3 High Quality Stocks To Consider!

+ Market Update

Market Latest

What a difference a week makes!

To start the month of September off, we saw all 3 leading US indexes (S&P 500, Dow Jones, Nasdaq) posting their worst week in over a year.

This may have been no surprise to those who love data as we have seen that September is historically the worst month in the market.

However, last week we saw a massive response with the S&P 500 posting its best weekly gain of 2024.

Therefore, we currently sit fairly flat in September, with the indexes sitting around 0.5% of where they ended in August.

Looking at the S&P 500 heat map, the majority of stocks have rebounded very well.

Surprisingly one of the worst performers last week was BRK.B (Berkshire Hathaway down 2.57%).

Some notable gainers include the semiconductor industry as a whole, for example Broadcom (+22.41%) and Nvidia (+15.82%).

Amazon (+8.81%), Tesla (9.28%) and Oracle (+14.26%) are also worth mentioning.

Notable News

We have news from the European Central Bank, who last week cut interest rates for the 2nd time this year.

And this week it is Mr. Jerome Powell’s turn where we will find out if we will see a cut of 25bps or 50bps.

Former Federal Reserve President has argued that there is a strong case we will should see a 50 basis point cut, and ultimately believes rates should come down by 150-200 bps very soon.

We also should not expect a lot to happen from this first rate cut which the markets are pricing in a 100% probability when the Fed meets on Sept 17-18.

Expectation is that we will see below 4% by the end of 2025.

Earnings This Week

As always, we will cover this on our YouTube channel, and for those that aren’t subscribed, we would love to have you in our community which is over 51,000.

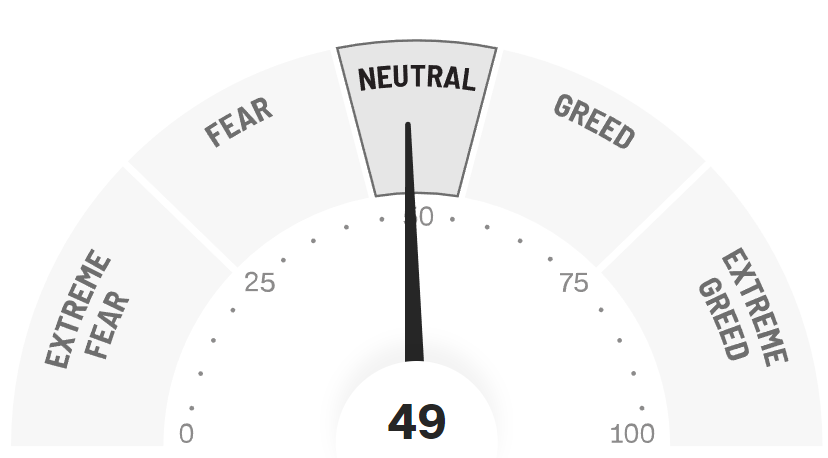

Fear and Greed Index

Market sentiment has changed very rapidly, it was only a month ago that we were sitting in Extreme Fear, one week ago in Fear and now we are in Neutral.

As always, the market can move very quickly and with the Fed speaking this week we are expecting volatility.

3 High Quality Stocks

Let us dive into the 3 High Quality Stocks we like.

To select those that we believe to be undervalued and worth a deep dive we have used the following criteria:

Dividend Safety 60+ (Safe)

ROIC > 10%

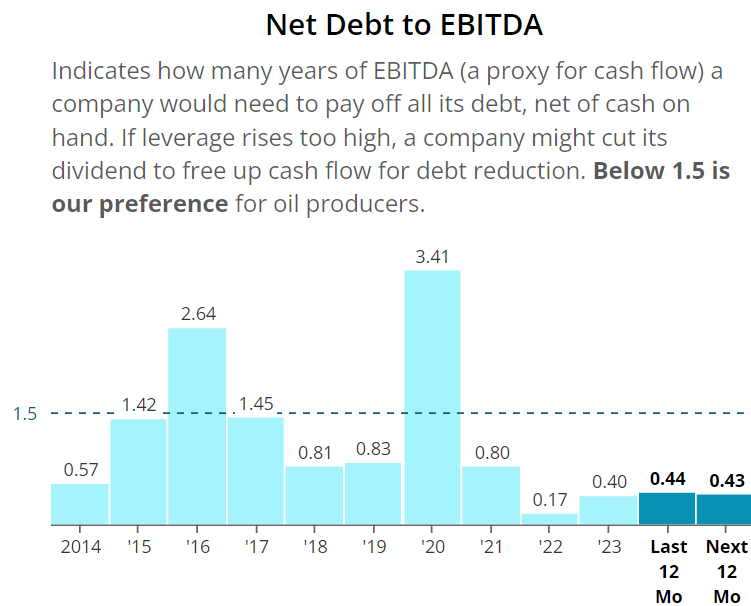

Net Debt to EBITDA below 3 (Strong Balance Sheet)

Upside > 10%

Alphabet (GOOGL)

Google provides internet-related services and products, including search engines, online advertising technologies, cloud computing, and software like Android and Chrome.

Over the last 10Y Google has significantly outperformed the S&P 500 and is up 420.19%!

As Google has just started to pay a dividend, we will ignore the dividend yield part for today, however on a Forward P/E basis we have an undervaluation signal as it is lower than the 5Y (19.6x v 23.3x).

Google is also the cheapest valued Company in the Magnificent 7.

Dividend Safety score of 80 indicates safety.

ROIC is very good and has been increasing over the longer term, above the 10% minimum we want to see in Companies we own.

28% in the more recent year is very good.

The Net Debt to EBITDA of 0 over the last 10 years and anticipated over the next 12 months, meaning it won’t even take them 1 day to pay off all of their debt net of cash on hand. Very good!

As per below, Wall Street see 29.38% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $188.11

So in conclusion for Alphabet, we see around a 15% margin of safety around the $160 mark with Wall Street indicating 30% upside.

If you want an even deeper dive, then check out this episode we recorded below on our YouTube channel:

Salesforce (CRM)

Salesforce is a cloud-based platform that provides customer relationship management (CRM) tools to help businesses manage sales, marketing, customer service, and other operations.

Over the last 10Y CRM has outperformed the S&P 500 up 337.11%!

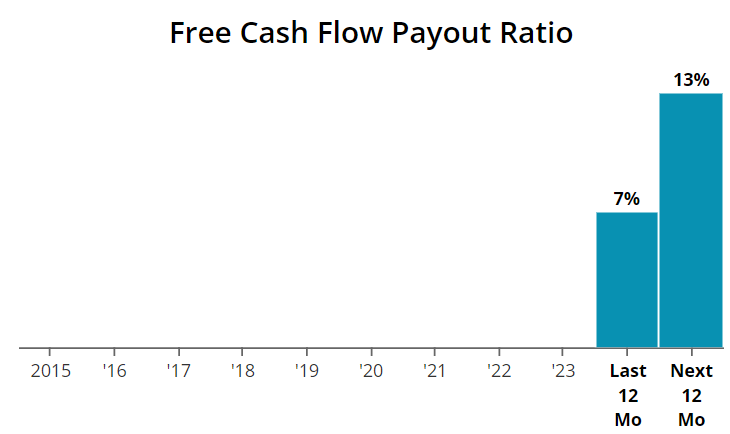

Salesforce has only recently started to pay a dividend so we have no safety score, however based on the low payout and strong balance sheet we believe it would be very high (80+).

One thing we love about this Company is the consistent increases to the free cash flow over time as depicted by the graph below.

ROIC is not what we would typically like to see, however given it has increased from the 2022 1% to 10% on a TTM (trailing twelve-month basis) we expect them to continue this upward trend moving forwards.

Net Debt to EBITDA is very good, 0 in 2024 and expected 0 over the next 12 months.

As per below, Wall Street see 20.74% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $317.57

So, in conclusion for Salesforce, we see around a 20% margin of safety around the $254 mark with Wall Street indicating 21% upside.

Chevron (CVX)

Chevron is an integrated energy company involved in the exploration, production, refining, and marketing of oil and natural gas, as well as the development of alternative energy sources.

As we can see below, over the last 10Y Chevron is up 12.67%, and whilst this has underperformed the S&P 500 (COVID took place in this period), we believe over the longer term this is a high quality stock that can outperform with a nice dividend too.

As per below, we get a double undervaluation signal as the current yield is above the 5Y average (4.64% v 4.18%) and the Forward P/E is marginally lower than the 5Y (11.7x v 12.1x).

Dividend Safety score of 90 indicates safety.

Love to see this consistency in growth year on year, with the increase to the dividends being 7% per year, on average, over the last 20 years.

They are also a Dividend Aristocrat with 25Y+ of increasing the dividend and 112Y of paying a dividend without a reduction!

ROIC is fairly inconsistent due to the fact that this industry is cyclical however we note it is strong over the last few years, with 13% in 2023.

The Net Debt to EBITDA of 0.4 for 2023 is very good to note as it indicates they have a strong balance sheet, and has been lowering from the highs of 2020.

As per below, Wall Street see 27.30% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $172.68

So in conclusion for Chevron, we see around a 20% margin of safety around the $138/9 mark with Wall Street indicating 27% upside.

Stock Valuation Model

If you are interested in valuing stocks yourself, we have created a valuation model below which you can pick up, this is the same version we use in our YouTube analysis:

Seeking Alpha

Seeking Alpha, one of the websites that I use when I review stocks on YouTube has a $25 off discount for your first year. This also includes a 7-day free trial for new users too!

Patreon

Join our community in the patreon where we discuss weekly buy and sells.

https://www.patreon.com/DividendTalks

Conclusion

We have gone through 3 High Quality Stocks to Buy.

However as always do your own due diligence and let us know your thoughts about today’s newsletter in the comments.

I hope you all have a great week ahead!

Thanks For Reading!

If you’d like to support this work feel free to buy me a coffee. The proceeds will contribute to the running costs of the newsletter.

Join the community of investors - subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today’s newsletter helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Note

I am not a financial advisor or licensed professional. Nothing I say or produce anywhere, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk.