3 Quality Stocks to Buy the Dip Before the Market Rotation Ends

Tech is wobbling, investors are nervous, and fundamentals are finally back in control - here are the companies worth scooping up now.

Market Update

A Mixed Week for U.S. Stocks

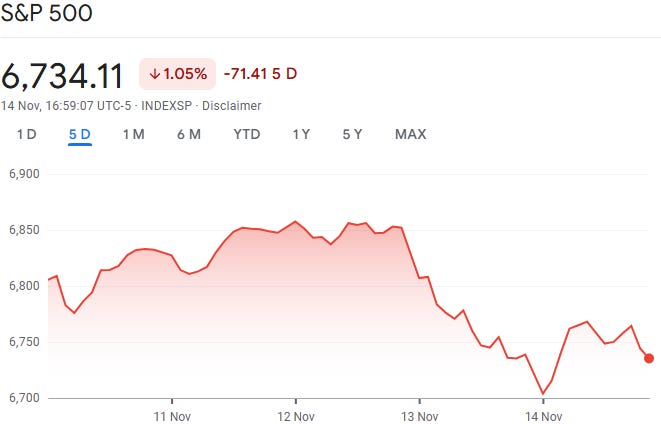

U.S stocks ended the week on a mixed note. The S&P 500 ended down 1% on the week.

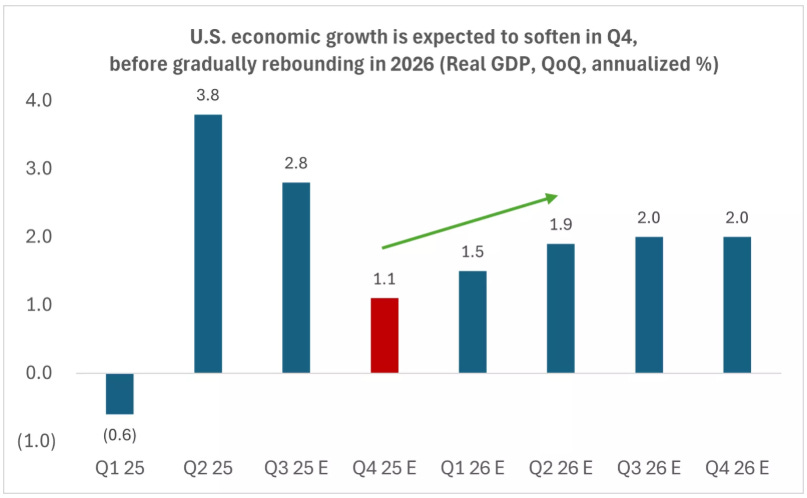

For most of the week, markets were under pressure as investors questioned whether growth stocks had simply run too far, too fast.

Concerns about stretched valuations and rising scrutiny on AI spending pushed money out of many of the names that had driven markets to fresh highs.

Friday brought a burst of volatility. With no major headlines to anchor trading, several indexes bounced back and clawed their way into positive territory by the close.

As the government shutdown wrapped up, the bigger story for markets last week was a sharp rotation beneath the surface.

The tech and AI giants that powered most of this year’s rally finally started to lose momentum.

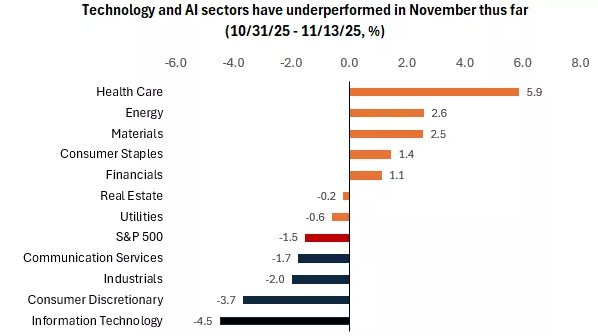

November has been a different picture so far, with technology lagging while sectors like health care, energy, and materials have quietly taken the lead.

Investors are beginning to question whether the market’s biggest winners are simply taking a breather or if a deeper shift is underway.

Shutdown Relief, But Not Full Clarity

The biggest political development was the end of the U.S government shutdown, the longest on record.

The new funding bill removes a major overhang for markets, but Thursday’s selloff showed investors are still unsure how quickly things will return to normal.

Economic Data Still in Question

Uncertainty around government data added to the choppiness. The White House warned that October jobs and inflation data may never be released, and the Bureau of Labor Statistics said it needs more time to finalize its release schedule. Late Friday, the BLS confirmed that the September jobs report will come out on November 20, giving investors at least one key data point to work with.

Last Weeks Winners & Losers

Top performers:

Eli Lily (+11%)

Cisco (+10%)

Merck & Co (+8%)

AbbVie (+6%)

AMD (+6%)

Biggest drops:

Dell (-9%)

Oracle (-7%)

Lam Research (-7%)

Tesla (-6%)

Paypal (-5%)

Notable News

December Rate Cut Probability Drops

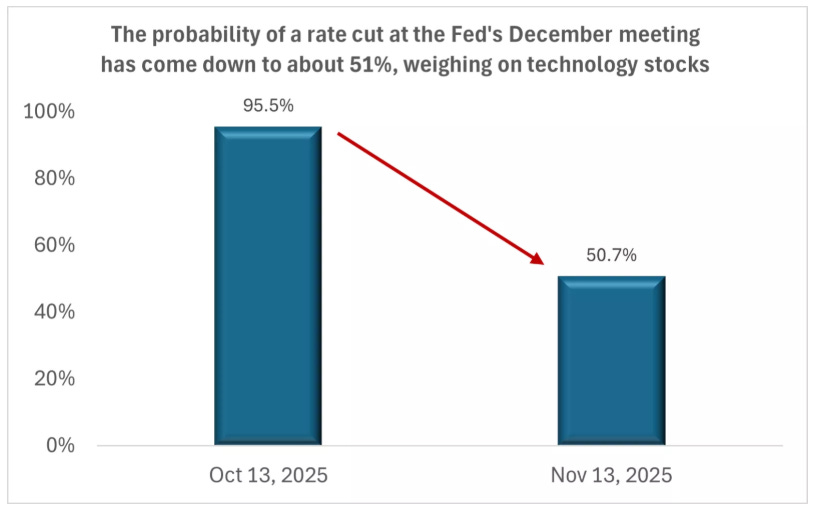

There’s growing worry that the Federal Reserve might not cut rates at its December meeting after all.

Just a few weeks ago, markets were almost certain a cut was coming, with odds sitting near 95 percent.

Today, that probability has dropped to roughly 51 percent, and investors are starting to feel the shift.

The U.S. Government Shutdown Ends - What It Means Now

After 43 days, the longest U.S. government shutdown in history ended on November 14, with a new funding bill that keeps the government running until January 30, 2026.

Here’s what actually matters moving forward.

1. Federal workers get backpay and furloughs are reversed

Roughly 1.4 million federal employees will now receive the pay they missed, with most payments landing by November 19. The bill also reverses the more than 4,000 layoffs across major agencies and prevents further cuts through January.

2. Key federal programs are restarting

Programs like SNAP are being restored, and airlines are expected to quickly return to full capacity after major disruptions last week. This comes just in time for the Thanksgiving travel rush.

3. Economic data will start flowing again

Government data releases will resume, though some early reports may be incomplete. For example, next week’s October jobs report is expected to include job gains but not the unemployment rate, since the household survey wasn’t completed during the shutdown.

4. Healthcare premiums remain a risk

A big open question is what happens to Affordable Care Act subsidies, which expire at the end of 2025. A vote to extend them is expected in December, but passage is not guaranteed. If Congress can’t agree, premiums could rise for millions and the risk of another shutdown early next year increases.

Earnings Season

Join 118,000+ investors on YouTube! 🎥

We break down earnings, market moves, and exclusive insights you won’t find anywhere else.

Don’t miss out — hit the button below to watch and subscribe now! 👇

YouTube Channel 🔔

Subscribe today and stay ahead of the market!

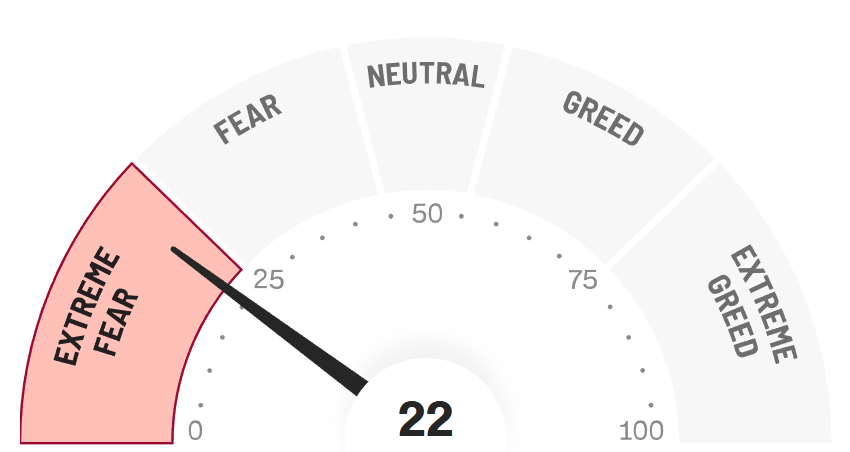

Fear & Greed Index

3 Quality Stocks to Buy the Dip

After a month of choppy trading and a sharp rotation out of tech, some of the market’s strongest businesses have quietly pulled back to far more attractive levels.

These aren’t speculative names or broken stories - just high-quality companies temporarily caught in the crossfire of shifting sentiment, higher rates, and election-year nerves.

If you’ve been waiting for a chance to add durable, cash-generating compounders at a discount, these three stand out right now.

1. Visa (V)

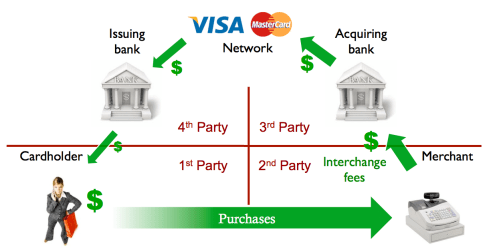

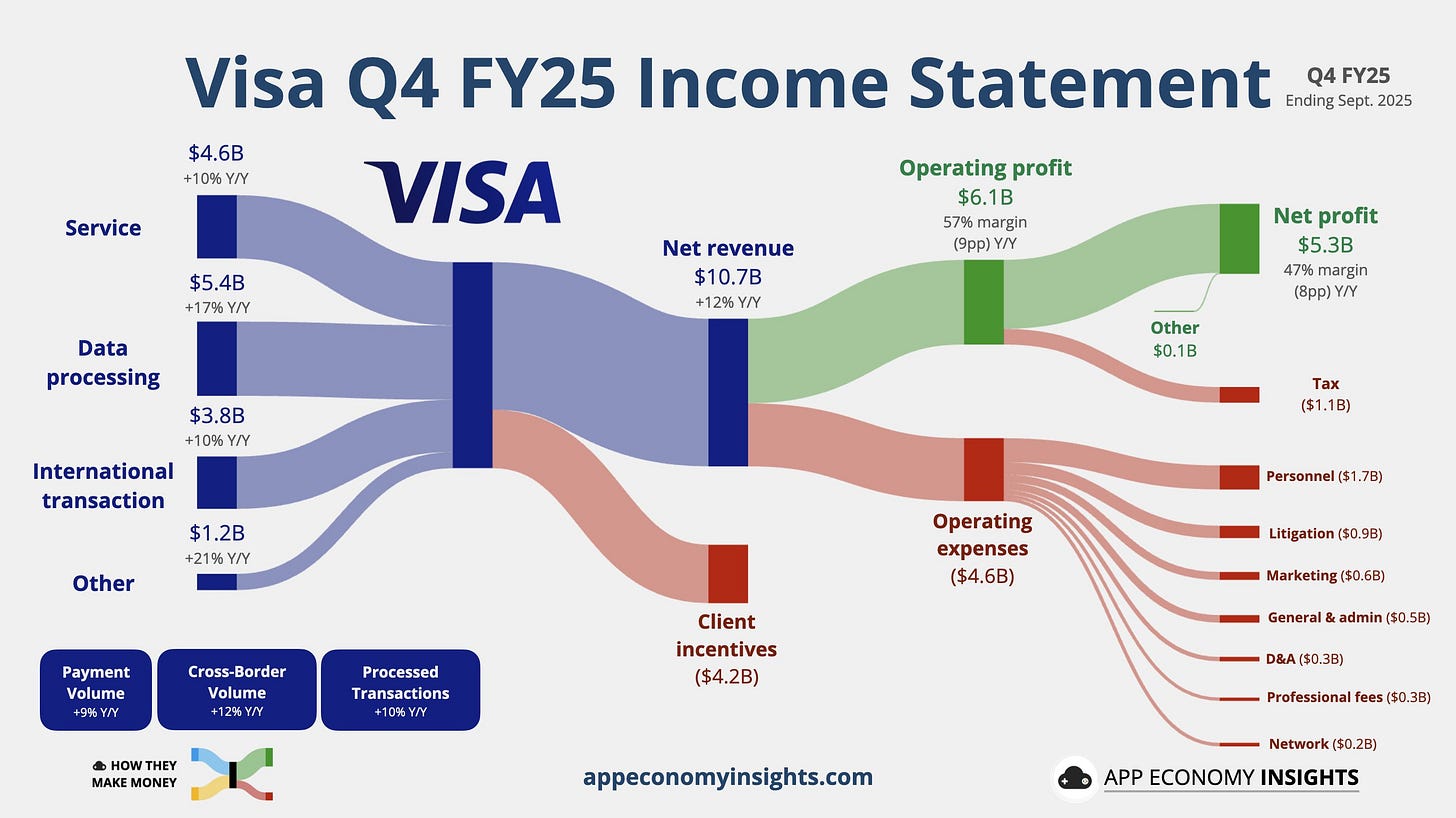

So… What Exactly Is Visa? And How Do They Make Money?

Most people think Visa is a bank. Or that they “lend” you money whenever you tap your card.

But the truth is far more interesting - and a lot more profitable.

Visa is essentially the world’s toll road for payments. Every time you buy a coffee, book a flight, or sign up for a Netflix subscription, there’s a tiny digital toll that gets paid. And Visa owns one of the busiest toll roads on Earth.

The key thing to understand?

Visa never touches your money.

They don’t hold deposits. They don’t issue credit. They don’t chase customers for repayments. That’s the bank’s job.

Visa’s job is to run the network that securely moves payment information from Point A (you buying something) to Point B (the merchant getting paid). Think of them as the ultra-fast traffic control system that keeps the global economy moving without a crash.

Here’s how the model works:

You swipe/tap/enter your card.

That signals the Visa network.Visa instantly checks with your bank:

“Is this person legit? Do they have funds/credit? Risk okay?”Visa sends the green light to the merchant.

Money flows from your bank to the merchant’s bank - but not through Visa.

For doing all this work, Visa charges tiny fees to the banks and merchants involved.

Tiny… but when you run 276 billion transactions a year, those pennies turn into billions.

It’s a dream business model:

Asset-light: No branches, no loan defaults, no credit risk.

High margin: Software-like economics.

Global: Every new shopper, card, or online purchase adds more traffic to the toll road.

Hard to replace: Once a system becomes the network everyone relies on, switching becomes almost impossible.

In short: Visa sells trust and speed at global scale.

And in a world where payments keep shifting online - and every tap, click, and subscription runs through companies like Visa - their toll road keeps getting busier every year.

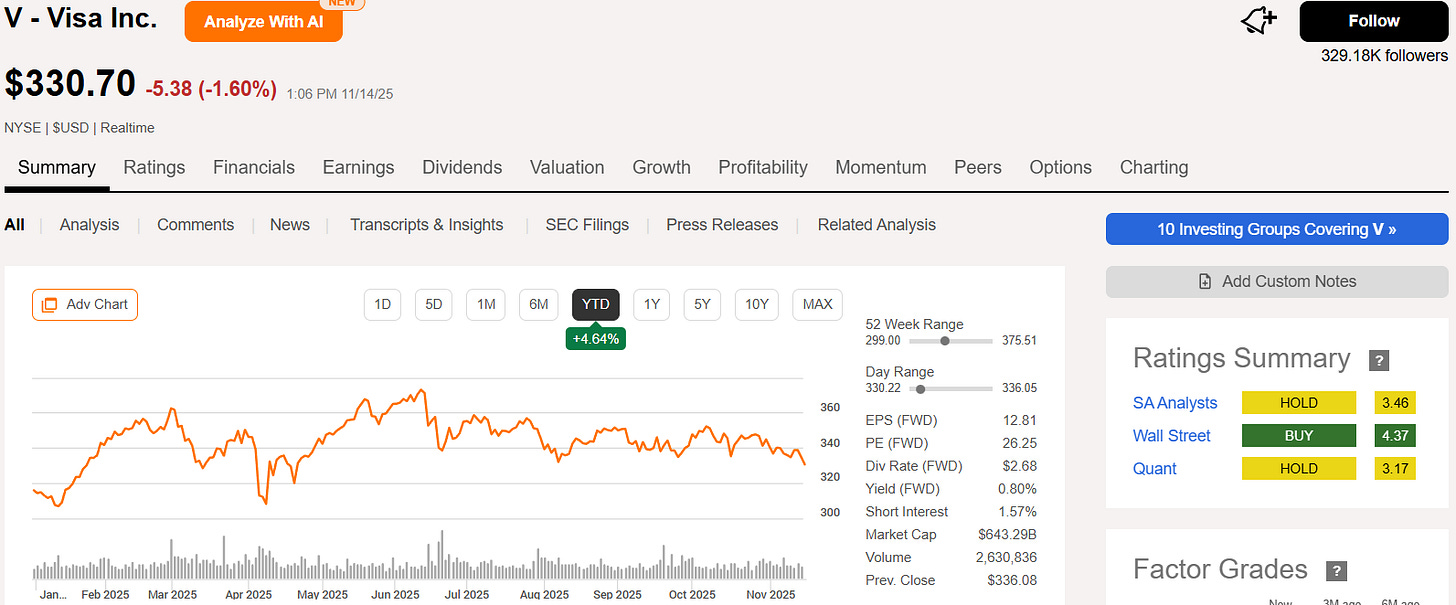

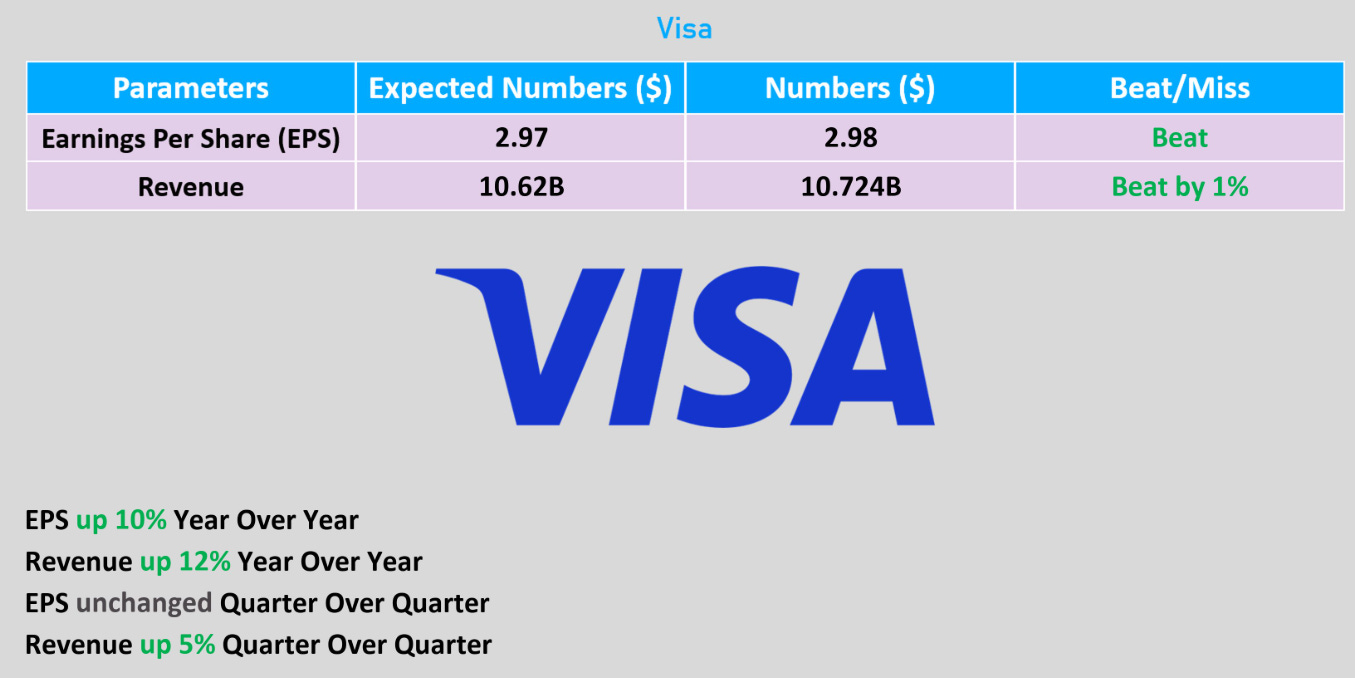

Why Visa Has Been Struggling Even After A Solid Quarter

On the surface, Visa’s recent results looked good. Revenue grew at a healthy pace, transactions were strong and cross border spending kept climbing. For most companies, that would be enough to lift the stock. But Visa has been a bit sluggish lately and there are a few reasons investors are not giving the company full credit for the quarter.

1) Big legal costs hiding underneath the strong numbers

Visa’s revenue looked great this quarter but expenses were another story. The company took a large litigation charge that pushed total operating costs much higher than expected. Investors hate surprises like this. Even when it is a one off cost, it raises questions such as what else could land on the expense line in the future and how much more legal risk might be out there. When a company has margins as good as Visa, any sudden jump in expenses gets attention.

2) Margin pressure starting to show

Revenue growth is steady but the cost base is starting to rise too. Visa has been spending more on tech, security, talent and partnerships. These are necessary investments but they also slow down margin expansion. Investors have become used to Visa being a consistent compounding machine with extremely high profitability. When margins flatten or show early signs of pressure, the market takes a step back.

3) Competition and pricing pressure are more visible

Visa still owns one of the most powerful networks in the world. But competition is louder than it used to be. Digital wallets, buy now pay later products and bank sponsored alternatives are growing. None of these threaten Visa today but they keep the market aware that the toll road may not grow at the same pace forever. Merchants and regulators are also pushing harder on fees. Even small changes here can influence sentiment.

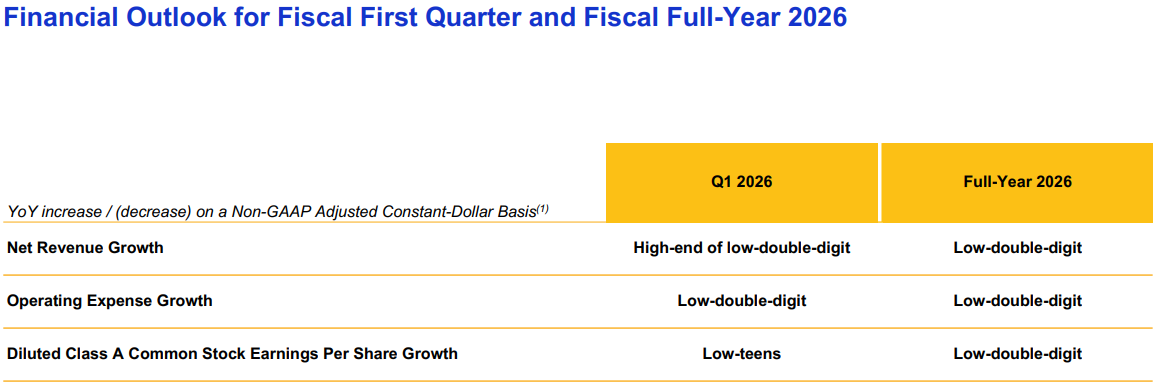

4) Solid numbers but no big spark in the outlook

The quarter was good but the forward commentary was more cautious. The company guided for steady growth rather than acceleration. In a business this large and mature, anything short of a strong outlook usually leads to muted stock reactions. Investors want momentum. When results are good but the future sounds more like another year of steady progress, the stock can drift.

Why Visa Remains One of the Strongest Compounders on the Market

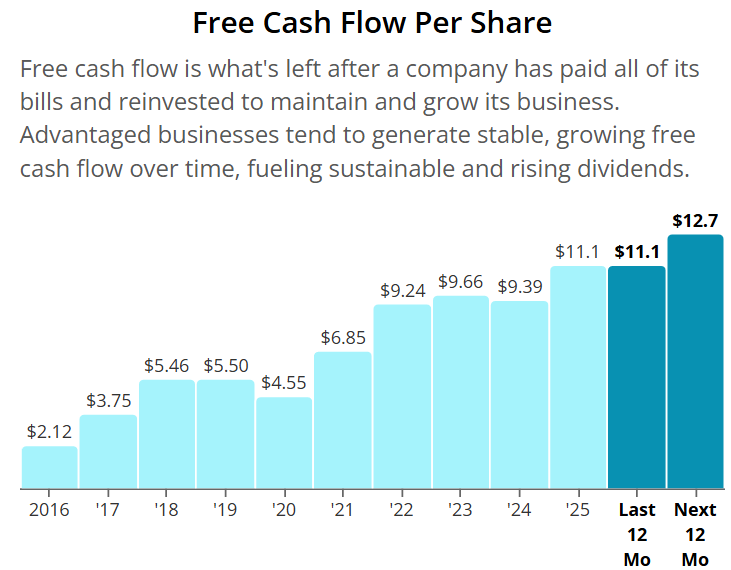

If you zoom out from the short term noise, Visa’s long term story is almost impossible to dislike. This is a business that behaves like a world class compounder. It grows steadily, it throws off piles of free cash and it quietly returns billions to shareholders every single year.

1) Free cash flow has exploded

Visa’s free cash flow has grown from just over $2 per share in 2016 to more than $11 today. That is the type of growth you normally see from a quickly scaling software company. What makes it more impressive is that Visa achieved this without taking on heavy risks or capital requirements. It is the definition of an asset light compounding machine.

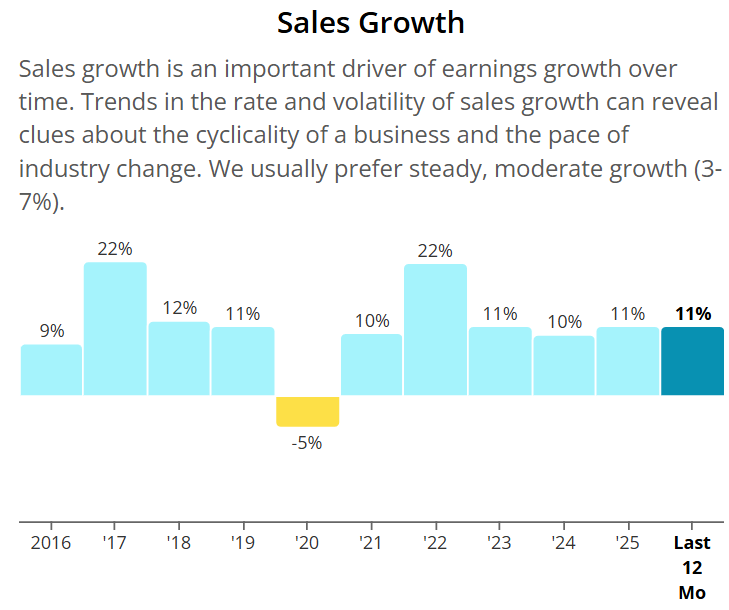

2) Sales growth has been near double digit for a decade

Very few mega cap companies can post almost uninterrupted high single digit to double digit revenue growth for ten years straight. Visa does it because the global shift from cash to digital payments never stops. Every tap, swipe and online checkout creates another tiny toll for Visa and these tolls compound beautifully over time.

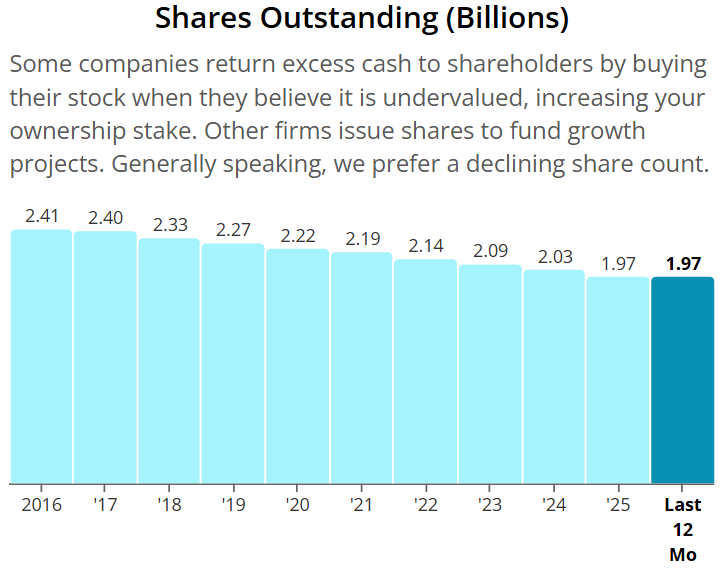

3) A shrinking share count boosts every existing shareholder

Visa has reduced its shares outstanding by nearly 20 percent over the last decade. This is exactly what you want as a long term investor. When a company buys back shares at a steady pace, your ownership stake quietly increases every year without you lifting a finger. It is one of the cleanest ways to drive compounding.

4) Dividend growth that actually matters

Visa’s dividend growth has compounded at roughly 17 percent per year over the last decade. The yield will never look huge on the surface, but the growth rate is what matters. When combined with buybacks, Visa rewards shareholders through both cash returns and ownership expansion.

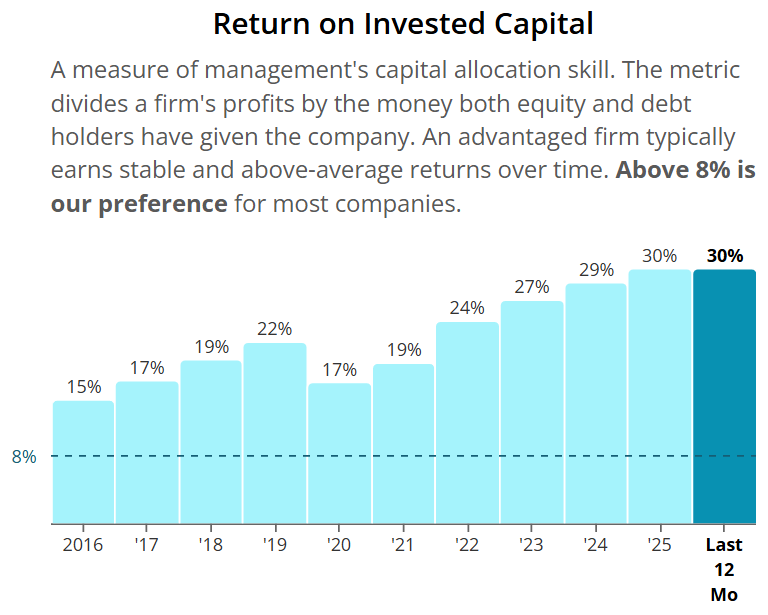

5) Returns on capital that separate the elite from the ordinary

Visa’s ROIC has climbed consistently and now sits around 30 percent. That tells you one thing. Every dollar Visa reinvests generates far more than one dollar back. High ROIC businesses tend to dominate their industries and they tend to outperform over long periods.

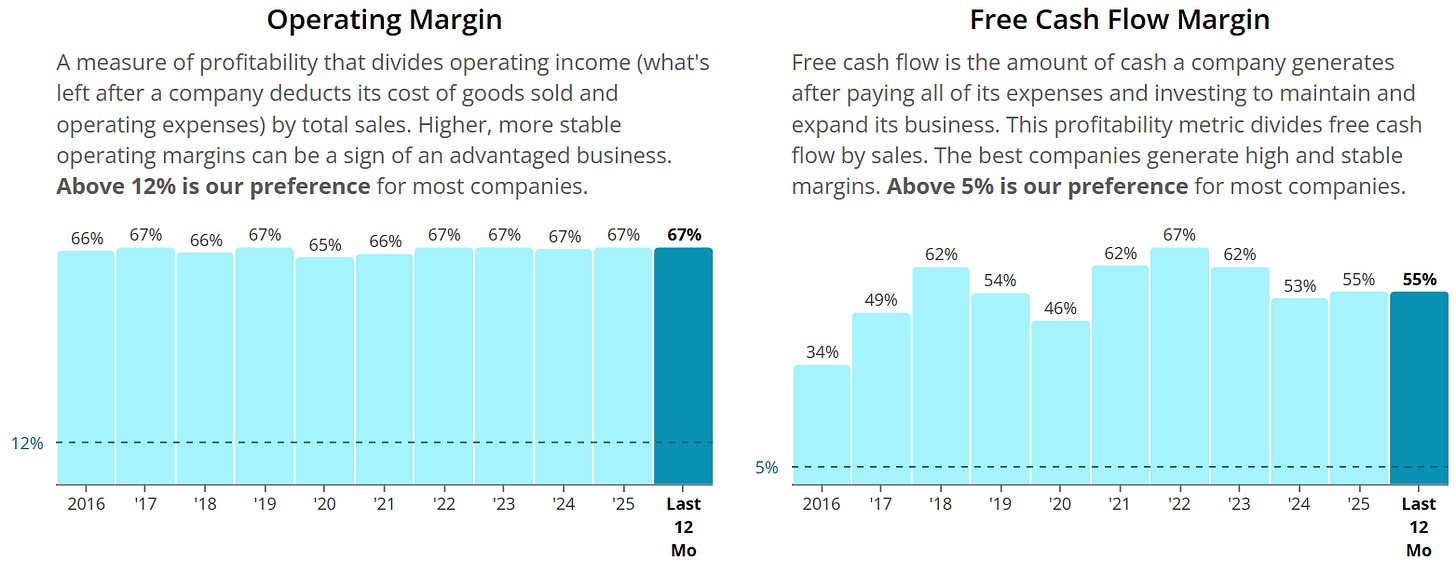

6) Best in class margins show how powerful the model is

Operating margins around 67 percent and free cash flow margins around 55 percent are almost unheard of at this scale. These margins prove that Visa does not need to fight for every dollar. The network does the heavy lifting. Once you own the payment rails, the profits fall in your lap.

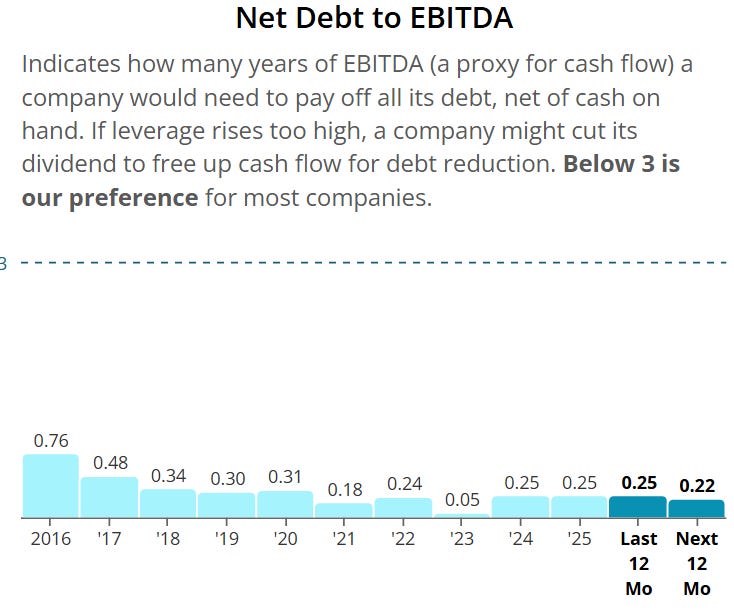

7) Rock solid balance sheet

Visa’s net debt to EBITDA ratio of roughly 0.25 shows a company that has almost no financial stress. They could wipe out their debt with a small fraction of annual cash flow. This gives them the freedom to invest, buy back shares and raise dividends without hesitation.

Short term bumps will always show up. Legal charges, competition headlines and margin jitters come and go. But underneath all of that is one of the most reliable compounding engines in the world. A company that grows, prints cash, reinvests intelligently and rewards shareholders year after year.

Visa is not an exciting story. It is a consistent one. And in long term investing, consistency is often where the real wealth is built.

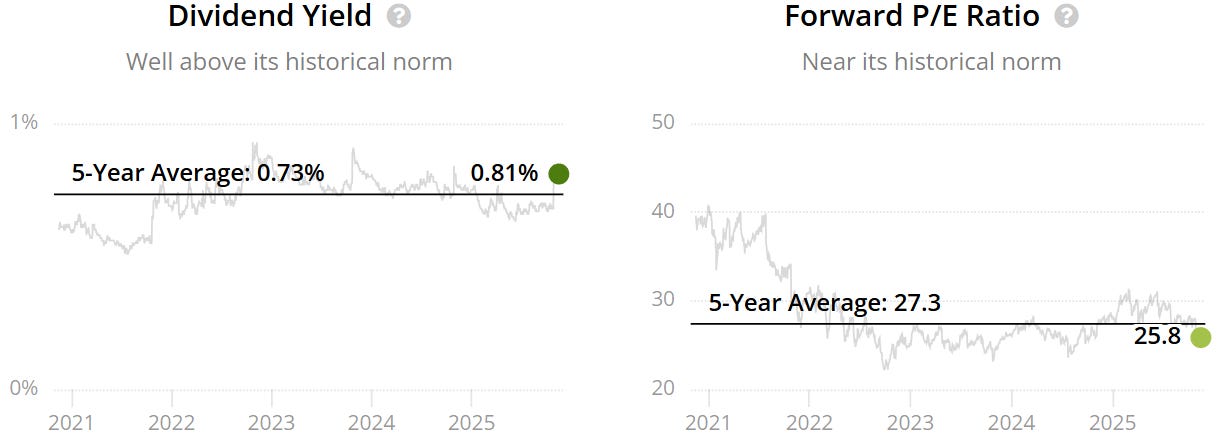

Valuation

The forward P/E sits below the historical - 25.8x v 27.3x. This could indicate the company is potentially undervalued.

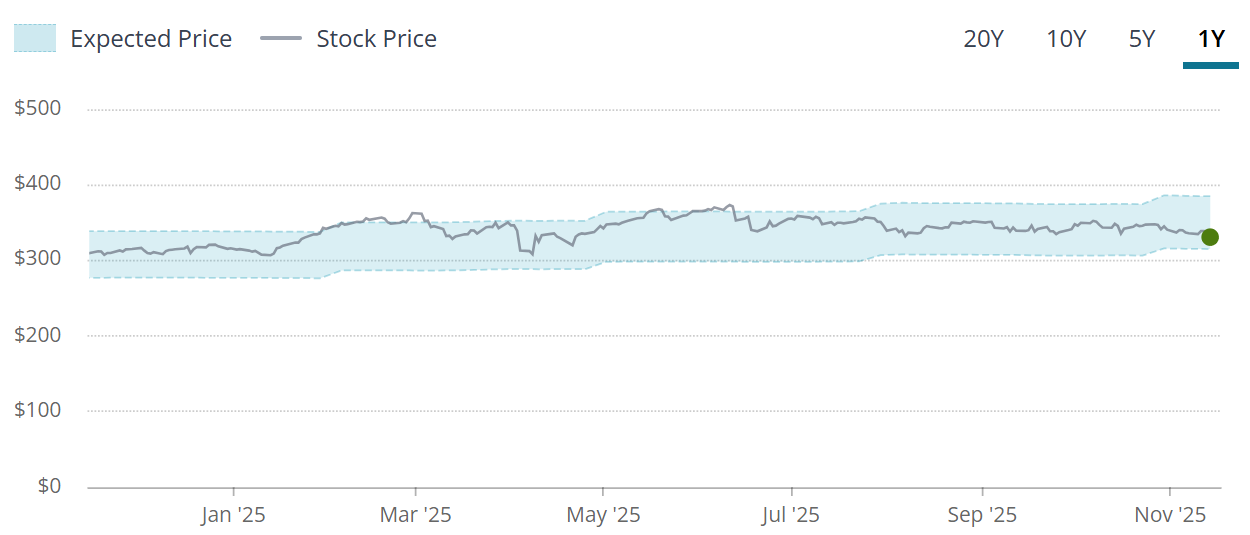

The blue tunnel methodology highlights that the company is towards the lower end of the intrinsic/fair value boundaries indicating potential undervaluation.

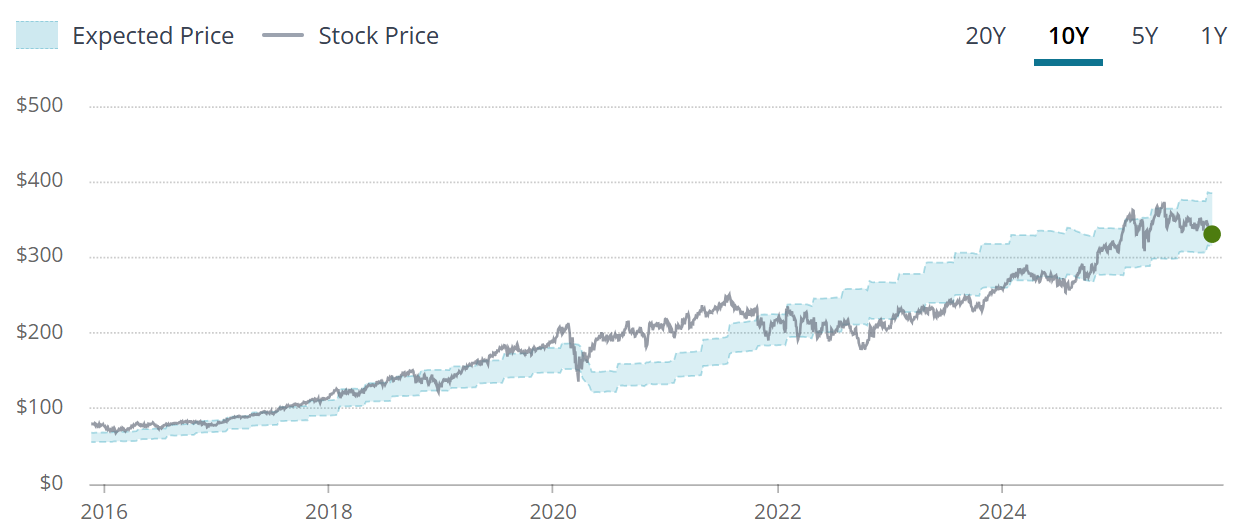

When we zoom out to the last 10Y we can see this Company has rarely traded at a massive discount.

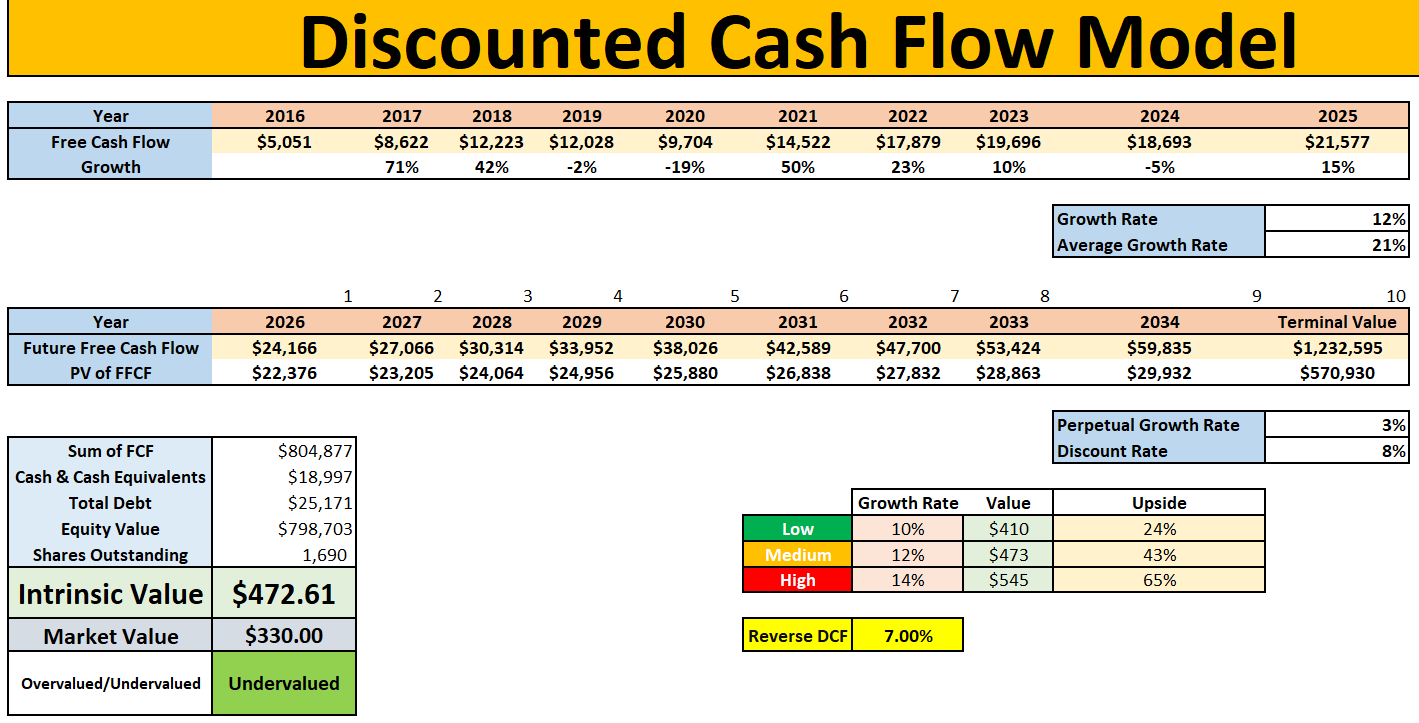

DCF Model

Using our DCF model a few things to note:

7% is baked into the FCF growth moving forwards.

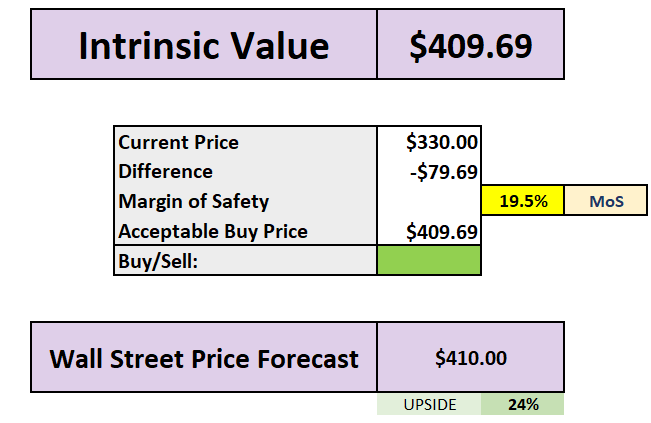

Using 10% (the lower rate) gives an intrinsic value of $410.

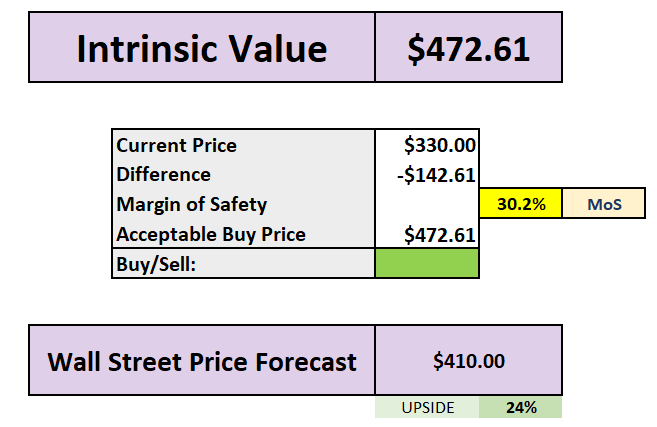

Using 12% (the middle rate) gives an intrinsic value of $473.

Using 14% (the higher rate) gives an intrinsic value of $545.

Using the lower growth rate of 10%, we get an intrinsic value of $410 which leads to a 20% margin of safety.

On average wall street see 24% upside into 2026.

Using the middle growth rate of 12%, we get an intrinsic value of $473 which leads to a 30% margin of safety.

Keep reading with a 7-day free trial

Subscribe to Dividend Talks to keep reading this post and get 7 days of free access to the full post archives.