3 Stocks To Consider After Market Drop!

+ Market Update

Market Latest

The S&P 500 was down 3.42% last week in what was its worst week since March 2023.

The NASDAQ was down 5.8%, which was its worst week since 2022.

A few concerns for the overall market included a weak August jobs report, in which a slow labour market fuelled worries about the overall health of the economy.

Later this month the Fed is expected to announce rate cuts of 0.25% however given the recent labour data this could be extended to 0.5% according to analysts.

As we can see from the above S&P 500 heat map, some of the biggest losers included Broadcom which was down 12.70%, Nvidia down 12.55% and Alphabet down 6.90%.

Notable News

We had news on Friday that both Dell and Palantir are to join the S&P 500 which saw them both pop after hours, Dell up 5% to $107 and Palantir up 8% to $32.71.

It was not long ago that both Super Micro Computer and CrowdStrike were added.

The labour market added 142,000 jobs, which came in under the 165,000 that economists had expected, as well as unemployment falling to 4.2% from 4.3% the previous month.

Capital Economics chief wrote in a note to clients that the August jobs report is "still consistent with an economy experiencing a soft landing rather than plummeting into recession."

Remember the Fed will meet on September 17-18 to decide on the interest rate cuts (if any).

We also have some fresh news from the weekend where Warren Buffett sold more of his Bank of America stock, and here is an interesting fact - Warren Buffett has sold more stocks than he has bought for Berkshire Hathaway in each of the last 7 quarters.

The value of his BAC holding has gone from approximately $41bn (end of Q2) to $34bn today.

Earnings This Week

As always, we will cover this on our YouTube channel, and for those that aren’t subscribed, we would love to have you in our community which is over 50,000.

Fear and Greed Index

The fear and greed index was just sitting in greed last week, and as we pointed out in that newsletter, market sentiment can change (and has) very quickly as we now see ourselves sitting in fear.

3 Undervalued Dividend Stocks

Let us dive into the 3 Undervalued Dividend Stocks we like.

To select those that we believe to be undervalued and worth a deep dive we have used the following criteria:

Dividend Safety 60+ (Safe)

ROIC > 10%

Net Debt to EBITDA below 3 (Strong Balance Sheet)

Upside > 10%

ASML (ASML)

ASML designs and manufactures advanced lithography machines used to create semiconductor chips in the microelectronics industry.

As we can see below, over the last 10Y ASML has significantly outperformed the S&P 500, up 704.29%.

As per below, we get a double undervaluation signal as the current yield is above the 5Y average (0.88% v 0.47%) and the Forward P/E is lower than the 5Y (27.3x v 34.2x).

Dividend Safety score of 82 indicates safety.

Excellent dividend growth over the last 10 Years, with an average increase of 26% year on year.

ROIC gives us faith that management are able to allocate their capital effectively and it is good to see the consistent levels above the minimums we want to see which is 12% for the semiconductor industry and increasing.

The Net Debt to EBITDA of 0 over the last 10 years and anticipated over the next 12 months, meaning it won’t even take them 1 day to pay off all of their debt net of cash on hand. Very good!

As per below, Wall Street see 55.72% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $1,152.

So, in conclusion for ASML, we see around a 35% margin of safety around the $749 mark with Wall Street indicating 56% upside.

LVMH

LVMH is a luxury goods company that produces and sells high-end products, including fashion, leather goods, perfumes, cosmetics, watches, and wines and spirits.

Over the last 10Y LVMH has outperformed the S&P 500 and is up 285.23%

As we can see below, LVMH is currently trading below it’s 5Y historical forward P/E of 26.5x, now sitting at 21.8x.

Dividend growth has historically been very strong, 17% on average over the last 5Y and 15% over the last 20Y.

ROIC is consistently above the 10% minimum and in fact has been straddling around the 20% mark over the last 10Y - always love to see consistency!

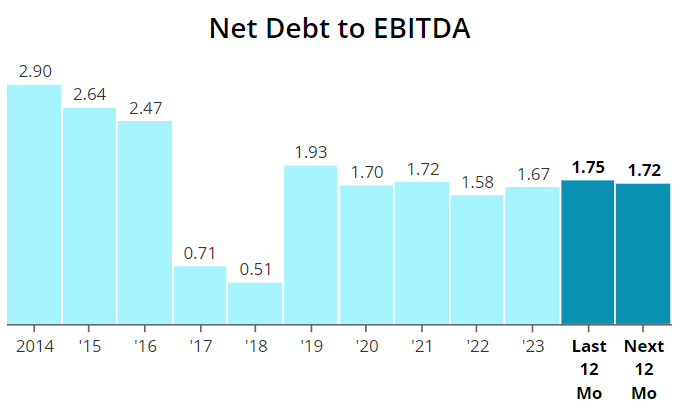

Net Debt to EBITDA has been decreasing from the highs in 2014 of 2.90, now sitting at 1.67 which is healthy indicating a good balance sheet and secure dividend.

As per below, Wall Street see 34.56% upside, with a target price that translates to $921.54.

When we last ran it through our valuation model our intrinsic value came to $910.25.

So, in conclusion for LVMH, we see around a 25% margin of safety around the $683 mark with Wall Street indicating 35% upside.

Microsoft (MSFT)

Microsoft develops, licenses, and sells software, hardware, and cloud services, with its most notable products being the Windows operating system, Microsoft Office, and Azure cloud platform.

As we can see below, over the last 10Y Microsoft is up 760.26%, significantly outperforming the S&P 500 during this period.

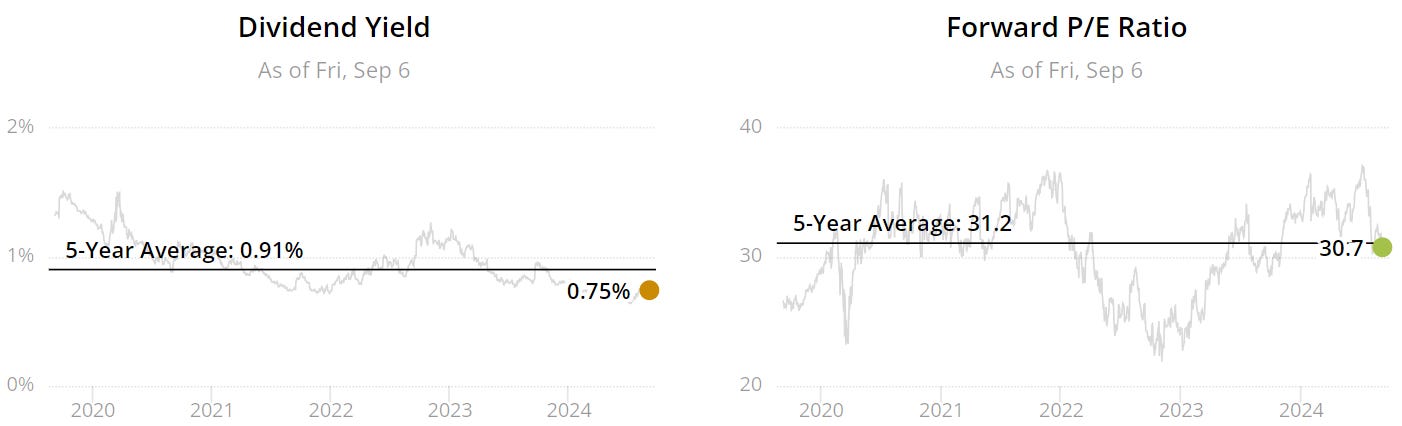

As per below, we get a double reasonable valuation signal as the current yield is marginally lower than the 5Y average (0.75% v 0.91%) and the Forward P/E is marginally lower than the 5Y (30.7x v 31.2x).

Dividend Safety score of 99 indicates safety.

Consistently strong dividend growth, with double digit increases over the last 5Y and 20Y.

ROIC is not only very strong but has been growing over the years, with 2024 coming in at 30%, making it a very attractive consideration for investors.

Excellent balance sheet and no surprises that the dividend safety score is the highest obtainable given the extremely low Net Debt to EBITDA figure.

As per below, Wall Street see 25.74% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $445.28.

So, in conclusion for Microsoft, we see around a 10% margin of safety around the $400 mark with Wall Street indicating 26% upside.

Conclusion

We have just gone through 3 Undervalued Dividend Stocks to consider.

However as always do your own due diligence and let us know your thoughts about today’s newsletter in the comments.

I hope you all have a great week ahead!

Thanks For Reading!

If you’d like to support this work feel free to buy me a coffee. The proceeds will contribute to the running costs of the newsletter.

Join the community of investors - subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today’s newsletter helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Note

I am not a financial advisor or licensed professional. Nothing I say or produce anywhere, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk.