3 Cheap Dividend Stocks!

+ Market Update

Market Latest

The S&P 500 started Q4 in a very volatile state. This was a direct effect of the below:

Tensions in the Middle East

Upcoming US Presidential Election

Port strikes on the East Coast

US labour market

Nonetheless, the US economy looks very strong due to:

US nonfarm-jobs report massively exceeding expectations (discussed further below).

Port strike reaching a resolution

Interest rates expected to lower into 2025

On a more granular level below we can see that the week was tough for some stocks:

Biggest losers included:

Humana (HUM) down 25%

Nike (NKE) down 8%

Moderna (MRNA) down 8%

Elevance Health (ELV) down 6%

Intel (INTC) down 6%

Biggest winners included:

Palantir (PLTR) up 9%

Exxon Mobil (XOM) up 8%

Bristol-Myers Squibb (BMY) up 6%

Albemarle (ALB) up 6%

Meta Platforms (META) up 5%

Notable News

We saw an incredible 254,000 increase in nonfarm payrolls which is up from August’s revised figure of 159,000 and significantly better than the consensus forecast of 159,000.

This helps ease any concern about the overall state of the labour market as unemployment rate edges lower.

As we can see from the above, the futures market is now pricing in two additional 0.25% Fed rate cuts before year-end.

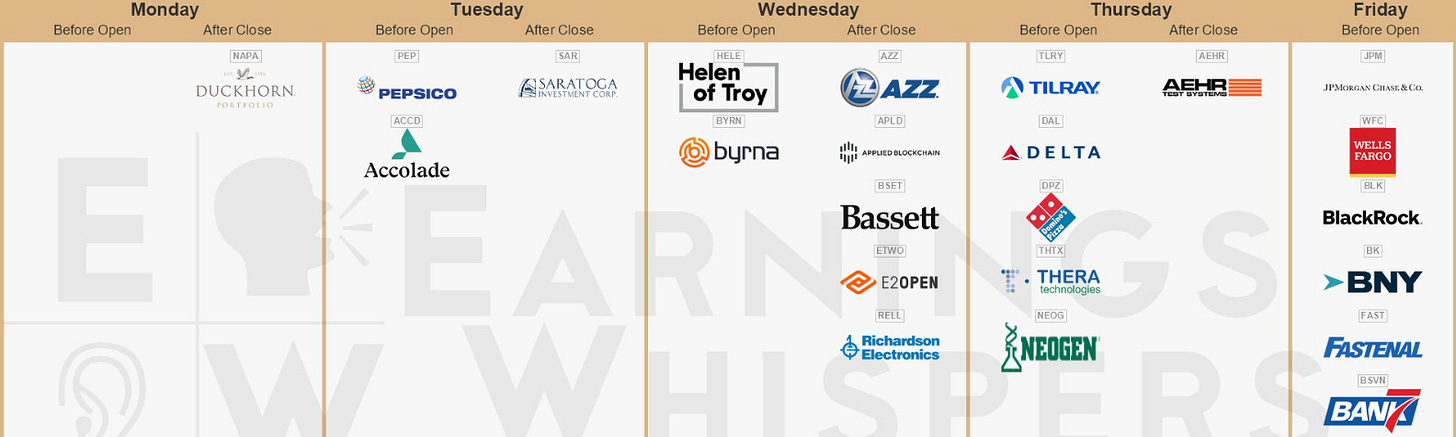

Earnings This Week

Earnings this week with some big banks reporting as well as PepsiCo (PEP) before market open on Tuesday.

As always, we will cover this on our YouTube channel, and for those that aren’t subscribed, we would love to have you in our community which is over 53,000.

Fear and Greed Index

Right now, market sentiment is on the border of Greed and Extreme Greed. Last month we were sitting in neutral and last year this time we were in Extreme Fear.

As the markets can change very quickly, don’t be surprised to see sentiment move into any other category within just a few days.

3 Cheap Dividend Stocks!

Let us dive into the 3 Cheap Dividend Stocks.

We typically use the following criteria to help identify stocks:

Dividend Safety 60+ (Safe)

ROIC > 10%

Net Debt to EBITDA below 3 (Strong Balance Sheet)

Upside > 10%

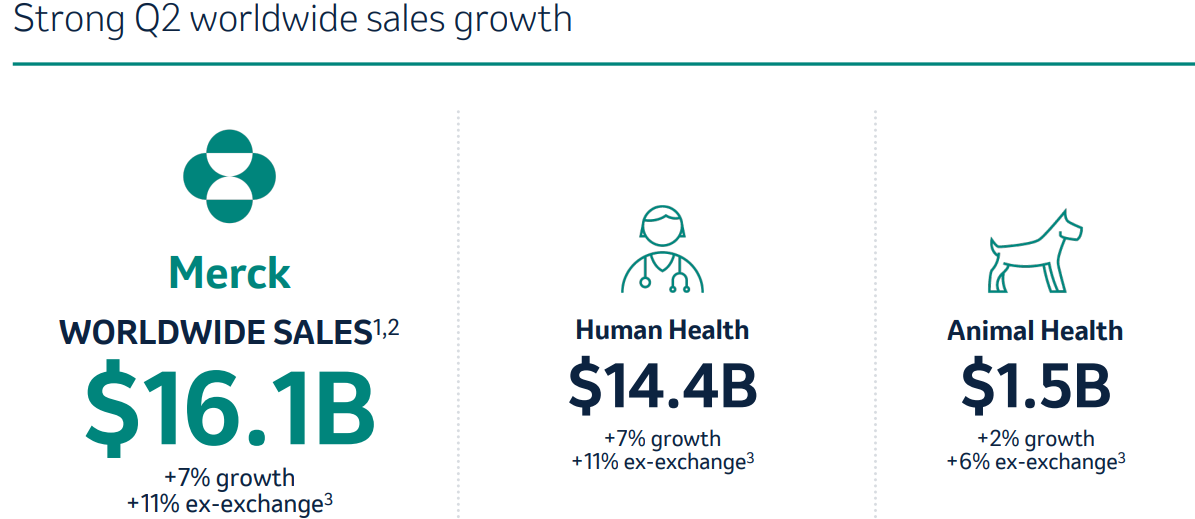

Merck & Co (MRK)

Merck & Co is a global pharmaceutical company that develops and manufactures medicines, vaccines, and therapies to address a wide range of medical conditions.

Over the last 10Y MRK is up 87%, and whilst this has underperformed the S&P 500, it has currently pulled back from its 52 week high by 20% and trades towards the lower end of the 52 week range.

As per below, we get a double reasonable valuation signal as the current yield is marginally lower than the 5Y average (2.81% v 2.95%) and the Forward P/E is also marginally lower than the 5Y (12.9x v 13.8x).

Dividend safety score of 90 indicates safety.

ROIC is above the minimum 10% we want to see, and has been increasing over the last 10Y, currently sitting at 24% on a trailing twelve-month basis.

Net Debt to EBITDA is below 3, although it has increased massively from 2022, good thing to note is that it is expected to come down to 0.87 over the next twelve months.

As per below, Wall Street see 28.12% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $146.22

So, in conclusion for MRK, we see around a 25% margin of safety around the $109 mark with Wall Street indicating 29% upside.

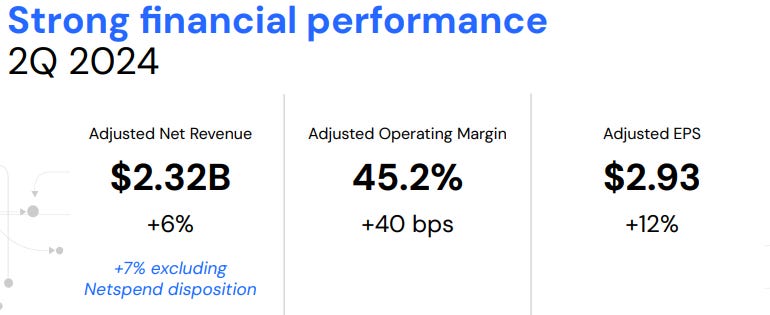

Global Payments (GPN)

GPN is a financial technology company that provides payment processing solutions and services to businesses and financial institutions worldwide.

Over the last 10Y GPN has performed in line with the S&P 500 and is up 169%.

As per below, we get a double undervaluation signal as the current yield is higher than the 5Y average (1.01% v 0.75%) and the Forward P/E is lower than the 5Y (8.1x v 13.5x).

Dividend Safety score of 70 indicates safety.

ROIC has been below the 10% we ideally want to see; however, it is positive to note it has been improving form the 2019-20 lows of 2% to 6% on a trailing-twelve month basis.

Net Debt to EBITDA has been straddling around the 3 maximum we want to see, with the expectation of it coming to 3.30 over the next 12 months.

As per below, Wall Street see 40.60% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $138.90

So, in conclusion for GPN, we see around a 30% margin of safety around the $97/98 mark with Wall Street indicating 42% upside.

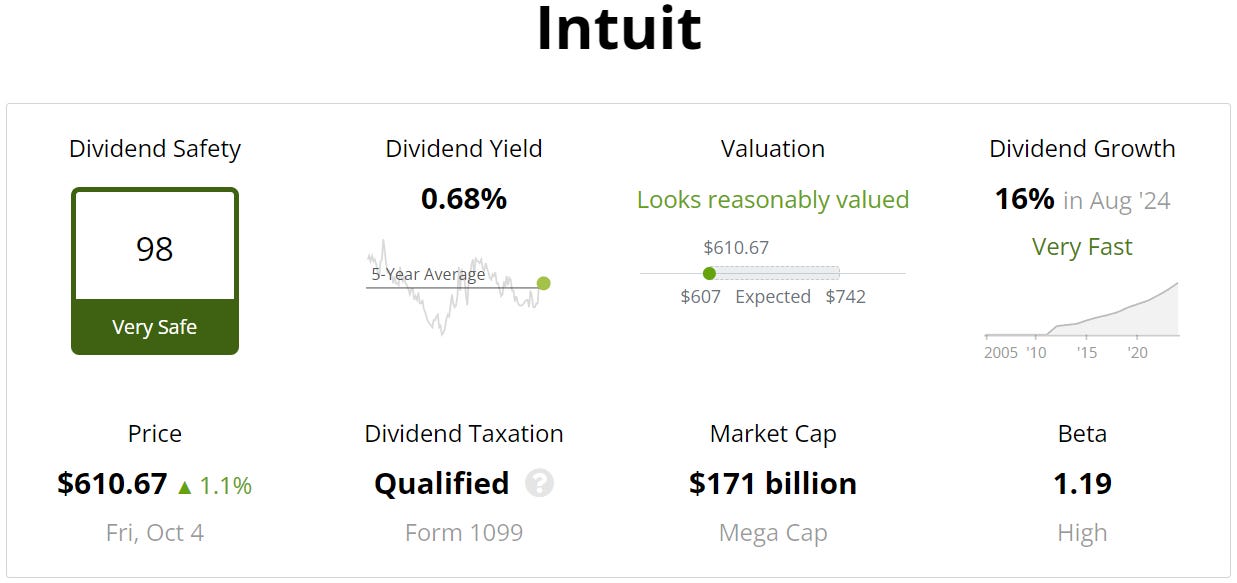

Intuit (INTU)

INTU is a financial software company that develops and sells products for accounting, tax preparation, and personal finance management, including popular tools like QuickBooks and TurboTax.

Over the last 10Y Intuit has significantly outperformed the S&P 500 up 652%.

As per below, we get a double reasonable valuation signal as the current yield is above the 5Y average (0.66% v 0.68%) and the Forward P/E is lower than the 5Y (31.7x v 35x).

Dividend Safety score of 98 indicates safety.

Consistently strong and double-digit growth year on year!

ROIC has been very strong over the last 10Y and even though it has been decreasing it is above the 10% minimum we look for.

Net Debt to EBITDA is 0.37 for 2024 and expected to decrease to 0.33 showing how strong the balance sheet is and below the 3 maximum we want to see.

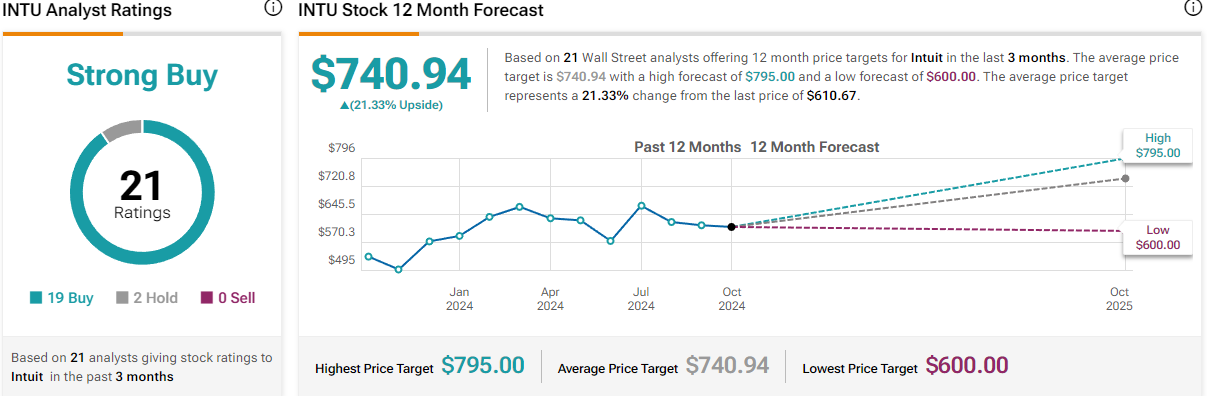

As per below, Wall Street see 21.33% upside over the next 12 months.

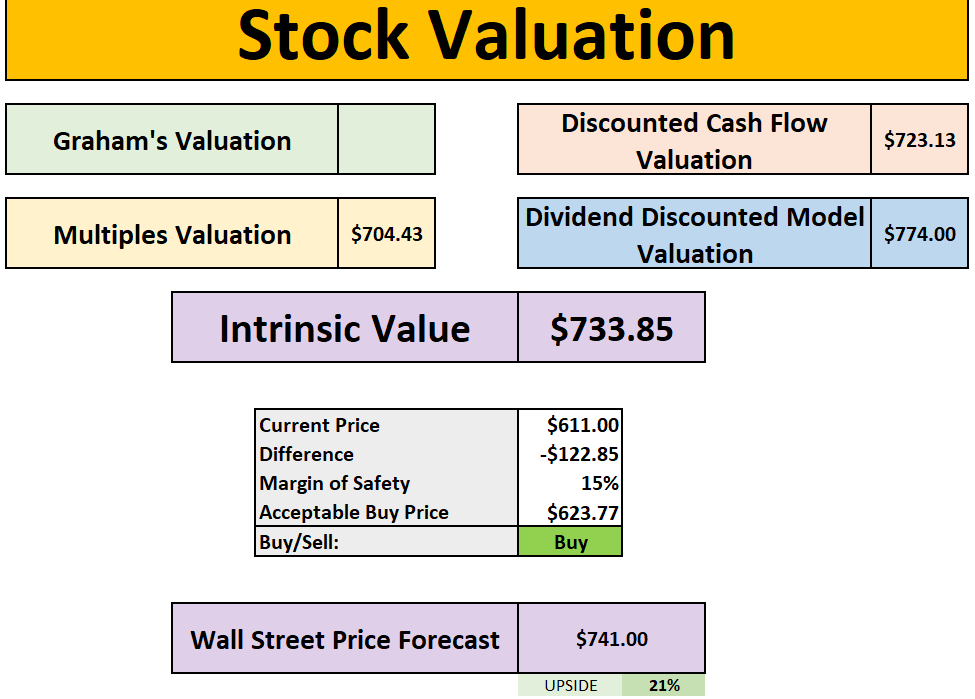

When we last ran it through our valuation model our intrinsic value came to $733.85

So, in conclusion for Intuit, we see around a 15% margin of safety around the $624 mark with Wall Street indicating 21% upside.

Stock Valuation Model

If you are interested in valuing stocks yourself, we have created a valuation model below which you can pick up, this is the same version we use in our YouTube analysis:

Seeking Alpha

Seeking Alpha, one of the websites that I use when I review stocks on YouTube has a $25 off discount for your first year. This also includes a 7-day free trial for new users too!

Patreon

Join our community in the Patreon where we discuss weekly buy and sells.

Conclusion

We have just gone through 3 Cheap Dividend Stocks.

However as always do your own due diligence and let us know your thoughts about today’s newsletter in the comments.

I hope you all have a great week ahead!

Thanks For Reading!

If you’d like to support this work feel free to buy me a coffee. The proceeds will contribute to the running costs of the newsletter.

Join the community of investors - subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today’s newsletter helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Note

I am not a financial advisor or licensed professional. Nothing I say or produce anywhere, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk.