2 Stocks to Buy After Earnings Crash

Market rebounds with tech leading the way — here’s why these picks stand out now.

Market Update

A Bounce Back Led by Tech and Strong Earnings

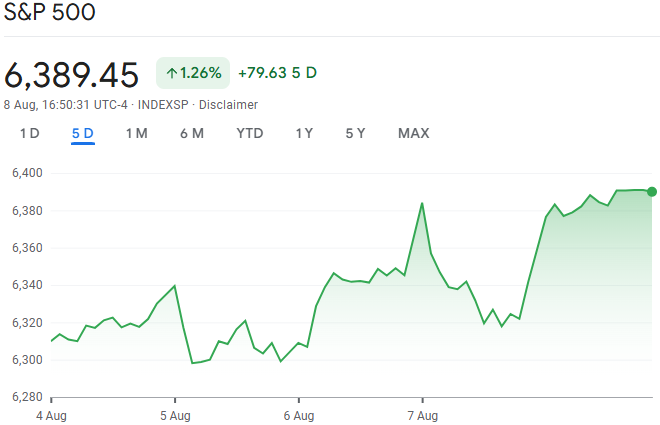

Last week, the market took a nice little rebound - and tech stocks, along with consumer discretionary, really stole the show. It’s a good sign, especially since these sectors tend to tell us a lot about where the economy’s headed.

Speaking of the economy, the services sector, which is huge (about 71% of the U.S. economy!), is still growing, even though some of the data in July gave mixed signals.

On the jobs front, productivity went up in the second quarter, which helped balance out rising wages. That’s important because it means companies aren’t feeling too much pressure on their costs right now.

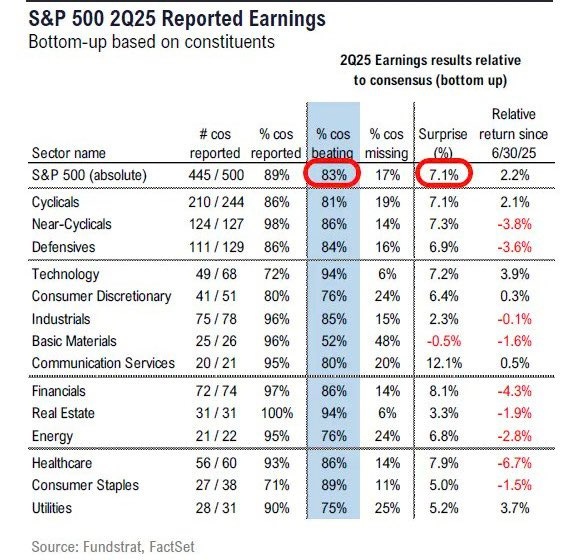

Earnings season is also giving us a reason to smile. Companies have been beating expectations, and as a result, earnings growth estimates jumped from 3.8% to nearly 10% since the end of June. That’s a big upgrade and a boost for investor confidence.

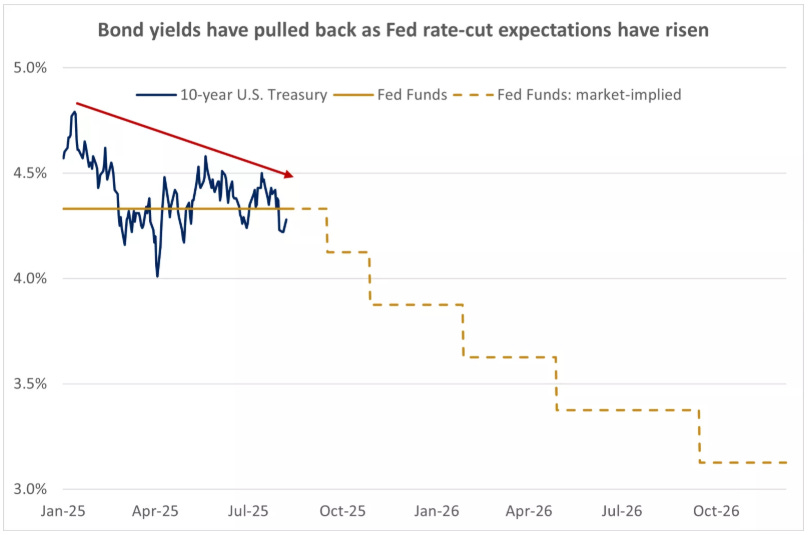

On the bond side, yields rose a bit last week, mainly because Treasury auctions didn’t attract quite as much demand. But overall, the longer-term trend in yields is still heading downward.

Winners and Losers This Week

Top performers:

Palantir (+21%)

Arista Networks (+18%)

Micron (+13%)

Apple (+13%)

Tesla (+9%)

Biggest drops:

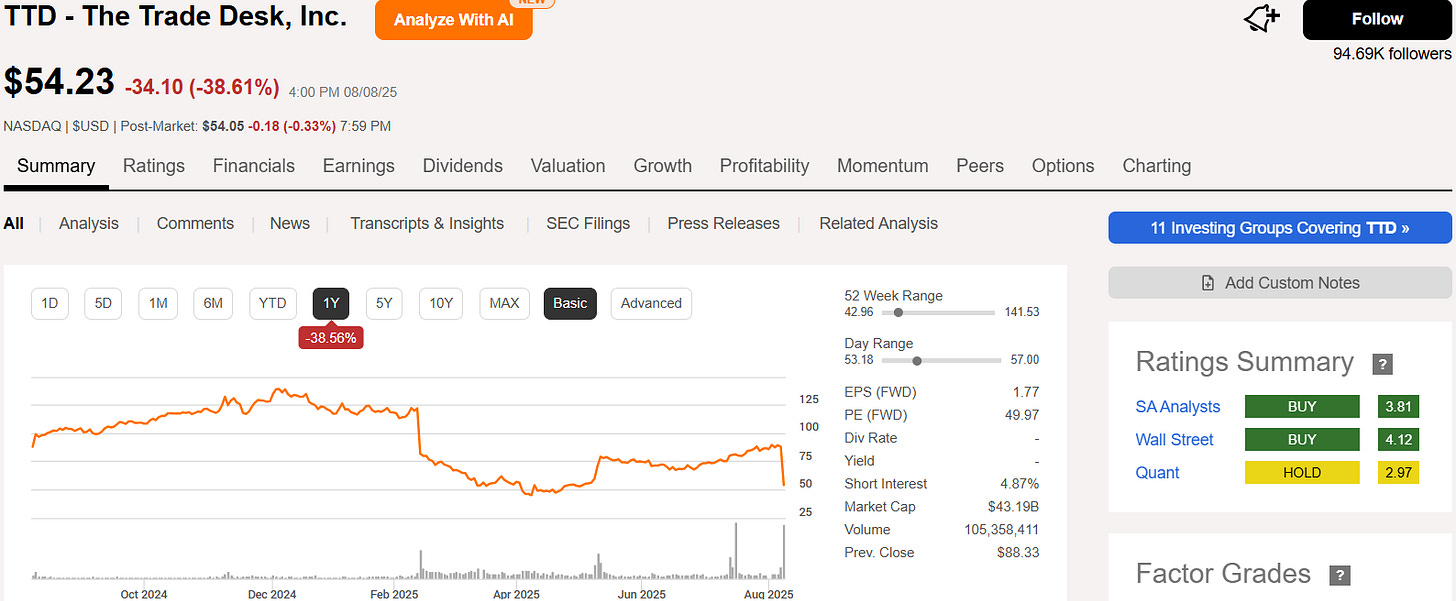

Trade Desk (-37%)

Fortinet (-24%)

Super Micro Computer (-21%)

Eli Lilly (-18%)

Warner Bros Discovery (-15%)

Notable News

The Trade Desk (TTD) - Down 37%

TTD’s stock plunged after the company reported weaker-than-expected revenue growth and a softer outlook for the rest of the year.

Investors are concerned about slowing demand in the digital advertising space, which has weighed heavily on shares.

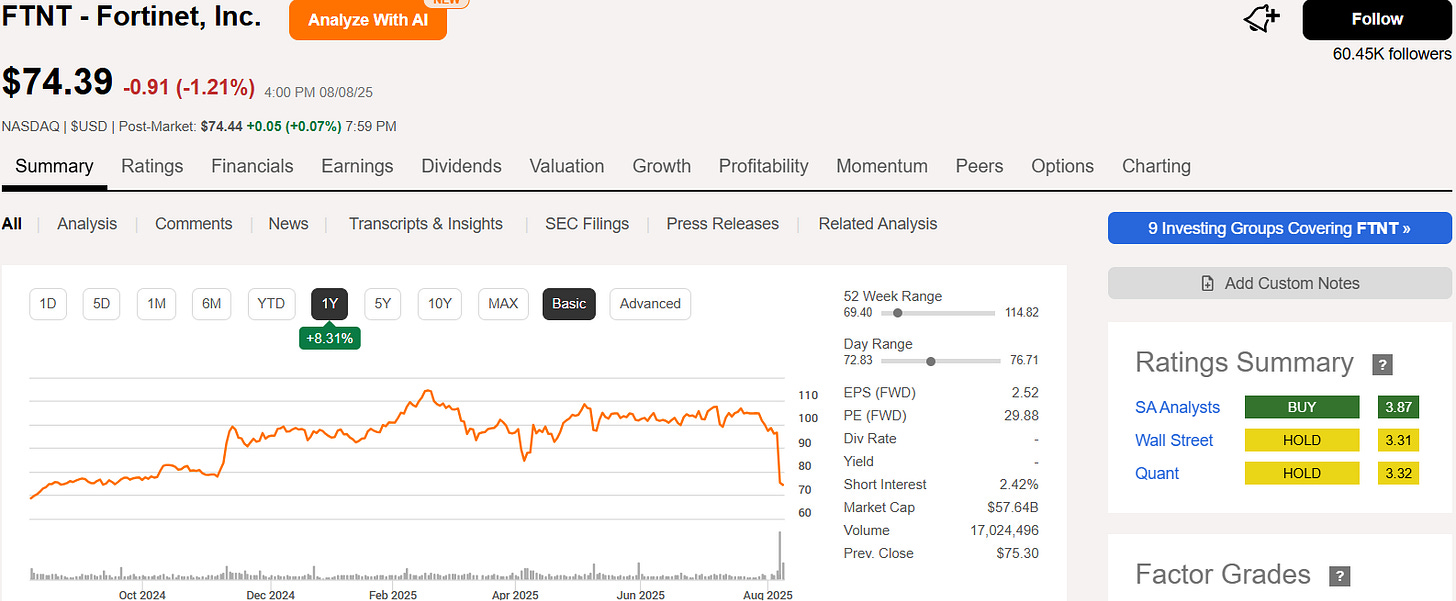

Fortinet (FTNT) - Down 24%

Fortinet’s sharp drop came despite beating earnings.

The selloff was triggered by worries that a key firewall upgrade cycle is nearing completion, raising doubts about the company’s near-term growth runway.

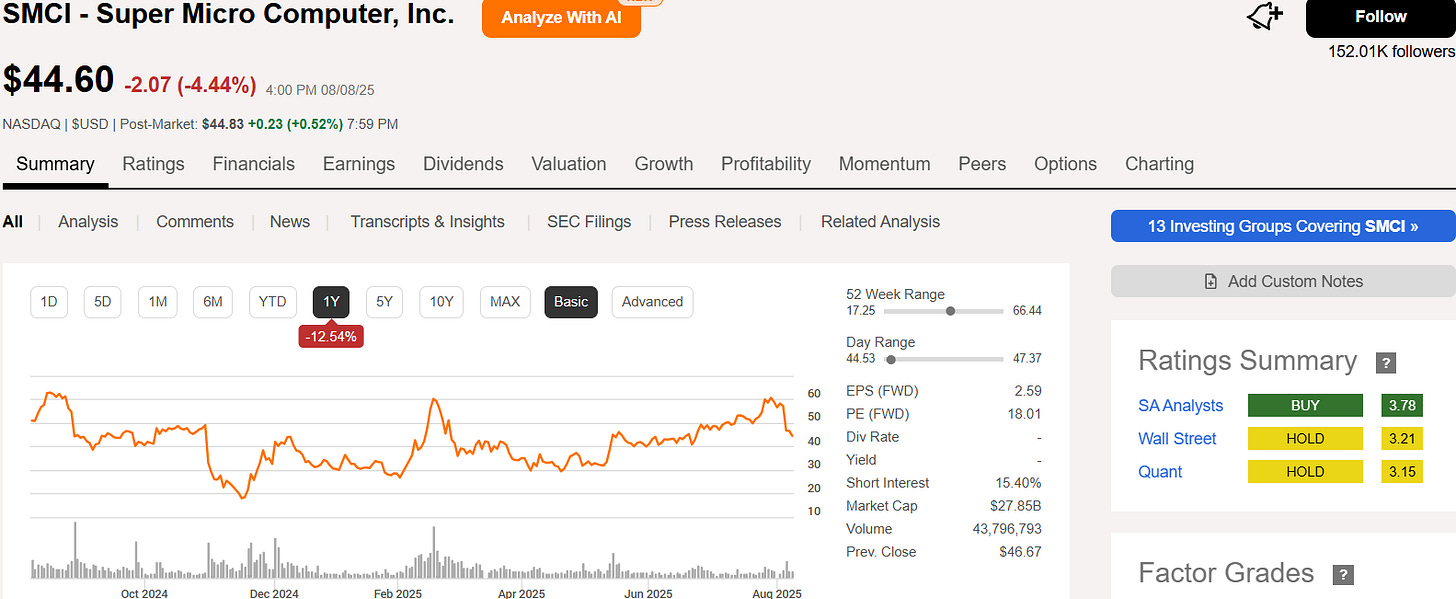

Super Micro Computer (SMCI) - Down 21%

SMCI’s stock fell after disappointing quarterly results and lowered guidance.

The company cited supply chain challenges and cautious demand in its core server business as the main reasons.

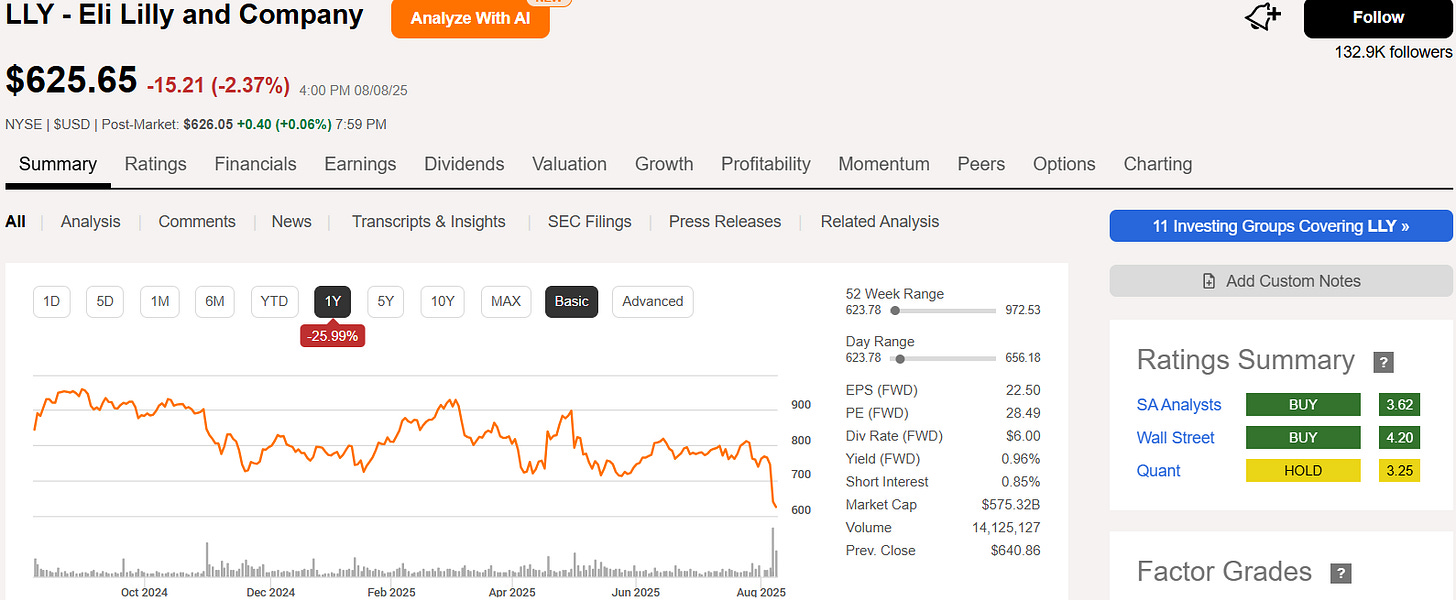

Eli Lilly (LLY) - Down 18%

Eli Lilly’s shares dropped following mixed news around its new weight-loss drug.

While the company reported strong overall sales and earnings beats, investors were disappointed with one drug’s trial results that didn’t meet high expectations.

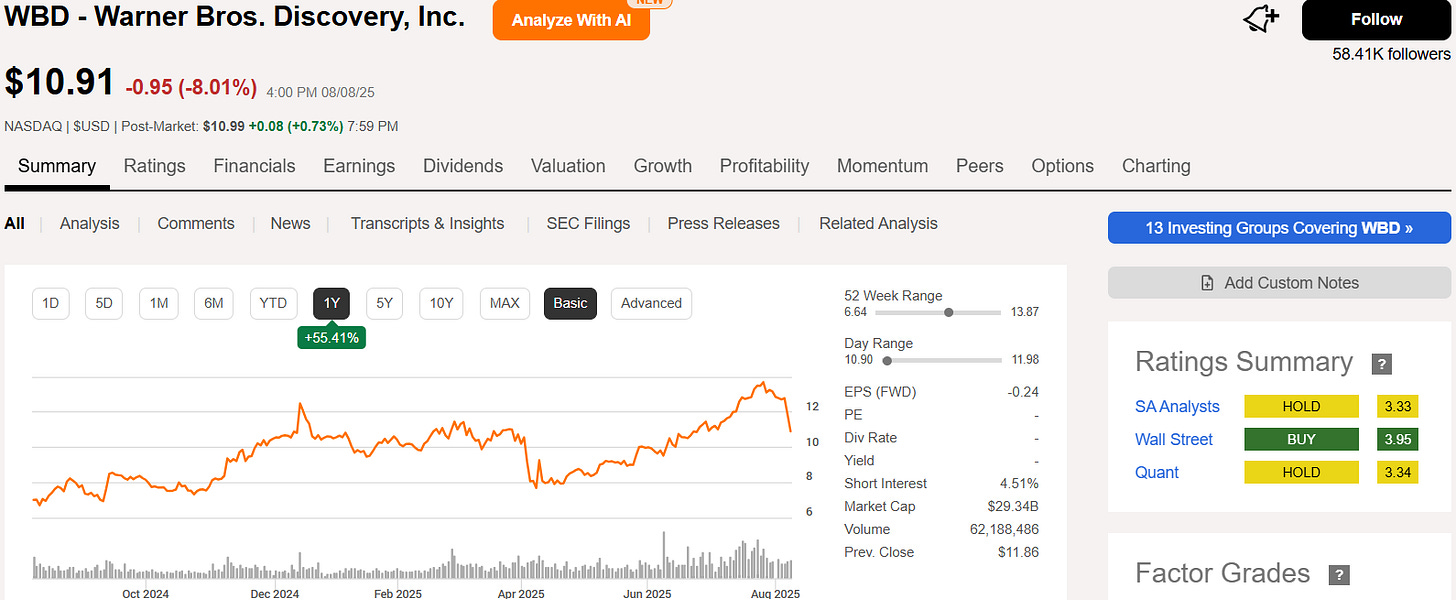

Warner Bros. Discovery (WBD) - Down 15%

WBD shares fell amid concerns over rising costs and intense competition in the streaming space.

Investors are also watching how the company manages its debt load while trying to grow its subscriber base.

Earnings This Week

Join 107,000+ investors on YouTube! 🎥

We break down earnings, market moves, and exclusive insights you won’t find anywhere else.

Don’t miss out — hit the button below to watch and subscribe now! 👇

YouTube Channel 🔔

Subscribe today and stay ahead of the market!

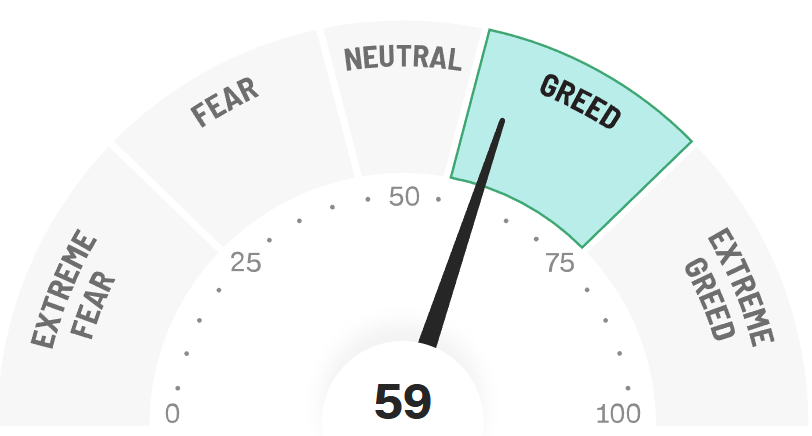

Fear & Greed Index

2 Quality Buy The Dip Stocks

Eli Lilly (LLY)

📉 What Happened with Eli Lilly?

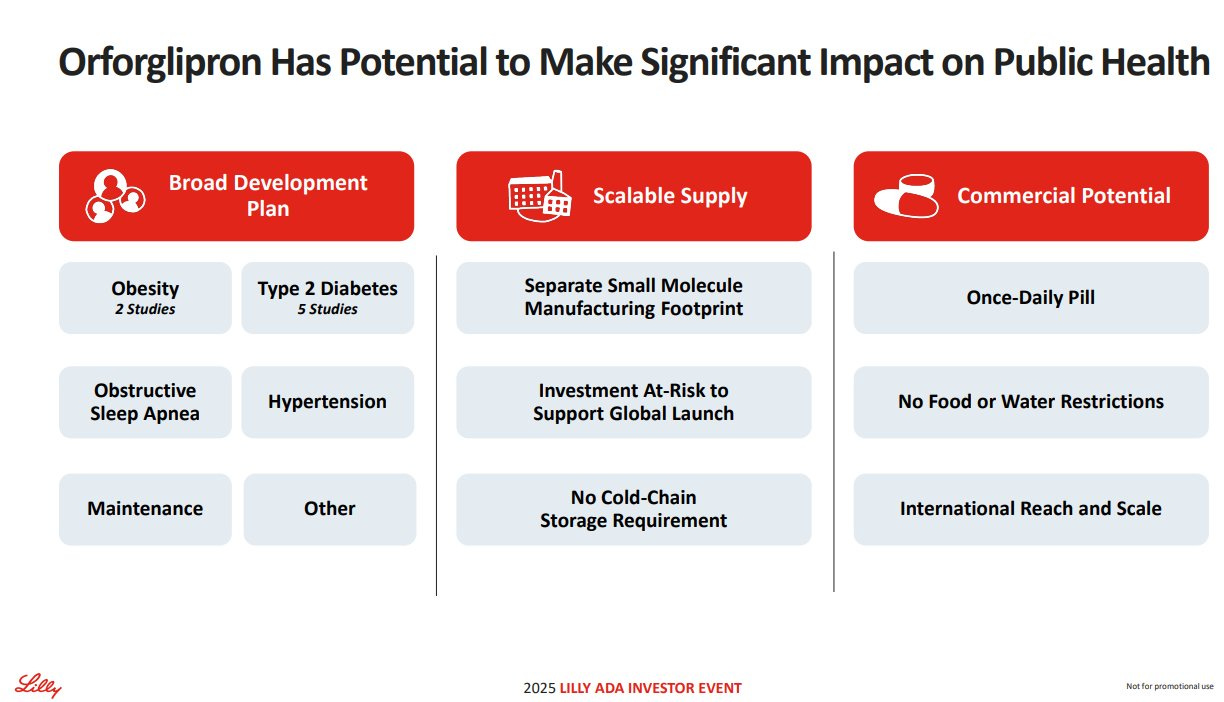

Last week, Eli Lilly’s stock took a big hit - falling around 18%. The main reason? A setback with their new oral weight-loss drug, orforglipron.

The latest trial results showed the drug helped people lose about 12.4% of their body weight over 72 weeks. While that sounds good, it actually came up short of what investors were hoping for - especially compared to a rival drug from Novo Nordisk that showed a bigger weight loss.

On top of that, more people stopped taking Lilly’s drug early because of side effects, which worried investors about how well the drug will do in the long run.

Even though Eli Lilly had some strong sales from other drugs like Zepbound and Mounjaro, the news about orforglipron overshadowed those wins and shook confidence in the stock.

Meanwhile, Novo Nordisk’s shares got a boost as it looks like they’re pulling ahead in the race for obesity treatments.

🚀 Why Now Could Be a Great Time to Consider Eli Lilly

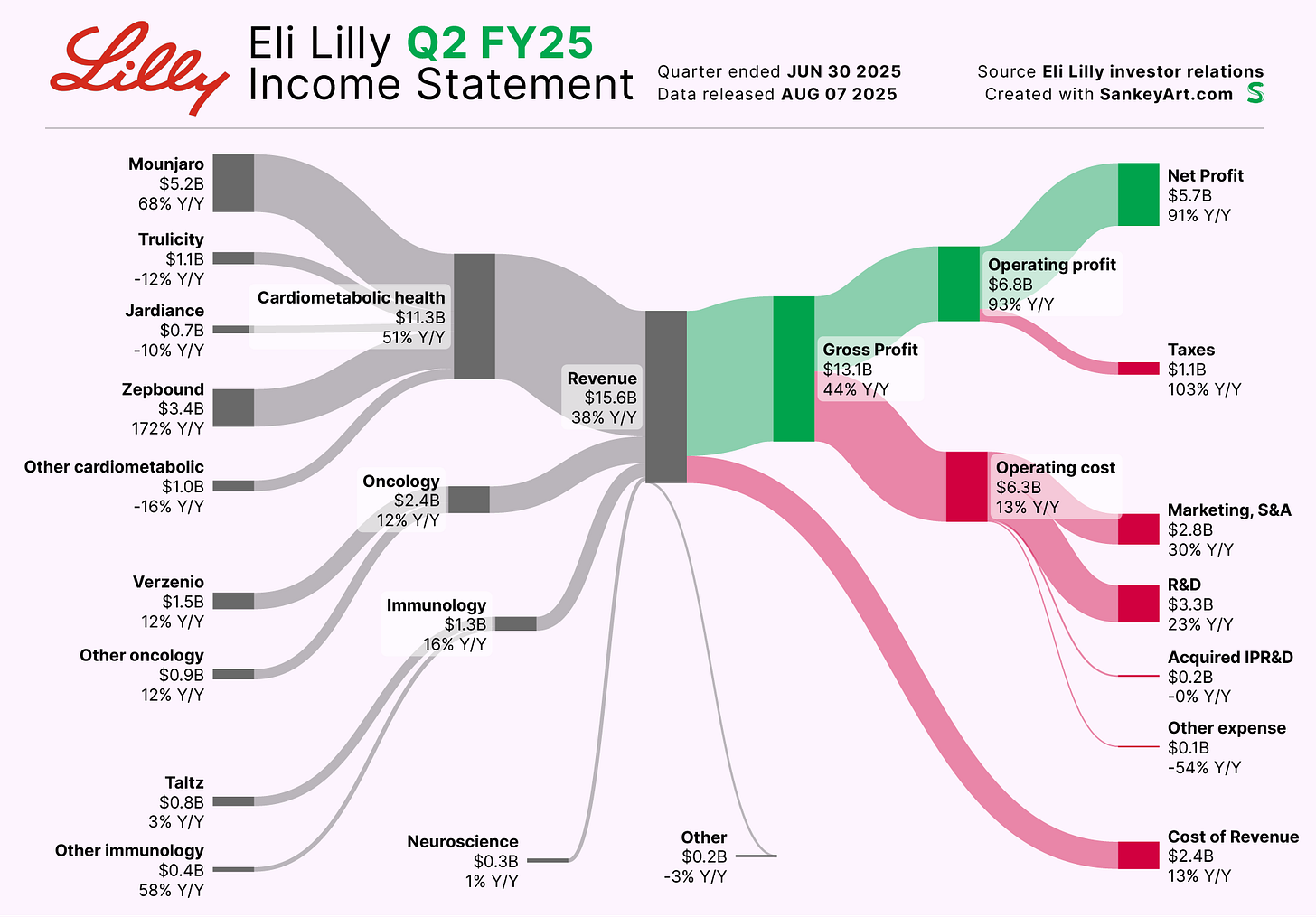

Yes, the stock took a hit after the Orforglipron news - but that’s mainly because the market was expecting a jaw-dropping breakthrough and didn’t get it. The truth? Eli Lilly crushed the quarter, with revenue soaring 38% year-over-year to $15.6 billion and big contributions from Mounjaro and Zepbound.

They also raised guidance for 2025, expecting $60–62 billion in revenue and stronger margins. This isn’t a one-trick pony - Lilly’s pipeline spans obesity, diabetes, oncology, neuroscience, and immunology, with new approvals and big investments fueling growth.

Orforglipron isn’t about beating other drugs on weight loss alone; it’s designed to make obesity treatment easier and more accessible in primary care. That’s a huge market opportunity still playing out.

With the stock pullback, you get a chance to buy into a market leader that’s not just riding a trend but building a broad platform for long-term growth.

⚖️ Why Eli Lilly Could Be a Smarter Bet Than Novo Nordisk

While Novo Nordisk has been the star performer in obesity treatments lately, Eli Lilly’s recent stock pullback might actually make it the more attractive opportunity today.

Eli Lilly has a more diversified pipeline and revenue base - not just obesity drugs, but also strong products in diabetes, immunology, and neuroscience. That diversity can help smooth out risks if one area stumbles.

Plus, Lilly’s strong sales growth from drugs like Mounjaro and Zepbound shows it can compete effectively and innovate fast. Novo Nordisk’s big lead in obesity treatments is clear, but it also means a lot of expectations are already priced into their stock.

Buying Eli Lilly now means getting a company with solid fundamentals and growth potential at a more reasonable price, while Novo Nordisk’s stock may be riding high and vulnerable to setbacks.

If you’re looking for growth with a bit more value and less hype, Eli Lilly could be the better shout.

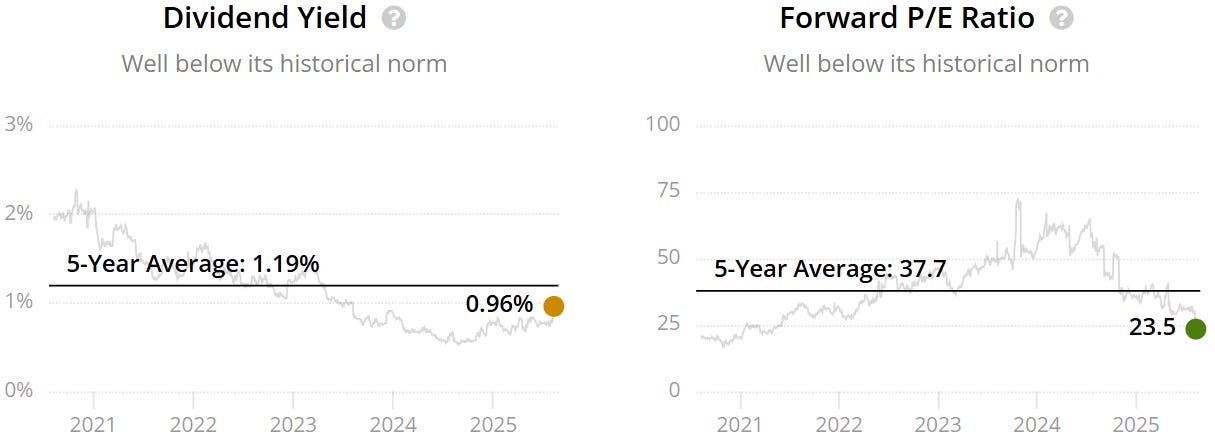

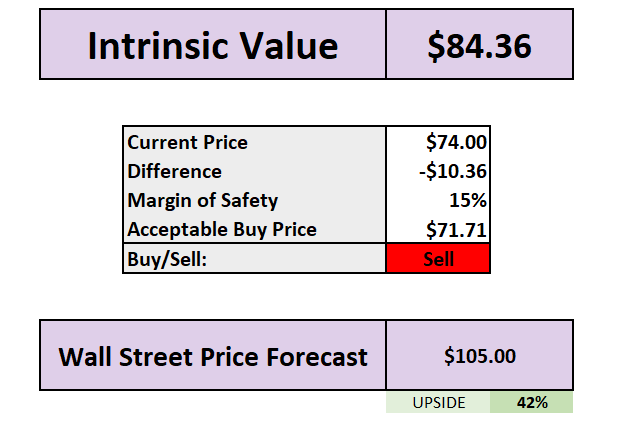

Valuation

It currently trades at a Forward P/E of 23.5x vs it’s historical 37.7x.

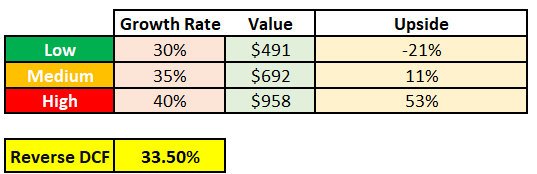

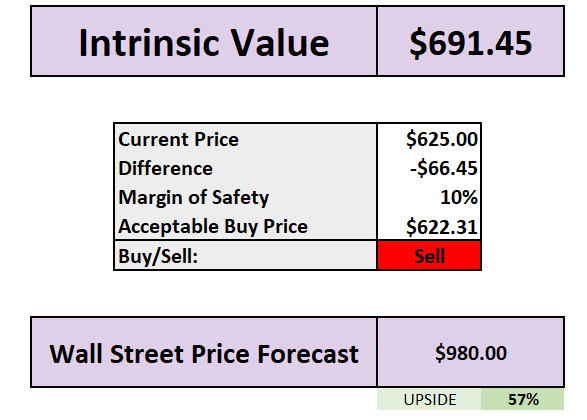

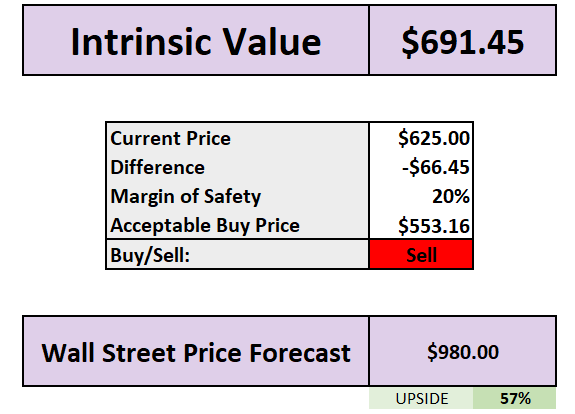

Depending on how much you see LLY growing it’s future free cash flow, you can see that there is upside.

Based on the reverse DCF, it has about 33.50% of growth currently baked into the numbers.

Based on 35% growth, we see around a 10% margin of safety up to $622.

Given the high growth already baked into the numbers, and the fact the growth rate is very high, we would consider this a good opportunity at a 20% MoS.

If we see this around $550 (perhaps next week) then this could be a strong consideration for our portfolio.

Analysts believe they can grow their EPS in the next 3-5Y at a rate of 32.22% annually.

Fortinet (FTNT)

📉 What Happened with Fortinet?

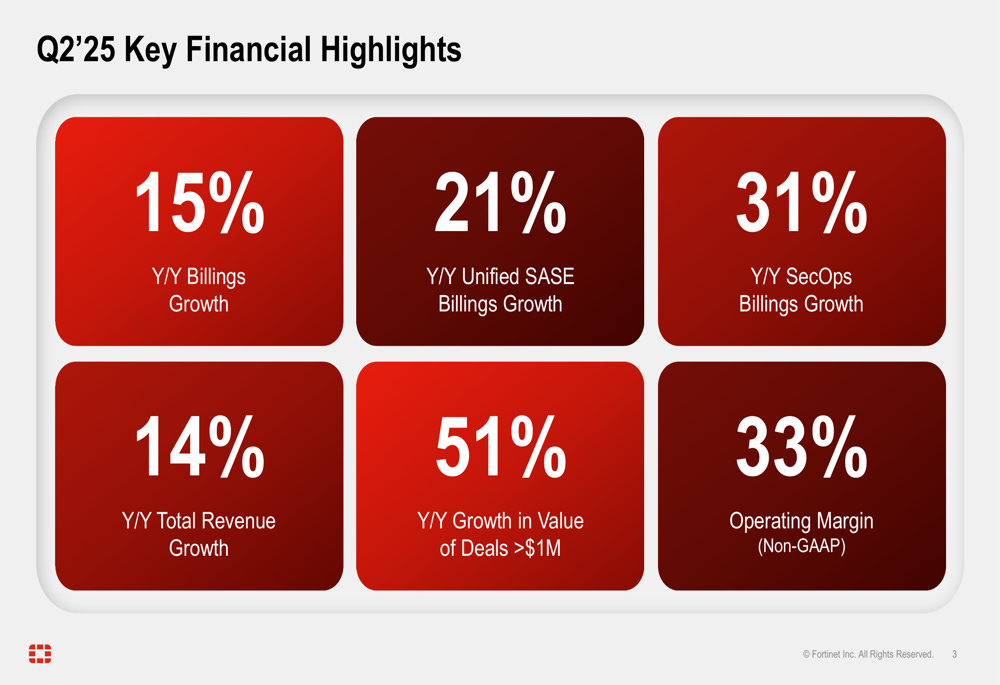

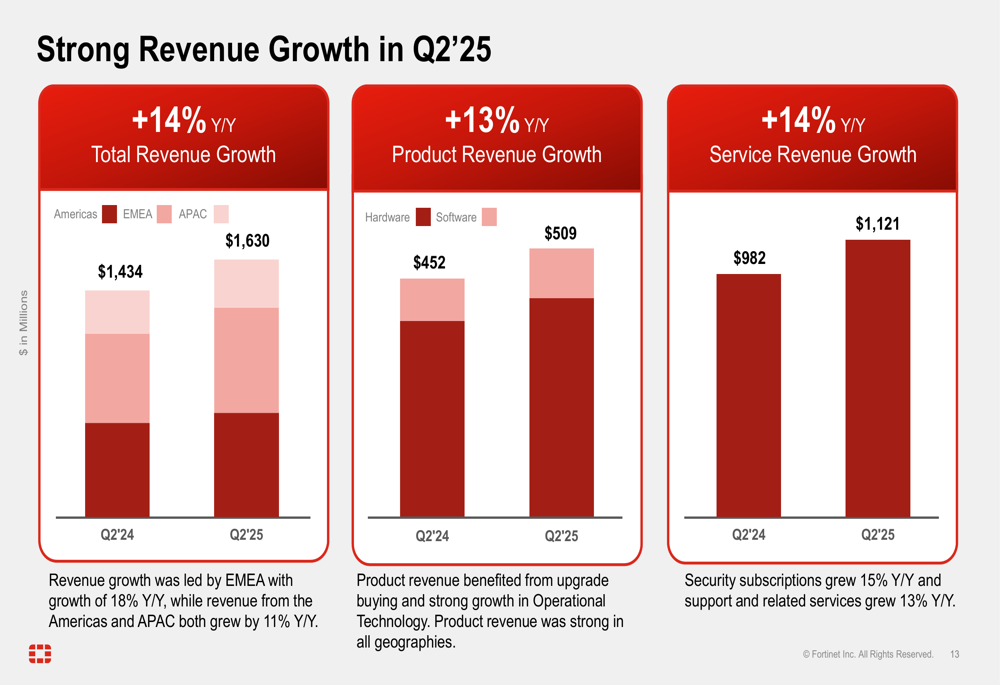

Fortinet’s stock took a surprising tumble, dropping about 24%, even though they reported solid earnings. Their revenue grew nicely, and earnings beat what analysts expected - so why the big sell-off?

The main issue was around their firewall business. Fortinet is in the middle of a big “refresh” cycle - basically, customers replacing old firewall products with new ones. The company said they’ve already completed almost half of this upgrade opportunity for next year, which got investors worried. Why? Because it means a big chunk of future firewall sales might be behind them already, raising questions about how much growth is left from this part of their business.

On top of that, Fortinet’s outlook for the next quarter came in a bit light compared to what Wall Street wanted to see, which added to the concerns.

That said, Fortinet is pushing hard into new areas like Secure Access Service Edge (SASE) and security operations tech - promising fields for the future. But right now, investors are focused on the short-term challenge: what happens when the firewall upgrade boom slows down.

So, even with good earnings in hand, the story around future growth caused the sharp drop last week.

🚀 Why Now Could Be a Good Time to Consider Fortinet

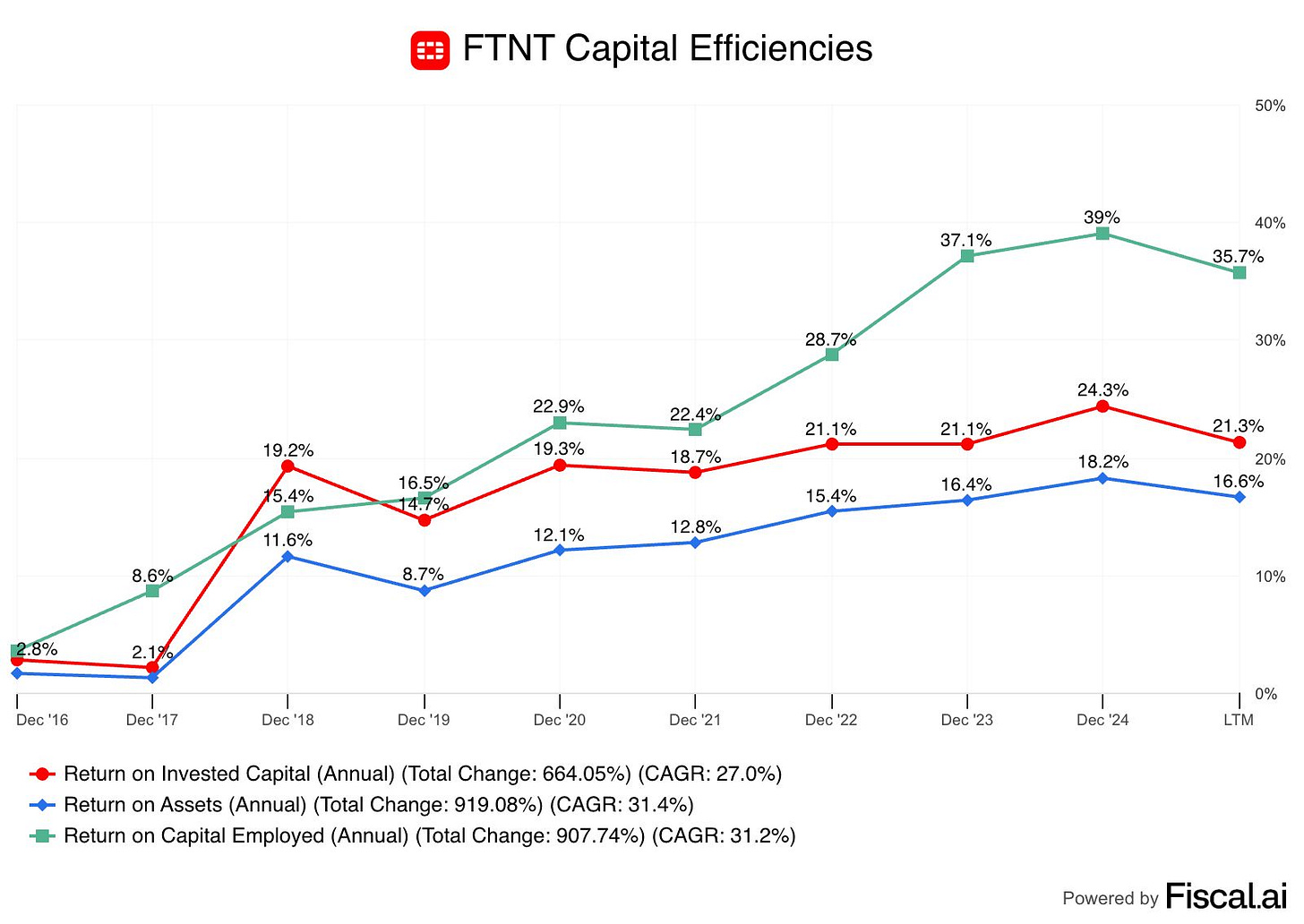

Even though Fortinet’s stock dropped sharply, the company’s fundamentals remain solid. Their recent earnings beat expectations, and revenue is still growing steadily - showing strong demand for their cybersecurity solutions.

Yes, the firewall refresh cycle is slowing, but Fortinet isn’t just relying on that anymore. They’re investing heavily in newer, fast-growing areas like Secure Access Service Edge (SASE) and advanced security operations tools. These areas have big potential as companies increasingly move to cloud and hybrid work setups.

Plus, the stock’s pullback gives investors a chance to buy in at a more attractive price (see valuation below), with the company positioned for long-term growth in the ever-important cybersecurity space.

If you believe in the rising need for robust security solutions worldwide, Fortinet’s current valuation could be a smart entry point before the next growth phase kicks in.

🛡️ Why Fortinet Might Be the Best Cybersecurity Pick Today

Fortinet isn’t just another cybersecurity company - it’s one of the few that offers a broad, integrated security platform that can protect businesses across networks, clouds, and endpoints. This gives it a big edge over competitors who focus on narrower solutions.

They’ve built a reputation for innovation, consistently launching new products that meet the evolving threats companies face. Their push into areas like Secure Access Service Edge (SASE) and security operations shows they’re not just keeping up - they’re leading the way.

On top of that, Fortinet has a huge and loyal customer base, ranging from small businesses to large enterprises, which provides steady recurring revenue and a strong foundation for growth.

With cybersecurity becoming a must-have for every organization - especially as cloud adoption and remote work keep rising - Fortinet’s comprehensive approach and proven track record make it a standout choice.

In a crowded market, Fortinet combines innovation, scale, and solid financials - making it arguably the best positioned cybersecurity company to own right now.

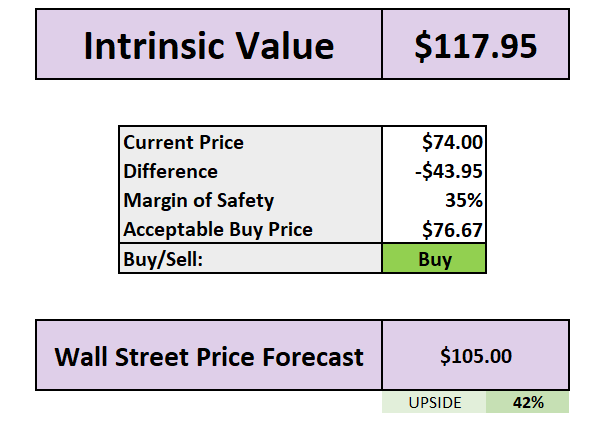

Valuation

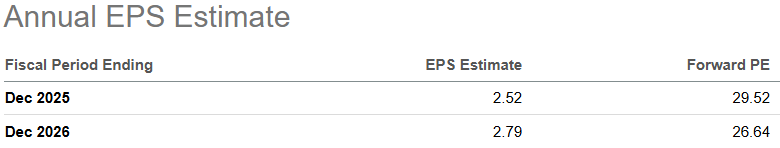

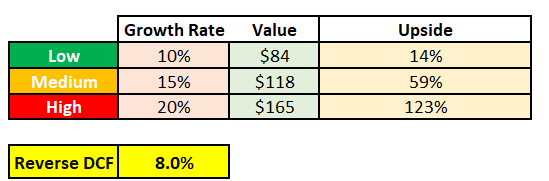

Based on 2026 EPS it is trading at a Forward P/E of 26.7x, historically their 5Y average is 49x.

Depending on how much you see FTNT growing it’s future free cash flow, you can see that there is upside.

Based on the reverse DCF, it has about 8% of growth currently baked into the numbers.

Based on 15% growth, we see around a 35% margin of safety up to $77.

Based on 10% growth, we see around a 15% margin of safety up to $72.

Analysts believe they can grow their EPS in the next 3-5Y at a rate of 13.83% annually.

Stock Resources

Stock Valuation Model 📊 (Unlock my stock valuation model as seen on YouTube)

Seeking Alpha 💵 ($30 off stock research tools I use daily.)

TipRanks 📈 (50% off expert stock research tools)

YouTube 🎥 (Join 107,000+ investors on YouTube!)

Patreon 👥 (Join my community for exclusive content)

Snowball Analytic (30% off portfolio tracker)

Thanks For Reading!

☕ Buy Me A Coffee – Your support helps cover the costs of running the newsletter.

📬 Join the community – Subscribe now to get weekly investment insights delivered straight to your inbox.

💬 Found this helpful? Share it with friends and colleagues! Your support keeps this newsletter FREE.

I hope you all have a great week ahead! 🌟

Dividend Talks💰

i am not able view this post, please check and let me know the reason