3 Stocks I'll BUY In October!

+ Market Update

Market Latest

We had another record-breaking week in the S&P 500 with Wall Street now firmly believing that we will see a “soft landing”, effectively suppressing the high inflation we have seen over the last few years without causing a recession.

As per above, the S&P 500 ended the week being 0.13% below the record close and up 20.99% YTD.

On a more granular level we can see that the week was not good for all stocks however, some of the biggest losers included Eli Lilly (LLY) down 4.74%, Moody’s (MCO) down 4.28% and Visa (V) down 3.37%.

Notable News

We had quite a lot going on last week, notably Micron Technology (MU) report, which set the stage for how the semiconductor market is performing.

The market loved this with the industry up very strongly last week:

We also saw the Department of Justice accuse Visa (V) of being an illegal monopoly, and as we said earlier it was down on the week by 3.37%.

No one could have seen this coming, or could they?

We had the best investor of our generation’s (Nancy Pelosi) husband sell 2,000 shares in July, making it another very timely transaction for the couple.

And finally, we now have the market confidently expecting another 50bps cut by the Fed when they meet again in November.

Earnings This Week

Earnings season continues with all eyes on Nike (NKE) who haven’t had the best 2024, down 18% YTD.

We also saw last Wednesday Micron report strong earnings which saw the stock soar up 14% during the week leading the market to believe the AI demand is continuing.

As always, we will cover this on our YouTube channel, and for those that aren’t subscribed, we would love to have you in our community which is over 52,000.

Fear and Greed Index

With all-time highs being hit in the S&P 500 we can see the market sentiment is in greed and it feels like such a long time ago we were sitting in fear. In fact, it was one year ago that we were in extreme fear.

As the markets can change very quickly, don’t be surprised to see sentiment move into any other category within just a few days.

3 Stocks I’m Buying

Let us dive into the 3 High Quality Stocks I’m looking to buy in October.

I have used the following criteria to help identify these stocks:

Dividend Safety 60+ (Safe)

ROIC > 10%

Net Debt to EBITDA below 3 (Strong Balance Sheet)

Upside > 10%

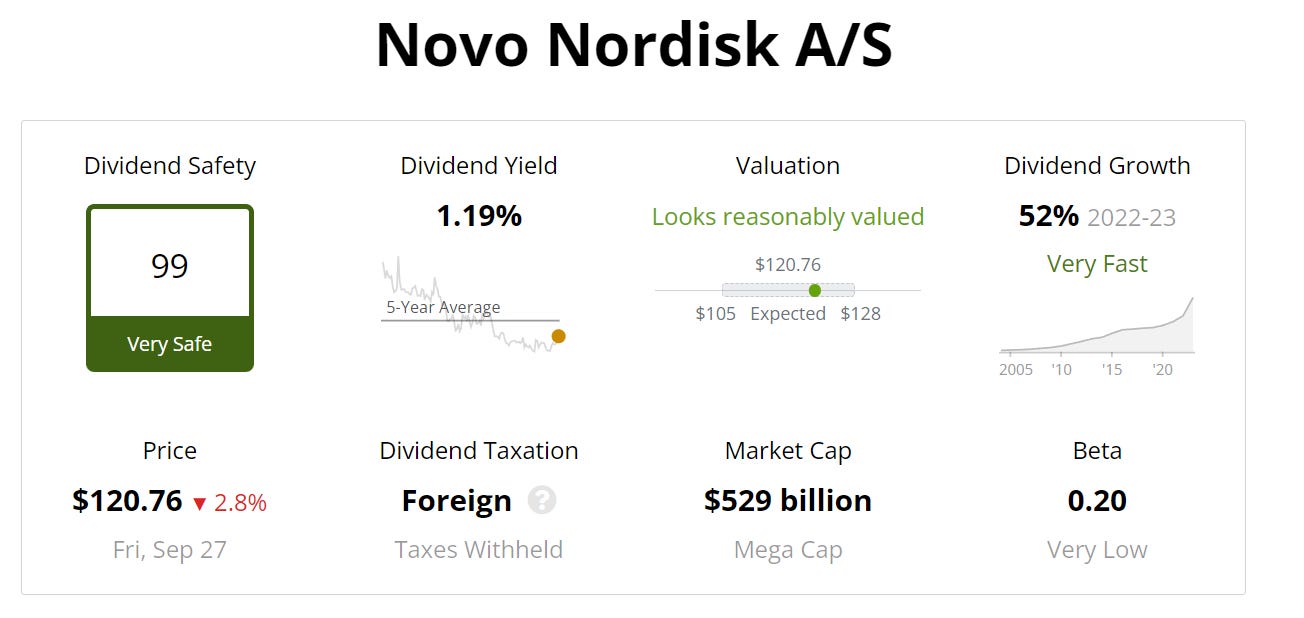

Novo Nordisk (NVO)

Novo Nordisk is a global healthcare company that specialises in developing treatments for chronic diseases like diabetes, obesity, and rare blood and endocrine disorders.

Over the last 10Y NVO has significantly outperformed the S&P 500 and is up 408%!

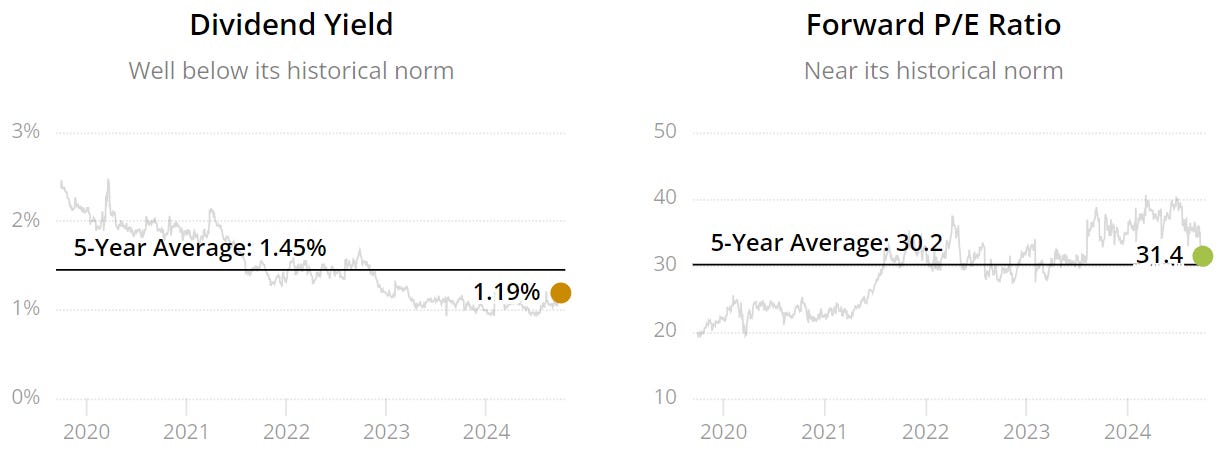

As per below, we get a double reasonable valuation signal as the current yield is lower than the 5Y average (1.19% v 1.45%) and the Forward P/E is marginally higher than the 5Y (31.4x v 30.2x).

Dividend Safety score of 99 indicates safety.

The dividend growth of this Company is incredible to see!

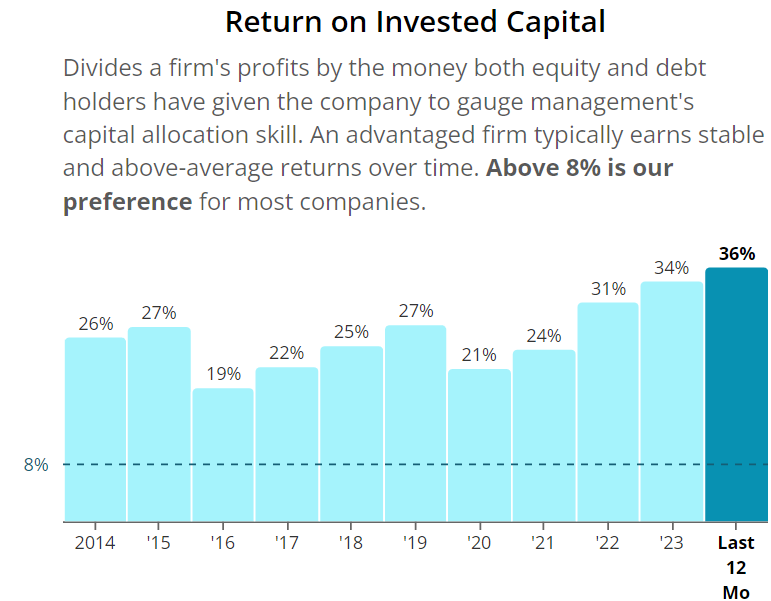

ROIC is one of the best we have ever seen!

Extremely impressive and gives us faith that management are able to effectively allocate their capital.

The Net Debt to EBITDA is also very impressive, with 0.10 for 2023 is below the 3 maximum we want to see and expected to drop to 0.06 over the next 12 months.

As per below, Wall Street see 19.18% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $133.81

So, in conclusion for NVO, we see around a 10% margin of safety around the $120 mark with Wall Street indicating 20% upside.

Whilst we believe this is a high-quality stock, we would wait for a larger margin of safety and hope to add this soon to our portfolio.

Elevance Health (ELV)

Elevance Health (formerly Anthem, Inc.) is a healthcare company that provides health insurance and related services, focusing on improving health outcomes and healthcare affordability.

Over the last 10Y ELV has significantly outperformed the S&P 500 and is up 330%!

As per below, we get a double reasonable valuation signal as the current yield is similar to the 5Y average (1.24% v 1.22%) and the Forward P/E is marginally lower than the 5Y (13.3x v 13.9x).

Dividend Safety score of 99 indicates safety.

Once again, dividend growth looks very very good and consistent!

ROIC is also very very good and consistent too, and sometimes we are happy to pay either a small premium for these types of Companies or a slightly smaller margin of safety.

The Net Debt to EBITDA has been 0 over the last 10Y and expected over the next 12m indicating it won’t even take them 1 day to pay off all of their debt net of cash on hand.

As per below, Wall Street see 15.23% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $589.86

So, in conclusion for ELV, we see around a 10% margin of safety around the $531 mark with Wall Street indicating 16% upside.

Whilst we believe this is a high-quality stock, we would wait for a larger margin of safety and hope to add more of this stock to our portfolio.

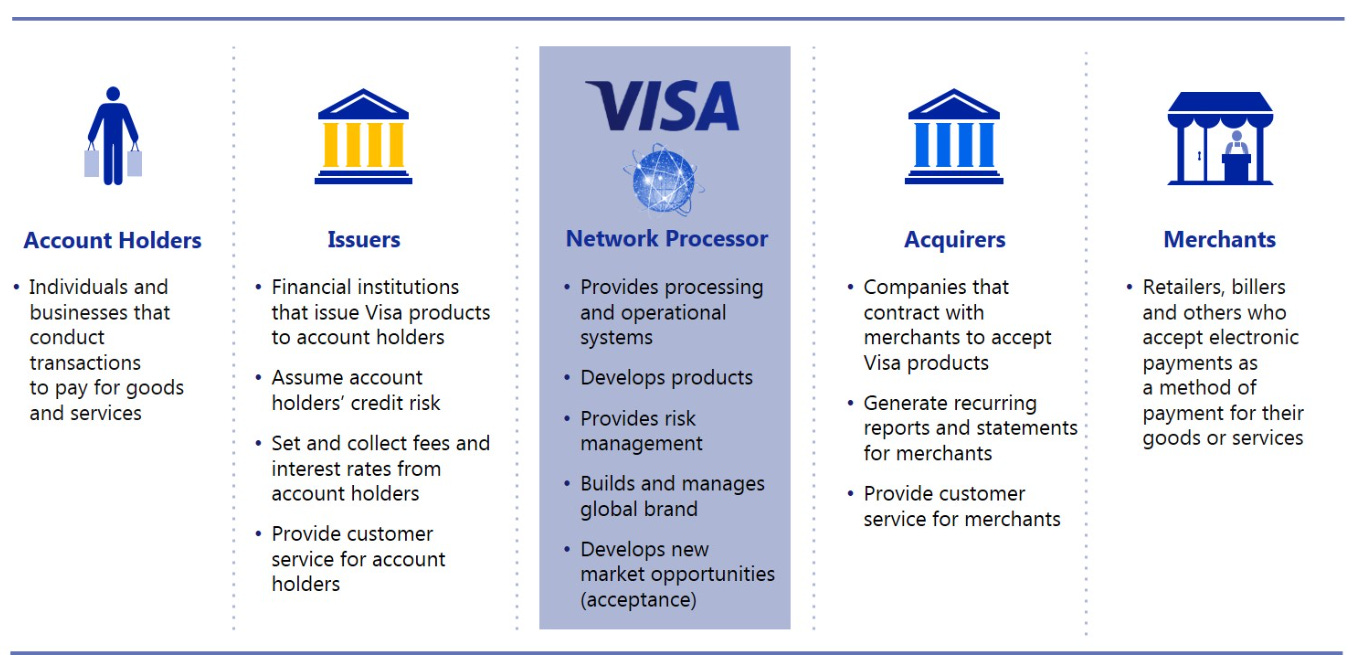

Visa (V)

Visa is a global payments technology company that facilitates electronic fund transfers, primarily through credit, debit, and prepaid cards.

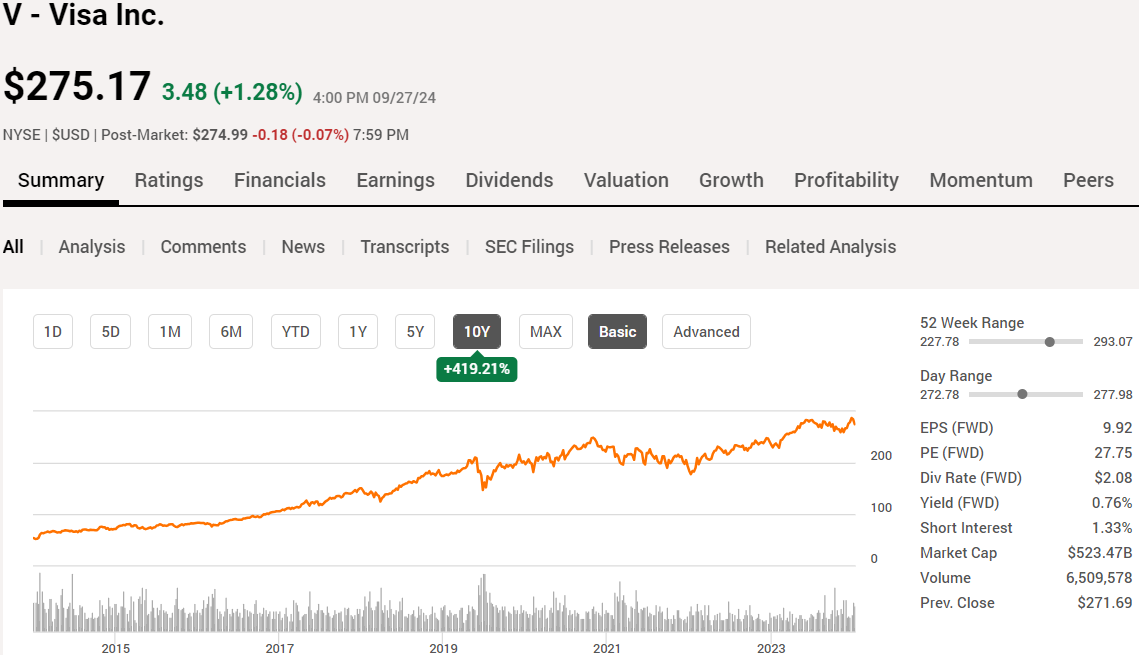

Over the last 10Y Visa has significantly outperformed the S&P 500 up 419%.

As per below, we get a double undervaluation signal as the current yield is above the 5Y average (0.76% v 0.72%) and the Forward P/E is lower than the 5Y (25.7x v 28x).

Dividend Safety score of 99 indicates safety.

Consistently strong and double digit growth year on year!

ROIC is very strong and has been increasing over the last 10Y.

Currently sitting at 36% on a trailing twelve month basis.

The Net Debt to EBITDA of 0.05 for 2023 showing how strong the balance sheet is and why we see a 99 dividend safety score.

As per below, Wall Street see 14.63% upside over the next 12 months.

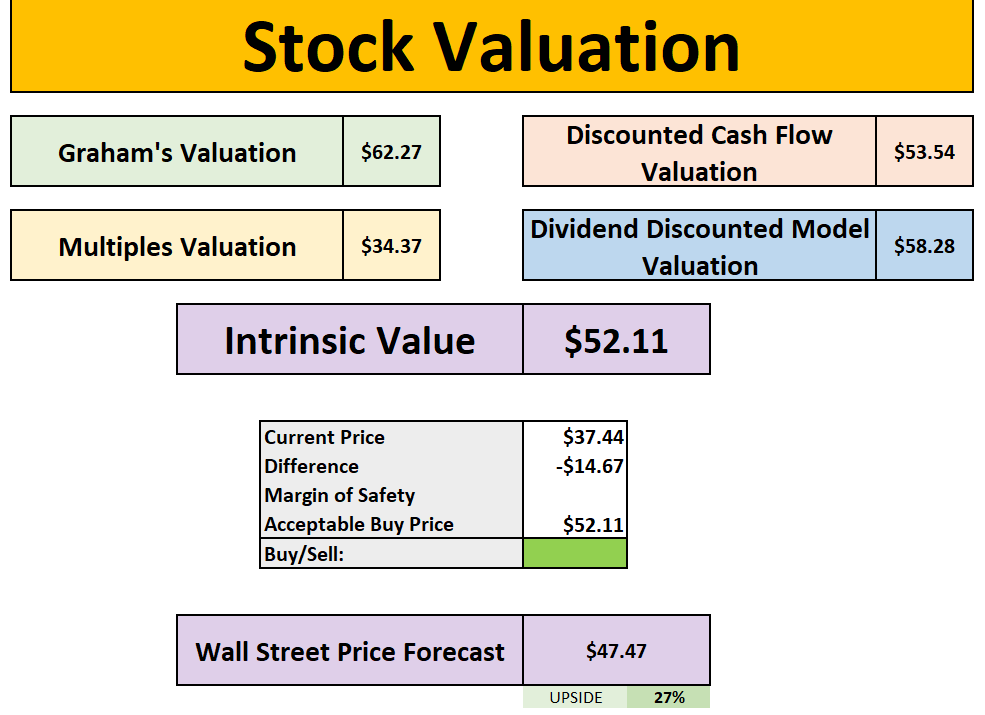

When we last ran it through our valuation model our intrinsic value came to $322.56

So, in conclusion for Visa, we see around a 15% margin of safety around the $274 mark with Wall Street indicating 15% upside.

Whilst we believe this is a high-quality stock, we would wait for a larger margin of safety before adding.

Stock Valuation Model

If you are interested in valuing stocks yourself, we have created a valuation model below which you can pick up, this is the same version we use in our YouTube analysis:

Seeking Alpha

Seeking Alpha, one of the websites that I use when I review stocks on YouTube has a $25 off discount for your first year. This also includes a 7-day free trial for new users too!

Patreon

Join our community in the Patreon where we discuss weekly buy and sells.

Conclusion

We have just gone through 3 Stocks I’m buying in October.

However as always do your own due diligence and let us know your thoughts about today’s newsletter in the comments.

I hope you all have a great week ahead!

Thanks For Reading!

If you’d like to support this work feel free to buy me a coffee. The proceeds will contribute to the running costs of the newsletter.

Join the community of investors - subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today’s newsletter helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Note

I am not a financial advisor or licensed professional. Nothing I say or produce anywhere, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk.