3 Quality Stocks Crashing — Time to Buy?

A deep dive into why these stocks are sliding, whether they’re undervalued, and what this week’s market moves mean for investors.

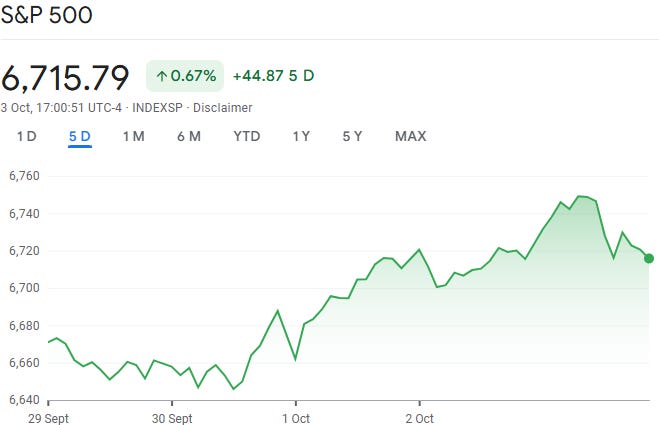

Market Update

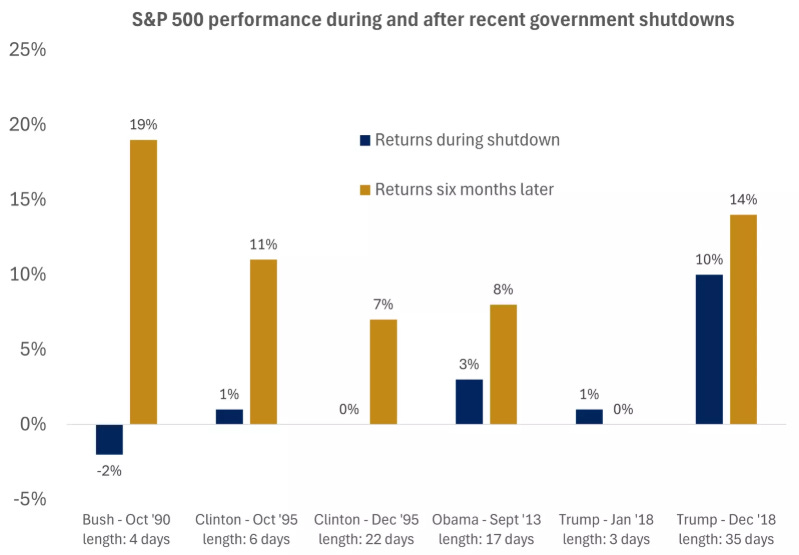

Markets brush off shutdown

Markets climbed higher despite the U.S. government shutting down on Thursday with investors seemingly more focused on weak job numbers from ADP, which boosted hopes the Fed will cut rates in October.

S&P 500 Record

We also saw the S&P 500 market cap climb over $60 Trillion for the first time ever.

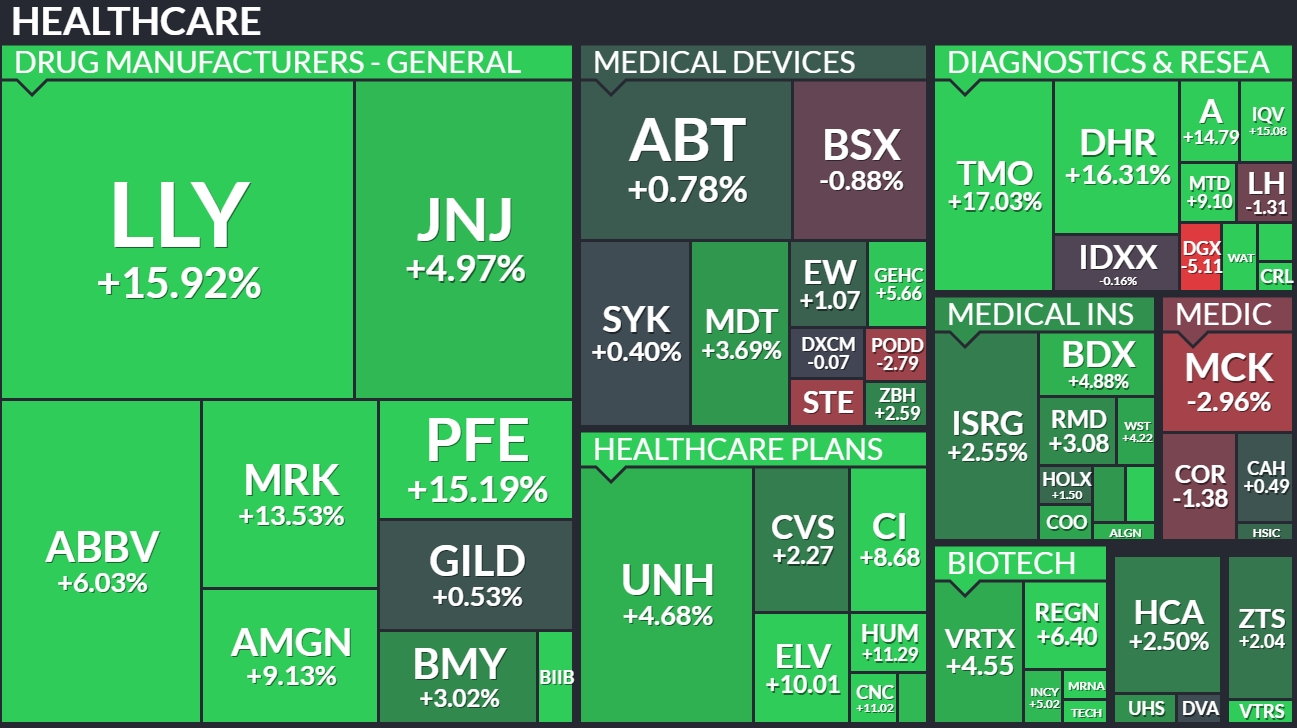

Why healthcare outperformed

Tariff relief: Trump had threatened 100% tariffs on branded drugs, but Pfizer struck a deal to cut certain drug prices and commit $70 billion to U.S. manufacturing. That eased investor fears.

Broad rally: Roughly 70% of healthcare stocks in the S&P 500 hit new 5-day highs, showing strong sector-wide momentum.

Investor sentiment: The sector benefited as investors sought defensive plays and welcomed clarity on drug pricing and tariffs.

Last Weeks Winners & Losers

Top performers:

Robinhood (+22%)

Micron (+19%)

Thermo Fisher (+17%)

Eli Lilly (+16%)

Pfizer (+15%)

Biggest drops:

Equifax (-7%)

Philip Morris (-7%)

Netflix (-5%)

Chevron (-4%)

Meta (-4%)

Notable News

Markets: Momentum rolls on

The third quarter ended strong: S&P 500 up 8%, Nasdaq up 11%, and small caps (Russell 2000) up 12%. The S&P even logged three new all-time highs, bringing the 2025 total to 31.

Two big forces are driving the rally:

AI tailwinds: Semiconductor and AI-linked stocks keep leading as data center and AI investment surges.

Lower rates: Fed easing is boosting rate-sensitive areas like consumer discretionary, small caps, and emerging markets.

Government shutdown headlines barely dented sentiment -history shows shutdowns rarely derail markets. But with U.S. stocks up 35% since April without a pullback, conditions look ripe for some profit-taking if uncertainty lingers.

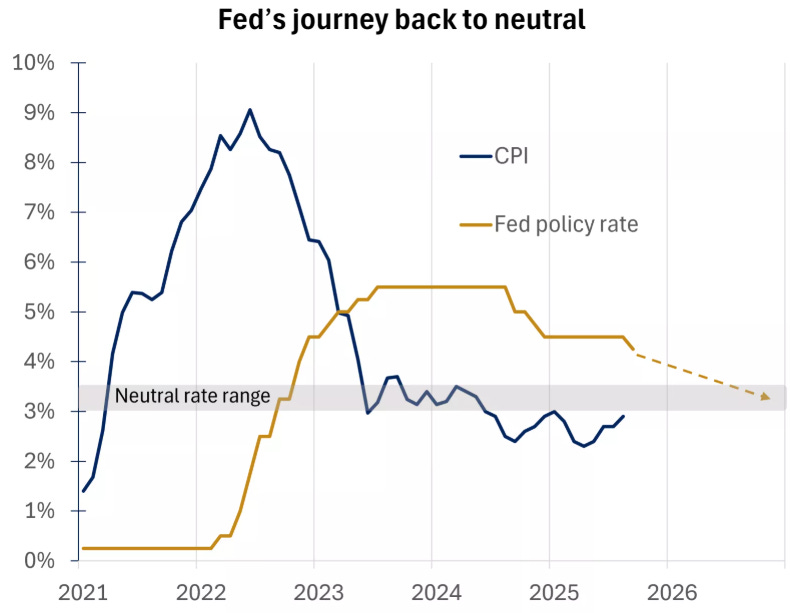

Fed: Flying blind, but easing continues

The Fed cut rates last month for the first time this year, citing softer labor data and contained inflation. Most officials now see policy as restrictive and expect a gradual shift lower to support employment.

The government shutdown complicates things: with official data on hold, the Fed is left relying on weaker private indicators like ADP payrolls, which showed softness. That likely keeps the focus on jobs and increases pressure to ease further.

Earnings This Week

Join 112,000+ investors on YouTube! 🎥

We break down earnings, market moves, and exclusive insights you won’t find anywhere else.

Don’t miss out — hit the button below to watch and subscribe now! 👇

YouTube Channel 🔔

Subscribe today and stay ahead of the market!

Fear & Greed Index

3 Quality Stocks

Lately, even the strongest names in the market have started to wobble.

After months of relentless gains, a few high-quality companies are finally showing cracks - not because their businesses are broken, but because sentiment has shifted.

This week, we’re looking at three standout stocks that have all taken a hit.

The question now: are these pullbacks a gift, or the start of something deeper?

1. Costco (COST)

Why is Costco flat YTD and down 15% from all time highs?

It’s unusual to see a company as steady as Costco standing still. Year to date, the stock is down, and it’s down roughly 15% from its all-time high. For a business known for consistent growth and loyal customers, that’s a rare sight.

So what’s behind the slowdown?

1. Expectations got too high

Costco entered 2025 priced for perfection. Investors expected another year of blockbuster results, but when the company merely delivered “very good” instead of “great,” the stock lost its spark. In markets like this, even solid performance can disappoint when expectations are sky-high.

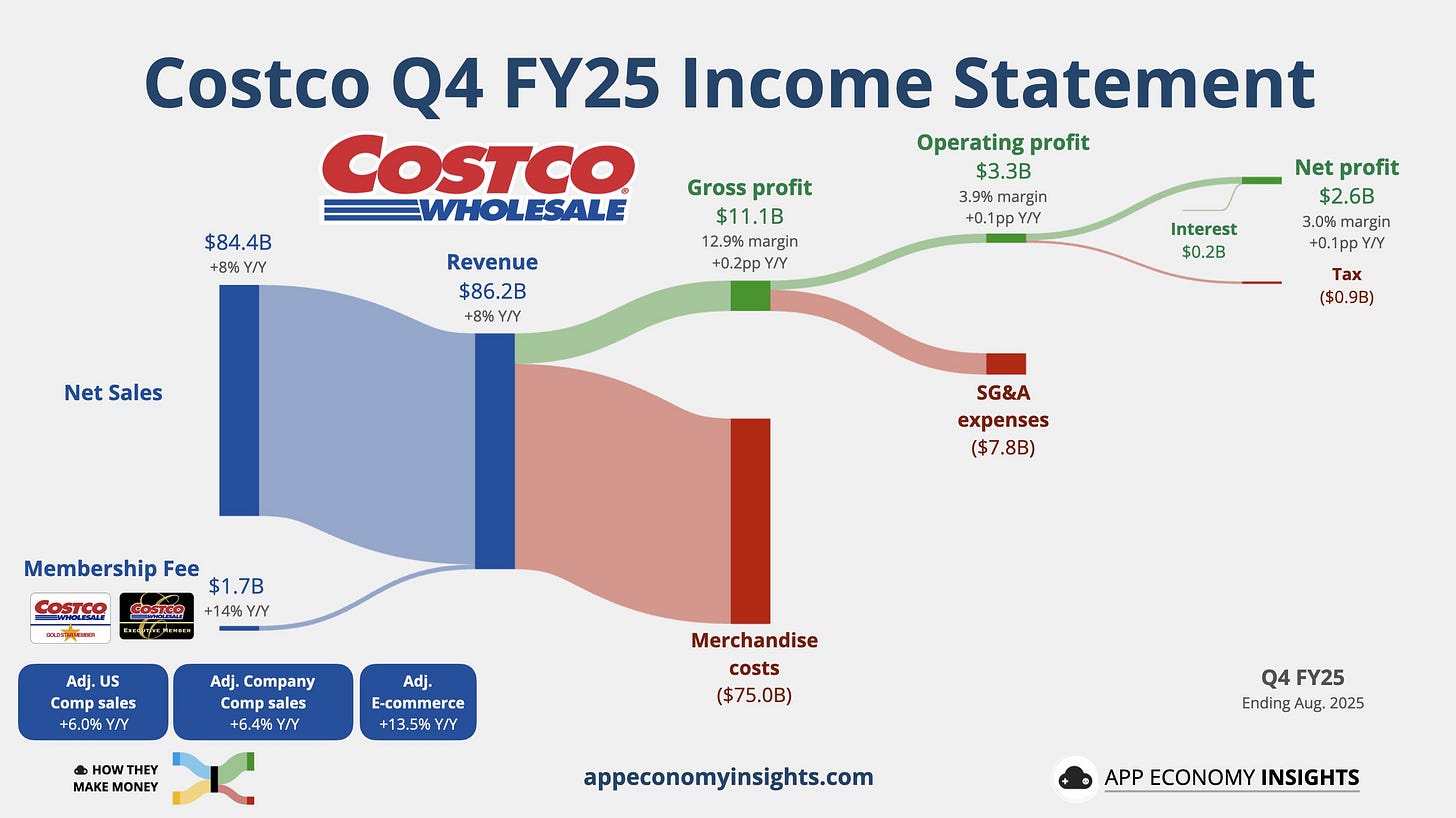

In Q4 FY2025, Costco posted $84.4 billion in net sales (total revenue including membership fees hit $86.16 billion) and delivered $2.61 billion in net income (~ $5.87 per share), beating expectations.

Membership fees alone jumped ~14%, helping stabilize margins even as revenue growth came in just over forecasts.

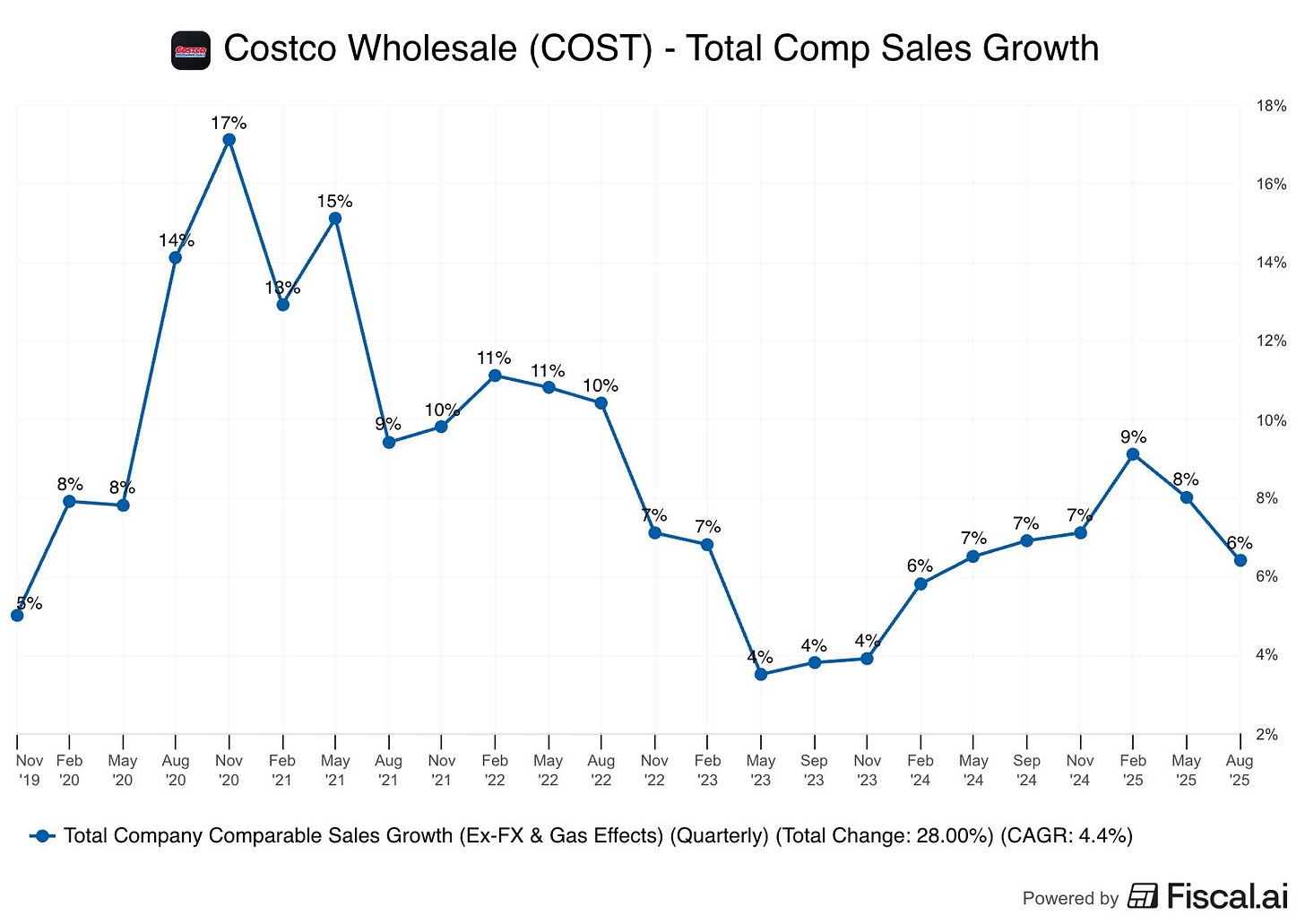

Costco’s Q4 FY25 results were solid but not spectacular. Comparable sales rose about 5.7% (or 6.4% excluding gas prices and currency effects), with U.S. comps hitting roughly 6%, showing that domestic momentum remains strong.

Margins stayed flat, and there was no membership fee hike, which Wall Street had been hoping for to boost profits. In short, the company delivered consistent, reliable results - strong operationally, but not the kind of upside surprise that moves a stock priced for perfection.

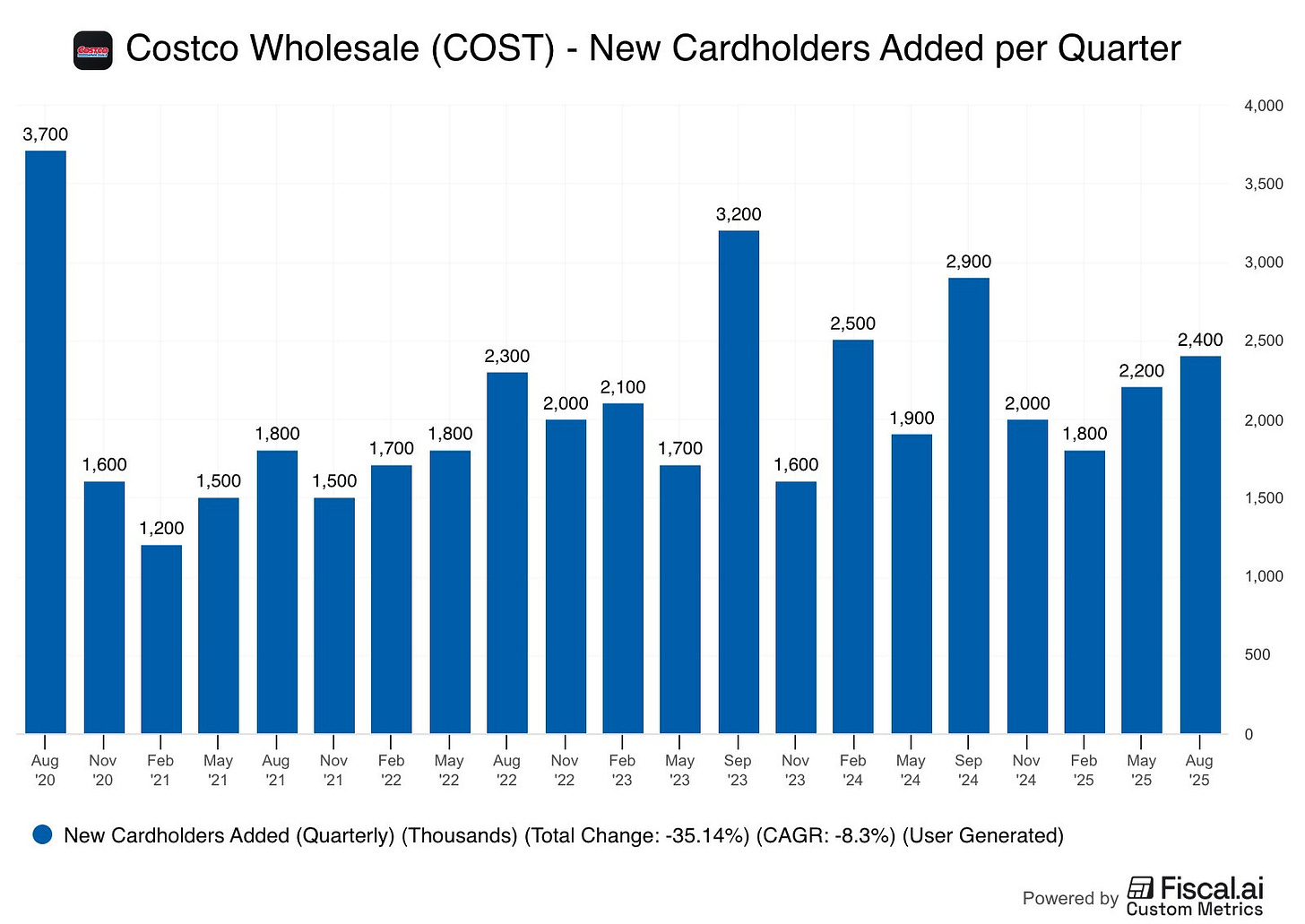

2. Membership growth cooling slightly

Membership renewals - Costco’s bread and butter - have softened a touch. Renewal rates in the U.S. and Canada have dipped to about 92%, while global renewals hover near 90%. It’s still incredibly strong, but investors have grown used to seeing those numbers inch higher every quarter.

3. Margins feeling the squeeze

Higher shipping, labor, and import costs have eaten into margins. Costco is famous for keeping prices low, but that discipline means it absorbs more of the inflation pain than most retailers.

4. Investors chasing flashier stories

This year, markets have been driven by AI and high-growth tech names. Defensive, steady companies like Costco just haven’t been in the spotlight. It’s not that anything’s wrong - investors are simply looking elsewhere for excitement.

In many ways, Costco’s flat year looks more like a pause than a problem. Fundamentals remain strong, and if sentiment swings back toward quality and stability, the stock could easily find its rhythm again.

5. Other things to note

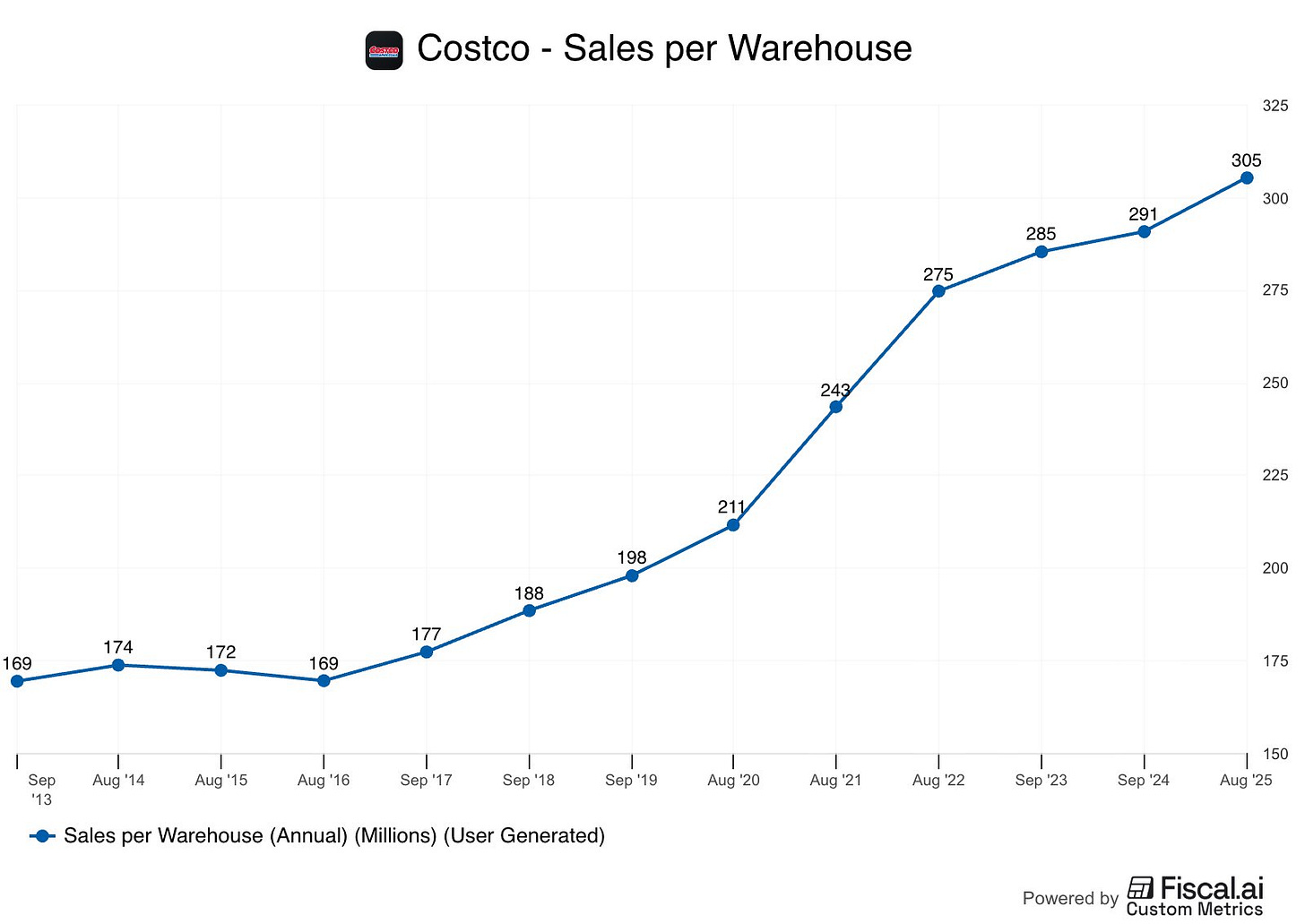

Costco has increased the sales they generate per warehouse by 50% from just 5 years ago.

They have also managed to find ways to increase sales by offering an additional hour to executive members which has paid off as well as seeing members upgrade to executive by around 9%.

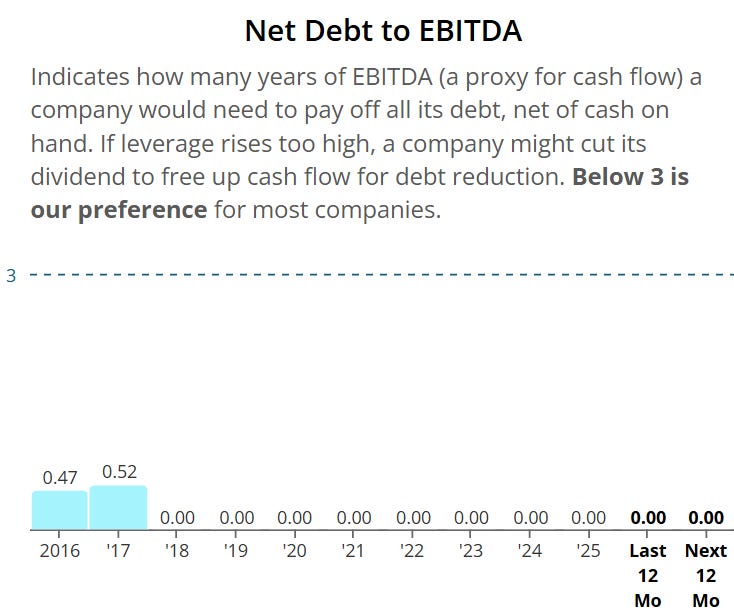

Net debt to EBITDA is 0 meaning it won’t take Costco even one day to pay off all of their debt - strong balance sheet.

Valuation

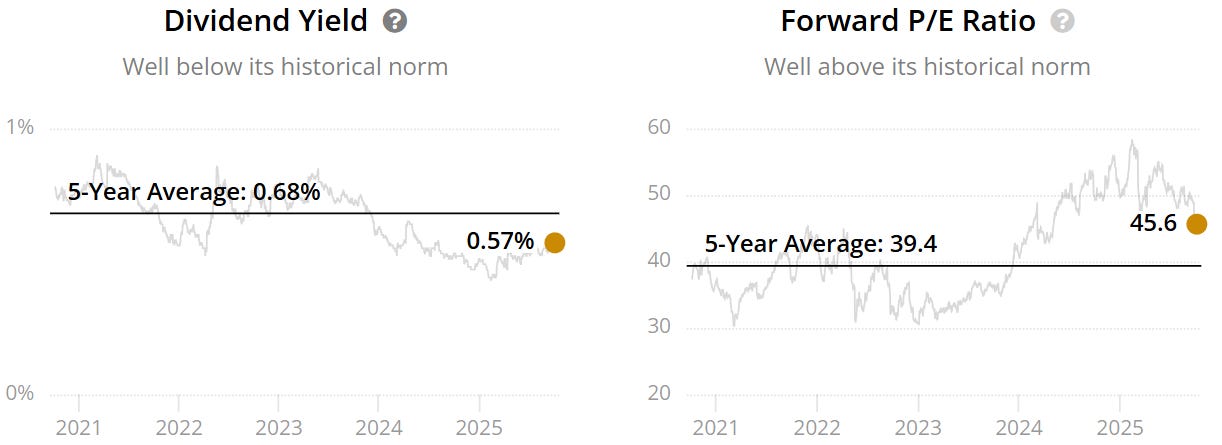

The forward P/E still even after the poor performance sits above the historical - 45.6x v 39.4x. This could indicate the company is overvalued.

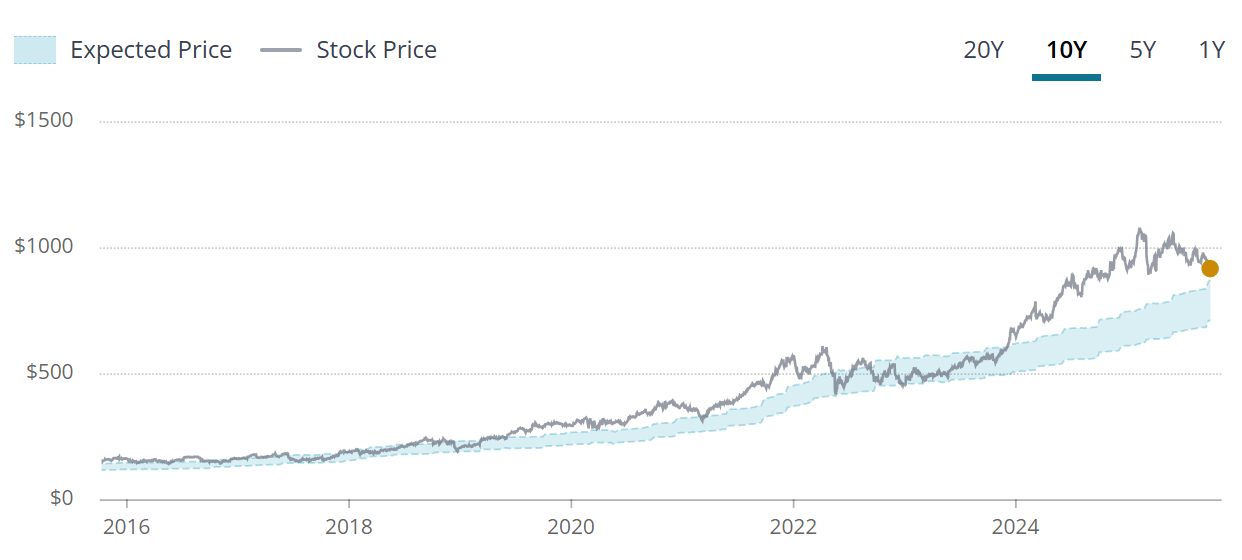

The blue tunnel methodology highlights that the company typically trades at a premium as it is above even the upper end and this seems to be a consistent trend looking back over 10Y.

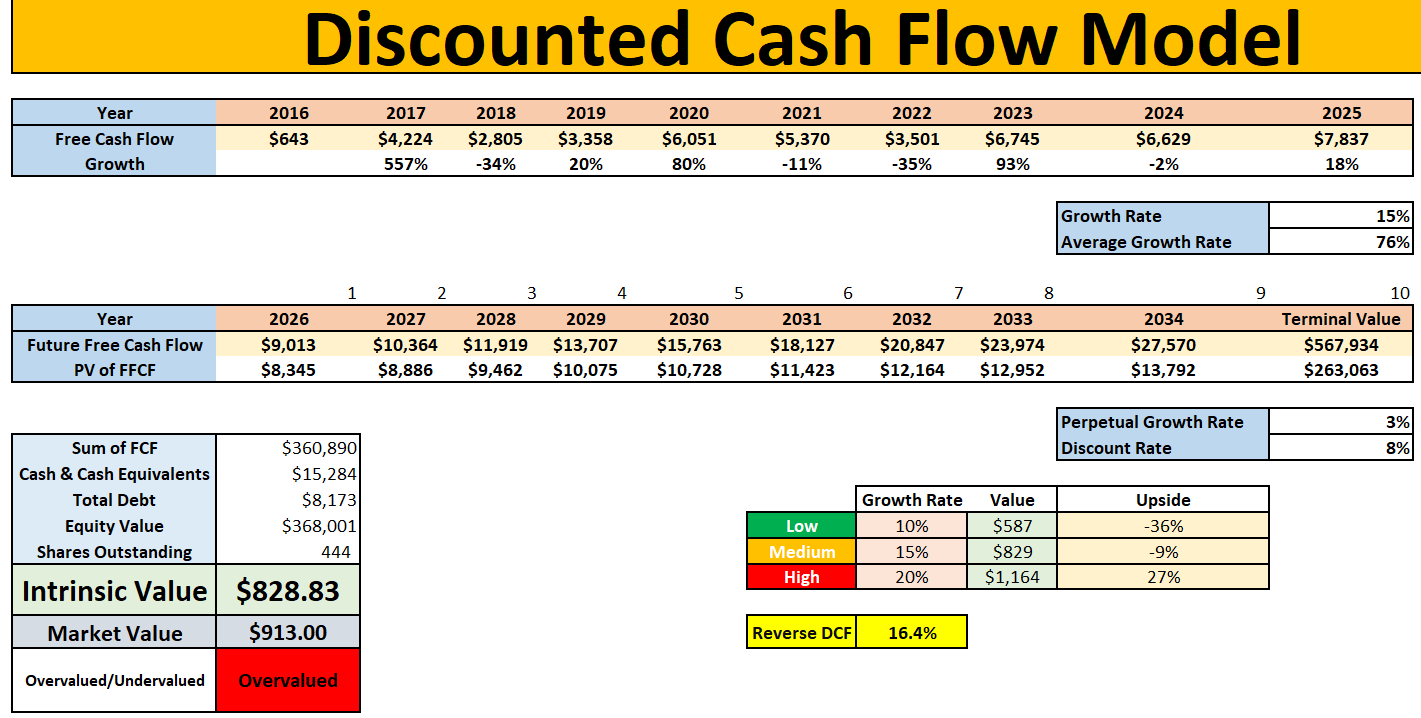

Using our DCF model a few things to note:

16.4% is already baked into the FCF growth moving forwards

Using 15% growth rate there is downside of 9%

Using the low rate of 10% downside of 36%

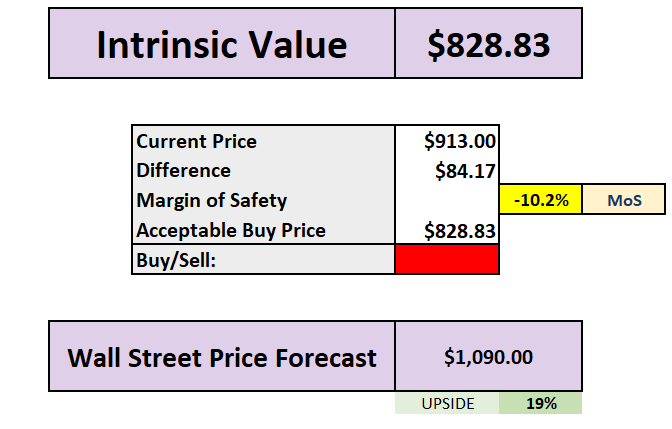

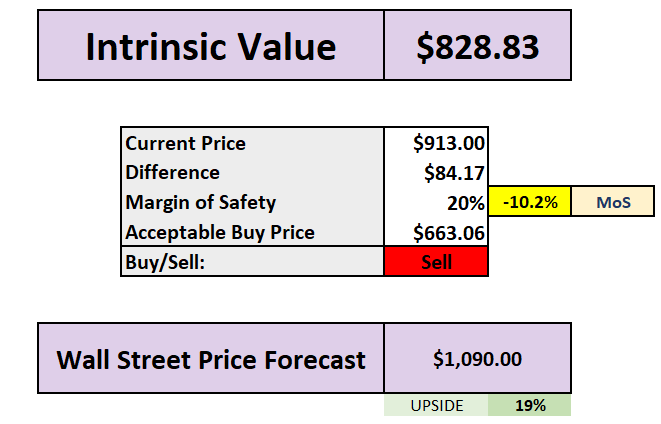

If we use the middle rate of 15%, there is currently no margin of safety on offer to investors, in fact you are paying a 10.2% premium.

Using a 15% growth rate, and a 20% margin of safety, Costco looks attractive at $663.

Keep reading with a 7-day free trial

Subscribe to Dividend Talks to keep reading this post and get 7 days of free access to the full post archives.