3 Bargain Stocks Everyone’s Ignoring While AI Mania Soars

Markets are at record highs, valuations are stretched, and AI hype is everywhere — yet these three companies combine growth, cash flow, and dividends in a way few investors are noticing.

Market Update

Three years ago, markets were in freefall. Inflation was raging, the S&P 500 had plunged nearly 25%, and investors had all but given up on the idea of a quick recovery. Then came November 2022 — and with it, the quiet launch of ChatGPT. That moment didn’t just spark an AI boom; it marked the beginning of one of the most powerful bull markets in recent memory.

Fast forward to today, and that same bull is still running — though not without its scars. The S&P 500 hit new all-time highs this week, climbing 1.22% to around 6,800, a level few would’ve believed possible back when inflation and rate hikes dominated every headline.

Still, the wall of worry hasn’t gone away. Tensions with China are heating up ahead of key trade deadlines. The U.S. labor market looks softer than it seems, hidden behind a patchy flow of government data. And the once unstoppable AI rally? Investors are finally starting to question whether valuations have sprinted too far ahead of reality.

Yet despite the noise, the market keeps climbing. Every dip has been met with buyers. Every doubt, with resilience. This bull market turns three this month — and unless something breaks dramatically, there’s a good chance it’ll still be standing to celebrate a fourth.

Last Weeks Winners & Losers

Top performers:

RTX (+13%)

3M (+10%)

Advanced Micro Devices (+9%)

Crowdstrike (+9%)

Micron (+8%)

Biggest drops:

Deckers (-13%)

Netflix (-9%)

Super Micro (-7%)

T-Mobile US (-5%)

Hershey (-4%)

Notable News

Bull Market comparisons

Since bottoming out in October 2022, the S&P 500 has surged nearly 90%—or 98% if you include dividends. It’s been an incredible run, but in the grand scheme of history, this rally isn’t an outlier. Over the past eight decades, the average bull market (there have been 12 before this one) has delivered gains of around 200% and lasted about five years.

In fact, most of them—eight to be exact—made it well past their third birthday. The record-holder, of course, was the 2009–2020 bull that ran for more than a decade.

So this one? It’s not a newcomer anymore, but it’s far from old age.

And while it’s tempting to obsess over anniversaries and milestones, bull markets don’t simply die of age. They end because of recessions or the Fed slamming on the brakes.

Cooler inflation = Fed rate cuts?

A government shutdown has thrown a wrench into the usual flow of economic data, delaying critical releases like the jobs report that the Fed depends on. But one number couldn’t wait — the inflation data. The Social Security Administration needed it to calculate next year’s cost-of-living adjustment for over 70 million Americans, so the Bureau of Labor Statistics brought back furloughed workers just to get it out.

And it was worth the wait.

Inflation came in cooler than expected. Headline CPI rose just 0.3% month-over-month (vs. 0.4% expected), while the core measure — which strips out food and energy — climbed 0.2% (vs. 0.3% expected), marking its slowest pace in three months. Year-over-year, both metrics landed at 3%, slightly softer than anticipated.

Digging deeper:

Housing inflation eased, with owners’ equivalent rent posting its smallest rise since early 2021.

Goods prices slowed too, helped by cheaper used cars, though tariffs pushed up furniture and clothing slightly.

Services inflation excluding housing also cooled, thanks in part to falling car insurance costs.

Taken together, it’s the kind of report that gives the Fed cover to act. Markets are now betting on an October 29 rate cut, lowering the fed funds range to 3.75%–4%, and another possible cut before year-end.

Earnings Are About to Take the Wheel

After three straight years of double-digit gains, the S&P 500 just notched fresh all-time highs — and valuations are starting to look stretched. At roughly 6,800, the index is trading near cycle-high price-to-earnings ratios. Investors seem increasingly hesitant to pay the kind of premiums last seen during the tech bubble. That means the next leg of this bull market can’t rely on multiple expansion — it’ll have to come from earnings growth.

And the good news? The setup still looks solid. U.S. companies are proving more resilient than many expected — growing profits even as trade tensions simmer and the labor market cools.

We’re now deep into third-quarter earnings season. Nearly 60% of S&P 500 companies are set to report in the next two weeks — including most of the “Magnificent 7.” Analysts expect that group to deliver 15% year-over-year earnings growth, versus 6.7% for everyone else, and 8.5% for the index overall.

So far, corporate commentary has struck a confident tone: high-income consumers are still spending, credit quality remains stable, and there’s a noticeable pickup in M&A activity. As the tech giants step up to report, all eyes are on whether AI spending — now approaching $400 billion this year, or nearly one-third of total S&P 500 capex — starts to show real returns.

For now, investors are giving them the benefit of the doubt. But if earnings continue to deliver in the coming quarters, it could provide the fuel this bull market needs to keep climbing.

Earnings Season

Join 116,000+ investors on YouTube! 🎥

We break down earnings, market moves, and exclusive insights you won’t find anywhere else.

Don’t miss out — hit the button below to watch and subscribe now! 👇

YouTube Channel 🔔

Subscribe today and stay ahead of the market!

Fear & Greed Index

📰 The 3 Bargains Left in an Overpriced Market

When markets sit at all-time highs, everything feels expensive. Growth stocks are priced for perfection, defensive names are stretched, and even dividend favourites have lost their margin of safety. It’s one of those rare moments when being patient almost feels reckless — but history tells us that’s usually when the best long-term opportunities hide in plain sight.

The truth is, while much of the market looks inflated, a handful of quality businesses are still trading at reasonable valuations — either because they’re out of favour, temporarily misunderstood, or quietly rebuilding after a rough stretch. These are the kinds of companies that tend to reward investors who can look beyond next quarter’s headlines.

This week, I’ve highlighted three U.S. stocks that fit the “bargains left in an overpriced market” theme. Each offers a different mix of stability, growth, and value — a combination that’s increasingly rare in today’s market.

One is a household name in logistics, trading near pandemic lows with a record-high dividend yield, yet quietly investing in new business lines and network automation to drive future growth.

Another dominates a critical piece of America’s infrastructure, providing steady cash flow and pricing power while benefiting from structural tailwinds in its sector.

The third is a growth-focused leader in its industry, expanding its network and customer base even as short-term results have tempered enthusiasm, creating an attractive entry point for patient investors.

Together, these three stocks offer a blend of reliable cash flow, operational strength, and growth optionality — exactly the kind of opportunities worth exploring when much of the market feels overpriced.

1. United Parcel Service

UPS – The Under‑Loved Logistics Giant

United Parcel Service (UPS) is one of the most recognisable names in global logistics — and for good reason. From your local street to international hubs, UPS moves millions of packages every day, delivering everything from e‑commerce orders to critical healthcare shipments. What often gets overlooked is just how sophisticated their integrated network is: hubs, sortation centres, automated facilities, and a fleet of planes and trucks all working in harmony.

This integrated network isn’t just impressive engineering; it’s a competitive moat. It allows UPS to operate efficiently at scale, adapt to surges in demand, and offer specialised services like temperature-controlled healthcare deliveries — a segment that management is aiming to double over the next few years.

Despite being a global powerhouse, the stock hasn’t exactly been in the spotlight. Investors are wary of slower e‑commerce growth and rising costs, which has left UPS trading at multiples below its historical averages. That creates an interesting setup: a household name with a fortress‑like network, modest but stable growth, and a dividend that cushions downside.

Why UPS Has Lagged in 2025 (and for a Long Time)

Despite its global footprint and massive logistics network, UPS has struggled to excite investors for years — and 2025 has been no different. Several factors have contributed to this underperformance:

Slowing E‑Commerce Growth

The boom of the past decade has tapered off. Online shopping growth is still positive, but at a slower pace, meaning package volume growth isn’t soaring like it used to. Investors who once counted on double-digit parcel growth now see modest gains.Rising Costs and Margin Pressure

Fuel, labour, and transportation costs have all risen, squeezing margins. While UPS is investing in automation and efficiency, these improvements take time to offset rising operating expenses.Macro and Market Sentiment

In a high-flying market, UPS feels “boring.” It’s not a flashy tech story or a meme-stock darling. Slower, steady growth doesn’t capture headlines, and that’s kept the stock largely off investor radars.Structural Challenges in Logistics

Competition is fierce. FedEx, Amazon Logistics, and regional carriers all pressure pricing. Plus, global trade uncertainties, tariffs, and supply chain disruptions add another layer of complexity to planning and growth.

All of this has created an unusual scenario: a company with strong fundamentals and a clear growth plan, yet a stock price that looks undervalued compared to its network, scale, and potential. For patient investors, this is exactly the kind of setup that can pay off when the market starts recognising UPS’s value again.

UPS touched its pandemic lows last week, a level we haven’t seen in years. Its trailing P/E is flirting with single digits, making it hard not to take notice. Are we at buy-and-forget levels yet?

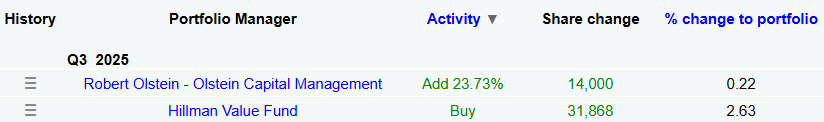

Interestingly, as the latest insider and institutional filings roll in, a couple of super-investors are showing confidence: Robert Olstein and the Himan Value Fund have both added to their UPS positions, signalling that at least some experienced hands see value here.

Why This Might Be the Perfect Time to Buy UPS

UPS is a company with both strengths and headwinds, and that mix is exactly what can create opportunity for patient investors.

Bulls point to long-term tailwinds:

UPS’s US ground and express delivery operations should continue benefiting from e-commerce growth, even if the boom of the past decade has slowed.

Its massive sortation network, global fleet, and integrated operations create a competitive moat that’s extraordinarily hard to replicate.

By using the same infrastructure for both express and ground shipments, UPS maintains industry-leading operating margins and efficiency.

Bears, however, warn of risks:

Economic fallout and tariff actions could pressure package demand and slow margin recovery.

Amazon is reducing volumes sent via UPS by more than 50% by mid-2026. While UPS has the flexibility to rationalize capacity roughly 1-for-1, execution risk remains.

Labor costs are rising, with the renegotiated Teamsters national master agreement driving significant wage inflation.

All that said, the stock trades near pandemic lows with a trailing P/E in the single digits and a record 7.5% dividend yield. For investors willing to accept short-term volatility, UPS combines valuation, scale, and growth optionality — a rare setup in an otherwise expensive market.

UPS’s Record Dividend: Attractive but Requires Caution

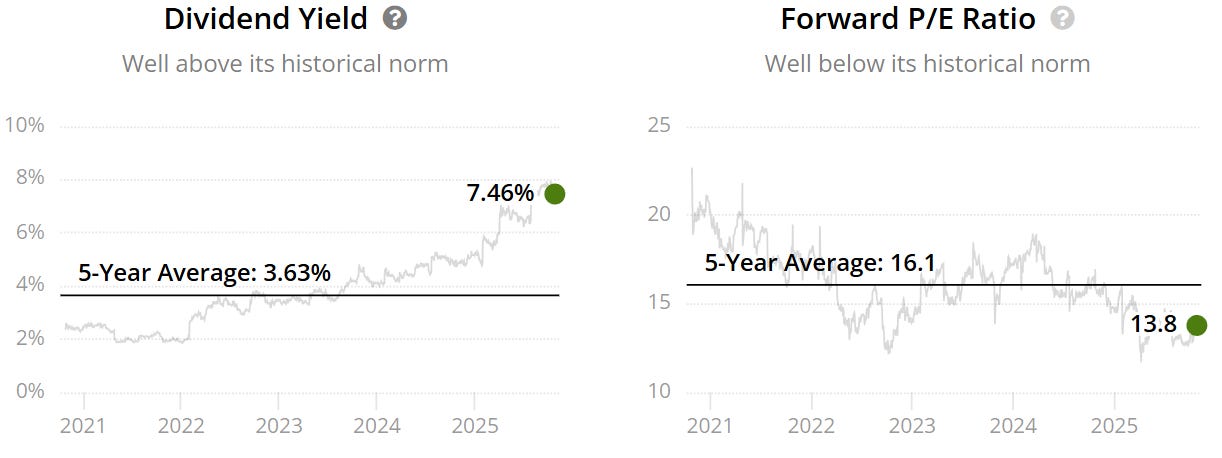

One of the most eye-catching numbers for UPS right now is its 7.5% dividend yield — the highest in the company’s history. For income-focused investors, that’s immediately compelling, especially in a market where many dividend payers are trading at stretched valuations.

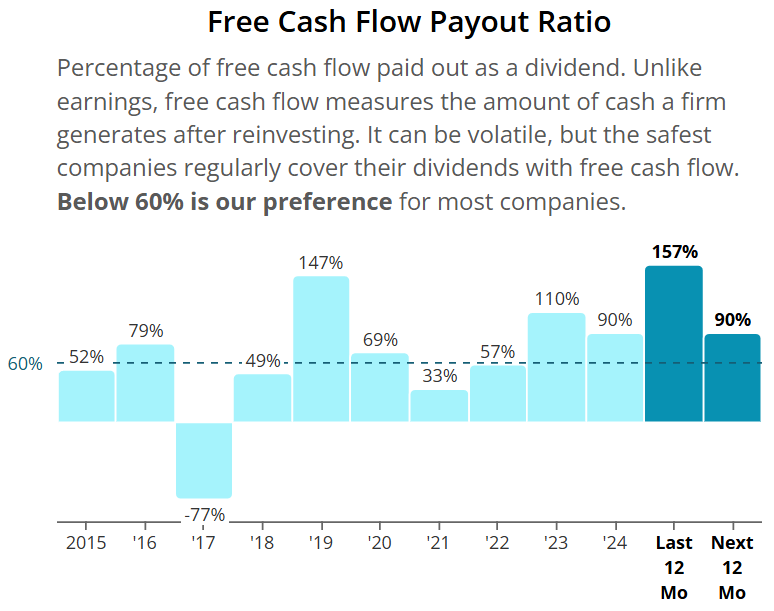

But here’s the nuance: dividends aren’t free money. UPS’s trailing twelve-month free cash flow payout ratio sits at 157%, meaning the company has been paying out far more than it generated in cash over the past year. That’s unsustainable over the long term. The good news? Analysts expect the payout ratio to drop to roughly 90% over the next 12 months, which is still high but far more reasonable.

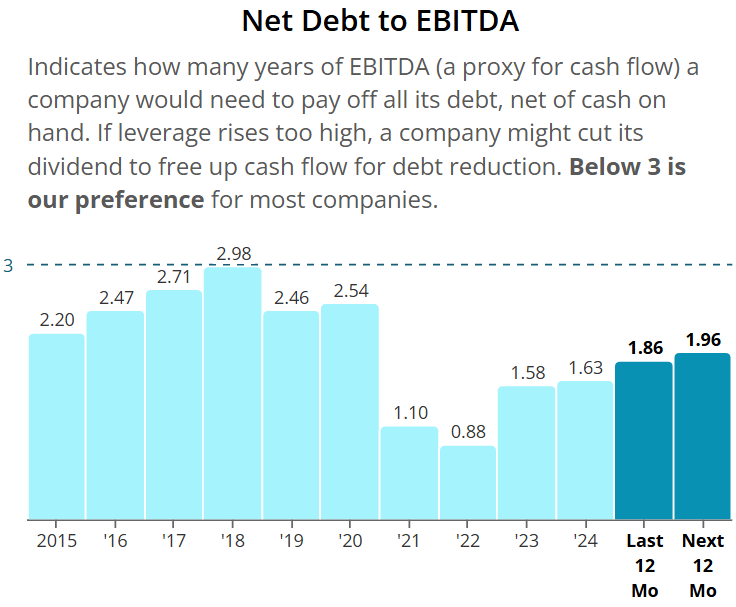

Meanwhile, UPS’s net debt to EBITDA ratio is currently 1.86, a moderate level of leverage that gives the company flexibility but also underscores the need to manage cash carefully if margins or revenue growth slow.

In short: the dividend is historically generous, and it provides downside support for the stock, but investors need to be aware that it’s not purely “free cash flow covered” at the moment. UPS’s growth initiatives, margin improvements, and careful capital management will be key to sustaining this yield without compromising financial stability.

Valuation

The forward P/E sits below the historical - 13.8x v 16.1x. This could indicate the company is potentially undervalued.

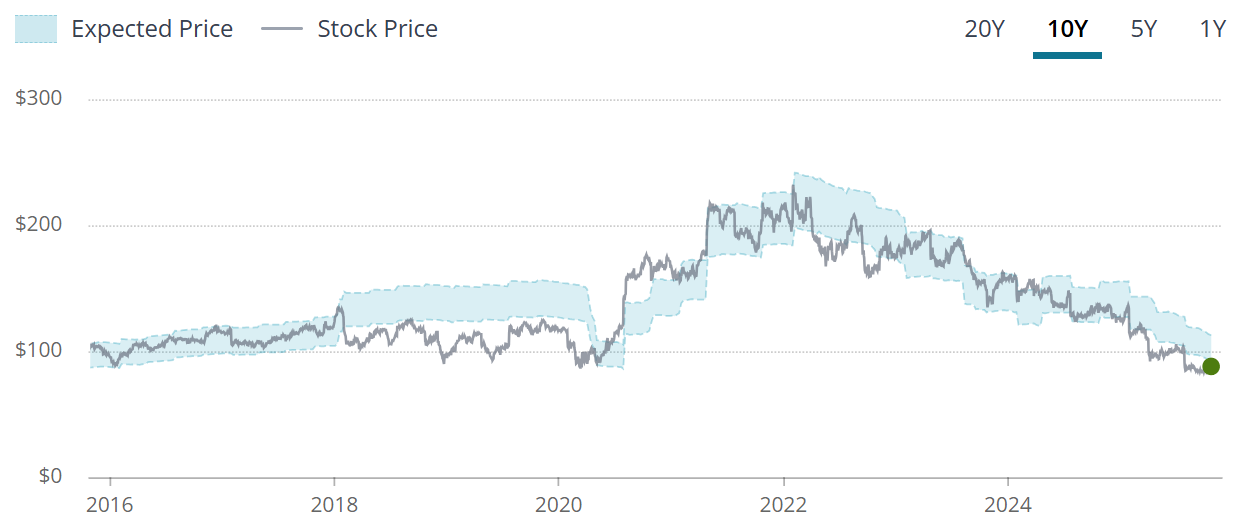

The blue tunnel methodology highlights that the company is below the bottom end of the intrinsic/fair value boundaries indicating undervaluation.

When we zoom out of the last 10Y we can see this Company has gone through a lot, but the takeaway here is that the intrinsic value peaked in 2022 and has been on a downward trend since, so investors will need to be convinced this can pick back up.

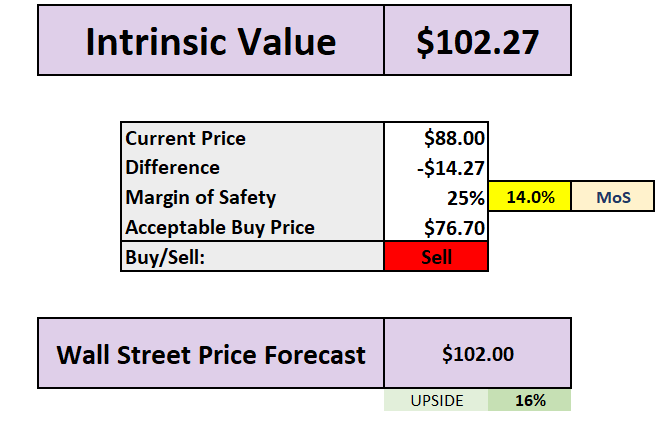

DCF Model

Using our DCF model a few things to note:

-2.5% is baked into the FCF growth moving forwards (yes, you read that right, negative growth)

Using 0% (no growth to free cash flow in the longer term) gives an intrinsic value of $110.

Using all 4 models we get an average intrinsic value of $102 which leads to a 14% margin of safety.

On average wall street see 16% upside into 2026.

A 25% MoS would be at a price of $77.

Keep reading with a 7-day free trial

Subscribe to Dividend Talks to keep reading this post and get 7 days of free access to the full post archives.