3 Stocks Near 52-Week Lows to Buy Now

These beaten-down names could benefit from AI momentum slowdown, seasonal market trends, and a softer Fed outlook

Market Update

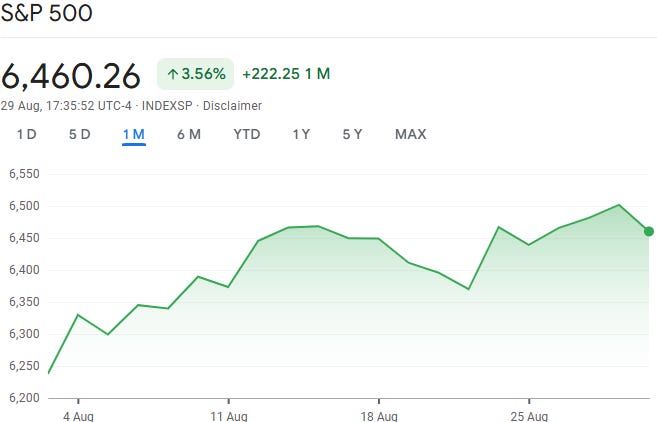

Summer has come to a close with August bringing the fourth straight month of gains, driven by excitement around AI and hopes that interest rates might start to ease.

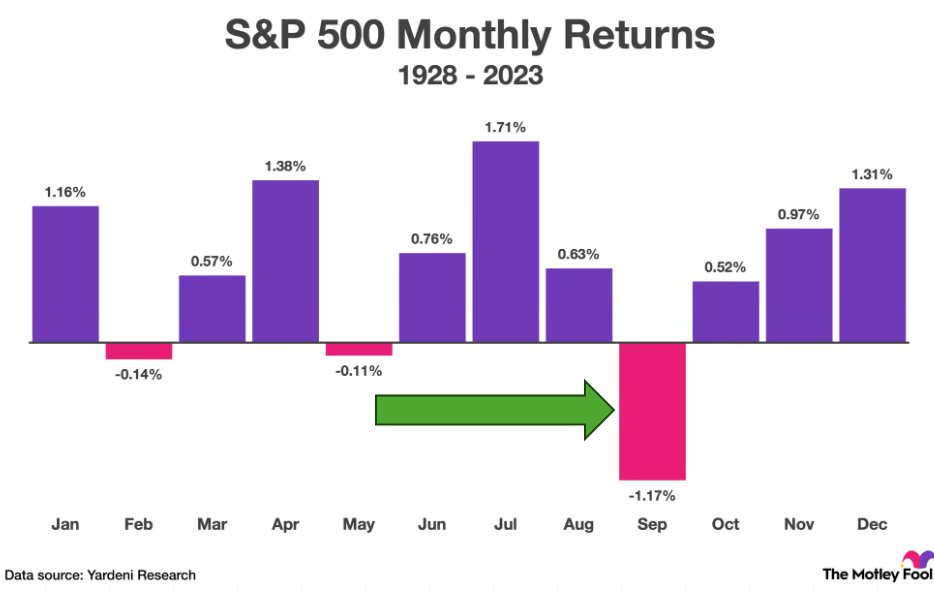

Whilst the summer rally has been impressive, history reminds us that September can be a different story.

Winners and Losers This Week

Top performers:

Deckers (+10%)

Autodesk (+8%)

Fair Isaac (+7%)

Royal Caribbean (+5%)

American Express (+4%)

Biggest drops:

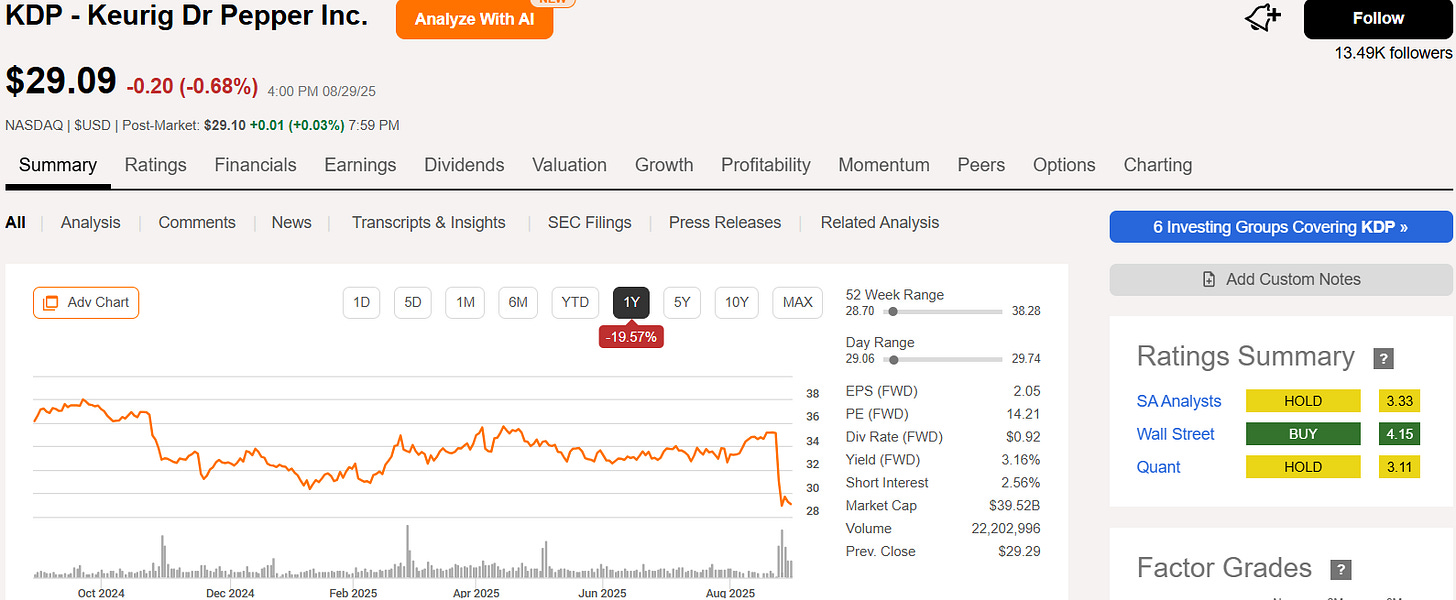

Keurig Dr Pepper (-17%)

Dell (-6%)

NextEra Energy (-6%)

Super Micro (-5%)

Oracle (-4%)

Notable News

Nvidia

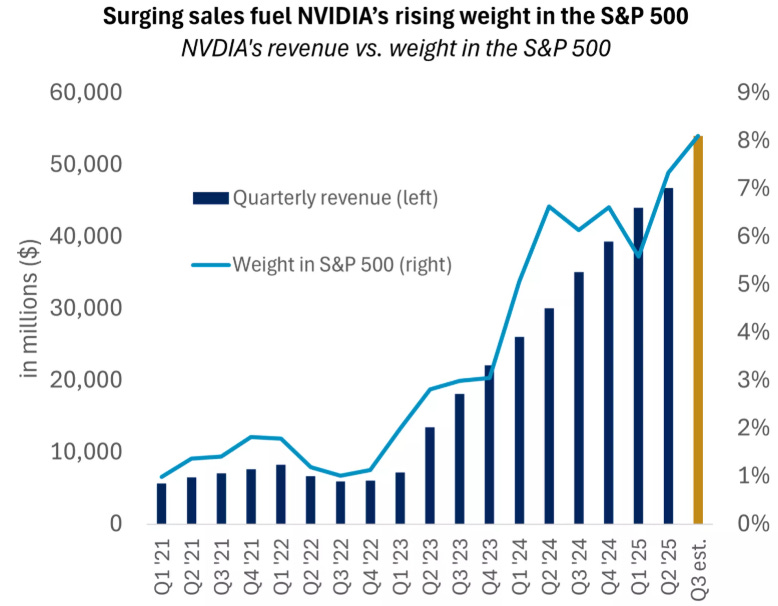

Last week, all eyes were on NVIDIA, a key player in the AI boom and now 8% of the S&P 500 with a $4.2 trillion market cap.

After an incredible run - up 35% this year following huge gains - its earnings were closely watched.

Revenue jumped 56% year-over-year, beating expectations, but the stock barely moved. Data center sales came in slightly below forecasts, and next-quarter guidance wasn’t as impressive as before - though potential chip sales to China could add upside.

Key takeaways:

AI demand is still strong, with cloud giants like Amazon, Google, Microsoft, and Meta investing billions. This spending is also boosting the U.S. economy, with hardware and software investment hitting multi-year highs. Finally, even for a stock growing this fast, sky-high expectations mean investors are quick to focus on any small “miss,” though AI’s adoption is still in its early stages.

What history tells us

As summer ends, the market is holding up well, supported by AI momentum, rising corporate profits, and hopes for a more accommodative Fed.

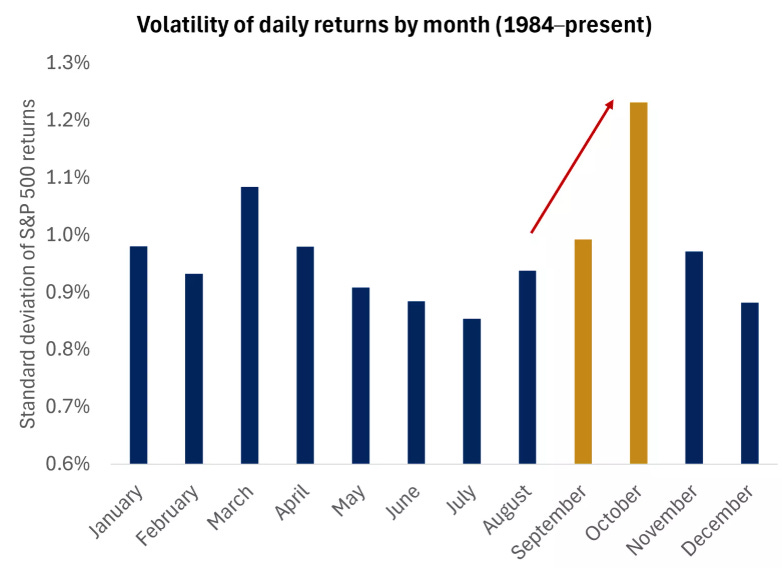

That said, the next couple of months are often seasonally choppier, with wider swings and softer returns. The bright side: these dips are usually temporary, and markets often rebound strongly afterward. Staying disciplined and setting realistic expectations is key.

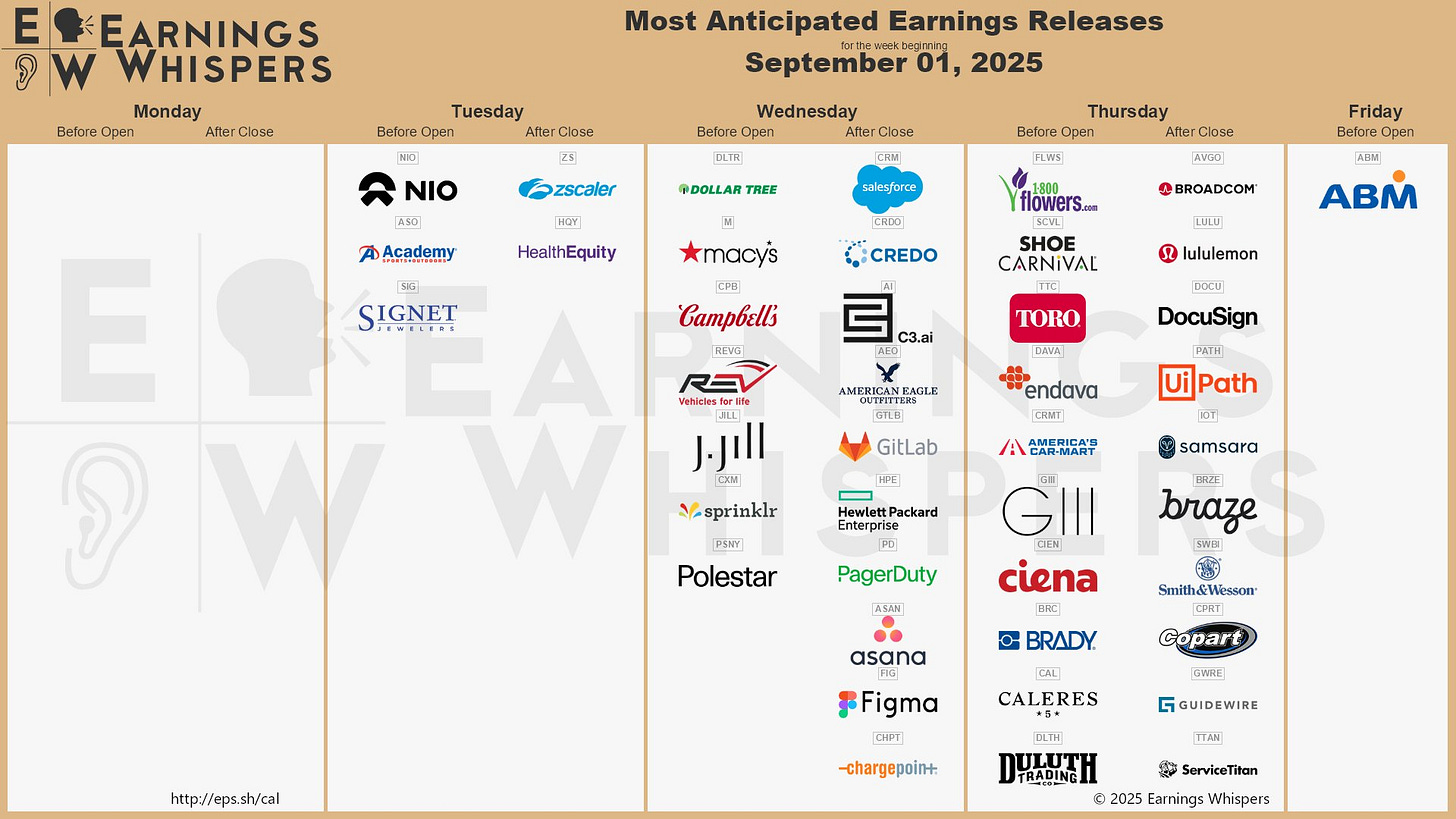

Earnings This Week

Join 109,000+ investors on YouTube! 🎥

We break down earnings, market moves, and exclusive insights you won’t find anywhere else.

Don’t miss out — hit the button below to watch and subscribe now! 👇

YouTube Channel 🔔

Subscribe today and stay ahead of the market!

Fear & Greed Index

3 Stocks Near 52 Week Lows:

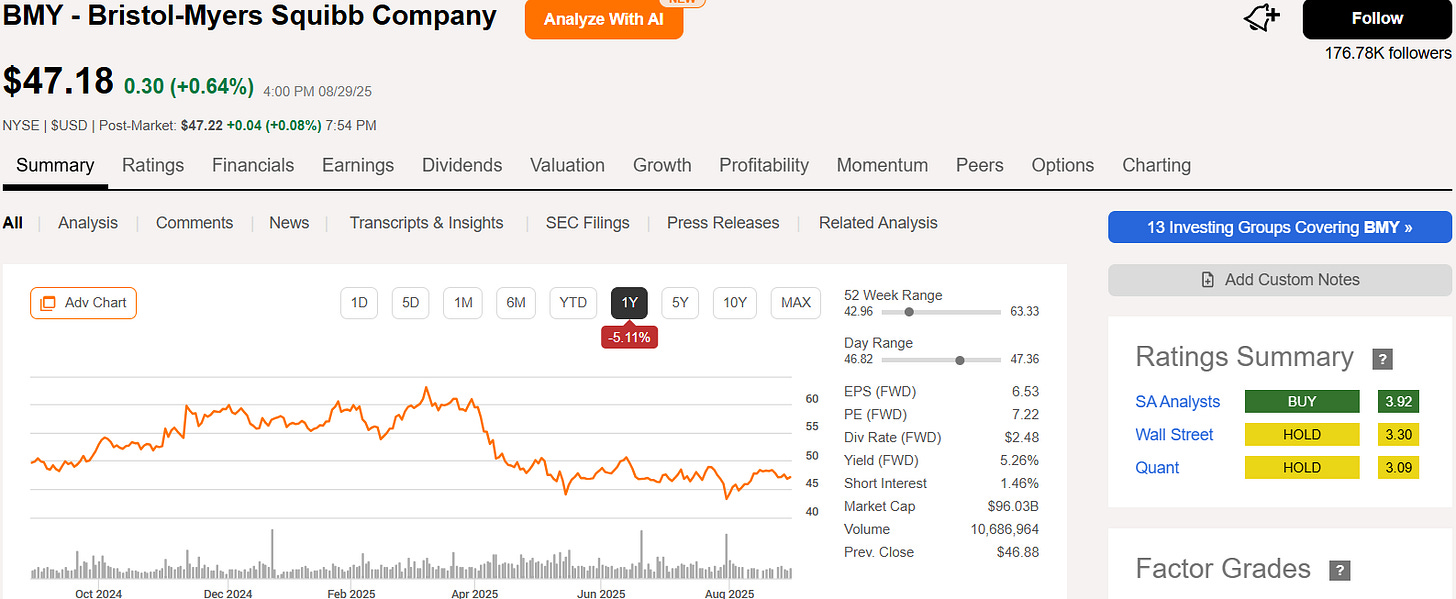

Bristol-Myers Squibb (BMY)

BMY develops and sells medicines primarily in oncology (cancer), immunology (autoimmune diseases), cardiovascular health, and fibrosis.

They focus on innovative therapies that target serious diseases, often through advanced biologics and small-molecule drugs.

Key products include cancer treatments like Opdivo and immunology drugs like Orencia.

Why has BMY disappointed in the last year?

Bristol-Myers Squibb’s stock has been down over the past year for several reasons:

Patent Expirations and Generic Competition: Sales of key drugs like Revlimid and Sprycel have declined as patents expire and generics enter the market.

Disappointing Trial Results: Setbacks in clinical trials, such as its schizophrenia drug Cobenfy, have raised concerns about the strength of its pipeline.

Acquisition Costs: Recent acquisitions, including the $14 billion purchase of Karuna Therapeutics, have added financial strain and affected profitability.

Regulatory Delays: Postponements in FDA decisions, like expanding the use of its blood cancer treatment Abecma, have raised questions about near-term growth.

These factors together have weighed on BMY’s stock over the past year.

Why could BMY be a current buying opportunity?

BMY could be an attractive buy today for several reasons:

Analyst Support: The stock has a “Buy” consensus, with a 12-month price target at the upper end of $62, suggesting potential upside from current levels.

Strong Growth Portfolio: Recent revenue growth has been driven by key drugs like Opdivo, Breyanzi, Reblozyl, and Camzyos.

Strategic Acquisitions: Purchases like Karuna Therapeutics have expanded BMY’s pipeline and strengthened its position in neuroscience.

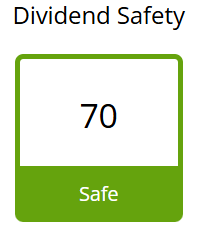

Dividend Yield: BMY offers a dividend of over 5%, appealing to income-focused investors.

While challenges like patent expirations and regulatory delays remain, the company’s strong fundamentals and strategic moves make it a compelling long-term opportunity.

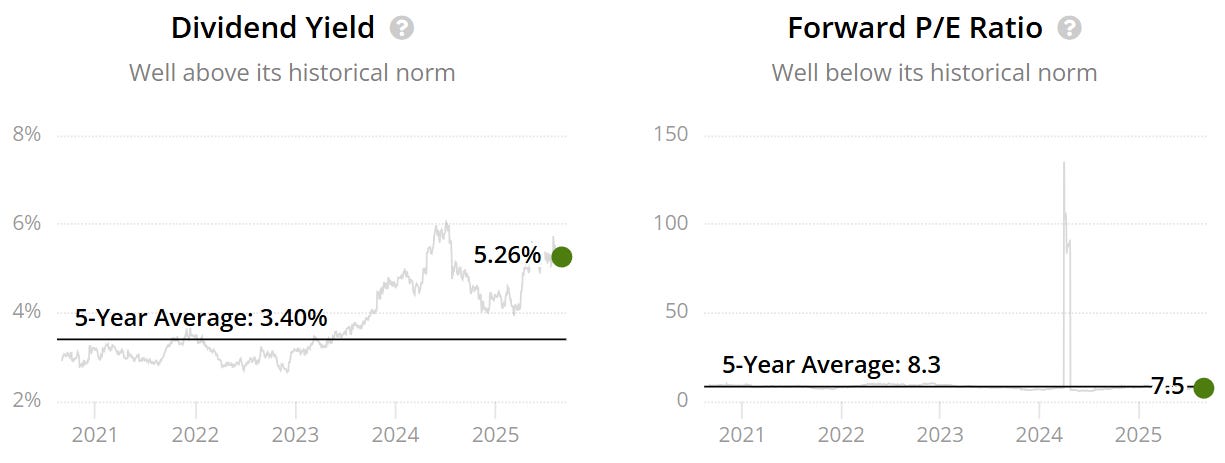

Valuation

It currently trades at a Forward P/E of 7.5x vs it’s historical 8.3x, whilst also offering a yield of 5.26% vs historical 3.40%.

The high yield also comes with a safe dividend score.

Our valuation model brings the intrinsic value to $62 giving a 25% margin of safety, with Wall Street seeing this at $55 into 2026.

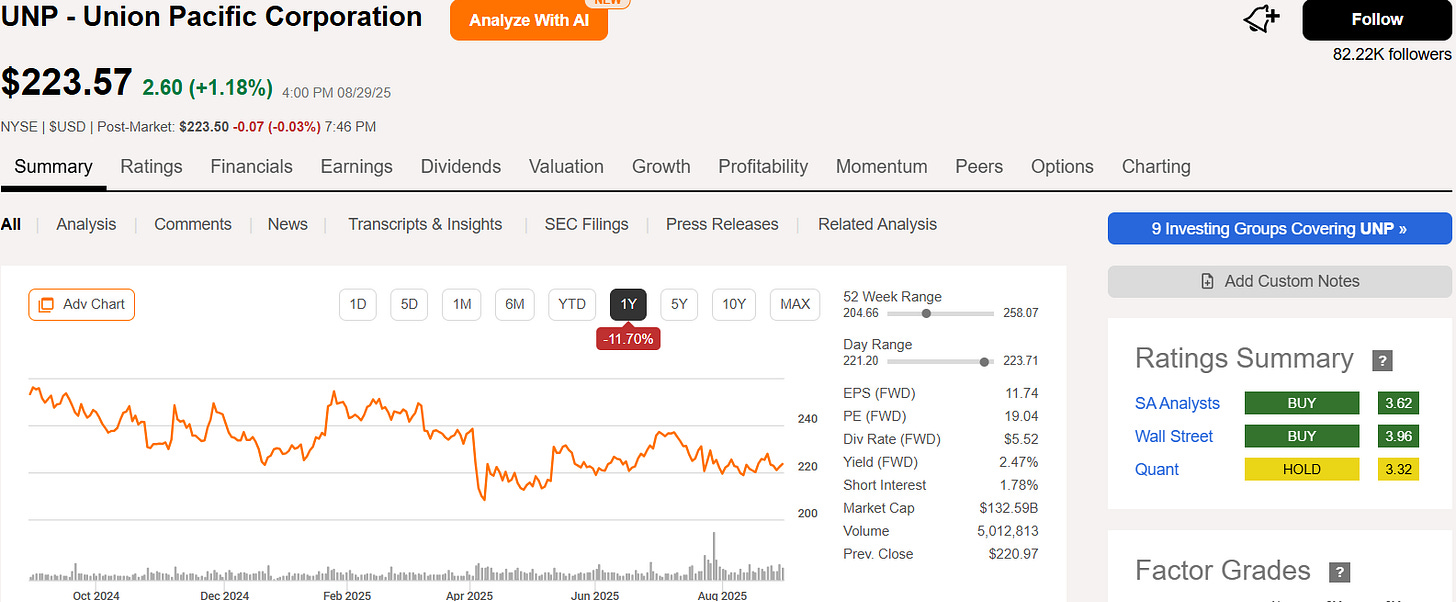

Union Pacific (UNP)

Union Pacific is one of the largest railroad companies in the U.S., providing freight transportation services across a network spanning 23 states.

The company moves a wide range of goods, including agricultural products, chemicals, coal, and industrial supplies.

Its business is tied closely to the health of the U.S. economy, as demand for freight transportation generally rises with industrial activity and consumer demand.

Why has UNP disappointed in the last year?

Union Pacific has seen its stock decline over the past year due to a mix of operational, regulatory, and market factors.

Operational Challenges: Safety concerns and workforce adjustments have put pressure on investor confidence, as the company navigates maintaining efficiency while meeting regulatory standards.

Merger Uncertainty: Union Pacific’s proposed $85 billion acquisition of Norfolk Southern has raised worries about regulatory approval, competition, and integration challenges.

Market Performance: Even with strong earnings in recent quarters, the stock has struggled to maintain previous highs, reflecting cautious sentiment from investors amid these uncertainties.

These factors combined have contributed to the stock’s underperformance over the past year.

Why could UNP be a current buying opportunity?

Union Pacific could be an attractive buying opportunity despite recent challenges.

Strong Earnings and Cash Flow: The company continues to generate robust revenue and profits, with solid operating efficiency reflected in its low operating ratio.

Strategic Growth Opportunities: The potential Norfolk Southern merger, if approved, could create the first transcontinental U.S. railroad, enhancing scale, network reach, and service capabilities.

Dividend and Long-Term Value: UNP offers a reliable dividend, making it appealing for income-focused investors, while long-term demand for freight transport supports steady growth.

With strong fundamentals and strategic initiatives, UNP is well-positioned for potential upside, even if near-term risks remain.

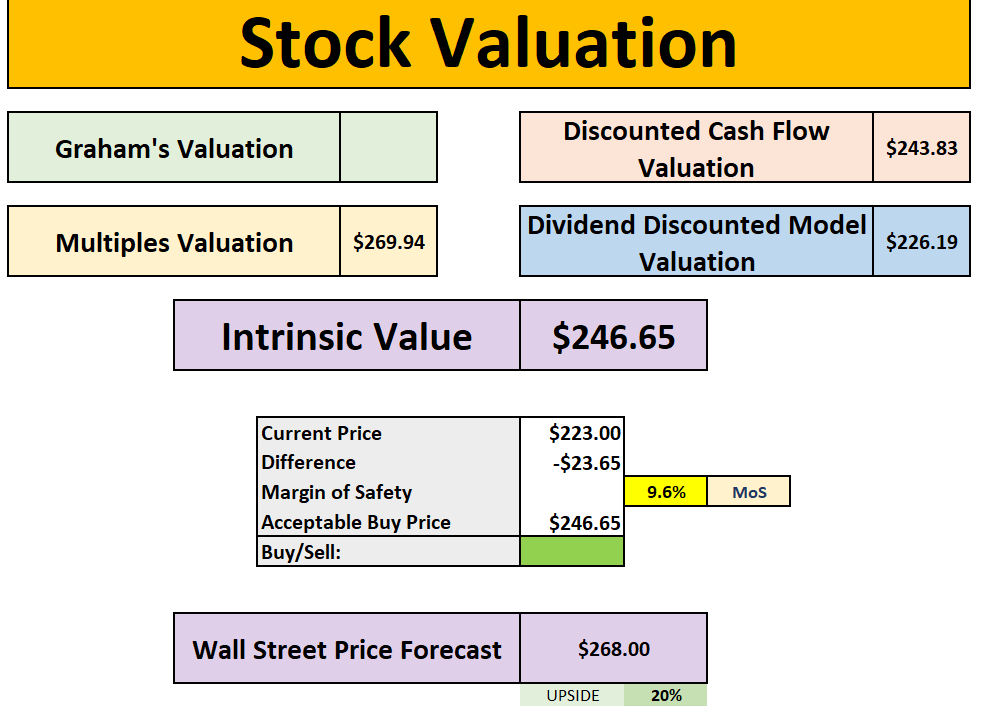

Valuation

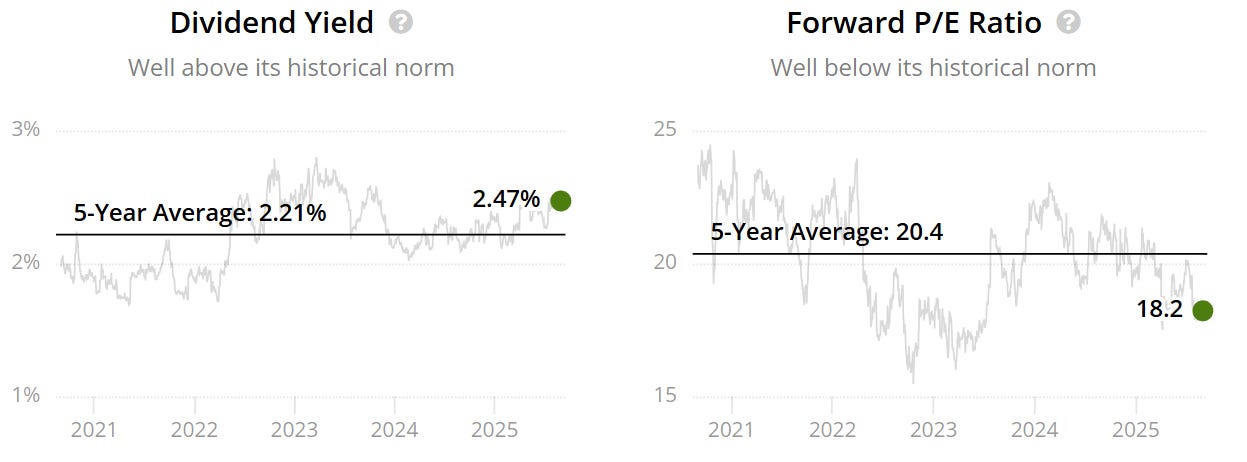

It currently trades at a Forward P/E of 18.2x vs it’s historical 20.4x, whilst also offering a yield of 2.47% vs historical 2.21%.

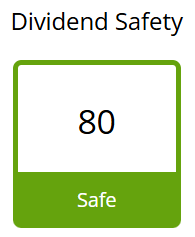

Yield also looks to be safe.

Our valuation model brings the intrinsic value to $247 giving a 10% margin of safety, with Wall Street seeing this at $268 into 2026.

Keurig Dr Pepper (KDP)

KDP is a leading beverage company in the U.S. and Canada, known for its wide range of soft drinks, juices, and coffee products.

It owns iconic brands like Dr Pepper, Snapple, Green Mountain Coffee, and Keurig’s single-serve coffee machines.

KDP generates revenue by selling beverages through retail, foodservice, and its subscription-based coffee pods.

Why has KDP disappointed in the last year?

Acquisition Concerns: The announced $18 billion acquisition of JDE Peet’s, aimed at splitting coffee and beverage operations, raised investor worries about higher debt and integration challenges.

Coffee Segment Underperformance: Net sales in the coffee business declined by around 2.6%, affected by commodity cost inflation, tariffs, and changing consumer preferences.

Stock Reaction: These factors, combined with uncertainty around the strategic shift, led to pressure on margins and a drop in investor confidence, weighing on KDP’s stock.

Why could KDP be a current buying opportunity?

Strong Beverage Business: KDP’s core soft drink and beverage segment continues to perform well, generating steady revenue and cash flow.

Strategic Coffee Expansion: The JDE Peet’s acquisition could create a global coffee powerhouse, offering long-term growth potential once integration is complete.

Dividend and Stability: KDP offers a reliable dividend, appealing to income-focused investors, while its diversified product portfolio helps weather market fluctuations.

Despite near-term uncertainties, the company’s strong fundamentals and strategic moves make it an attractive opportunity for long-term investors.

Valuation

It currently trades at a Forward P/E of 13.9x vs it’s historical 19.2x, whilst also offering a yield of 3.16% vs historical 2.27%.

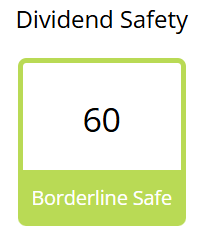

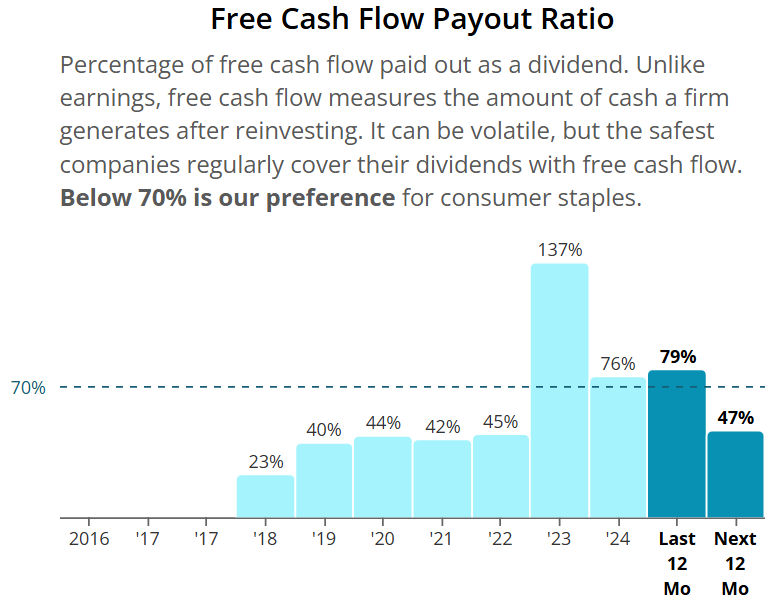

Dividend does however sit at borderline safe.

FCF payout should be reducing to 47% over the next 12 months which is a positive sign.

Likewise Net Debt to EBITDA looks ok below 4.

Our valuation model brings the intrinsic value to $36 giving a 20% margin of safety, with Wall Street seeing this at $39 into 2026.

Stock Resources

Stock Valuation Model 📊 (Unlock my stock valuation model as seen on YouTube)

Seeking Alpha 💵 ($30 off stock research tools I use daily.)

TipRanks 📈 (40% off expert stock research tools)

YouTube 🎥 (Join 109,000+ investors on YouTube!)

Patreon 👥 (Join my community for exclusive content)

Snowball Analytic (30% off portfolio tracker)

I hope you all have a great week ahead! 🌟

Dividend Talks💰

Note:

I’m not a financial advisor. All content is for educational purposes only. Invest and trade at your own risk—I'm not responsible for any financial outcomes.

Interesting wrap! The summer rally has been impressive, but I agree September often brings a reality check. Nvidia’s results really highlight how stretched expectations have become: Even a strong beat isn’t enough if guidance softens. The BMY, UNP, and KDP breakdowns are useful too. Some good reminders that valuation and dividends can create opportunities even when sentiment is weak. Staying patient through seasonal volatility seems like the right move here.

Your content is gold, keep it coming!