3 AI Stocks to Buy Now for Q4 2025

With inflation cooling, the Fed eyeing rate cuts, and markets at all time highs this week, here are three AI leaders poised to outperform into Q4 2025.

Market Update

The market found its footing this week, with the S&P 500 climbing 1.4% to new all time highs.

Investors were glued to the latest inflation updates, and the numbers told a mixed story.

Consumer prices ticked up in August, with CPI running at 2.9% on an annualized basis - roughly what Wall Street had expected.

On the other hand, producer prices continued easing, slipping to 2.6%.

Taken together, inflation looks elevated but not spiraling, giving markets some breathing room for now.

Still, looming tariffs could complicate the picture and add fresh price pressures in the months ahead.

Winners and Losers This Week

Top performers:

Oracle (+26%)

Micron (+20%)

Lam Research (+14%)

Tesla (+13%)

Palantir (+12%)

Biggest drops:

Humana (-10%)

Chipotle (-6%)

Estee Lauder (-6%)

Constellation Brands (-6%)

Netflix (-4%)

Notable News

CPI Inflation

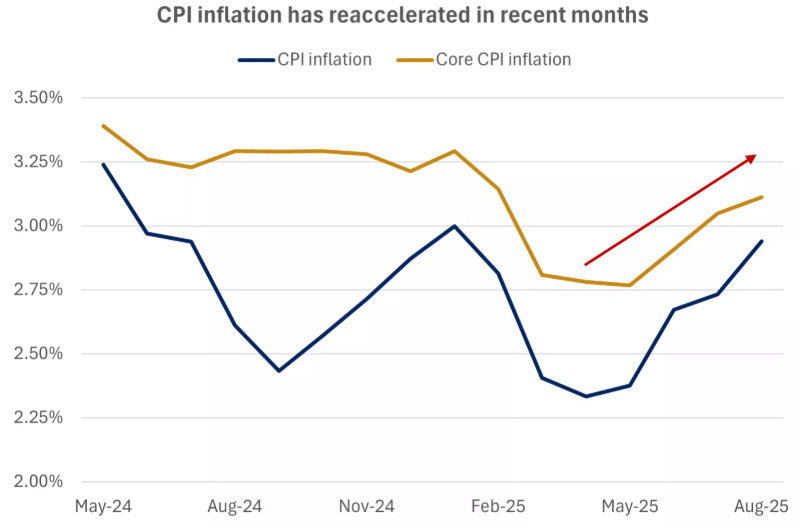

All eyes were on last week’s CPI report, and it more or less delivered what investors were bracing for.

Headline inflation picked up slightly in August, rising to 2.9% from 2.7% the month before.

The culprit? Energy costs - especially gasoline, which jumped nearly 2% in a single month. Stripping out food and energy, core CPI stayed put at 3.1%, right in line with expectations.

Looking ahead, tariffs could add some short-term pressure as higher import costs trickle down to consumers. With inflation still running above the Fed’s 2% goal - and signs of the labor market cooling - the stage looks set for the Fed to move ahead with rate cuts to keep growth supported.

What this means for investors: markets are likely to stay focused on the Fed’s September meeting. A softer labor market paired with inflation that isn’t running away gives the Fed cover to ease, which could be a tailwind for stocks in the months ahead.

Producer Price Inflation

Producer prices came in softer than expected in August, giving markets another sign that inflation pressures are easing beneath the surface.

The Producer Price Index (PPI) fell to 2.6% annualized, well below forecasts for a jump to 3.3%. A big driver of the drop was trade services, which slid 1.7% on the month- suggesting wholesalers and retailers are tightening margins rather than passing costs along. Core PPI, which strips out food and energy, also cooled more than expected, dipping to 2.8% year-over-year.

Overall, this marked a return to the uneven but downward trend we’ve seen in wholesale inflation this year. While tariffs could still add some pressure in the months ahead, for now it looks like businesses are absorbing a good chunk of those costs.

What this means for investors: cooler PPI data gives the Fed more breathing room. If producer costs stay contained, it lowers the risk of a fresh inflation spike - helping support the case for rate cuts and, in turn, potentially a friendlier backdrop for equities.

The Labor Market

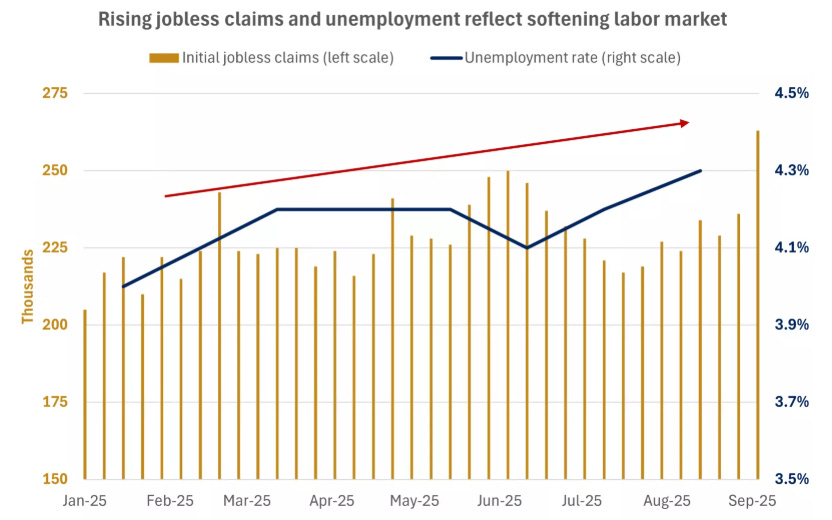

The labor market continues to show cracks beneath the surface. The latest update from the Bureau of Labor Statistics revealed that job growth over the past year was weaker than initially thought, with a downward revision of 911,000 jobs through March 2025.

That’s even softer than forecasts for an 800,000-job cut, highlighting that the earlier employment reports had overstated the strength of hiring.

Weekly jobless claims added to the cautious tone. New claims climbed to 263,000 - the highest level in four years and well above expectations - while continuing claims held steady at just under 2 million.

Taken together, the data paints a picture of a labor market that is cooling, though not collapsing. The unemployment rate sits at 4.3%, still comfortably below the long-term average of 5.7%. But with fewer workers entering the labor force, partly due to demographics and tighter immigration, participation has slipped to 62.3% from 62.7% a year ago.

What this means for investors: a softer labor market strengthens the case for Fed rate cuts. With inflation contained and jobs data coming in weaker, the Fed will likely move to cushion the economy. For markets, that means monetary policy could soon shift more firmly into a supportive gear.

Fed Rate Cuts

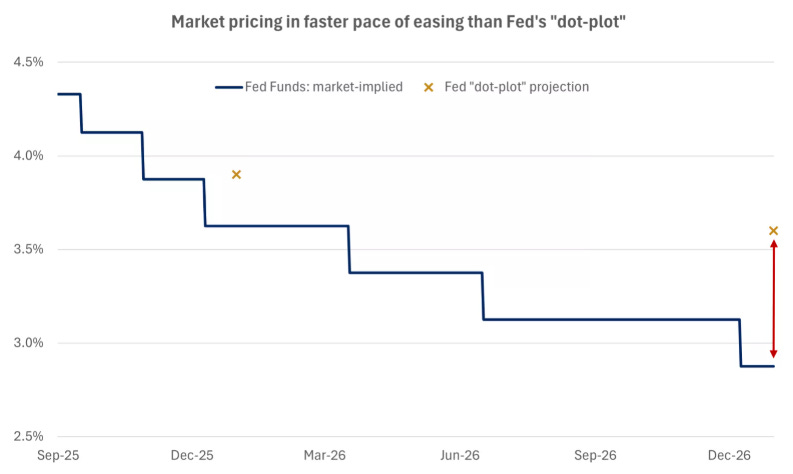

The Fed looks ready to shift back into easing mode. Even though inflation is still running above its 2% target, the central bank appears focused on protecting the labor market, which has been showing clearer signs of cooling. At this month’s meeting, the Fed will also release updated projections for growth, inflation, unemployment, and interest rates.

Back in June, policymakers projected the fed funds rate would fall to 3.6% by the end of next year. Markets, however, are betting on an even faster pace of cuts, with rates dipping below 3% over the same period.

Bond markets have already started to react. The 10-year Treasury yield briefly touched 4.0% last week, matching its lows from April. That move has helped fuel strong returns in fixed income this year, with U.S. investment-grade bonds up about 6.5% - comfortably ahead of their starting yields.

What this means for investors: lower short-term rates could weigh on T-bill yields, but the overall yield curve has room to normalize. The 10-year Treasury will likely stay in the 4.0%–4.5% band - anchored by Fed cuts on one side, but limited by inflation uncertainty and persistent deficits on the other.

For investors, this backdrop should keep bond returns attractive while helping support equities at the same time.

Earnings This Week

Join 110,000+ investors on YouTube! 🎥

We break down earnings, market moves, and exclusive insights you won’t find anywhere else.

Don’t miss out — hit the button below to watch and subscribe now! 👇

YouTube Channel 🔔

Subscribe today and stay ahead of the market!

Fear & Greed Index

3 Stocks For Q4

Let us dive into these 3 Stocks I have selected for the Q4 of 2025.

I have used the following criteria to help identify these stocks:

1. Outperformed S&P 500 last 10Y

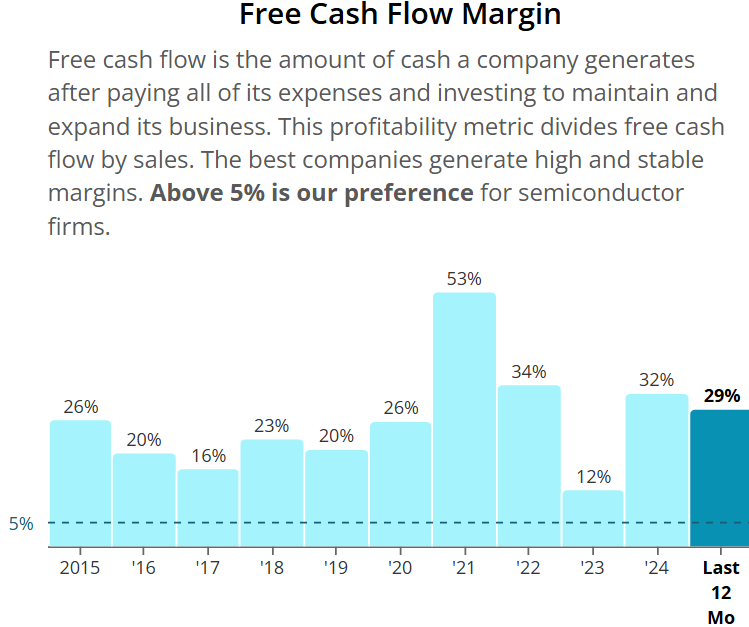

2. Free Cash Flow Margin 20%+

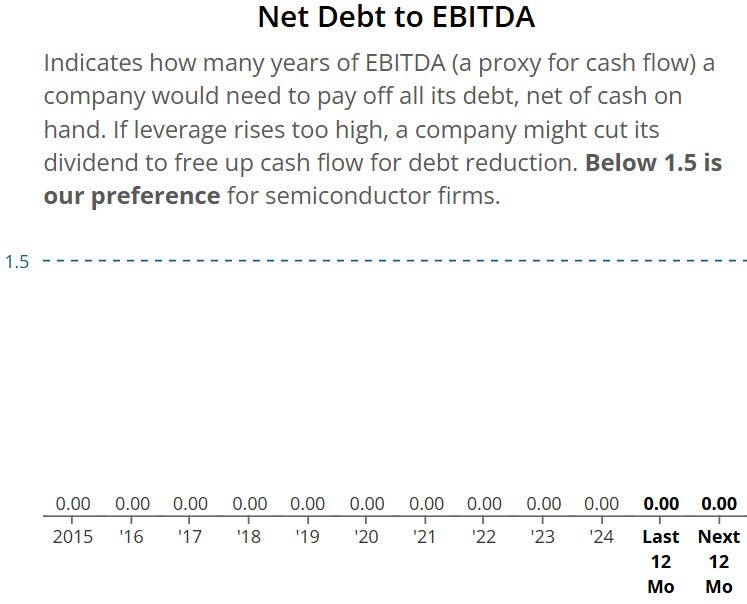

3. Net Debt to EBITDA <1.5

4. ROIC > 10%

ASML (ASML)

What is ASML?

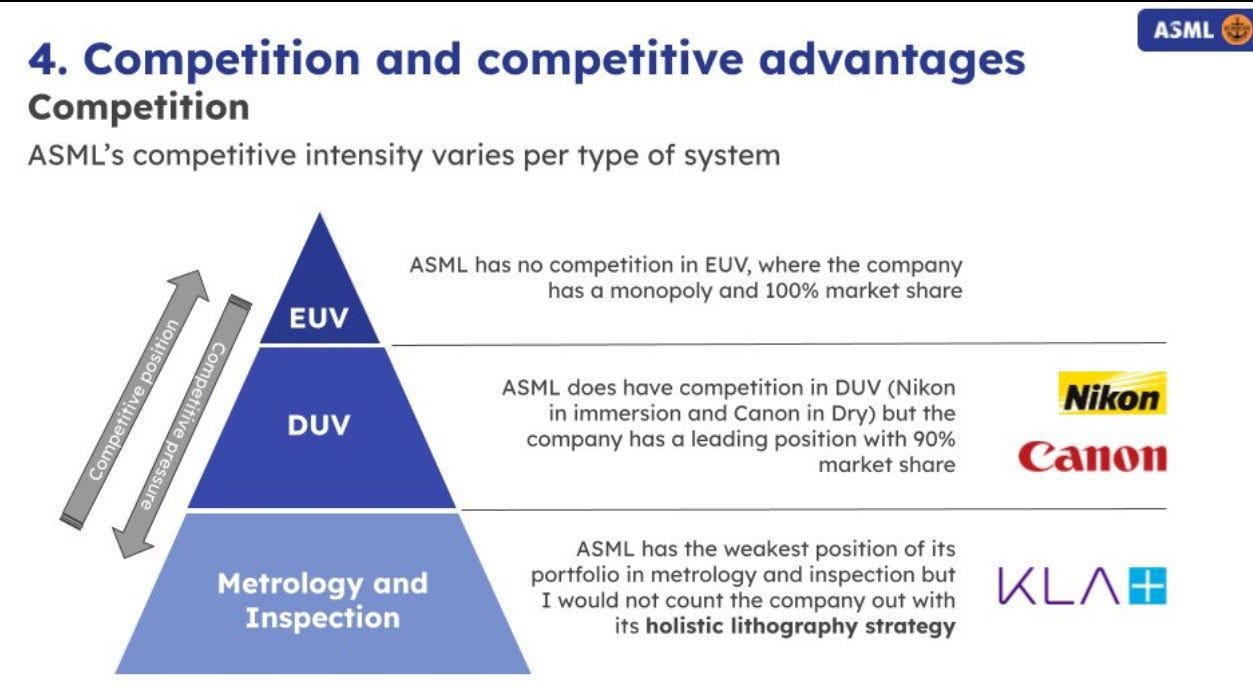

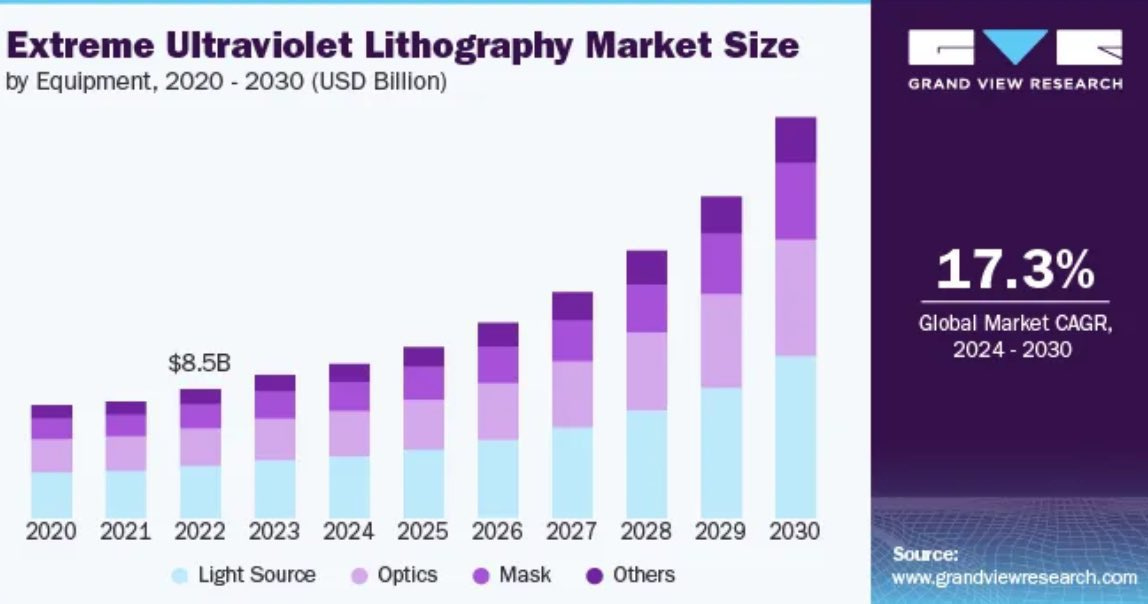

ASML makes the world’s most advanced lithography machines, including EUV systems, which no competitor can currently match.

These machines are incredibly complex - some cost over $200 million and take six jumbo jets to ship - making them nearly impossible to replicate.

ASML’s moat lies in its proprietary technology, deep supplier network, and long-term contracts with chip giants like TSMC, Intel, and Samsung.

Its dominant position is protected by decades of R&D, thousands of patents, and government export controls.

Latest Earnings

Why buy ASML?

When you strip away the noise of daily market headlines, ASML stands out as one of those rare businesses that is simply too critical to fail. They don’t just sell machines—they sell the only machines in the world capable of producing the most advanced chips. That monopoly status gives them pricing power, fat margins, and a moat wider than almost anything else in tech.

Heading into Q4 FY25, the setup looks attractive. The market has punished the stock on short-term order timing and semiconductor cycles, but the long-term demand story hasn’t changed. Every major chipmaker—from TSMC to Intel to Samsung—literally cannot move forward without ASML’s EUV systems. As the world demands more computing power, ASML remains the gatekeeper.

Buying ASML today is less about catching the next quarter’s beat and more about owning a company that has entrenched itself at the heart of global technology for decades to come.

Management are also buying back shares on a consistent and aggressive basis.

Outperformed S&P 500 and QQQ last 10Y

Free Cash Flow Margin 20%+

Net Debt to EBITDA <1.5

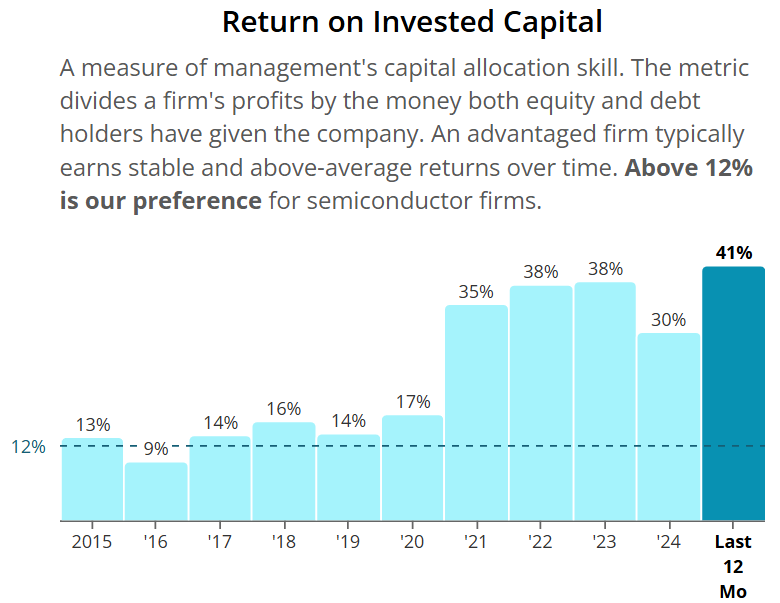

ROIC > 10%

Valuation

Keep reading with a 7-day free trial

Subscribe to Dividend Talks to keep reading this post and get 7 days of free access to the full post archives.