3 Undervalued Dividend Kings!

+ Japanese Carry Trade Explained

Market Latest

What a week we have had in the stock market!

It started off with Japanese stocks falling to their worst loss since 1987’s Black Monday.

We then ended the week with U.S stocks having their best day since 2022.

The S&P 500 closed out the week 3.16% up.

As we can see from the below heat map it was a very mixed result across the board.

Some losers last week include, Pfizer -6%, UnitedHealth -5% and Tesla -4%

Some winners last week include, Uber +16%, Expedia +13% and Eli Lilly +11%

Earnings This Week

Looking ahead this week, earnings season continues with some very big names:

As always, we will cover this on our YouTube channel, and for those that aren’t subscribed, we would love to have you in our community which is nearing 50k.

Notable News

Inflation Data

Wednesday 14th we are expecting US inflation data for July with 2.9% expected (June was 3%).

Wednesday 14th we are expecting UK inflation data for July with 2.3% expected (June was 2%).

Japan Carry Trade Explained:

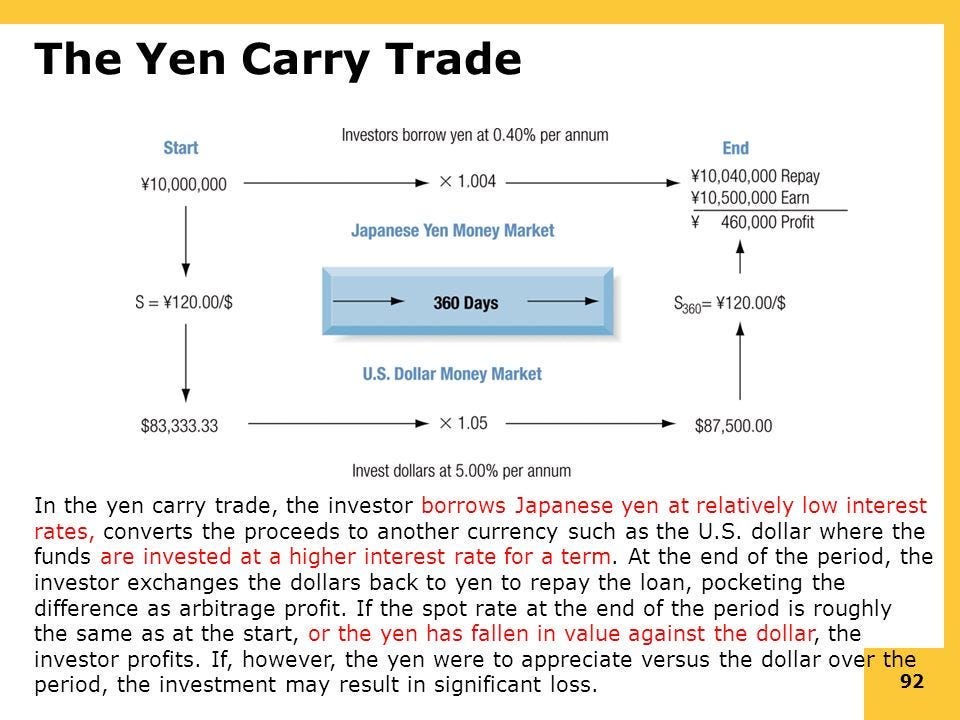

What is a carry trade?

When you borrow money in a place where interest rates are low and use it to invest elsewhere in assets that generate some kind of return.

How did this begin?

For many years, the place to get money on the cheap has been Japan, where interest rates have held steadily at or near zero.

An investor could borrow Japanese yen (for a small fee) and use that yen to buy, say, US tech stocks or government bonds or the Mexican peso — all of which have offered solid returns in recent years.

In theory, as long as the yen remains low against the dollar, you can pay back what you borrowed and still walk away with a tidy profit.

Why was this popular?

For the century so far, you would have made more money in the yen-peso carry trade than you would have done in the S&P 500.

It proved especially popular in the last four years, because Japan was the only major economy in the world offering essentially free money. (While the US, Europe and others were raising interest rates to fight inflation, Japan has had the opposite problem, and it kept borrowing rates low to encourage economic growth.)

Borrowing for next to nothing and getting a 5% return on a US Treasury sounds like a no-brainer.

It’s pretty good arbitrage, however it is not risk-free. You need to have the exchange rate work in your favour.

Why are there issues?

Problems began when the yen’s value started going up a few weeks ago, eroding the potential profit from a carry trade.

Last week, the Bank of Japan raised interest rates for the second time since March, pushing the yen even higher (and thus making it more expensive to pay back your yen-based loan).

Meanwhile, the dollar weakened as the Federal Reserve strongly hinted at looming rate cuts, and US tech stocks declined.

If you’re a carry trader, you headed for the exits. But so did everyone else.

The carry trade relies on borrowing, which means it’s a leveraged position. (As a general rule, whenever you hear of leverage in finance, think “high risk.”)

How does this spiral?

Once even minor losses start to accrue, lenders are going to demand that you pony up more cash to cover your potential losses, a process known as a margin call.

That may mean selling stocks to raise cash, or closing out the position completely.

Not everyone will have a margin call at once, but the riskiest people may, and then they start to liquidate.

This then creates losses for people down the chain, and then they have to sell, and then it’s just spirals.

On Monday, the Japanese stock market fell 12.4%, triggering a global rout.

Source: CNN

Undervalued Dividend Kings

Let us dive into the 4 Undervalued Dividend Kings.

To select those that we believe to be undervalued and worth a deep dive we have used the following criteria:

Forward P/E below 25

Dividend Safety 60+ (Safe)

ROIC > 10%

Net Debt to EBITDA below 3 (Strong Balance Sheet)

Upside > 10%

Target (TGT)

Retail company that sells a wide variety of products, including clothing, electronics, groceries, and household items, through its physical stores and online platform.

As we can see below Target has outperformed the S&P 500 over the last 10 years.

We also get a double undervaluation signal below as the current yield of 3.31% is higher than the 5Y average of 2.42%.

We can also see that the forward P/E of 14.1x is lower than the 5Y of 17.6x

Divided Safety score of 80 indicates safety.

ROIC gives us faith that management are able to allocate their capital effectively and it is good to see the consistent levels around 17% which is ideally the minimum we want to see for consumer retailers.

The Net Debt to EBITDA of 1.75 for 2024 is also very good to note as it indicates they have a strong balance sheet.

As per below, Wall Street see 30.45% upside over the next 12 months.

When we run it through our valuation model our intrinsic value comes to $178.49.

So in conclusion for Target, we see around a 25% margin of safety around the $134 mark with Wall Street indicating 31% upside.

Abbott Laboratories (ABT)

Global healthcare company that develops and sells medical devices, diagnostics, nutritional products, and branded generic pharmaceuticals.

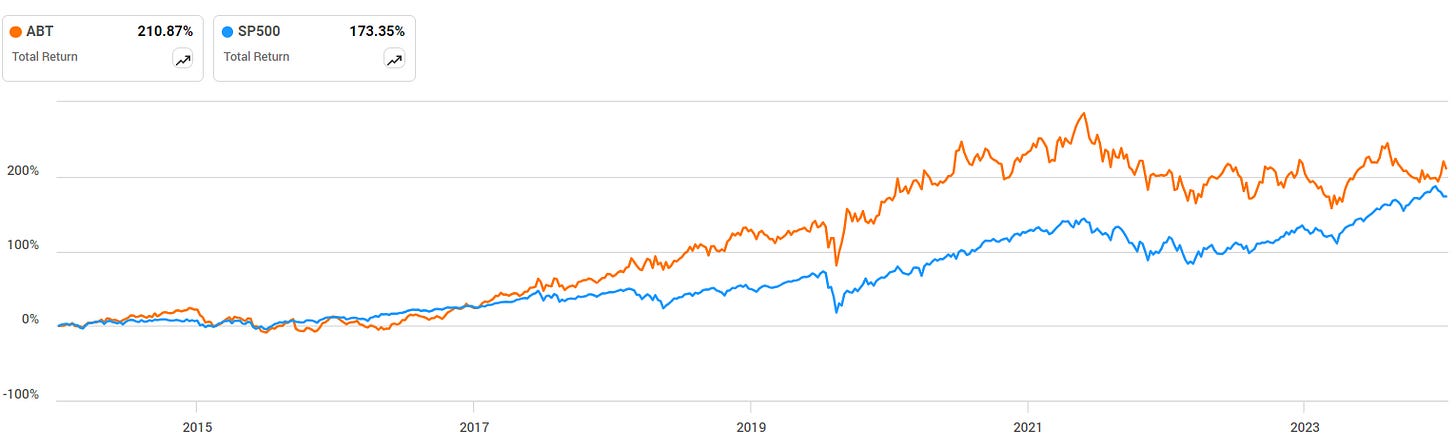

As we can see below ABT has outperformed the S&P 500 over the last 10 years.

We also get a double undervaluation signal below as the current yield of 2.02% is higher than the 5Y average of 1.65%.

We can also see that the forward P/E of 22.1x is lower than the 5Y of 24.8x

Divided Safety score of 90 indicates safety.

ROIC looks good overall, with 2023 coming in at 13%.

The Net Debt to EBITDA of 0.82 for 2023 is very good to note.

As per below, Wall Street see 16.82% upside over the next 12 months.

When we run it through our valuation model our intrinsic value comes to $130.04.

So in conclusion for ABT, we see around a 15% margin of safety with Wall Street indicating 17% upside.

Genuine Parts Company (GPC)

Global distributor of automotive replacement parts, industrial parts, and business products, serving customers through a network of stores and distribution centers.

We get a double undervaluation signal below as the current yield of 2.92% is higher than the 5Y average of 2.69%.

We can also see that the forward P/E of 14.2x is lower than the 5Y of 17.8x

Divided Safety score of 80 indicates safety.

ROIC looks good overall, with 2023 coming in at 18%.

The Net Debt to EBITDA of 1.61 for 2023 is very good to note.

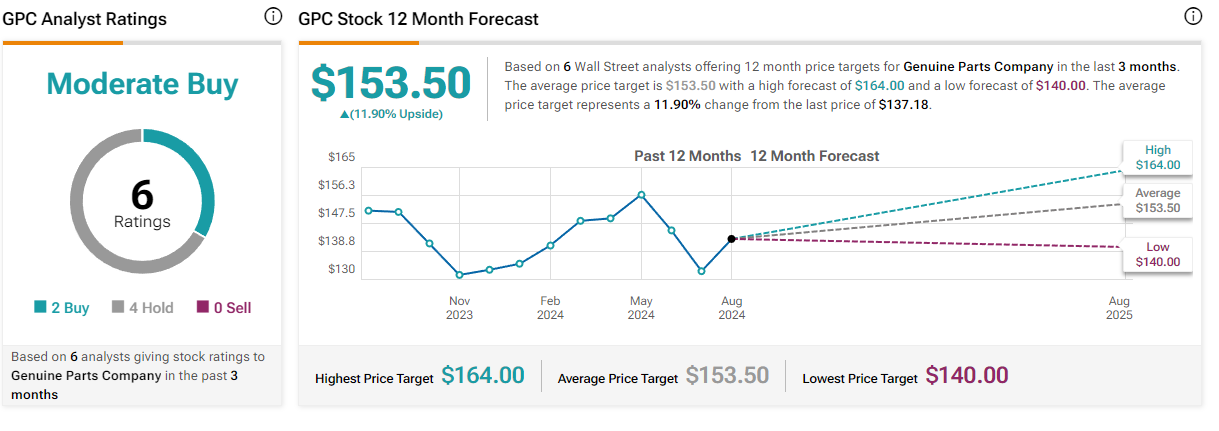

As per below, Wall Street see 11.90% upside over the next 12 months.

When we run it through our valuation model our intrinsic value comes to $158.73.

So in conclusion for GPC, we see around a 15% margin of safety with Wall Street indicating 12% upside.

KNGS Dividend King ETF

It is important to understand that some investors would rather have exposure through an ETF.

This has been made possible with a new ETF, ticker symbol KNGS.

Created in November 2023, it holds an elite group of 38 companies with 50+ years of increasing the dividend.

The top holdings consist of the below:

Note: This has an expense ratio of 0.35% and the performance since inception is +9.83%.

Latest YouTube Videos!

Some videos we have covered this week on the YouTube channel:

6 Undervalued REITs to Buy Before Interest Rate Cuts:

6 Undervalued Dividend Stocks Near 52 Week Lows:

3 Beaten Down Growth Stocks At 52 Week Lows:

Stock Valuation Model

If you are interested in valuing stocks yourself, we have created a valuation model below which you can pick up, this is the same version we use in our YouTube analysis:

Seeking Alpha

Seeking Alpha, one of the websites that I use when I review stocks on YouTube has a $25 off discount for your first year. This also includes a 7-day free trial for new users too!

Patreon

Join our community in the patreon where we discuss weekly buy and sells.

https://www.patreon.com/DividendTalks

Conclusion

We have just gone through 3 Undervalued Dividend Kings to buy.

However as always do your own due diligence and let us know your thoughts about today’s newsletter in the comments.

I hope you all have a great week ahead!

Thanks For Reading!

If you’d like to support this work feel free to buy me a coffee. The proceeds will contribute to the running costs of the newsletter.

Join the community of investors - subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today’s newsletter helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Note

I am not a financial advisor or licensed professional. Nothing I say or produce anywhere, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk.