3 Stocks to Buy Now for H2 2025

Markets are at all-time highs - but risks are rising. Here’s how I’m thinking about growth, yields, and global shifts going into the second half.

Market Update

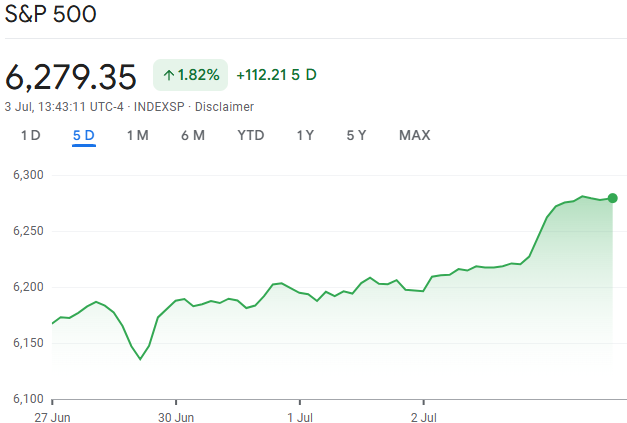

It’s been a wild first half of 2025. Despite some ups and downs, markets ended June at all-time highs, with both the S&P 500 and Nasdaq up over 6% so far this year.

We saw a sharp drop earlier in the year - nearly 20% - as shifting policies spooked investors.

But things turned around thanks to solid economic data and cooling trade tensions.

Looking ahead, the July 9 deadline for the 90-day tariff pause could stir things up again.

And just in the last week the S&P 500 was up 2%.

On a granular level, we had some very strong performers last week.

Biggest winners included:

Oracle (ORCL) up 12%

Amgen (AMGN) up 7%

Apple (AAPL) up 6%

PepsiCo (PEP) up 6%

Biggest losers included:

Centene (CNC) down 38%

Elevance Health (ELV) down 7%

Palantir (PLTR) down 7%

Advanced Micro Devices (AMD) down 4%

Notable News

Growth Is Slowing, But the Path Still Looks Steady

The first half of 2025 was shaped by policy uncertainty.

In April, the U.S. announced sweeping tariffs that could’ve pushed the effective rate from 2.3% to over 25%, sparking recession fears.

Since then, tensions have eased, and the current rate sits closer to 15%.

A recent deal with Vietnam helped too, cutting their rate to 20%, down from 46% in April.

That said, tariffs are still a key focus and could rise again, especially with the 90-day pause ending July 9.

So far, inflation’s been under control, but higher prices may show up later this year as companies run down inventories and pass on costs - potentially squeezing consumer spending and corporate margins.

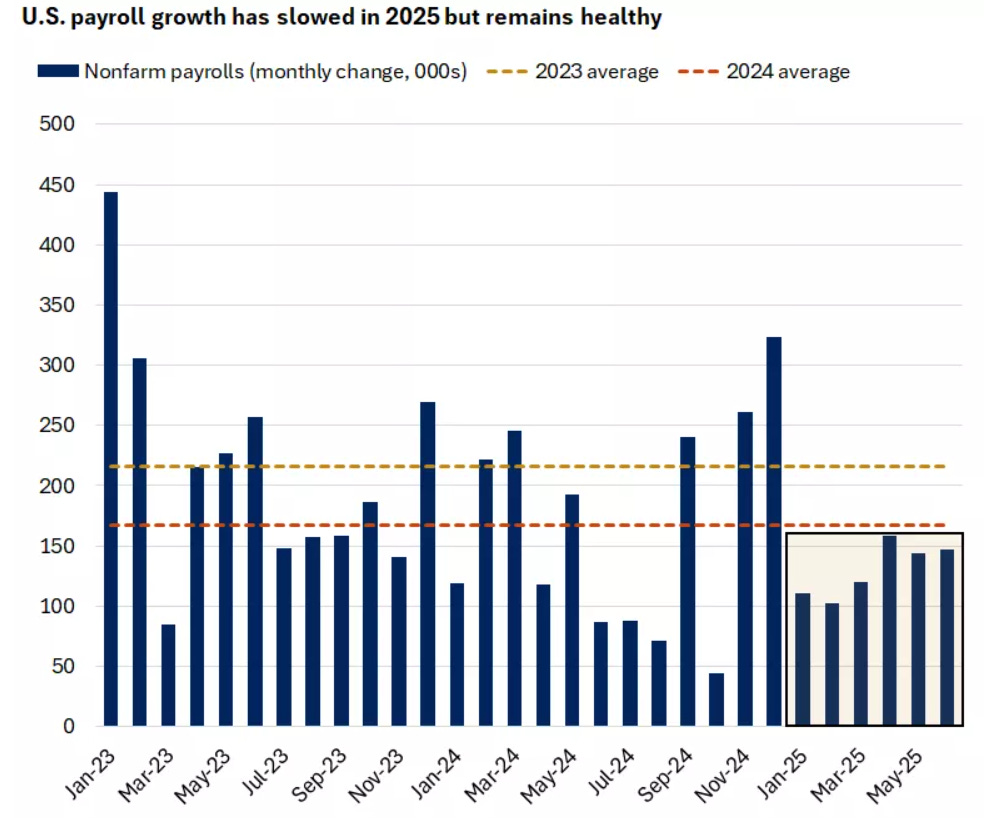

On the bright side, the economy remains resilient.

Jobs data last week beat expectations, unemployment dipped to 4.1%, and jobless claims fell to a six-week low.

Meanwhile, the OBBA bill could extend tax cuts and add new breaks for tips, overtime, and seniors.

So while growth may slow short term, 2026 could bring a pickup - especially with possible policy support and rate cuts ahead.

U.S. Stocks Fall Behind (For Now)

For years, U.S. stocks have outperformed most of the world - winning 12 of the past 15 years.

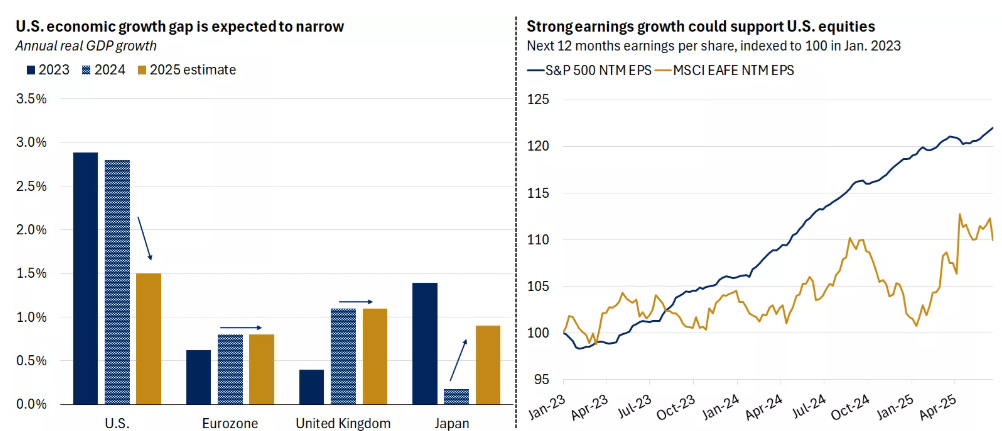

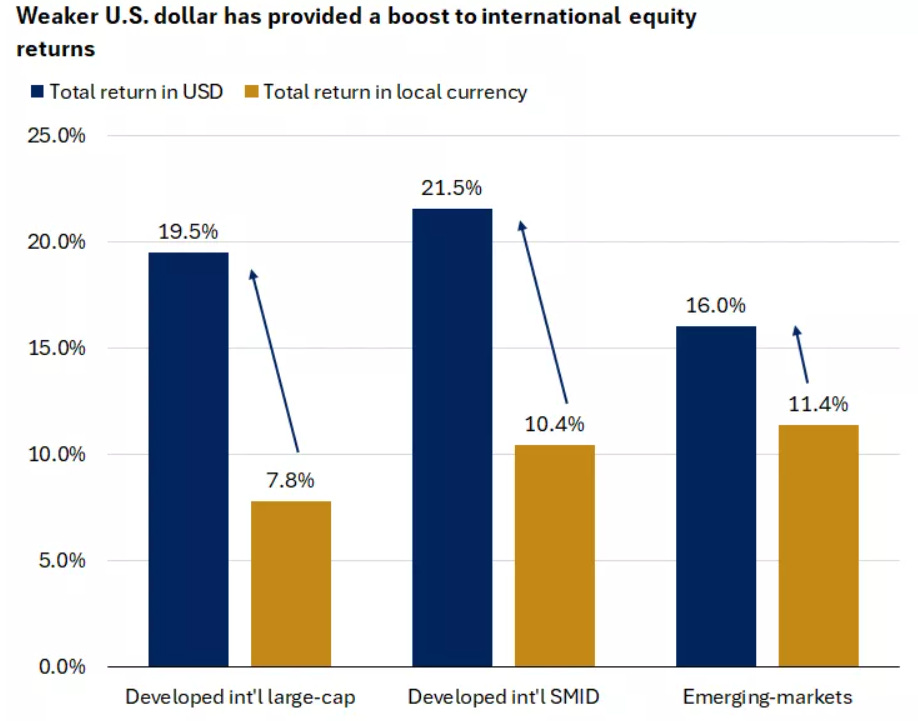

But that flipped in the first half of 2025, with international markets, especially Europe, taking the lead.

Germany’s ramped-up spending and deeper rate cuts from the European Central Bank gave European stocks a solid boost.

Meanwhile, recent U.S. policy moves are expected to slow growth a bit, narrowing the usual U.S. edge.

That said, U.S. companies still look stronger on the earnings front - helped by AI momentum and potentially friendlier policy ahead.

On the other hand, international profits may be under pressure as tariffs dampen global demand.

A weaker U.S. dollar also played a big role in international outperformance this year, falling over 10% as growth slowed and questions swirled about its long-term dominance.

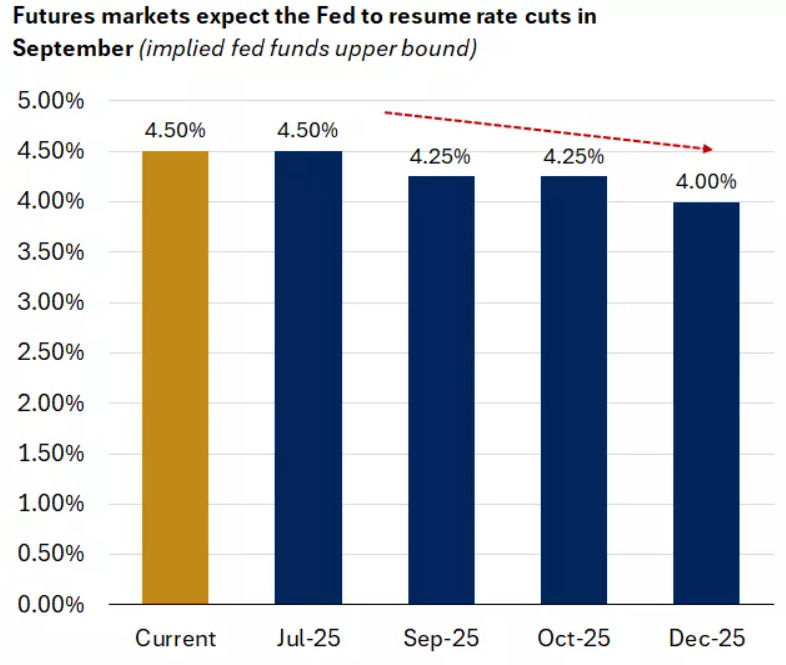

Yields Stuck in a Range as Fed Eyes Cuts

Even though inflation came in lower than expected in the first half, the Fed kept rates steady - waiting to see how tariffs play out.

At its June meeting, the Fed signaled two cuts still likely in 2025, the same as projected back in March.

They now expect just one cut in 2026 (down from two), and another in 2027, hinting at a slower, more cautious path.

One wild card? Debt. The proposed tax bill could add $4.1 trillion to the national debt over the next decade.

That could push debt-to-GDP from around 100% today to 130%, possibly making investors demand higher yields - especially on longer-term bonds - as compensation for rising fiscal risks.

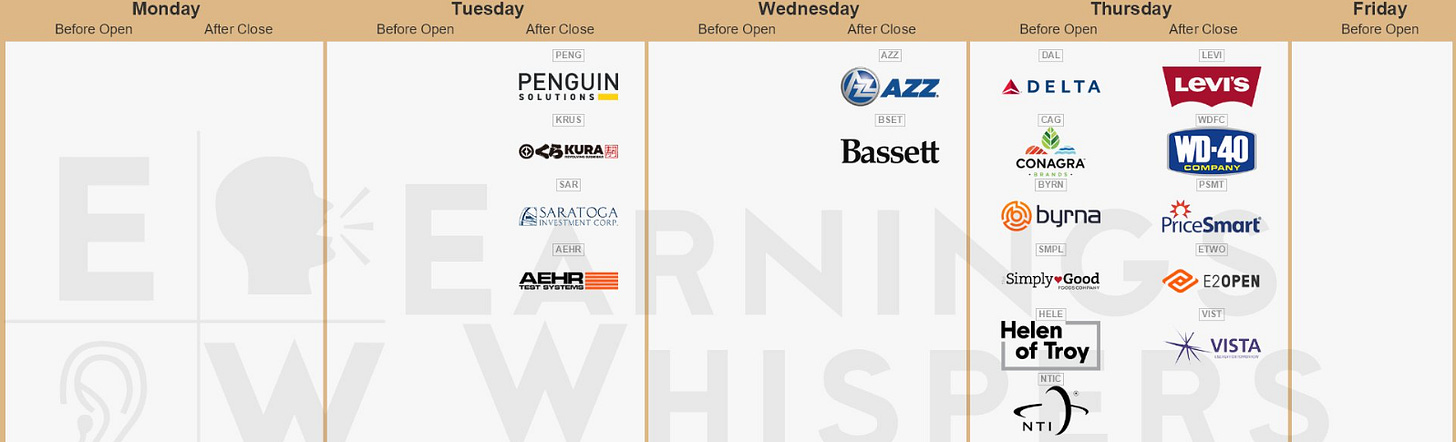

Earnings This Week

Join 99,000+ investors on YouTube! 🎥

We dive deeper into earnings (and more) on our channel. Don't miss out - click below to watch now!👇

YouTube Channel 🔔

Click here to subscribe and stay updated!

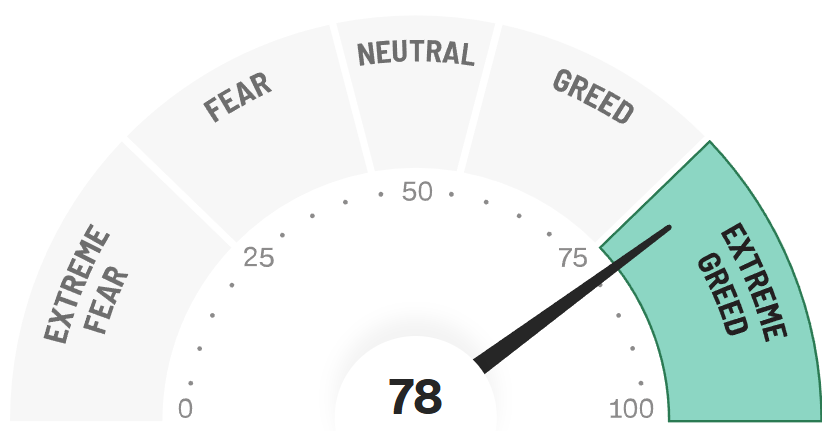

Fear & Greed Index

3 Stocks For H2

Let us dive into these 3 Stocks I have selected for the second half of 2025.

I have used the following criteria to help identify these stocks:

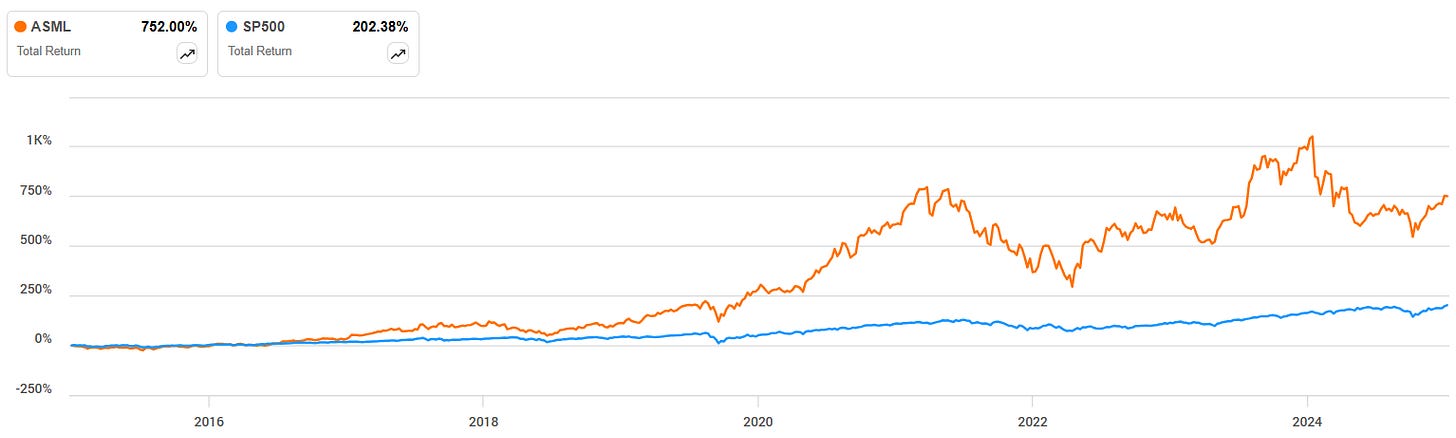

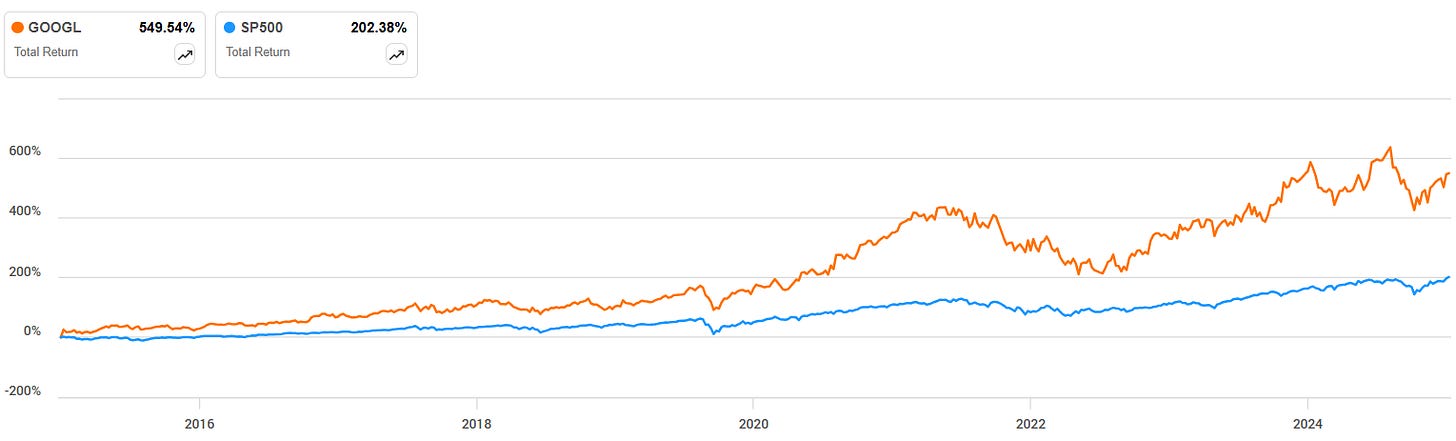

1. Outperformed S&P 500 last 10Y

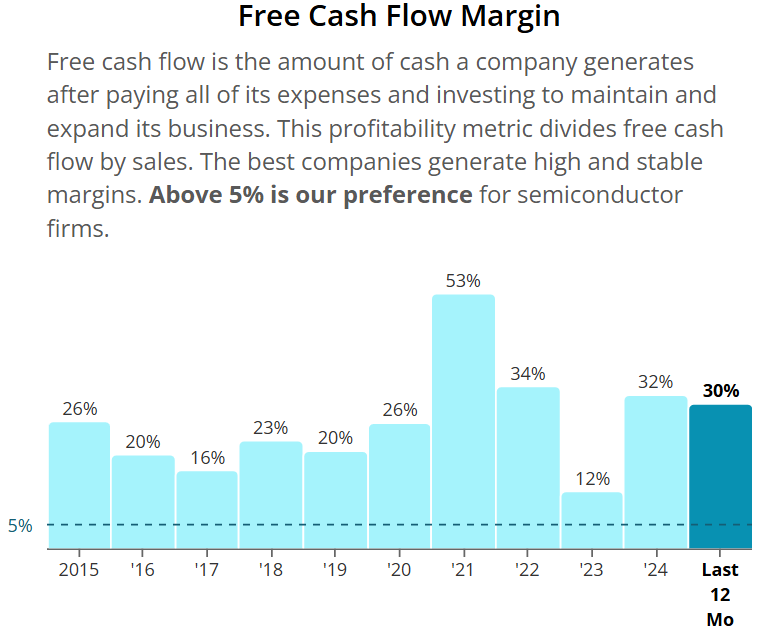

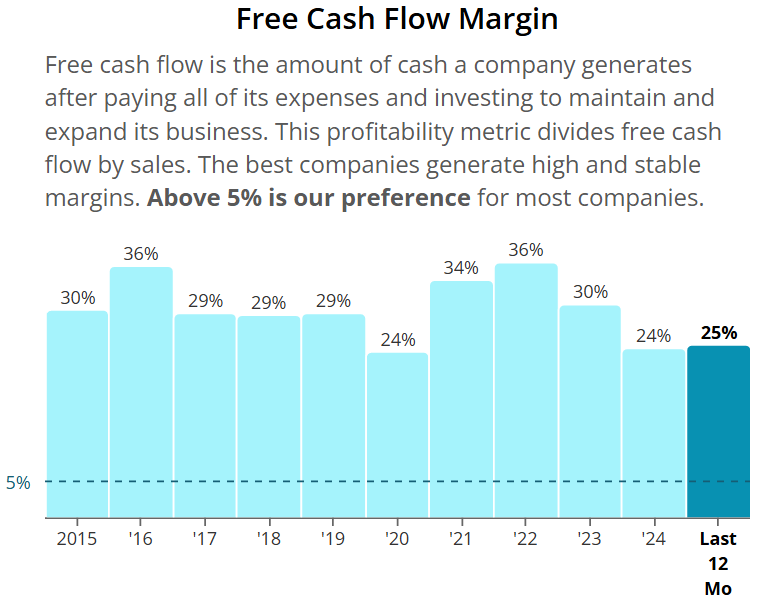

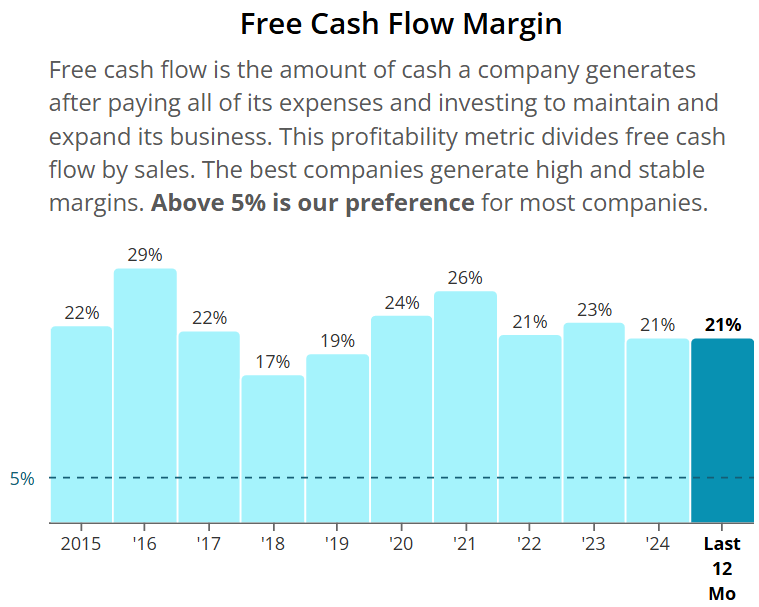

2. Free Cash Flow Margin 20%+

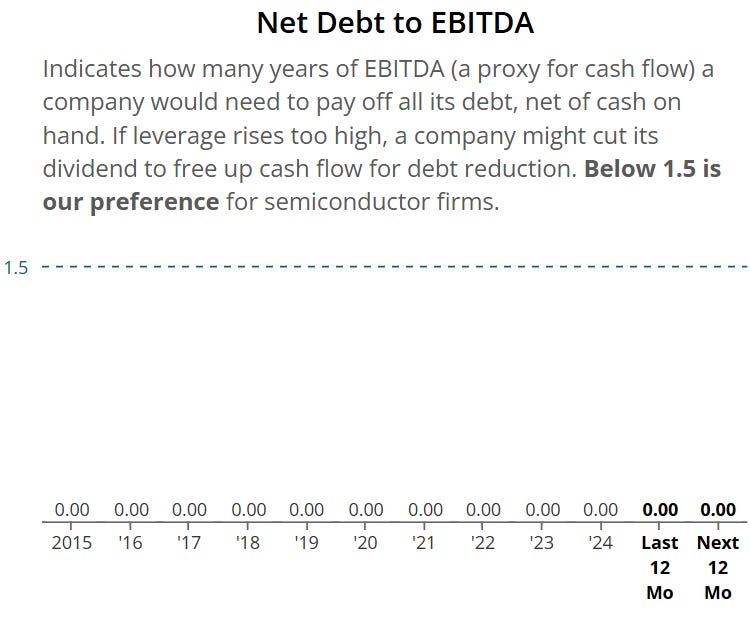

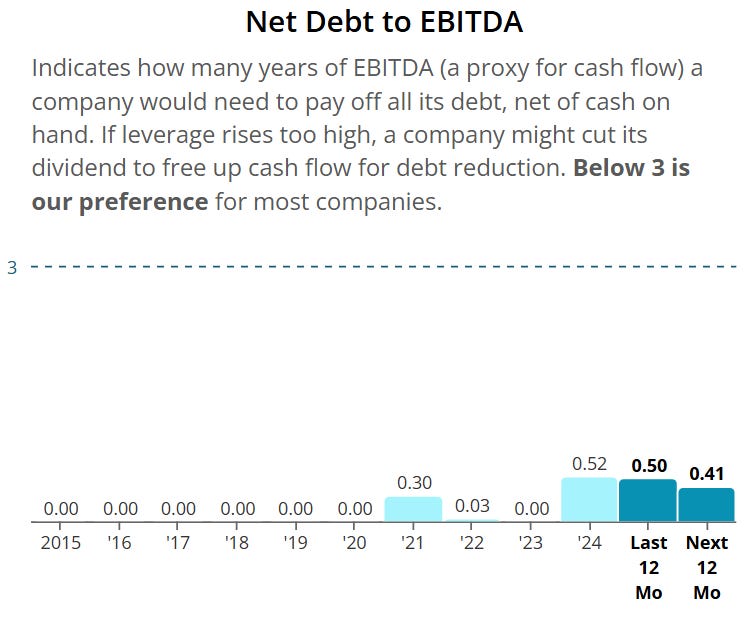

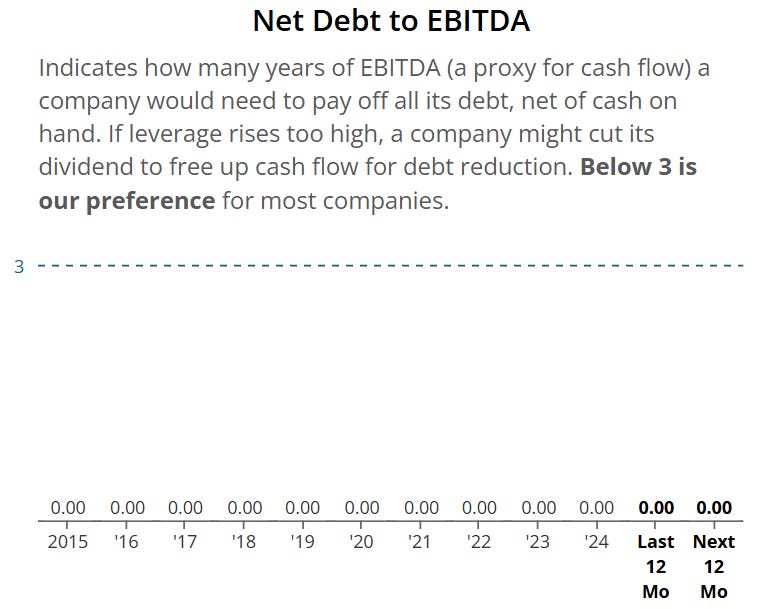

3. Net Debt to EBITDA <1.5

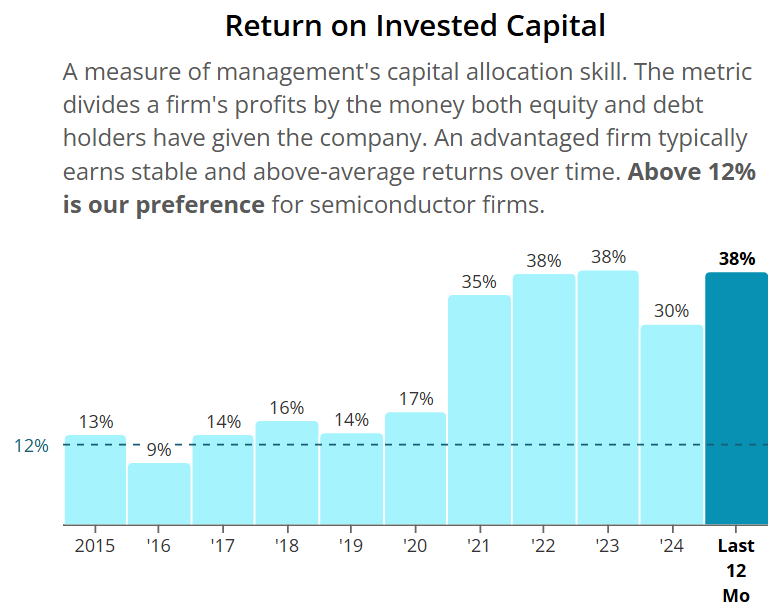

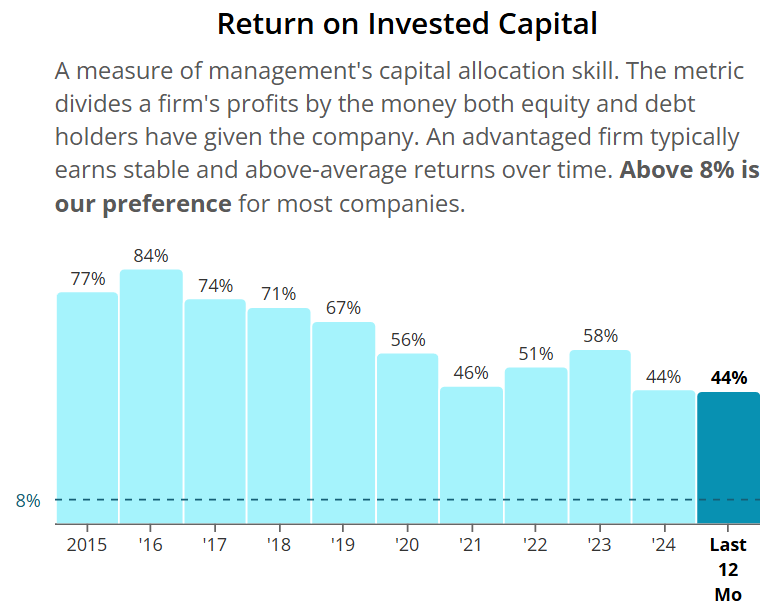

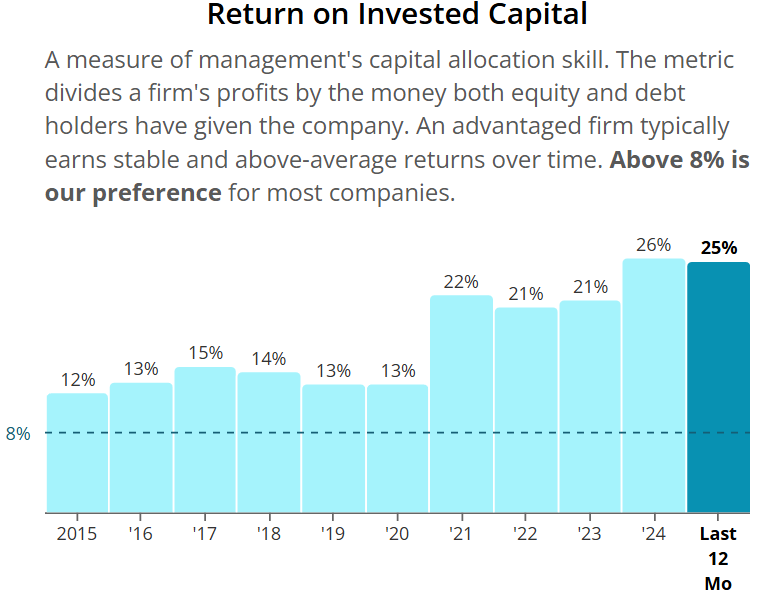

4. ROIC > 10%

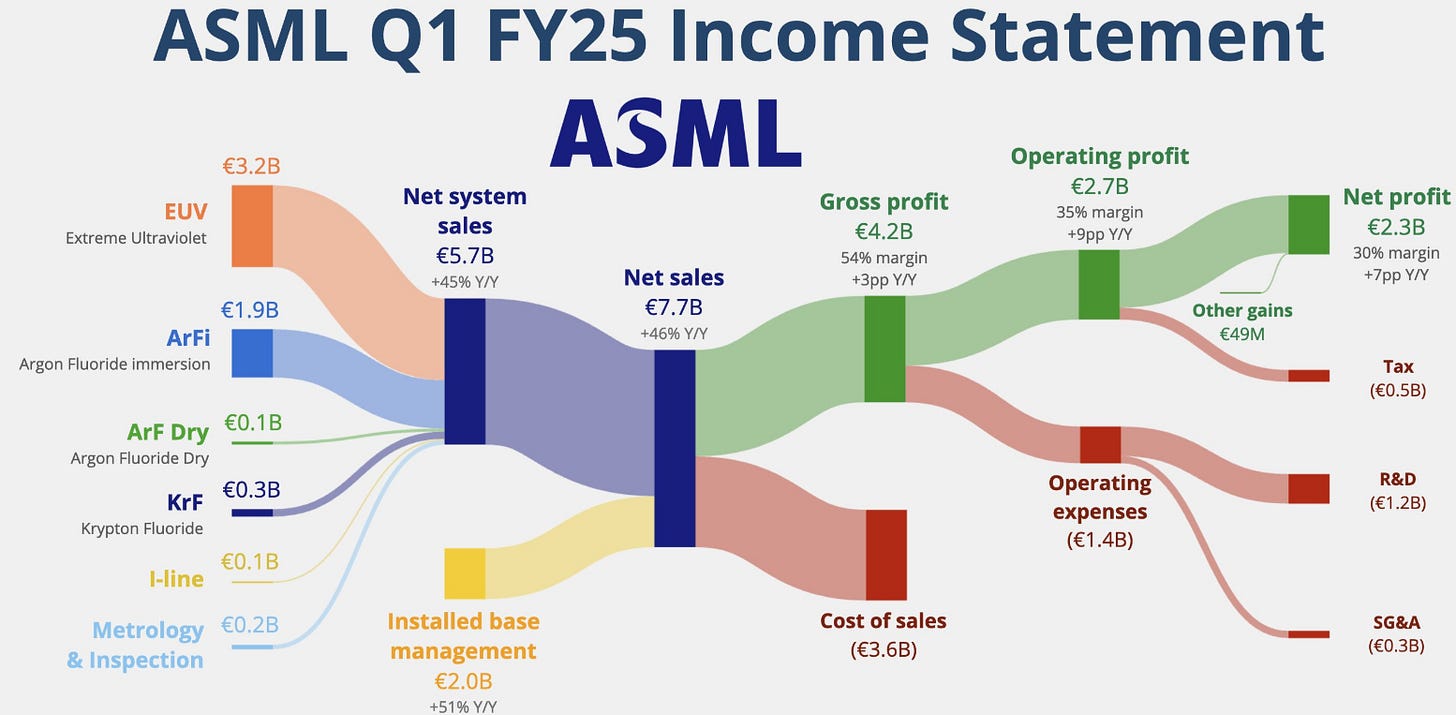

ASML (ASML)

ASML makes the world’s most advanced lithography machines, including EUV systems, which no competitor can currently match.

These machines are incredibly complex - some cost over $200 million and take six jumbo jets to ship - making them nearly impossible to replicate.

ASML’s moat lies in its proprietary technology, deep supplier network, and long-term contracts with chip giants like TSMC, Intel, and Samsung.

Its dominant position is protected by decades of R&D, thousands of patents, and government export controls.

Outperformed S&P 500 last 10Y

Free Cash Flow Margin 20%+

Net Debt to EBITDA <1.5

ROIC > 10%

Valuation

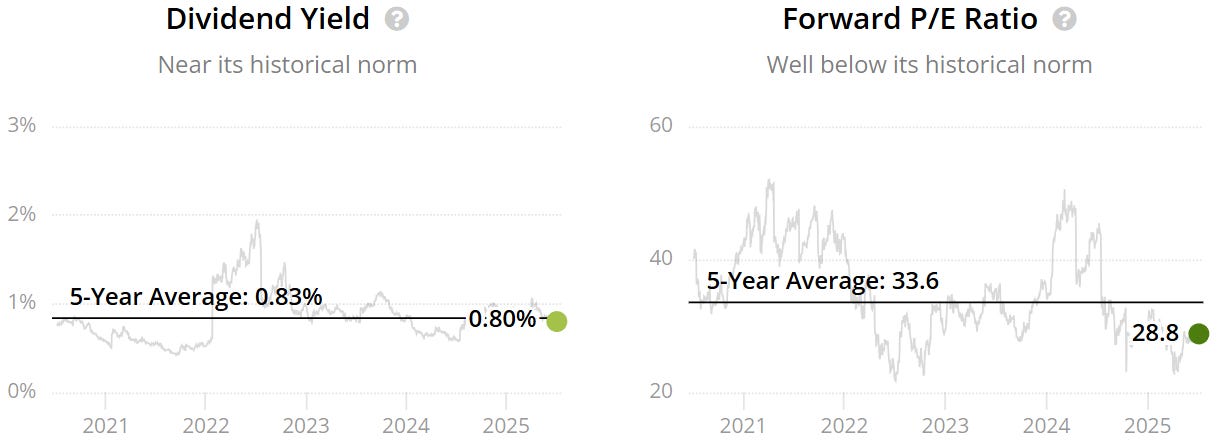

It trades at a forward P/E of 28.8x which is lower than it’s 5Y at 33.6x.

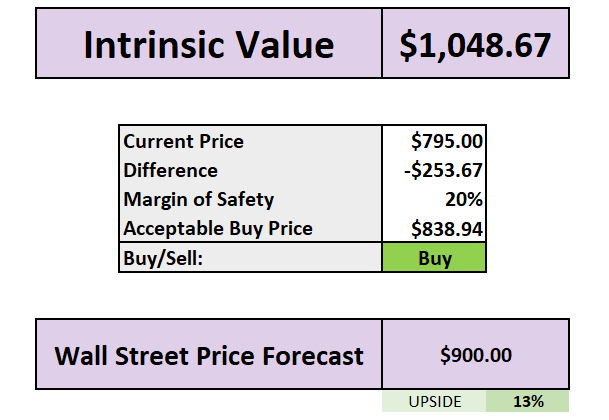

ASML is offering a 20% Margin of Safety at $839.

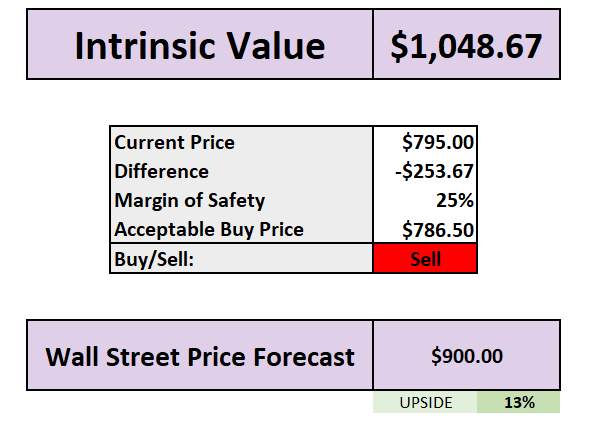

ASML is offering a 25% Margin of Safety at $787.

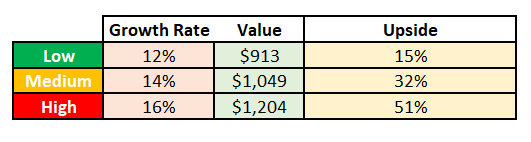

This is based on a growth rate to the free cash flow moving forwards at 14%.

If you want to see a deeper dive, then check out our YouTube video analysis on ASML from days ago:

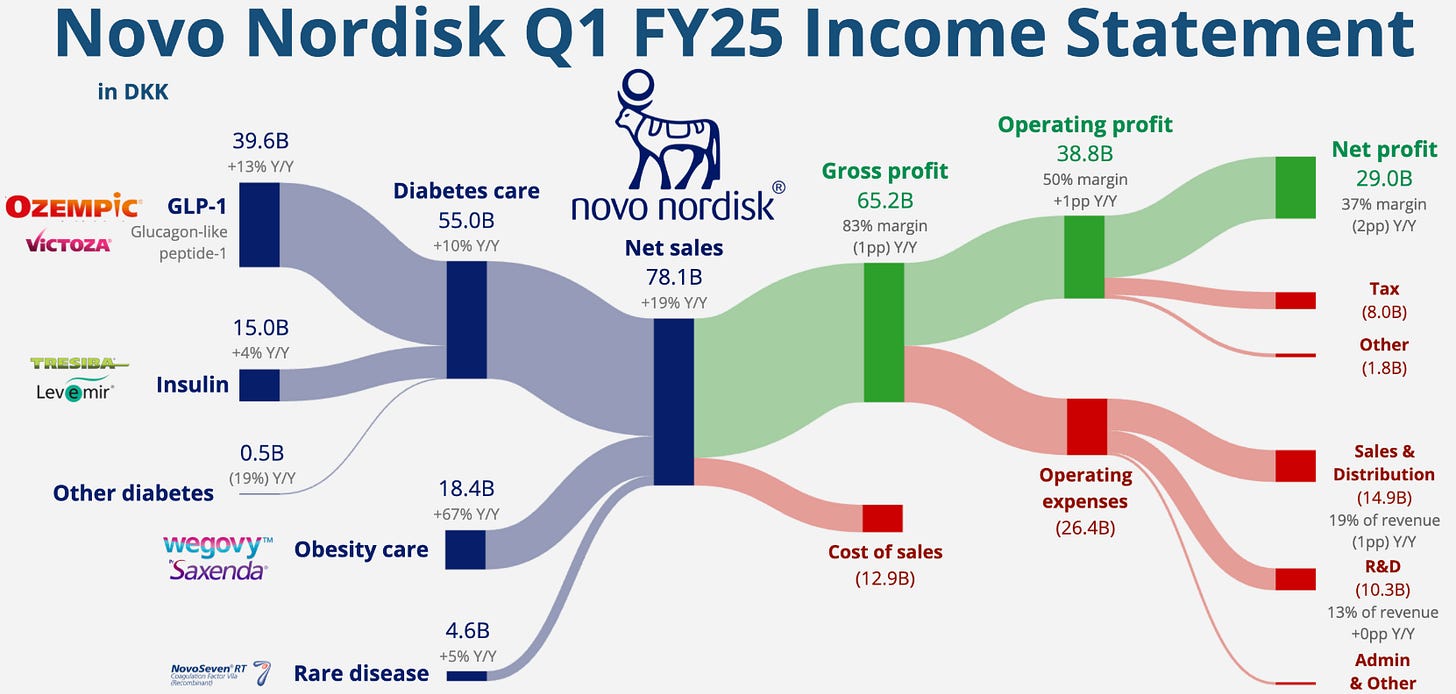

Novo Nordisk (NVO)

Novo Nordisk is a Danish pharmaceutical company specializing in diabetes, obesity, and rare disease treatments.

It’s best known for its GLP-1 drugs like Ozempic and Wegovy, which help manage blood sugar and promote weight loss.

Its moat comes from decades of expertise in insulin and metabolic diseases, a strong pipeline of next-generation therapies, and global manufacturing capabilities.

Patents, regulatory approvals, and physician trust help protect its market leadership.

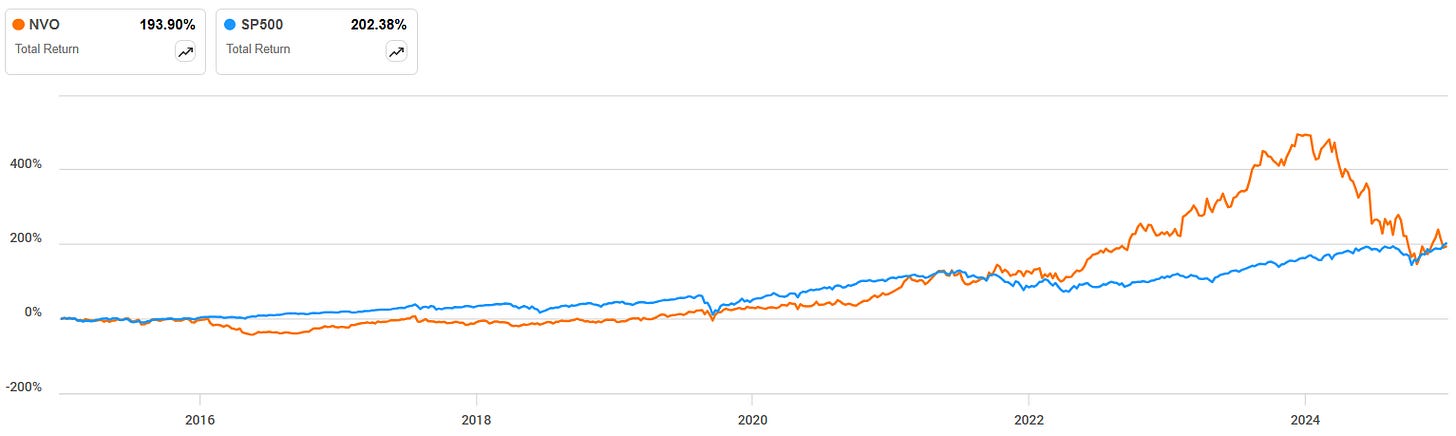

Marginal underperformance vs S&P 500 last 10Y

Free Cash Flow Margin 20%+

Net Debt to EBITDA <1.5

ROIC > 10%

Valuation

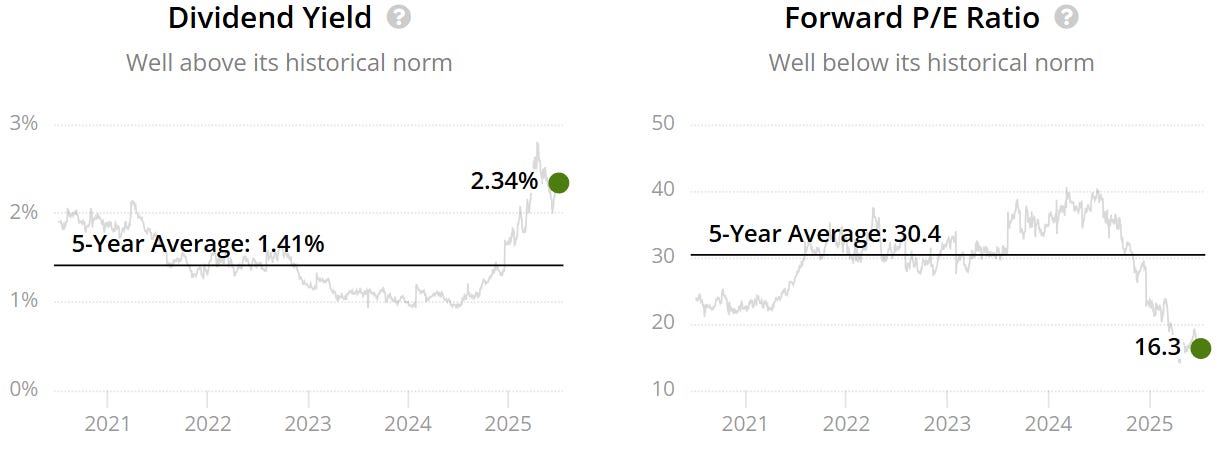

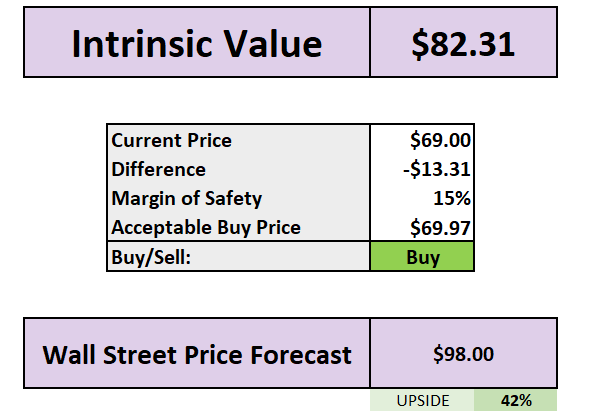

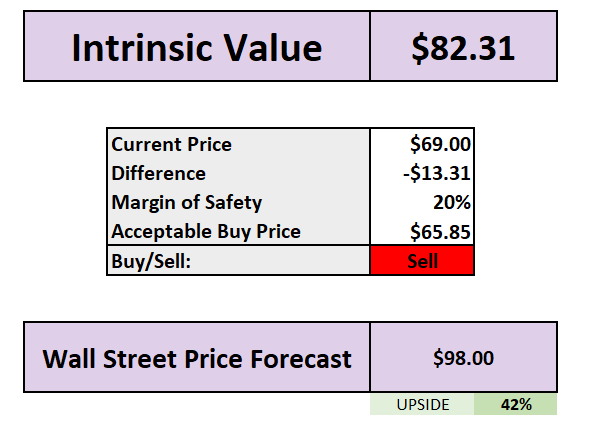

It trades at a forward P/E of 16.3x which is lower than it’s 5Y at 30.4x.

NVO is offering a 15% Margin of Safety at $70.

NVO is offering a 20% Margin of Safety at $66.

This is based on a growth rate to the free cash flow moving forwards at 14%.

If you want to see a deeper dive, then check out our YouTube video analysis on NVO from days ago:

