3 Stocks To BUY After The Crash

Positioning yourself as markets react to trade headlines, the government shutdown, and rising uncertainty.

Market Update

Global Trade War Reignited

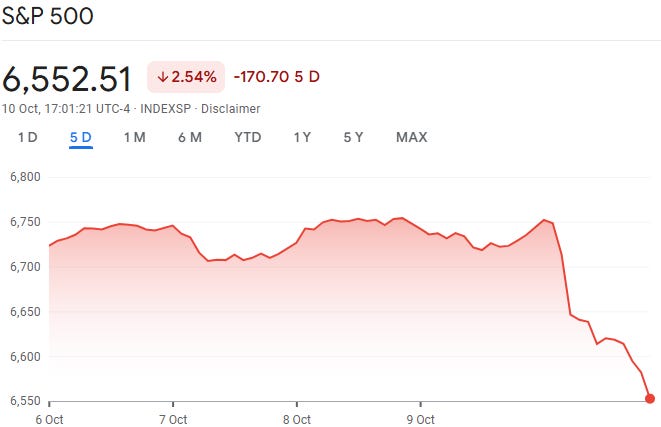

U.S. markets took a sharp hit Friday after President Trump shook up trade headlines and the S&P 500 closed 2.54% down on the week.

On Truth Social, he suggested he might cancel a planned meeting with China’s president and floated “a massive increase in tariffs” on Chinese goods.

By the end of the day, he announced plans for a 100% tariff on China and new export controls on critical software starting November 1.

Chip stocks were especially hard hit—AMD fell 7.7%, Broadcom 5.9%, and Qualcomm dropped 7.3% after China also launched an antitrust probe. Even regional banks struggled, as investors worried about a potential escalation in the trade war.

China, meanwhile, responded with new rare-earth export restrictions and port fees for U.S. vessels, adding to the uncertainty.

Gold climbed toward $4,000 an ounce, while oil prices fell as the U.S. government shutdown stretched into its 10th day.

Last Weeks Winners & Losers

Top performers:

Advanced Micro Devices (+31%)

Dell (+7%)

Netflix (+6%)

PepsiCo (+6%)

Arista Networks (+6%)

Philip Morris (+5%)

Biggest drops:

Applovin (-17%)

KLA Corp (-11%)

Lam Research (-10%)

Pfizer (-9%)

Qualcomm (-9%)

Verizon (-9%)

Notable News

October Volatility

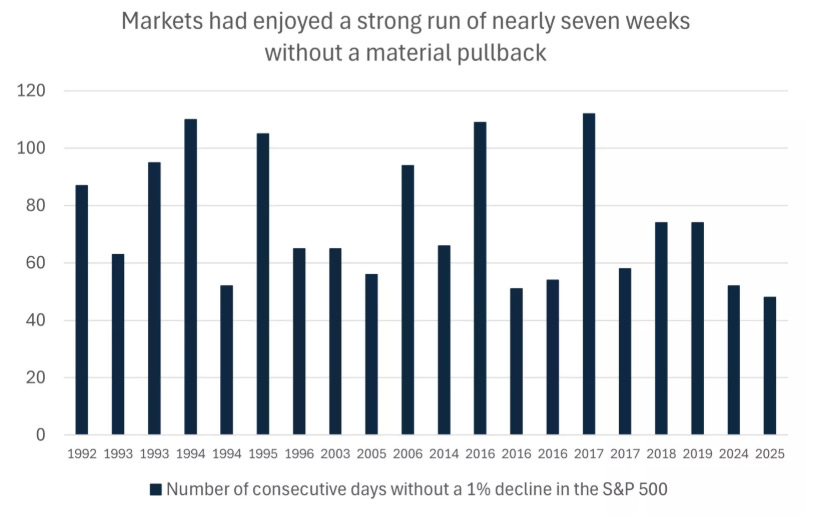

October may be reminding investors why it has a reputation for volatility. After a remarkably steady rally, Friday’s trade headlines triggered the first 1% daily drop in the S&P 500 in nearly 50 days—a streak only seen a handful of times over the past 25 years.

A few factors suggest markets could stay a bit jittery. Historically, October has been the most volatile month of the year, and this year isn’t guaranteed to be different. Political and economic news—like a prolonged government shutdown, trade-policy surprises, or unexpected economic data—can make swings sharper.

Volatility is part of the market’s rhythm, with three to four 5–10% dips typical each year.

Government Shutdown

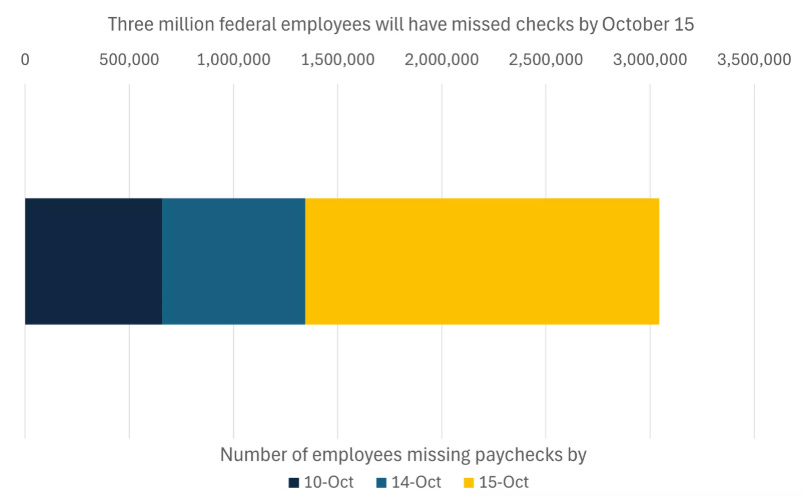

The federal government shutdown has now entered its second week, making it the fourth-longest in U.S. history. Congress shows little sign of compromise—lawmakers have left D.C., the House is in recess, and the Senate won’t return until Tuesday after a seventh failed vote on funding. The main sticking point remains health care measures.

So far, the economic impact has been limited, but the longer the shutdown continues, the more noticeable it becomes. Over 650,000 federal employees have missed paychecks, and that number could exceed three million by a third week, including active service members. Key services are stalling too—from IRS processing to federal program applications and nutrition benefits.

JPM CEO Worried About Stock Market Correction

Jamie Dimon is sounding a note of caution for investors. On AI, he acknowledges its potential—“AI is real, it will pay off”—but warns that much of the money pouring in now will likely be wasted, much like the early days of cars or TVs.

Dimon also flagged a bigger concern: he sees a higher chance of a significant stock market drop over the next six months to two years than what current prices suggest.

He points to rising uncertainty from geopolitics and government debt as reasons investors should be thinking twice before assuming calm markets ahead.

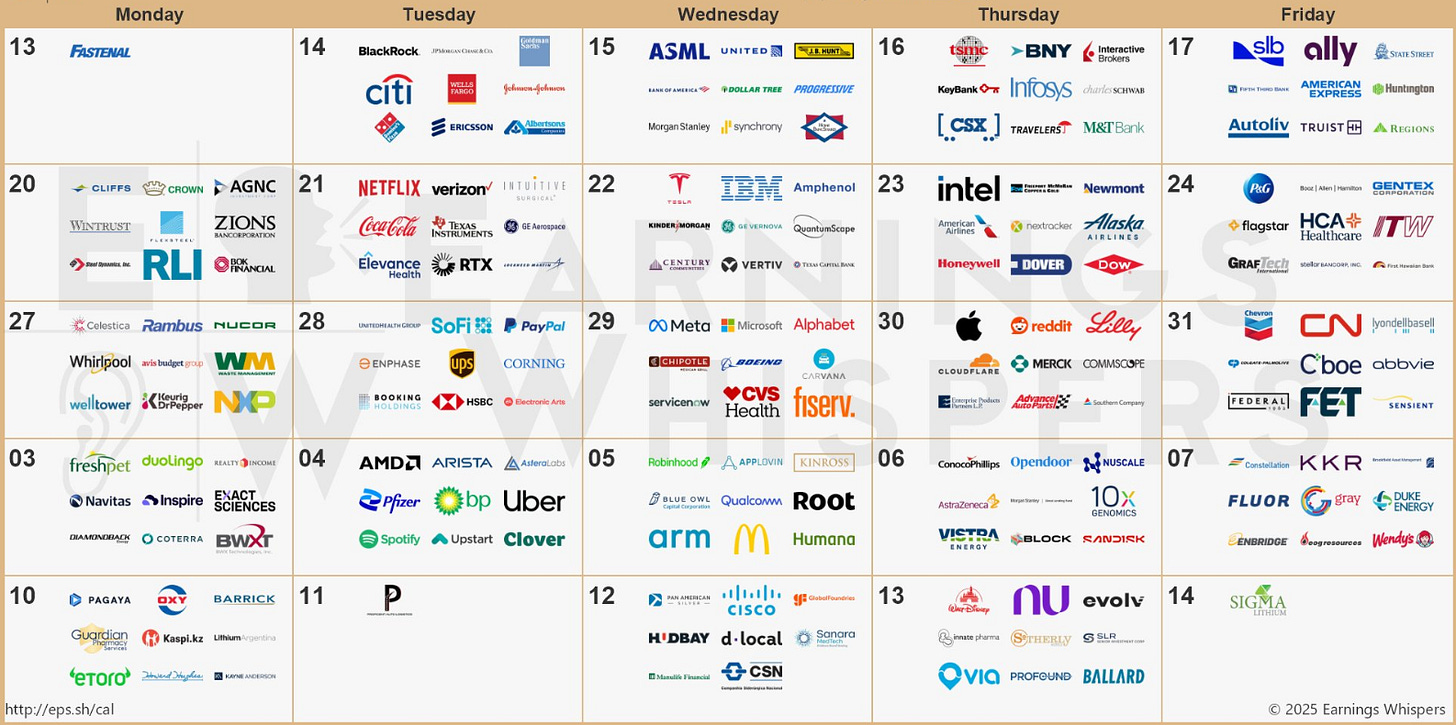

Earnings Season

Earnings This Week

Earnings This Quarter

Join 114,000+ investors on YouTube! 🎥

We break down earnings, market moves, and exclusive insights you won’t find anywhere else.

Don’t miss out — hit the button below to watch and subscribe now! 👇

YouTube Channel 🔔

Subscribe today and stay ahead of the market!

Fear & Greed Index

3 Stocks To BUY

Even strong, well-known companies haven’t been immune to last week’s turbulence.

Trade headlines, the government shutdown, and rising uncertainty have rattled markets, pushing some high-quality stocks lower—not because their businesses are failing, but because sentiment has shifted.

Here are three companies that have taken a hit and could be worth a closer look as the dust settles.

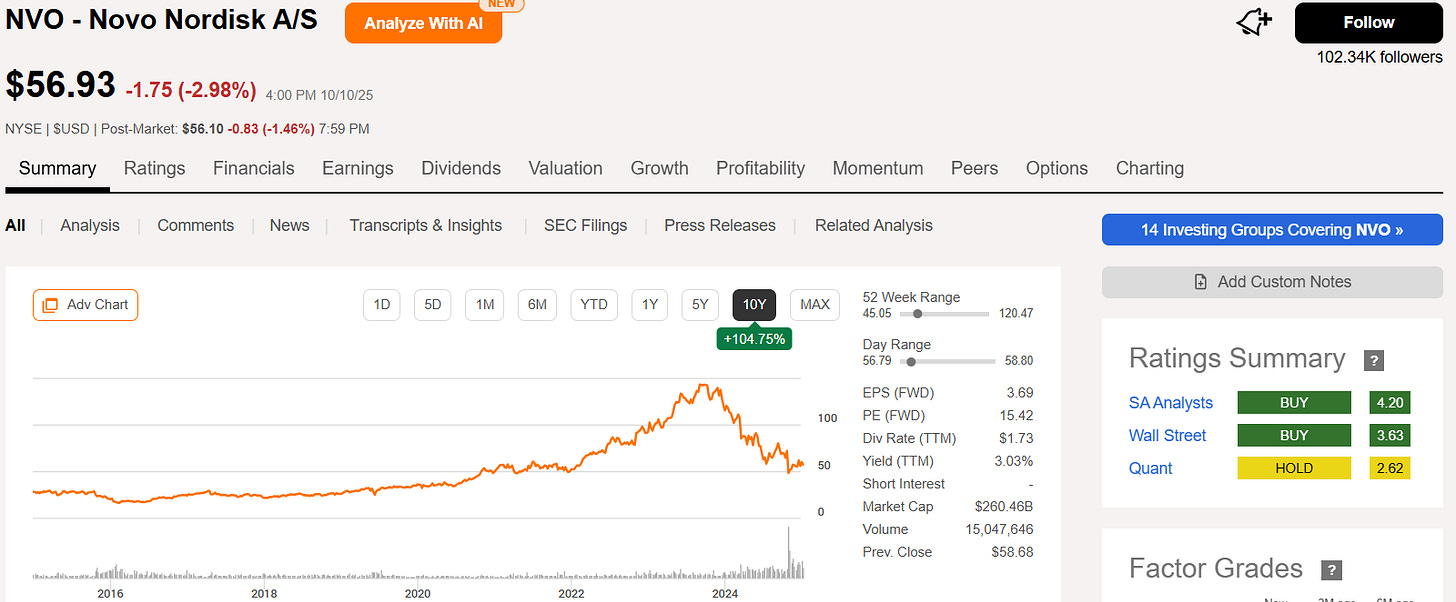

1. Novo Nordisk (NVO)

Novo Nordisk: A Leader in Diabetes and Obesity Care

Novo Nordisk is a global healthcare company renowned for its leadership in diabetes and obesity care.

With a rich history of innovation, the company has developed groundbreaking treatments that have transformed the lives of millions worldwide.

Its portfolio includes well-known medications such as Ozempic® and Wegovy®, which have become synonymous with effective management of type 2 diabetes and weight loss.

Recent Stock Performance Challenges

Despite its strong market position, Novo Nordisk’s stock has faced significant challenges in recent times.

Year-to-date, the stock has declined by approximately 34%, and over the past 12 months, it has experienced a total return of -52%.

In fact it faced it’s largest drawdown at one point being down by 66%.

Several factors have contributed to this downturn:

Intensifying Competition: The market for GLP-1 medications, such as Ozempic® and Wegovy®, has become increasingly competitive. New entrants and generic versions have emerged, putting pressure on Novo Nordisk’s market share and pricing power.

Regulatory and Pricing Pressures: In key markets like the United States, there has been growing scrutiny over drug pricing. Initiatives aimed at reducing healthcare costs have led to tighter reimbursement policies, impacting the sales of Novo Nordisk’s products.

Operational Restructuring: In an effort to streamline operations and focus on core areas, Novo Nordisk announced the closure of its cell therapy research and development division, resulting in the layoff of nearly 250 employees.

Strategic Acquisitions: The company has made significant investments, such as the recent acquisition of Akero Therapeutics for up to $5.2 billion, to expand its portfolio in obesity and liver disease treatments. While these moves aim to bolster long-term growth, they have raised concerns among investors about short-term financial strain.

These factors have combined to create a challenging environment for Novo Nordisk’s stock performance. However, the company’s strong fundamentals and strategic initiatives may position it for a potential rebound as it navigates these hurdles.

Why Novo Nordisk Stands Out

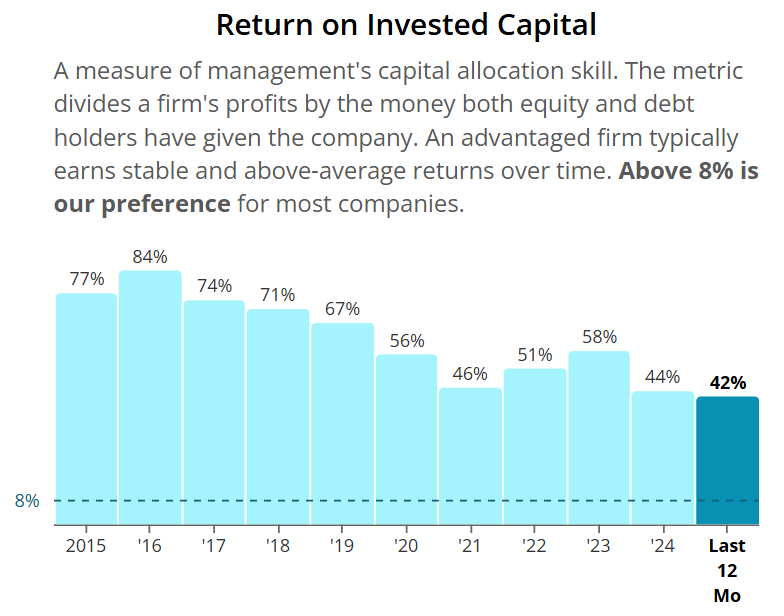

Novo Nordisk isn’t just a market leader — it’s a model of efficiency and disciplined execution.

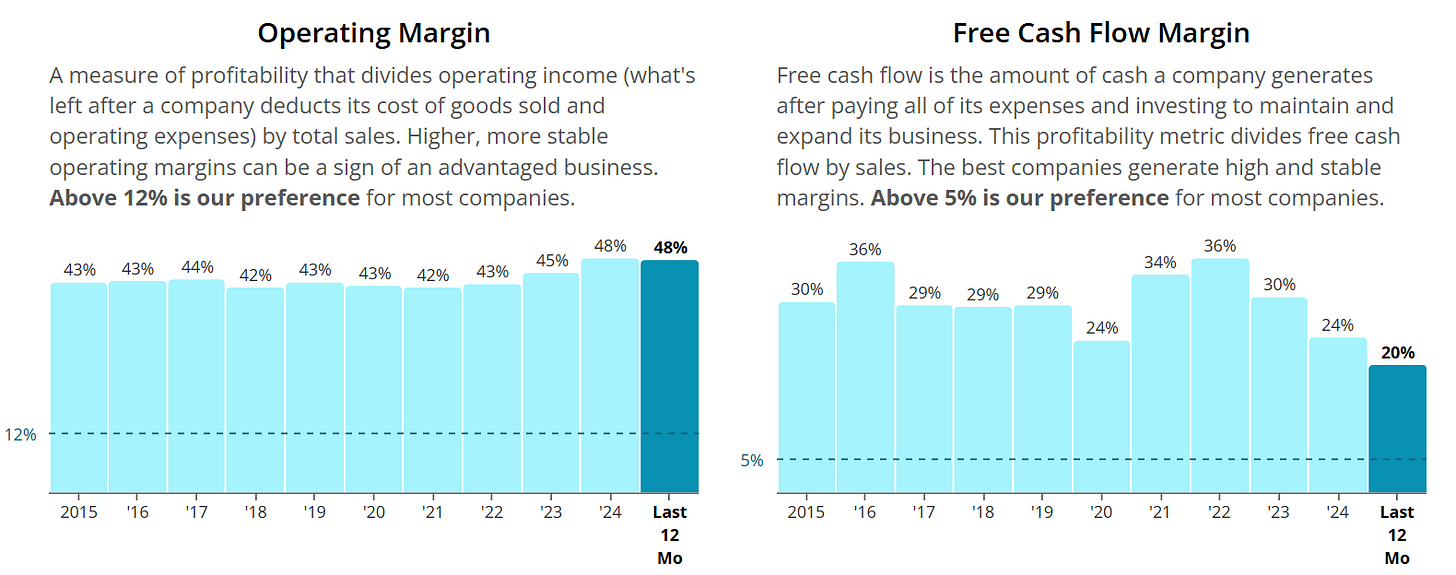

The company consistently delivers high returns on invested capital, with ROIC sitting at an impressive 42%, showing how effectively it turns capital into profit.

Operating margins have steadily climbed over the past decade, rising from 43% to 48%, while free cash flow margins remain strong and consistent at around 20%, giving the company ample flexibility to invest in growth or return cash to shareholders.

Financial strength is further underscored by a conservative balance sheet, with net debt to EBITDA at just 0.54, providing resilience in times of market turbulence.

Combined with its dominant position in diabetes and obesity care, Novo Nordisk’s efficiency, profitability, and capital discipline make it one of the highest-quality companies in healthcare — a standout growth story with strong fundamentals to back it up.

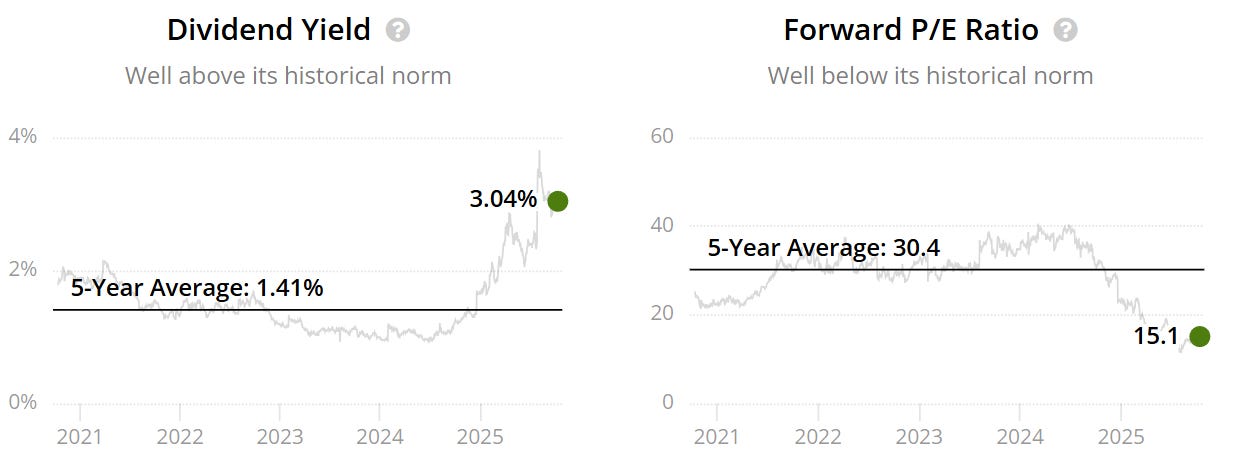

Valuation

The forward P/E sits significantly below the historical - 15.1x v 30.4x. This could indicate the company is severely undervalued.

On top of that, you’re also getting a yield of 3.04%, this is well above historical 1.41%.

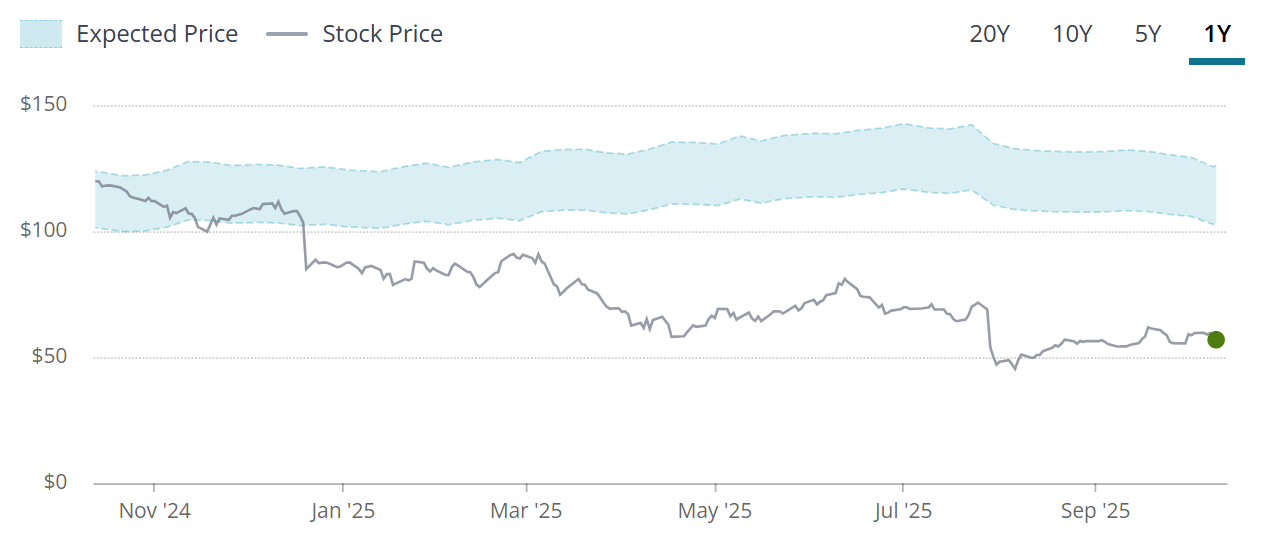

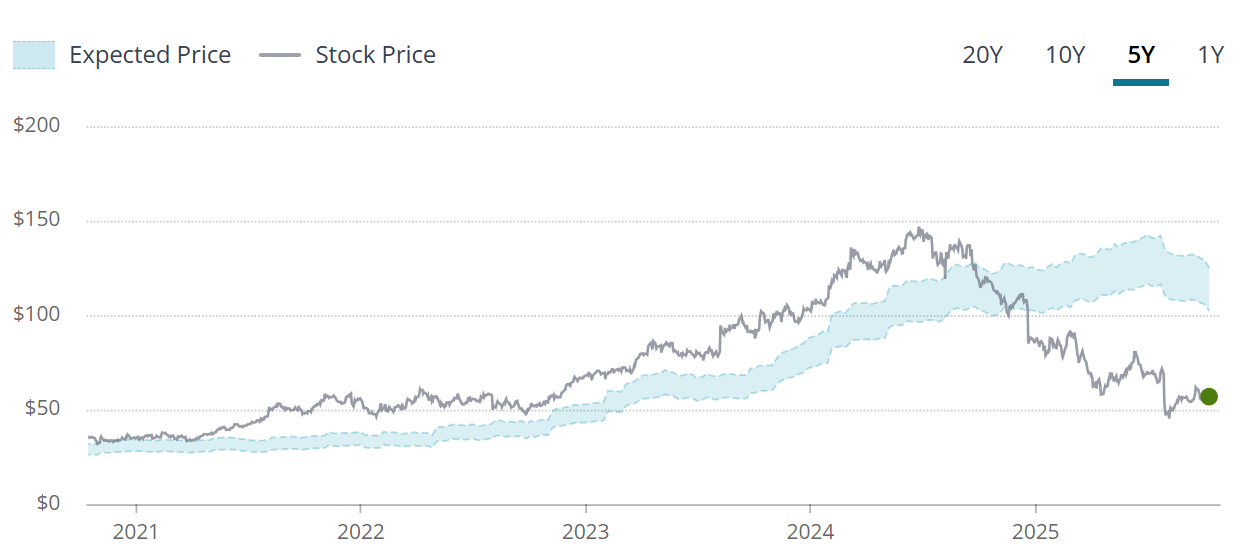

The blue tunnel methodology highlights that the company is significantly below the bottom end indicating a current huge discount.

What makes this fascinating is that when we zoom out to the last 5Y this is a company that typically trades at a premium (stock price above the upper end of the blue tunnel).

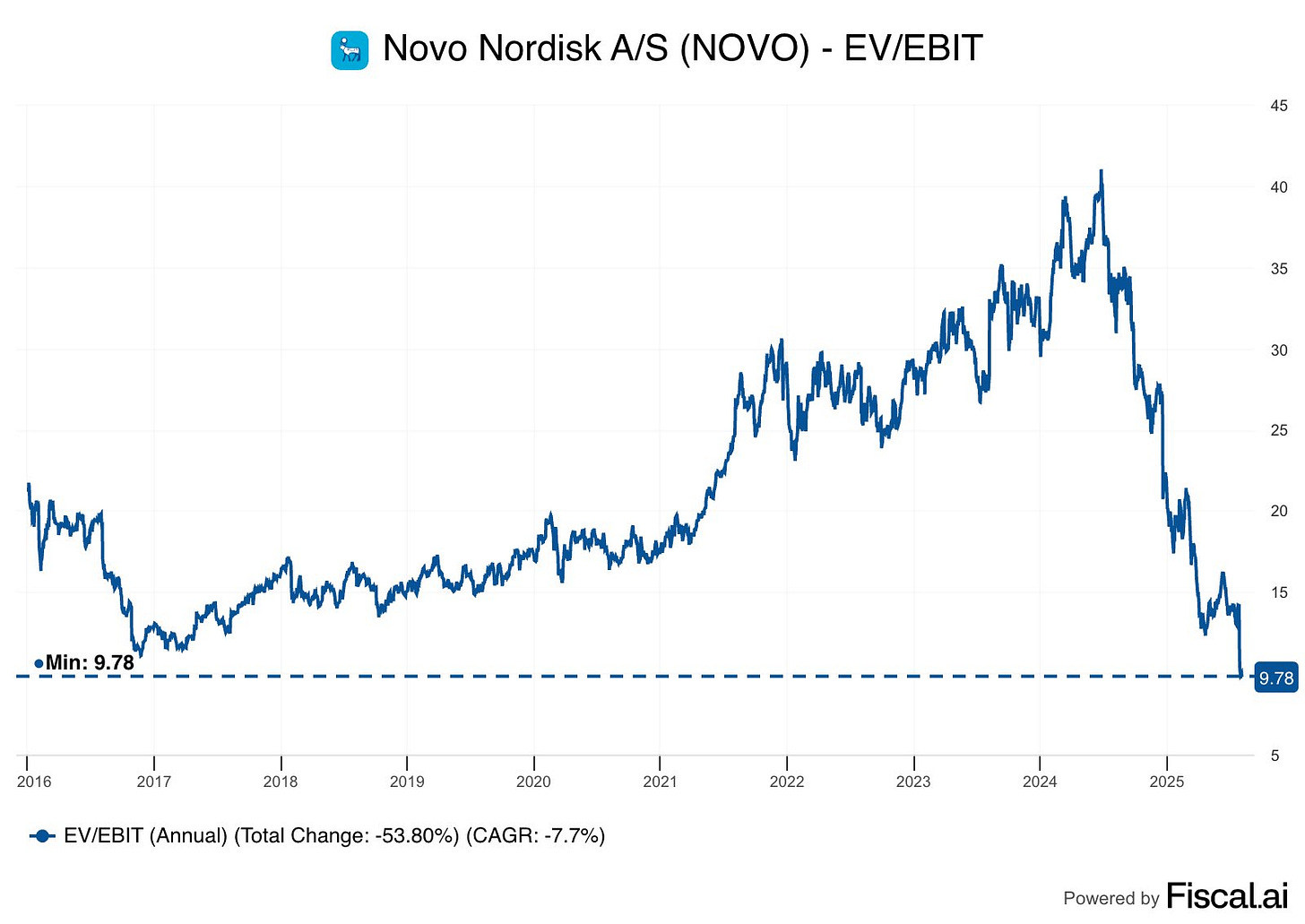

It’s also trading at a decade low with regards to EV/EBIT.

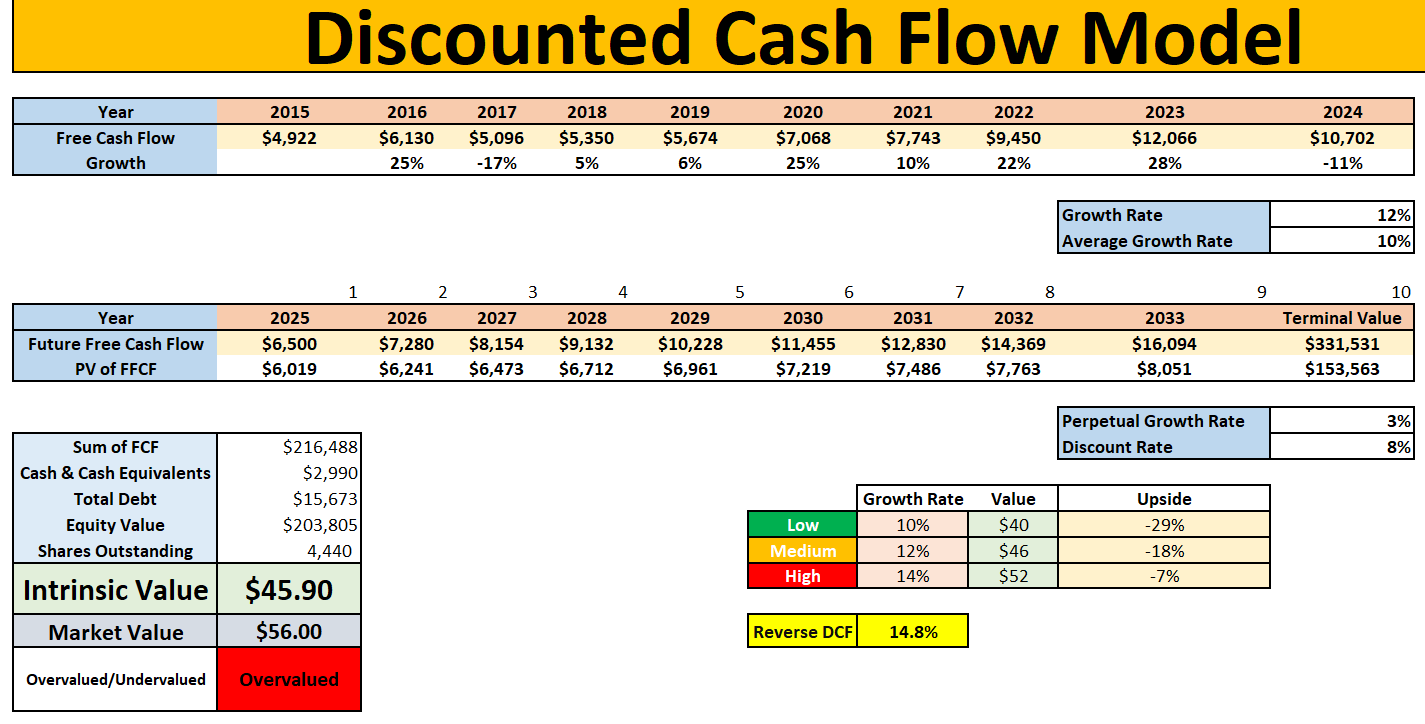

DCF Model

We have 2 scenarios here based on whether you believe the issues the company is facing is short term of longer term.

Scenario 1 is using the updated guidance that management gave out recently by cutting FCF expectation.

Scenario 2 is by maintaining the original guidance.

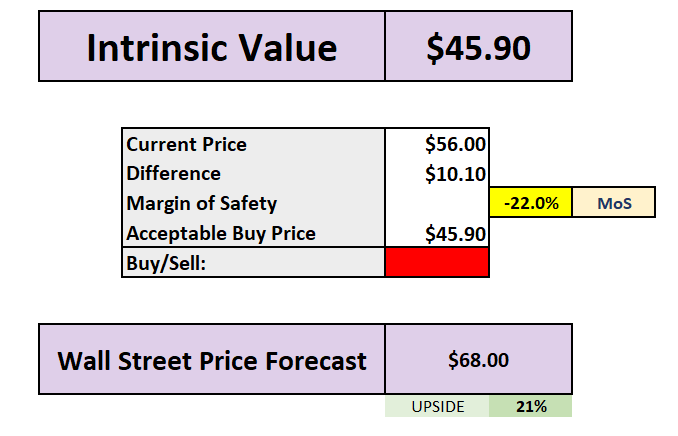

Scenario 1:

Using our DCF model a few things to note:

14.8% is baked into the FCF growth moving forwards

Using the middle rate of 12% growth there is downside of 18%

Using the higher rate of 14%, there is still downside of 7%

If we use the middle rate of 12%, there is no margin of safety, in fact you are paying a 22% premium. Wall Street however see 21% upside into 2026.

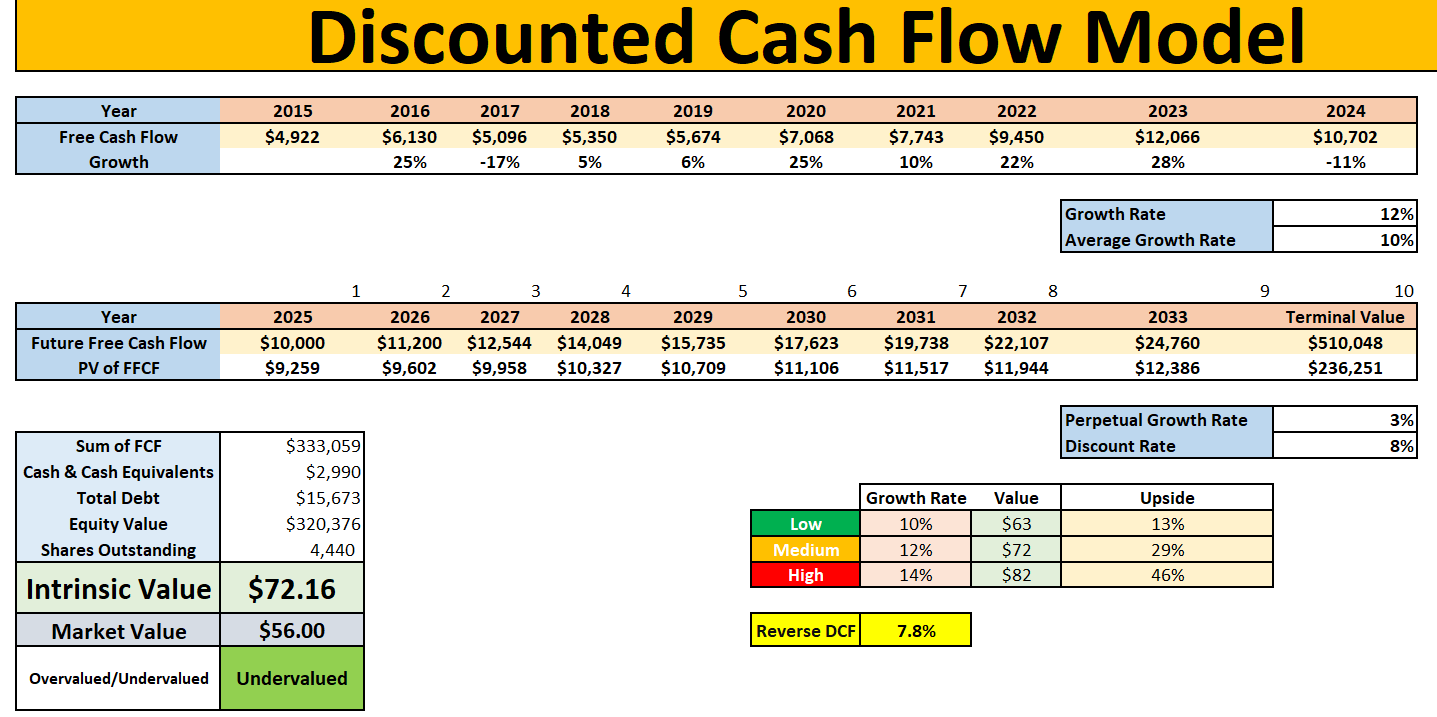

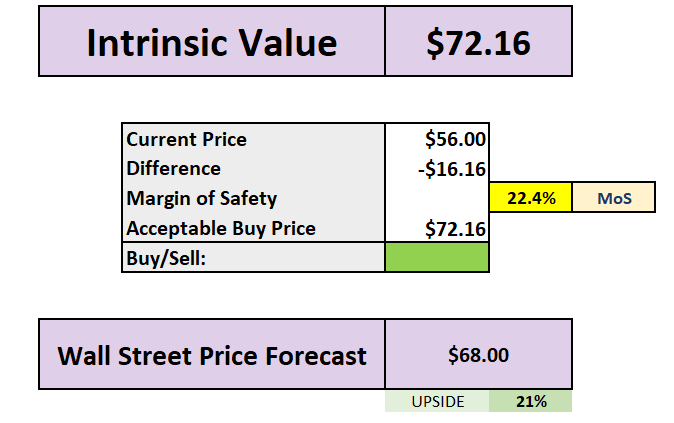

Scenario 2

Using our DCF model a few things to note:

7.8% is baked into the FCF growth moving forwards

Using the middle rate of 12% growth there is upside of 29%

Using the higher rate of 14%, there is still upside of 46%

If we use the middle rate of 12%, there is a 22% MoS.

Keep reading with a 7-day free trial

Subscribe to Dividend Talks to keep reading this post and get 7 days of free access to the full post archives.