20 Undervalued Dividend Stocks!

Time To Add These To the Portfolio?

Introduction

What Does Undervaluation Mean?

Undervalued means something different to every investor, what could be undervalued to you may not necessarily be undervalued to your neighbor or friend.

So let’s talk basics, at the base level an undervalued stock is when it is selling at a price that is significantly below what is assumed to be its intrinsic value.

One example being, if a stock is selling for $50, but it is worth $100 based on predictable future cash flows (any other forms of valuation methods), then it is an undervalued stock.

It could also mean a stock that is trading with a significant margin of safety.

Margin of safety

Margin of safety is an investing principle that we use when purchasing stocks. It means to only purchase them when their market price is significantly below their intrinsic value.

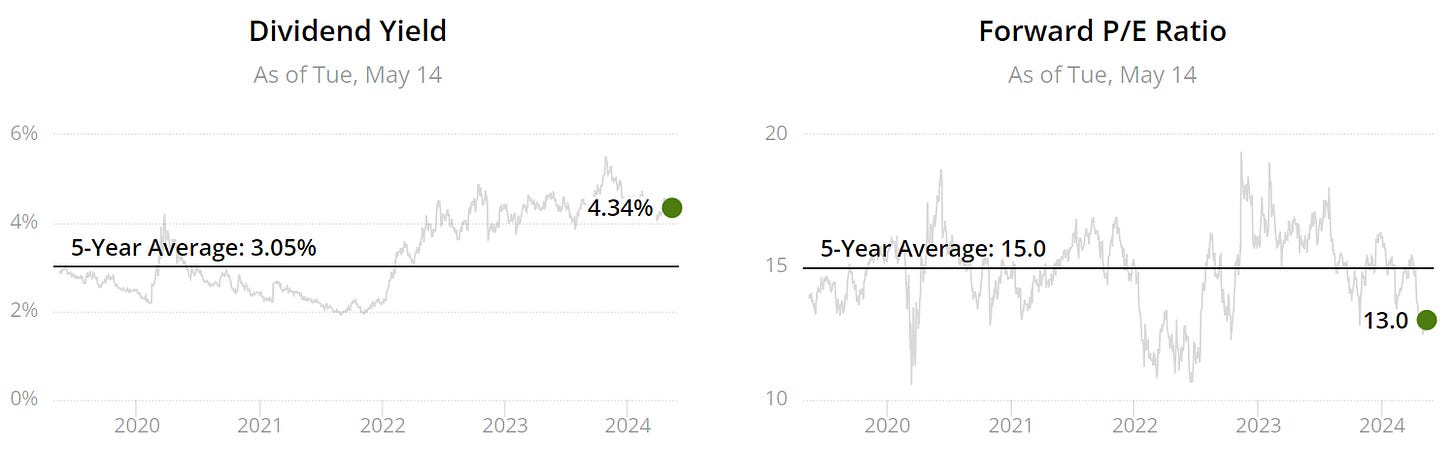

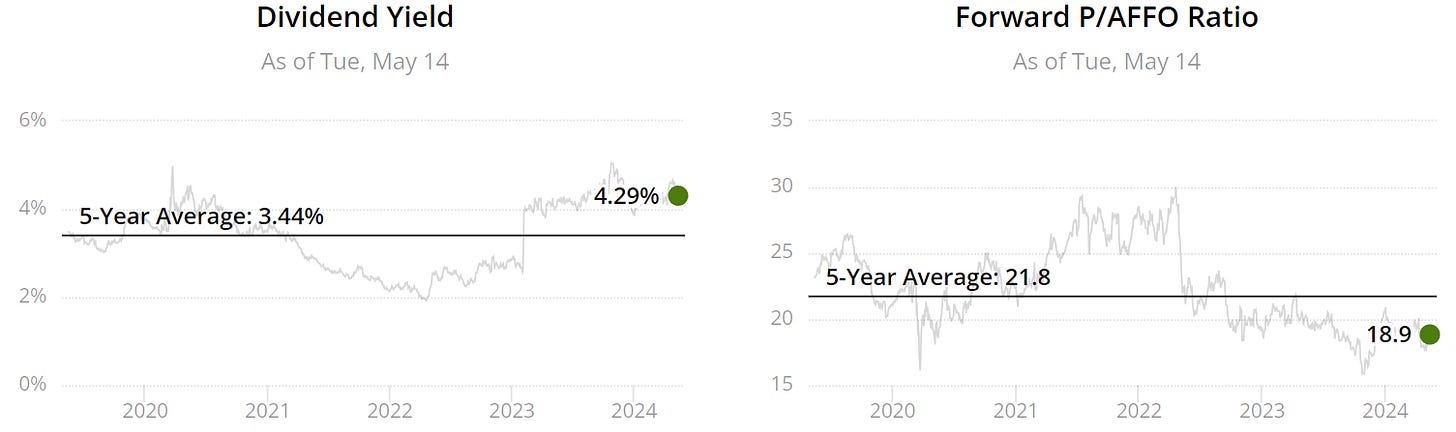

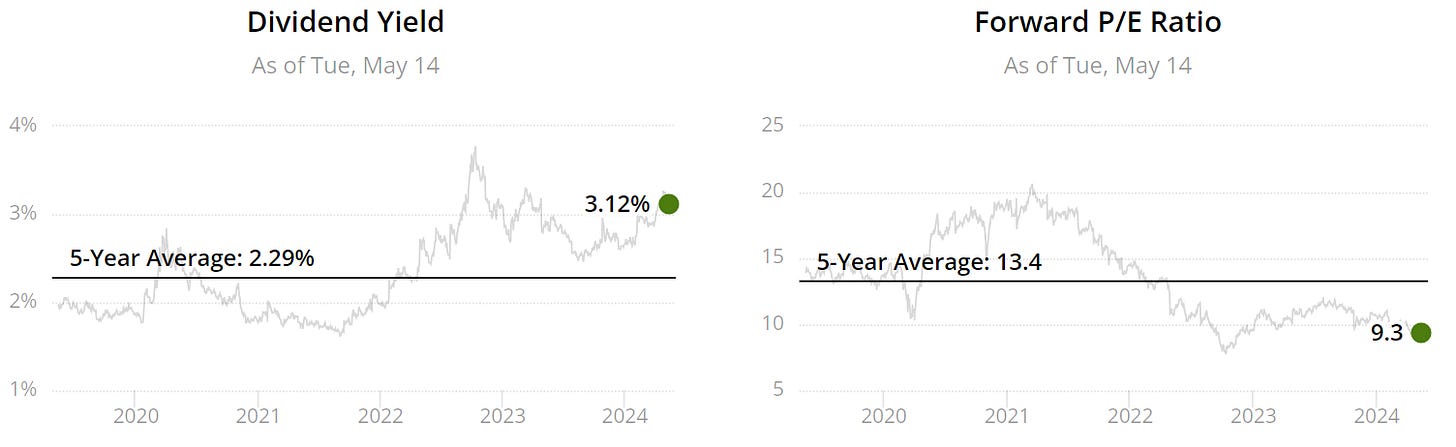

Dividend Yield Theory

As part of our 20 undervalued dividend stocks today we are going to analyse them based on dividend yield theory (DYT).

This theory states that a company is undervalued when the current yield is sitting above the historical yield (we can use the 5-year average today).

Example 1:

Piano Company Yield is 3.28% today.

Piano Company Yield on average over the last 5 years was 2.71%.

Therefore, we would say that today based on dividend yield theory, Piano Company is undervalued.

Example 2:

Hamburger Company Yield is 3.84% today.

Hamburger Company Yield on average over the last 5 years was 4.47%.

Therefore, we would say that today based on dividend yield theory, Hamburger Company is overvalued.

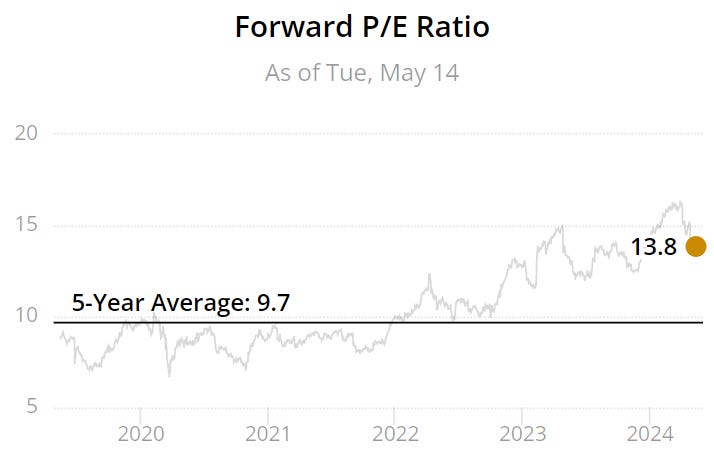

The same can be said for the forward P/E, however the opposite would be true.

Example 3:

Chicken Company forward P/E is 14.2 today.

Chicken Company forward P/E was 16.4 on average over the last 5 years.

Therefore, we would say that today, Chicken Company is undervalued.

Example 4:

Orange Company forward P/E is 13.8 today.

Orange Company forward P/E was 9.7 on average over the last 5 years.

Therefore, we would say that today, Orange Company is overvalued.

Double Sign Of Undervaluation!

We would say we have a double sign of undervaluation when a Company is both trading at a higher yield than on average over the last 5 years, and the forward P/E is lower than that of the 5-year average.

20 Stocks With A Double Undervaluation Signal

So which stocks meet this criteria?

Let’s take a look below:

Stock 1 - British American Tobacco (BTI)

Stock 2 - EPR Properties (EPR)

Stock 3 - Verizon (VZ)

Stock 4 - Crown Castle (CCI)

Stock 5 - Realty Income (O)

Stock 6 - VICI Properties (VICI)

Stock 7 - Agree Realty (ADC)

Stock 8 - CVS Health (CVS)

Stock 9 - Roche Holding AG (RHHBY)

Stock 10 - T.Rowe Price (TROW)

Stock 11 - Public Storage (PSA)

Stock 12 - American Electric Power (AEP)

Stock 13 - Prologis (PLD)

Stock 14 - Clorox (CLX)

Stock 15 - Johnson & Johnson (JNJ)

Stock 16 - Medtronic (MDT)

Stock 17 - Starbucks (SBUX)

Stock 18 - Comcast (CMCSA)

Stock 19 - NextEra Energy (NEE)

Stock 20 - Hershey (HSY)

Latest YouTube Video

In our latest video we have ran through 4 Undervalued Dividend Kings:

And in our weekly video below we covered 6 Undervalued Dividend Stocks Near 52 Week Lows:

If you are interested in valuing stocks yourself we have created a valuation model below which you can pick up:

Conclusion

Whilst we have ran through dividend yield theory and selected a number of stocks that meet this criteria, you should always do your own due diligence but this could be used as a starting point for identifying stocks that could be undervalued.

Thanks For Reading!

If you’d like to support this work feel free to buy me a coffee. The proceeds will contribute to the running costs of the newsletter.

Join the community of investors - subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today’s newsletter helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Note

I am not a financial advisor or licensed professional. Nothing I say or produce anywhere, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk.