3 Bargain Stocks to Buy at 52-Week Lows Before 2026

With rate cuts looming, labor data stabilizing, and a possible Santa Claus rally ahead, these beaten-down names may be poised for a major rebound.

Market Update

The first week of December wrapped up with a quiet but hopeful hum on Wall Street. Major U.S. indexes drifted higher - nothing flashy, just a steady climb - as investors started placing early bets that the Federal Reserve might finally loosen its grip on interest rates at its next meeting.

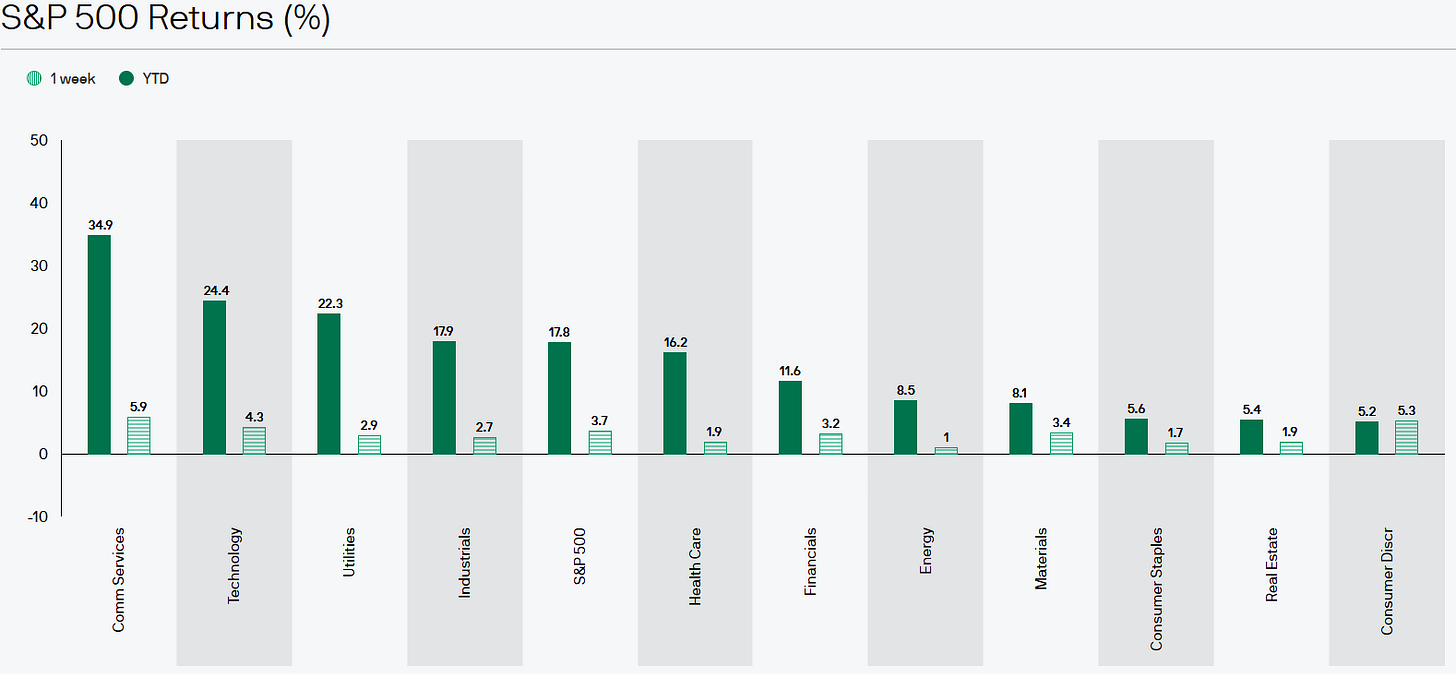

Tech stocks led the charge, nudging the Nasdaq up nearly 1%, while small caps weren’t far behind. Even the S&P 500, moving at more of a Sunday-afternoon pace, still managed a modest gain. Traders noted the calm: lighter-than-usual volume, the kind of week where the market seems to exhale.

But beneath the smooth surface, the economy told a more complicated story.

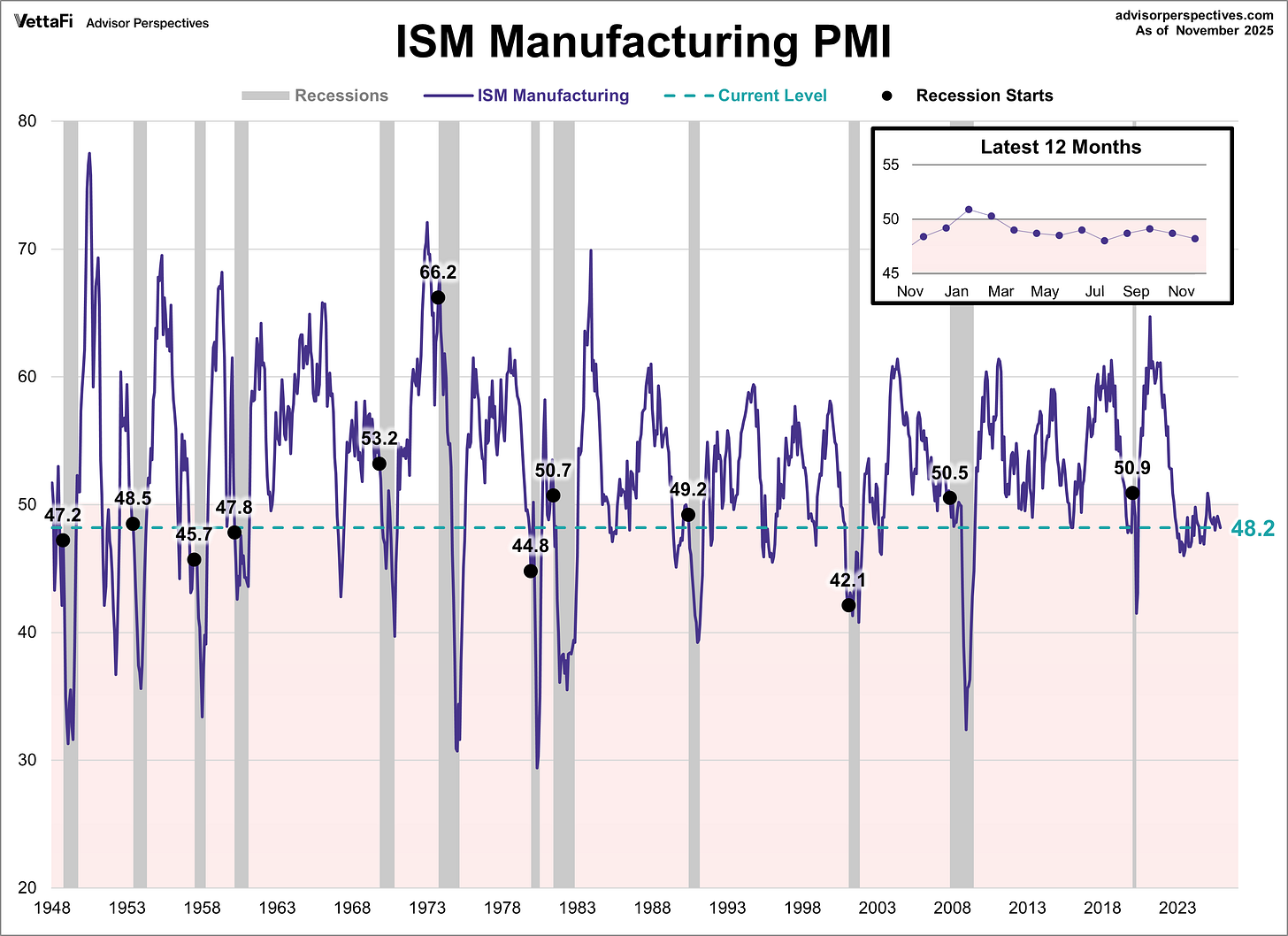

Manufacturing continued its long slide, shrinking for a ninth straight month.

The latest ISM data showed factories pulling back on new orders, hiring, and deliveries - signs of an industry that’s still cooling. Costs, meanwhile, kept creeping higher.

Services, however, painted a different picture - one of resilience. Activity in that sector not only grew but hit its fastest pace since February, and prices eased a bit, a welcome shift for businesses and consumers alike.

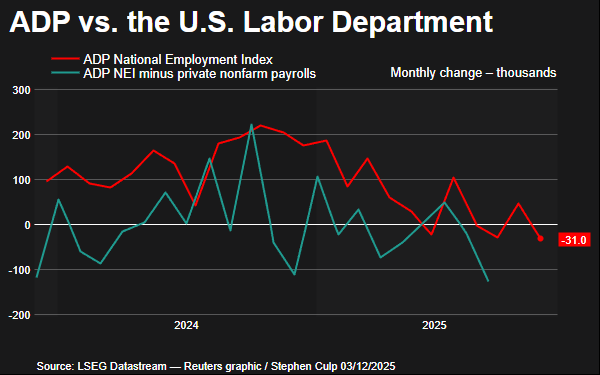

Jobs data added another twist. Private payrolls posted their biggest drop since early 2023, with small businesses leading the pullback. Layoff announcements climbed as well. And yet, in a surprising counterpoint, unemployment claims fell to their lowest level in more than two years. A labor market that’s slowing - but not uniformly.

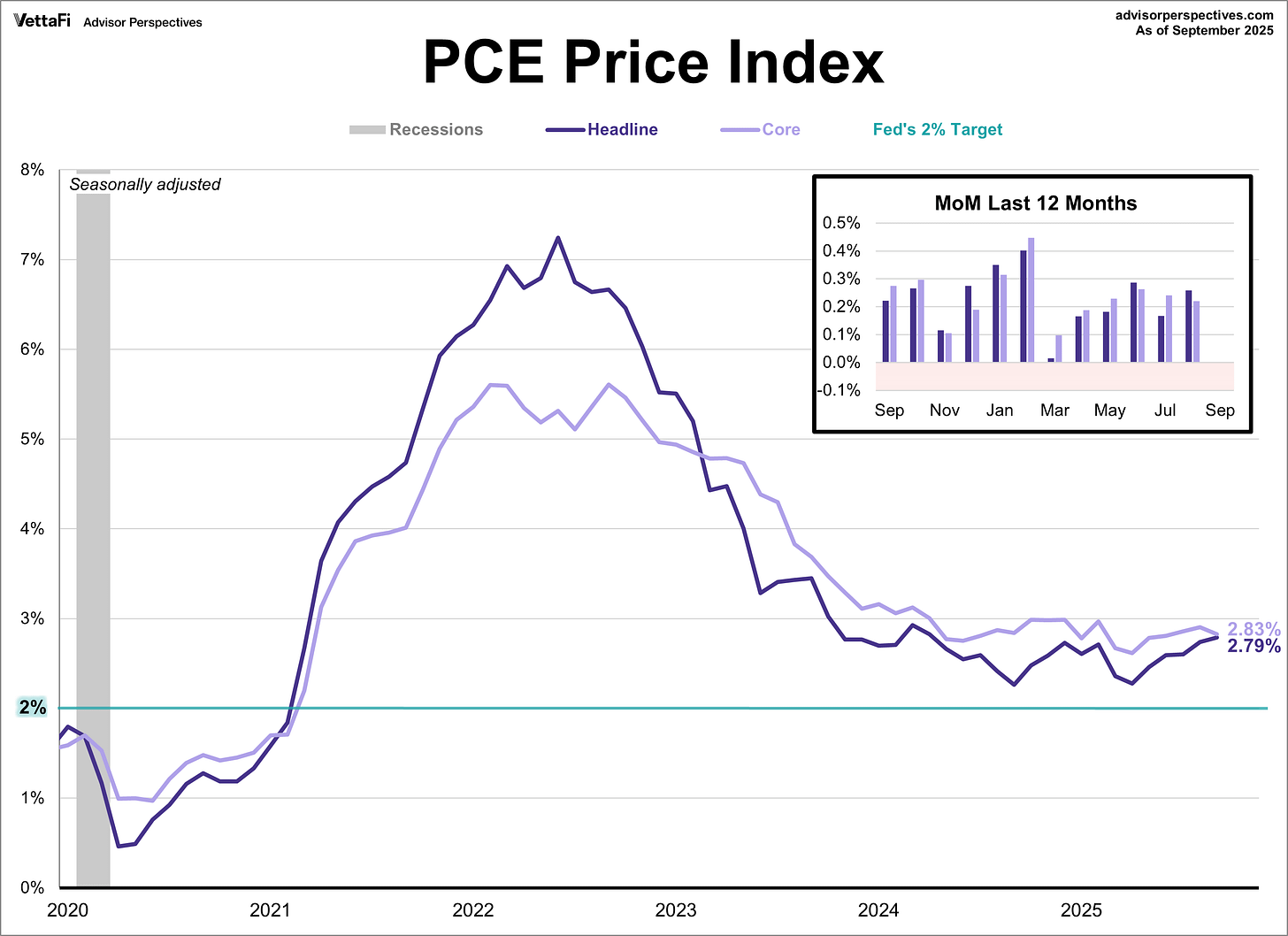

Inflation? Still sticky, still inching along. September’s PCE report (finally released after delays) showed little change, keeping both headline and core inflation at 2.8% year over year. Consumer sentiment, though, ticked up slightly as people felt a bit more optimistic about their personal finances - even if high prices remain a stubborn weight.

All told, it was a week full of subtle shifts, mixed signals, and cautious optimism - the kind of backdrop that sets the stage for a pivotal Fed meeting just around the corner.

Last Weeks Winners & Losers

Top performers:

Microchip Tech (+23%)

Dollar General (+21%)

Salesforce (+13%)

Estee Lauder (+12%)

Adobe (8%)

Biggest drops:

Netflix (-7%)

Kroger (-7%)

Eli Lily (-6%)

Kimberley Clark (-6%)

Philip Morris (-6%)

Notable News

Fed Meeting This Week

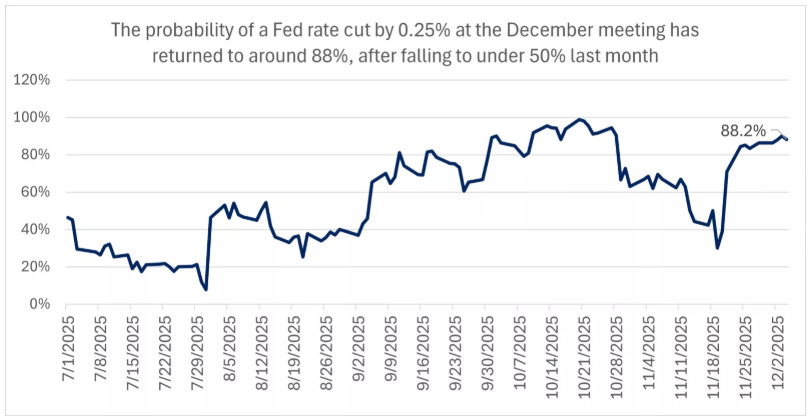

The biggest catalyst between now and year-end is the Fed’s December 9–10 meeting. Investors won’t just get a rate decision - they’ll also see new economic projections and the updated “dot plot,” the Fed’s roadmap for where rates may head over the next few years.

It is expected that the Fed will cut rates next week, not because the economy is faltering, but because it wants to bring policy back toward a neutral 3.0%–3.5% range. Historically, markets tend to respond well when rate cuts happen in a still-stable economy.

Near-term growth may look softer - partly due to the October government shutdown and mixed labor-market signals - but it is expected that the broader economy will grow at trend next year. The Fed likely won’t want to risk a shaky labor patch turning into something more serious.

Inflation is another reason the Fed has room to move. It has stayed in the 2.5%–3.0% range, and consumer inflation expectations recently eased from 4.5% to 4.1%. Altogether, these factors point to a Fed that’s ready to continue cutting rates at its December meeting.

U.S. Nonfarm Jobs Report

The next major data moment in December will be the November nonfarm jobs report - our first full look at the labor market since the October government shutdown disrupted the numbers. When the data drops on December 16, it should finally give investors a clearer read on where hiring and wages really stand.

Expectations are muted: economists are looking for just 38,000 new jobs, a step down from September’s 119,000. Unemployment is expected to edge up slightly, and wage growth to cool - but still remain above inflation, meaning workers should continue earning positive real wages.

Overall, the labor market has been giving mixed signals. Hiring demand has softened, job openings have slipped, and ADP payrolls even turned negative last month. But weekly jobless claims remain steady - and recently fell - suggesting the market isn’t on the brink of a sharp downturn.

On the supply side, longer-term pressures like an aging workforce, flat participation, and immigration constraints continue to limit available labor. Taken together, this likely means investors should get used to a new normal: slower job gains, but a labor market that’s easing - not collapsing.

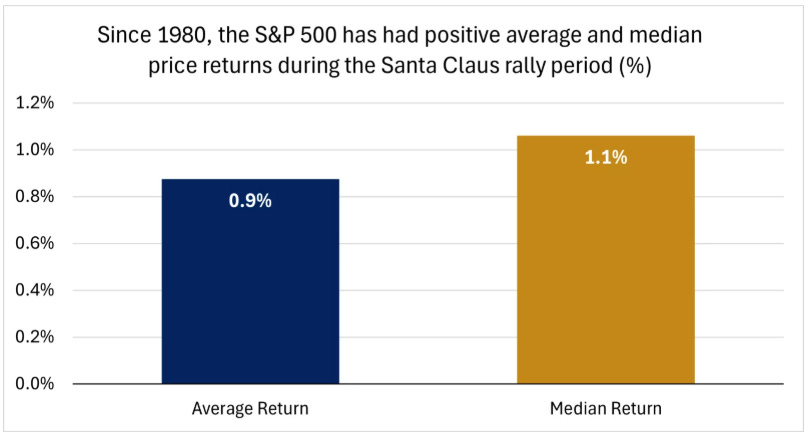

Santa Claus Rally

The final December catalyst is the one investors love to talk about: the Santa Claus rally. Historically, the last five trading days of the year plus the first two of January have been a sweet spot for markets. Since 1980, this period has delivered gains 73% of the time, with the S&P 500 averaging a 1.1% bump.

This comes on the heels of a strong run since the April lows, with the S&P 500 up roughly 38% and only one modest pullback along the way. As we head into year-end, it’s a natural moment for investors to check their positioning.

Earnings Season

Join 118,000+ investors on YouTube! 🎥

We break down earnings, market moves, and exclusive insights you won’t find anywhere else.

Don’t miss out — hit the button below to watch and subscribe now! 👇

YouTube Channel 🔔

Subscribe today and stay ahead of the market!

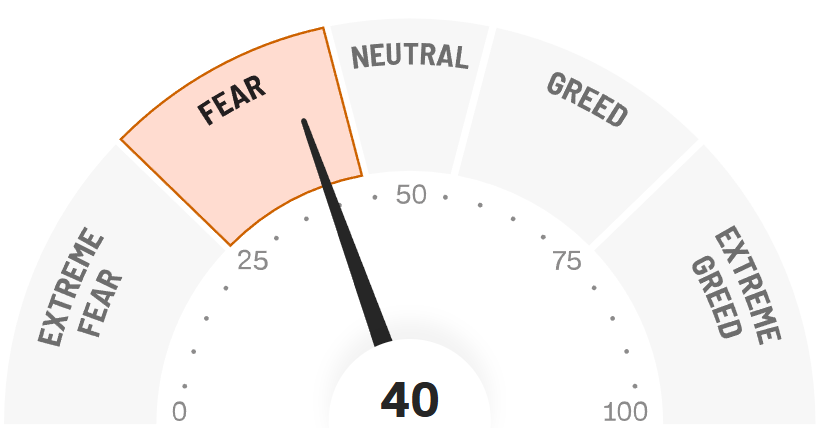

Fear & Greed Index

3 Dividend Stocks at 52 Week Lows

After a year defined by rate-hike whiplash, mixed labor signals, and a market rally that left plenty of names behind, a surprising number of high-quality companies are still trading near their 52-week lows.

These aren’t speculative flyers or story stocks - they’re solid businesses that fell out of favor while the market chased momentum elsewhere. Now, with rate cuts on the horizon and sentiment beginning to turn, some of these beaten-down names are setting up for quietly compelling long-term entries.

As we head into the end of 2025 and look toward 2026, the opportunity isn’t just about buying what’s cheap - it’s about buying what’s unjustly cheap.

The three stocks below check that box. Each one offers durable fundamentals, attractive valuations, and the kind of catalysts that can turn a forgotten laggard into a future outperformer. If you’ve been waiting for long-term bargains with real upside as the cycle shifts, these belong on your radar.

1. VICI Properties (VICI)

What VICI Properties Actually Does

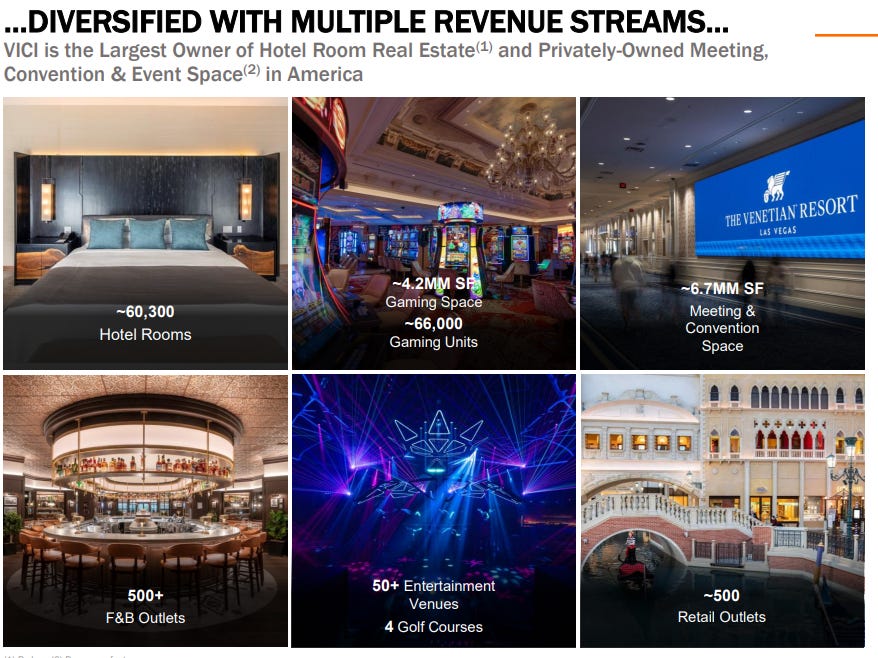

VICI Properties is one of the largest and most specialized experiential real estate owners in the United States.

Instead of focusing on traditional commercial properties like offices or apartments, VICI owns iconic entertainment and hospitality assets - primarily full-scale casino resorts on the Las Vegas Strip and across the country. These are high-traffic, high-cash-flow properties that are extremely difficult to replicate, giving VICI a durable competitive moat.

The company operates as a net-lease REIT, which means tenants are responsible for property-level expenses such as taxes, insurance, and maintenance. This structure gives VICI predictable, long-term revenue streams with built-in rent escalators. Its portfolio includes marquee names like Caesars Palace, MGM Grand, Venetian Resort, and dozens of regional gaming properties. Beyond gaming, VICI has been expanding into golf courses, entertainment districts, dining, and other experiential venues to diversify its income sources.

In short, VICI is a “pick-and-shovel” play on leisure, travel, and entertainment. It doesn’t run the casinos -it owns the real estate and collects steady, inflation-linked rent backed by long-term leases.

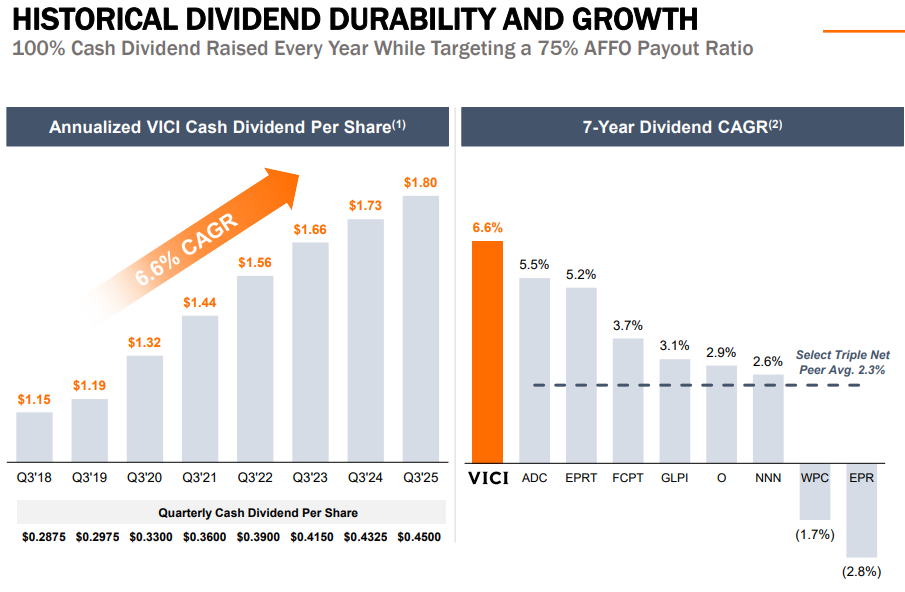

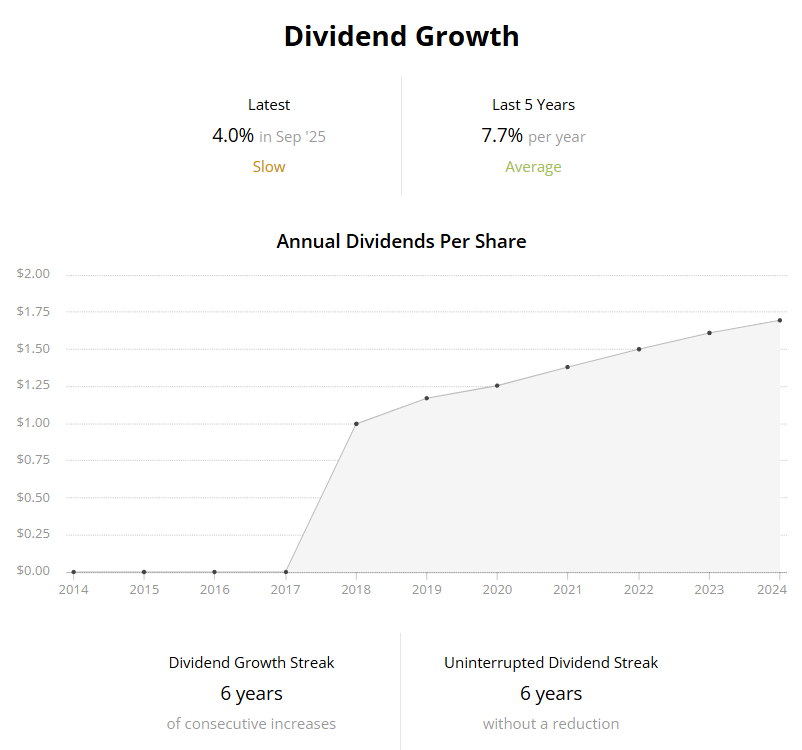

For investors, that means stable cash flows, defensive characteristics, and consistent dividend growth anchored by some of the most valuable entertainment properties in the world.

Why VICI Has Struggled in 2025 and Is Sitting at a 52-Week Low

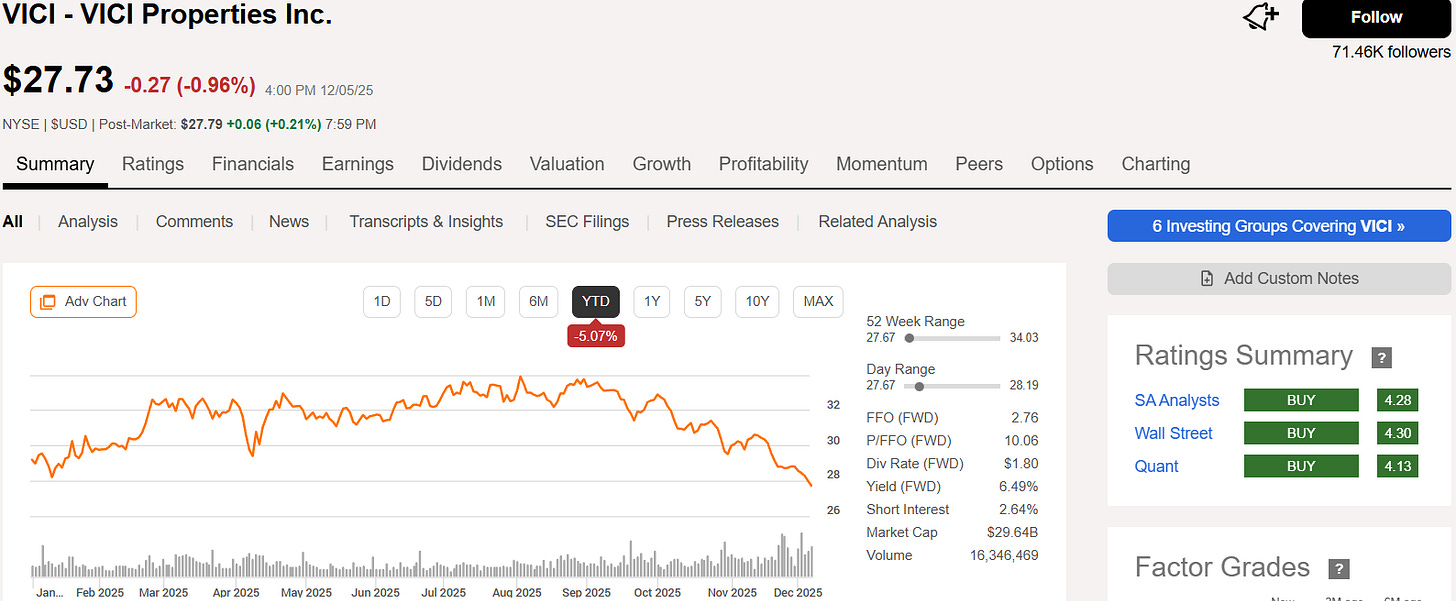

Despite its high-quality assets and dependable rent income, VICI has had a rough stretch in 2025.

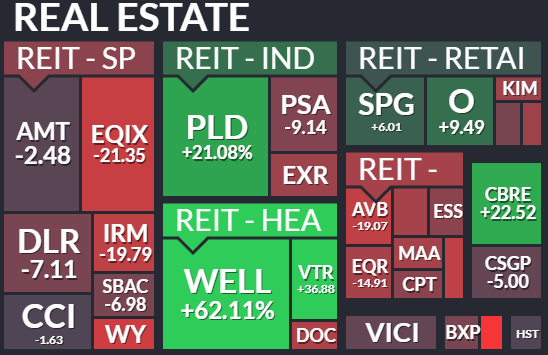

The biggest drag hasn’t been the business - it’s been the macro environment. As interest rates remained elevated longer than expected earlier this year, REITs across the board saw pressure.

REITs YTD:

Higher rates make income-producing real estate less attractive compared to safer yields in Treasuries, leading many investors to rotate out of REITs altogether.

Another headwind was sentiment-driven. With limited new acquisitions and a quieter deal pipeline, some investors worried VICI’s growth might be slowing. At the same time, concerns around Las Vegas consumer spending - despite being largely exaggerated - added more pressure to the stock.

But importantly, none of these issues reflect cracks in VICI’s fundamentals. Rent coverage remains strong, occupancy is effectively 100%, and lease escalators continue to push cash flows higher.

What we’re seeing is a valuation reset driven by macro forces, not operational weakness. And historically, these are exactly the moments that create attractive entry points for long-term investors.

Why Now May Be a Great Time to Buy VICI Properties

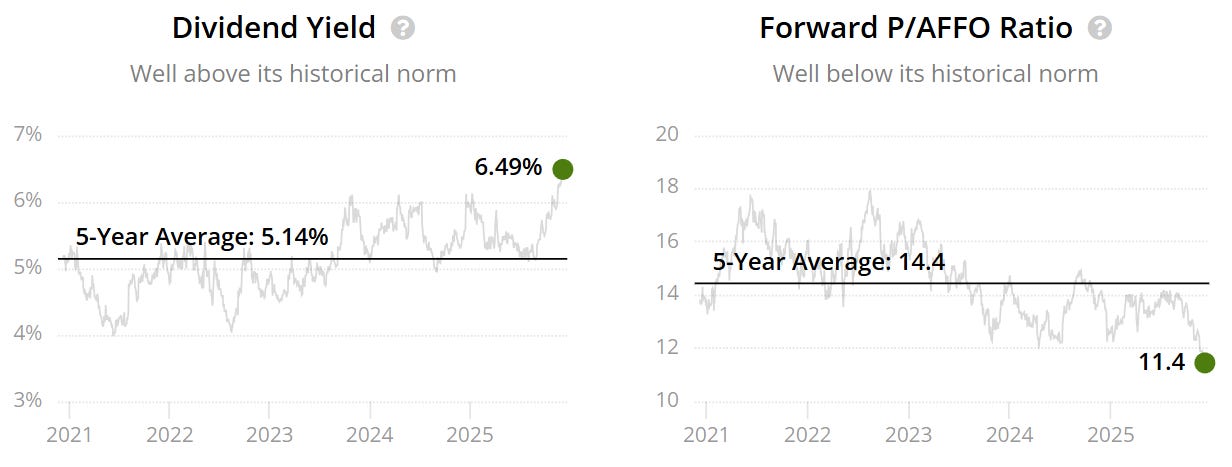

Here’s the setup: VICI’s stock is sitting at its lowest level in a year precisely as the environment is turning in its favor.

With rate cuts expected from the Fed and Treasury yields already slipping, income-focused assets are regaining attention.

This is where VICI shines.

The company offers long-term contractual rent growth, inflation-linked escalators, and one of the safest dividends in the REIT universe - yet it’s trading at a discount not seen since the pandemic recovery years.

Meanwhile, VICI’s balance sheet is healthy, its tenants remain strong, and its pipeline for future experiential acquisitions is reopening as financing conditions improve. Lower interest rates reduce its cost of capital, making new deals more attractive and boosting long-term growth potential.

The market punished VICI for macro reasons - not company-specific ones. Now, those macro pressures are easing just as the stock sits at a rare bargain zone. For investors looking for dependable income, defensive cash flows, and upside as REIT sentiment rebounds, VICI offers one of the cleanest risk-reward opportunities in the sector going into 2026.

Check out my deeper dive on YouTube last week running through VICI in more detail:

Valuation

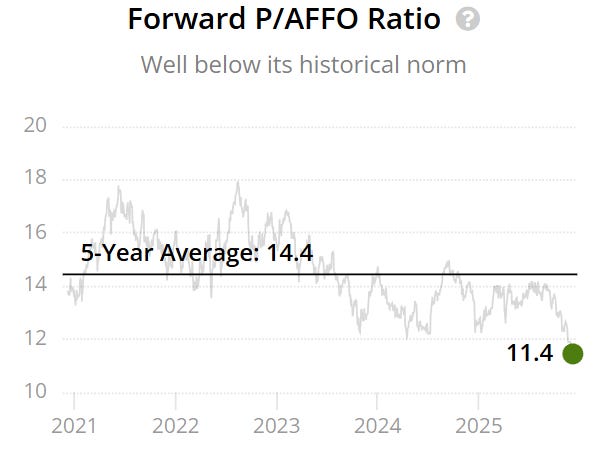

The forward P/AFFO sits below the historical - 11.4x v 14.4x.

This could indicate the company is potentially severely undervalued. It is also the lowest valuation in at least the last 5 years.

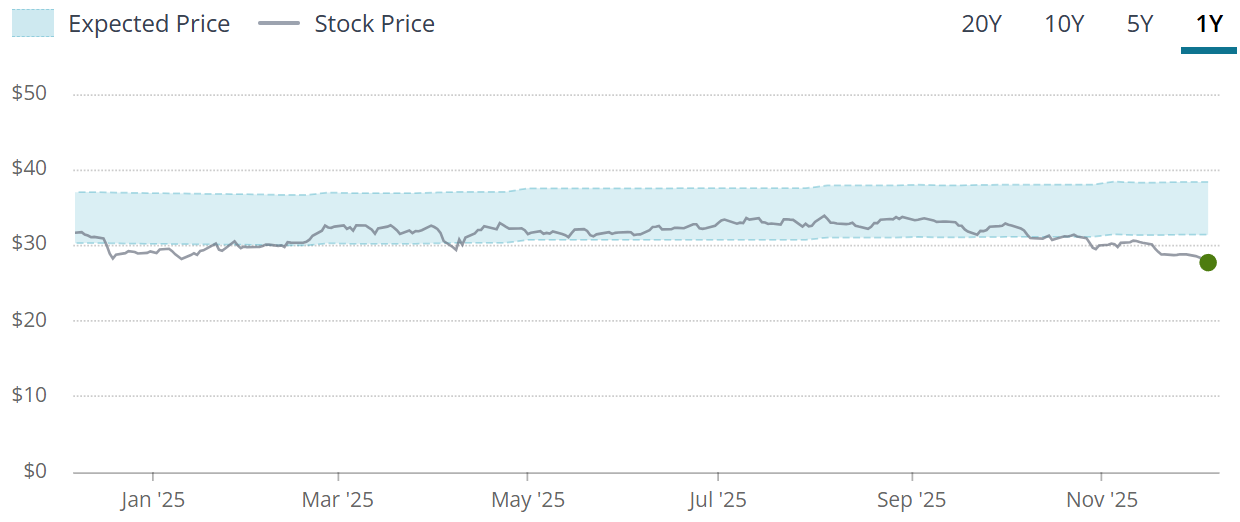

The blue tunnel methodology highlights that the company is below the bottom end of the intrinsic/fair value boundaries indicating a potential undervaluation.

When we zoom out to the last 10Y we can see that the Company has offered investors very few times to buy this at a discount, notably the previous time was the COVID crash.

Intrinsic Price

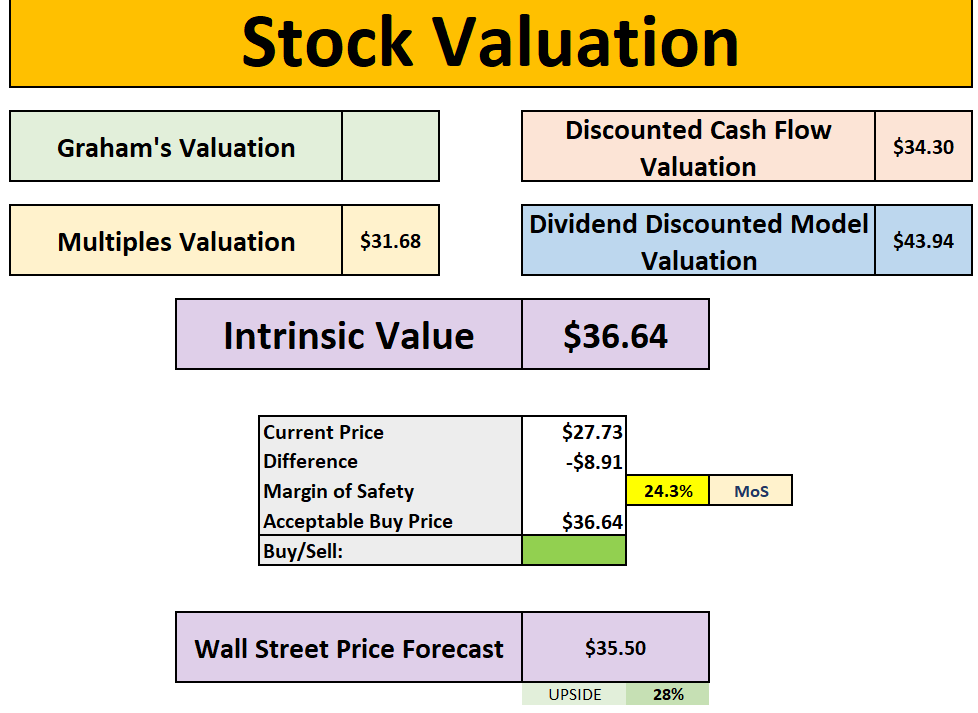

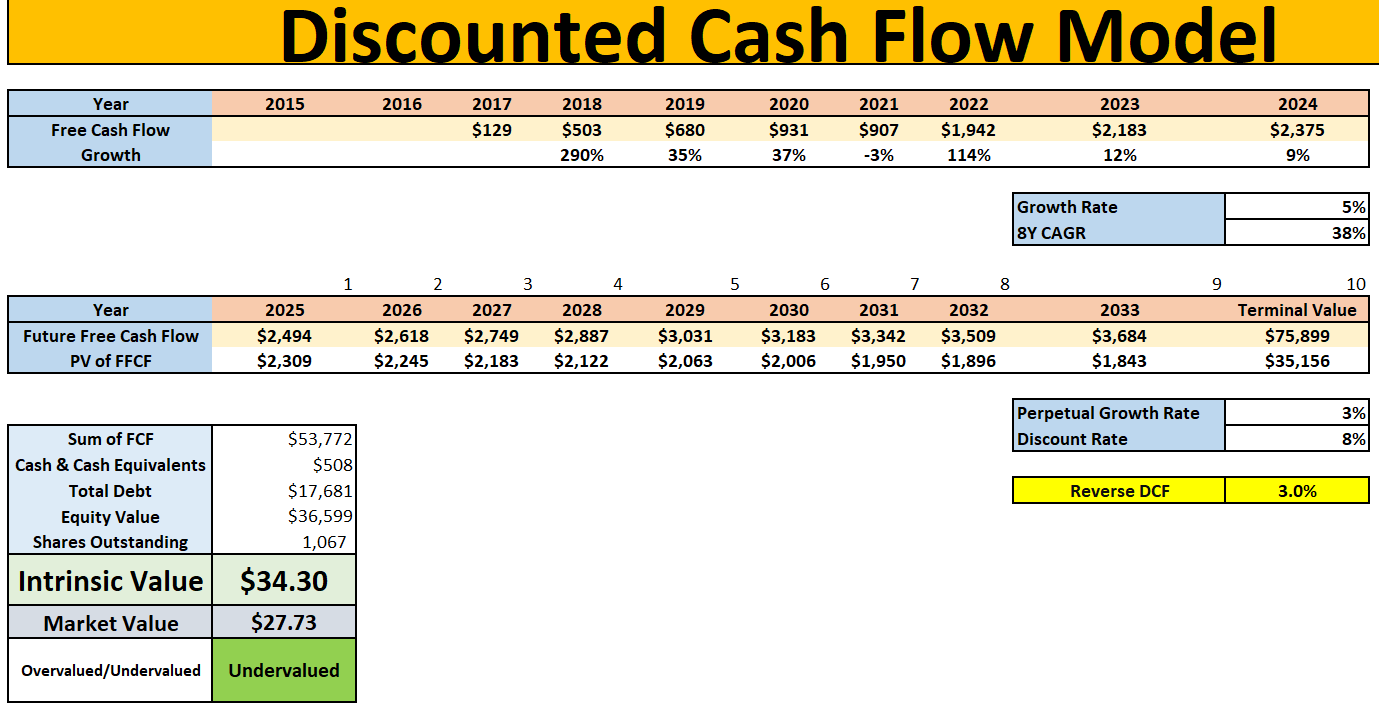

Using the 3 models, we get the average price arriving at $36.64 meaning investors are getting a 24% margin of safety, with Wall Street seeing this at $35.50 into 2026, highlighting 28% upside.

Solely looking at the DCF model we can see on a reverse basis, 3% is currently baked in.

Keep reading with a 7-day free trial

Subscribe to Dividend Talks to keep reading this post and get 7 days of free access to the full post archives.