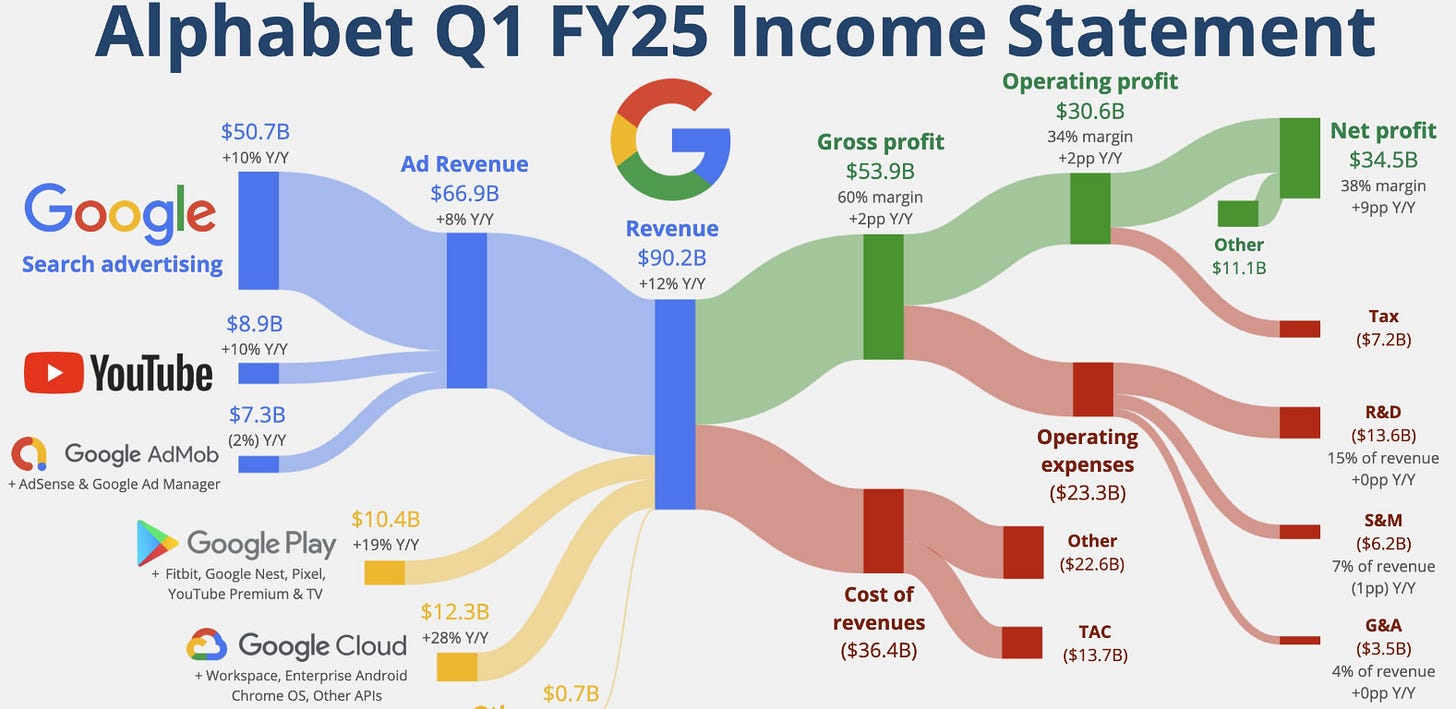

Alphabet (GOOGL)

Google is the world’s leading search engine and a major player in digital ads, YouTube, Android, and cloud services.

Its moat is built on massive user data, advanced AI, and unmatched scale in search and advertising.

Google’s dominance is reinforced by default search agreements, a vast ecosystem (Gmail, Maps, Chrome), and years of infrastructure investment.

This creates powerful network effects and high switching costs for users and advertisers.

Outperformed S&P 500 last 10Y

Free Cash Flow Margin 20%+

Net Debt to EBITDA <1.5

ROIC > 10%

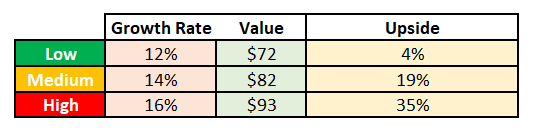

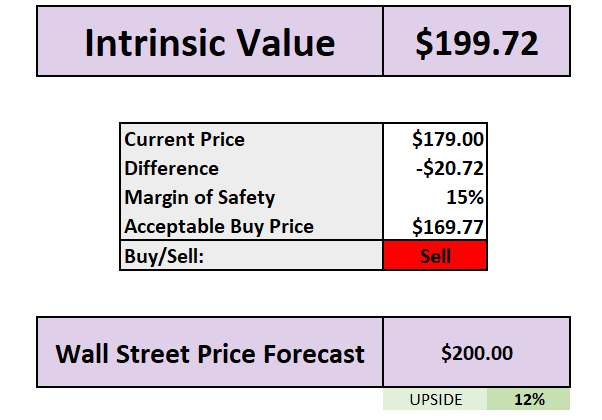

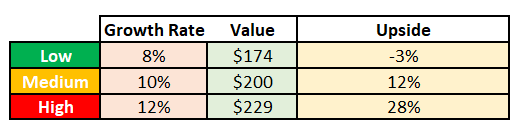

Valuation

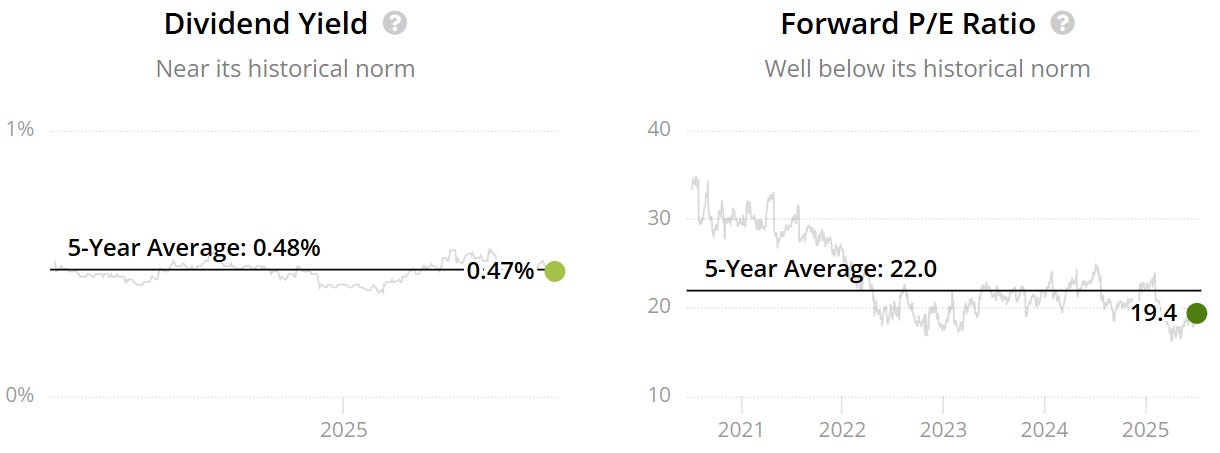

It trades at a forward P/E of 19.4x which is lower than it’s 5Y at 22x.

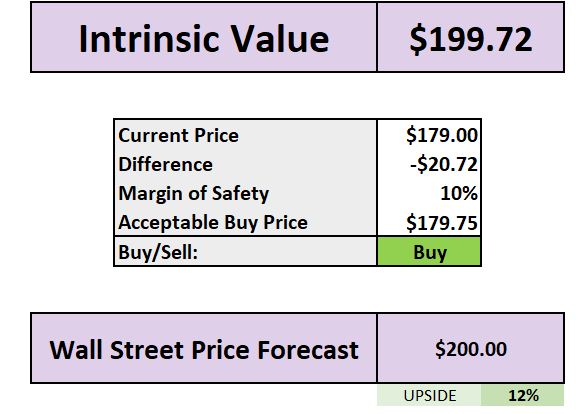

GOOGL is offering a 10% Margin of Safety at $180.

GOOGL is offering a 15% Margin of Safety at $170.

This is based on a growth rate to the free cash flow moving forwards at 10%.

If you want to see a deeper dive, then check out our YouTube video analysis on GOOGL from days ago:

Stock Resources

Stock Valuation Model 📊 (Unlock my stock valuation model as seen on YouTube)

Seeking Alpha 💵 ($30 off stock research tools I use daily.)

TipRanks 📈 (50% off expert stock research tools)

YouTube 🎥 (Join 99,000+ investors on YouTube!)

Patreon 👥 (Join my community for exclusive content)

Snowball Analytic (30% off portfolio tracker)

Thanks For Reading!

☕ Buy Me A Coffee – Your support helps cover the costs of running the newsletter.

📬 Join the community – Subscribe now to get weekly investment insights delivered straight to your inbox.

💬 Found this helpful? Share it with friends and colleagues! Your support keeps this newsletter FREE.

I hope you all have a great week ahead! 🌟

Dividend Talks💰

$ASML looks interesting. ASML holds a strong position in the semiconductor space, with impressive revenue growth of +46.4% YoY in Q1.

If GOOG can successfully exit its legal drama in one piece next month then its as close to a no-brainer as there is.