2 Stocks To Consider After Market Drop!

+ Market Update!

Market Latest

The S&P 500 definitely felt like a mini rollercoaster ride last week as we end up 2.19% down.

One of the main causes for this was when the Fed spoke on the 19th, and as we can see from above that caused a fairly large dip, which part of it was bought up on 20th.

We will explain this in more detail later on in this article.

Biggest losers last week included:

Novo Nordisk (NVO) down 22%

Micron (MU) down 12%

Cintas (CTAS) down 12%

Starbucks (SBUX) down 10%

VICI Properties (VICI) down 8%

Zoetis (ZTS) down 8%

Chevron (CVX) down 7%

Prologis (PLD) down 7%

Home Depot (HD) down 6%

and many, many others.

Notable News

Interest Rate Cut

The December FOMC meeting revealed a more cautious approach by the Federal Reserve toward future rate cuts.

While the Fed reduced rates by 0.25%, bringing them to a range of 4.25%–4.5%, the updated dot plot signalled only two rate cuts in 2025, compared to the four projected during the September meeting.

The Fed believes it can adopt a more gradual approach to rate cuts, citing two key areas of uncertainty:

Inflation trajectory: While the Fed acknowledged that inflation has significantly declined over the past two years, it remains above the 2.0% target. The Fed expects inflation to continue easing but at a slower rate, with its latest projections indicating core personal consumption expenditure (PCE) inflation reaching 2.0% by 2027.

Government policy, particularly tariffs: Chair Powell briefly mentioned potential changes in trade and tariff policies that could influence inflation. However, he emphasized that the lack of clarity around these policies makes it difficult to draw firm conclusions about their impact on inflation forecasts.

Market Volatility

Market volatility following a strong rally is expected and should not unsettle long-term investors.

After a 27% rise in the S&P 500 as of last Monday, some market pullback is natural, especially with year-end approaching, as investors focus on profit-taking, rebalancing portfolios, and tax-loss harvesting.

The S&P 500 is still up 25% in 2024.

Bond Yields Rise

Bond yields have risen as well, with the 10-year U.S. Treasury yield now exceeding 4.5%. This increase has been fuelled by

reduced expectations for rate cuts

stronger economic growth

higher inflation projections.

However, for balanced investors, these higher yields may offer an opportunity to gradually shift any excessive cash allocations into the investment-grade bond market.

Investors can also take advantage of periods of volatility and market pullbacks to diversify, rebalance, and add high-quality investments in both stocks and bonds—aligned with their personal risk tolerance and financial goals—even if the Fed adopts a more gradual approach to rate cuts in the year ahead.

Micron (MU) Earnings

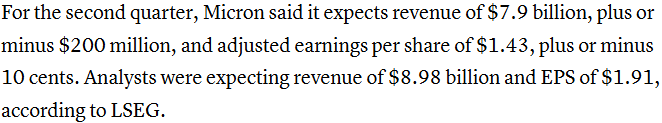

The quarter for Micron was fairly strong as shown below, however they were punished for the Q2 guidance.

Guidance:

If you want more detail on this and our own valuation of MU, check out our video from last week:

Novo Nordisk

The main reason for this huge drop, making it down 22% on the week was:

Perhaps an overreaction to the small difference?

If you want more detail on this and our own valuation of NVO, check out our video from last week:

Earnings This Week

Given the festive period this week, there will be no Companies reporting their earnings.

However, be sure to subscribe to our YouTube channel where we will be looking forward to 2025 and the opportunities that we can find in the Stock Market.

We would love to have you in our community which is heading over 67,000:

Fear and Greed Index

The Fear and Greed Index, which currently sits at 28, indicates a state of "Fear" in the market, reflecting cautious investor sentiment.

This suggests that market participants are leaning toward risk aversion, potentially creating opportunities for contrarian investors.

We can see below that on Thursday it closed at extreme fear, with last week ending in Neutral.

2 Stocks To Consider

I have used the following criteria to help identify these stocks:

Dividend Safety 60+ (Safe)

ROIC > 10%

Net Debt to EBITDA below 1 (Strong Balance Sheet)

Upside > 20%

UnitedHealth Group (UNH)

UnitedHealth Group is a multinational healthcare company based in the United States.

UnitedHealth Group's revenue streams include:

Health Insurance Premiums through UnitedHealthcare, providing individual, employer, Medicare, and Medicaid plans.

Healthcare Services and Technology via Optum Health, offering care delivery and management solutions.

Pharmacy Benefits through OptumRx, managing prescription drug plans.

Consulting and Analytics via Optum Insight, delivering data-driven healthcare solutions.

They have outperformed in the last 4 quarters (all beats vs analyst expectations) and anticipate growth against the year-on-year EPS comparative.

Over the last 10Y UNH has massively outperformed the S&P 500.

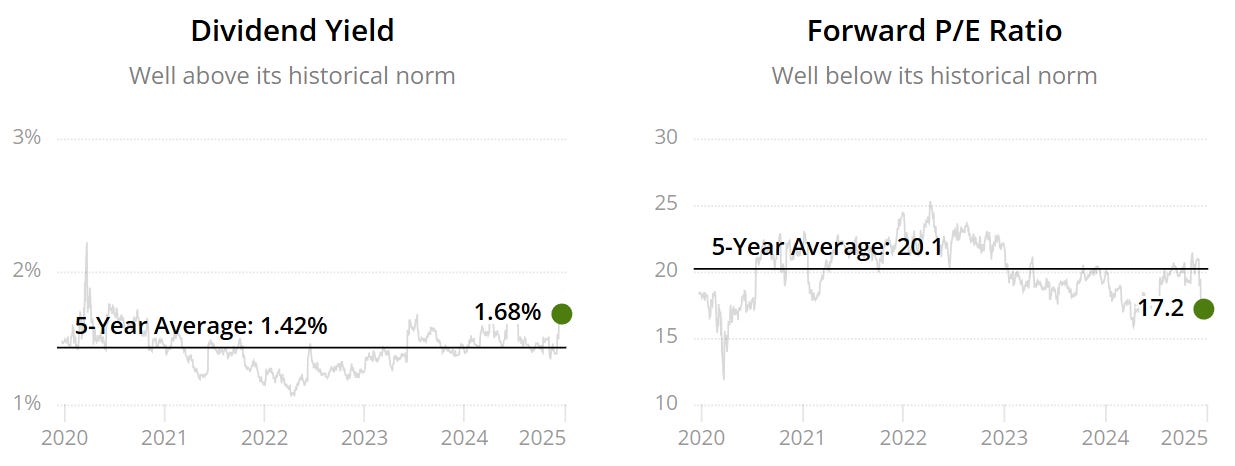

As per below, we get a double undervaluation signal on the yield, as the current yield is above the 5Y average (1.68% v 1.42%) with an undervaluation signal on the Forward P/E as it is lower than the 5Y (17.2x v 20.1x).

We also note a very safe dividend score of 99.

They have an incredible dividend growth history, essentially haven increased it by 41% on average every year, over the last 20 years.

You will also find it incredibly hard to find a Company with as consistent growth to their free cash flow, year on year, and we expect the next 12 months to continue that upwards trajectory to $32 per share.

Their top line also has some very impressive consistent growth, with nearly a 3x over the last 10 years.

ROIC is very strong and consistent which we love to see. 19% every year over the last 5.

Excellent balance sheet with the Net Debt to EBITDA sitting at 1 in 2023 and expected to come down to 0.96 over the next 12 months.

As per below, Wall Street see 25% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $595:

So, in conclusion for UNH, we see around a 15% margin of safety around the $505 mark with Wall Street indicating 25% upside.

Prologis (PLD)

Prologis is a global leader in logistics real estate, specialising in the development, acquisition, and management of industrial properties such as warehouses and distribution centers.

Its properties support the supply chains of major businesses across various industries.

Prologis' income streams primarily come from:

Rental Income from leasing industrial properties to tenants such as retailers, manufacturers, and logistics companies.

Property Sales through the acquisition and disposition of real estate assets.

Development and Management Fees from developing and managing properties for third-party investors.

They have either outperformed or come in line in the last 4 quarters (vs analyst expectations) and anticipate growth against the year-on-year FFO comparative.

Over the last 10Y PLD has outperformed the S&P 500 and is currently trading at it’s 52 week low.

As per below, we get a double undervaluation signal on the yield, as the current yield is above the 5Y average (3.72% v 2.59%) with an undervaluation signal on the Forward P/AFFO as it is lower than the 5Y (22.5x v 28.3x).

We also note a safe dividend score of 61.

They have also been increasing the dividend at a double digit rate for the last 5 years on average.

They did however cut the dividend in the last recession.

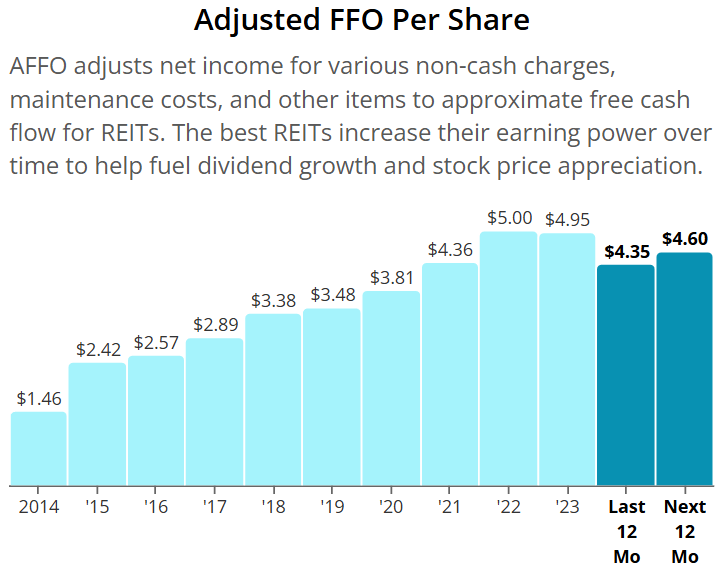

The AFFO has been increasing over the last 10Y at more than a 3x, however we note that it is anticipated to fall slightly over the next 12 months.

We have to point out below that they have diluted your position as a shareholder over time, however this is extremely common for REITs as they retain little of the internally generated cash flow after paying out the majority as dividends.

For Industrial REITs like PLD, we want the Net Debt to EBITDA to be below 5, and whilst they have straddled around that year on year, we can see it isn’t too far off.

As per below, Wall Street see 25% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $126:

So, in conclusion for PLD, we see around a 20% margin of safety around the $101 mark with Wall Street indicating 25% upside.

Stock Resources

Stock Valuation Model

If you are interested in valuing stocks yourself, we have created a valuation model below which you can pick up, this is the same version we use in our YouTube analysis:

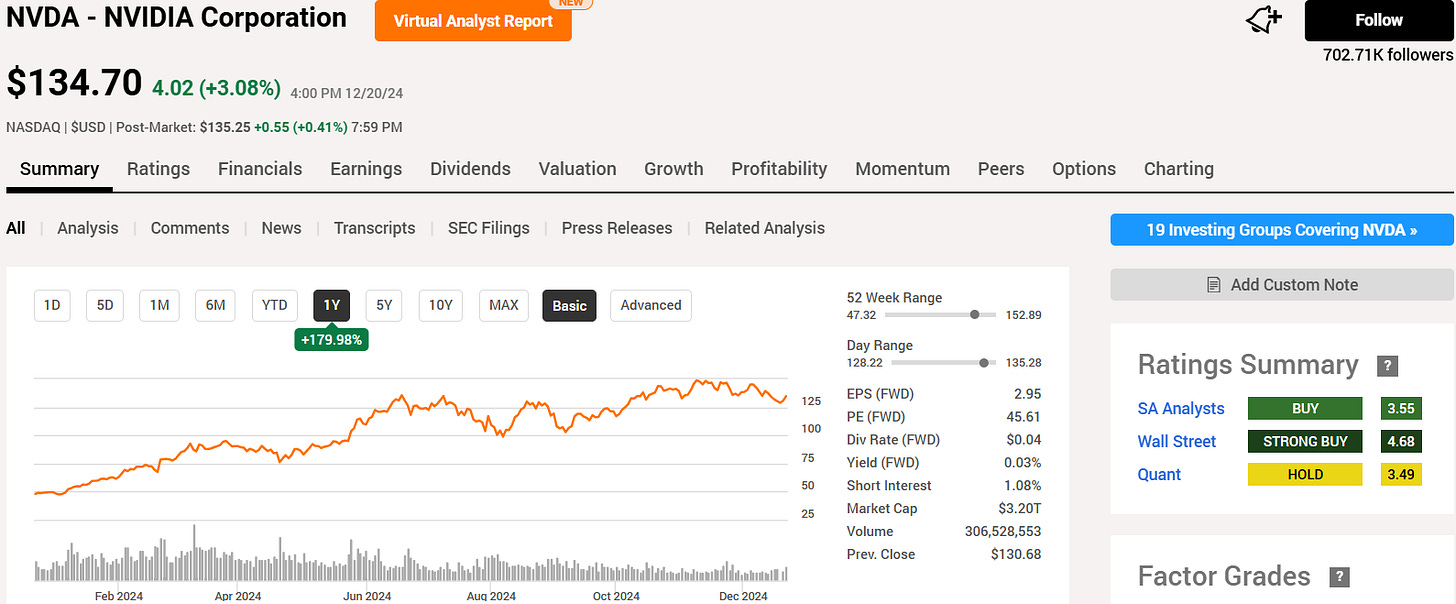

Seeking Alpha

They are one of the main stock analysis websites I use in my videos and you can get a discount below.

Patreon

Join our community in the Patreon where we discuss weekly buy and sells.

Snowball Portfolio Tracker

Snowball is a great portfolio tracker which allows you to have all of your investments in one place, with a ton of amazing features.

You can also get a 14-day free trial to check it out:

Conclusion

We have just gone through 2 stocks to consider after the market drop last week.

However as always do your own due diligence and let us know your thoughts about today’s newsletter in the comments.

I hope you all have a great week ahead!

Thanks For Reading!

If you’d like to support this work feel free to buy me a coffee. The proceeds will contribute to the running costs of the newsletter.

Join the community of investors - subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today’s newsletter helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Note:

I am not a financial advisor or licensed professional. Nothing I say or produce anywhere, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk.