3 World-Class Stocks Hiding in Plain Sight

The market’s been distracted by AI mania — but these compounding machines are where the real long-term opportunity lies.

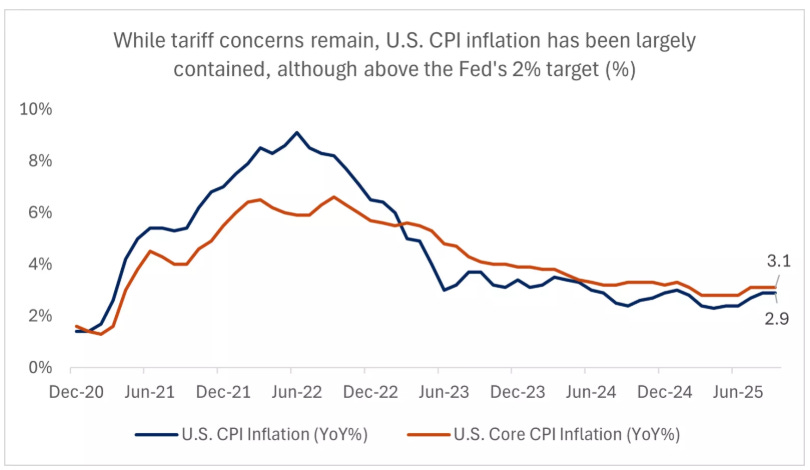

Market Update

Markets End a Wild Week on a High

After a rollercoaster week, U.S. stocks managed to finish higher — a relief after the sharp sell-off that rattled markets just days earlier.

The week started on a brighter note as tensions between the U.S. and China cooled slightly, giving investors some breathing room.

A few dovish comments from the Fed and a wave of deal activity in the AI space also helped lift spirits early on.

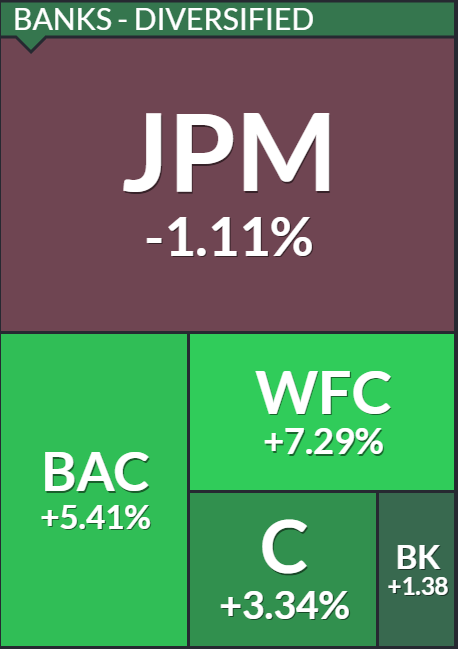

Earnings season kicked off in full swing, led by big banks like JPMorgan, Citigroup, and Wells Fargo — all of which topped expectations.

Bank performances for the week

By Friday, around 12% of S&P 500 companies had reported, and an impressive 86% had beaten analyst forecasts. That wave of positive results helped steady investor sentiment after a rocky few sessions.

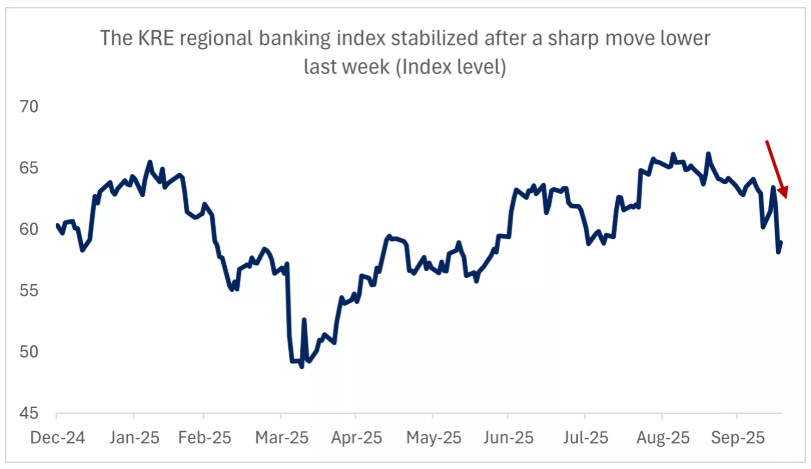

But not everything was smooth sailing. Midweek, regional bank worries resurfaced after a couple of lenders flagged potential loan fraud issues, reigniting concerns about credit quality. That spike in uncertainty briefly sent volatility to its highest level since April before markets recovered into the weekend.

All in all, it was a week that reminded investors how quickly sentiment can swing — but also how resilient this market still is beneath the surface.

Last Weeks Winners & Losers

Top performers:

Estee Lauder (+15%)

KLA Corp (+13%)

Prologis (+12%)

Micron (+11%)

American Express (+10%)

Biggest drops:

Kenvue (-8%)

Robinhood (-7%)

Arista Networks (-7%)

Hewlett Packard (-6%)

Eli Lilly (-4%)

Notable News

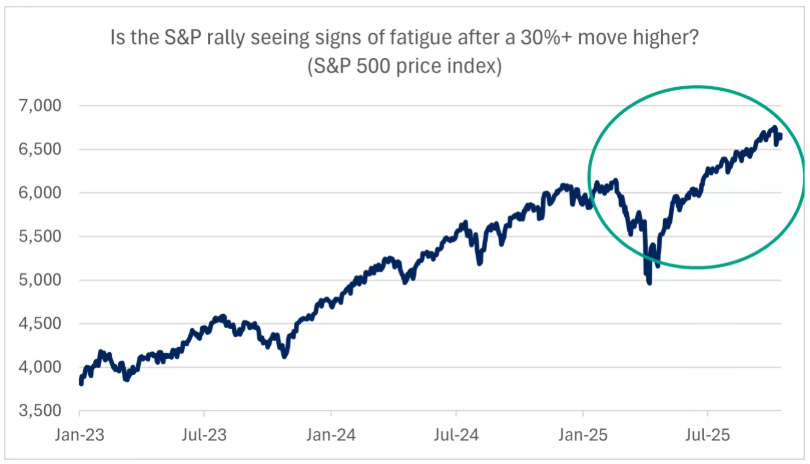

After a Big Rally, Markets May Finally Be Catching Their Breath

After a 35% surge in the S&P 500 with barely a pullback, markets are finally showing signs of fatigue.

Three main factors are driving the current uncertainty:

Trade & Policy Risks: Tensions between the U.S. and China are flaring again, but a potential meeting between Trump and Xi later this month could cool things down. Meanwhile, the U.S. government shutdown — now in its third week — risks trimming economic growth if it drags on.

Regional Bank Worries: A few smaller banks, like Zions and Western Alliance, disclosed loan fraud losses, sparking renewed concern. Larger banks remain solid, but investors are watching credit quality closely.

Market Fatigue: The VIX has spiked above 20, Treasuries are seeing inflows, and the S&P 500 just saw its biggest one-day drop since April — all signs of a market taking a breather after an extraordinary run.

Earnings Season

Join 115,000+ investors on YouTube! 🎥

We break down earnings, market moves, and exclusive insights you won’t find anywhere else.

Don’t miss out — hit the button below to watch and subscribe now! 👇

YouTube Channel 🔔

Subscribe today and stay ahead of the market!

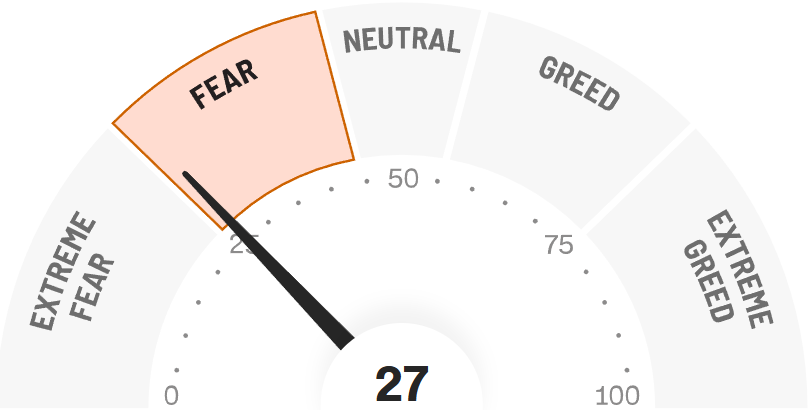

Fear & Greed Index

3 Stocks To BUY

After a volatile few months in the market, quality is starting to matter again.

Many high-flying names have come back down to earth, and some of the strongest, most profitable businesses in the world are finally trading at reasonable levels.

This week, I’m breaking down three market leaders that have quietly underperformed in 2025 — but whose fundamentals tell a very different story.

Each of these companies combines world-class margins, consistent free cash flow growth, and disciplined capital returns.

In other words, they’re the kind of compounders worth paying attention to when everyone else is chasing the next hot story.

Let’s start with the first one.

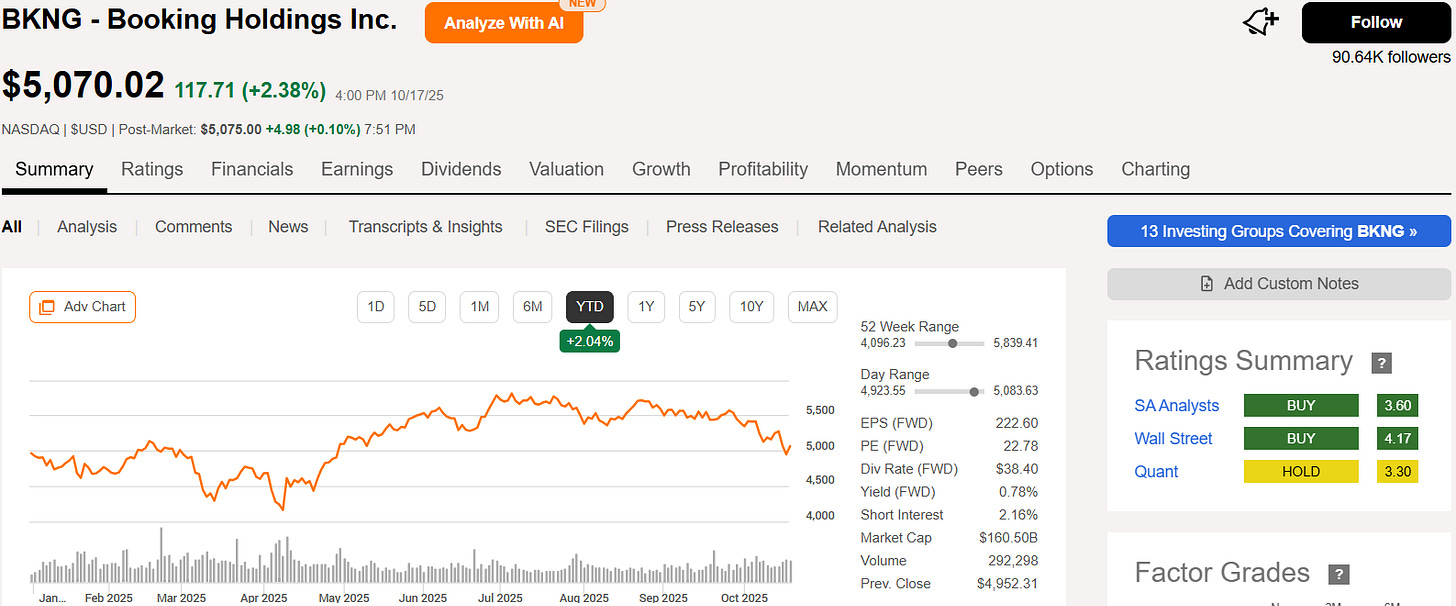

1. Booking Holdings (BKNG)

What is Booking Holdings?

Booking Holdings is the company behind some of the world’s biggest travel platforms — including Booking.com, Priceline, and Kayak.

They make it easy for people to book hotels, flights, and rental cars online, while helping travel businesses fill rooms and seats.

In short, they’re the quiet giant powering much of the global travel industry every time someone clicks “book now.”

Why Booking Holdings Has Lagged in 2025 — Even After a Strong Quarter

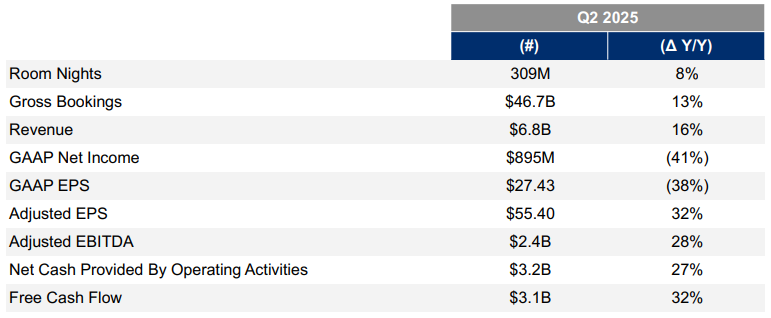

Booking Holdings actually posted a strong Q2 FY25 on paper. Revenue was up around 16% year-over-year, adjusted earnings jumped more than 30%, and cash flow remained healthy.

Yet despite the solid numbers, the stock has drifted lower year-to-date — and here’s why.

Too much optimism priced in

Expectations were sky-high after years of travel recovery. When a stock is already valued for perfection, even good results can disappoint if guidance sounds cautious.Guidance and growth normalization

Management signaled that growth will slow in the second half of the year as the easy post-pandemic comparisons fade. Investors took that as a warning that the boom is tapering off.Softness in U.S. travel

While European and Asian travel demand remains strong, U.S. bookings have cooled, with shorter stays and more price-sensitive consumers cutting into growth.Rising costs

Expenses for marketing, staff, and technology continue to climb, pressuring margins even as revenue rises.Macro and currency headwinds

A strong dollar and global uncertainty — from inflation to geopolitical tension — have added another layer of drag.

In short, Booking’s business remains solid, but investors have started to question whether its best growth days are already behind it for this cycle.

Why This Might Be the Perfect Time to Buy Booking

While Booking’s share price has stumbled in 2025, the underlying business tells a very different story — one of quiet strength and relentless execution.

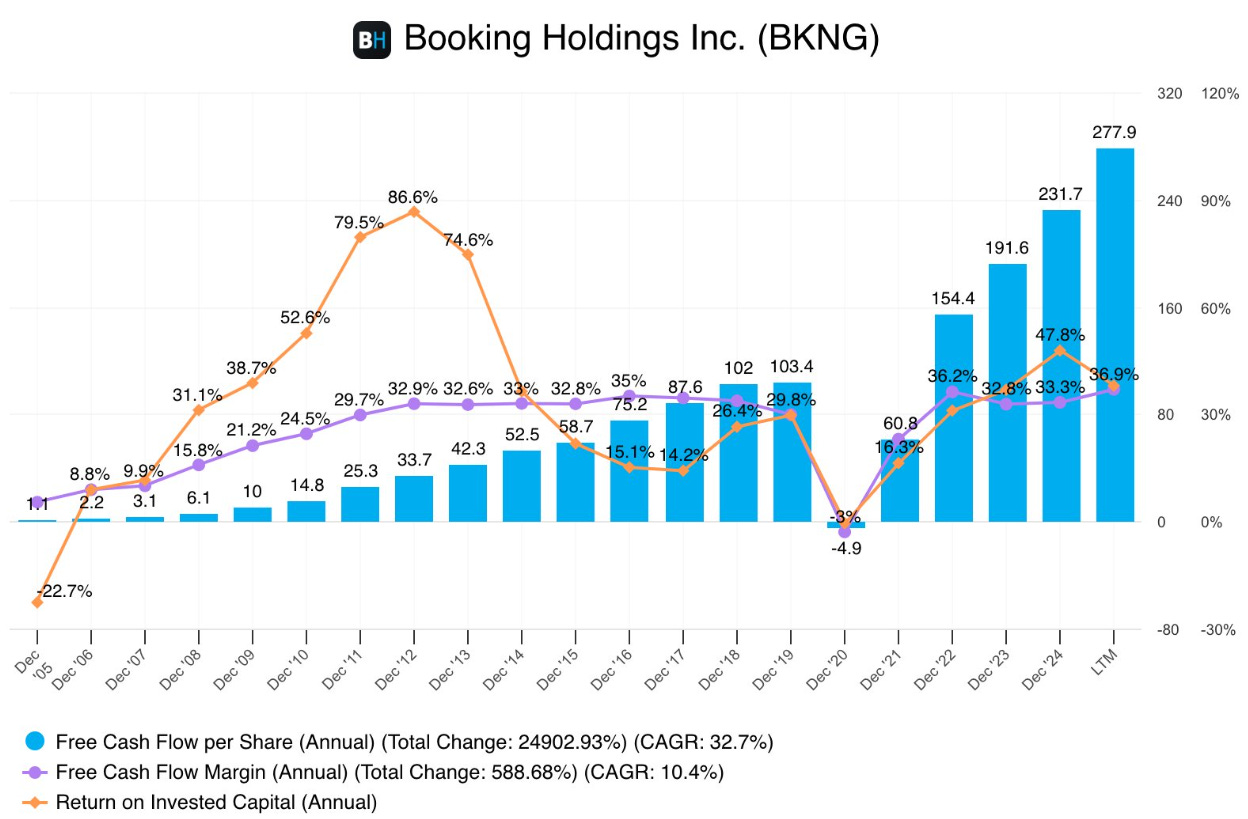

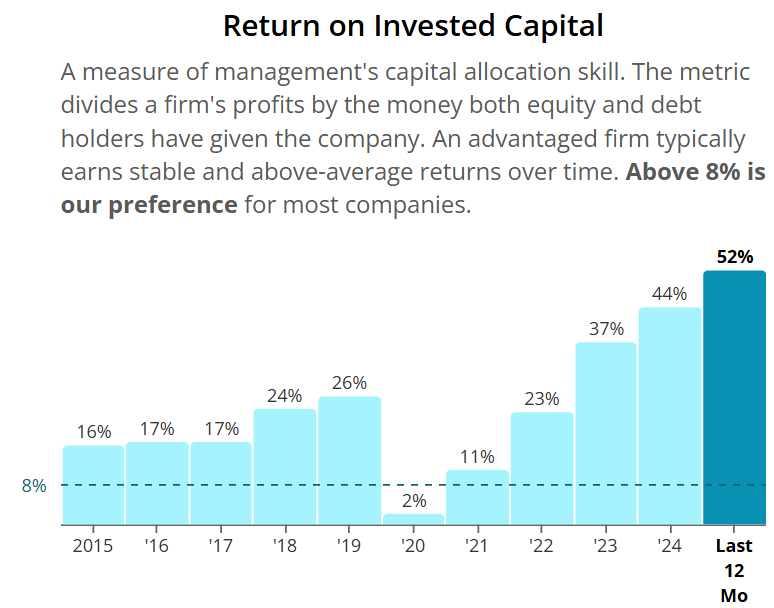

Over the last decade, Booking has grown free cash flow per share by 33% annually, and seen free cash flow margin grow with a 10% CAGR, and has a stellar 52% return on invested capital (ROIC) — numbers few companies in any industry can match.

Even more impressive, gross margins sit at 87%, second only to the very top of the market among large-cap peers.

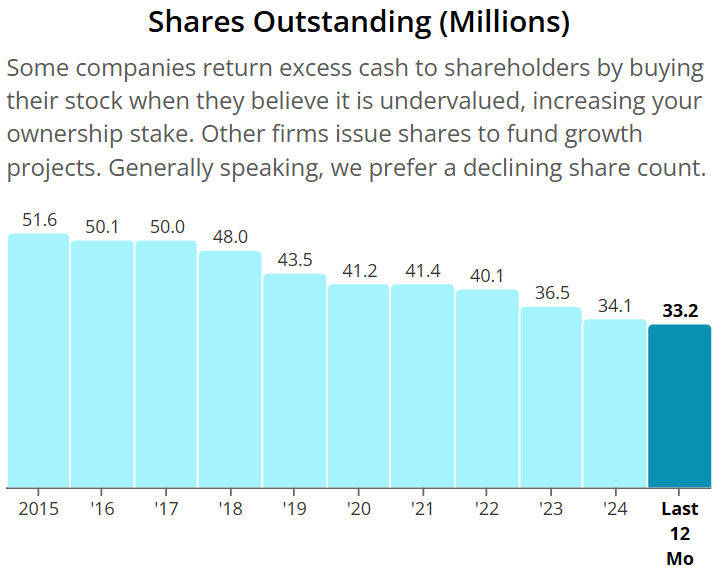

Operationally, the business is leaner than ever. Shares outstanding have fallen from 51.6 million to just 33.2 million over the past 10 years — a huge win for long-term holders.

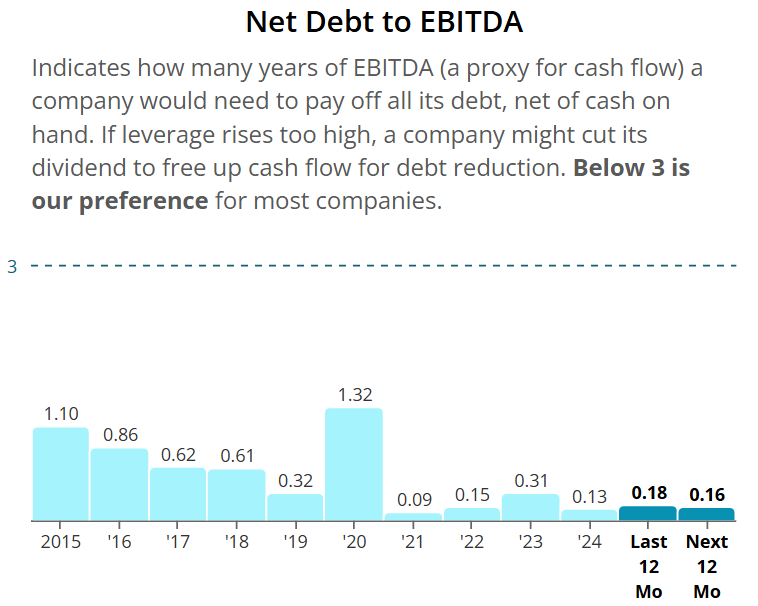

And with net debt to EBITDA at only 0.18, the balance sheet gives Booking plenty of room to keep buying back stock or reinvest in growth.

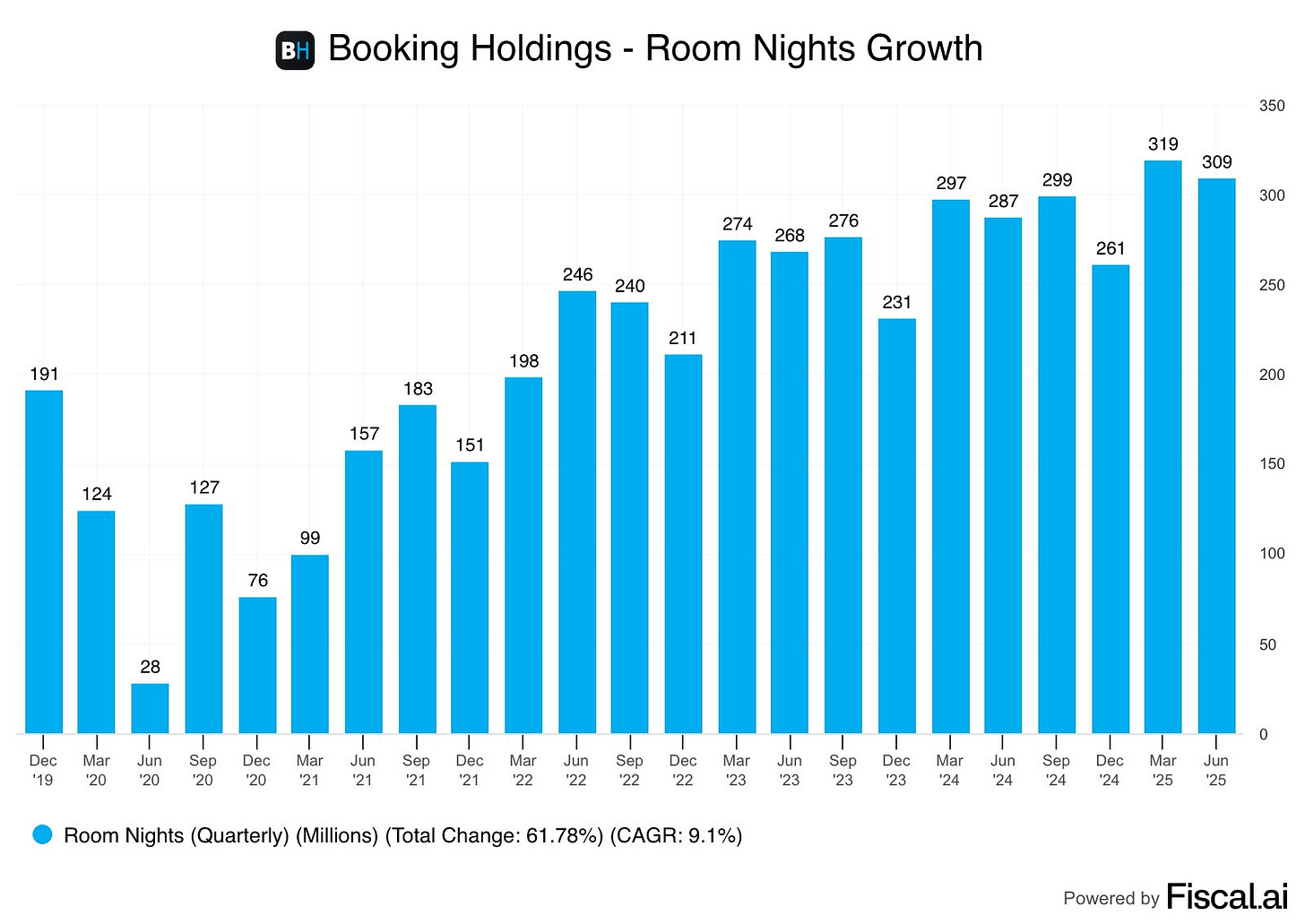

Growth-wise, the momentum hasn’t slowed either. Room nights booked have compounded at roughly 9% per year over the past five years,

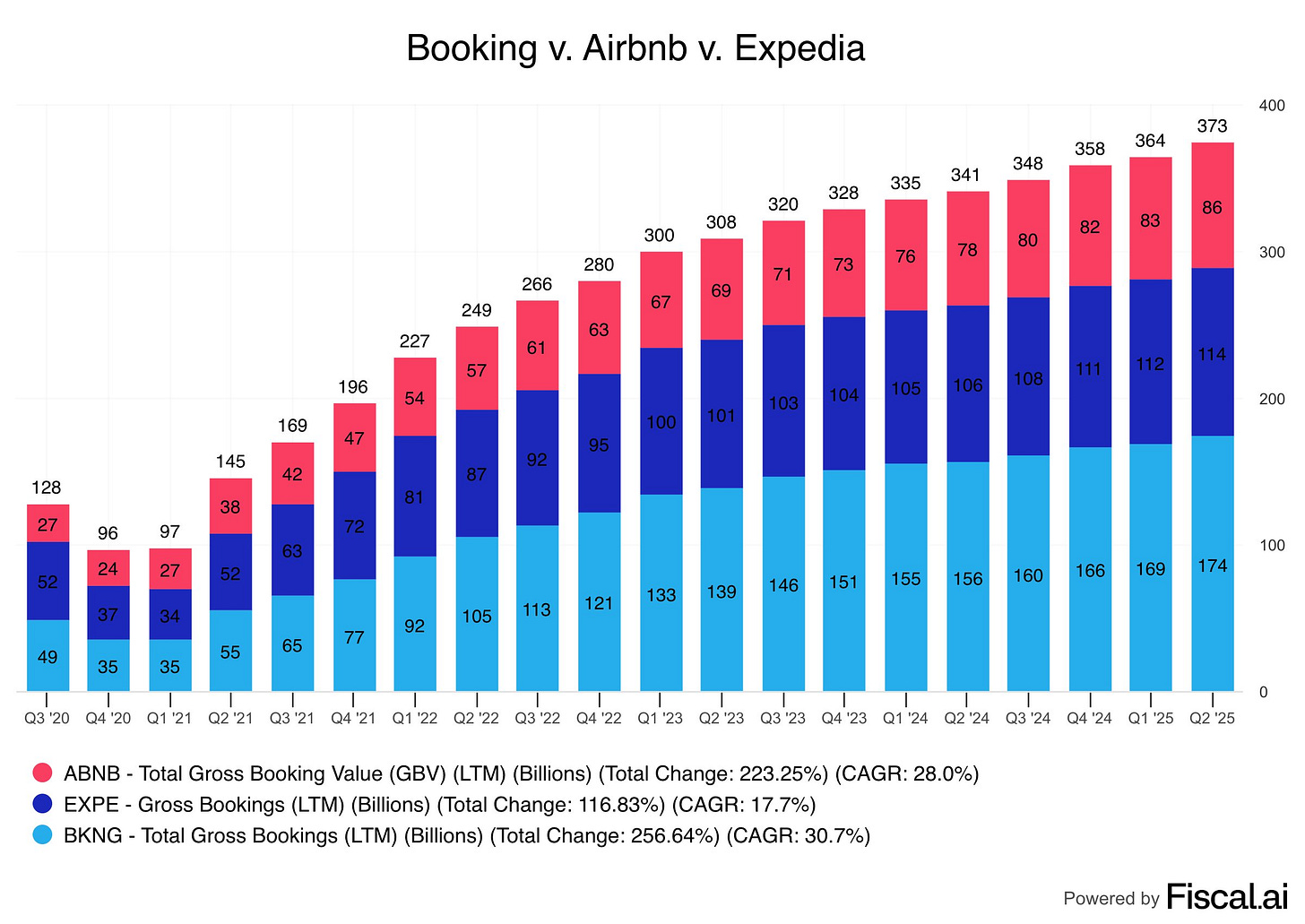

and when you compare overall top-line growth, Booking has outpaced Airbnb and Expedia with a 31% CAGR — remarkable for a company of its size.

So while the market fixates on slowing short-term travel trends, long-term investors see a business that continues to compound quietly in the background — high margins, strong returns, and massive buybacks.

For those with patience, this pullback might be the window you wait years for.

Valuation

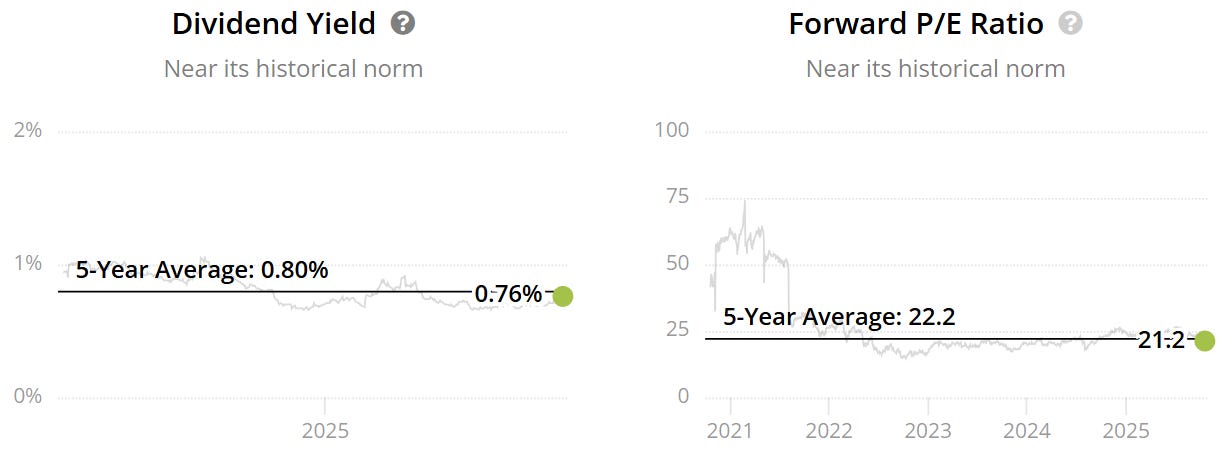

The forward P/E sits below the historical - 21.2x v 22.2x. This could indicate the company is potentially undervalued.

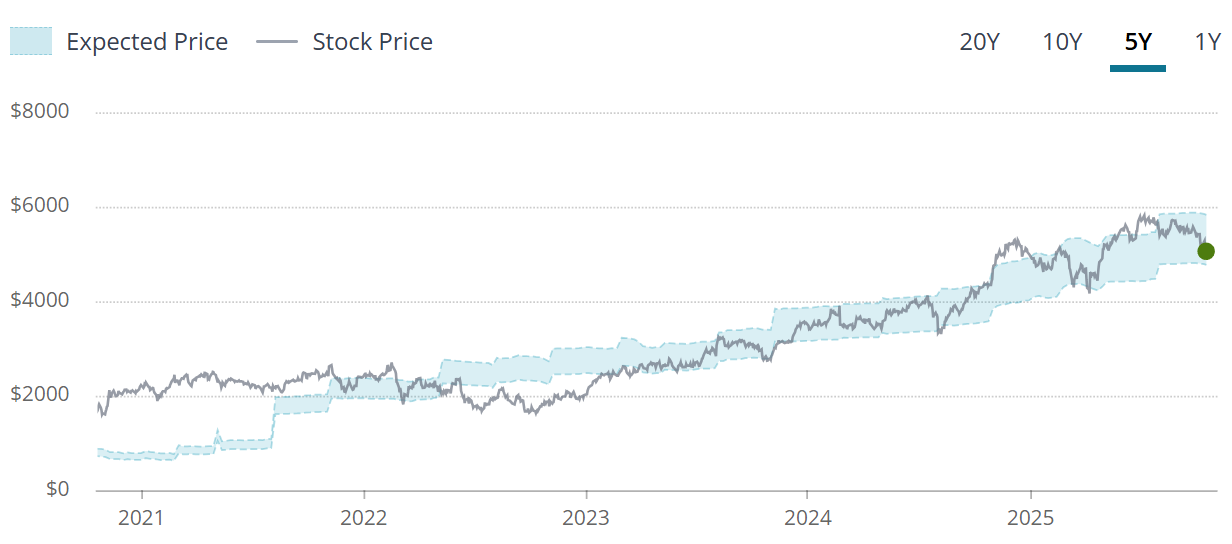

The blue tunnel methodology highlights that the company is at the bottom end of the intrinsic/fair value boundaries indicating a reasonable/slight undervaluation.

When we zoom out to the last 5Y we can see that the Company has offered investors a few times to buy this at a discount, notably in 2022.

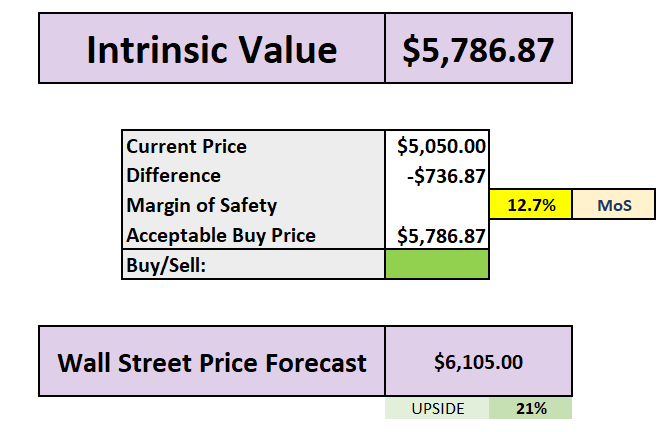

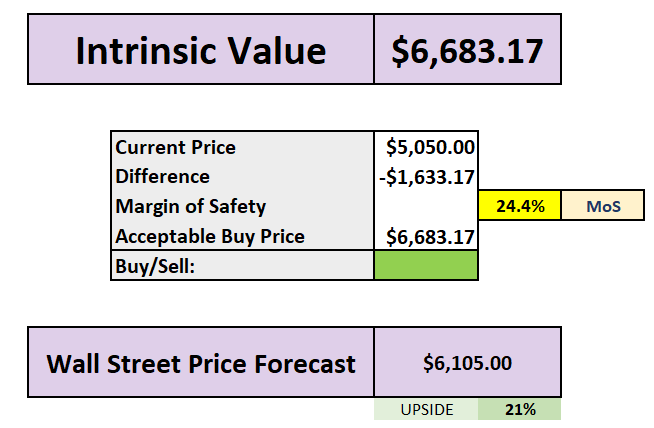

DCF Model

Using our DCF model a few things to note:

4.1% is baked into the FCF growth moving forwards

Using the middle rate of 6% growth there is upside of 15%

Using the higher (but still reasonable) rate of 8%, we note 32% upside

If we use the middle rate of 6%, there is 13% margin of safety on offer to investors, with Wall Street seeing 21% upside into 2026.

Using the higher growth rate of 8% you are getting a 24% MoS.

Keep reading with a 7-day free trial

Subscribe to Dividend Talks to keep reading this post and get 7 days of free access to the full post archives.