3 Stocks You Need for 2026 — From Amazon to Emerging Leaders

After a messy 2025, markets are shifting. Inflation is cooling, jobs are stabilizing, and these 3 picks could be at the forefront of next year’s gains.

Market Update

A noisy finish to 2025 - and a constructive start to 2026

U.S stocks ended the last full trading week of the year mixed with the S&P 500 little changed.

The week started on shaky ground. Tech-stock weakness continued from the prior week, as worries around AI spending, lofty valuations, and potential overbuilding weighed on investor sentiment. Mixed economic data, including November’s jobs report on Tuesday, added to the uncertainty.

But markets rallied by week’s end. An encouraging inflation report and strong earnings from Micron Technology helped ease some of the tech-related concerns, nudging indexes higher and improving sentiment around AI and innovation.

Looking at the big picture:

Data was noisy but encouraging. Inflation and labor reports were heavily distorted by the government shutdown. Still, they point toward moderating wage pressures, easing inflation, and a gradually stabilizing labor market.

The Fed may lean toward easing in 2026. With wage growth cooling and hiring softening - not drastically, but enough to matter - a gradual easing bias seems likely.

Market leadership could broaden. Elevated tech valuations, improved liquidity, and stronger earnings momentum across cyclicals, mid caps, and international equities support a potential rotation beyond mega-cap tech.

Portfolio positioning matters. A balanced approach looks sensible: neutral tech exposure, broader equity diversification, benchmark-neutral bond duration, and a review of cash allocations as yields drift lower.

As 2025 winds down, the delayed employment and inflation reports provide the final major data points before investors step back from the constant drumbeat of headlines and enjoy the holidays. While the numbers deserve a healthy dose of skepticism, even in their imperfect form, they reinforce a constructive outlook for markets in 2026. They also hint that the rotation in market leadership we’ve seen quietly building beneath the surface could have staying power in the year ahead.

Last Weeks Winners & Losers

Top performers:

Carnival (+13%)

Micron (+10%)

Comcast (+9%)

Applovin (+8%)

Lam Research (+7%)

Biggest drops:

Nike (-13%)

ServiceNow (-10%)

Constellation Brands (-8%)

Uber (-7%)

Broadcom (-5%)

Notable News

Inflation cooled - but don’t call it “mission accomplished” just yet

Last week’s inflation report caught almost everyone off guard.

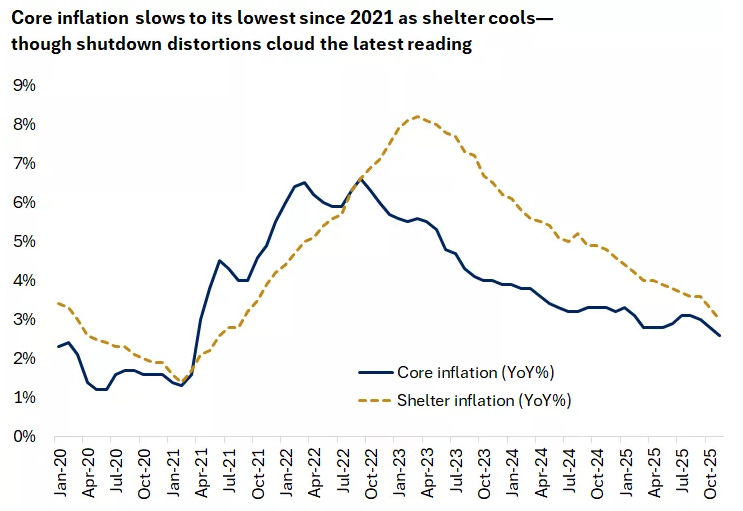

November CPI came in much cooler than expected. Headline inflation dropped to 2.7% from 3.1%, while core inflation (which strips out food and energy) fell to 2.6% from 3%. That’s the slowest core inflation we’ve seen since 2021 - and it came in below every economist forecast.

At first glance, it looks like a big win in the inflation fight.

But there’s a catch.

Because of the government shutdown, the Bureau of Labor Statistics didn’t get all the price data it normally collects in October. To fill in the gaps, they had to make assumptions - especially around housing, which makes up about one-third of CPI.

And housing inflation suddenly cooled a lot.

That’s unusual. Shelter prices usually move slowly, not sharply. The most likely explanation is that the BLS assumed zero housing inflation in October due to missing data, which made the slowdown look bigger than it really is.

In other words, inflation probably didn’t cool quite as fast as the headline numbers suggest.

It may take another month or two before investors - and the Fed - get a clean picture of what’s really happening under the hood.

That said, the longer-term trend still matters. Housing inflation is easing, and over time that should slowly pull services inflation lower. A faster drop would be a welcome surprise.

Inflation is likely to stays range-bound in the first half of the year and remains above the Fed’s 2% target into 2026 - just a bit better than where we were in 2025.

Progress? Yes. Victory? Not yet.

The job market is moving slowly - but it may be finding its footing

If the inflation data felt messy, the labor market data didn’t do much to clear things up.

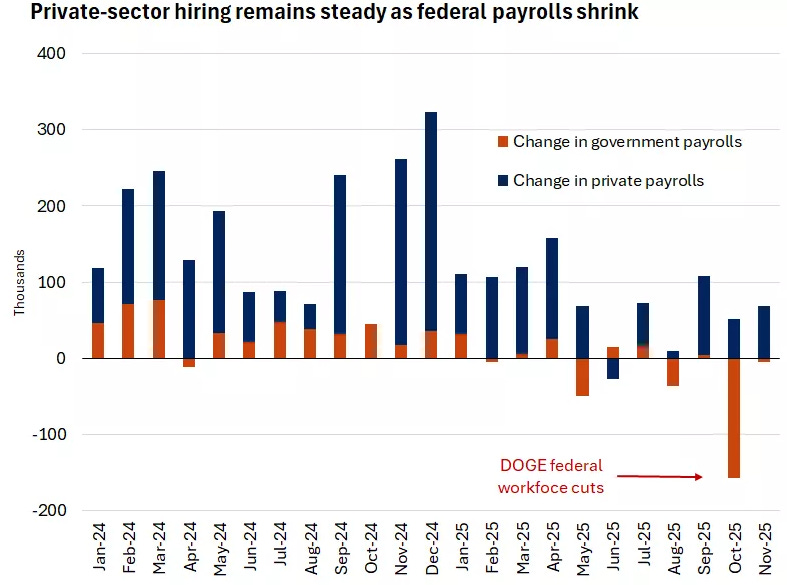

Because of the government shutdown, the BLS released both the October and November jobs reports at the same time - and the numbers told a choppy story. In November, the economy added 64,000 jobs, slightly better than expected. But that came right after a 105,000 job drop in October, the biggest monthly decline since 2020.

That headline October loss looks scary - until you dig in.

Most of it came from the federal government. About 157,000 federal jobs disappeared as workers who took the administration’s deferred-resignation offer officially rolled off payrolls. That’s a one-time adjustment, not a sign the broader economy is rolling over. From here, federal employment should be fairly stable.

The private sector picture is more important - and more encouraging. Across October and November, private employers added about 121,000 jobs in total. That’s not booming, but it’s a healthy, sustainable pace. Hiring is still concentrated in health care, while manufacturing continues to lose jobs for a seventh straight month.

Unemployment adds another layer to the story. October’s rate wasn’t reported due to the shutdown, but in November it rose to 4.6%, the highest level in four years. On the surface, that sounds negative - but the increase came largely because more people re-entered the labor force, which is actually a good sign.

That’s the theme right now: for every positive data point, there’s a counterweight.

Still, the most likely path forward isn’t collapse - it’s stabilization.

Not strong. Not broken. Just steady.

Market leadership may finally start to spread out

As we head into the new year, the backdrop is quietly improving.

The Fed is edging toward slightly looser policy. A new tax bill is adding some modest fiscal support. Tariff headlines have faded. And economic growth is holding up. None of this is dramatic on its own - but together, it creates a very different setup than we’ve had over the past few years.

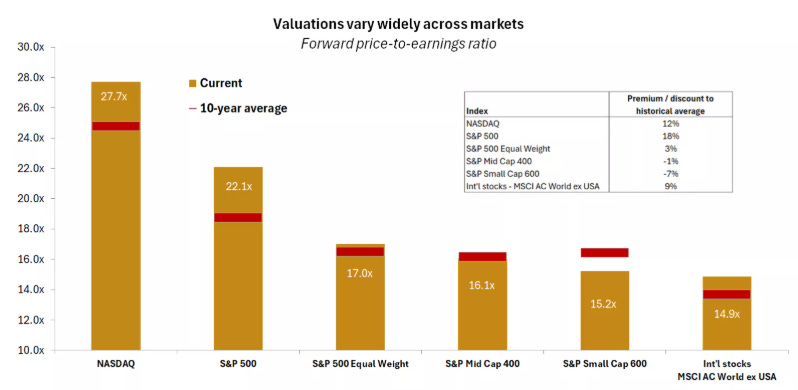

After a long stretch where a handful of mega-cap tech stocks did most of the heavy lifting, the market may be ready to broaden.

Since early November, investors have started to rotate away from the biggest technology names that have dominated since the bull market began in 2022. AI isn’t going away - it remains a powerful long-term tailwind - but questions are creeping in. Spending is enormous. Returns aren’t always clear yet. Debt issuance is rising. And in some areas, there’s growing concern about overbuilding.

The result looks less like a collapse and more like a healthy pause in the most expensive parts of the market.

At the same time, other areas are starting to wake up. Productivity gains - helped in part by AI - could boost profits well beyond Big Tech. Cyclical sectors, small- and mid-cap stocks, value investments, and even international markets are all trading close to their own historical averages, not stretched extremes. As liquidity improves and credit becomes easier to access, these parts of the market have room to run.

We’re already seeing early signs of this shift. Since November, the equal-weight S&P 500 has outperformed the traditional, mega-cap-weighted index by about 3% - a small but encouraging signal that leadership is starting to spread.

Portfolio Thoughts

There’s still plenty we don’t know. The data has been noisy, and it may take time for the picture to fully clear. Even so, the economic and market backdrop looks supportive of another year of positive returns in 2026 - even if leadership shifts away from the same winners we’ve relied on in the past.

With that in mind, here are four ideas worth considering as we head into the new year.

1. Stay invested in innovation - just don’t put all your eggs in one basket

AI remains a powerful long-term theme, and investors should abandon it. But after years of tech dominance, concentration risk is real. A more balanced approach - keeping tech exposure near benchmark levels and splitting allocations between growth and value - can help manage risk while still participating in innovation.

2. Look beyond the usual suspects

If market leadership broadens, opportunity won’t be limited to mega-cap stocks. Consider areas that have been left behind: U.S. mid-caps, international small- and mid-cap stocks, and emerging markets. Valuations are more reasonable, and earnings momentum is starting to improve.

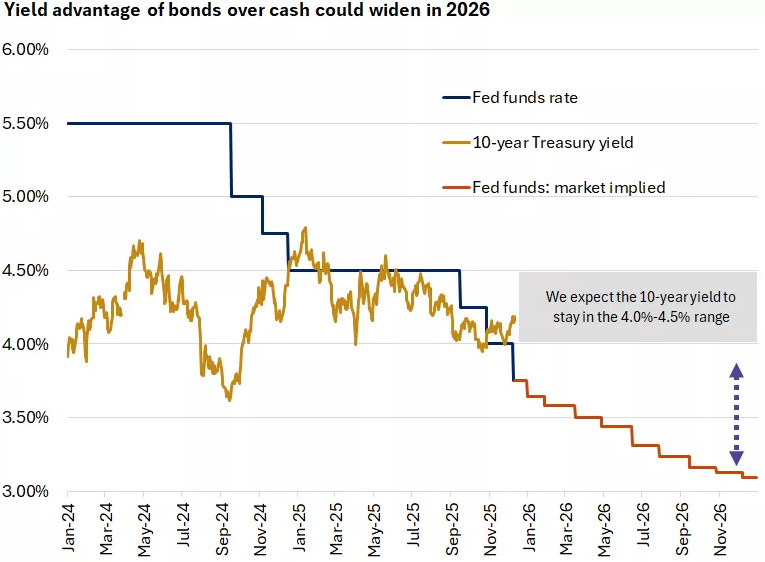

3. Let bonds do what they’re supposed to do again

After years of disappointment, bonds are once again offering real income. Even with recent declines, 10-year Treasury yields are still near the higher end of their post-2008 range. That makes high-quality bonds useful not just for stability, but for income as well.

4. Revisit large cash balances

As the Fed eventually cuts rates, cash yields are likely to come down. That doesn’t mean cash has no role - but it’s worth asking whether some of it could work harder. For some investors, that may mean adding to high-quality bonds; for others, gradually increasing equity exposure, depending on goals and risk tolerance.

The common thread across all four: stay invested, stay diversified, and stay flexible. The market environment is changing - portfolios should evolve with it.

Earnings Season (Back again in the New Year)

Join 118,000+ investors on YouTube! 🎥

We break down earnings, market moves, and exclusive insights you won’t find anywhere else.

Don’t miss out — hit the button below to watch and subscribe now! 👇

YouTube Channel 🔔

Subscribe today and stay ahead of the market!

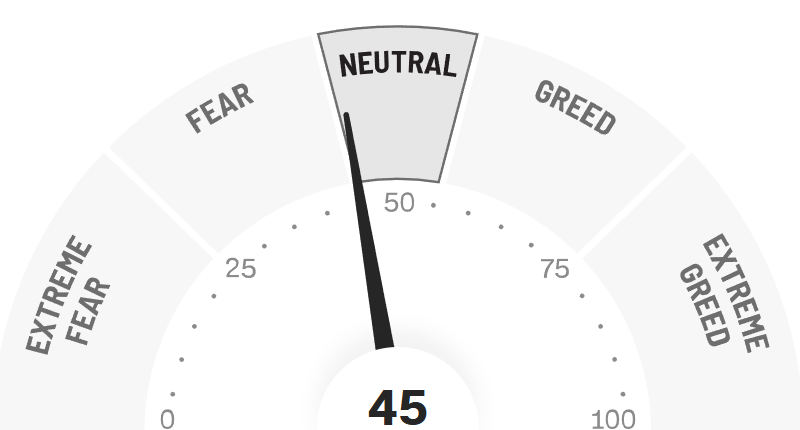

Fear & Greed Index

3 Stocks For 2026

What the Experts Are Saying Before We Reveal Our 3 Picks

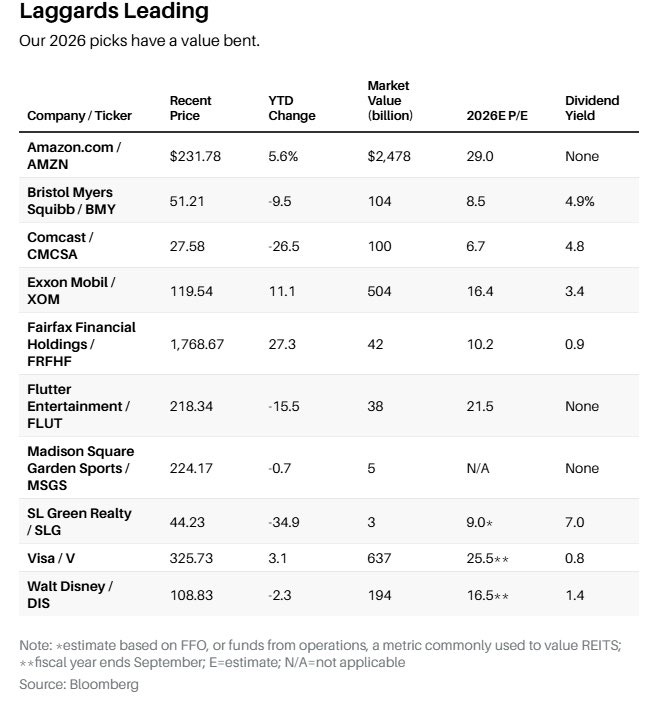

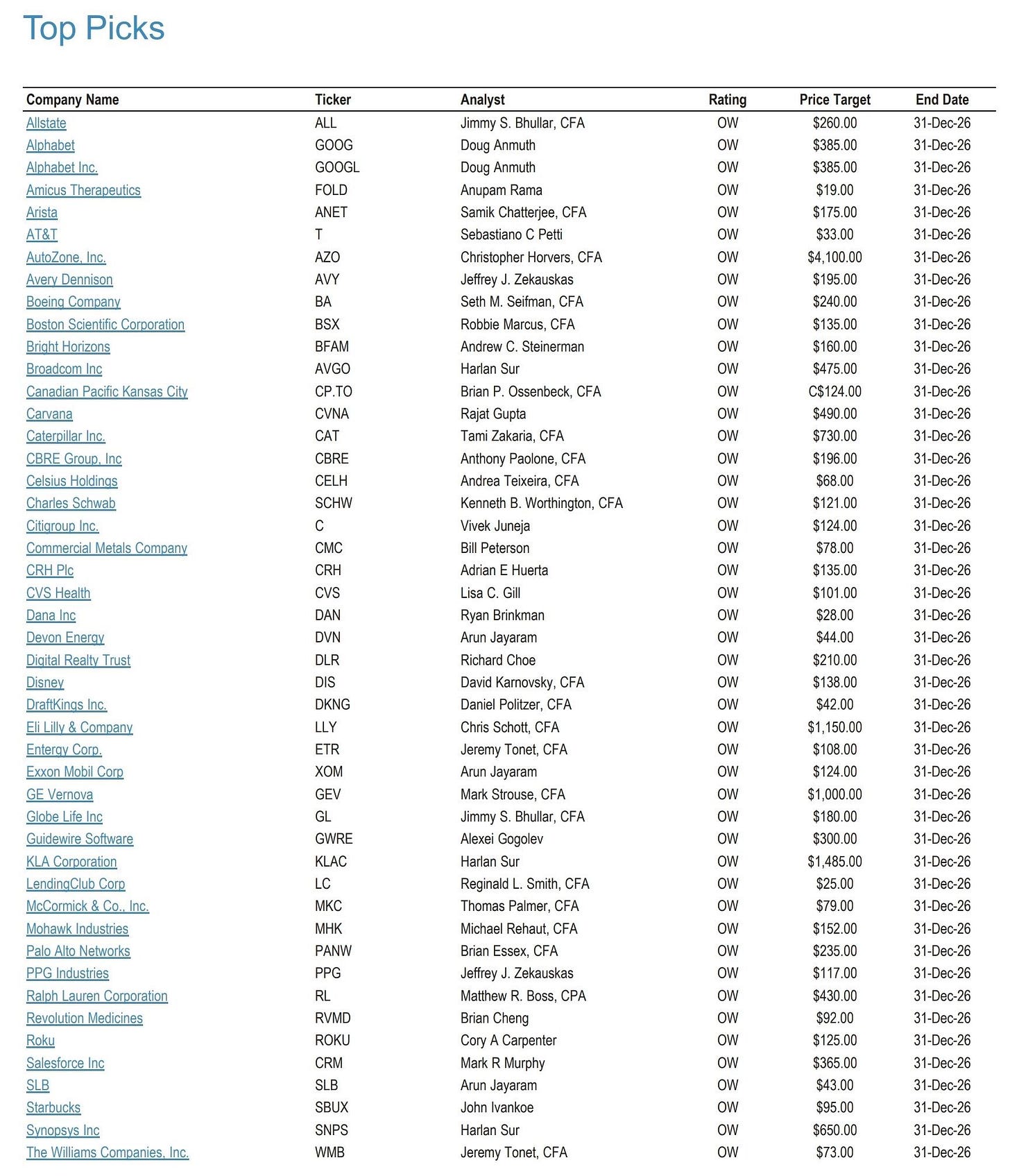

Before we dive into our 2026 stock ideas, it’s worth taking a look at what some of the biggest names on Wall Street are highlighting. Barron’s and JPMorgan have already put their cards on the table with top picks for the year ahead - offering a mix of mega-cap tech, steady growth names, and a few surprises.

Barron’s tends to focus on companies with strong earnings momentum and resilience across market cycles, while JPMorgan is looking for opportunities that combine solid fundamentals with potential upside from market rotation and improving liquidity.

Below, we’ve included their top picks so you can see which companies are getting the nod from some of the most closely watched research desks in the industry.

These selections provide helpful context and set the stage for our own recommendations - which focus on a balance of established leaders and emerging opportunities poised to perform in 2026.

Barron’s 2026 Picks

JP Morgan ‘s 2026 Picks

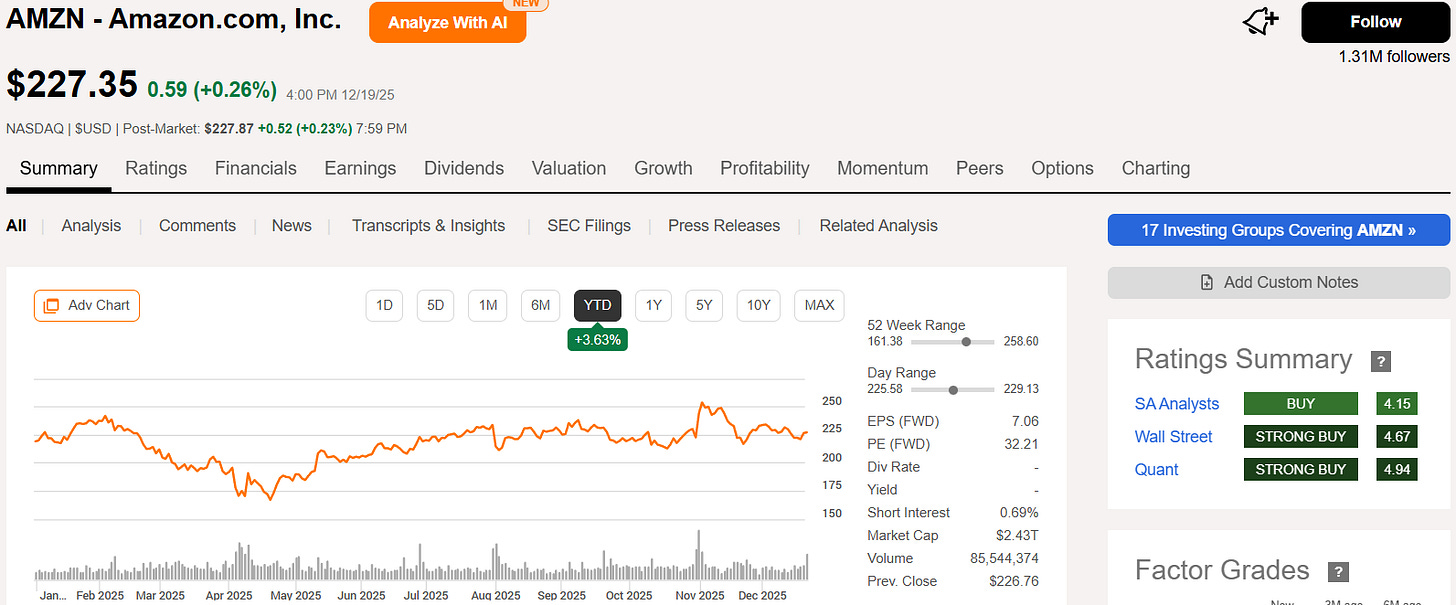

Our No.1 Pick - Amazon (AMZN)

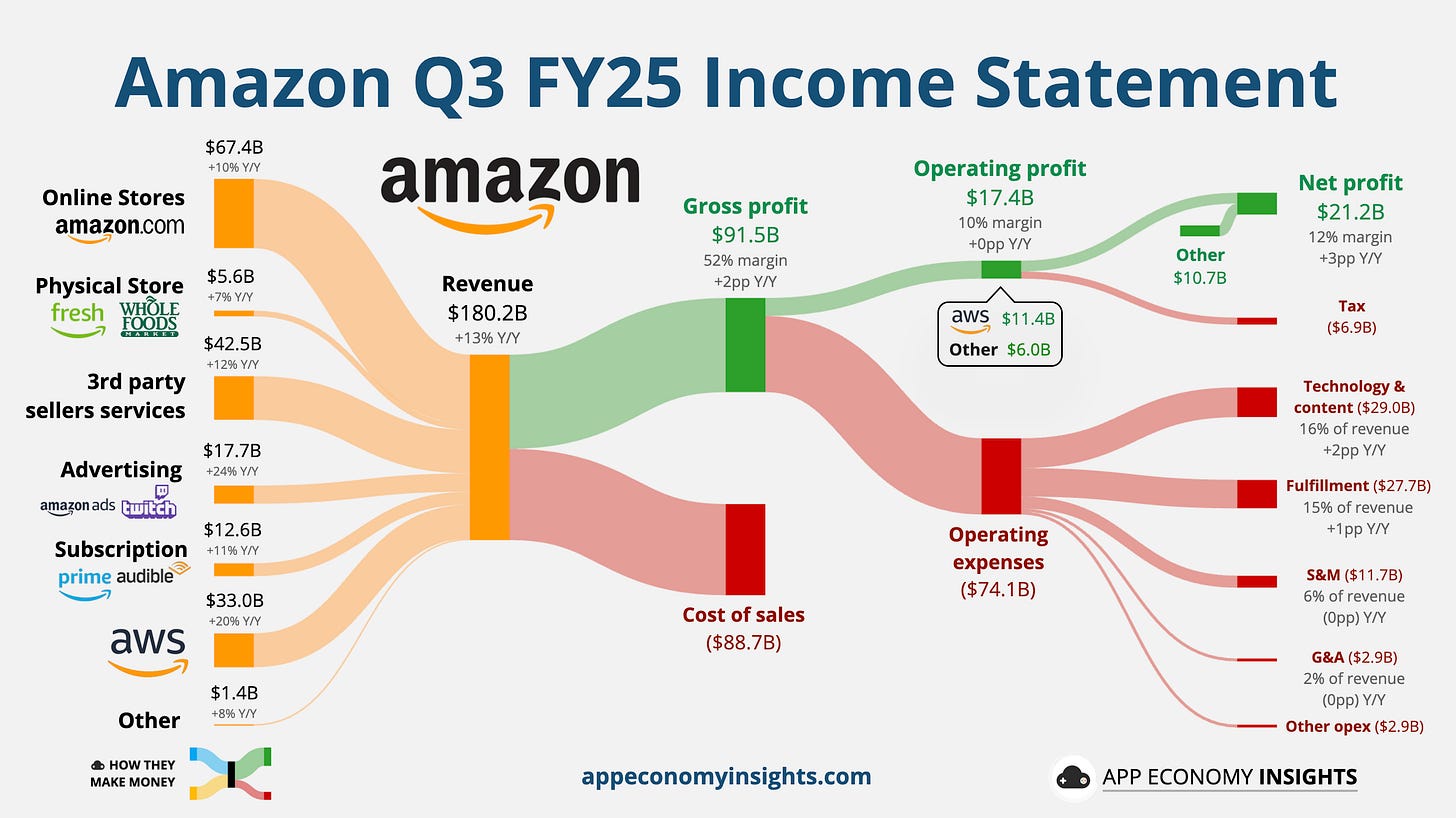

What Amazon Actually Does - Beyond the Online Store

Most people think of Amazon as just an online retailer - the place to order everything from books to groceries.

But that’s only part of the story.

Amazon is actually a global technology and logistics powerhouse with multiple revenue streams that often fly under the radar.

Here’s what people don’t always realize:

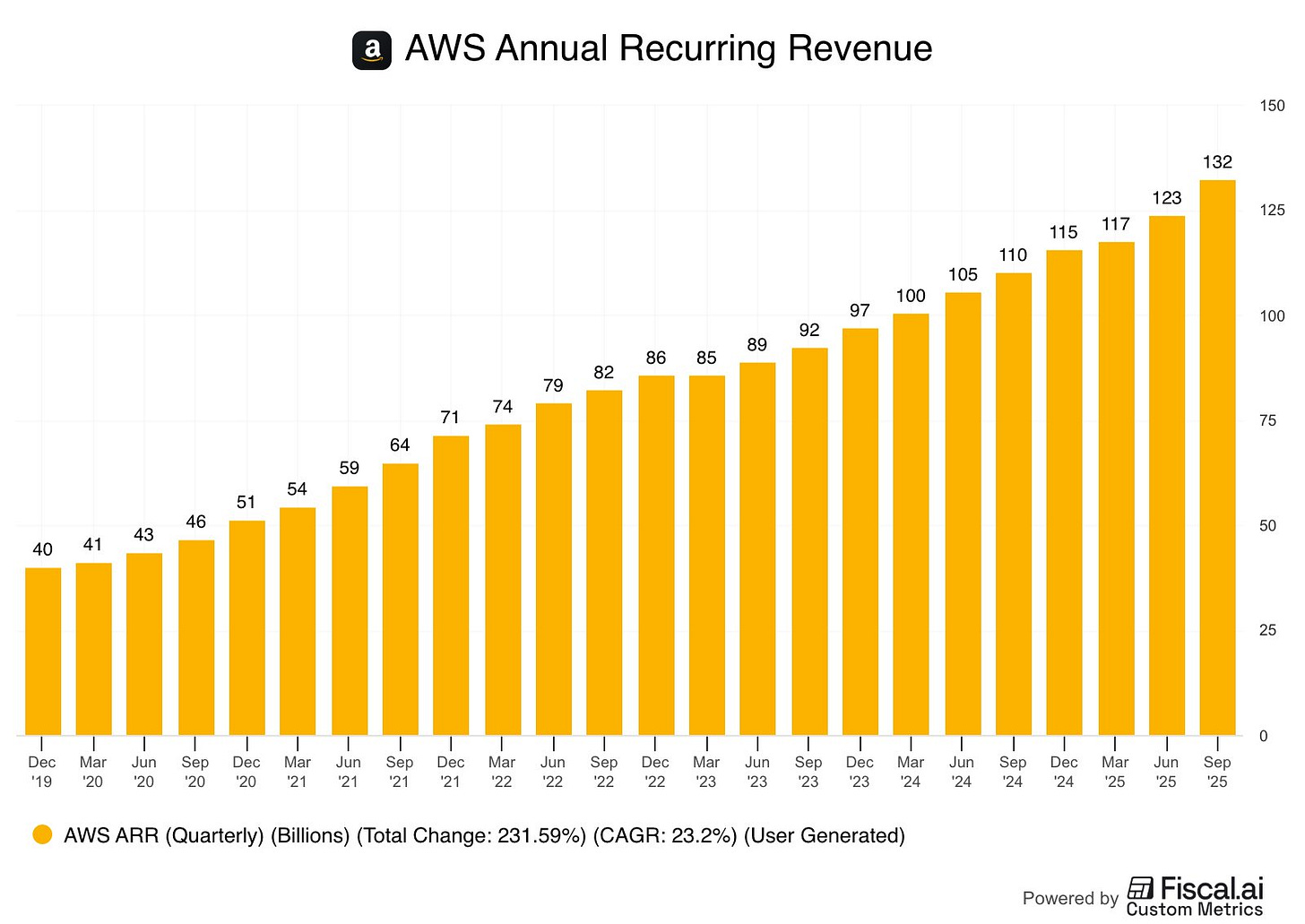

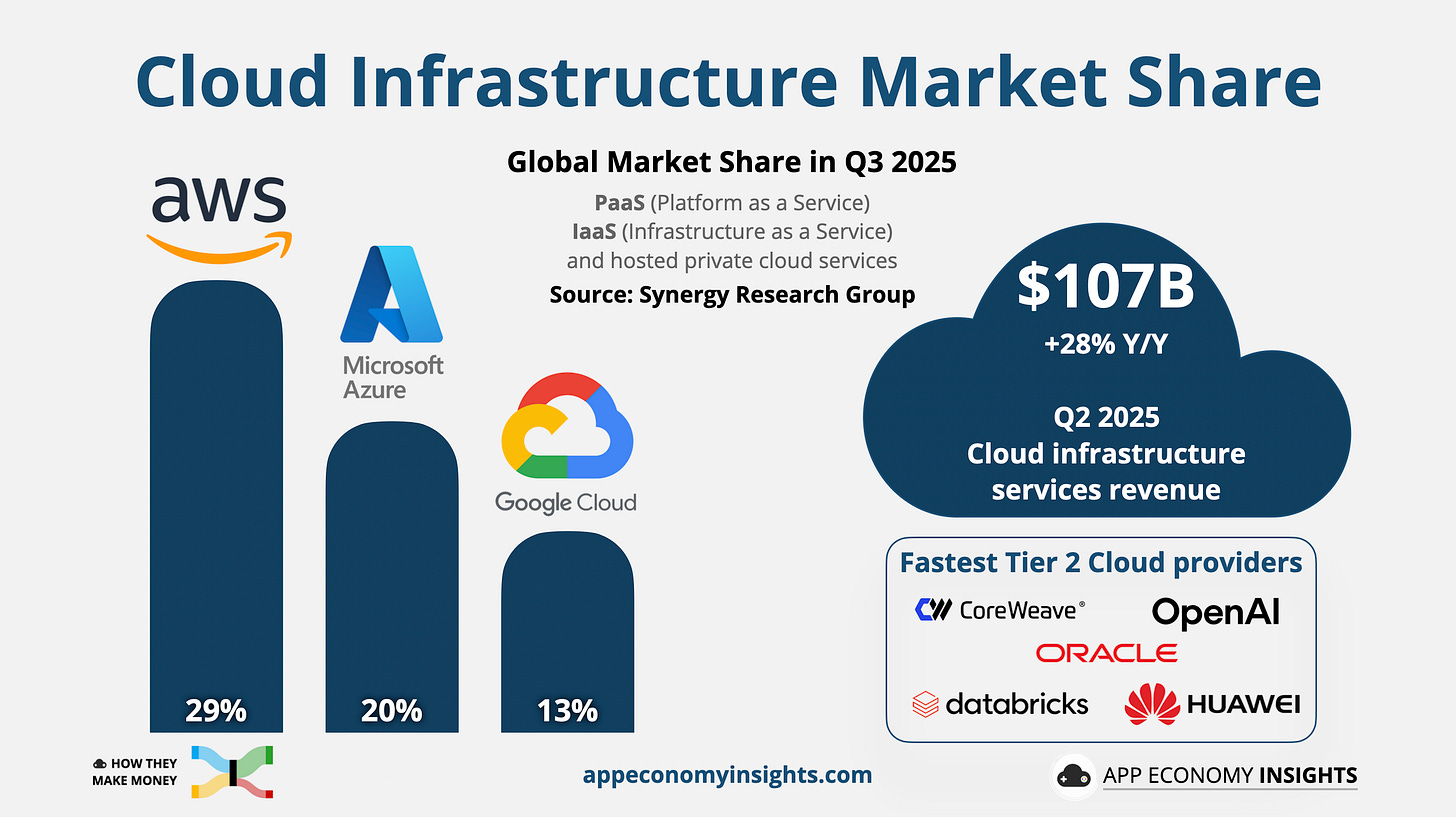

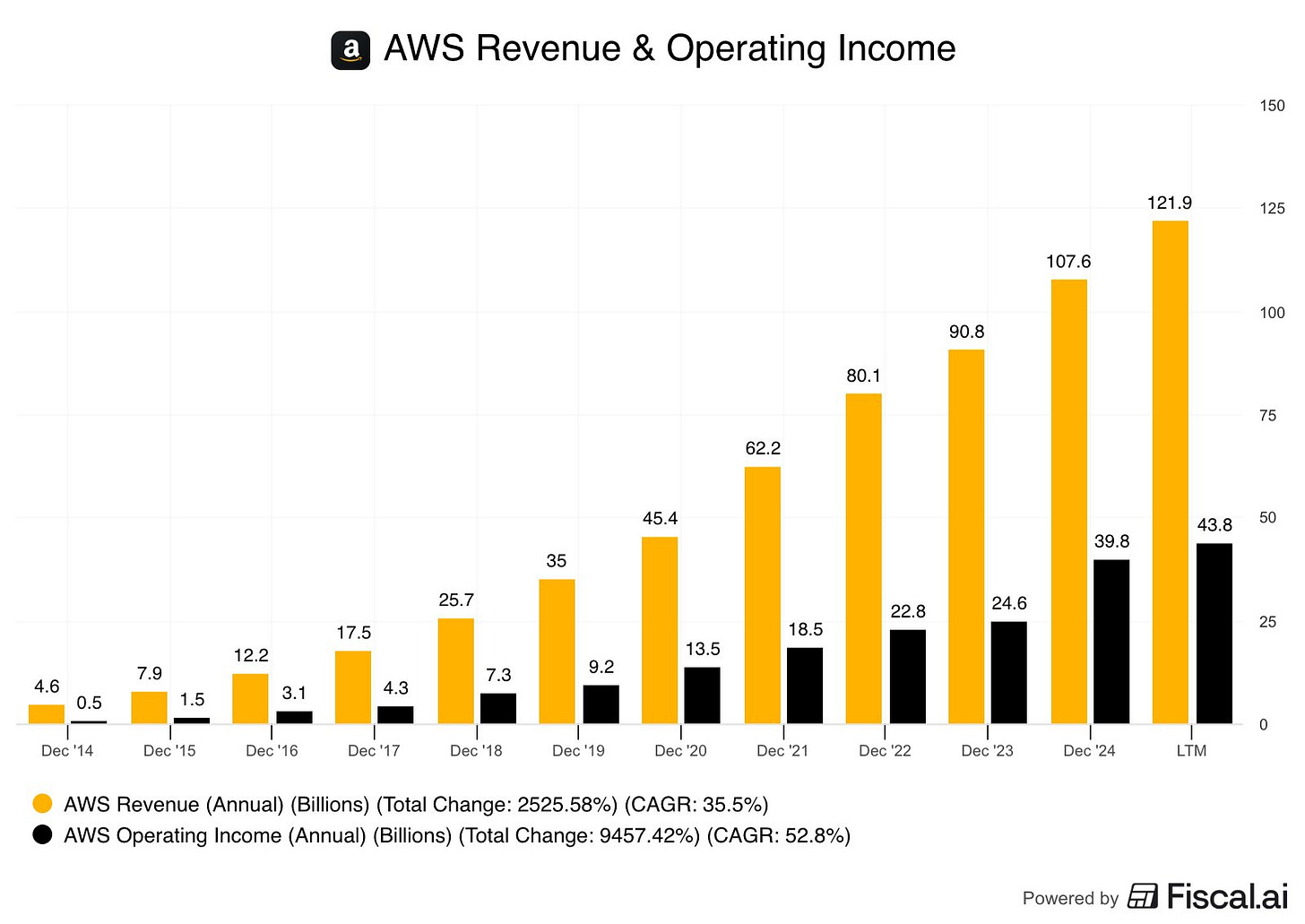

Amazon Web Services (AWS): The company’s cloud division is the real profit engine, powering websites, apps, and enterprise solutions worldwide.

It is also the market leader…

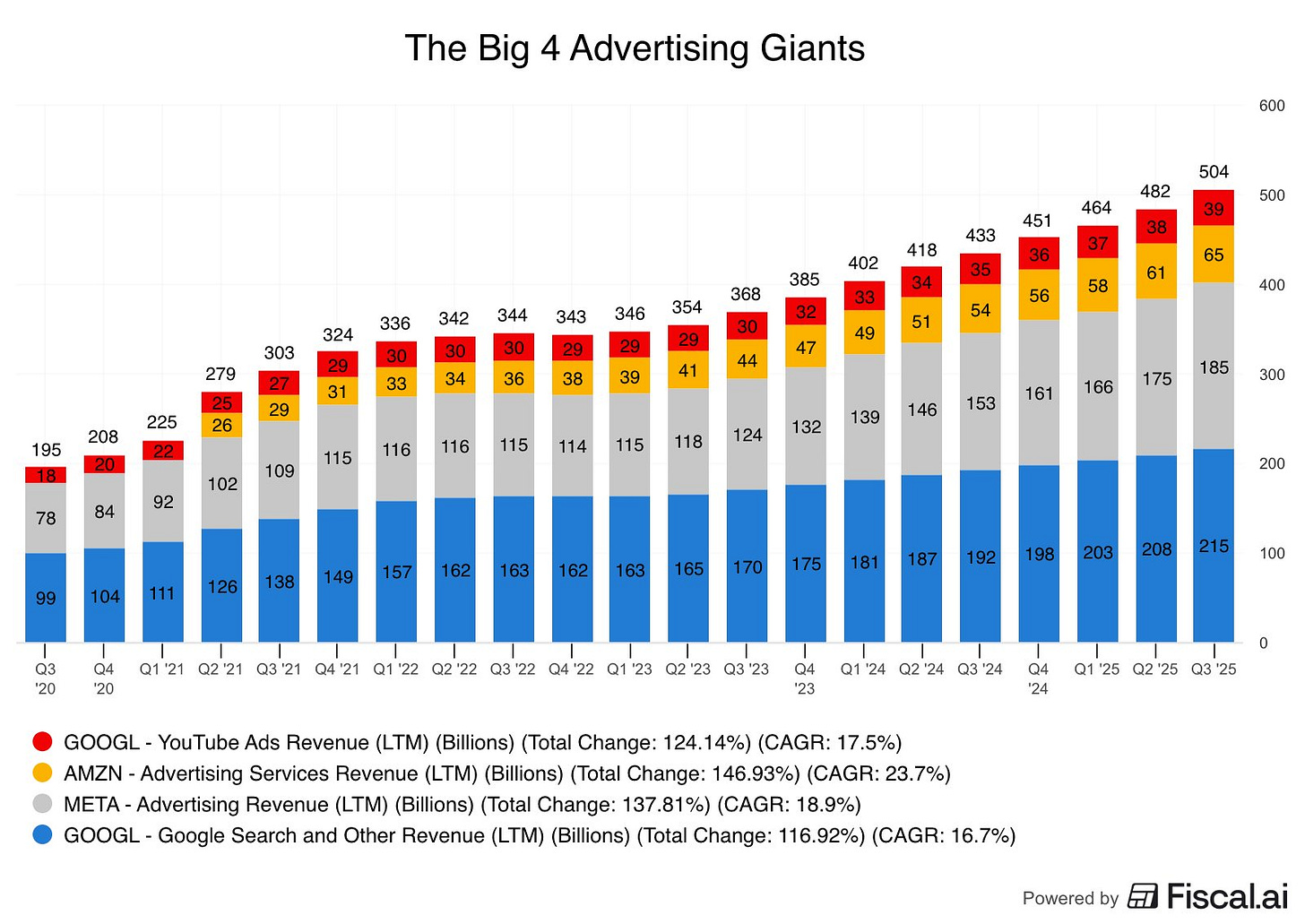

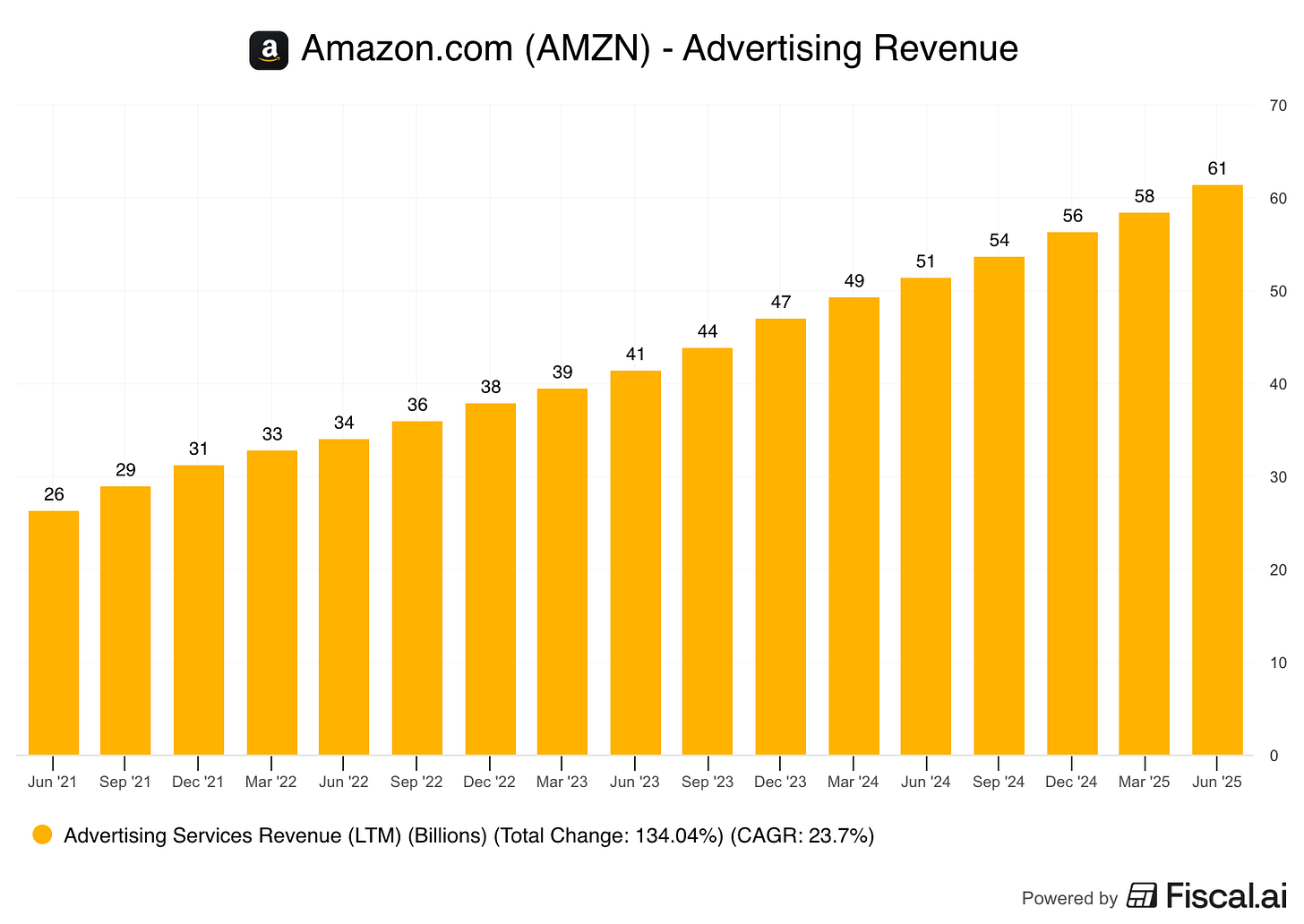

Advertising: Amazon’s ad business is booming, growing faster than the other tech giants and adding a highly profitable revenue stream.

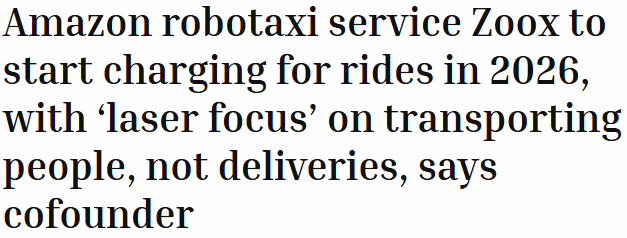

Logistics and Delivery Innovations: Beyond Prime shipping, Amazon invests in fulfillment centers, last-mile delivery, drones, and autonomous vehicles, including experiments with robo-taxis and self-driving delivery, giving it unmatched speed and efficiency.

AI and Machine Learning: From Alexa to warehouse automation, AI streamlines operations and develops new products.

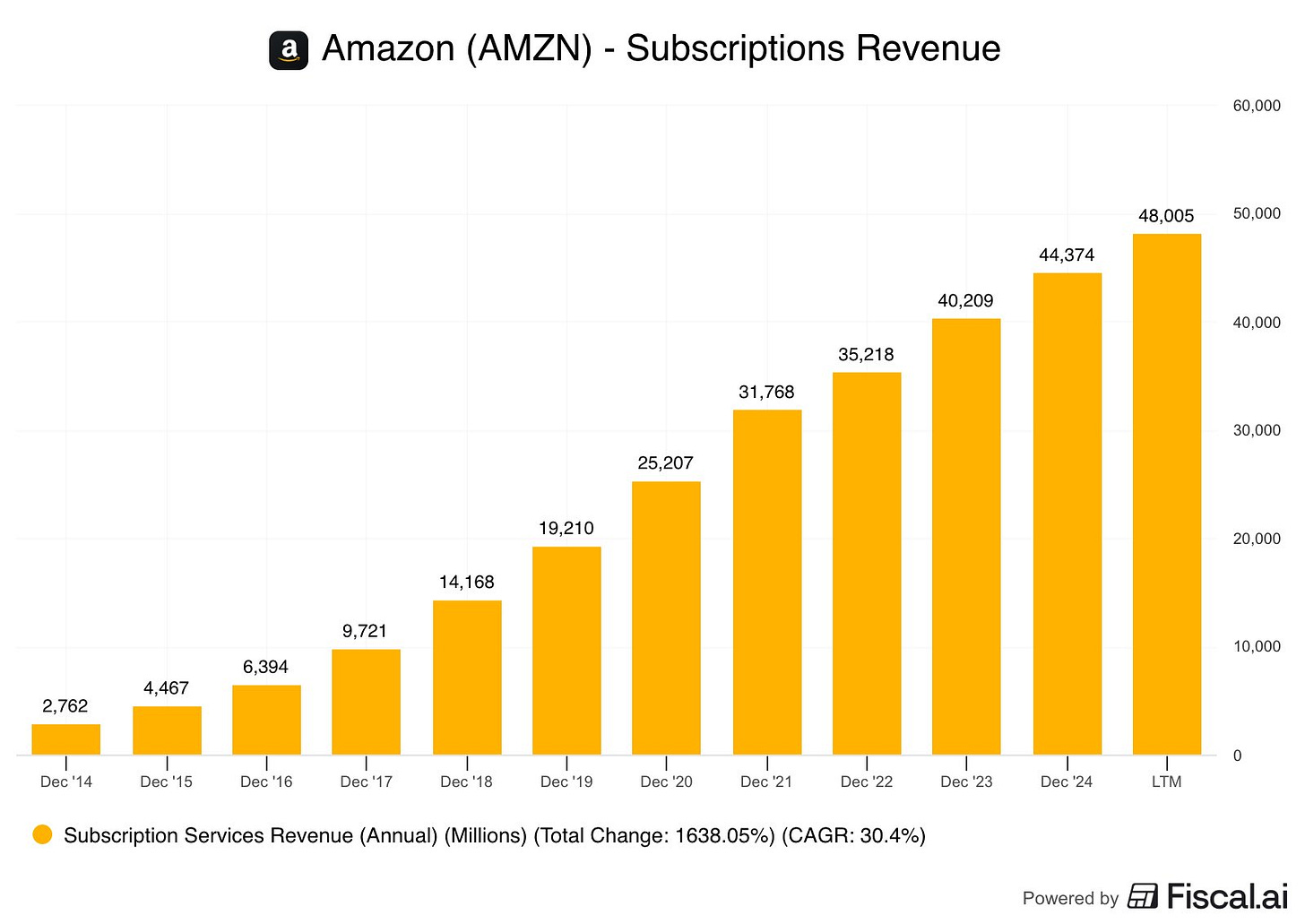

Subscriptions and Digital Services: Prime, Kindle Unlimited, and Amazon Music generate steady recurring income and reinforce customer loyalty.

New Ventures: Amazon continues exploring healthcare (Amazon Pharmacy), grocery automation (Amazon Fresh and Go), entertainment (Prime Video), and emerging technologies like autonomous transport, positioning it for growth far beyond traditional retail.

In short, Amazon isn’t just a store - it’s a multi-dimensional tech company with diverse, often hidden, profit engines that give it resilience and long-term growth potential.

Why Amazon (AMZN) Has Struggled in 2025 (Even With a Solid Q3)

AMZN delivered a solid third quarter in 2025.

Revenue rose about 13% year-over-year, driven by strong performance in its cloud business and advertising.

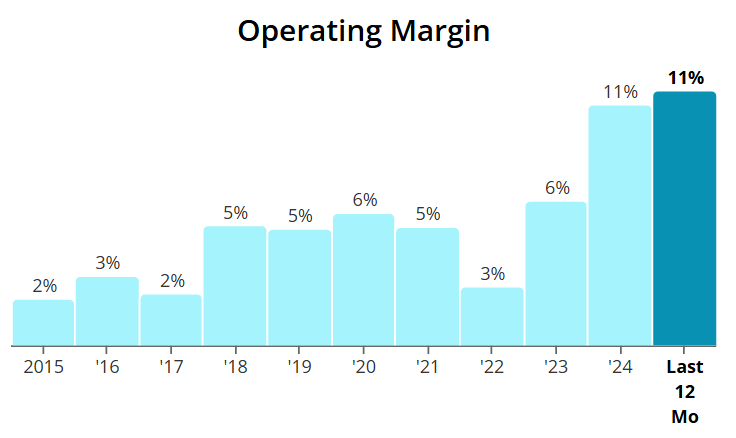

Earnings per share came in at roughly $1.95, up 36% from the year earlier, while operating income improved and the company expanded margins in its most profitable segments.

Even so, the stock hasn’t kept pace. Here’s what’s been holding it back:

1. Rotation Out of Mega-Cap Winners

Despite healthy results, Amazon is caught in a broader market shift. Large-cap winners, especially those that dominated in the AI and platform narratives, have become sources of cash as investors chase newer stories. That means Amazon is getting sold even when it’s executing.

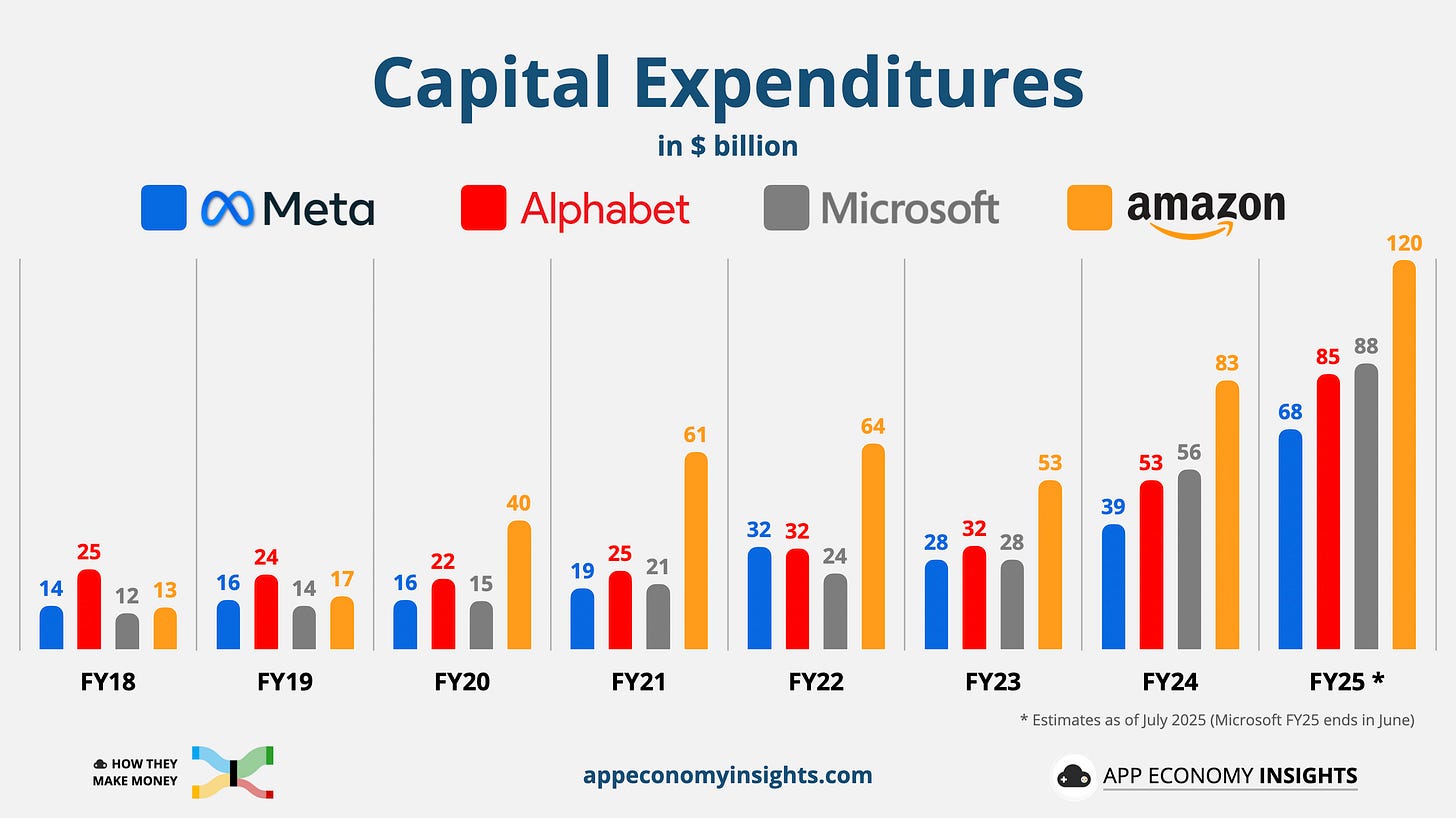

2. Sentiment Whiplash Around AI Capex

Amazon is doubling down on AI infrastructure - building data centers, developing models, scaling AWS’s back-end. Strategically it’s smart, but investors are increasingly asking: when will the payoff arrive? 2025’s patience drought means firms leaning into heavy capex aren’t getting rewarded yet, even with solid short-term results.

3. E-Commerce Growth Looks “Good, Not Great”

Amazon’s retail business grew slower than the pandemic years, which raises expectations issues. The core ecommerce growth is still intact but because the “surge” baseline is gone, the market treats steady growth as underwhelming.

4. AWS Is Strong - but the Bar Was Higher

Amazon Web Services continued to post double-digit growth and improved profitability in Q3, but earlier this year the market was expecting “explosive” cloud growth tied to all things AI. Now “strong” is good - but not enough to pique premium valuations.

5. Macro Uncertainty Clouds Large-Cap Outlook

When borrowing costs, inflation, and consumer sentiment are predictable, Amazon shines. In 2025, the lack of clarity from the Federal Reserve and patchy economic data has turned that upside-down. Growth is still happening - but the risk of “what if the economy weakens?” is weighing more heavily on the stock.

6. The Market Is Rewarding Tactical - Not Long-Term - Right Now

The current rotation is geared toward short-term narratives (value, small-caps, unloved sectors). Amazon plays the long game: compounding value, global expansion, back-end platform strength. That’s great for long-term investors, but it means the market isn’t currently paying a premium for what Amazon is doing.

Why This Might Be the Perfect Time to Buy Amazon

Amazon’s share price may not reflect it, but the company is quietly strengthening across every major part of its business. With the market rotating away from mega-caps and sentiment clouded by short-term noise, long-term investors are getting something rare: a chance to buy Amazon while fundamentals are accelerating.

Here’s why this setup is unusually attractive:

1. AWS Is Re-Accelerating at the Perfect Moment

After a digestion period in 2023–2024, AWS is growing double digits again, with operating income and margins expanding. AI demand is now flowing directly into AWS through inference, training workloads, and enterprise upgrades.

AWS earnings strength tends to show up with a lag - meaning the next 12 months could surprise to the upside.

2. Advertising Is a High-Growth Profit Engine

Amazon’s ad business is growing faster than any other major segment, and it carries margins closer to AWS than retail.

Advertisers love Amazon because ads hit consumers at the point of purchase.

This high-margin engine is scaling rapidly - and the market still undervalues how big it could become.

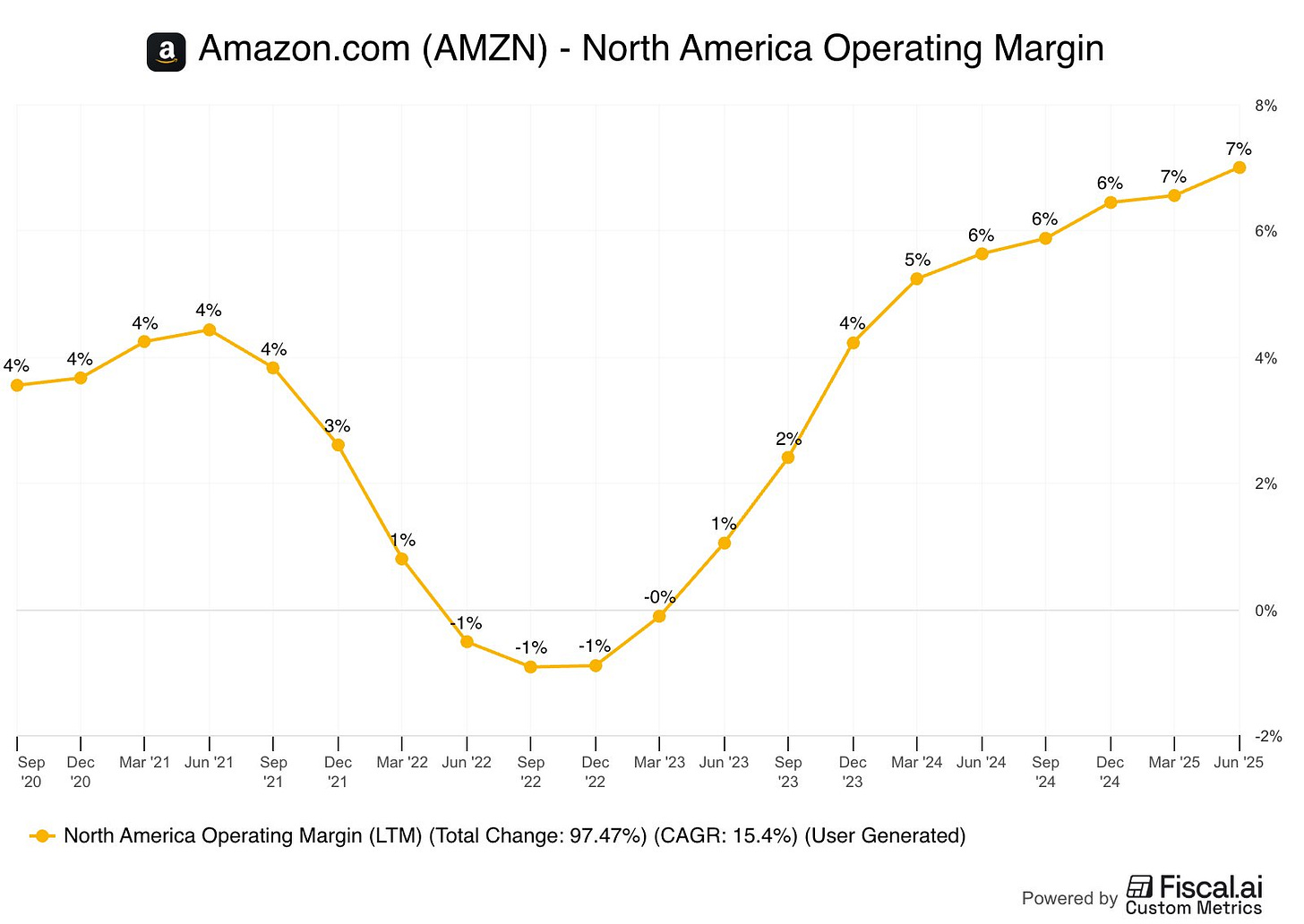

3. Retail Margins Are Quietly Improving

Amazon’s years of heavy investment in logistics are finally paying off:

Same-day and next-day delivery coverage is expanding

Operating leverage is increasing

The North America and International retail segments continue to improve profitability

Amazon isn’t just growing revenue - it’s growing operating efficiency, which has a compounding effect on earnings.

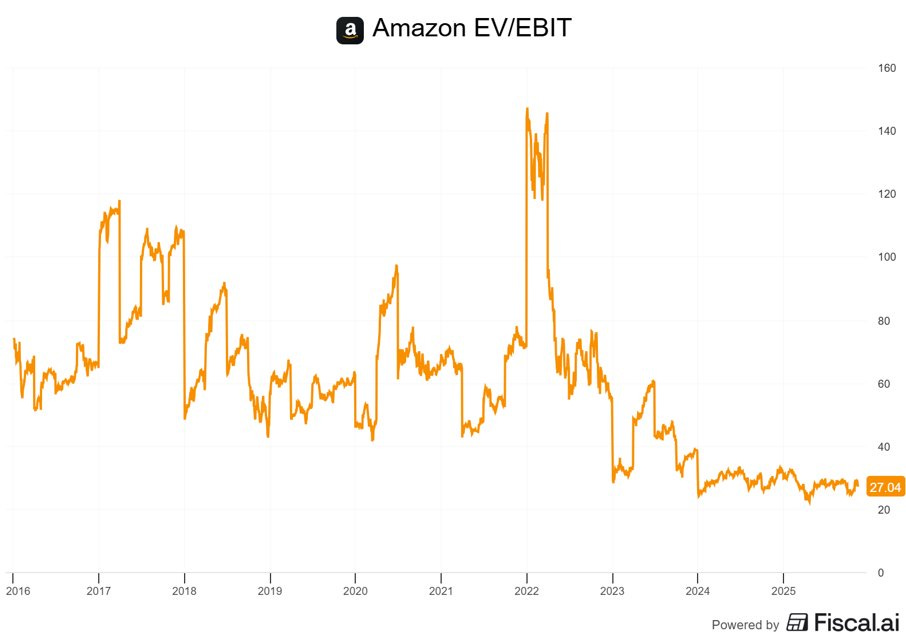

4. The Market Rotation Has Created a Valuation Window

In 2025, investors have shifted away from mega-caps, not because of deteriorating fundamentals, but because they’re chasing cheaper sectors.

This rotation has pushed Amazon’s valuation lower at the exact moment its earnings power is improving.

Amazon rarely gets discounted when its core businesses are strengthening - this is the mismatch long-term investors look for.

5. Cash Flow Is Expanding Again

After a major capex cycle, Amazon’s free cash flow has swung sharply positive.

With AWS, ads, and logistics efficiencies all improving, Amazon’s cash generation profile is set to expand meaningfully over the next few years.

6. Projected Double-Digit EPS Growth Ahead

Wall Street expects strong earnings reacceleration over the next three to give years.

That growth is supported by:

Expanding margins

AWS strength

Advertising scale

International profitability

Controlled capex

It’s a setup Amazon hasn’t had in years - and the stock price hasn’t caught up yet.

Valuation

Amazon is trading at a decade low with regards to EV/EBIT.

PEG also looks incredibly attractive below 2 sitting at 1.78x Forward looking (1.40 TTM).

One of the most attractive valuations across the whole S&P 500

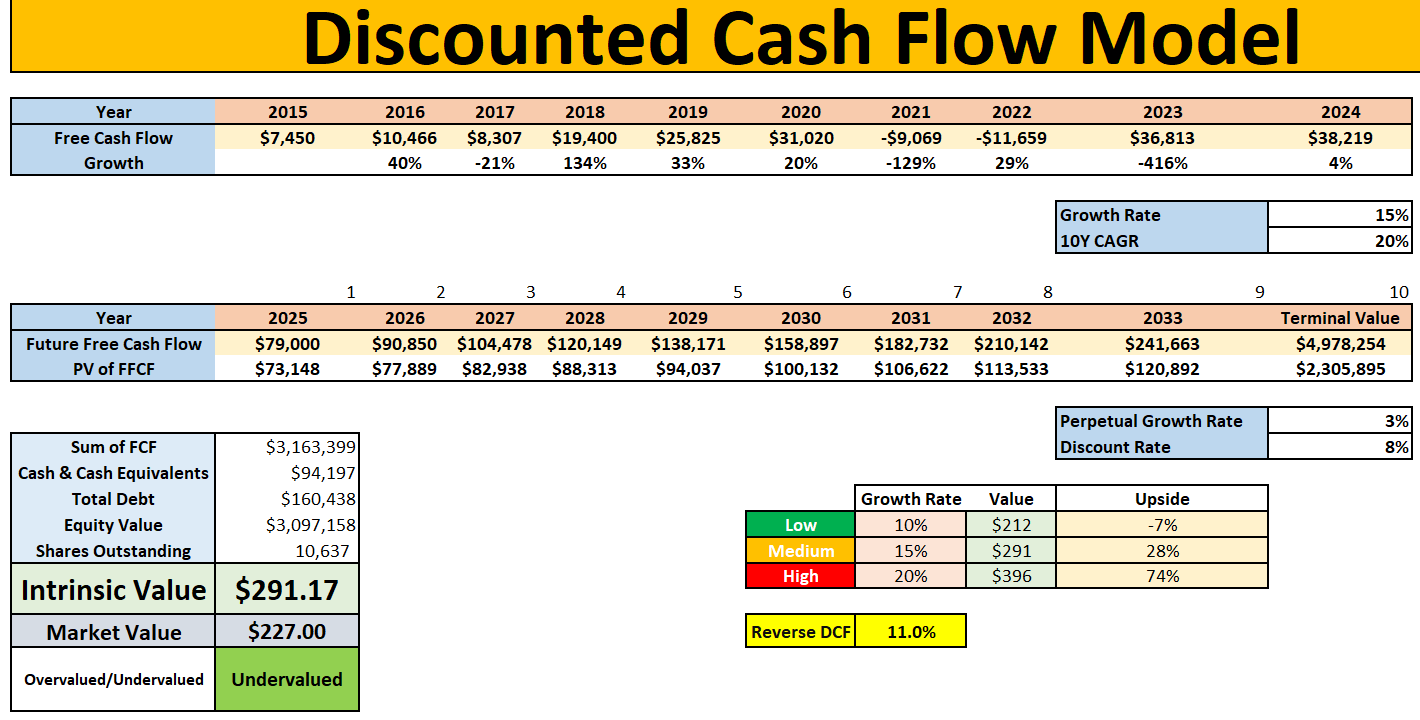

DCF Model

Using our DCF model a few things to note:

11% is baked into the FCF growth moving forwards.

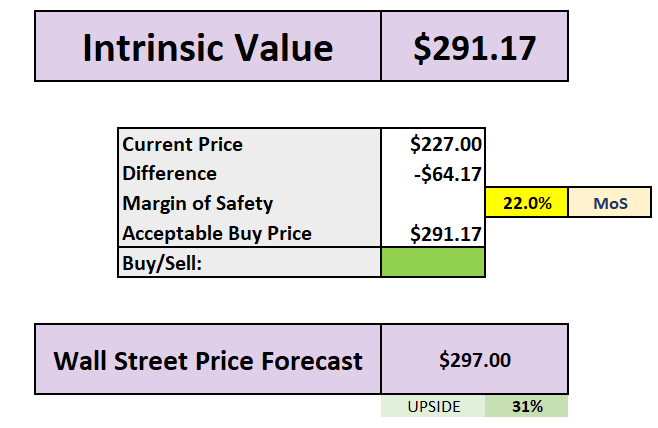

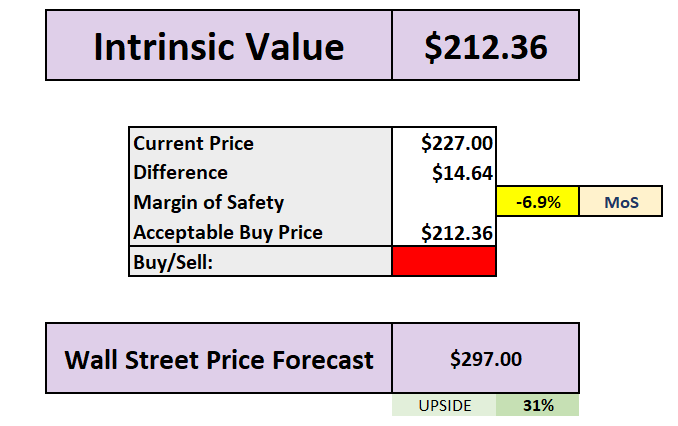

Using 10% (the lower rate) gives an intrinsic value of $212.

Using 15% (the middle rate) gives an intrinsic value of $291.

Using 20% (the higher rate) gives an intrinsic value of $396.

If we use the middle rate of 15%, there is 22% margin of safety on offer to investors, with Wall Street seeing 31% upside into 2026.

However, if you think these numbers are optimistic, the lower growth rate of 10% would equate to paying a 7% premium today.

Keep reading with a 7-day free trial

Subscribe to Dividend Talks to keep reading this post and get 7 days of free access to the full post archives.