🔥 3 Growth Stocks I'm Still Loading Up On (While the Rest of the Market Looks Overvalued)

S&P 500 valuations are flashing red. But these 3 growth stocks are still flying under the radar—and I'm buying big..

Market Update

Markets have bounced back sharply, with global equities up 20% since the April lows, driven by strong earnings, improving trade sentiment, and solid fundamentals.

The S&P 500 is back over 6,000 and gained 2.1% last week.

Valuations are elevated and may reflect some investor complacency, but earnings—especially from mega-cap tech—have been a key driver of the rally.

Risks still linger, from Fed decisions to tariff deadlines and the debt ceiling. Volatility could rise, but strong fundamentals continue to provide a solid base.

On a granular level, we had some very strong performers just last week.

Biggest winners included:

Micron (MU) up 15%

Airbnb (ABNB) up 9%

Meta (META) up 8%

Lam Research (LRCX) up 7%

Starbucks (SBUX) up 7%

Notable News

The Labour Market Is Cooling, But Still Strong

Last week’s jobs report was closely watched, and it delivered a bit of reassurance: while the labour market is clearly cooling, it’s doing so gradually—not collapsing.

The U.S. added 139,000 jobs in May, slightly above expectations.

Unemployment held steady at 4.2%, still among the lowest levels on record.

Health care led the way with 62,000 new jobs, followed by leisure and hospitality with 48,000.

On the flip side, manufacturing lost 8,000 jobs—likely feeling the pressure from tariffs—and federal employment dropped by 22,000, the biggest monthly decline since 2020.

Despite the softer pace, job growth is still strong enough to keep unemployment from rising. The broader trend of low hiring and low firing continues, and wage growth remains ahead of inflation.

Market Analysis: Two Months Off the Lows and Still Climbing

Just two months after the April 8 low, global markets have bounced back hard. The MSCI All Country World Index hit a new all-time high last week, and the S&P 500 is up nearly 20% since the bottom—though still about 3% below its own record.

This rally isn’t just hype. It’s been driven by solid fundamentals: trade tensions have eased, tax policy has taken center stage, and the economic data remains surprisingly strong. Corporate earnings are holding up well too.

Still, valuations have round-tripped back to pre-correction levels. That doesn’t mean a crash is coming, but it does suggest investors may be getting a bit too comfortable—especially as growth starts to slow.

Earnings Season Wraps Up: Solid Results Despite the Noise

Q1 earnings season is in the books, and despite all the macro noise, S&P 500 companies delivered. Profits grew 12.5% year-over-year—marking the third quarter out of the last four with double-digit growth.

Yes, 2025 earnings forecasts have been revised down from 14% to 8.5%, but 2026 estimates remain steady, hinting at a potential reacceleration ahead. Plus, the forward 12-month earnings estimate just hit a new high, giving markets some solid footing beneath the rally.

Some of the Q1 strength may have been pulled forward by companies racing to beat upcoming tariffs. But the biggest gains came from growth sectors: tech, communication services, and consumer discretionary—now over half of the S&P 500. Tech earnings jumped 20%, comms surged 33%, and discretionary rose 8%, helping restore confidence in a part of the market that had been under pressure earlier this year.

AI spending remains a major theme too—enough to push NVIDIA back to the top as the world’s most valuable company.

Earnings This week

Join 96,000+ investors on YouTube! 🎥

We dive deeper into earnings (and more) on our channel. Don't miss out - click below to watch now!👇

YouTube Channel 🔔

Click here to subscribe and stay updated!

Fear & Greed Index

3 Growth Stocks

Google (GOOGL)

Google is a global technology company specializing in internet services and products.

It dominates online search with its Google Search engine and generates most of its revenue through digital advertising via Google Ads.

The company also offers a wide range of products, including YouTube, Android, Google Cloud, and hardware like Pixel devices.

Additionally, Google invests in AI, self-driving technology (Waymo), and other innovative projects.

Google's income streams include:

Advertising Revenue: The largest source, generated from Google Ads on Search, YouTube, and partner websites.

Cloud Computing: Revenue from Google Cloud services, including storage, AI, and enterprise solutions.

Hardware Sales: Income from Pixel phones, Nest smart devices, and other hardware.

Google Play Store: Revenue from app sales, in-app purchases, and subscriptions.

YouTube Subscriptions & Services: Income from YouTube Premium, YouTube Music, and YouTube TV.

Other Bets: Revenue from experimental projects like Waymo (self-driving cars) and Verily (health tech).

They recently announced their largest acquisition ever of Wiz Security for $32bn.

Their fastest revenue stream has been growing strongly over the last few years, with growth in the latest quarter sitting at 28%.

They hope that this acquisition can help propel them even further as they are not the current market leader.

They also continue to spend significantly and for FY25 their CAPEX estimate is $75bn.

They have outperformed in all of their last 4 quarters (vs analyst expectations), and expect EPS growth in 3 of the next 4.

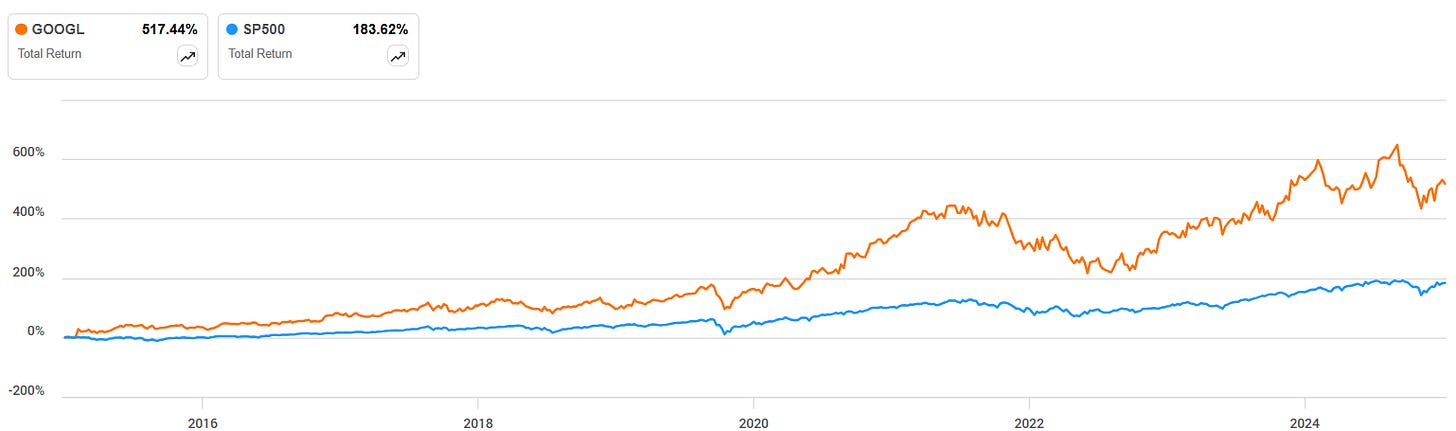

They have also massively outperformed against the S&P 500 over the last 10Y.

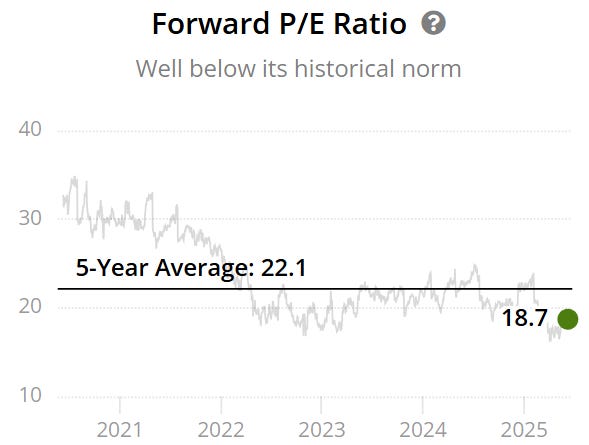

We get an undervaluation signal as the current Forward P/E of 18.7x sits below the 5Y average of 22.1x.

Another undervaluation signal noted below as the trading price is below the blue tunnel which signals the intrinsic value.

ROIC is consistently very high and increasing.

Margins look very strong, with operating showing signs of efficiencies, going from 26% 10Y ago to 33% now.

They also have a very strong balance sheet as Net Debt to EBITDA sits at 0 consistently for the last 10Y.

As per below, Wall Street see 16% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $200 using the DCF model:

We have used a growth rate of 10%, but if you believe 8% or 12% is more appropriate you can see the value below:

So, in conclusion for Google, we see around a 15% margin of safety around the $170 mark with Wall Street indicating 16% upside.

Uber (UBER)

Uber is a technology platform that connects riders with drivers through its mobile app, allowing users to book on-demand transportation.

It also offers food delivery through Uber Eats and freight services via Uber Freight.

The company operates in hundreds of cities worldwide, using dynamic pricing based on demand.

Uber earns revenue by taking a commission from each transaction made on its platform.

Uber generates revenue through multiple streams:

Mobility (Ride-Hailing): Uber earns a commission of 15–30% on each ride, including additional fees like booking and cancellation charges.

Delivery (Uber Eats): Revenue comes from commissions (15–30%) charged to restaurants, delivery and service fees paid by customers, and advertising fees from restaurants promoting their listings.

Freight: Uber Freight connects shippers with carriers, generating revenue through service fees.

Advertising: Uber offers advertising opportunities within its app, allowing merchants to promote their services, which has become a growing revenue stream.

Subscription Services: Uber offers subscription plans like Uber One, providing benefits such as discounted rides and free deliveries for a monthly fee.

Strategic Partnerships: Collaborations with companies like Lime integrate services such as bike and scooter rentals into the Uber app, contributing to revenue through shared services.

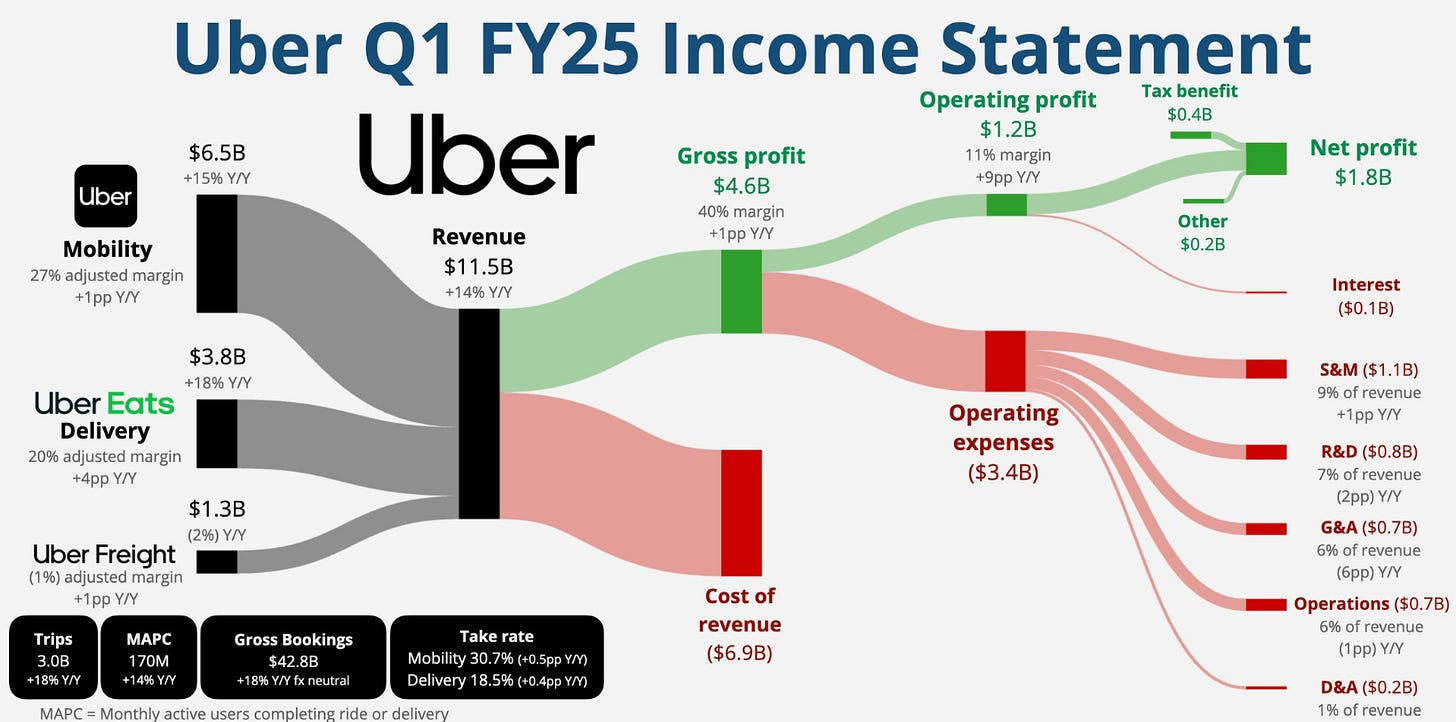

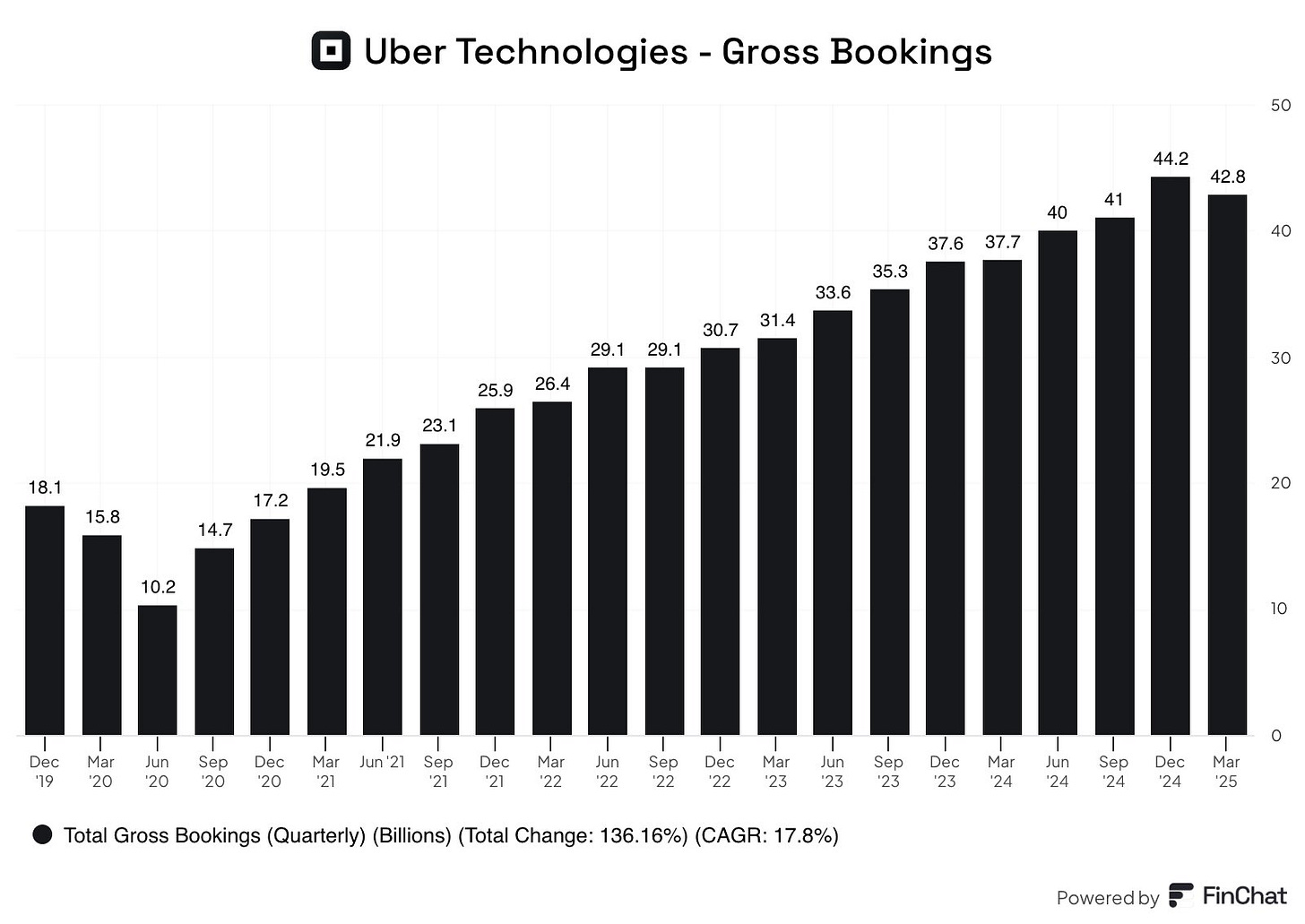

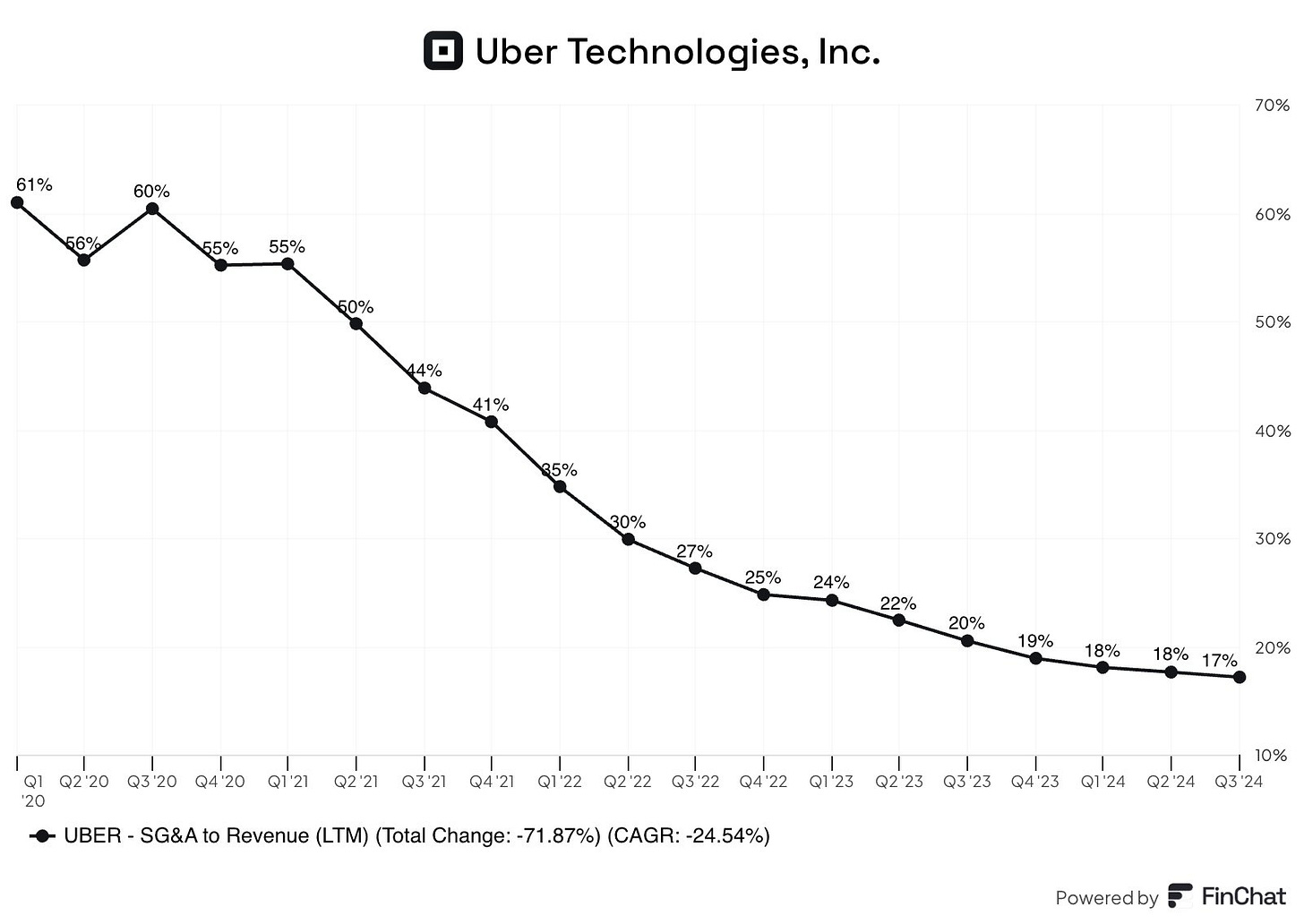

The company has seen some incredible efficiencies over time and improvements to many metrics:

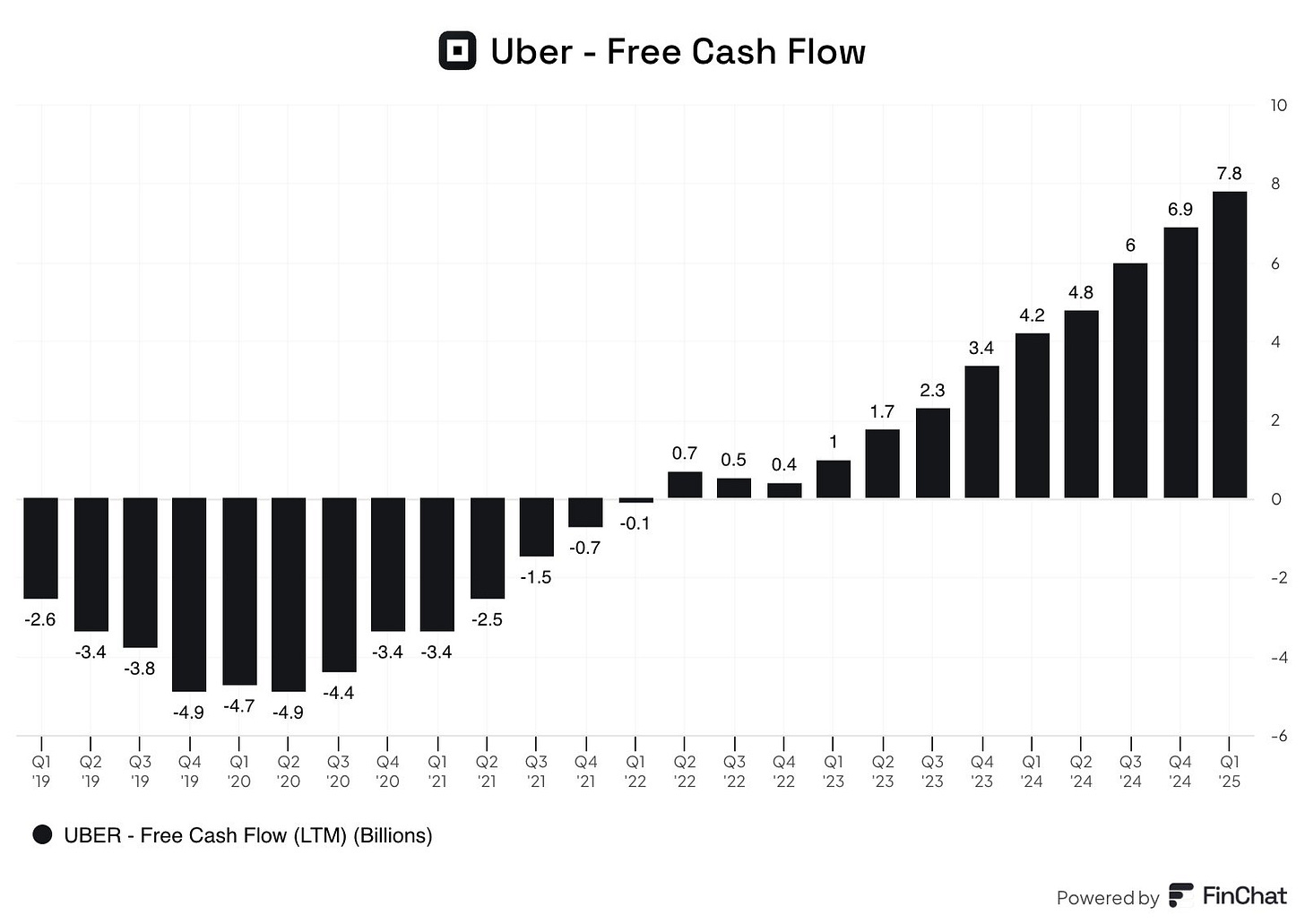

Free Cash Flow

Monthly Active Users

Trips Per Customer

Gross Bookings

Operating Leverage Improving

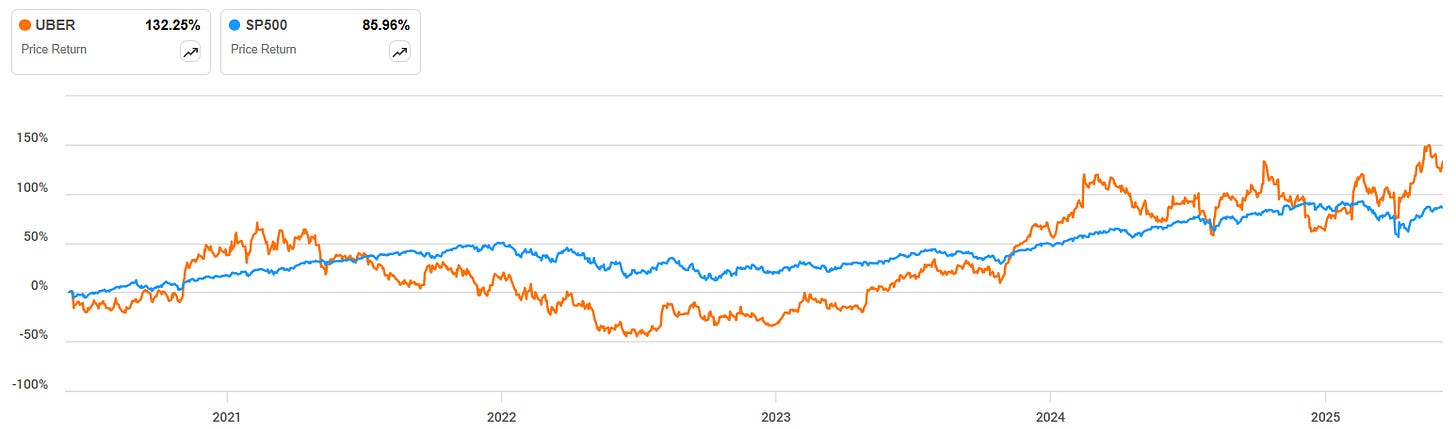

They have outperformed in all of their last 4 quarters (vs analyst expectations), and expect EPS growth in 1 of the next 4.

They have also outperformed against the S&P 500 over the last 5Y.

They are trading at the lowest valuation (EV/OCF) in the last few years.

Against the sector median they are trading at a 36% discount based on a P/E TTM basis but on a forward looking basis they are trading at a 22% premium.

ROIC has recently turned positive and is increasing.

The same can be seen on the margins below too.

Net Debt to EBITDA is very good too at 0.69 TTM.

As per below, Wall Street see 15% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $104 using the DCF model:

We have used a growth rate of 10%, but if you believe 8% or 12% is more appropriate you can see the value below:

So, in conclusion for Uber, we see around a 20% margin of safety around the $84 mark with Wall Street indicating 15% upside.

Amazon (AMZN)

Amazon is a global e-commerce, cloud computing, and digital services company.

It operates an online marketplace selling products from various categories and provides services like Amazon Prime, AWS (cloud computing), and Kindle.

The company also develops smart devices (Alexa, Echo) and produces entertainment content through Amazon Studios.

Additionally, it has expanded into logistics, grocery stores (Whole Foods), and AI technology.

Amazon's income streams include:

E-commerce Sales – Revenue from selling products on Amazon.com, including first-party (Amazon-owned inventory) and third-party marketplace sales (where Amazon takes a commission).

Amazon Web Services (AWS) – Cloud computing services, including hosting, storage, and AI solutions, which generate high-margin revenue.

Subscription Services – Revenue from Amazon Prime memberships, Kindle Unlimited, and other recurring services.

Advertising – Ads displayed on Amazon’s platform, sponsored product listings, and video advertisements.

Physical Stores & Other Ventures – Sales from Whole Foods, Amazon Fresh, and brick-and-mortar stores, as well as emerging businesses like healthcare and AI services.

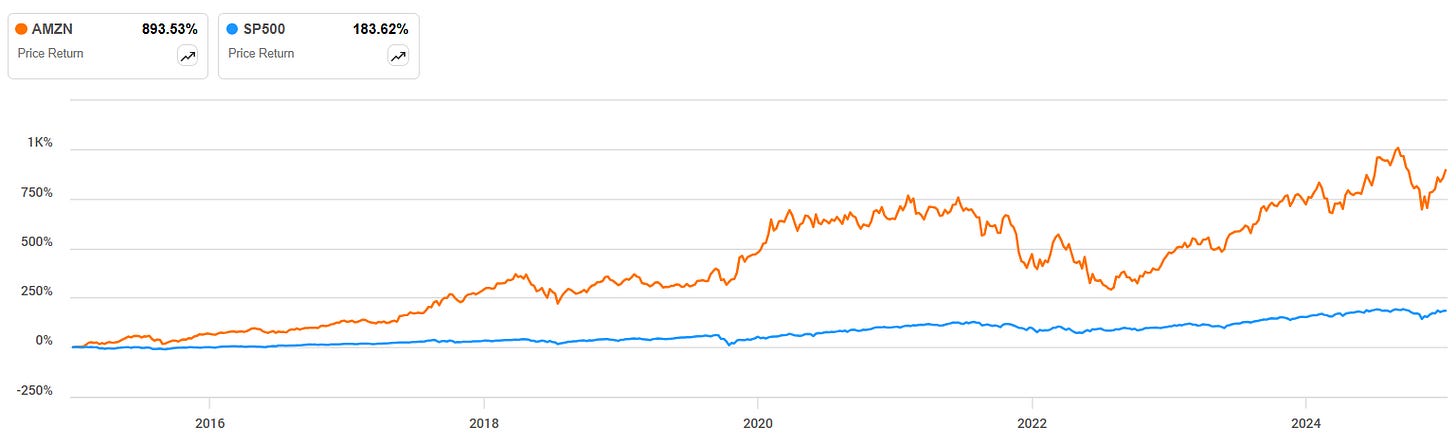

They have outperformed in all of their last 4 quarters (vs analyst expectations), and expect EPS growth in 3 of the next 4.

They have also massively outperformed against the S&P 500 over the last 10Y.

AWS, their 2nd fastest growing revenue segment grew 17% Y/Y.

They also are the market leader covering 29% market share.

Their fastest growing revenue stream was advertising up 18% Y/Y.

Amazon does trade above the sector on a Forward P/E by 103%, however they currently trade 81% lower than their historical 5Y average.

The same conclusion arrives even if you look at P/S, P/B and P/CF.

Their FCF has been increasing over time and only expects to increase further over the next 12 months.

Out of the last 10Y, 9 of them they have increased revenue by double digits, including the most recent 2024.

ROIC has also been improving significantly, from the lows of 2022 at 3%, it now sits at 12%.

This is very important as they expect to spend $100bn on CAPEX for their AI strategy this year.

Margins are also looking healthy.

They also have a strong balance sheet as Net Debt to EBITDA currently sits at 0.39.

Remember this is the number of years it would take them to pay off all of their debt, net of cash on hand.

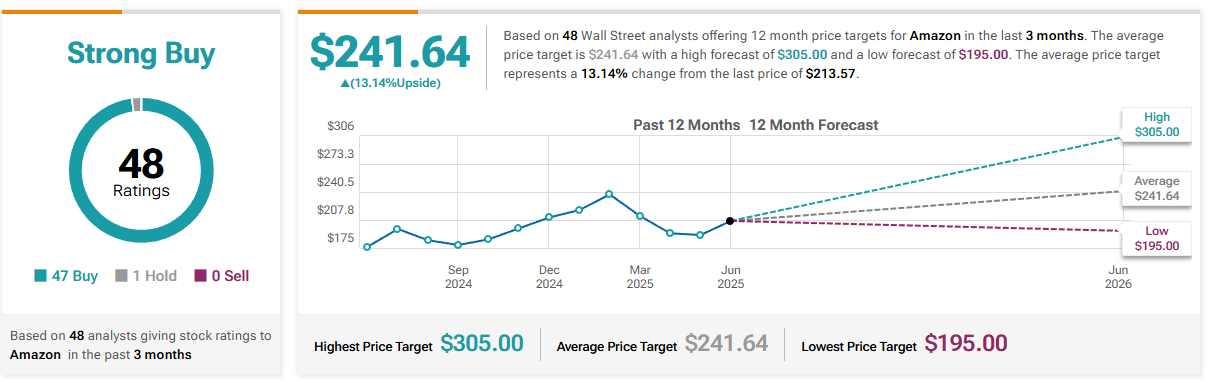

As per above, Wall Street see 13% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $230:

We have used a growth rate of 20%, but if you believe 25% or 30% is more appropriate you can see the value below:

So, in conclusion for Amazon, we see around a 10% margin of safety around the $207 mark with Wall Street indicating 13% upside.

Stock Resources

Stock Valuation Model 📊 (Unlock my stock valuation model as seen on YouTube)

Seeking Alpha 💵 ($30 off stock research tools I use daily.)

TipRanks 📈 (50% off expert stock research tools)

YouTube 🎥 (Join 96,000+ investors on YouTube!)

Patreon 👥 (Join my community for exclusive content)

Snowball Analytic (30% off portfolio tracker)

Thanks For Reading!

☕ Buy Me A Coffee – Your support helps cover the costs of running the newsletter.

📬 Join the community – Subscribe now to get weekly investment insights delivered straight to your inbox.

💬 Found this helpful? Share it with friends and colleagues! Your support keeps this newsletter FREE.

I hope you all have a great week ahead! 🌟

Dividend Talks💰

Note:

I’m not a financial advisor. All content is for educational purposes only. Invest and trade at your own risk—I'm not responsible for any financial outcomes.