3 Stocks I'm Buying in November

The October volatility didn’t scare me - it revealed opportunity. Here’s where I’m putting fresh capital this month.

Market Update

Markets Split as Tech Giants Carry the Load

It was a mixed week for U.S. stocks. Big tech once again did the heavy lifting, while smaller names struggled to keep up. The Nasdaq led the pack, driven by relentless strength in mega-cap tech companies riding the artificial intelligence wave.

But beneath the surface, the rally was narrow. The S&P 500 barely moved - even though seven of its eleven sectors actually fell.

Earnings Season: The Magnificent Seven Take the Stage

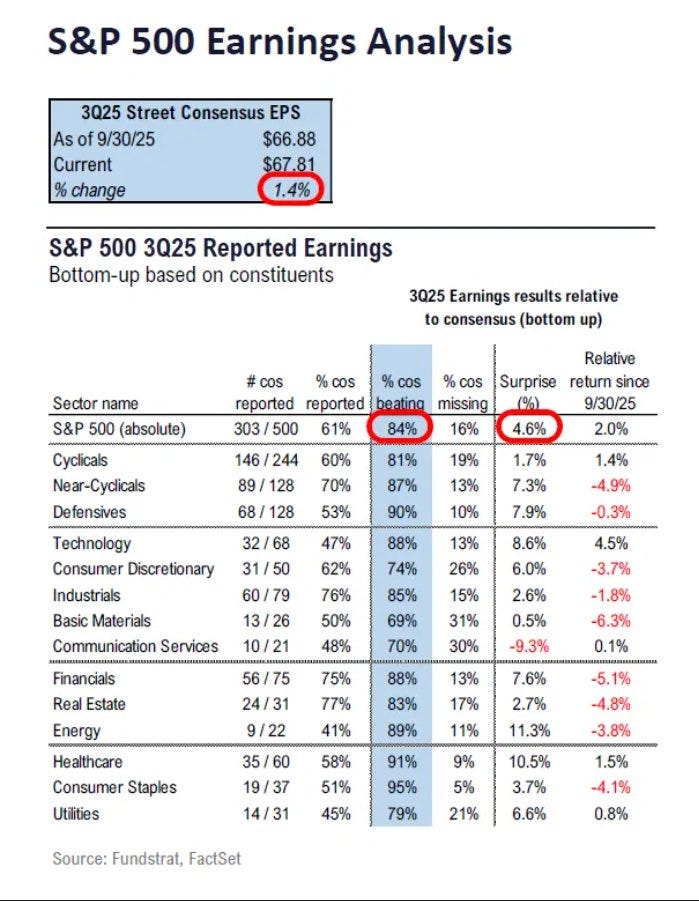

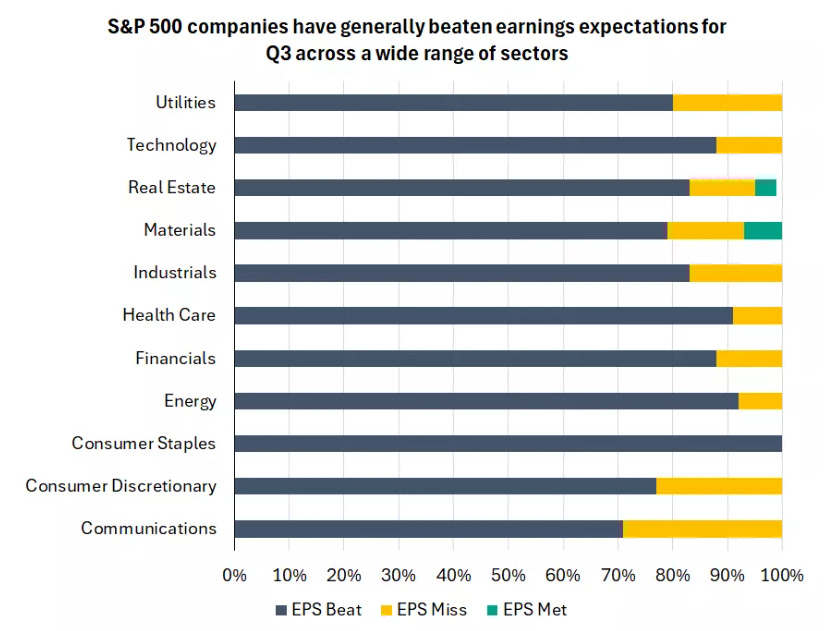

Earnings season is in full swing, with over a third of S&P 500 companies now reporting.

So far, 83% have beaten Wall Street’s earnings expectations.

Among the so-called “Magnificent Seven,” reactions were mixed. Microsoft, Apple, and Meta dipped after their results, while Amazon and Alphabet moved higher. NVIDIA, meanwhile, made history - its stock surged past a $5 trillion market cap midweek, making it the first company ever to cross that milestone.

U.S. and China Hit Pause on the Trade War

Markets also found some relief from geopolitics. In South Korea, U.S. President Donald Trump and China’s President Xi Jinping agreed to a one-year trade truce. The deal includes modest concessions: lower U.S. tariffs on Chinese imports, a pause on China’s rare earth export controls, and renewed Chinese purchases of U.S. soybeans and agricultural goods.

It’s far from a full peace treaty, but the move offered a short-term boost to sentiment and eased fears of further escalation - for now.

Fed Cuts Rates, But Cautions Investors

The Federal Reserve was the other major headline. As expected, the central bank cut rates by 0.25%, bringing the benchmark range to 3.75%–4.00%.

The vote wasn’t unanimous - two officials broke ranks, with one pushing for a bigger 0.50% cut and another preferring no change at all. That split underscores how divided the Fed has become as it tries to balance sticky inflation against a cooling labor market.

After the meeting, Fed Chair Jerome Powell tamped down hopes for more cuts this year, calling a December move “not a foregone conclusion.” With the ongoing government shutdown delaying key economic data, Powell hinted that the Fed may take a wait-and-see approach heading into year-end.

Last Weeks Winners & Losers

Top performers:

UPS (+11%)

Caterpillar (+10%)

Amazon (+9%)

Nvidia (+9%)

Palantir (+9%)

Biggest drops:

Altria (-13%)

Meta (-12%)

Boeing (-9%)

Elevance (-7%)

Oracle (-7%)

Notable News

Corporate Profits Stay Strong as the AI Boom Powers On

Corporate America continues to surprise on the upside. With roughly two-thirds of S&P 500 companies now having reported earnings, most have beaten expectations - a clear sign that businesses are holding up well despite higher tariffs and a slowing economy.

At the same time, the AI frenzy keeps fueling markets. Big tech once again led the charge, helping large-cap indexes reach new record highs by the end of the week. Not every report was a winner - Microsoft’s results fell short of lofty expectations, and Meta’s plan to fund heavy AI investments through new debt didn’t sit well with investors, sending its shares lower.

But brighter news from Apple and Amazon reignited optimism. Amazon’s stock jumped more than 10% on Friday alone, giving both the Nasdaq and S&P 500 another leg up - now nearly 40% above their April lows.

Still, the excitement has many wondering whether we’re entering bubble territory. Fed Chair Jerome Powell pushed back on that narrative, pointing out that today’s tech leaders have real earnings, strong balance sheets, and proven business models - unlike the speculative players of the dot-com era.

That said, expectations are sky-high. Over the long run, these companies will need to prove that their massive AI investments can keep delivering real profits - not just promise - to justify the valuations investors are now baking into the market.

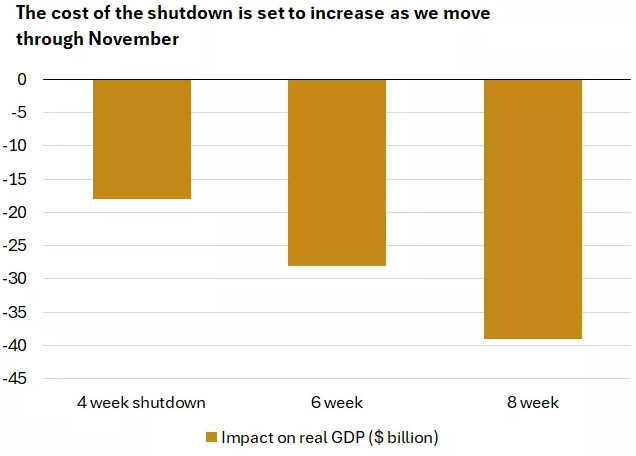

Shutdown Disruptions Start to Bite

The ongoing government shutdown is beginning to show real cracks in the system - and the Fed is right to be concerned about flying blind. Without government funding, a wave of important economic data has been delayed, including what would have been the first estimate of third-quarter GDP this week.

Still, not all the news is bad. Private-sector data is offering some encouraging signs of resilience. State-level unemployment claims remain stable, showing no big spikes in job losses. ADP’s new weekly payroll tracker also shows hiring continuing at a steady, if modest, pace - around 60,000 new jobs a week through October.

But the broader economic toll is mounting. Hundreds of thousands of federal workers and contractors remain unpaid, government services are grinding to a halt, and roughly 40 million Americans are facing disruptions to SNAP benefits. The Congressional Budget Office estimates the shutdown has already shaved about 1% off annualized fourth-quarter GDP growth - a hit that could climb to 1.5% by mid-November and 2% by the end of the month, or nearly $40 billion in lost output.

With the shutdown on track to become the longest in U.S. history, the hope is that mounting economic pressure will finally push Congress toward compromise. So far, markets seem largely unfazed - but that resilience could be tested if the political stalemate drags on much longer.

A Not-So-Scary October

October brought its fair share of market jitters, but investors came out the other side largely unshaken. Volatility spiked mid-month, yet by the time the dust settled, major indexes had held their ground.

As we move into November, uncertainty remains - from the ongoing government shutdown to questions about when the Fed will finally start cutting rates - but the broader picture still looks constructive.

Looking ahead, there are reasons to stay optimistic. Economic growth is expected to pick up through 2026, helped by lower interest rates, a fresh round of personal and corporate tax cuts, and easing trade frictions. Together, these forces could give both consumers and businesses a meaningful lift.

On the market side, the AI investment boom shows few signs of slowing. Big tech continues to benefit from this wave of spending, while smaller companies could gain from improving growth, lower borrowing costs, and friendlier tax policy.

Earnings Season

Join 116,000+ investors on YouTube! 🎥

We break down earnings, market moves, and exclusive insights you won’t find anywhere else.

Don’t miss out — hit the button below to watch and subscribe now! 👇

YouTube Channel 🔔

Subscribe today and stay ahead of the market!

Fear & Greed Index

3 Stocks I’m Buying in November

October’s volatility had investors on edge, but the market’s resilience told a different story - one of strength beneath the surface.

AI spending is still accelerating, rates are likely past their peak, and companies are delivering real profits despite the noise.

For patient investors, that’s the perfect setup.

In this environment, I’m focusing on businesses with pricing power, strong cash flows, and exposure to the themes driving this cycle forward.

Here are the three stocks I’m buying in November - and why I think they can keep compounding through whatever the market throws next.

1. Meta Platforms (META)

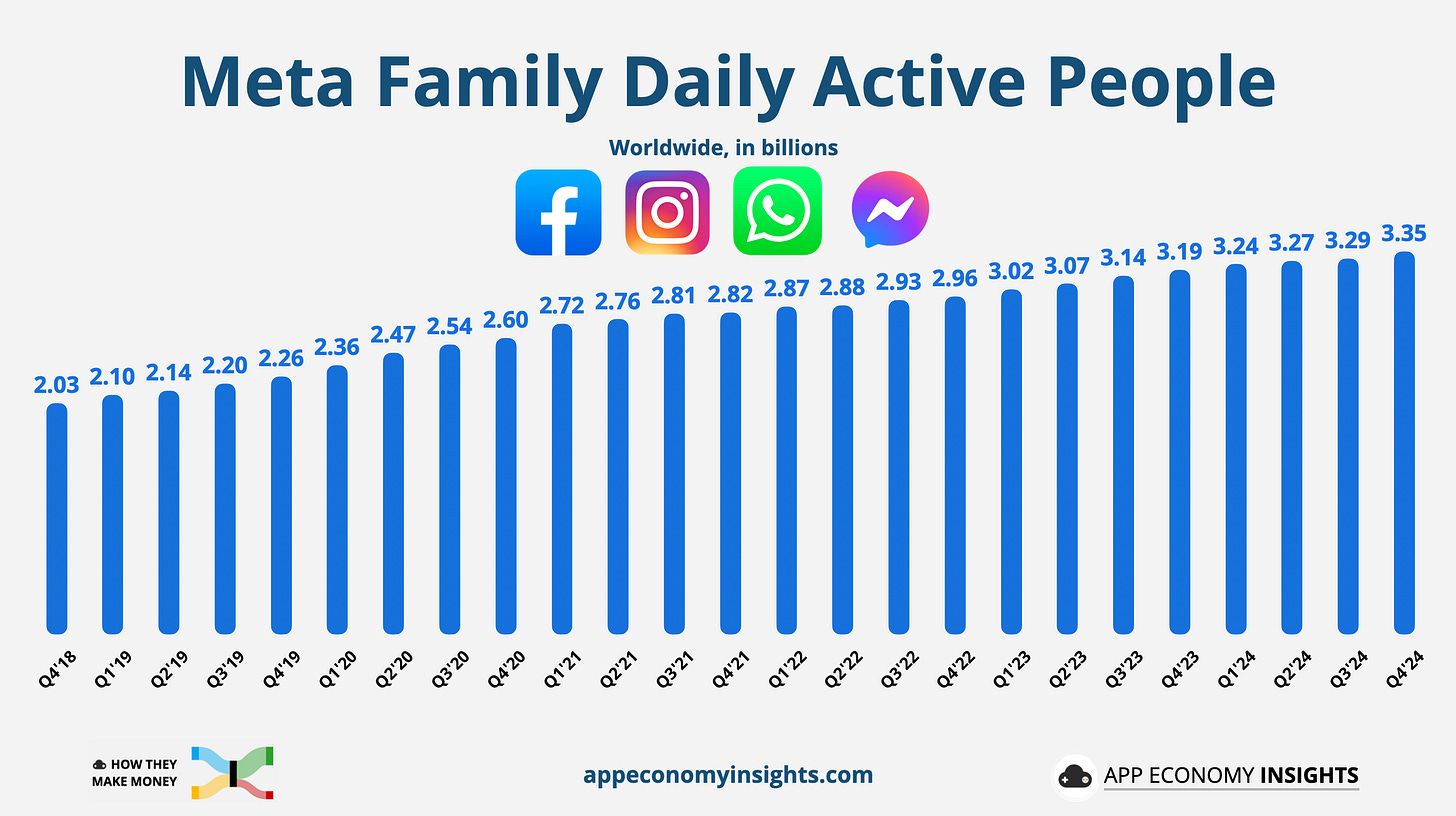

Meta Platforms is best known as the company behind Facebook, Instagram, and WhatsApp - three of the biggest social networks on the planet.

Billions of people use these apps every day to connect with friends, share photos, watch videos, and even shop online.

In other words, Meta isn’t just a tech company; it’s a hub for how people communicate and spend time online.

Beyond social media, Meta owns Oculus, a leading virtual reality (VR) headset brand, and has invested heavily in building the “metaverse” - a digital world where people can interact in 3D spaces.

While these futuristic projects grab headlines, most of Meta’s revenue still comes from advertising, helping businesses of all sizes reach highly targeted audiences across its platforms.

Meta has faced its share of challenges in recent years - increased competition, changing privacy rules, and skepticism around its metaverse bets.

But it remains a cash-generating powerhouse.

With billions of users, a strong grip on social advertising, and plenty of room to grow its newer ventures, Meta is a company that can keep compounding value over the long term - especially for investors who look past the short-term noise.

Why Meta Dropped After Earnings

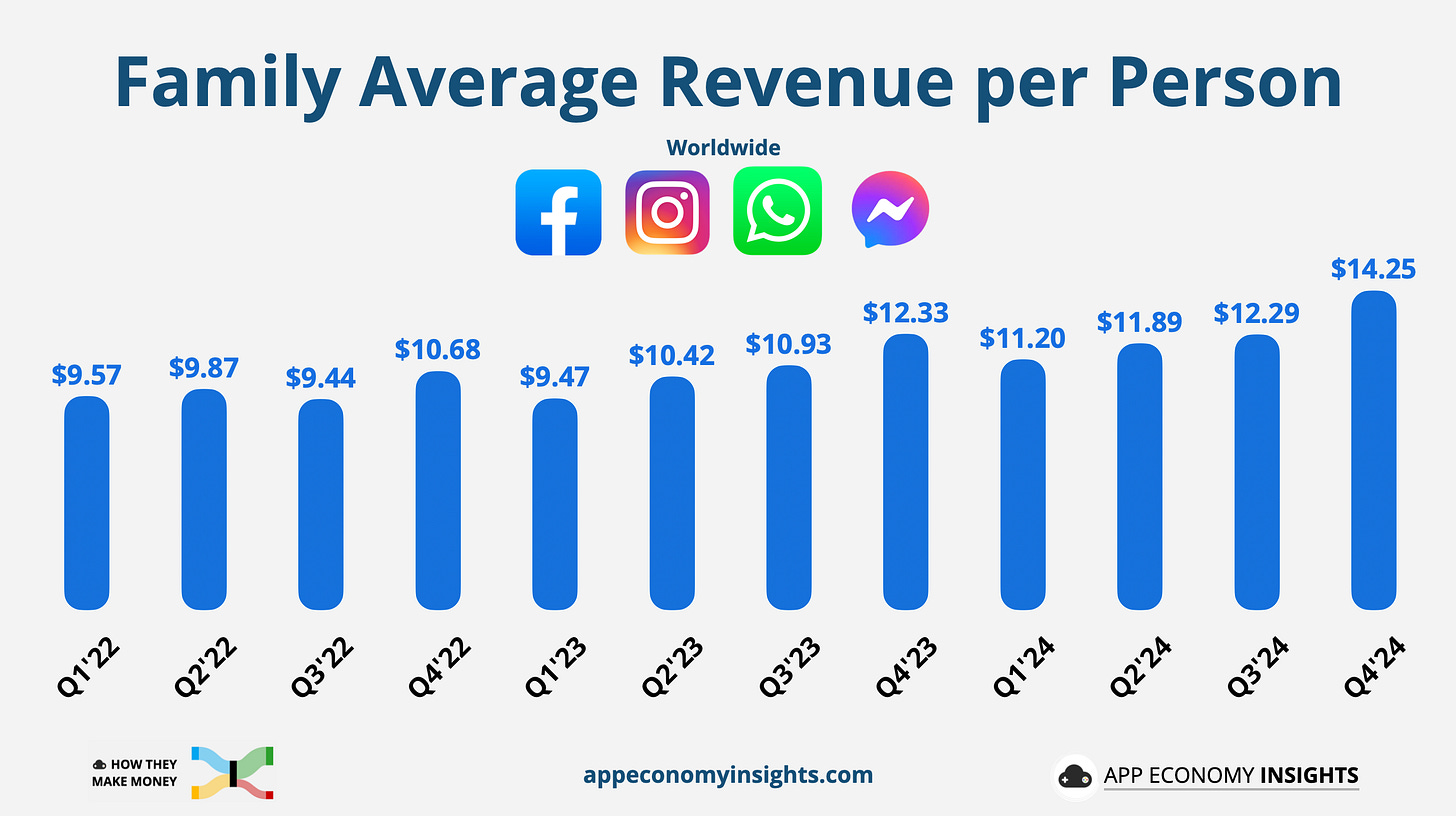

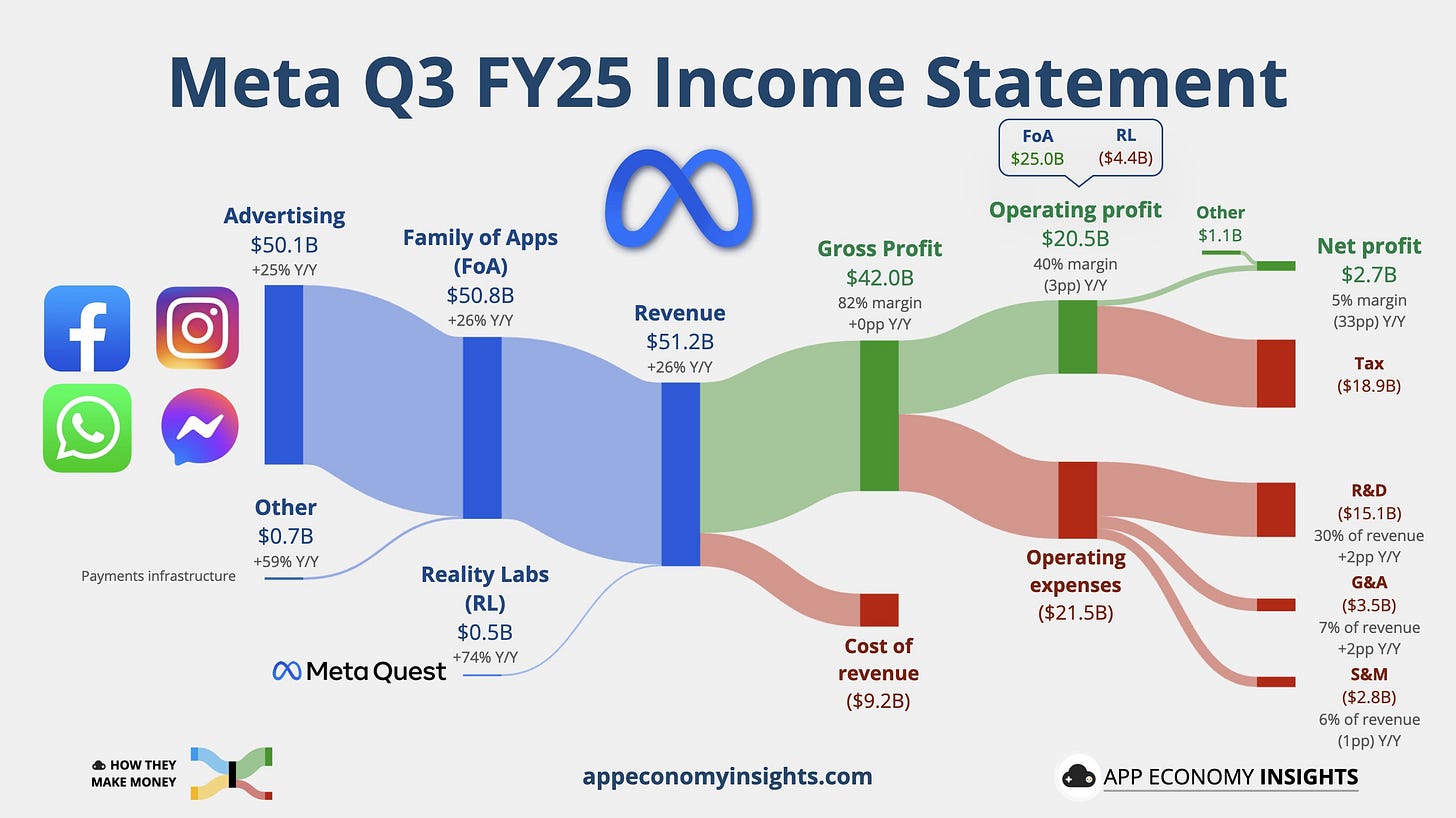

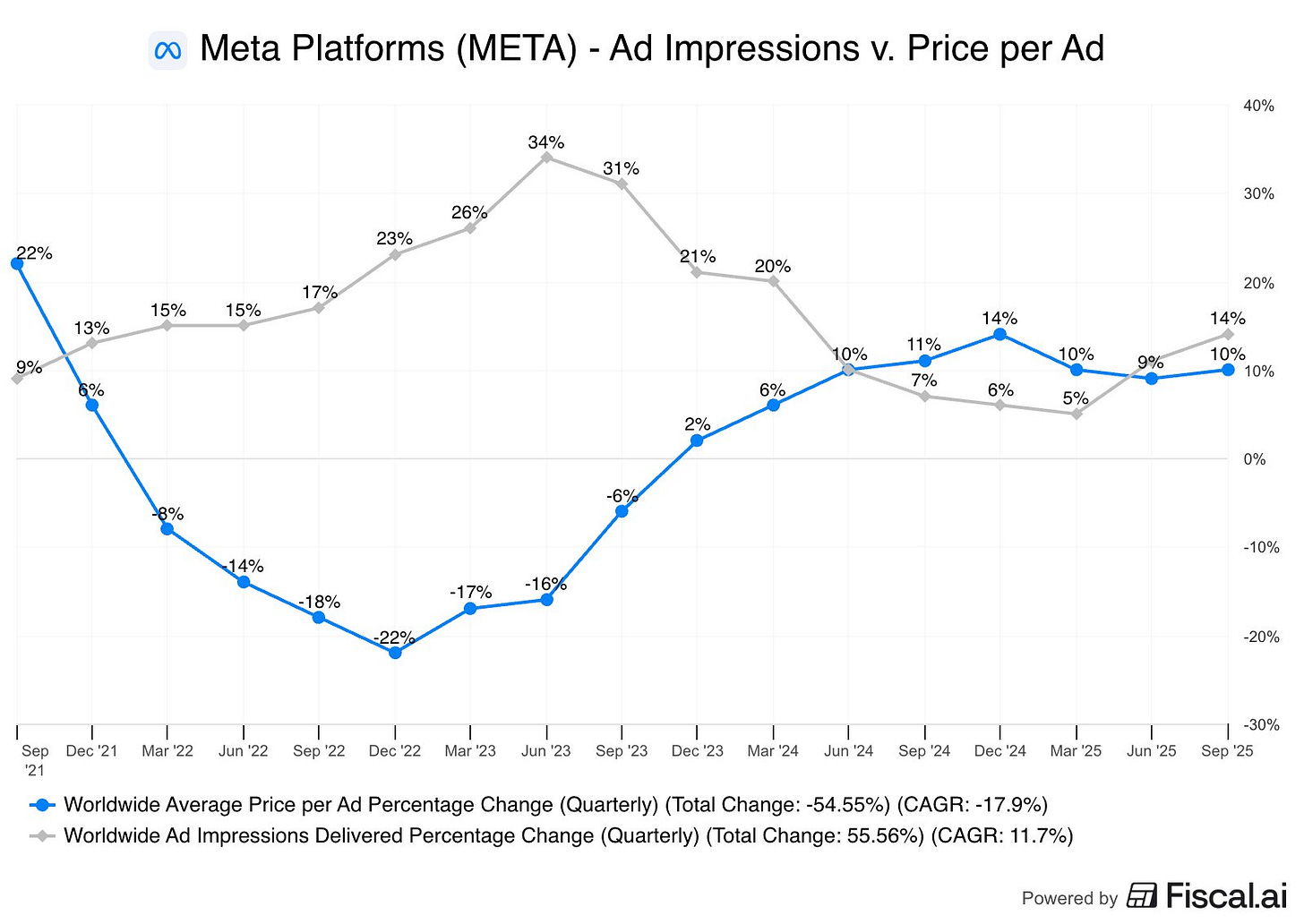

On the surface, Meta’s third-quarter results looked solid: revenue reached $51.2 billion, up 26% year-over-year. Daily active users across its apps rose to 3.54 billion, and ad impressions and average ad prices both increased.

But despite these positive numbers, the stock pulled back for three main reasons:

One-Time Tax Charge & EPS Shock

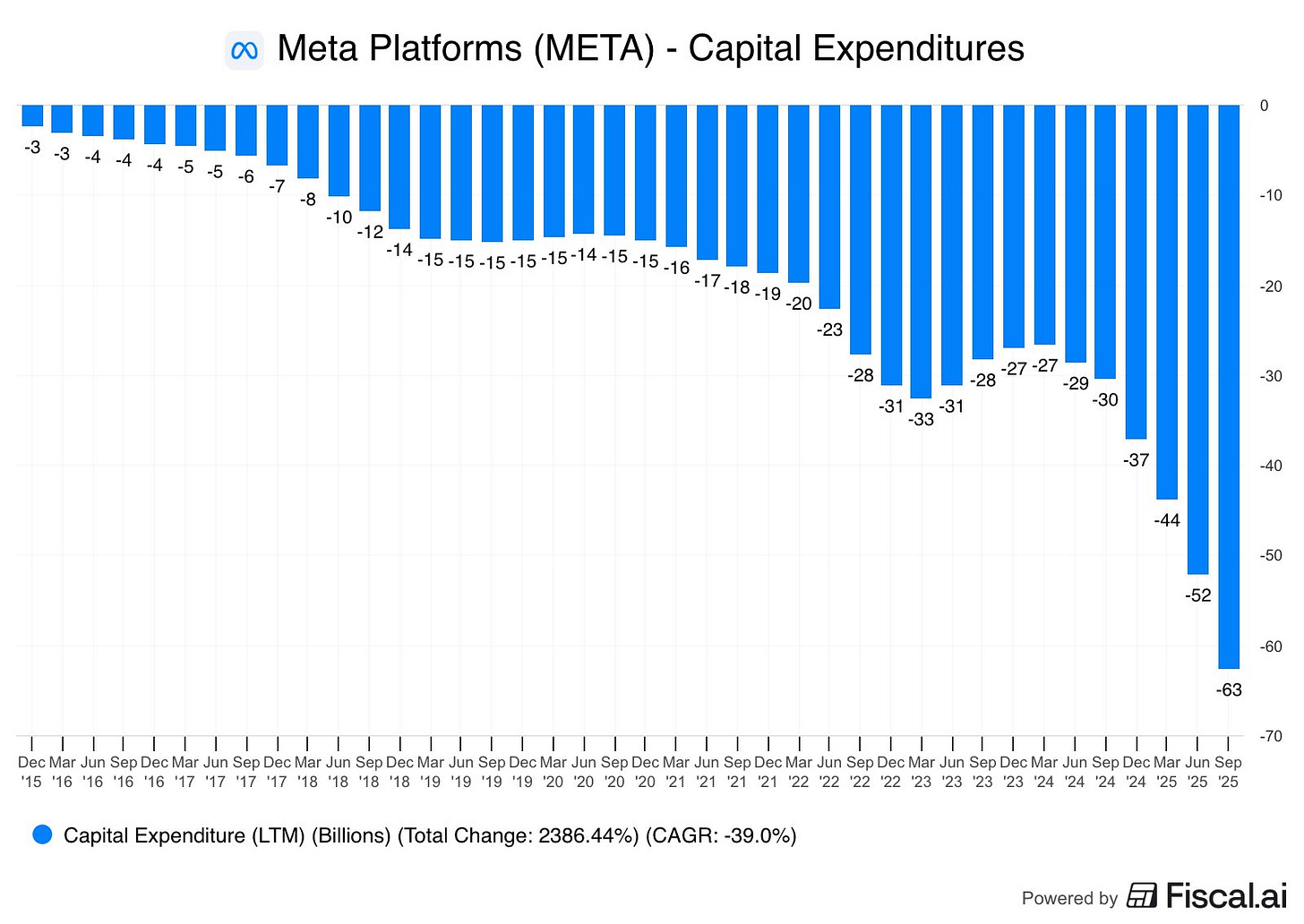

Meta reported diluted earnings per share (EPS) of just $1.05, well below expectations. This number included a non-cash, one-time tax charge of nearly $16 billion. Adjusted for this, EPS would have been around $7.25 - showing that the underlying business is still strong.Capital Expenditures (Capex) Ramp-Up

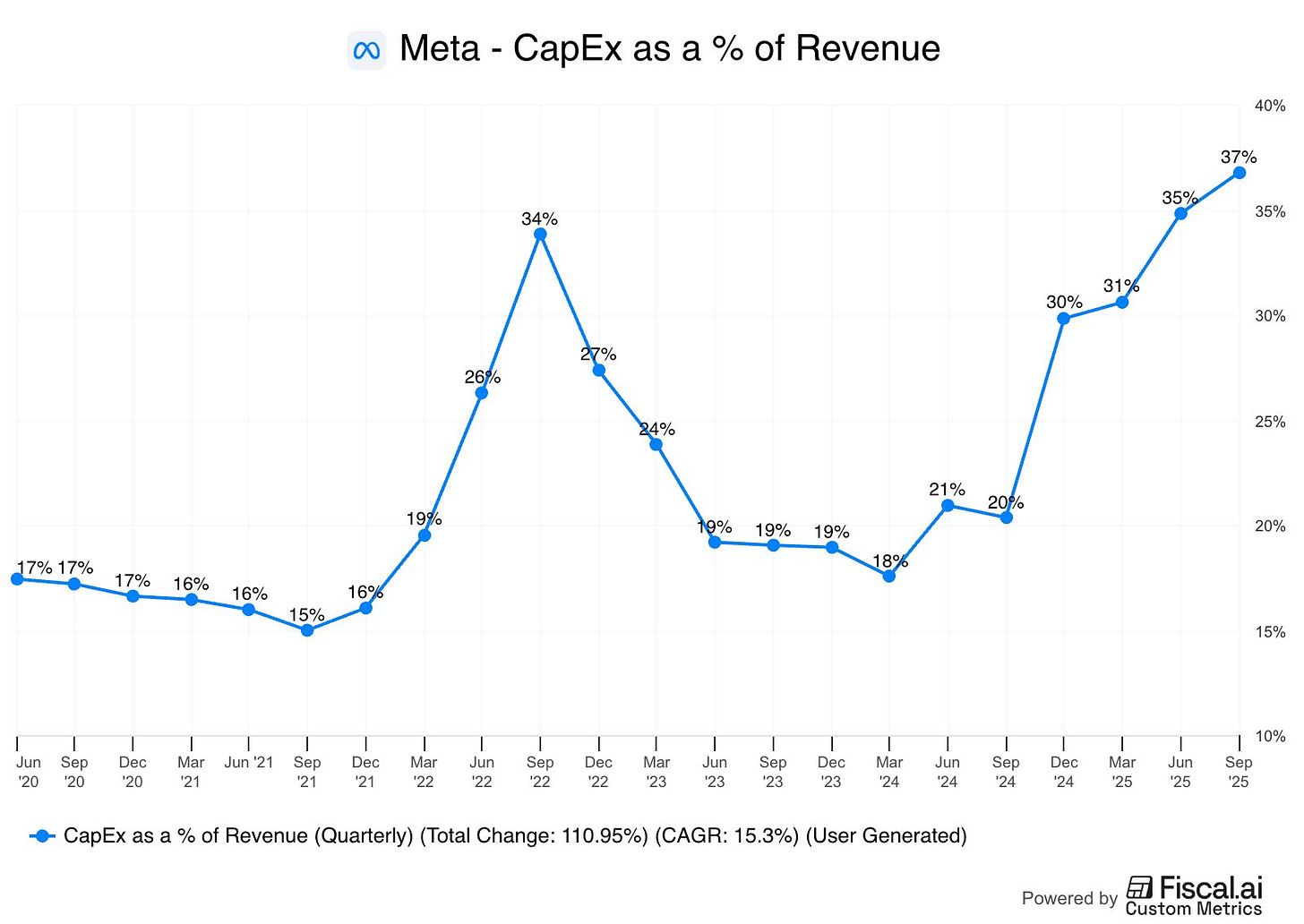

Meta’s spending is increasing dramatically. For Q3, capex totaled roughly $19.4 billion, and the company raised its full-year guidance to $70–72 billion. This spending covers everything from data centers to AI infrastructure to Reality Labs. While it positions Meta for future growth, the scale of investment spooked short-term investors.We can also note that as a % of revenue, CAPEX spending continues to climb.

Timing of Returns

While ad revenue continues to grow, investors are wary about how quickly the massive investments in AI and the metaverse will translate into profits. Combined with the tax charge and ramped capex, the earnings report highlighted that Meta is spending big today for growth that may pay off over the next several years.

Historically though, their return on invested capital has been strong.

Why This Might Be the Perfect Time to Buy Meta

Meta’s recent pullback after earnings might feel concerning at first glance, but when you dig into the numbers, it could be a rare opportunity for long-term investors.

First, the balance sheet is rock solid. Over the past ten years, Meta has maintained a net debt-to-EBITDA ratio of 0, and even on a trailing twelve-month basis, it sits at just 0.05. That’s practically debt-free - giving the company tremendous flexibility to invest in growth without risking its financial health.

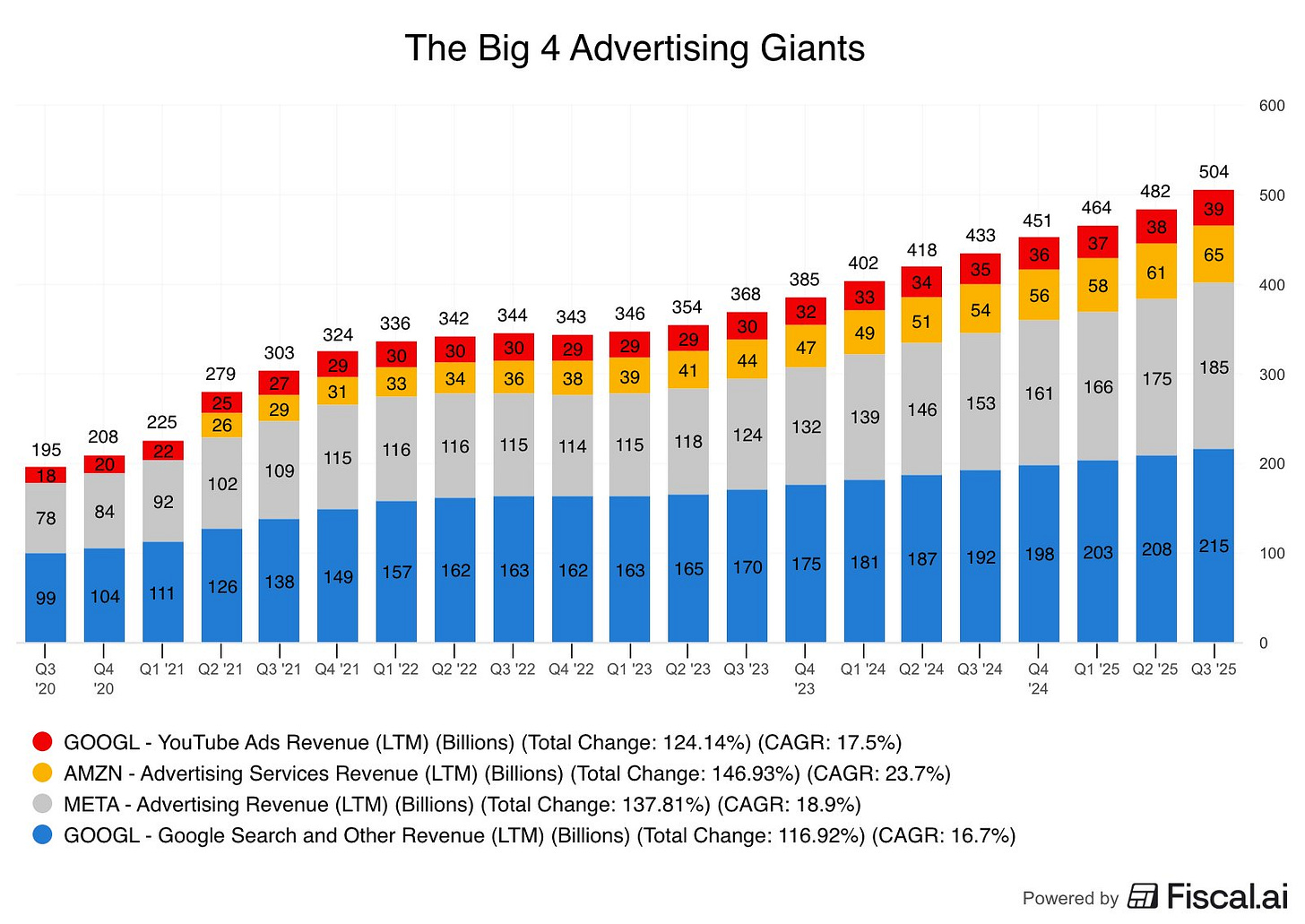

Next, growth remains impressive. Among the big advertising giants, Meta has been the second-fastest growing since 2020, with a 19% CAGR, trailing only Amazon.

Operating income has climbed steadily as well, up 30% CAGR since 2015, highlighting the company’s ability to convert revenue into profits.

Even in this quarter, the core business shows double-digit growth in both price per ad and impressions delivered - evidence that Meta’s advertising engine remains strong and resilient, despite short-term investor jitters.

When you combine this robust financial position with billions of engaged users, a dominant position in social advertising, and a clear runway for AI and metaverse investments, it paints a compelling picture: Meta isn’t just surviving short-term volatility - it’s building for long-term compounding growth.

For investors willing to look past the headlines, this pullback could be the chance to buy a world-class business at a momentary discount, before the market fully prices in its long-term potential.

Valuation

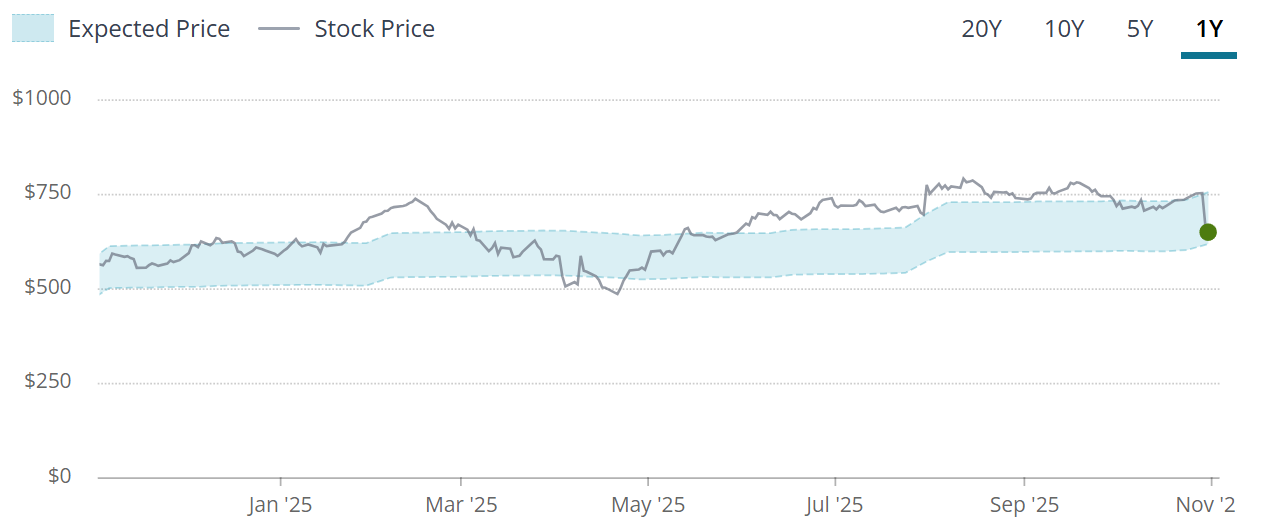

The forward P/E sits below the historical - 21.9x v 23.3x. This could indicate the company is potentially undervalued.

The blue tunnel methodology highlights that the company is towards the bottom end of the intrinsic/fair value boundaries indicating potential undervaluation.

When we zoom out of the last 10Y we can see this Company has traded a lot in an undervaluation signal below the bottom end, highlighting that more often than not the market offers META to investors at a discount.

DCF Model

Using our DCF model a few things to note:

9% is baked into the FCF growth moving forwards.

Using 12% (the lower rate) gives an intrinsic value of $800.

Using 14% (the middle rate) gives an intrinsic value of $921.

Using 16% (the higher rate) gives an intrinsic value of $1,059.

Using the lower growth rate of 12%, we get an average intrinsic value of $800 which leads to a 19% margin of safety.

On average wall street see 36% upside into 2026.

Using the middle growth rate of 14%, we get an intrinsic value of $921 which leads to a 30% margin of safety.

Keep reading with a 7-day free trial

Subscribe to Dividend Talks to keep reading this post and get 7 days of free access to the full post archives.