3 Stocks I’m Buying in the Middle of This AI Sell-Off

Volatility and rate jitters are shaking markets — and opening up rare opportunities.

Market Update

U.S stocks slipped this week, even as earnings and economic data delivered a few bright spots.

Traders blamed the pullback on a familiar pair of worries: stretched valuations and fresh doubts over whether the AI boom can keep paying for itself.

Forward P/E of S&P 500

The S&P 500 ended the week down 2.11%

The Nasdaq took the hardest hit, while mid-caps and small-caps held up a bit better but still ended in the red.

The S&P 500 now sits roughly 4% below its late-October peak, though a choppy Friday rebound helped soften the week’s damage.

The spotlight, of course, was on NVIDIA.

Its blowout revenue and upbeat forecast briefly lifted the market - until sentiment flipped mid-morning and the stock dragged the indices lower. No new catalyst, just the market’s lingering unease about AI’s true payoff.

Walmart’s strong e-commerce-driven quarter offered a counterbalance, and the long-delayed September jobs report landed with a mixed thud: hiring perked up, but unemployment edged to a four-year high.

Meanwhile, traders spent the week gaming the odds of a December Fed cut. A cautious tone in October meeting minutes kept uncertainty high, but dovish comments from NY Fed President John Williams nudged rate-cut odds to nearly 70% by Friday.

Last Weeks Winners & Losers

Top performers:

Google (+9%)

Paccar (+8%)

Merck & Co (+6%)

Medtronic (+6%)

Johnson & Johnson (+5%)

Biggest drops:

AMD (-17%)

Micron (-15%)

Robinhood (-13%)

Palantir (-10%)

Uber (-9%)

Notable News

AI Stocks - Nvidia

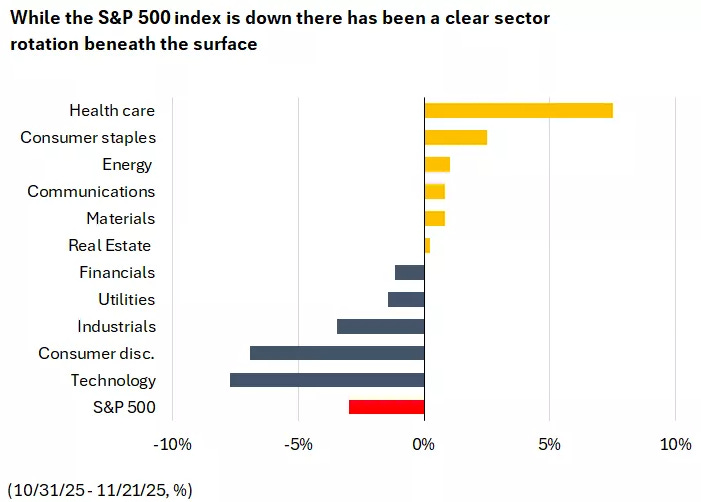

AI stocks stayed under pressure this week. The Magnificent Seven have stumbled through November, sliding roughly 6% and dragging large-caps - especially the Nasdaq - lower.

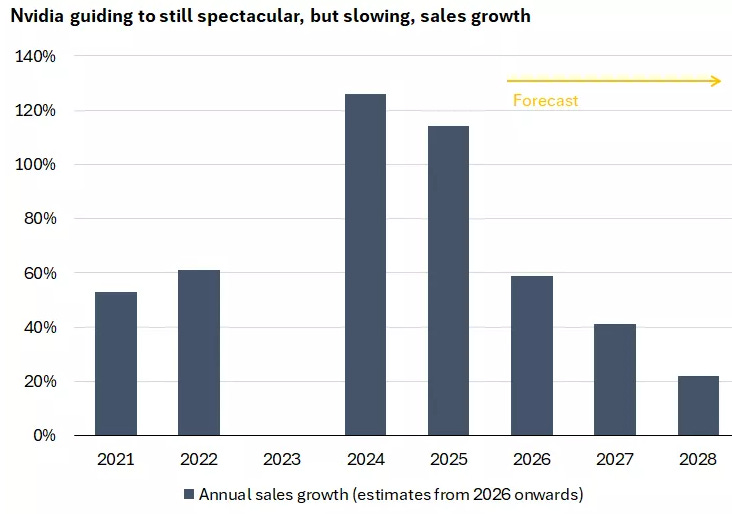

NVIDIA’s results looked great on paper: stronger Q3 sales, better Q4 guidance, and hints that long-term AI revenue could blow past the already-massive forecasts. The stock even sparked a 1% pop in the S&P at the open. But the optimism evaporated fast. By the close, NVIDIA and the broader market had flipped red - something that’s happened only a handful of times since the 1950s.

Why the turn?

Two things seem to be weighing on investors. Growth is still strong, but the pace is expected to cool from its recent rocket-like trajectory. And despite Jensen Huang’s efforts to swat down “AI bubble” talk, the market is getting uneasy about how long companies can justify current levels of AI spending.

Even so, this wobble doesn’t change the bigger picture. Mega-caps continue to post strong earnings, AI investment remains robust, and valuations, while high, aren’t flashing bubble-level extremes. Still, traders should expect more hiccups - if not from fundamentals, then from shifting sentiment and stretched expectations.

The Fed Struggle

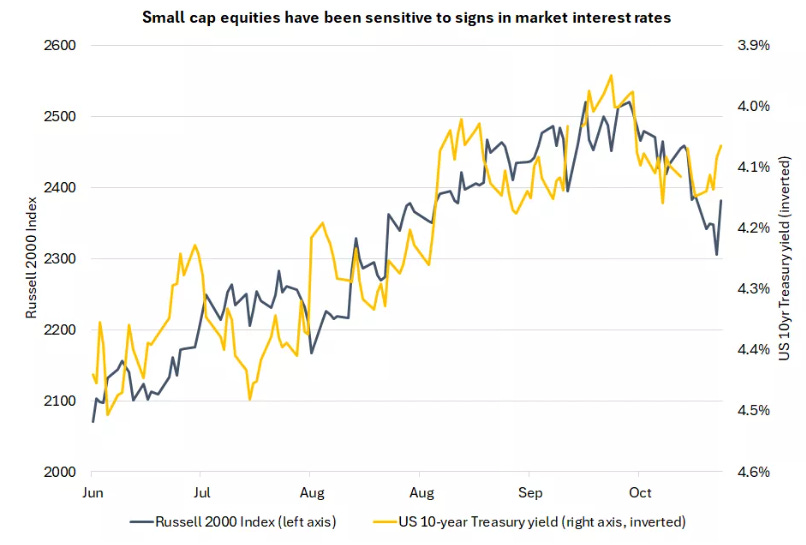

After two straight rate cuts in September and October helped fuel the market’s 2025 rally, investors are now unsure what the central bank will do at its early-December meeting.

A big part of the uncertainty comes from the fallout of the record-long government shutdown, which scrambled economic data collection. The long-delayed September jobs report finally arrived last week - and only added to the confusion. Hiring looked better than expected at 119,000, with gains spread across more sectors, but previous months were revised down and unemployment continues to drift higher.

And that’s it: the last clean labor-market reading the Fed will get before its December 10 decision. The October and November jobs reports won’t land until December 16, and inflation data is in similar limbo with no October CPI and November arriving too late. For a central bank targeting employment and inflation, flying partially blind is far from ideal.

The Fed’s October minutes show the anxiety clearly: policymakers worried about “limitations to the availability of federal government data,” and hawkish members warned that further cuts, with inflation still at 3%, risk entrenching price pressures.

Markets have been whipped around by the uncertainty. A December cut was nearly fully priced in at the end of October, then odds collapsed to 30% early last week before rebounding to roughly 70% after dovish comments from NY Fed President John Williams.

If fewer cuts reflect a stronger economic backdrop - not sticky inflation - small companies could still benefit from growth tailwinds even if borrowing stays somewhat more expensive.

Diversification

Volatility always feels louder when it arrives after a long stretch of calm - like a sudden jump cut in a movie. But it doesn’t mean investors need to rewrite their entire playbook.

Instead, this latest AI-driven pullback is a useful reminder of why diversification matters.

As tech wobbled, money started drifting into overlooked areas like health care and materials/energy.

With valuations still much lower there, these sectors could have more room to catch up if AI stocks face more selling pressure.

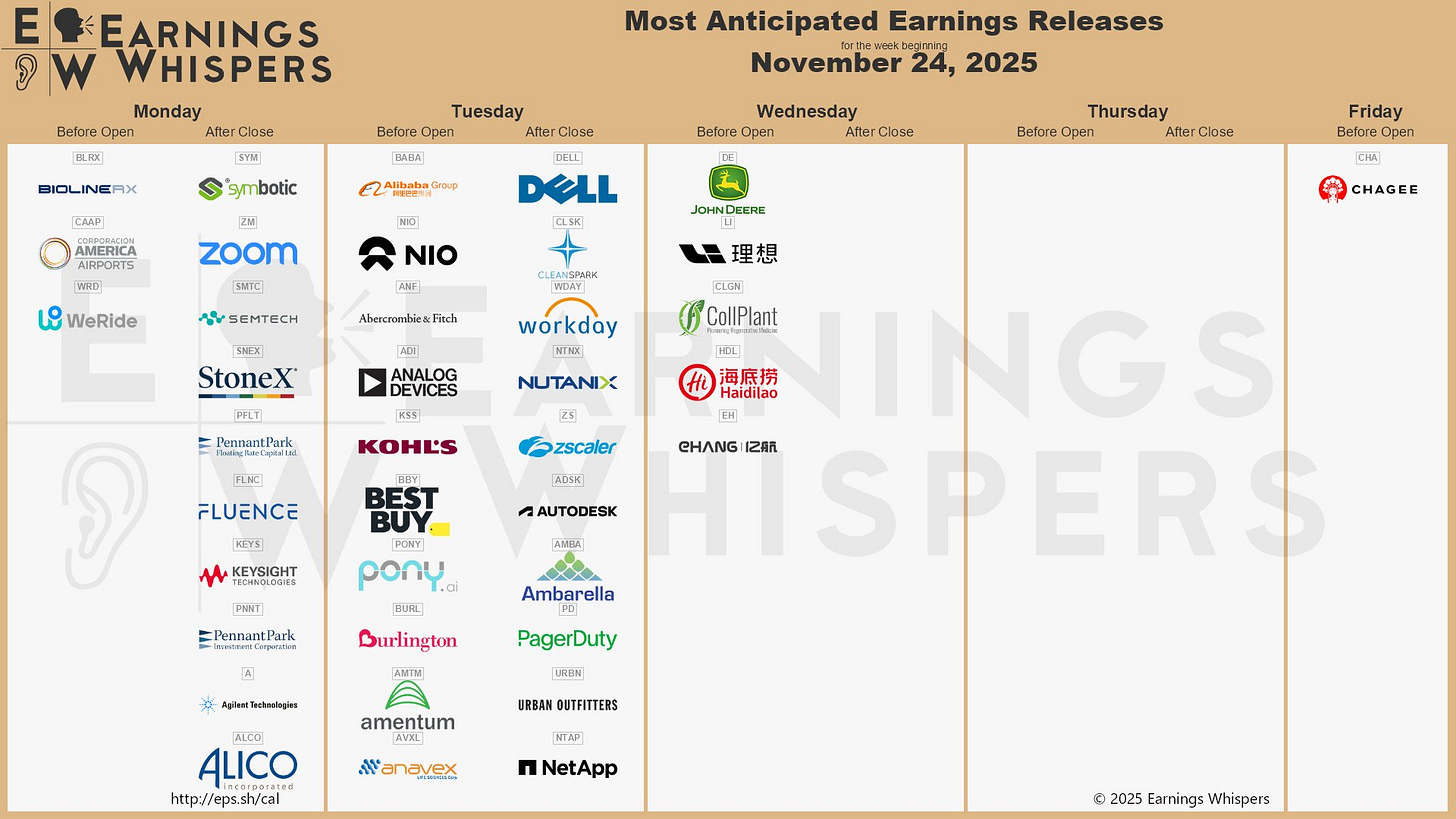

Earnings Season

Join 118,000+ investors on YouTube! 🎥

We break down earnings, market moves, and exclusive insights you won’t find anywhere else.

Don’t miss out — hit the button below to watch and subscribe now! 👇

YouTube Channel 🔔

Subscribe today and stay ahead of the market!

Fear & Greed Index

3 Stocks I’m Buying in the Middle of This AI Sell-Off

The past few weeks have reminded investors how quickly a calm market can turn cloudy.

AI leaders are wobbling, the Fed is operating with patchy data, and sentiment is swinging harder than usual.

But moments like this rarely signal “pull back and hide.” More often, they reveal where the next round of leadership is forming.

With volatility shaking loose some compelling opportunities, here are the three stocks I’m buying now - not in spite of the uncertainty, but because of it.

1. Mastercard (MA)

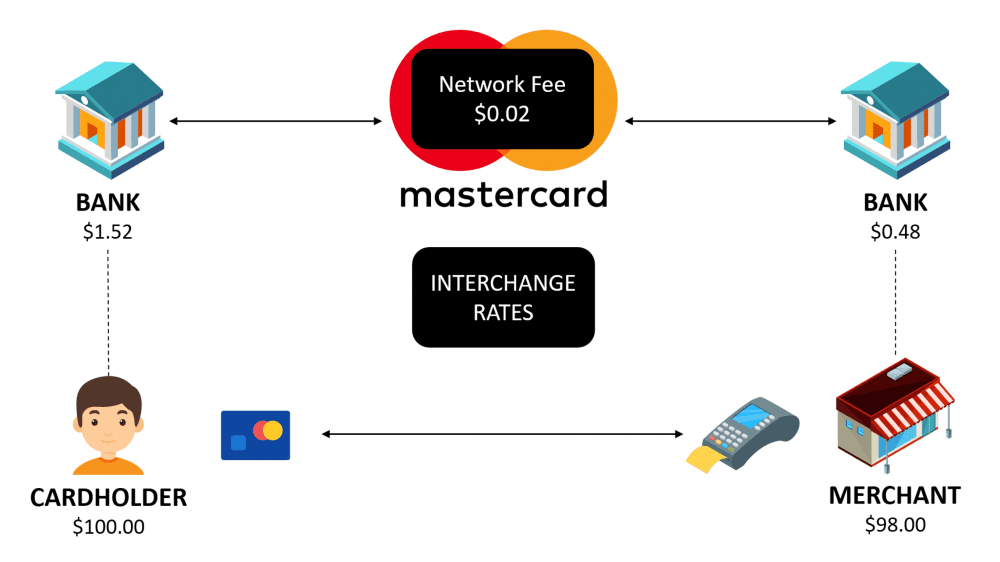

What Mastercard Actually Does

Mastercard isn’t a bank - it’s the network that connects them.

Every time someone swipes, taps, or pays online with a Mastercard, the company earns a small fee for securely moving money between the buyer’s bank and the seller’s bank.

They don’t lend money or take on credit risk - they simply run the rails that make global payments possible.

And because they sit in the middle of billions of transactions every day, Mastercard earns steady, high-margin revenue no matter which card you use or where you shop.

In short, it’s the digital tollbooth of global commerce - quietly collecting a fee every time money moves.

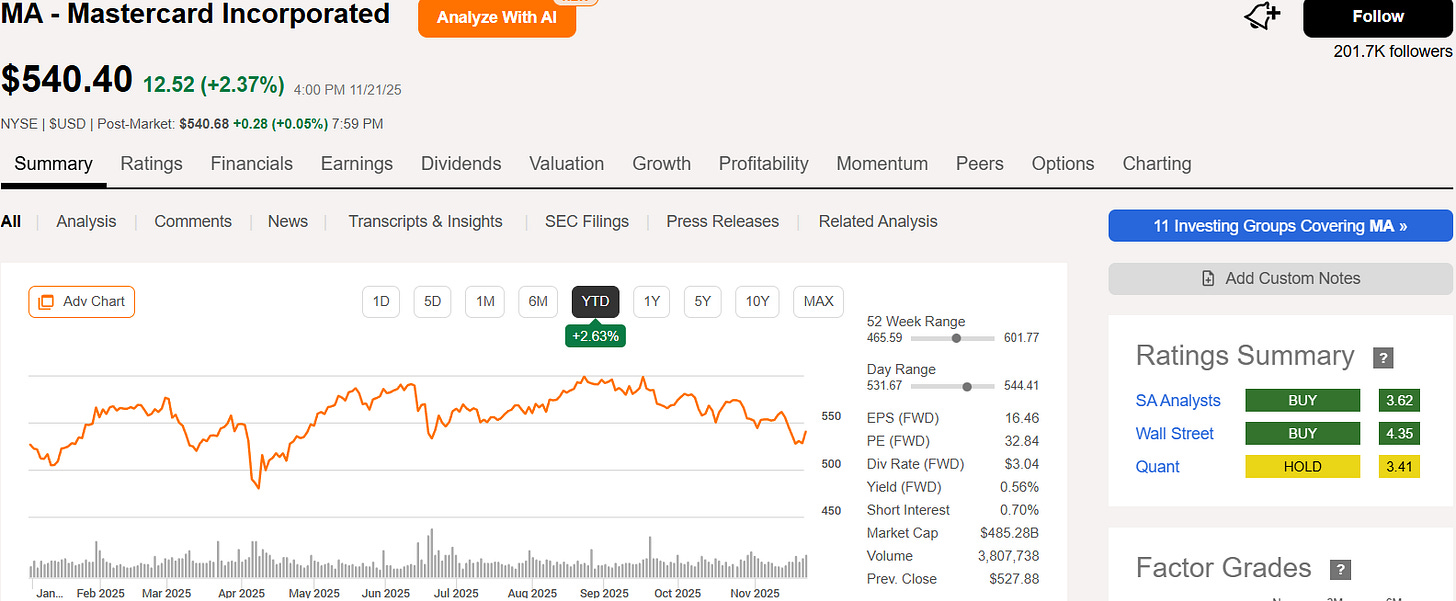

Why Mastercard (MA) Has Struggled in 2025 (Even With a Solid Q3)

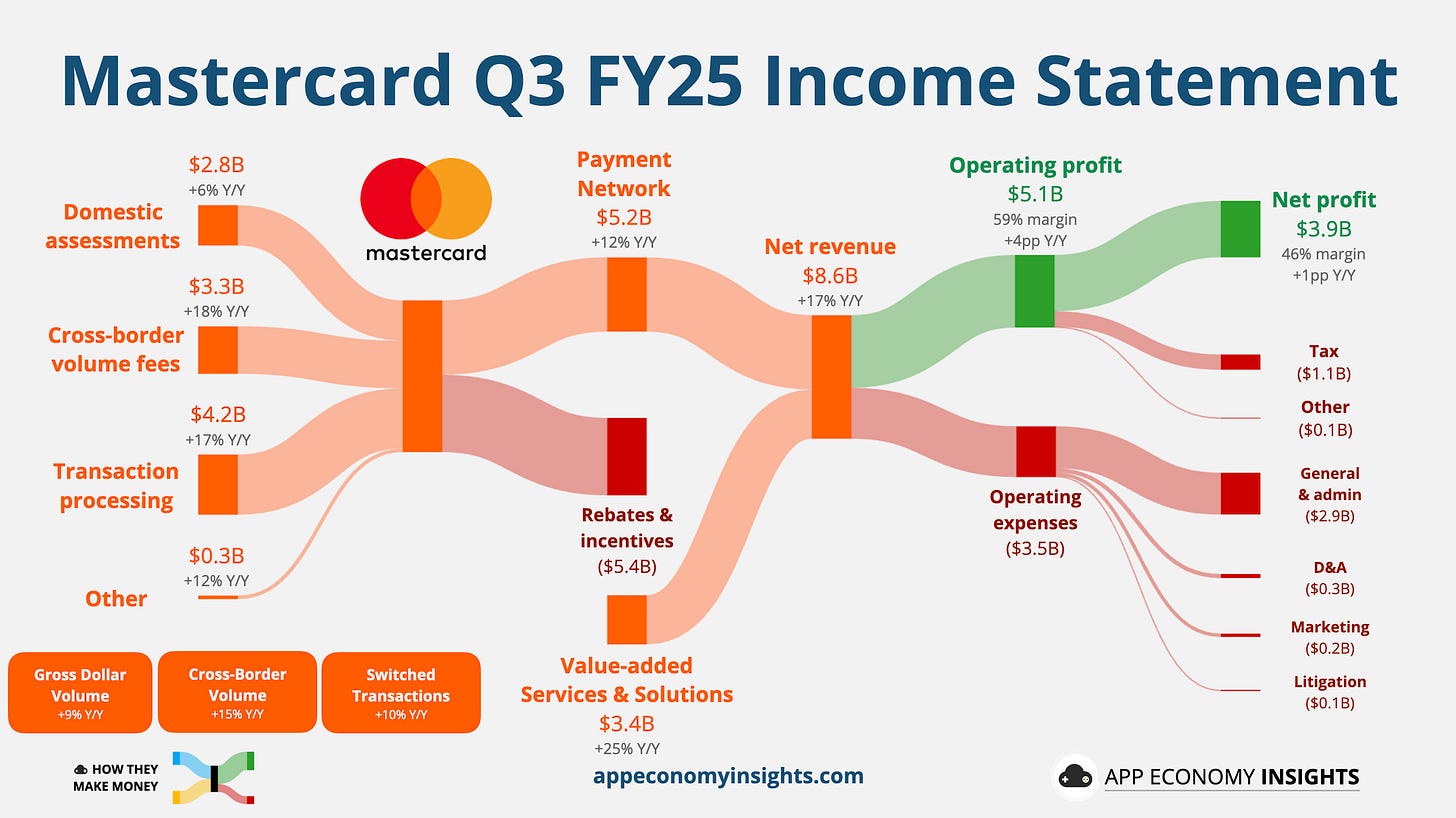

On the surface, Mastercard’s 2025 story looks strong.

In Q3, the company reported adjusted earnings of $4.38 per share, up from $3.89 a year ago.

Revenue rose 17% year‑over‑year to $8.6 billion (~15% on a currency‑neutral basis).

Gross dollar volume grew roughly 9% locally, and purchase volume increased about 10%.

Value‑added services, including fraud prevention and digital authentication, rose about 25%, outpacing the rest of the business.

Net income on a GAAP basis reached approximately $3.9 billion, up ~20% year‑over‑year.

Yet despite these strong results, the stock has under‑performed.

Here’s why:

1. The market is rotating away from “perfect” businesses.

Even with solid growth, investors have shifted toward sectors seen as cheaper or more cyclical. High-quality compounders like Mastercard are often sold first in such rotations.

2. Rate-cut ambiguity is clouding visibility.

Mastercard benefits when consumer spending and credit conditions are predictable. With uncertainty around the Fed’s next moves and incomplete economic data, investors are discounting potential growth.

3. Valuation compression is quietly biting.

Even though the fundamentals are strong, elevated valuations make high-quality names vulnerable when money flows into sectors that currently look undervalued.

4. Macro narratives are overshadowing fundamentals.

Consumer spending, cross-border volumes, and services growth remain healthy. But headlines - AI volatility, Fed uncertainty, and market rotation - are grabbing attention and weighing on sentiment.

Why This Might Be the Perfect Time to Buy Mastercard

While the market has rotated away from high-quality names like Mastercard, the company’s fundamentals tell a different story - one of consistent growth, operational strength, and capital efficiency.

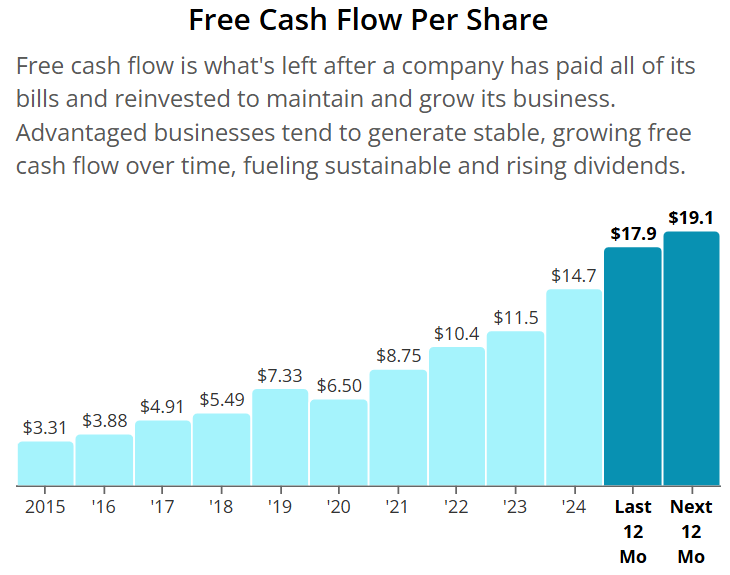

1. Free Cash Flow Growth

Mastercard’s free cash flow per share has grown steadily from $3.31 in 2015 to $14.70 in 2024, reflecting a business that not only generates cash but does so increasingly efficiently.

2. Revenue Consistency

The company has delivered double-digit revenue growth in 8 of the last 10 years, a remarkable record for a global payments processor. Even during periods of macro uncertainty, Mastercard has proven its ability to expand the top line reliably.

3. Shareholder Returns

Mastercard has steadily returned capital to shareholders. Over the last decade, shares outstanding have declined from 1.14 billion to 911 million, amplifying earnings and cash flow per share.

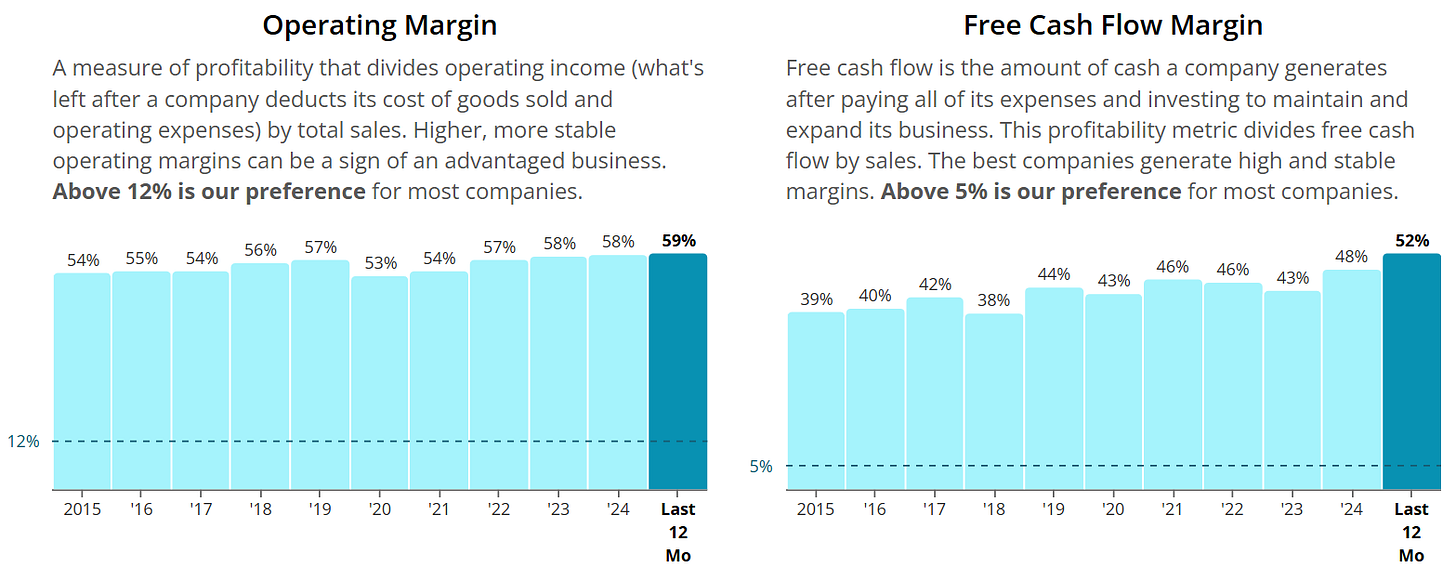

4. Exceptional Profitability

Operating margins remain elite, climbing from 54% a decade ago to 59% today, while free cash flow margin has expanded from 39% ten years ago to 52% today, highlighting the high-quality nature of its earnings.

ROIC sits at an impressive 54% on a trailing twelve-month basis. These metrics show that Mastercard is not only growing but doing so with highly efficient capital deployment.

5. Strong Balance Sheet

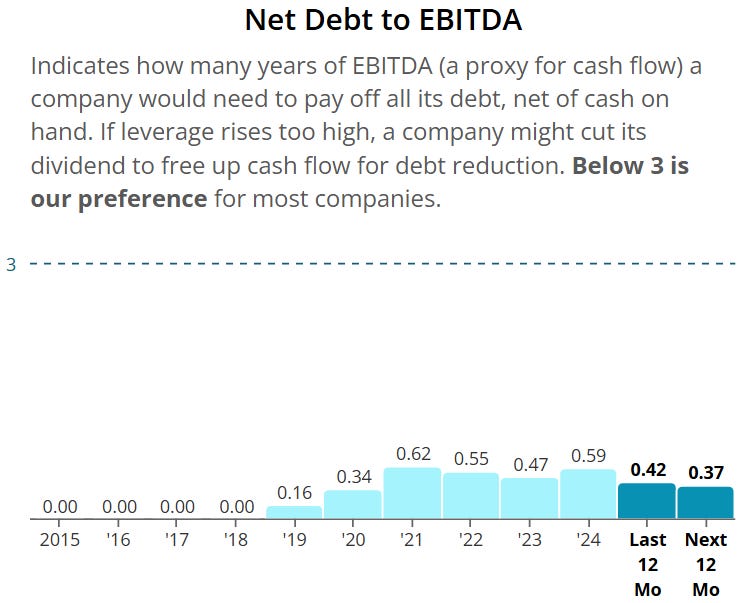

The company’s net debt to EBITDA ratio is only 0.42, giving it flexibility to invest in growth opportunities or return cash to shareholders without stretching its balance sheet.

6. Future Earnings Potential

Analysts project double-digit EPS growth over the next four quarters, supported by continued revenue growth, share repurchases, and operational efficiency.

Taken together, these fundamentals suggest that Mastercard is not just a high-quality business - it’s a resilient, cash-generating machine trading in a period of market uncertainty.

For investors willing to look past short-term rotation and headline volatility, this could be a compelling entry point.

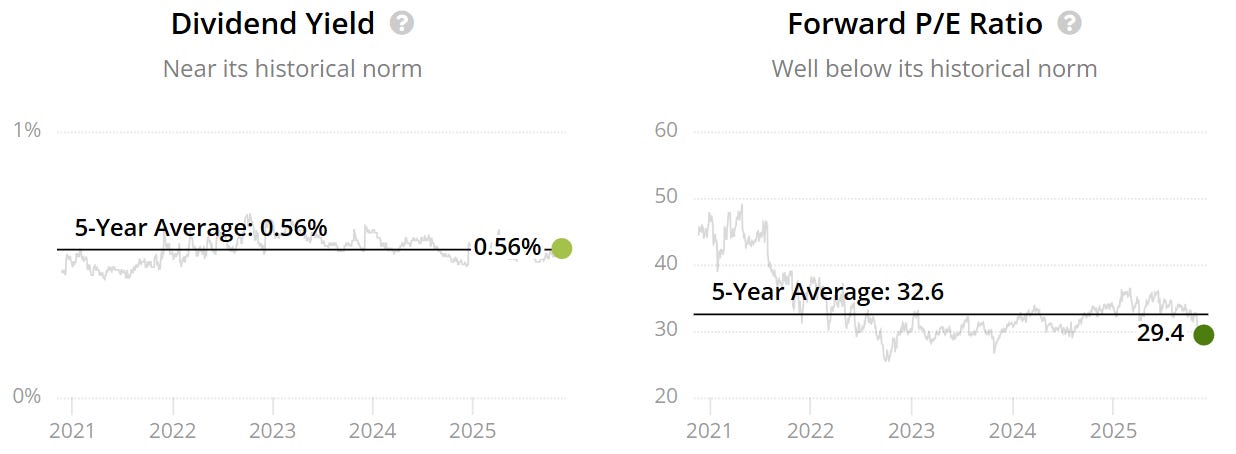

Valuation

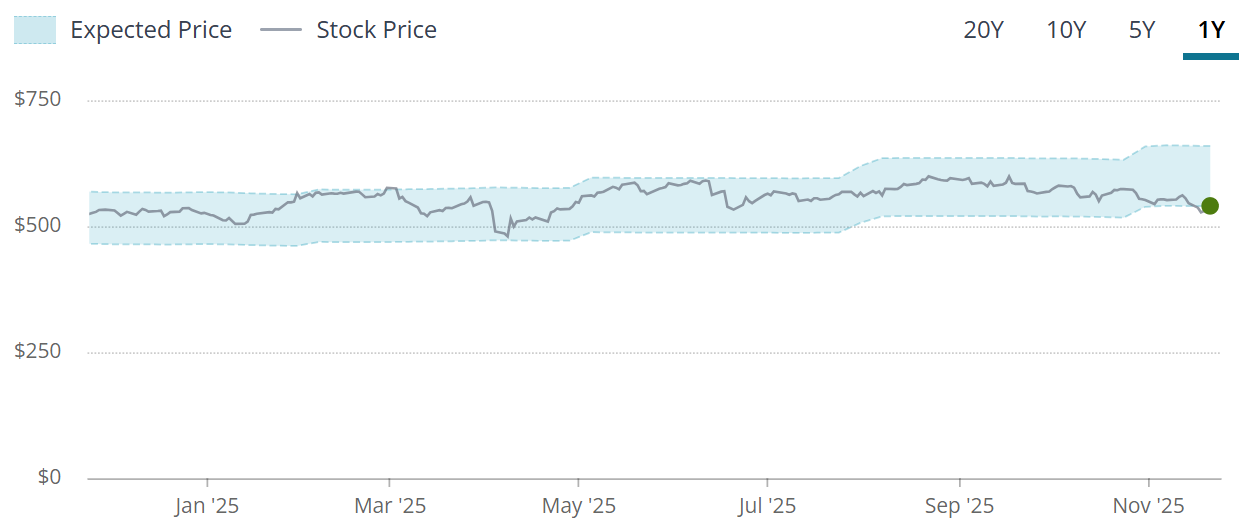

The forward P/E sits below the historical - 32.6x v 29.4x. This could indicate the company is potentially undervalued.

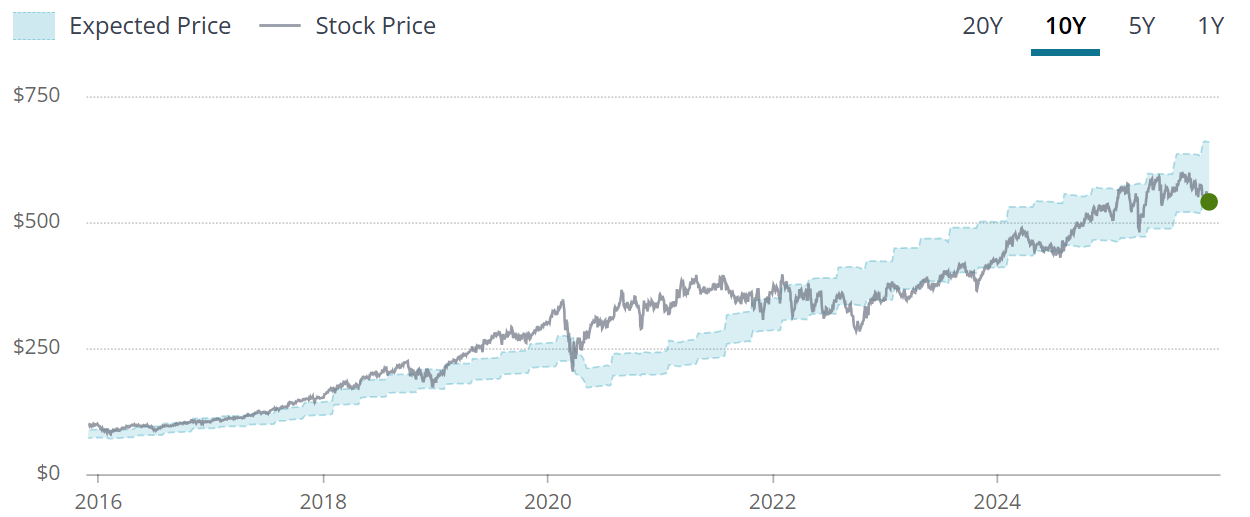

The blue tunnel methodology highlights that the company is at the bottom end/slightly outside of the intrinsic/fair value boundaries indicating a potential undervaluation.

When we zoom out to the last 10Y we can see that the Company has offered investors very few times to buy this at a discount.

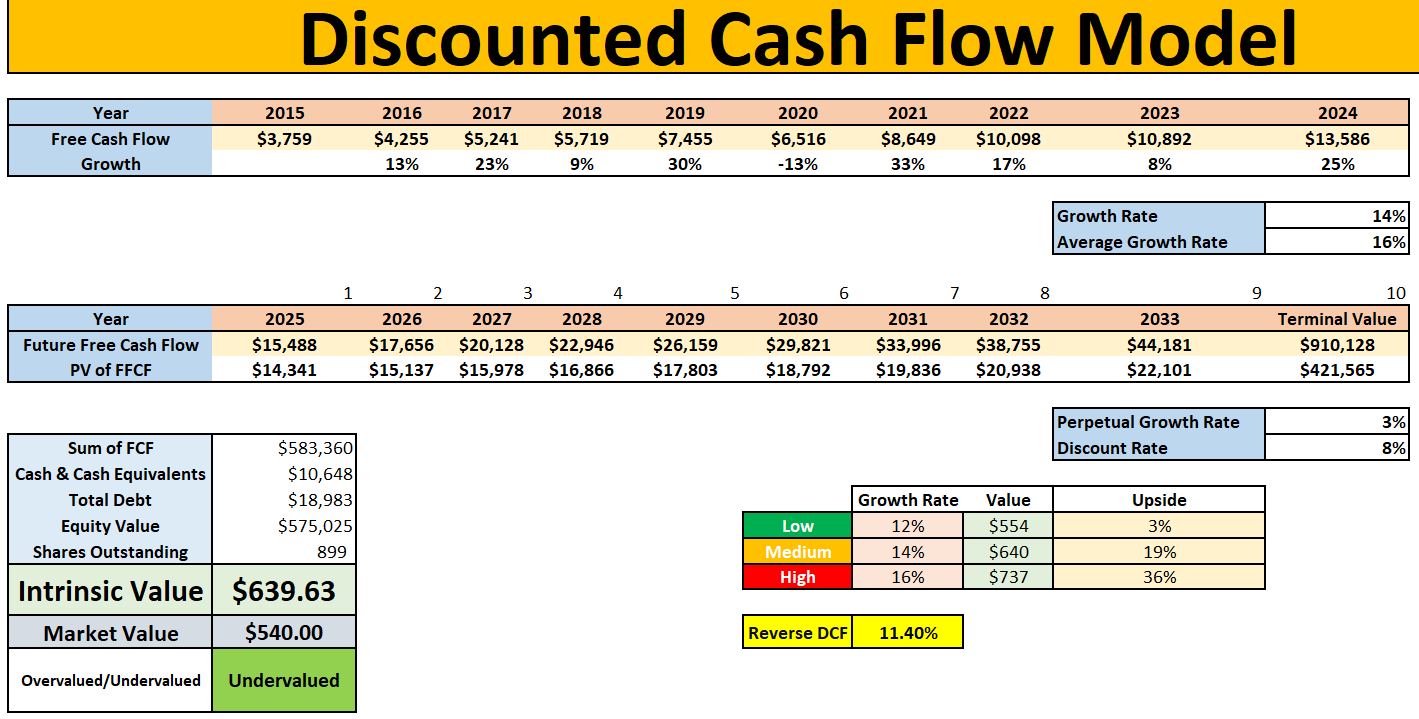

DCF Model

Using our DCF model a few things to note:

11.40% is baked into the FCF growth moving forwards.

Using 12% (the lower rate) gives an intrinsic value of $554.

Using 14% (the middle rate) gives an intrinsic value of $640.

Using 16% (the higher rate) gives an intrinsic value of $737.

If we use the middle rate of 14%, there is 16% margin of safety on offer to investors, with Wall Street seeing 28% upside into 2026.

Using their 10Y average and higher growth rate of 16% you are getting a 27% MoS.

Keep reading with a 7-day free trial

Subscribe to Dividend Talks to keep reading this post and get 7 days of free access to the full post archives.