2 Stocks to Buy After the Earnings Crash

Markets are still climbing, but cracks are forming. With the Fed under pressure and speculative froth rising, these post-earnings dips may be your best shot at quality bargains.

Market Update

Markets Keep Climbing - But for How Long?

Stocks continue to push higher, helped by strong earnings and renewed optimism around trade. Fresh deals are easing some of the uncertainty heading into the key August 1 deadline.

This week could stir things up. We’ve got a packed schedule: major earnings, Fed policy updates, and economic data - all of which could shake the calm. Investors are especially tuned in for any signs that rate cuts could start as early as September.

With valuations already stretched, earnings will need to carry more of the weight from here.

Beating Expectations Isn’t Enough Anymore

The chart below shows how stocks reacted on their earnings day - and it’s telling. Even when companies beat analyst expectations, many of them still fell.

Why? Valuations are stretched. In this kind of environment, good isn’t always good enough.

The majority of Companies in the S&P 500 are trading at some astronomically high valuations.

Winners and Losers This Week

Earnings were a mixed bag. Some names crushed it, others got hammered.

Top performers:

Thermo Fisher (+15%)

Northrop Grumman (+10%)

Hershey (+9%)

T-Mobile (+7%)

Merck (+6%)

AMD (+6%)

Biggest drops:

Texas Instruments (–15%)

Chipotle (–13%)

Molina Healthcare (–10%)

Philip Morris (–10%)

Intel (–10%)

Lockheed Martin (–9%)

A reminder: even in a strong market, not every stock gets the memo.

Notable News

Earnings Now Take Center Stage

Valuations have already had a strong run - S&P 500’s forward P/E is above 22x, the highest since 2021. From here, earnings will need to do the heavy lifting.

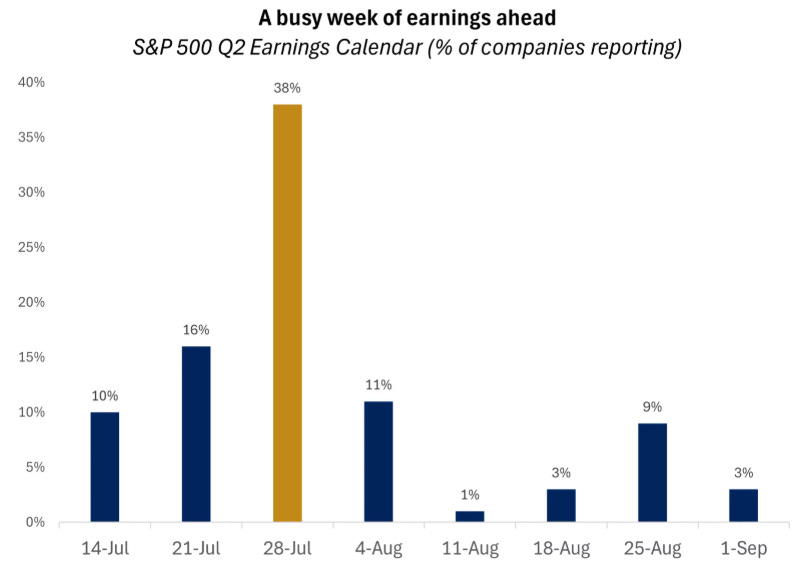

And this week is big: nearly 40% of S&P 500 companies report, including heavyweights like Microsoft, Meta, Apple, and Amazon.

So far, results have been solid. About 83% of companies are beating estimates, with earnings surprises averaging 7%. That’s bumped expected Q2 earnings growth for the S&P 500 to 5.5%, up from 4% just a few weeks ago. Banks have led the way, pointing to stable credit and a resilient consumer.

The Magnificent 7 are still doing the heavy lifting. Their earnings are expected to grow 14% - well ahead of the 3% for the rest of the index. AI demand continues to fuel tech, and a weaker dollar is giving an extra boost, especially to sectors like tech and industrials that earn a large chunk overseas.

A Quick Word of Caution

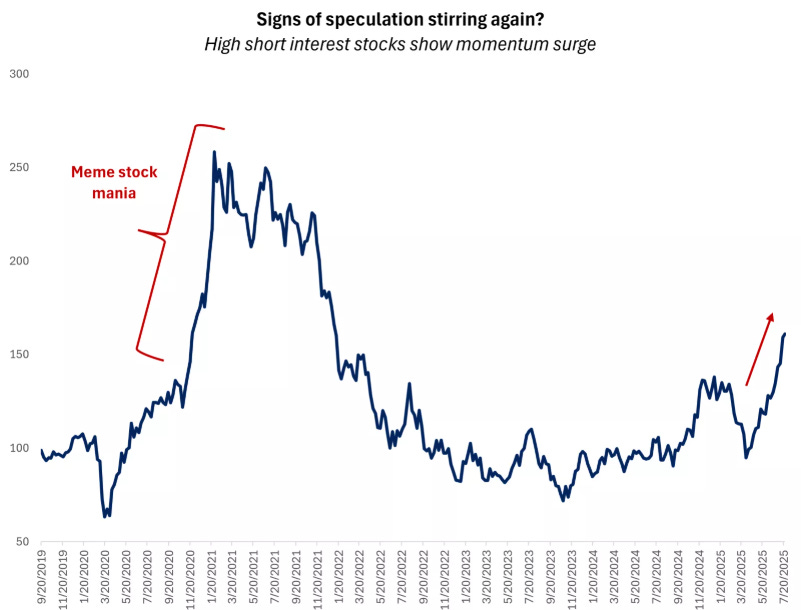

As markets calm down, complacency tends to creep in. We’re starting to see that now.

Meme stocks are making a comeback, with retail traders piling into heavily shorted names and sending them on wild swings - moves that often have little to do with fundamentals and can unwind just as quickly.

It’s a sign of froth - but not full-blown euphoria. The AAII sentiment survey shows investors are still relatively cautious, suggesting we’re not yet at the kind of peak that usually precedes a sharp pullback.

Still, something to keep an eye on.

The Fed Is Feeling the Heat

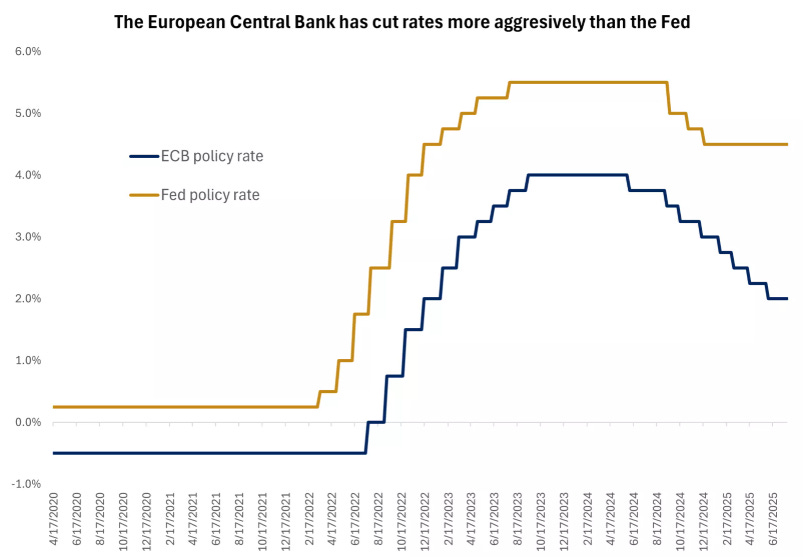

Pressure is building on the Federal Reserve to start cutting rates. The White House is pointing to other central banks - like the ECB, which has already cut by 2% - while the Fed has only moved 1% so far.

Add in the politics: Jerome Powell’s term ends next year, and there’s speculation the administration wants to name a successor soon. That’s raising concerns about the Fed’s independence.

Still, there are guardrails. Any new Fed Chair needs Senate approval, and rate decisions come from a vote across the entire FOMC - not just Powell.

For now, strong economic data and lingering inflation suggest the Fed will stay on hold at this week’s meeting. But markets are watching closely. If trade uncertainties clear after August 1, Powell might open the door to a rate cut at Jackson Hole later in August.

Earnings This Week

Join 105,000+ investors on YouTube! 🎥

We dive deeper into earnings (and more) on our channel. Don't miss out - click below to watch now!👇

YouTube Channel 🔔

Click here to subscribe and stay updated!

Fear & Greed Index

3 Quality Buy The Dip Stocks

ASML (ASML)

Why ASML Stock Slid After Q2 FY25 Earnings - Despite €7.7 Billion in Revenue

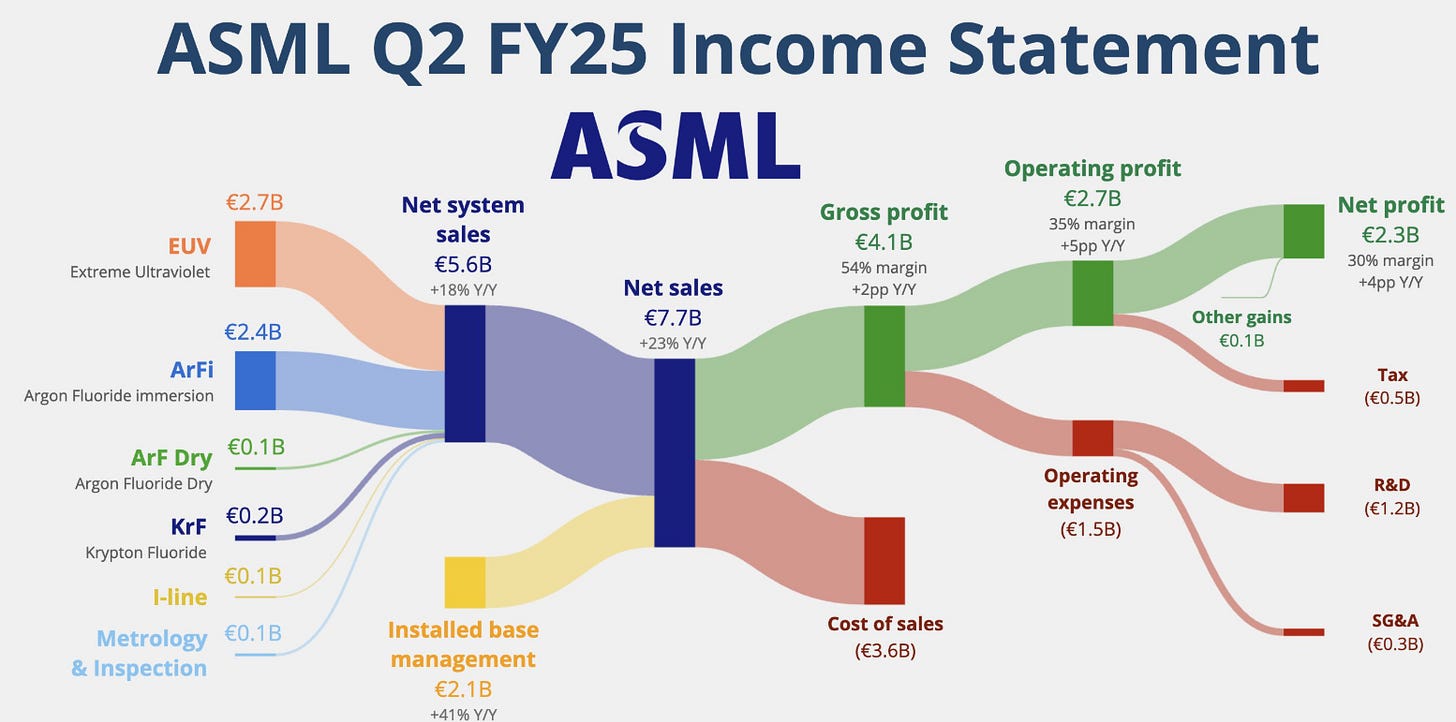

Last week, ASML reported a blockbuster quarter - €7.7 billion in net sales and €2.3 billion in net income, with a 53.7% gross margin at the top end of guidance.

On the surface, it should have been cause for celebration.

So why did the share price sink nearly 8–10% on the day? It came down to the tone and expectations around 2026, not current performance.

Even as bookings surged to €5.5 billion - including €2.3 billion for its high‑end EUV systems - management issued a cautionary outlook. ASML told investors it could no longer guarantee growth in calendar year 2026, citing rising geopolitical risk, potential U.S. tariffs, and macro uncertainty.

Their forecast for Q3 (€7.4–7.9 billion) and full‑year 2025 growth (~15%) came in below many analyst expectations.

In short: the quarter was strong, but the lack of clear upside guidance for 2026 rattled investors.

They’d expected the AI-driven investment boom to fuel accelerating orders - instead, ASML held back.

ASML is still the only game in town

ASML isn’t just any chip company. It’s the company that makes the machines needed to print the world’s most advanced semiconductors. Without its EUV tech, there’s no Nvidia, no TSMC 2nm, and no AI arms race.

Every major chipmaker - from Intel to Samsung to TSMC - relies on ASML equipment. The company just shipped its first next-gen High-NA EUV system (EXE:5200B) and expects full-volume adoption by 2026–27.

Yes, the near-term outlook is cloudy. But if you zoom out, ASML is positioned at the heart of three secular booms: AI, high-performance computing, and geopolitical chip independence.

Sometimes the best businesses come with the messiest charts

ASML stock has never been "cheap." It trades at a premium because it deserves one - and moments like these, when great companies get punished for being cautious, are often your window.

Long-term, the demand for its machines isn’t going away - if anything, it's compounding. The short-term dip came from guidance uncertainty, not business deterioration.

If you believe in the chip cycle, AI infrastructure, and technological progress - this pullback might be a rare second chance to own a generational business at a more reasonable price.

It currently trades at a Forward P/E of 26.1x vs it’s historical 33.5x.

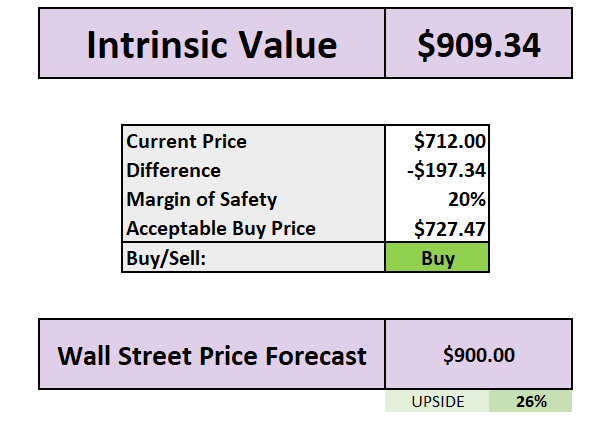

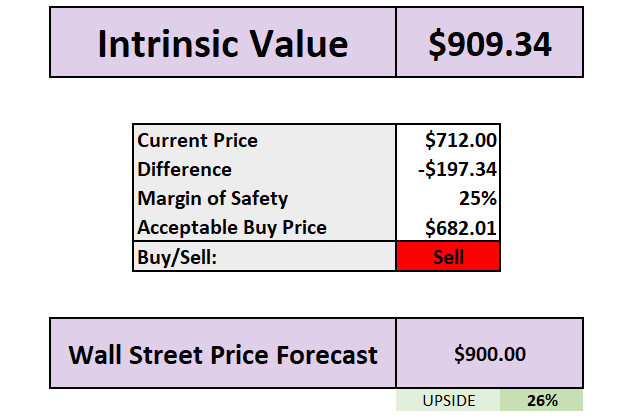

Valuation

Depending on how much you see ASML growing it’s future free cash flow, you can see that there is upside.

Based on the reverse DCF, it has about 8.50% of growth currently baked into the numbers.

Based on 12% growth, we see around a 20% margin of safety up to $727.

We see 25% MoS at $682.

Lockheed Martin (LMT)

Why Lockheed Martin Stock Dropped After Earnings - And Why It Might Be Overdone

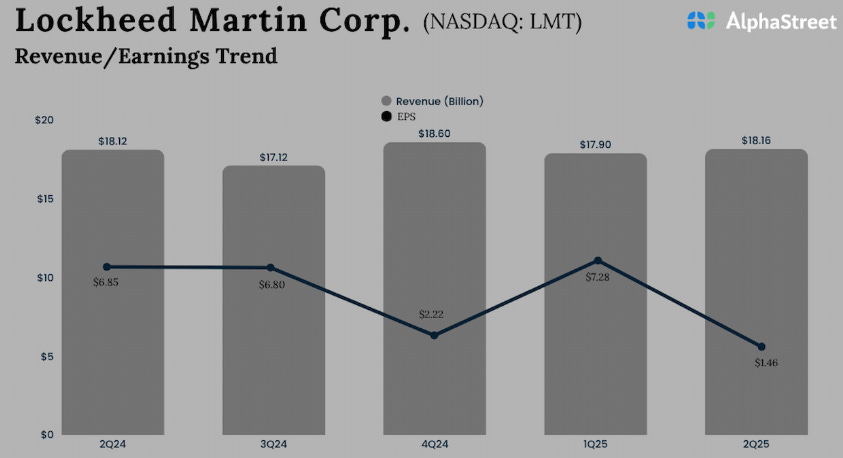

Lockheed Martin’s Q2 FY25 results came in with a thud - and investors didn’t hesitate to react. The stock dropped nearly 10% after reporting $18.16 billion in revenue, a slight year-over-year increase but still below analyst expectations of around $18.6 billion.

But it wasn’t just a top-line miss that rattled markets. The real shock came from the bottom line: net income collapsed to $342 million, down almost 80% from a year ago. GAAP earnings per share came in at $1.46, miles below the expected ~$6.50.

The reason? Lockheed took $1.6 billion in pre-tax charges, mainly tied to losses on classified aerospace projects and international helicopter programs. Add in some asset write-downs and tax charges, and cash from operations plunged to just $200 million. Free cash flow went negative.

To top it off, management cut full-year profit guidance from roughly $27 per share to a range of $21.70–$22.00. That hit investor confidence hard - and the selloff was swift.

But here’s why the dip might be short-sighted

This wasn’t a collapse in demand - it was a one-off hit from specific programs. Lockheed is still sitting on a $157 billion backlog, and defense budgets are only heading one direction: up. The U.S. is expanding investment into hypersonics, missile defense, and next-gen aerospace. Europe, too, is rearming at a pace not seen in decades.

The F-35 program alone remains a multi-decade cash engine. And while the charges hurt in the short term, they don’t reflect long-term earnings power.

Valuation is suddenly attractive

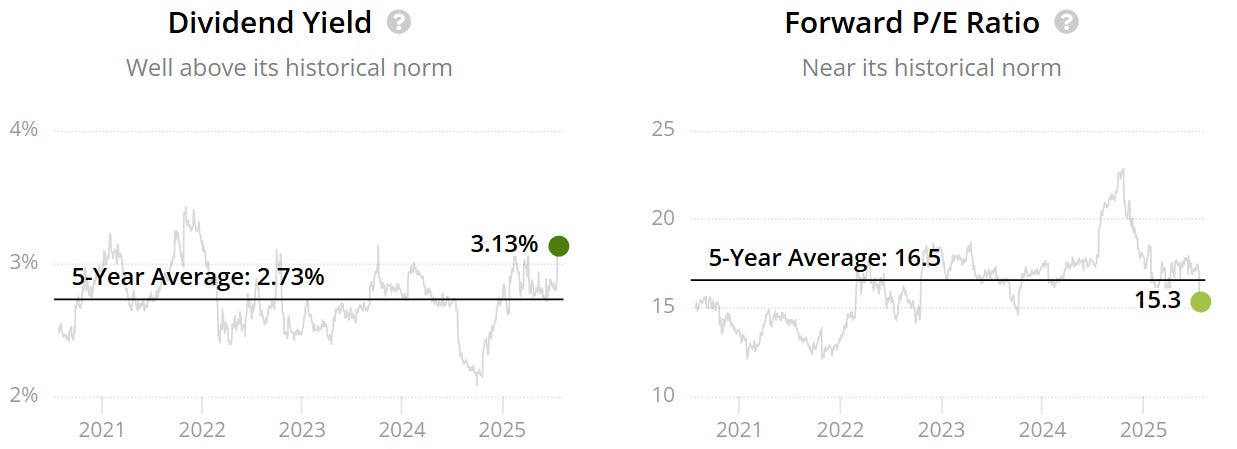

After the drop, Lockheed now trades at under 16x forward earnings - a discount to its own 10-year average - and offers a 3.1% dividend yield, backed by strong cash flow generation outside of this one bad quarter.

If you believe in long-term defense spending and want exposure to one of the most critical defense contractors in the world, this selloff could be a rare entry point.

This wasn’t a demand problem. It was a one-off punch that bruised the quarter - but likely hasn’t broken the business.

When war spending goes up, so does Lockheed - just not always in a straight line

Markets often want smooth, linear growth. But defense doesn’t work like that. Orders can be lumpy, contract timing uneven, and geopolitical risk hard to price in.

That’s why this dip might be a gift: the underlying demand is still there, and Lockheed remains a mission-critical supplier with predictable cash flow, strong returns on capital, and one of the safest dividends in the S&P 500.

For long-term investors? This may be one of those rare chances to buy world-class defense exposure while the market is busy being impatient.

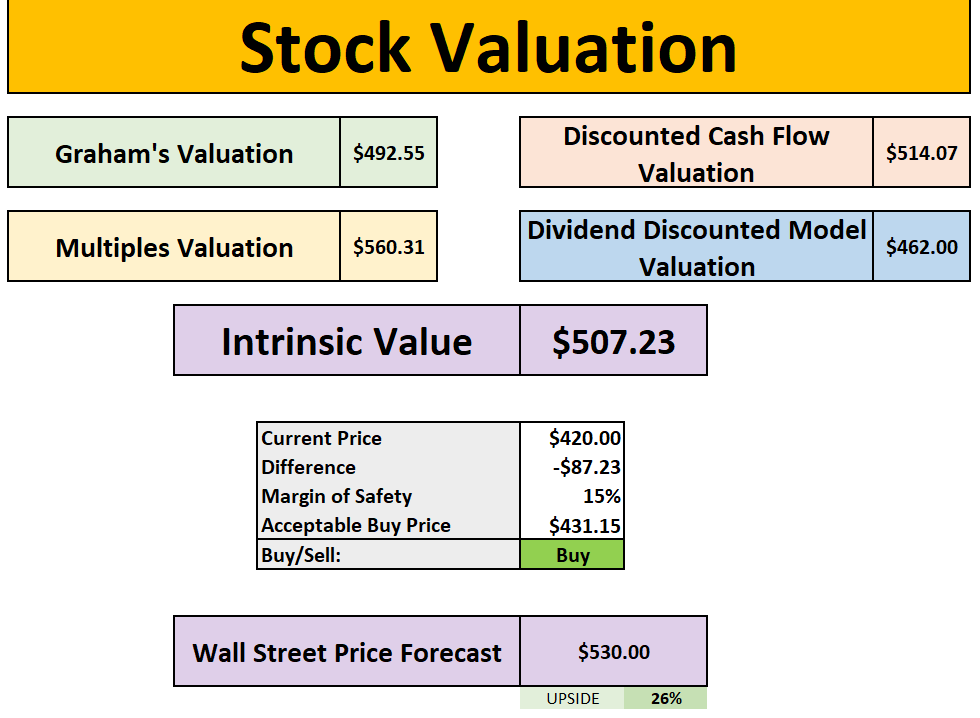

Stock Valuation

LMT currently has a 15% MoS at ~$430.

LMT has a 20% MoS at ~$406.

Stock Resources

Stock Valuation Model 📊 (Unlock my stock valuation model as seen on YouTube)

Seeking Alpha 💵 ($30 off stock research tools I use daily.)

TipRanks 📈 (50% off expert stock research tools)

YouTube 🎥 (Join 105,000+ investors on YouTube!)

Patreon 👥 (Join my community for exclusive content)

Snowball Analytic (30% off portfolio tracker)

Thanks For Reading!

☕ Buy Me A Coffee – Your support helps cover the costs of running the newsletter.

📬 Join the community – Subscribe now to get weekly investment insights delivered straight to your inbox.

💬 Found this helpful? Share it with friends and colleagues! Your support keeps this newsletter FREE.

I hope you all have a great week ahead! 🌟

Dividend Talks💰