3 Bargain Stocks at 52-Week Lows With Big Upside in 2026

Markets are broadening as tariffs, geopolitics, and Fed uncertainty dominate headlines - creating rare opportunities beneath the surface.

Market Update

Last Week

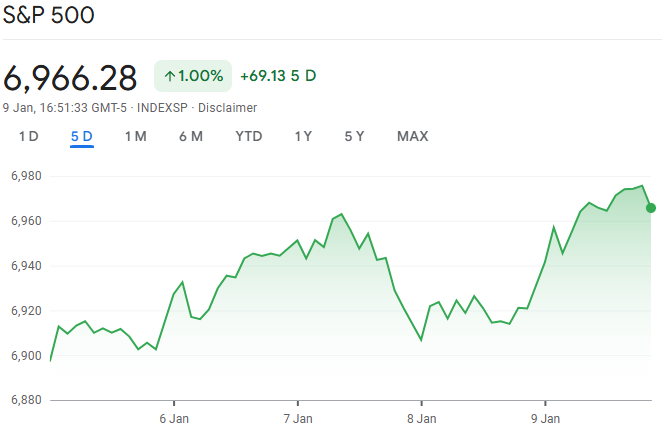

Stocks kicked off the year on a strong note, brushing aside rising geopolitical tension and pushing major indexes to fresh highs.

Policy headlines drove some sharp sector swings. Defense stocks sold off midweek after President Trump warned contractors they wouldn’t be allowed to buy back shares or pay dividends unless they ramped up production. A day later, the script flipped: a proposed jump in military spending sent the group sharply higher as investors recalibrated for bigger government checks.

Housing stocks followed a similar rollercoaster. Builders initially dropped on news the administration may limit institutional buying of single-family homes. But the mood turned fast after Trump directed Fannie Mae and Freddie Mac to purchase $200 billion in mortgage bonds, aiming to push mortgage rates lower. Agency credit spreads tightened quickly, and housing stocks rebounded.

Early takeaway: the market’s rally is broadening - and policy, not just earnings, is setting the tempo.

2025 Reflection

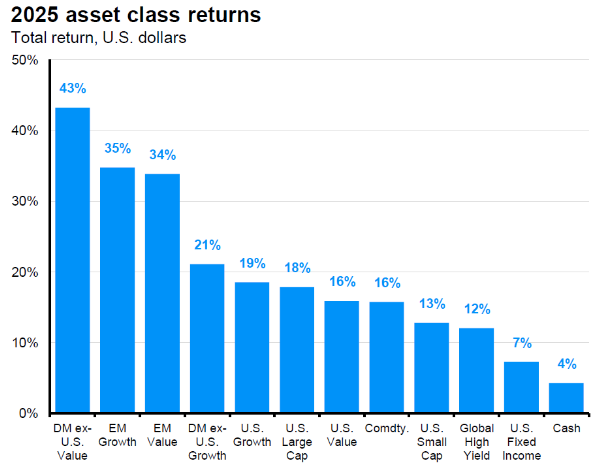

Last year the markets was a tug-of-war between two forces: tariffs and AI.

In April, tariffs slammed global growth expectations. Stocks sold off, bonds rallied, and outside the U.S., policymakers stepped in fast. Europe, the UK, and Canada cut rates. Governments rolled out fiscal support. That mix of easier money, stimulus, and eventual trade deals lit a fire under international stocks and pushed global yields higher.

The U.S. told a different story. Tariffs pushed inflation expectations up, keeping the Fed on hold and delaying fiscal stimulus until 2026. Treasuries rallied - and for the first time since before the GFC, U.S. stocks lagged almost every major market.

And yet… AI changed the ending.

Despite all of that, the S&P 500 still returned 18%. Nearly 60% of those gains came from tech, as AI investment powered earnings growth. The rally even broadened a bit: AI capex lifted industrials and energy, while banks benefited from stronger capital markets activity. Value stocks still lagged growth - but by less than 3%, a huge improvement from the last two years.

The takeaway: AI more than offset the drag from tariffs - but the easy gains are behind us.

From here, U.S. AI exposure needs to be a bet on what’s coming next, not what already happened. And with uncertainty still high, diversification finally matters again. International markets are delivering returns without sacrificing performance, and real assets like infrastructure and real estate can add resilience when correlations rise.

Last Weeks Winners & Losers

Top performers:

Intel (+16%)

Amazon (+9%)

Micron (+9%)

Intel (+9%)

Lockheed Martin (+9%)

Biggest drops:

AMD (-9%)

Arista Networks (-8%)

Dell (-6%)

Kroger (-5%)

AbbVie (-4%)

Notable News

Oil Supply Risk Is Shifting - and It’s Not Where You Think

The first week of 2026 wasted no time reminding investors how fast the backdrop can change.

In just days, markets digested fresh labor data, escalating geopolitics, and the prospect of a Supreme Court decision that could reshape U.S. tariff policy. But the headline grabbing the most attention was U.S. action in Venezuela - and what it could mean for oil.

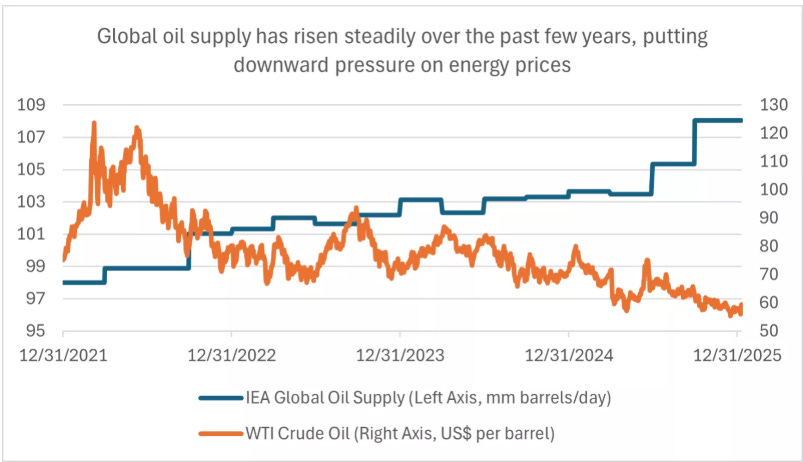

From a pure macro lens, Venezuela isn’t systemically large. It accounts for less than 1% of global GDP, trade, and oil production, despite sitting on massive reserves. If tensions stay contained, the near-term risk to global growth looks limited.

The bigger issue is what comes next.

The U.S. has signaled plans to oversee a transition of power and help rebuild Venezuela’s oil infrastructure with the backing of major energy companies. That’s not a short project - estimates run a decade and over $100 billion - but it introduces an important long-term question for markets: more oil, into an already oversupplied world.

Oil prices are already hovering near multi-year lows. Global supply remains ample, and structural demand headwinds - like EV adoption, especially in China - aren’t going away. If Venezuelan production eventually comes back online in a meaningful way, it could add downward pressure on prices, not lift them.

That’s the tension for energy investors. In the near term, geopolitical disruption can push prices modestly higher. Over the longer run, successful rebuilding could mean lower prices, tighter margins, and tougher economics for producers - not exactly a gift to shareholders.

Bottom line: Venezuela may be small today, but the precedent and the long-term supply implications are what markets should be watching.

The Job Market Is Cooling - Not Cracking

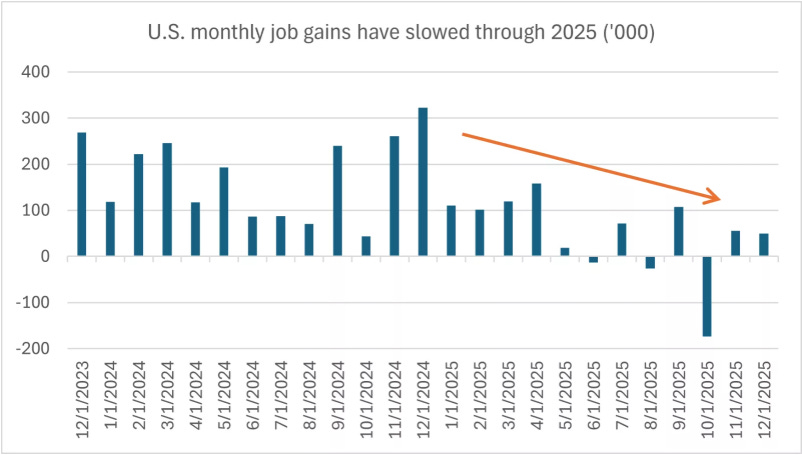

The latest jobs report delivered a familiar message: the U.S. labor market is cooling - slowly, not breaking.

December payrolls rose by just 50,000, missing expectations and continuing last year’s trend. Revisions to prior months pushed the three-month average into negative territory, and 2025 job growth averaged just 49,000 a month, a sharp step down from 2024. The hiring engine is clearly losing steam.

The stabilizer, for now, is unemployment.

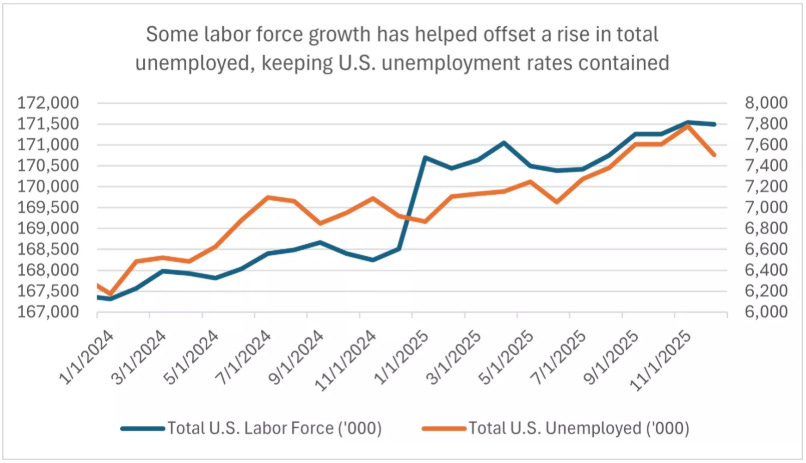

The jobless rate held at 4.4%, slightly better than expected and still well below the long-term U.S. average. Labor force growth - modest, but positive - has helped absorb a rising number of unemployed workers, keeping the headline rate contained despite immigration and demographic headwinds.

For the Fed, this doesn’t change the script.

The labor market is cooling enough to argue for patience, but not weak enough to force urgency. This report alone doesn’t justify faster or deeper rate cuts - but it does reinforce the case for one to two cuts later in 2026, assuming inflation keeps cooperating.

That brings us to the next test: inflation data on January 13. CPI is expected to come in around 2.7% year over year - still above target, but stable. Crucially, inflation hasn’t re-accelerated despite tariffs and stronger growth. If that trend holds, the Fed should gain confidence as the year progresses.

Bottom line: jobs are slowing, unemployment is steady, and the Fed is still in wait-and-see mode - with a gradual easing bias intact.

Tariff Risk Is Real - but the Market Isn’t Panicking

A Supreme Court ruling on U.S. tariffs could arrive in the weeks ahead - and markets are already gaming out the outcome.

The case centers on whether the administration overstepped its authority by using emergency powers to impose tariffs so broadly. A strike-down would sound dramatic, but the market impact may be more muted than the headlines suggest.

Why? Because tariffs likely wouldn’t disappear - they’d just slow down.

The administration has other tools available, like national security or unfair-trade statutes. Those routes are messier and take longer, but they keep tariffs very much in play. Any legal reset would likely mean delay, not repeal.

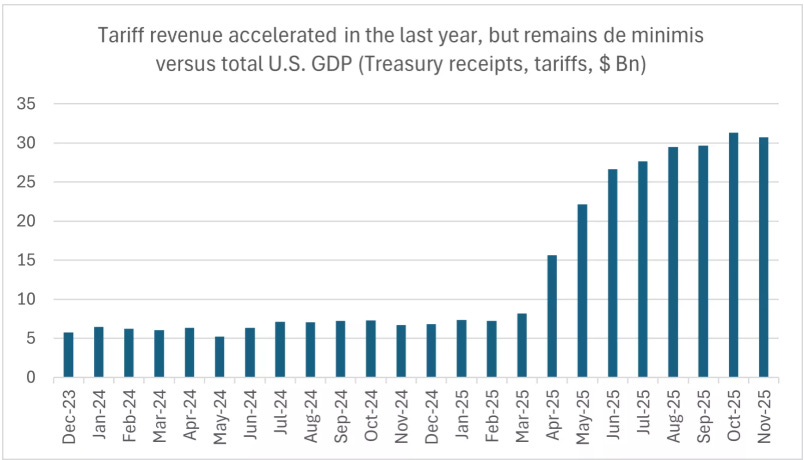

There’s also chatter about refunds - potentially up to $150 billion to companies hit by tariffs. But there’s no clean mechanism to deliver that money, and any process would almost certainly get tangled in court. Even if refunds do arrive, the size is small relative to the U.S. economy - and could even provide a modest growth tailwind rather than a shock.

Zooming out, markets seem comfortable looking past the noise.

Earnings expectations for 2026 have moved higher, now running near 15% growth, and the economy continues to surprise on the upside. Fourth-quarter GDP is tracking around 5%, well above trend. Against that backdrop, the S&P 500 is already up close to 2% to start the year, while 10-year Treasurys are still offering yields around 4.1%.

Bottom line: even if the Court clips the administration’s wings, the economic and market engines are still running - and that’s where investor attention remains.

Trump Targets Credit-Card Rates in New Affordability Push

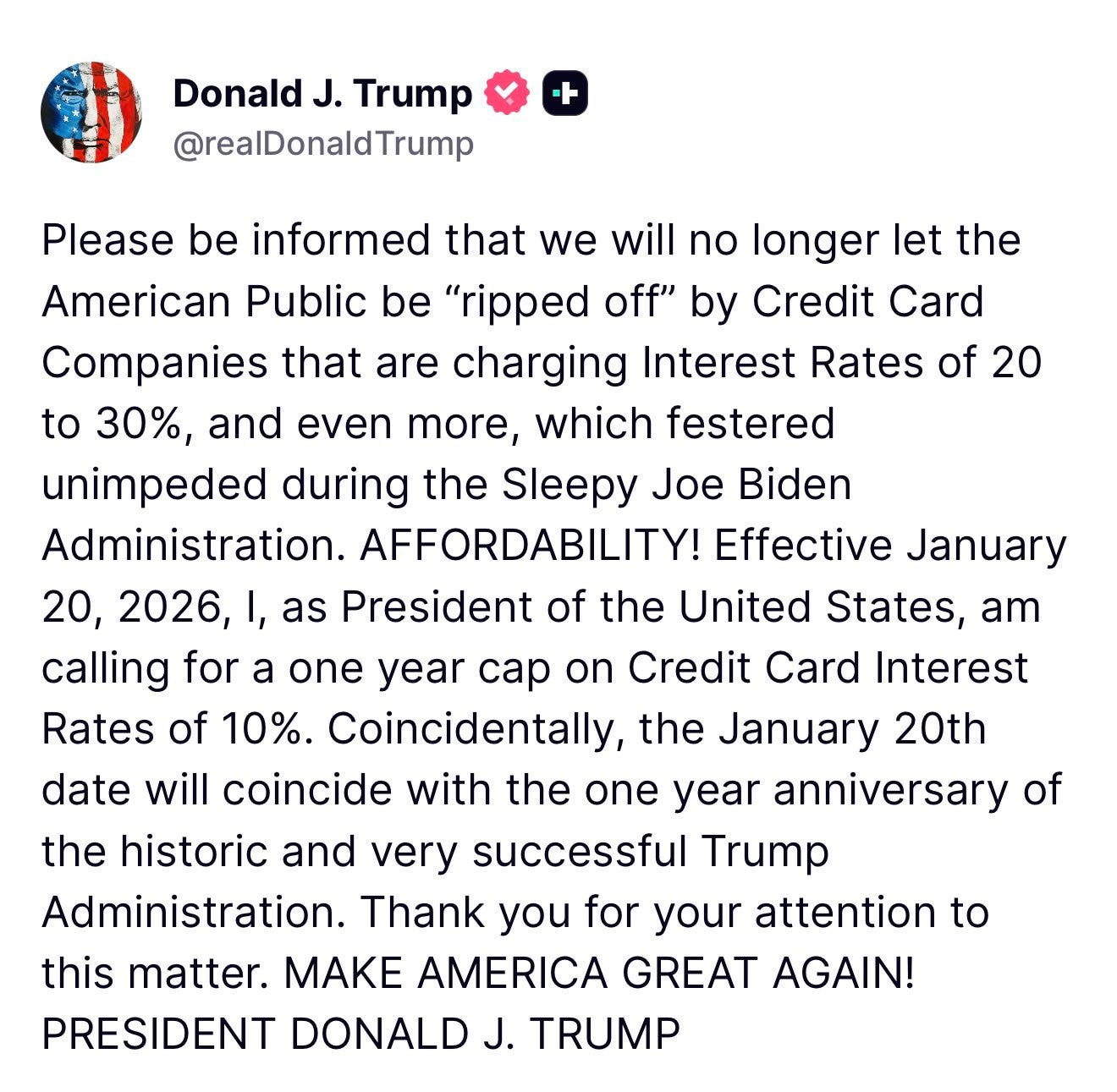

President Trump is taking aim at the cost of living again - this time by calling for a one-year cap on credit-card interest rates at 10%.

With average credit-card rates sitting near 23%, the proposal is meant to ease pressure on households carrying revolving debt, especially lower- and middle-income borrowers. Trump says the cap would begin January 20 and frames it as protection against what he calls excessive charges by card issuers.

The proposal fits into a broader affordability push. In recent days, the administration has moved to restrict institutional purchases of single-family homes and floated a plan for Fannie Mae and Freddie Mac to buy $200 billion in mortgage bonds to help bring borrowing costs down. Trump is expected to outline more of this agenda later this month at the World Economic Forum in Davos.

The policy trade-offs are real.

While borrowers would benefit from lower interest costs, banks would likely respond by tightening credit, especially for riskier households, and introducing new fees to offset lost revenue. That’s one reason credit-card rates have rarely, if ever, been capped at such low levels - Fed data shows they haven’t dipped below 10% in decades.

Politically, the idea has momentum. Bipartisan legislation was introduced last year, and Senator Bernie Sanders has publicly backed the proposal. Still, past efforts to cap card-related charges have struggled in court, including a recent attempt to limit late fees that was blocked by a federal judge.

Bottom line: the affordability message is resonating - but implementation, and unintended consequences, will matter far more than the headline.

Earnings Week

Join 119,000+ investors on YouTube! 🎥

We break down earnings, market moves, and exclusive insights you won’t find anywhere else.

Don’t miss out — hit the button below to watch and subscribe now! 👇

YouTube Channel 🔔

Subscribe today and stay ahead of the market!

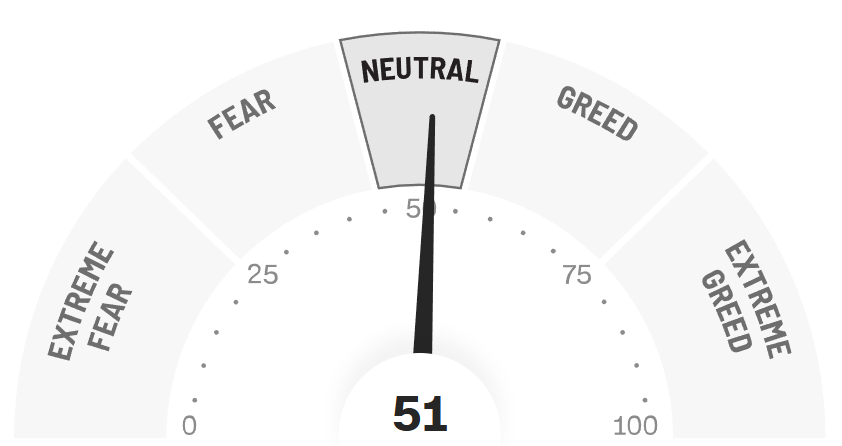

Fear & Greed Index

3 Bargain Stocks at 52-Week Lows

After a year dominated by tariff headlines, geopolitical shocks, and an AI-driven rally that lifted the indexes but left many stocks behind, the market is starting to feel less one-note.

Beneath the surface, leadership is broadening. Small caps and value are stirring. Policy uncertainty is creating pockets of pressure. And in the process, a growing list of high-quality companies are still trading near their 52-week lows - not because their businesses are broken, but because attention moved elsewhere.

These aren’t hype trades or turnaround gambles. They’re established companies with real cash flows that fell out of favor as investors crowded into momentum and mega-cap growth. Now, with the labor market cooling, the Fed leaning toward gradual easing, and diversification back in focus, the setup is quietly improving.

As we look at 2026, the opportunity isn’t simply about buying what’s cheap - it’s about buying what’s been mispriced by a narrow market.

The three stocks below fit that profile. Each combines durable fundamentals, depressed valuations, and clear catalysts that could matter as the cycle evolves. For investors willing to look past the headlines, these are the kinds of setups that tend to reward patience.

A quick note for regular readers:

I’m closing a short, private 20% annual upgrade offer later today for those who’ve been following along and are considering upgrading.

It’s limited to 20 spots and expires tonight.

If you’d like full access to full valuations, spreadsheets and future paid sections, you can claim it below 👇

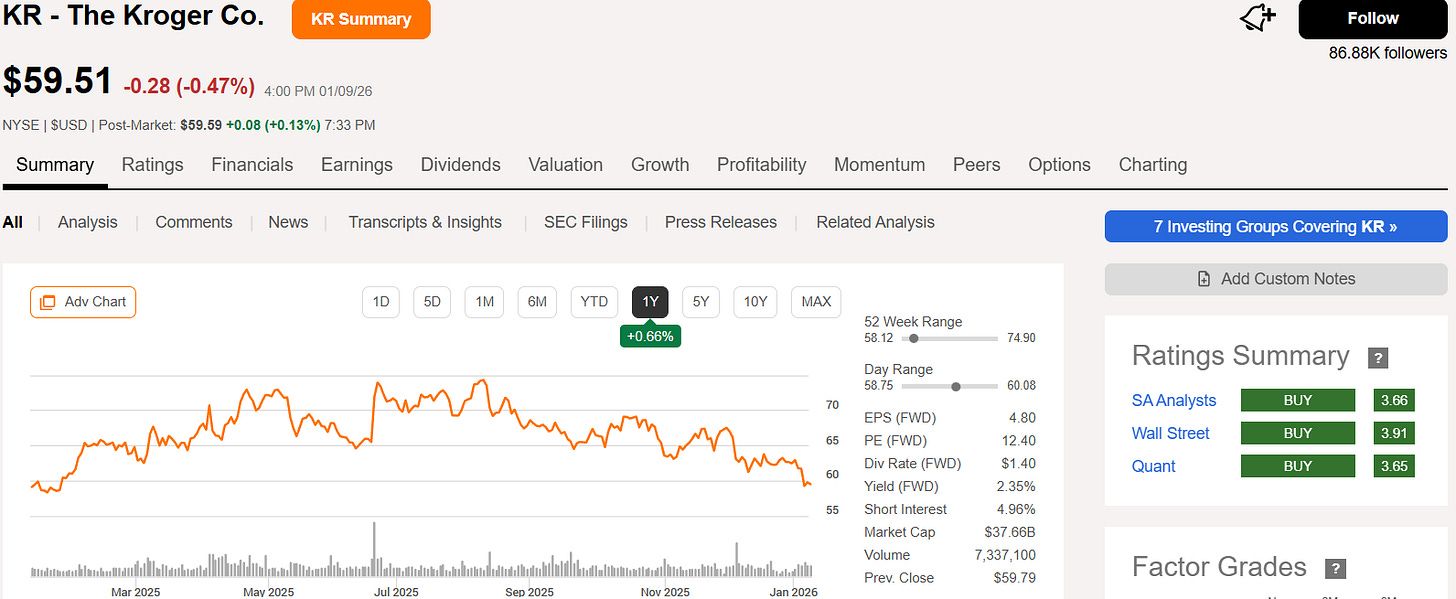

1. Kroger (KR)

What Kroger Actually Does

Kroger is more than just a grocery store - it’s one of the largest and most diversified consumer staples companies in the U.S., operating over 2,700 locations under dozens of banners, many of which shoppers may not even realize belong to the Kroger family. Beyond groceries, Kroger runs pharmacies, fuel centers, and private-label brands, all supported by one of the most sophisticated logistics and supply chain networks in the industry.

Its real edge comes from vertical integration. Through its “Our Brands” private-label division, Kroger manufactures tens of thousands of products in-house, often at higher margins than national brands. Combined with its digital and loyalty ecosystem, the company gathers deep insights into customer behavior, powering targeted promotions, repeat visits, and consistent sales growth.

Kroger also benefits from structural advantages in the grocery business: recurring demand for essentials, pricing power, and nationwide scale that can absorb inflationary pressures better than smaller competitors. Add in recent investments in e-commerce and delivery, and Kroger is positioning itself to capture both in-store and online growth.

In short, Kroger isn’t just a supermarket - it’s a consumer staples powerhouse that delivers steady revenue, recurring cash flow, and resilient margins, even in uncertain economic environments.

That combination makes its current valuation near 52-week lows an intriguing opportunity for investors looking for defensive yet growth-capable exposure.

Why Kroger Has Struggled in 2025

Even with a resilient core business, Kroger’s stock has been under pressure throughout 2025, pushing shares toward 52‑week lows as several headwinds converged, and currently on a 20% drawdown.

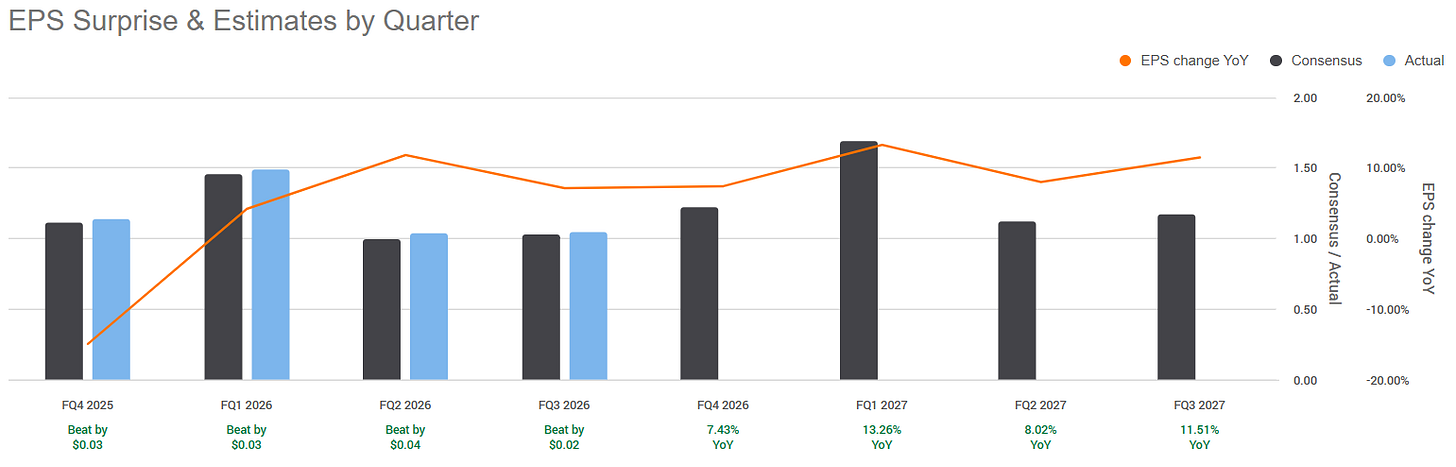

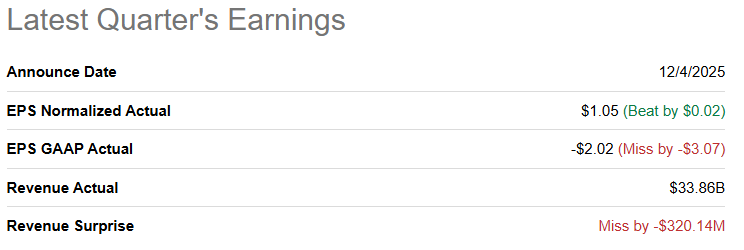

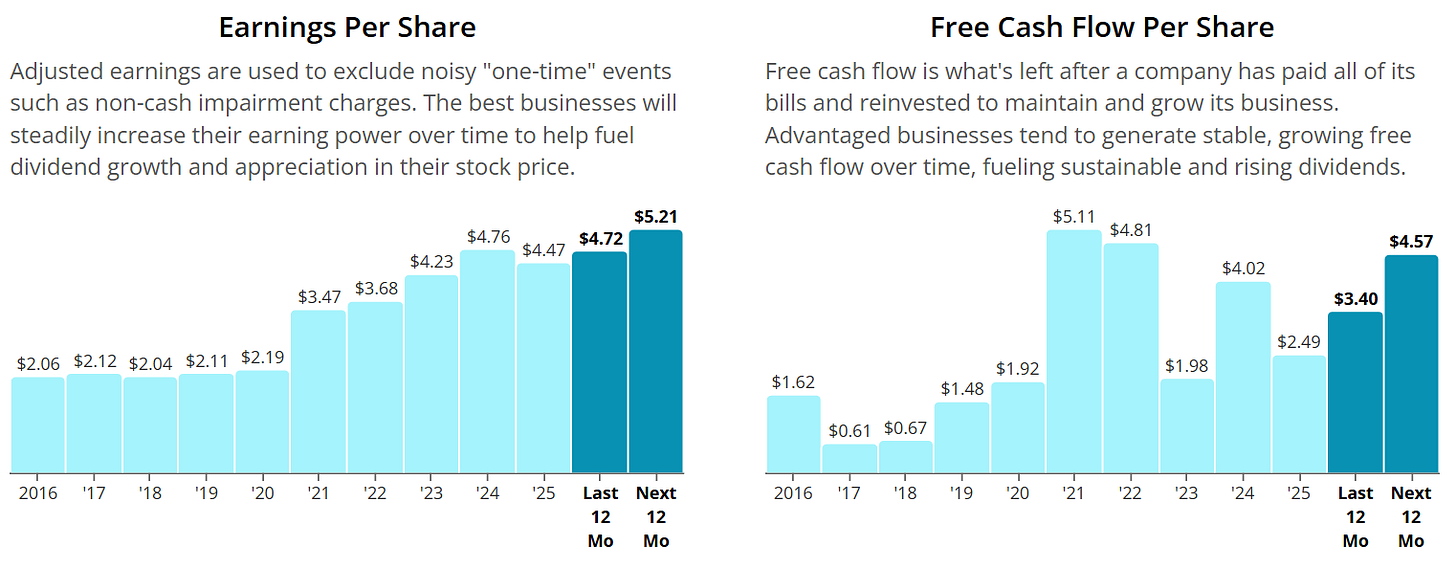

Revenue and earnings pressure: While Kroger has typically beaten earnings expectations,

quarterly revenue has repeatedly missed forecasts, highlighting challenges in converting foot traffic into consistent growth. Recent reports showed flat sales and earnings below consensus, signaling near-term financial headwinds.

Operational and restructuring costs: Kroger has undertaken significant changes, including scaling back automated fulfillment centers and closing underperforming stores. These moves aim to improve long-term efficiency but have weighed on short-term profits.

Intense competition: Discount chains like Aldi and Lidl, alongside strong regional players, are taking market share in key areas. At the same time, online delivery and e-commerce rivals are reshaping customer expectations, pressuring traditional grocers.

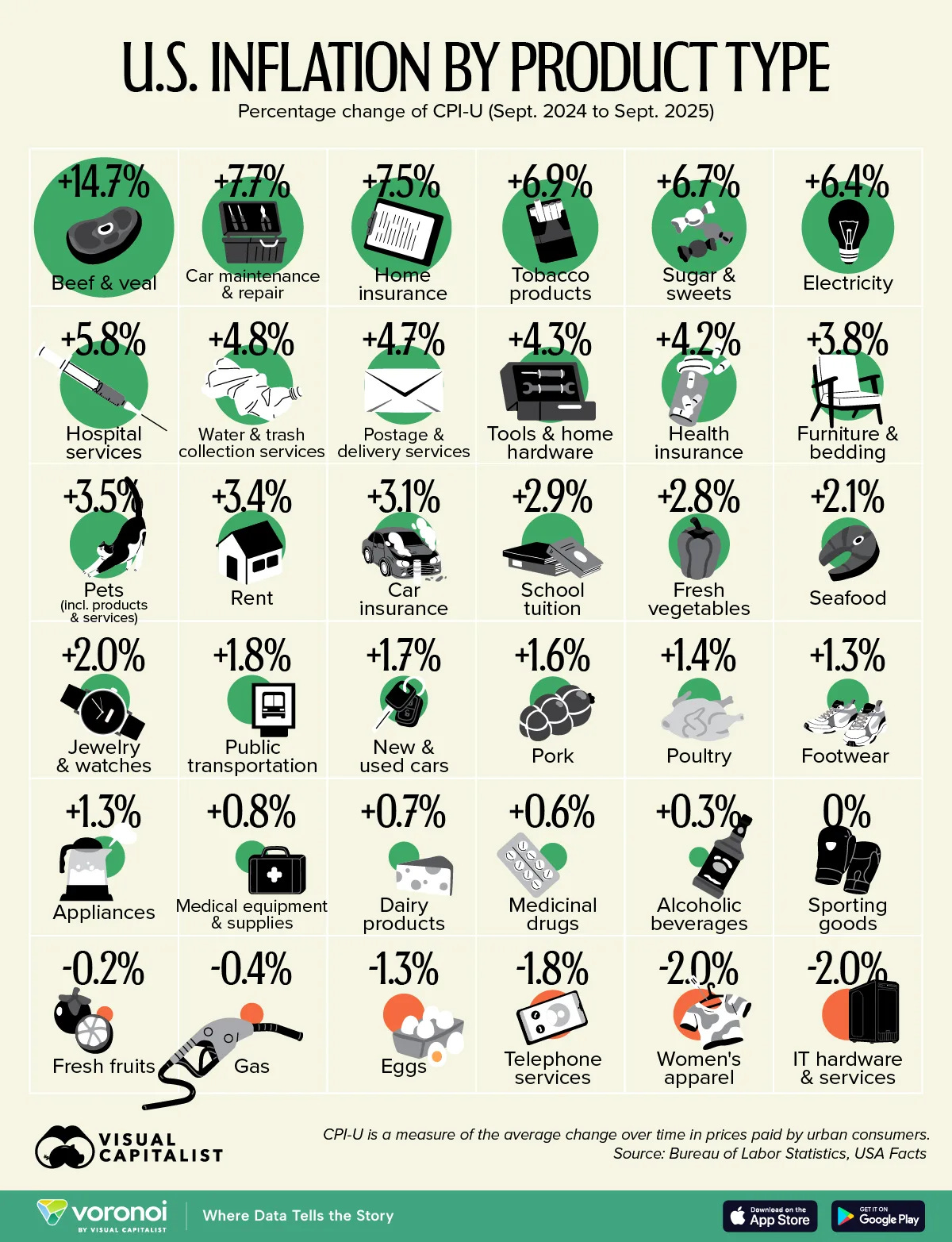

Macro and consumer pressures: Inflation and cost-of-living concerns have led Kroger to rely on promotions and price cuts to maintain traffic.

While this strategy supports shoppers, it also squeezes margins and can disappoint investors focused on profitability.

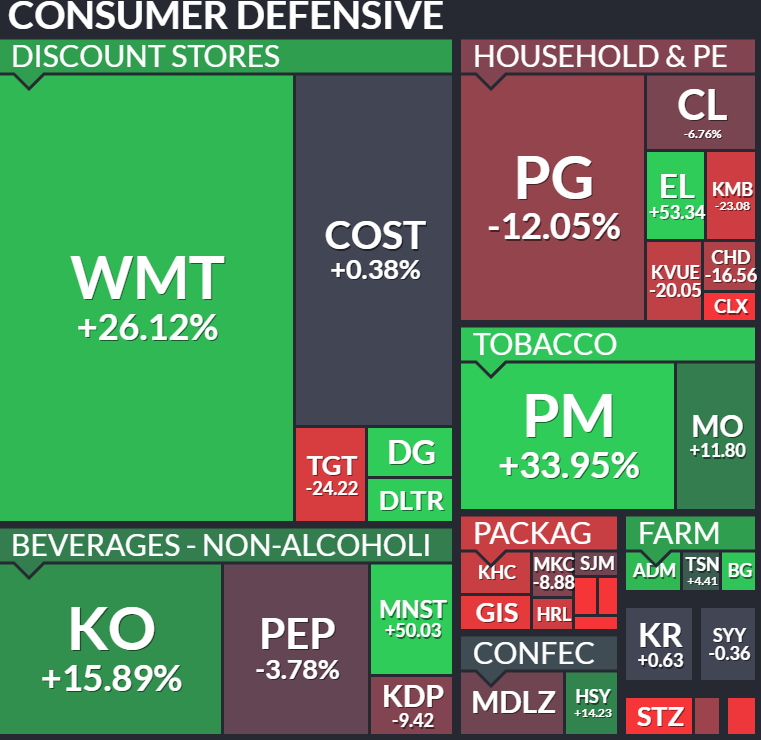

Consumer Defensive 1Y Performance:

Strategic uncertainty: The failed Albertsons merger and leadership changes created periods of uncertainty. While management has been stabilizing operations, investors typically prefer consistent execution and clarity, which was lacking at times.

These factors combined help explain why Kroger has lagged broader consumer staples and retail peers, leaving the stock near its 52-week low and presenting potential opportunities for value-focused investors.

Why Now May Be a Great Time to Buy Kroger

After a turbulent 2025, Kroger is quietly emerging as a compelling value opportunity in 2026. The stock has been weighed down by short-term concerns - margin pressure, cautious consumers, competitive intensity, and lingering questions around the failed Albertsons merger - but many of the company’s structural strengths remain intact and underappreciated.

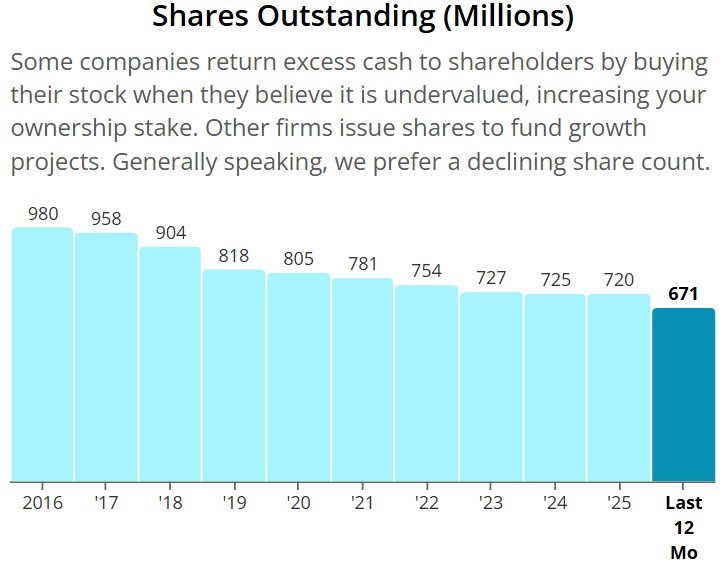

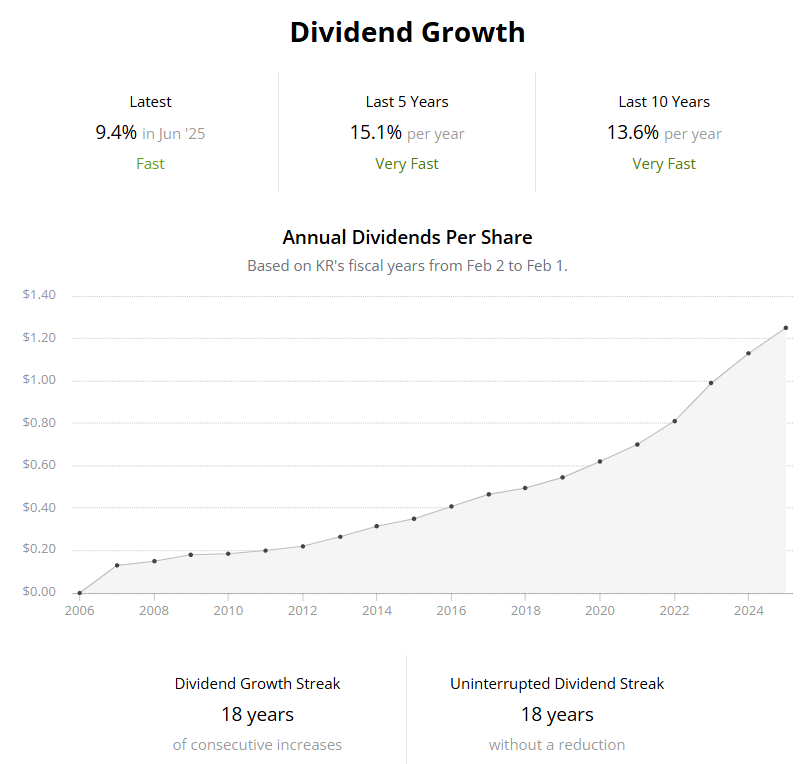

Defensive, recession-resilient business: Grocery demand is inherently stable, and Kroger’s scale, private-label portfolio, and loyalty ecosystem give it pricing power that smaller competitors can’t match. Even during softer economic periods, Kroger generates consistent cash flow, which supports dividends, share buybacks, and debt reduction.

Margin tailwinds as inflation normalizes: The margin pressure that hit Kroger in 2025 may start to ease in 2026 as inflation trends stabilize. The company has historically managed cost cycles effectively, and a more predictable input-cost environment could unlock earnings upside without needing a spike in sales.

Undervalued relative to fundamentals: Kroger now trades near multi-year lows despite steady revenue, strong consumer demand, and one of the most resilient business models in retail. The disconnect between market sentiment and Kroger’s fundamentals suggests an attractive entry point for long-term investors.

Strategic growth catalysts: Beyond its defensive moat, Kroger continues to invest in e-commerce, delivery, and data-driven marketing, which could incrementally lift top-line growth and strengthen customer retention. Combined with potential margin improvements, these initiatives create optionality for upside beyond baseline expectations.

In short, Kroger offers a rare combination of defensive stability, easing cost pressures, and deep value, making it a compelling stock to consider while the market remains focused on short-term noise.

Valuation

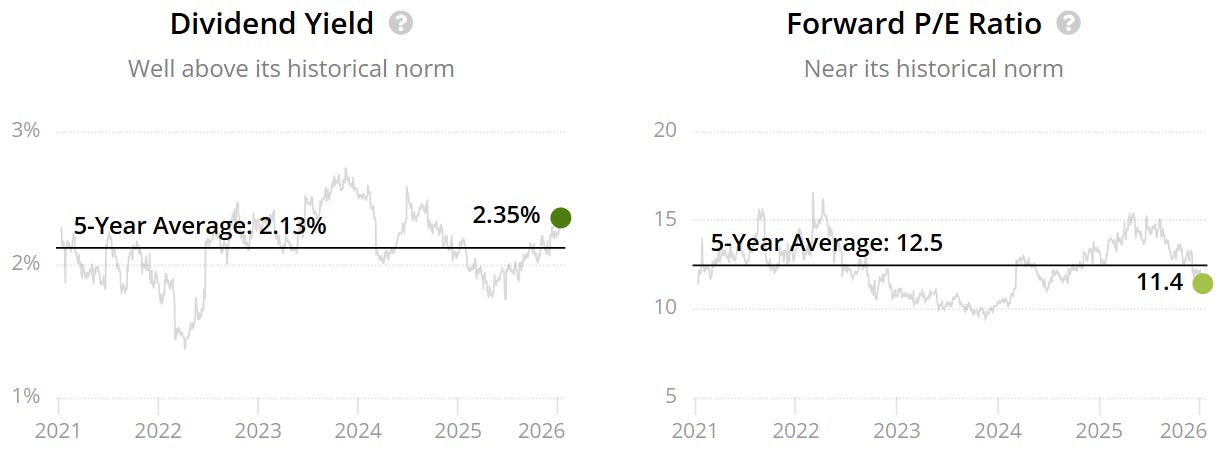

The forward P/E sits slightly below the historical - 11.4x v 12.5x.

This could indicate that the company is potentially undervalued.

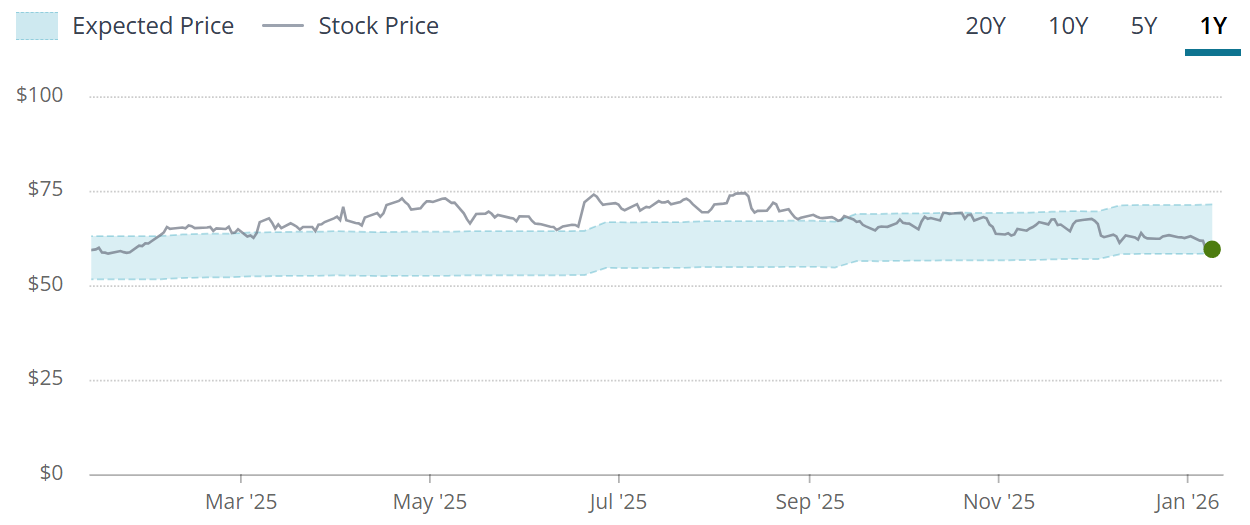

The blue tunnel highlights that the company is towards the bottom end of the intrinsic/fair value boundaries indicating a potential undervaluation signal.

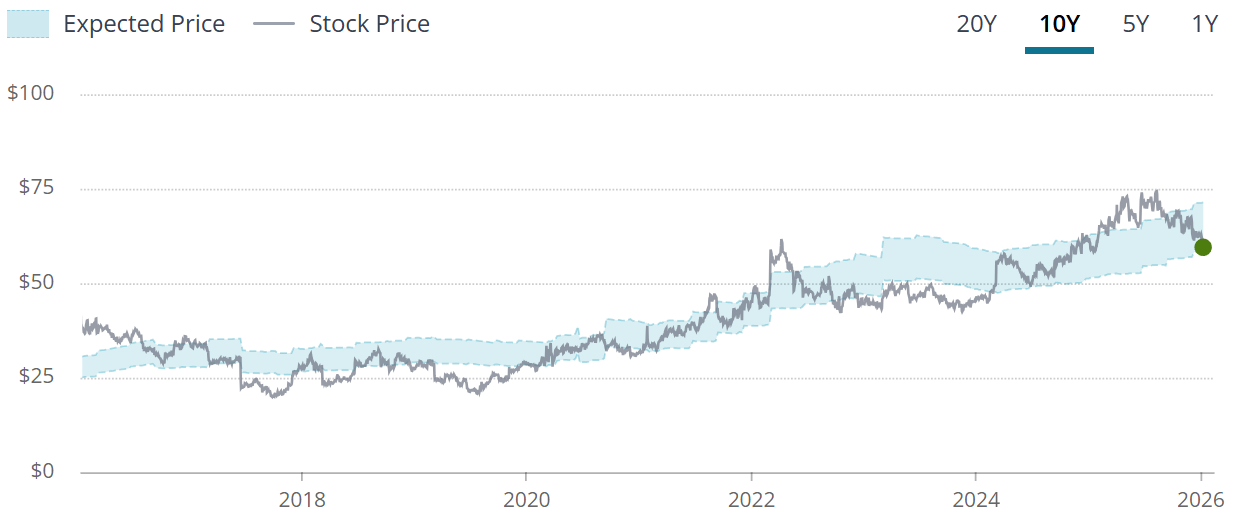

When we zoom out to the last 10Y we can see that the Company has offered investors multiple opportunities to buy this undervalued.

Intrinsic Price

Keep reading with a 7-day free trial

Subscribe to Dividend Talks to keep reading this post and get 7 days of free access to the full post archives.