3 Stocks to Buy After the Market Pullback

AI hype is cooling, layoffs are rising - but the fundamentals haven’t cracked. Here’s where real opportunity is hiding right now.

Market Update

Markets Break Their Winning Streak as Tech Takes a Breather

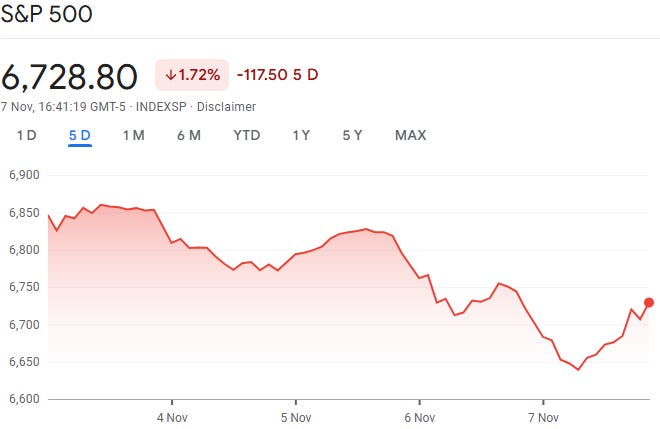

After three straight weeks of gains, stocks finally hit a wall. The tech-heavy Nasdaq led markets lower as investors started questioning just how much higher those AI-fueled valuations could really go. Growth stocks, which have powered the market’s run since April, saw the sharpest pullback with the S&P 500 down nearly 2% this week.

But it wasn’t just tech jitters. The ongoing U.S. government shutdown - now the longest on record - started to seep into market sentiment. Headlines about the FAA reducing flight traffic and growing concerns over the impact on GDP made investors a little more cautious heading into November.

Services Rebound, Manufacturing Still in Trouble

America’s services sector - which makes up most of the economy - returned to growth last month. The ISM Services Index rose to 52.4, its strongest reading since last October. Orders picked up, and 11 industries reported expansion.

Manufacturing, however, remained stuck in reverse. ISM’s Manufacturing PMI slipped again to 48.7, marking the eighth straight month of contraction.

Consumer Mood Turns Sour

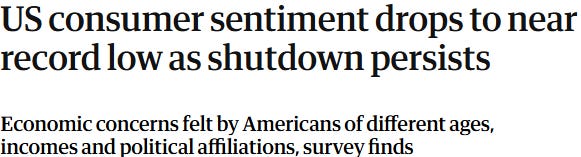

Consumers aren’t feeling great. The University of Michigan’s sentiment index dropped to 50.3 - the weakest since 2022. People are more worried about their personal finances and short-term business conditions, and inflation expectations ticked slightly higher to 4.7%. The government shutdown likely didn’t help confidence either.

Bonds Hold Up as Investors Seek Safety

While equities slipped, bonds caught a bid. Treasuries and municipal bonds both delivered positive returns, with shorter-term yields easing a bit. But the riskier corners of the bond market struggled - high-yield debt fell as investors moved to safety amid the week’s equity sell-off.

Last Weeks Winners & Losers

Top performers:

Kenvue (+17%)

Datadog (+17%)

Eli Lily (+7%)

Amgen (+7%)

Philip Morris (+6%)

Biggest drops:

Axon (-18%)

Palantir (-11%)

Robinhood (-11%)

AMD (-9%)

Nvidia (-7%)

Notable News

Sentiment Cools, but Fundamentals Still Shine

After months of relentless optimism, markets finally hit pause last week. A few cautious comments from major bank CEOs were all it took to remind investors that even the hottest stories - like AI - have limits when valuations stretch too far. With the Nasdaq up seven months in a row, a bit of profit-taking was bound to happen. In short, AI enthusiasm just ran headfirst into valuation reality.

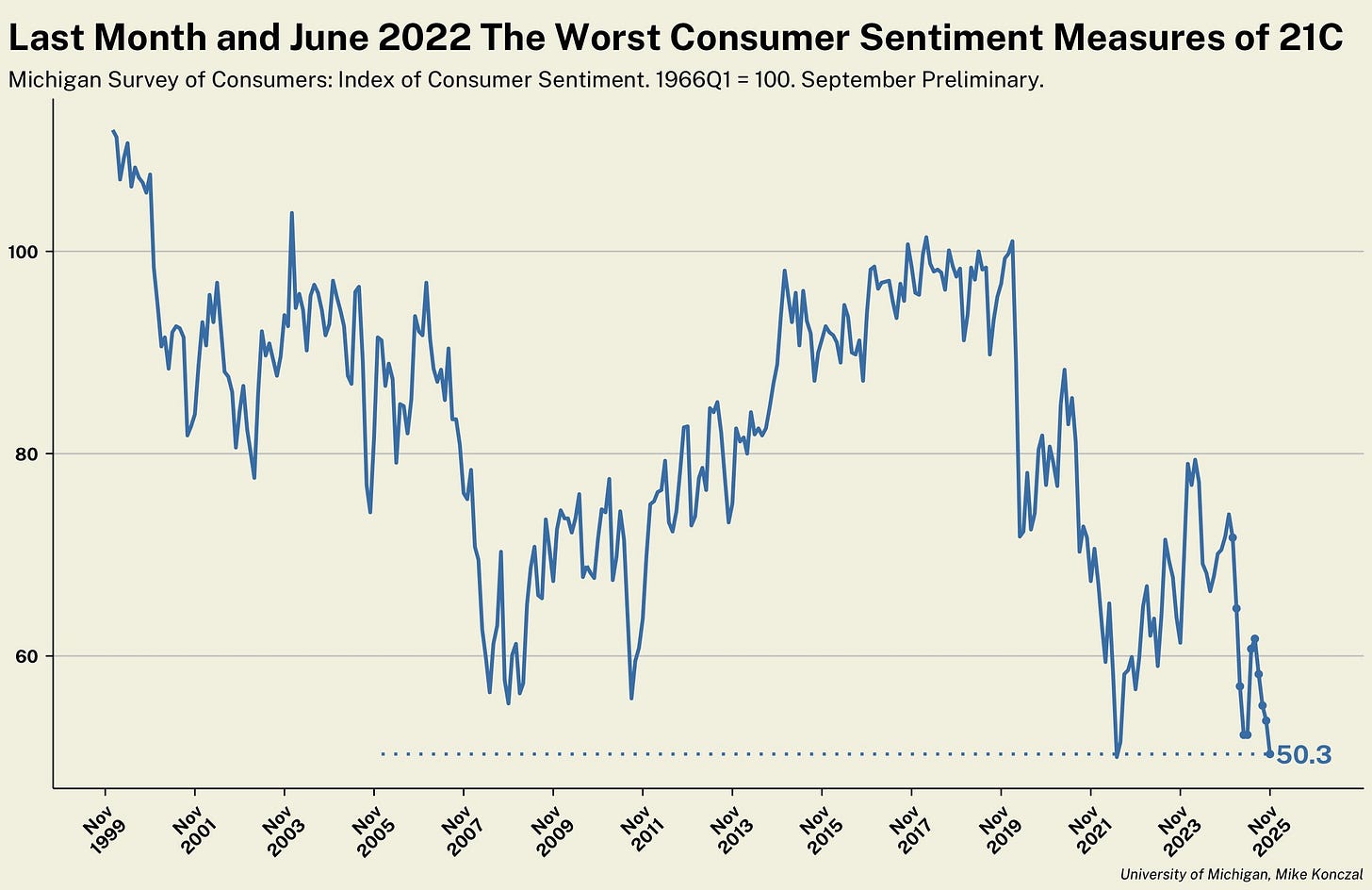

But here’s the interesting part: underneath the surface, company fundamentals are still humming along nicely. About 85% of S&P 500 companies have now reported Q3 earnings - and the results have been solid. Roughly 82% have beaten expectations, ahead of the five-year average, putting the index on track for 12% earnings growth - the fourth straight quarter of double-digit gains.

Tech continues to lead the charge. The sector delivered 22% earnings growth, with the “Magnificent Seven” - Amazon, Apple, Meta, Alphabet, and Microsoft - once again outpacing the broader market. Many of these firms even raised profit guidance and AI-related spending, signaling confidence that demand is still growing fast.

And that spending isn’t just hype. For these companies, AI investment is quickly becoming a matter of survival - fall behind now, and the next wave of AI-driven competitors could make it hard to catch up.

Is AI Becoming the Next Bubble?

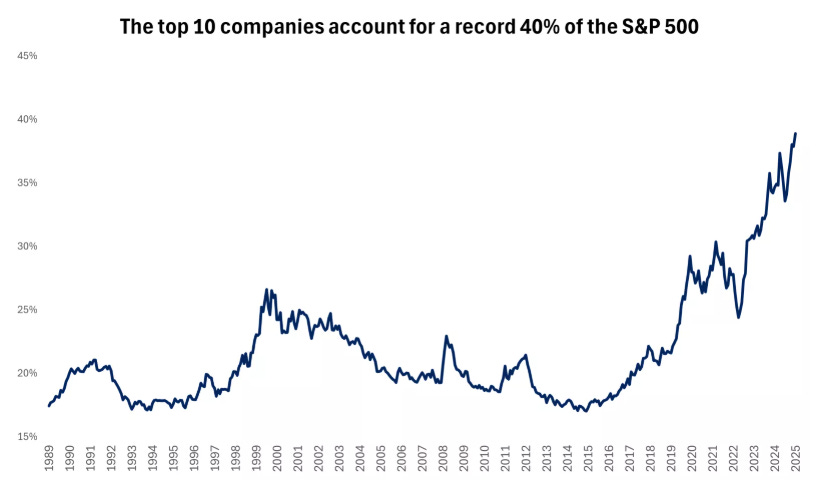

Ever since ChatGPT burst onto the scene in late 2022, the “Magnificent Seven” have gone parabolic - up nearly 190%, helping lift the S&P 500 by around 75%. That surge has created something we haven’t seen before: extreme market concentration. The top ten stocks now make up over 40% of the entire S&P 500.

At the heart of this story is NVIDIA, the undisputed backbone of the AI revolution. The company recently became the first in history to cross a $5 trillion market cap - a staggering milestone that puts it:

Bigger than five of the S&P 500’s 11 sectors

Equal to about 60% of the entire Russell 2000 small-cap universe

Roughly half the size of Europe’s STOXX 600 index

And larger than Germany’s GDP

No wonder investors are asking: is this the start of an AI bubble?

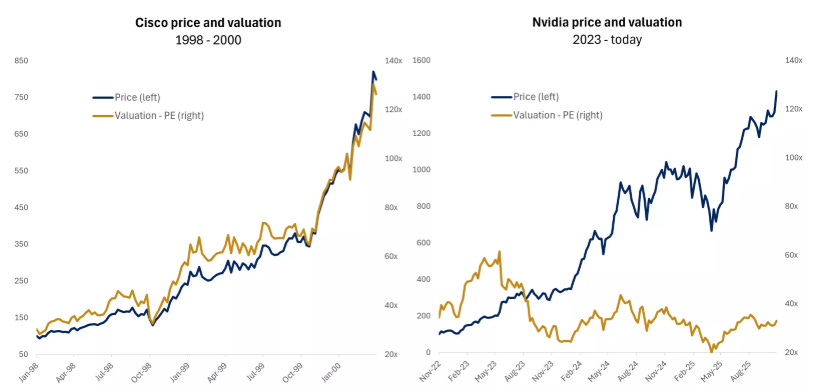

Déjà Vu - But Not Quite 2000

It’s easy to draw parallels to the dot-com era, but there are crucial differences this time around.

Profits, not promises: Today’s tech giants are mature, cash-generating machines. They’re weaving AI into businesses that already produce strong earnings - not chasing speculative ideas with no revenue.

Cash-funded expansion: Mega-cap tech firms are bankrolling their massive AI investments with cash flow, not debt. Unlike the heavily leveraged telecoms of the late ’90s, they’re spending from a position of financial strength.

Valuations have logic: Yes, valuations are rich - but not dot-com crazy. This rally has been fueled by profit growth, not just expanding multiples. That suggests future returns will depend more on earnings power than hype.

A friendlier Fed: Back in 2000, rising rates helped burst the bubble. Today, the Fed is easing, creating a far more supportive backdrop.

How AI Is Starting to Reshape the Job Market

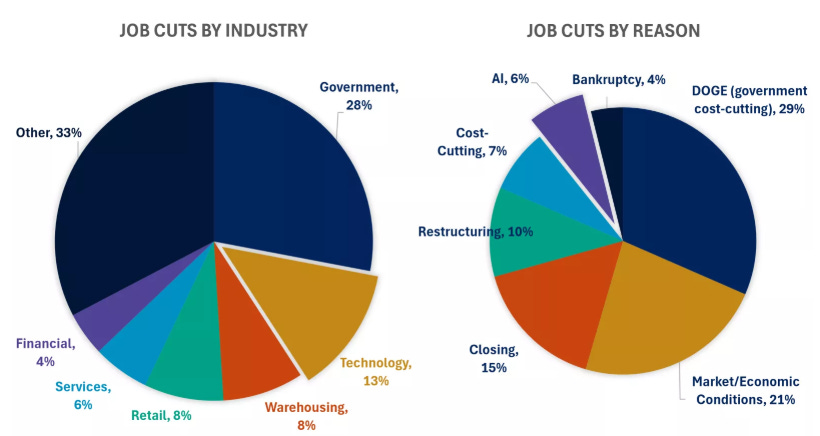

One of the biggest shifts in this year’s economy has been the cooling labor market - a key reason the Fed restarted rate cuts in September. With official data delayed by the record-long government shutdown, investors have been relying on private reports for clues.

According to ADP, U.S. companies added 42,000 private jobs in October after two months of declines - a sign of some stabilization, though the broader trend still points to a gradual slowdown.

Adding to the unease, layoff announcements jumped again. Challenger, Gray & Christmas reported that October job cuts nearly tripled from a year ago, and interestingly, AI was cited as the second most common reason for those layoffs - behind general cost-cutting. So far this year, about 6% of all announced job cuts have been linked to AI. It’s not the main driver yet, but it’s beginning to register.

Early research is starting to connect the dots, too. A St. Louis Fed study found that sectors embracing generative AI most aggressively - like software and data-related fields - are also seeing higher unemployment. For example, software developer job openings are down roughly 75% from their post-pandemic peak. Meanwhile, jobs that rely on human touch - from childcare to hairstyling - have remained largely unaffected.

The message? AI isn’t crashing the job market, but it’s clearly reshaping it, hitting knowledge and tech roles first while leaving people-focused industries mostly untouched - for now.

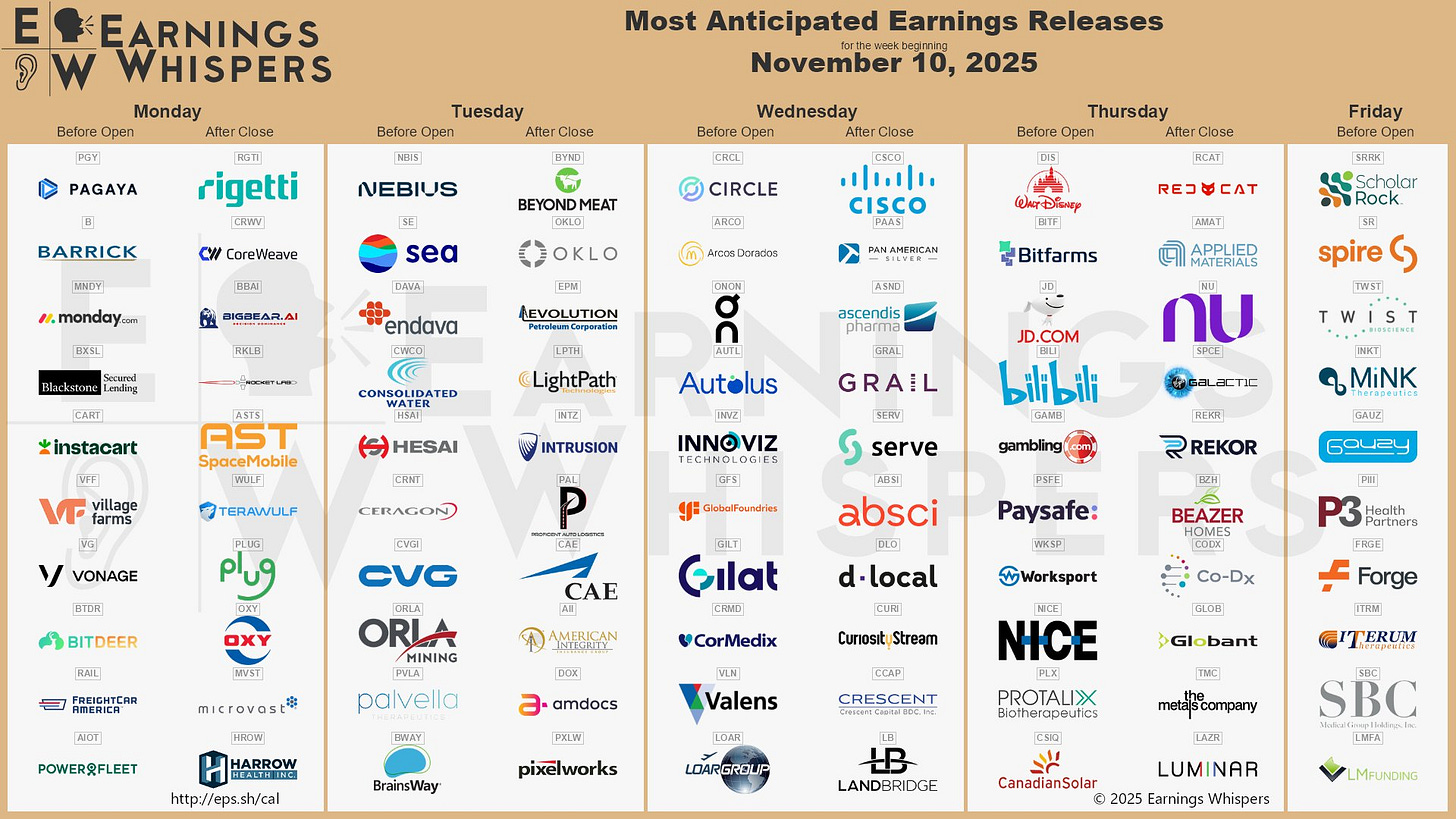

Earnings Season

Join 117,000+ investors on YouTube! 🎥

We break down earnings, market moves, and exclusive insights you won’t find anywhere else.

Don’t miss out — hit the button below to watch and subscribe now! 👇

YouTube Channel 🔔

Subscribe today and stay ahead of the market!

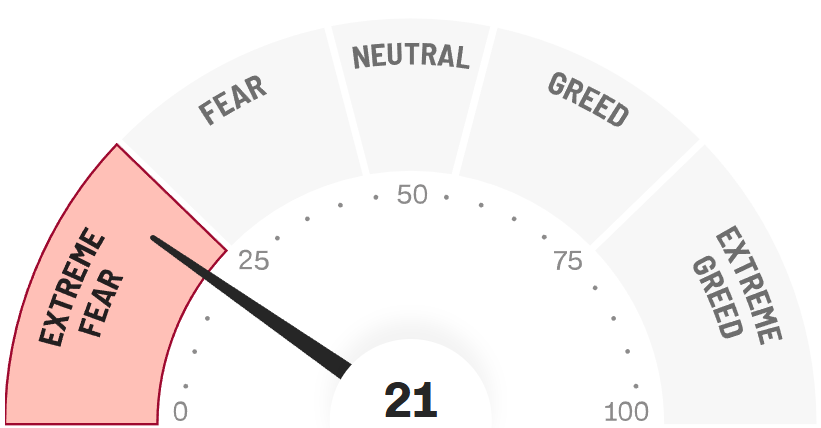

Fear & Greed Index

3 Stocks to Buy After the Market Pullback

The past few weeks have reminded investors that even the strongest rallies need to pause.

After seven straight months of gains, the market finally exhaled - tech stocks cooled, sentiment dipped, and the headlines turned cautious.

But beneath the surface, the story looks very different. Earnings are still growing at a double-digit pace, balance sheets remain strong, and corporate spending on AI and automation hasn’t slowed a bit.

What we’re seeing isn’t a collapse - it’s a reset.

A rare window where strong businesses briefly fall out of favor while the crowd tries to make sense of short-term noise.

That’s exactly when long-term investors should be paying attention.

Here are three world-class companies that not only look resilient through this pullback - but positioned to come out even stronger once sentiment turns.

1. Mercado Libre (MELI)

What is MercadoLibre?

Often called the “Amazon of Latin America,” MELI is the region’s largest e-commerce and fintech company, operating across 18 countries including Brazil, Mexico, and Argentina.

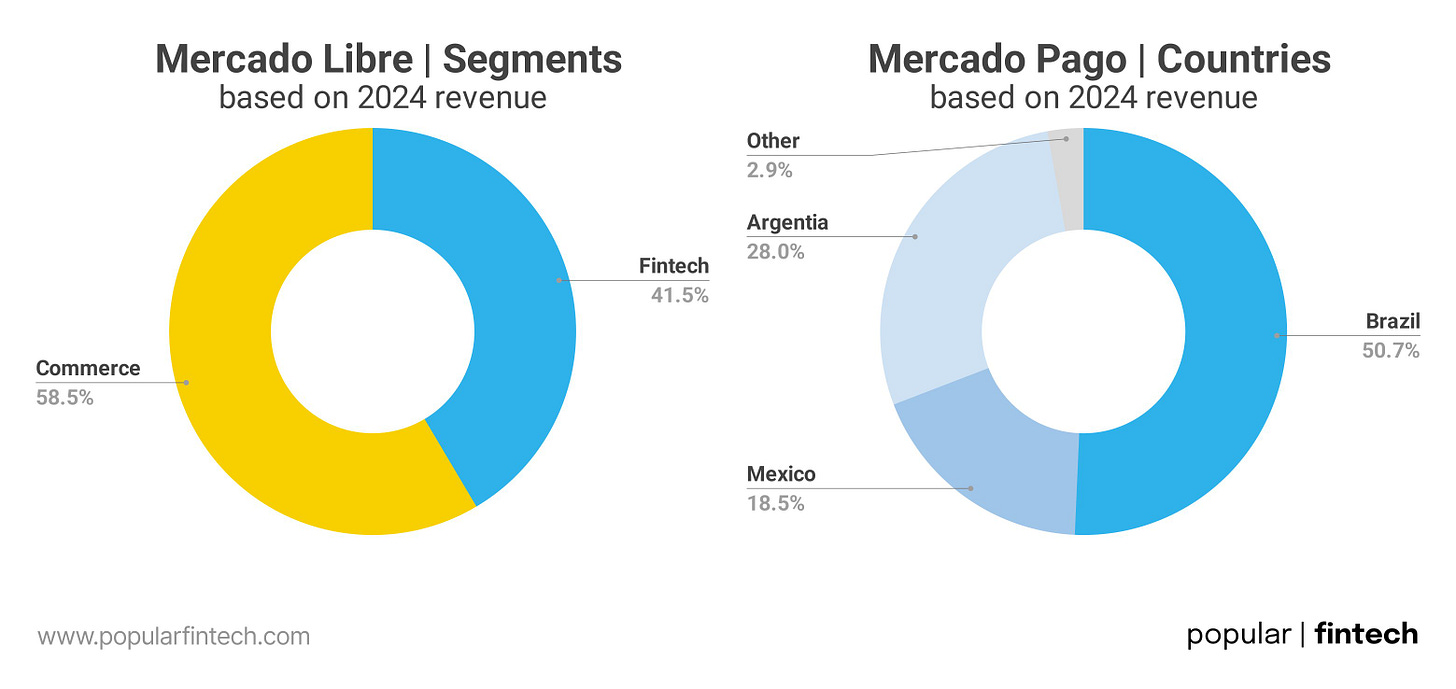

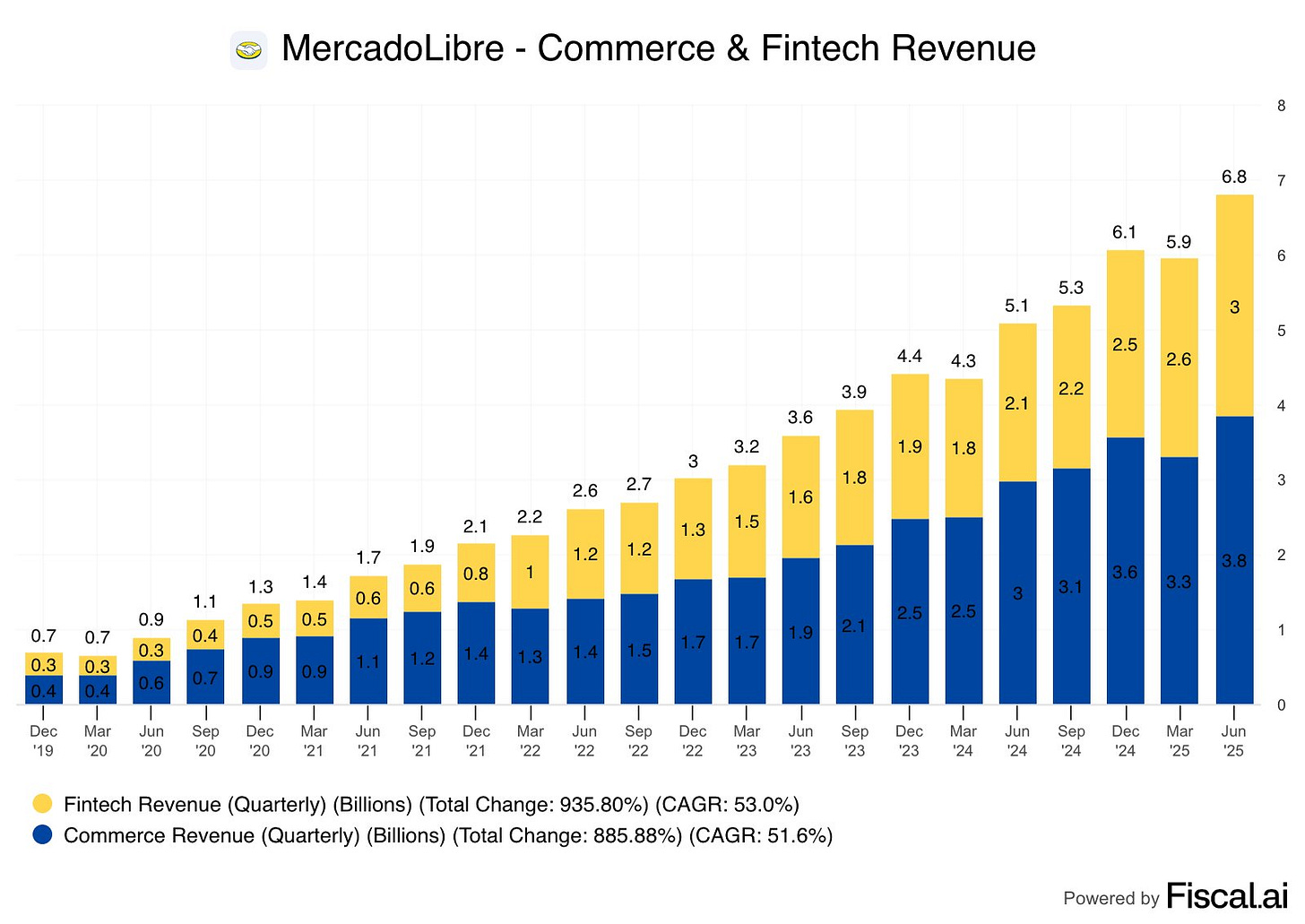

It runs an online marketplace where millions of merchants sell everything from electronics to fashion, but its real power lies in its fintech arm, MercadoPago, which handles digital payments, credit, and even investment products.

In many parts of Latin America, where access to traditional banking is still limited, MercadoLibre has become more than just a shopping platform - it’s a financial ecosystem powering everyday life. Its blend of commerce, logistics, and fintech has made it one of the most dominant and innovative companies in emerging markets.

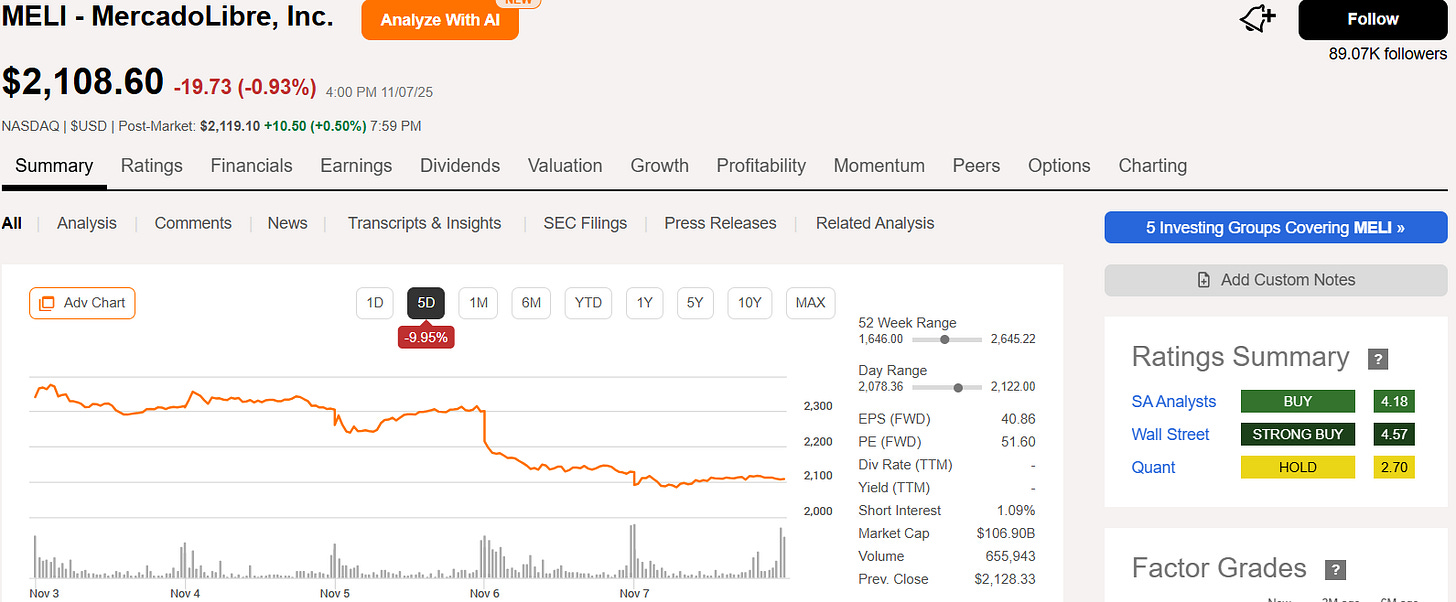

A Short-Term Shakeout, Not a Broken Story

MercadoLibre shares dropped around 10% last week, but the sell-off looks more like a sentiment reset than a shift in fundamentals.

The weakness came after renewed competitive and macro pressures across its key Latin American markets - particularly Brazil, Mexico, and Argentina.

The biggest headline was Amazon expanding its footprint across Latin America, cutting merchant fees, and stepping more directly into MercadoLibre’s turf. That reignited old fears about market share and margins - even though MercadoLibre still dominates the region’s e-commerce and digital payments space.

At the same time, some investors grew cautious about the company’s fast-growing fintech arm, Mercado Pago, especially its credit business. Loan growth remains impressive, but rising provisioning costs and softer consumer spending in high-inflation economies sparked worries about short-term profitability.

And then there’s the bigger picture: after such a strong run this year, many investors simply chose to take profits as the broader tech sector cooled. In that sense, MercadoLibre’s pullback mirrors what we’ve seen across growth names - less about a business issue, more about a valuation reset.

For long-term investors, that’s often where opportunity hides. MercadoLibre remains one of the few companies in emerging markets with real scale, consistent profitability, and a structural tailwind behind both e-commerce and digital finance.

The fundamentals haven’t changed - only the sentiment has.

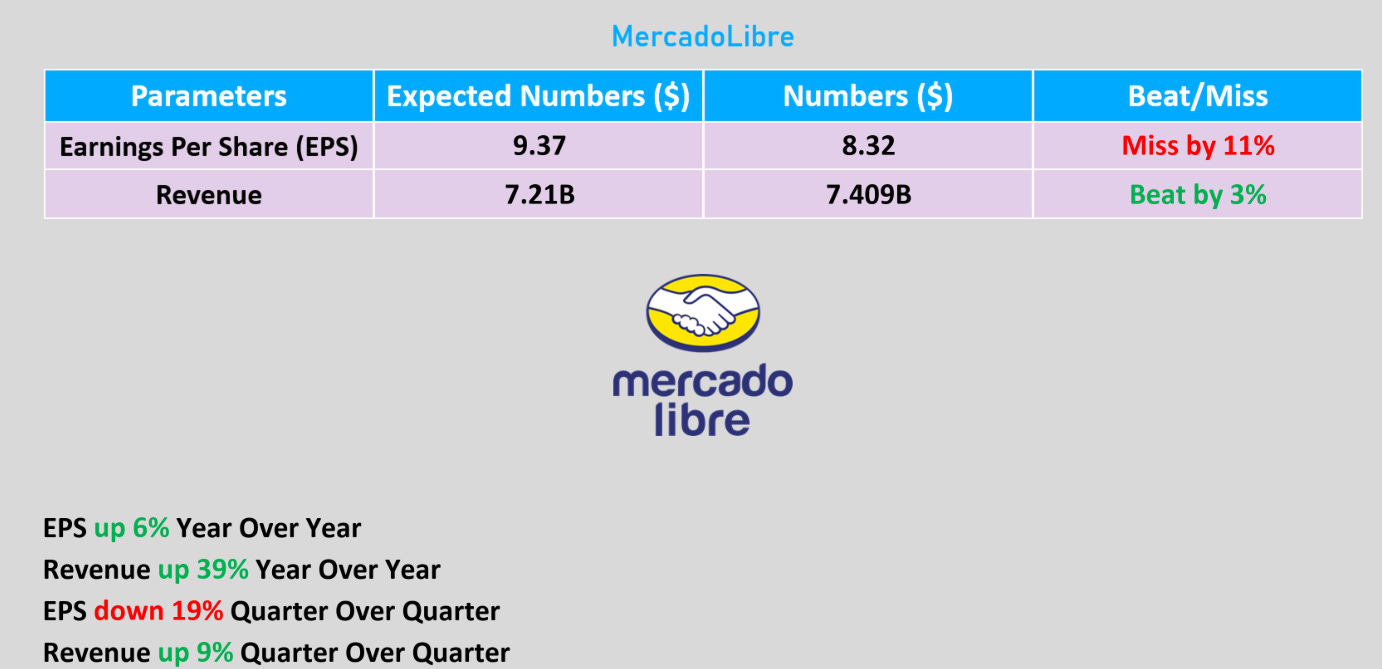

Q3 2025 Earnings Recap

MercadoLibre delivered a strong top line again, but the market’s reaction shows investors are leaning heavily into the margin and profitability story.

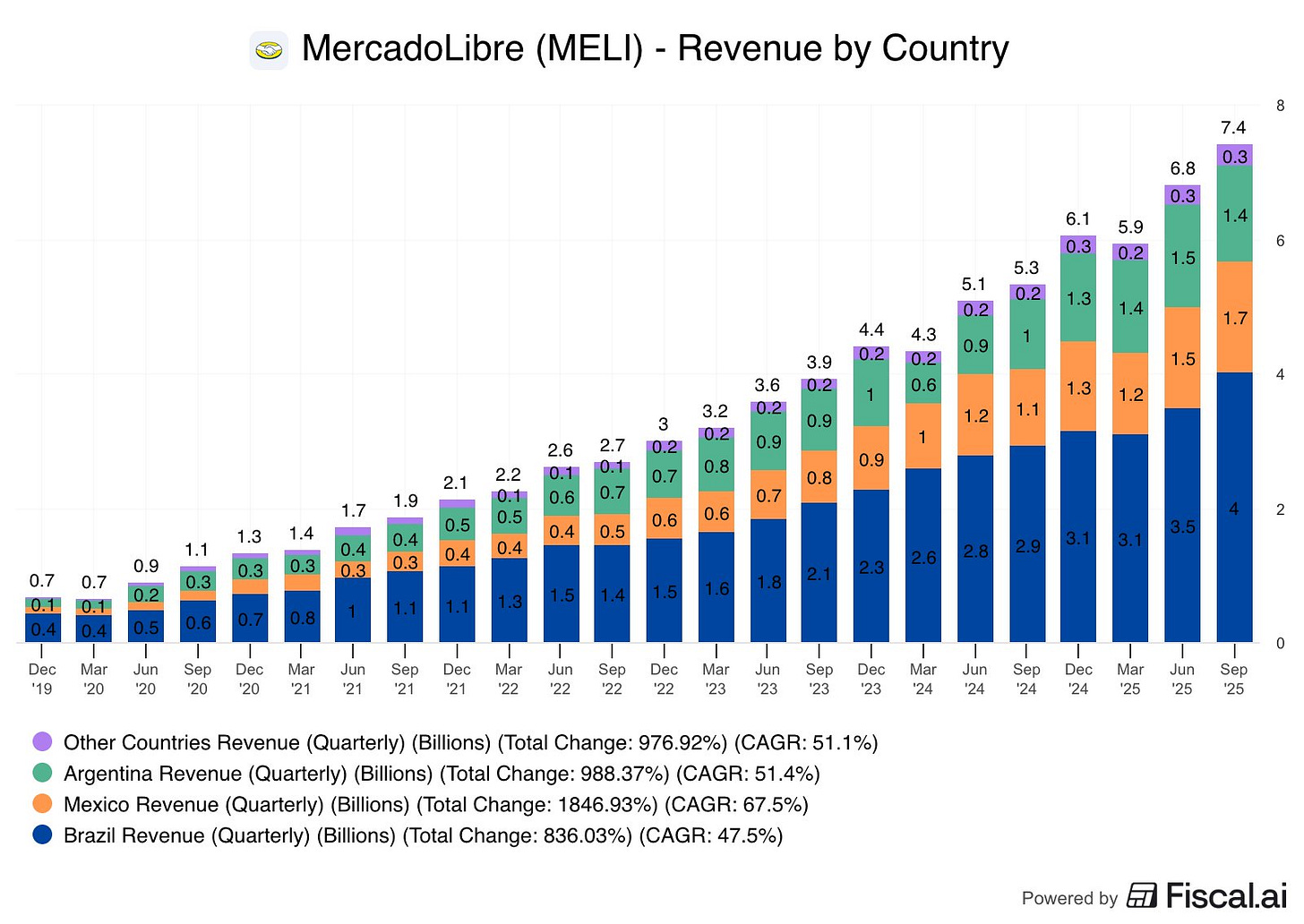

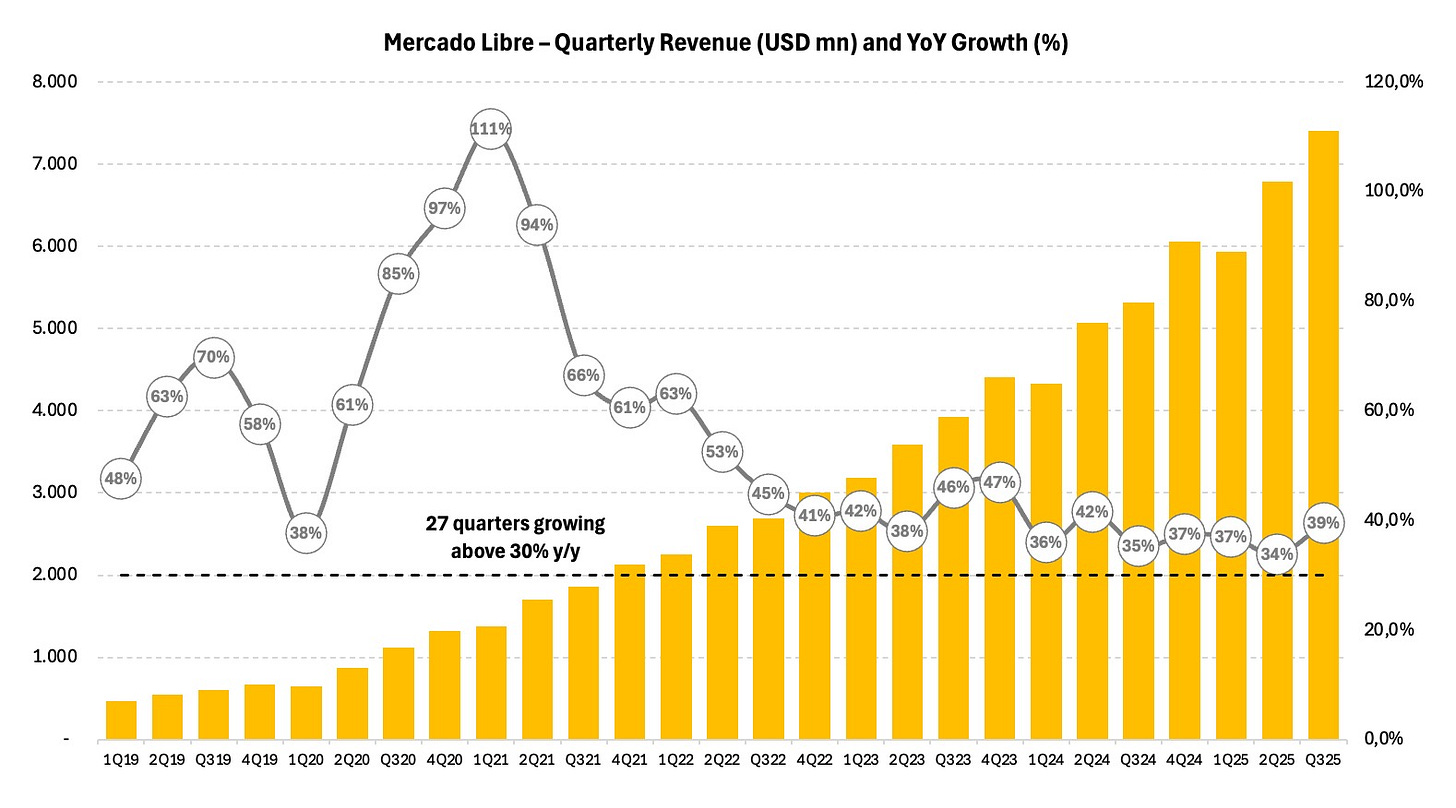

Revenue came in at $7.41 billion, up ~39.5% year‑on‑year - ahead of estimates.

Adjusted EPS was $8.32, which missed consensus expectations.

The company noted higher investment spending, particularly in logistics, marketing and competitive initiatives (especially in Brazil), putting pressure on short‑term margins.

Despite the earnings miss, the underlying business continued to scale: growth in e‑commerce, fintech adoption, and regional expansion remain very much intact.

Revenue has also been growing at double-digit rates across every location since 2012 - a rare feat in any market.

Why MercadoLibre Stands Out

MercadoLibre isn’t just another high-growth company - it’s a business that consistently delivers results in a challenging, emerging-market environment.

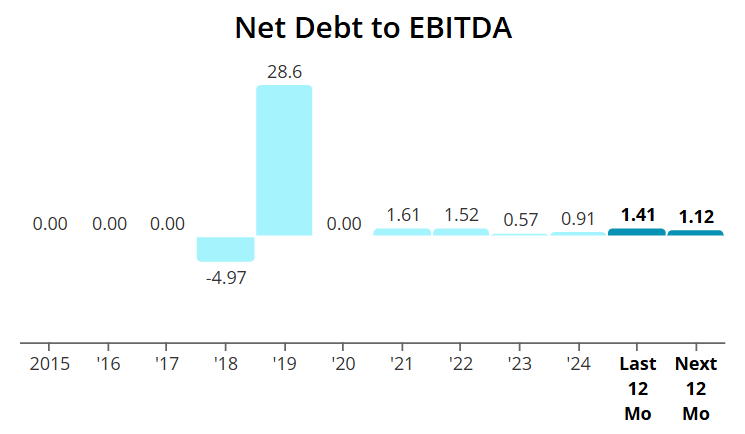

One key differentiator is its financial strength: the company maintains a net debt to EBITDA ratio of just 1.41, giving it the flexibility to invest aggressively in growth while keeping leverage low.

Equally remarkable is its extraordinary growth consistency.

MercadoLibre has now posted 27 consecutive quarters of year-over-year revenue growth above 30%, making it the only public company in the world - out of over 83,000 - to sustain this kind of performance.

This streak underscores not only the resilience of its business model but also the execution discipline of management.

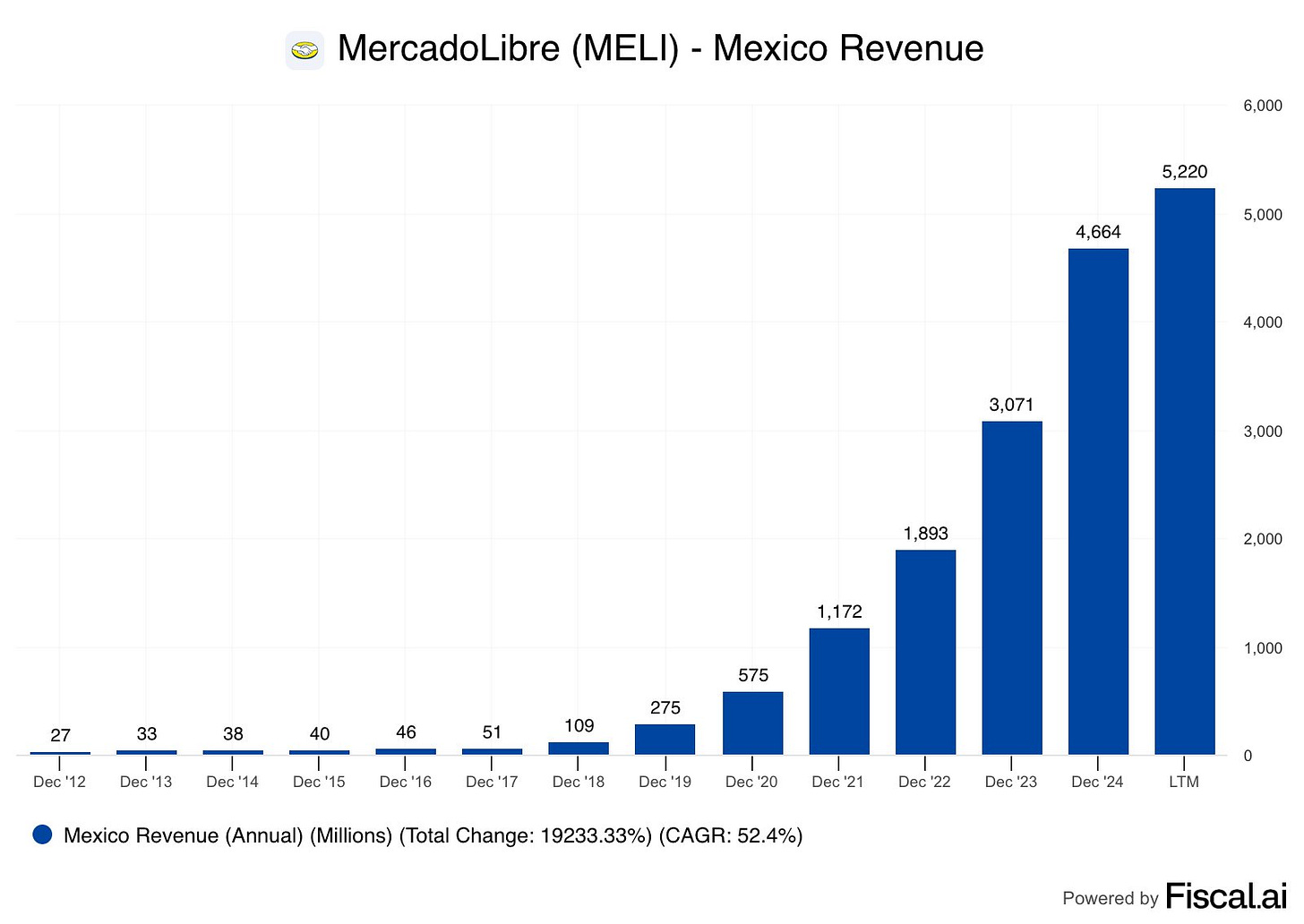

Regionally, the company is thriving. Mexico, one of its largest markets, has seen revenue grow at a 52% compound annual growth rate over the past 12 years, a reflection of both market opportunity and MercadoLibre’s strong competitive positioning.

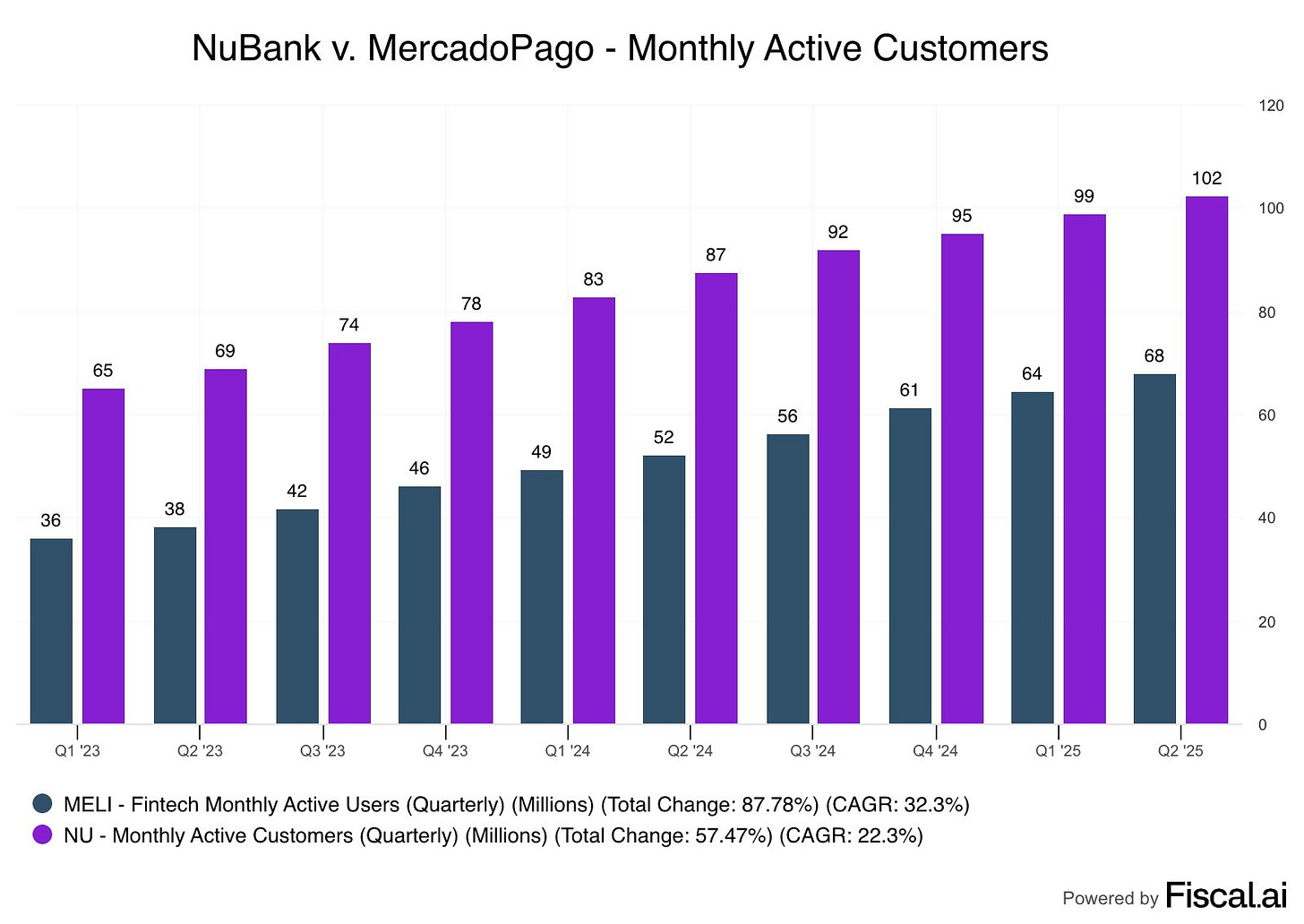

The fintech segment, MercadoPago, is also outpacing many peers. It now boasts 68 million monthly active users, growing 30% year-over-year, compared with NuBank’s 102 million users growing 17% YoY.

Across both commerce and fintech, MercadoLibre has delivered 50%+ compound annual growth over the last five years, highlighting the strength of its dual-engine strategy.

Taken together, low leverage, unmatched growth consistency, and rapid expansion in key markets make MercadoLibre a standout pick.

For investors, this is a company where the fundamentals - not just sentiment - drive the opportunity, making the recent pullback a compelling entry point.

Valuation

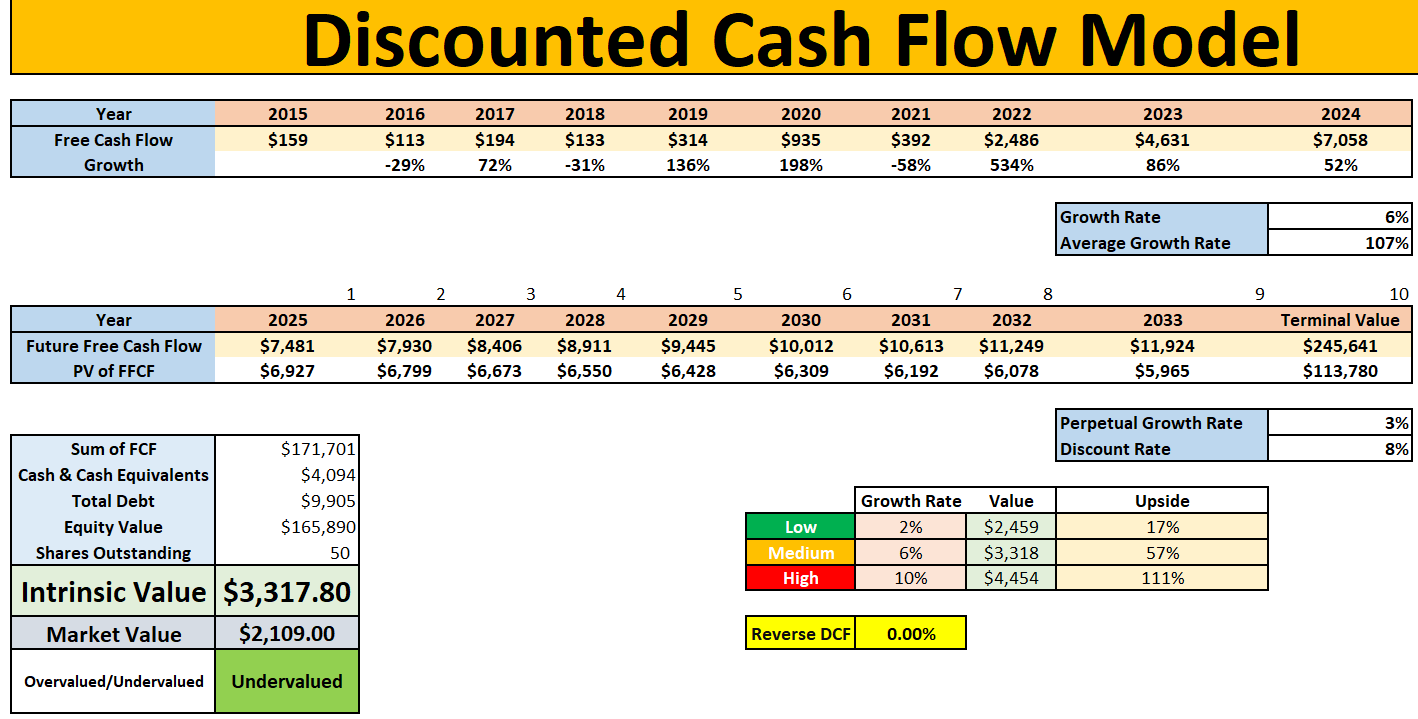

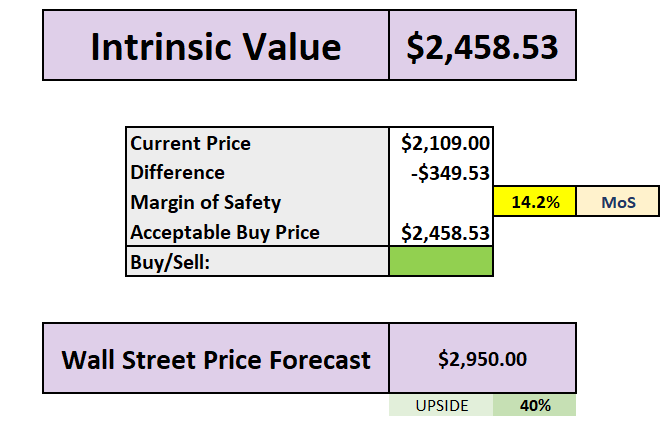

Using our DCF model a few things to note:

0% is baked into the FCF growth moving forwards (meaning if you are buying at today’s price then no growth is projected)

Using the middle rate of 6% growth there is upside of 57%

Using the higher (but still reasonable) rate of 10%, we note more than a 2x at 111% upside

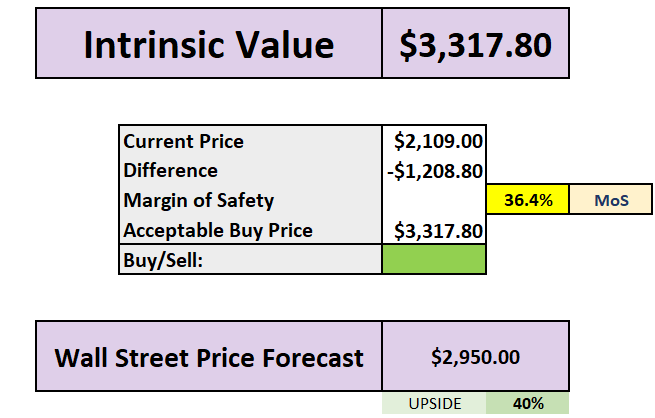

If we use the middle rate of 6%, there is 36% margin of safety on offer to investors, with Wall Street seeing 40% upside into 2026.

Even using the super conservative low growth rate of 2% you are getting a 14% MoS.

Keep reading with a 7-day free trial

Subscribe to Dividend Talks to keep reading this post and get 7 days of free access to the full post archives.