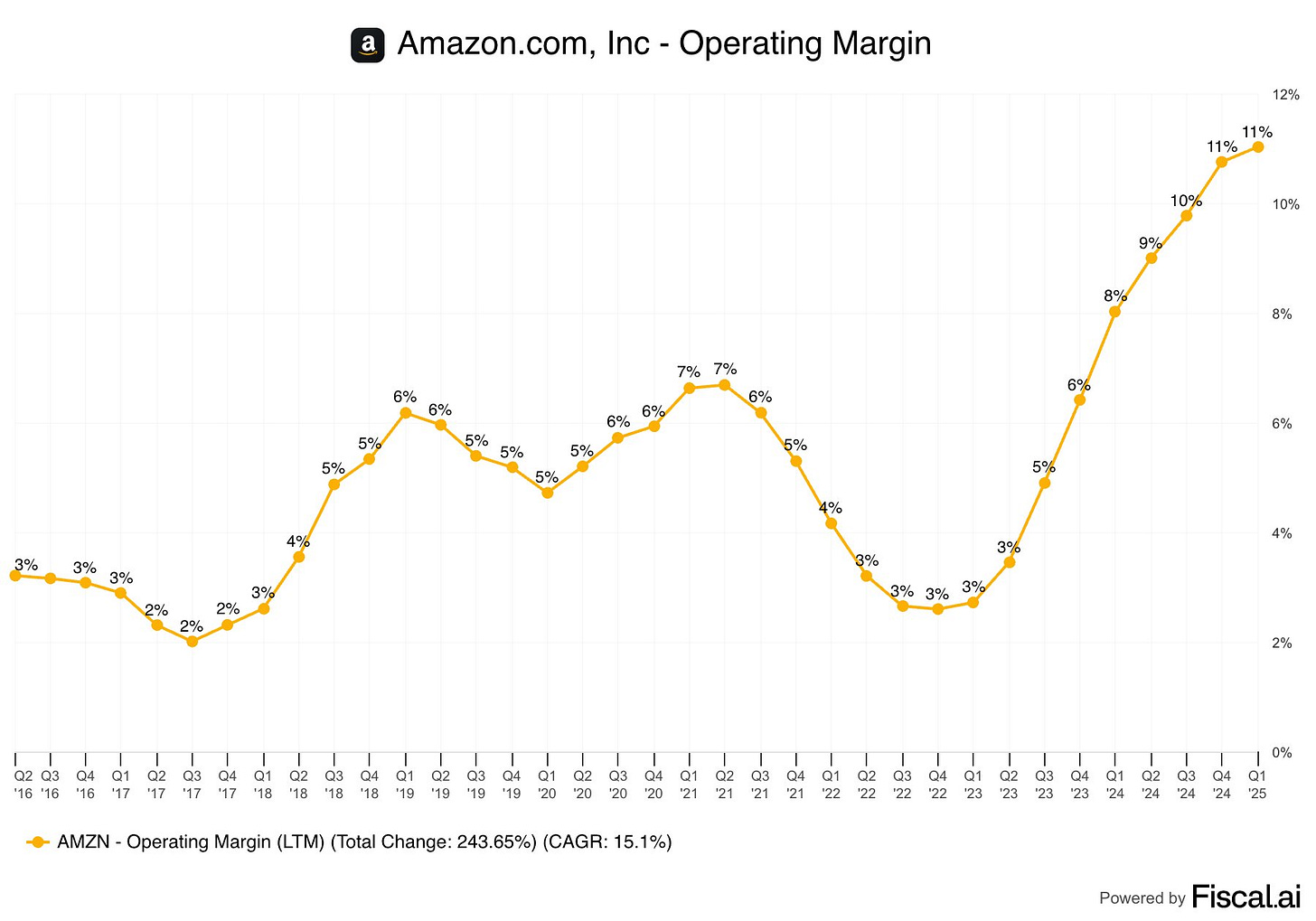

Margins are already starting to improve, and with cost discipline in place, earnings power is set to grow faster than revenue. Combine that with a stock price that has barely budged this year while others in Big Tech soared, and the setup for a catch-up trade looks compelling.

For long-term investors, Amazon offers a rare mix: a dominant retail engine, a world-leading cloud business, and emerging AI upside—all at a relative discount compared to its peers. That’s why it deserves serious consideration in any portfolio looking for durable growth.

One of the most overlooked parts of Amazon’s story is how much room it has to improve margins. For years, heavy spending on warehouses, delivery infrastructure, and Prime perks kept profits thin. But that investment phase is now shifting toward efficiency.

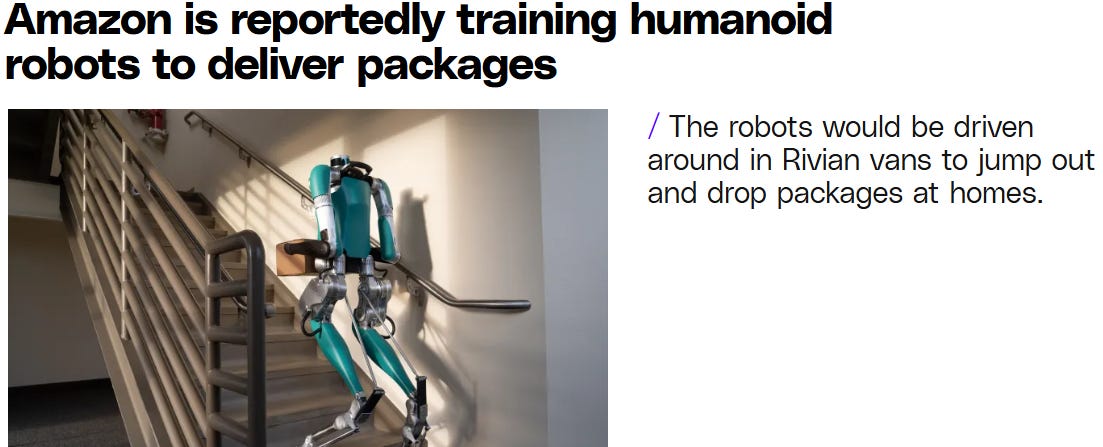

Robotics is a huge part of that. Amazon already has over a million robots working alongside employees, and it continues to roll out advanced automation across its fulfillment centers. The goal is faster delivery at lower cost—and every efficiency gain drops straight to the bottom line.

Add to that smarter use of AI in logistics, tighter expense controls in retail, and a high-margin AWS business stabilizing, and Amazon has multiple levers to push profitability higher. That margin expansion potential is a big reason the stock could surprise to the upside from here.

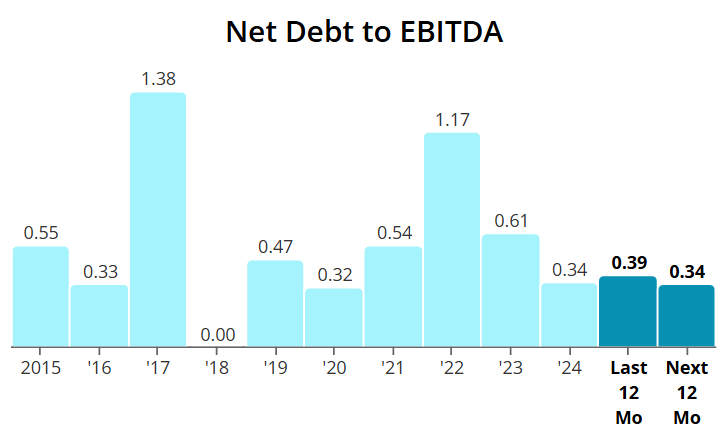

Amazon’s balance sheet also provides a layer of comfort for investors.

With a net debt to EBITDA ratio of just 0.39, the company carries very little leverage compared with peers.

This low debt level gives Amazon flexibility to continue investing in growth initiatives, like robotics and AI, without putting pressure on its finances—another reason it’s well-positioned for a rebound.

Valuation

Keep reading with a 7-day free trial

Subscribe to Dividend Talks to keep reading this post and get 7 days of free access to the full post archives.