3 Undervalued Dividend Growth Stocks!

+ Rate Cuts Are Coming!

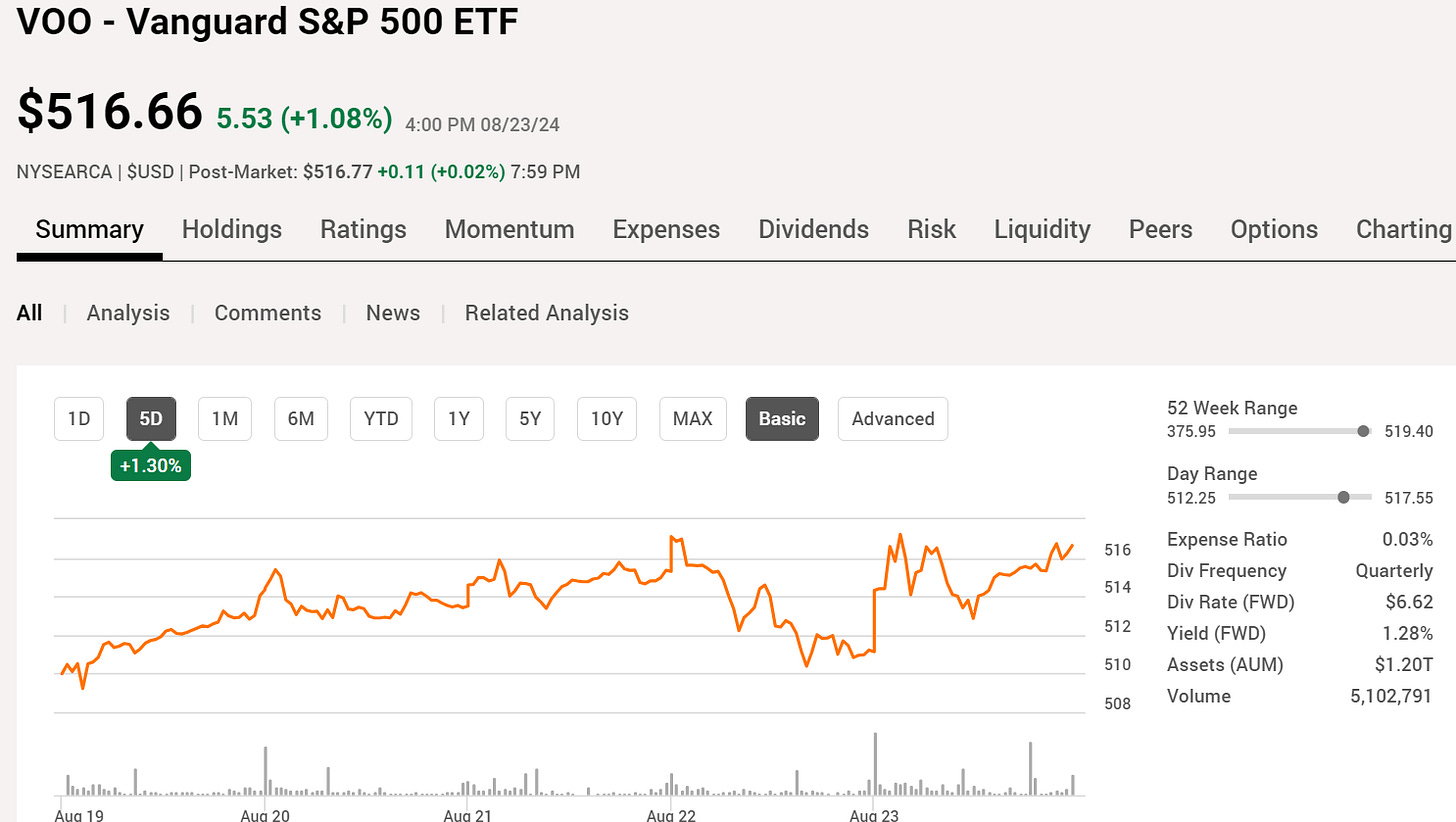

Market Latest

Last week we saw the S&P 500 up 1.30% as Wall Street got the message they had been waiting for from the Federal Reserve Chair, Mr. Jerome Powell, that the long-awaited interest rate cuts are finally coming.

On Friday Powell said “the time has come” in relation to rate cuts which are currently at a 23-year high.

He also mentioned that the labour market had cooled enough not to pressure inflation higher.

Nearly every industry ended up in the green last week on the back off this news with just a few ending negatively.

Earnings This Week

Looking ahead this week, we have the big name everyone has been waiting for:

Nvidia reports after market close on Wednesday and the market will be watching to see if they can continue the massive growth from previous quarters.

As always, we will cover this on our YouTube channel, and for those that aren’t subscribed, we would love to have you in our community which is now officially over 50,000.

Fear and Greed Index

We also note that one week ago we were sitting in fear, however now we have moved into neutral:

Undervalued Dividend Growth Stocks

Let us dive into the 3 Undervalued Dividend Growth Stocks we like.

To select those that we believe to be undervalued and worth a deep dive we have used the following criteria:

5Y Dividend Growth Rate > 10%

Dividend Safety 60+ (Safe)

ROIC > 10%

Net Debt to EBITDA below 3 (Strong Balance Sheet)

Upside > 10%

Kroger (KR)

Kroger is a large retail company that operates supermarkets and multi-department stores, offering groceries, household goods, and pharmacy services.

As we can see below, over the last 10Y Kroger is up 103.81%, and whilst this has slightly underperformed the S&P 500 during this period, we believe over the longer term this is a high quality stock that can outperform.

As per below, we get a double undervaluation signal as the current yield is above the 5Y average (2.46% v 2.17%) and the Forward P/E is marginally lower than the 5Y (11.5x v 12.1x).

Dividend Safety score of 71 indicates safety.

Love to see this consistency in growth year on year, with the increase to the dividends being 14% per year, on average, over the last 10 years.

ROIC gives us faith that management are able to allocate their capital effectively and it is good to see the consistent levels around the mid teens which is above the minimum 10% we like to see.

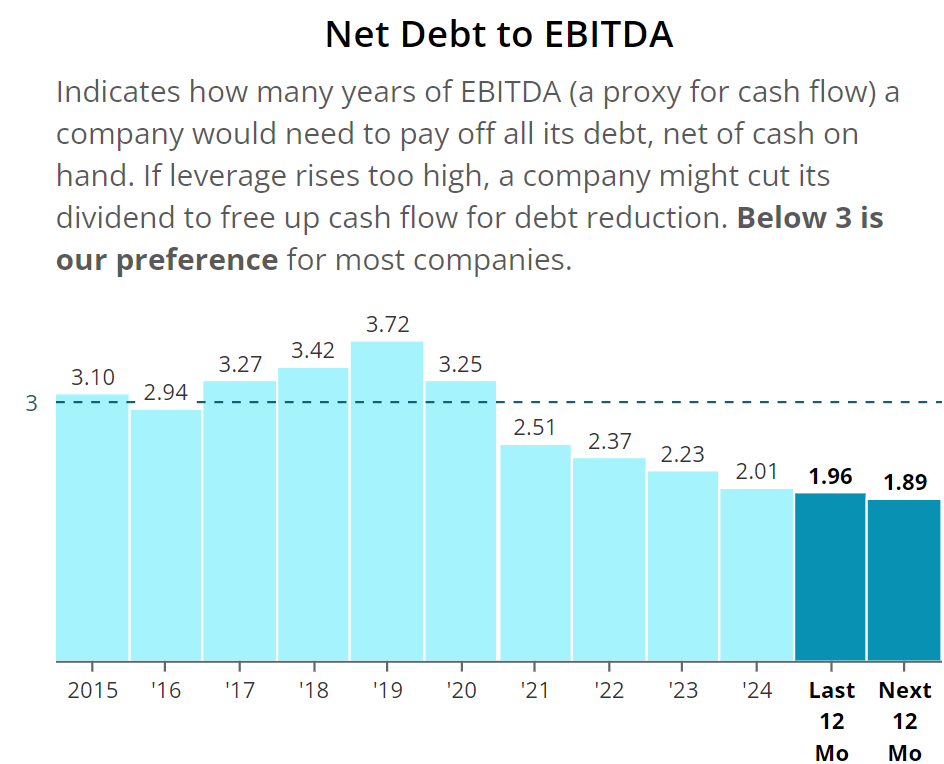

The Net Debt to EBITDA of 2.01 for 2024 is also very good to note as it indicates they have a strong balance sheet, and has been lowering from the highs of 2019, with the reduction expected to continue into 2025 at 1.89.

As per below, Wall Street see 13.19% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $62.87.

So in conclusion for Kroger, we see around a 20% margin of safety around the $50/$51 mark with Wall Street indicating 13% upside.

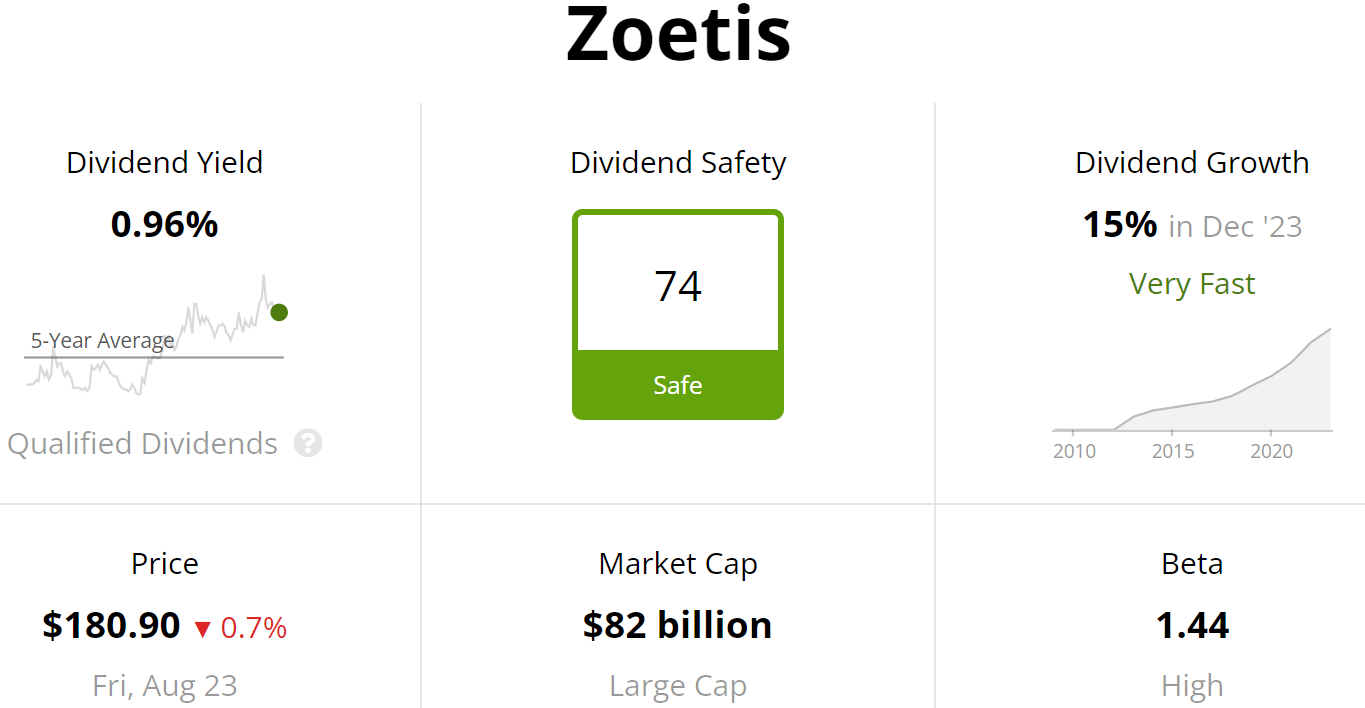

Zoetis (ZTS)

Zoetis is a global animal health company that develops, manufactures, and sells medicines, vaccines, and diagnostic products for livestock and pets.

Over the last 10Y Zoetis has significantly outperformed the S&P 500 and is up 411.63%, and that is without including dividends reinvested!

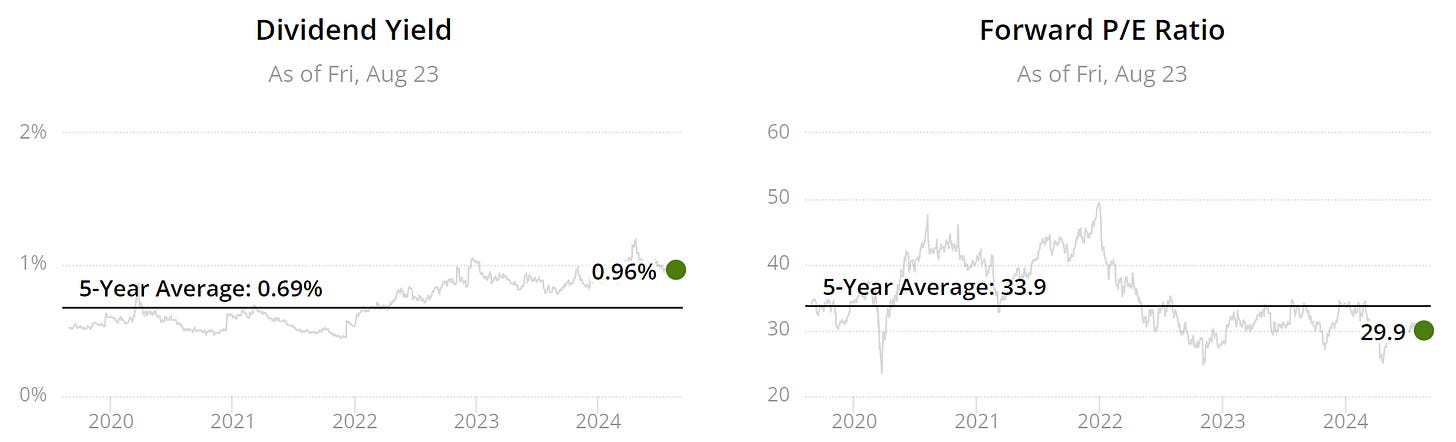

As per below, we get a double undervaluation signal as the current yield is above the 5Y average (0.96% v 0.69%) and the Forward P/E is marginally lower than the 5Y (29.9x v 33.9x).

Dividend Safety score of 74 indicates safety.

One of our favourites in terms of Dividend Growth, 23% every year over the last 10Y on average!

ROIC sitting between 20-30% on average over the last 10Y is a very good sign. Remember one thing we like to see with strong metrics is consistency and that is what we get with Zoetis.

The Net Debt to EBITDA of 1.27 for 2023 is very good to note and it has consistently been below 3 over the last 10 years.

As per below, Wall Street see 16.64% upside over the next 12 months.

When we last ran it through our valuation model our intrinsic value came to $225.09.

So in conclusion for Zoetis, we see around a 20% margin of safety around the $180 mark with Wall Street indicating 17% upside.

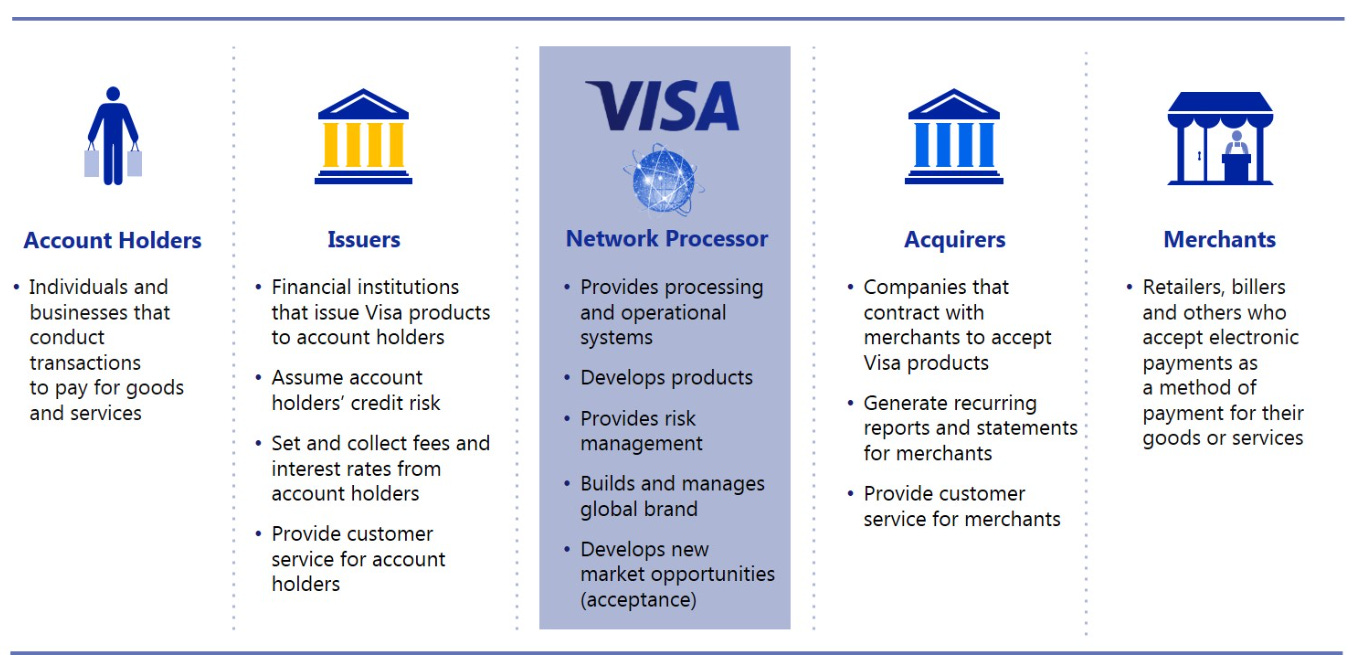

Visa (V)

Visa is a global payments technology company that facilitates electronic fund transfers, primarily through credit, debit, and prepaid cards.

Over the last 10Y Visa has significantly outperformed the S&P 500 up 403.37%.

As per below, we get a double undervaluation signal as the current yield is above the 5Y average (0.78% v 0.71%) and the Forward P/E is marginally lower than the 5Y (25x v 28.4x).

Dividend Safety score of 99 (the highest score obtainable indicates safety).

Another one of our favourites in terms of Dividend Growth, 18% every year over the last 10Y on average!

ROIC sitting between 20-40% on average over the last 10Y is a very good sign.

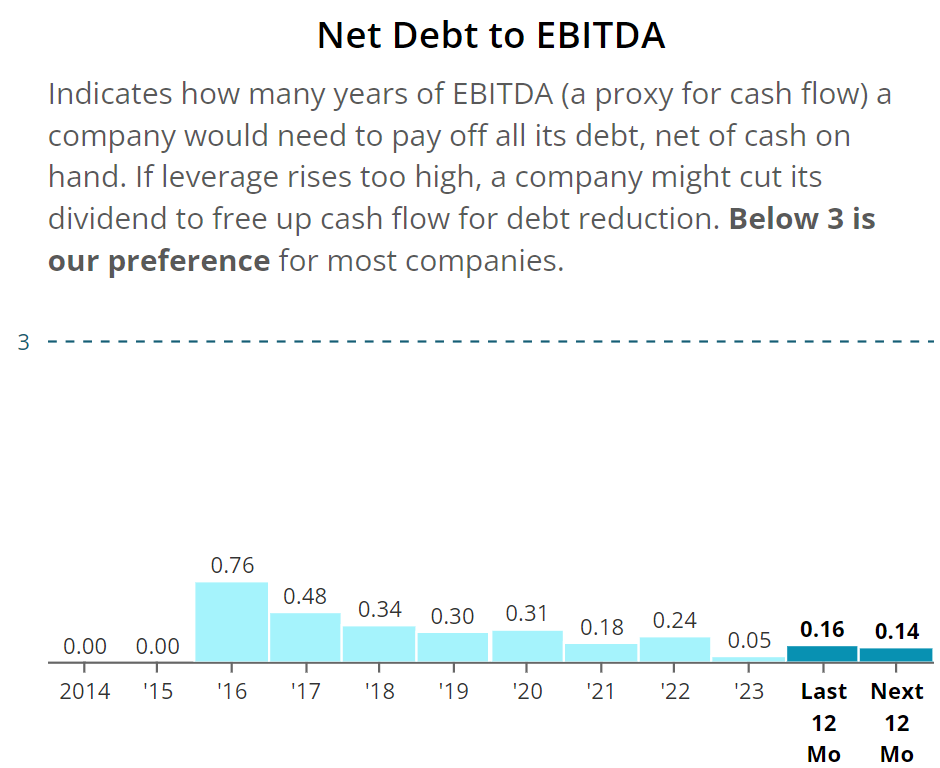

The Net Debt to EBITDA of 0.05 for 2023 is excellent.

As per below, Wall Street see 17.94% upside over the next 12 months.

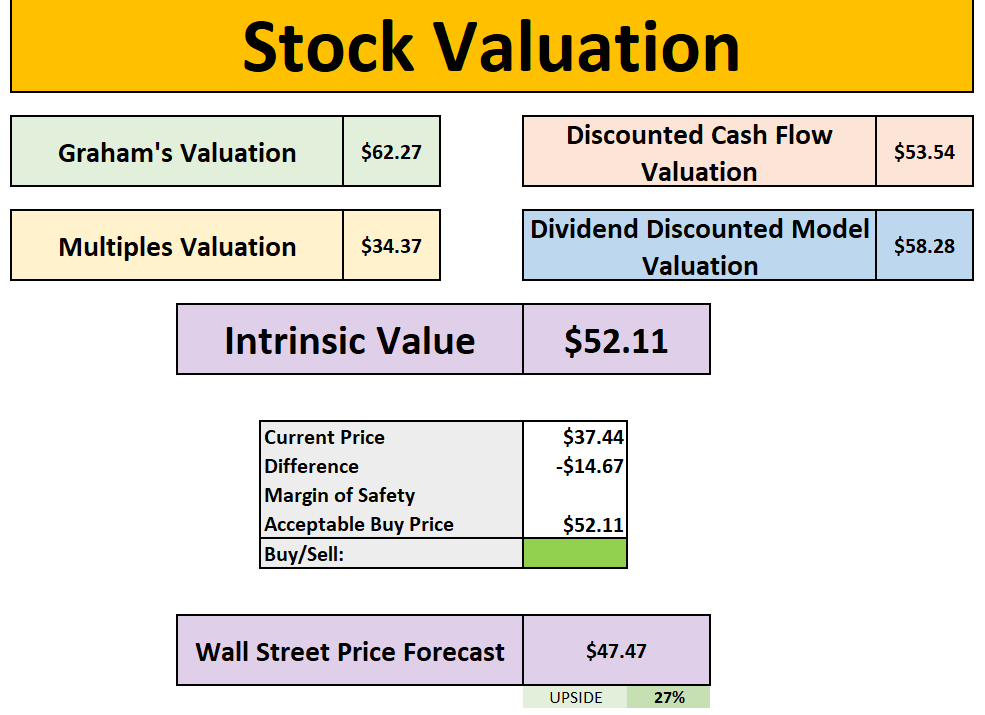

When we last ran it through our valuation model our intrinsic value came to $322.90.

So in conclusion for Visa, we see at least a 15% margin of safety around the $275 mark with Wall Street indicating 18% upside.

Stock Valuation Model

If you are interested in valuing stocks yourself, we have created a valuation model below which you can pick up, this is the same version we use in our YouTube analysis:

Seeking Alpha

Seeking Alpha, one of the websites that I use when I review stocks on YouTube has a $25 off discount for your first year. This also includes a 7-day free trial for new users too!

Patreon

Join our community in the patreon where we discuss weekly buy and sells.

https://www.patreon.com/DividendTalks

Conclusion

We have just gone through 3 Undervalued Dividend Growth Stocks to buy.

However as always do your own due diligence and let us know your thoughts about today’s newsletter in the comments.

I hope you all have a great week ahead!

Thanks For Reading!

If you’d like to support this work feel free to buy me a coffee. The proceeds will contribute to the running costs of the newsletter.

Join the community of investors - subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today’s newsletter helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Note

I am not a financial advisor or licensed professional. Nothing I say or produce anywhere, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk.