4 Insiders Just Bought This Explosive AI Growth Stock

Is This The Ultimate Bullish Signal?

Introduction: The Ultimate Market Signal

For any investor trying to find conviction in a volatile market, the constant search is for a clear, reliable signal amidst the noise. What if the most powerful signal of all came not from Wall Street analysts, but from the people who know a company inside and out?

Imagine a scenario where the most senior leaders - the Chief Executive Officer, the Chief Financial Officer, and the Chief Operating Officer - all start buying their own company’s stock with their own money. This is a rare and powerful vote of confidence.

Now, what does it mean when this exact scenario unfolds at a key player in the artificial intelligence revolution, Marvell Technology, especially after its stock has taken a significant hit this year? Let’s explore the most surprising takeaways from this unique situation.

The 5 Most Surprising Takeaways About Marvell Technology (MRVL)

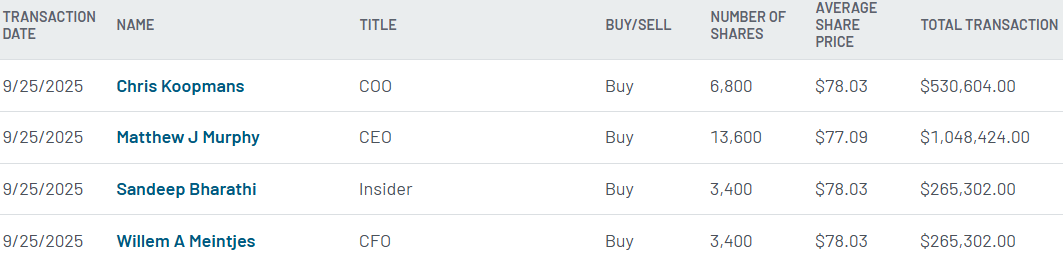

1. The Blinking Buy Signal: Top Executives Are All In

In just the last few days, the CEO, CFO, and COO of Marvell have all purchased company shares, topping up their personal positions by 5% to 7%. This isn’t historical data; it’s a fresh and highly relevant signal from the highest level of management, amounting to over $2.1 million in the most recent quarter alone.

The legendary investor Peter Lynch famously highlighted the importance of such actions:

“when insiders buy it is one of the most bullish signals in the market because management only buys shares when they believe the stock price will in fact go higher”

This unified action is a powerful statement. It suggests that the leadership team, with its unparalleled insight into the company’s operations and future pipeline, collectively believes the stock is undervalued and poised for growth, particularly in its AI-related opportunities.

2. The AI Paradox: A Key Player Trading at a Steep Discount

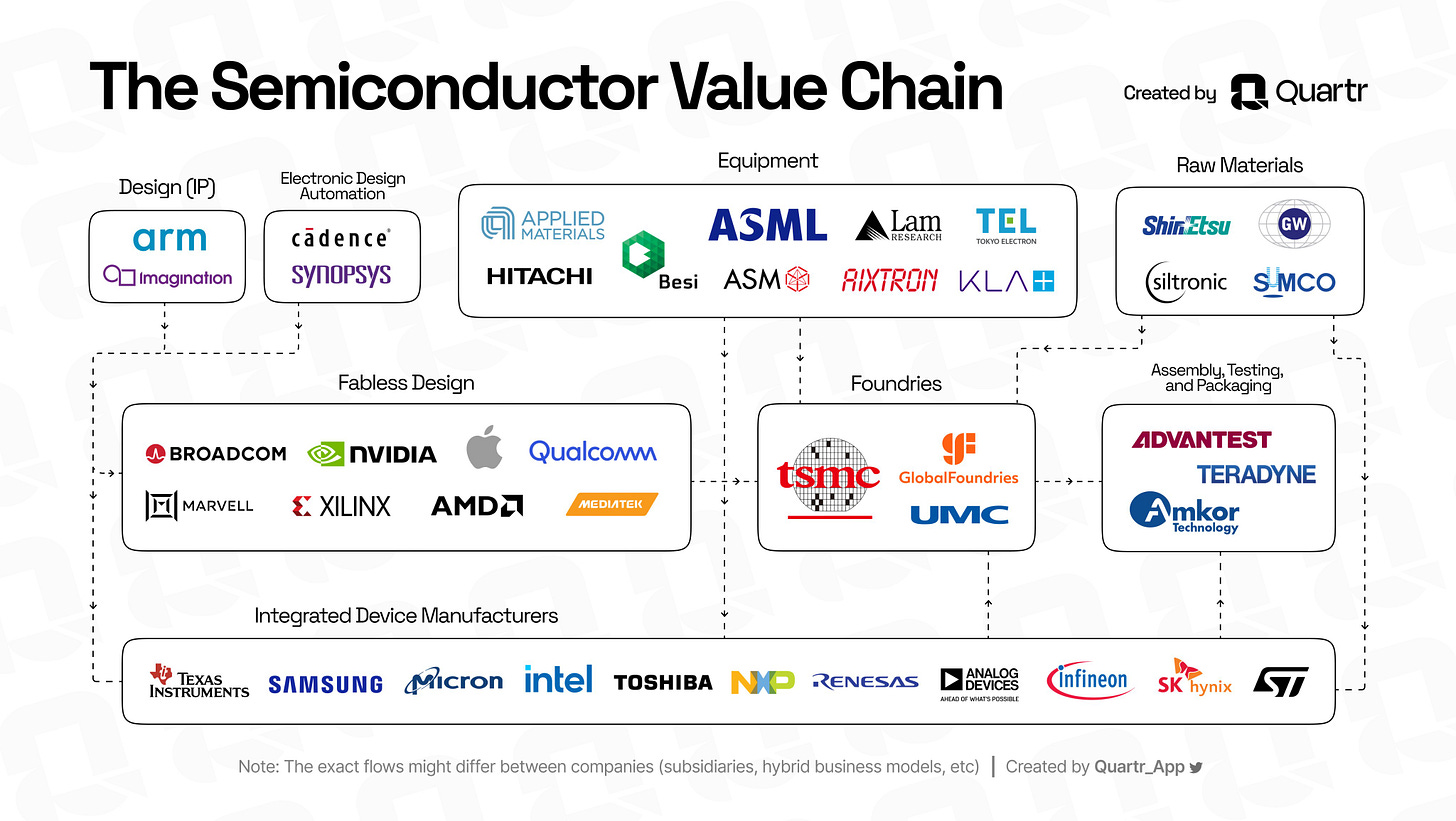

Marvell Technology is a critical component of the AI infrastructure boom. Operating on a fabless model, it designs the high-performance “brains” for advanced hardware without owning costly factories.

The company specializes in custom AI accelerators for hyperscale clients like Google, Amazon, and Microsoft and is a key player in the networking chips essential for AI data centers.

Management expects the company’s AI revenue alone to quadruple in the next two years.

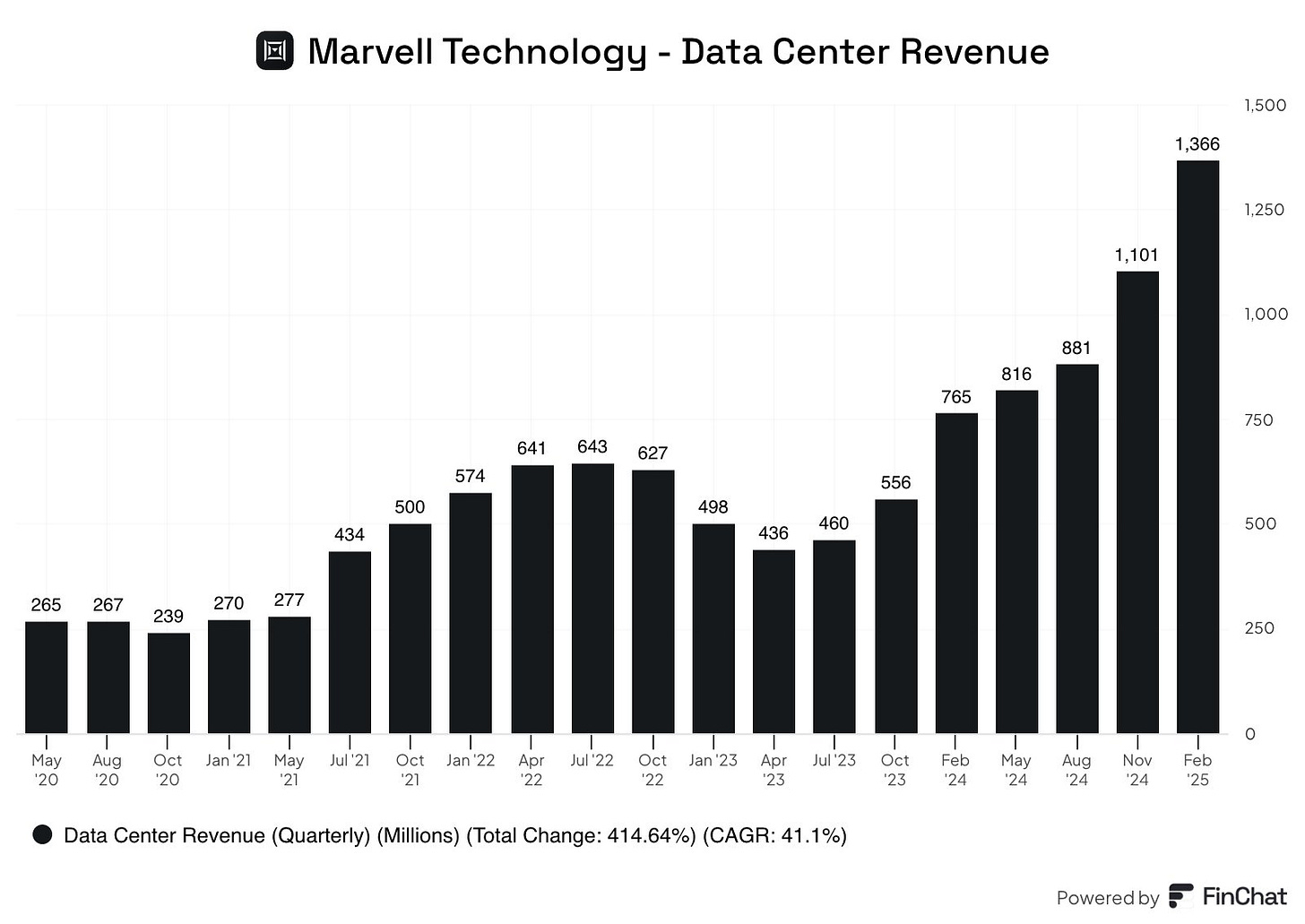

In fact, they’ve now almost tripled their data center business over the last 2 years.

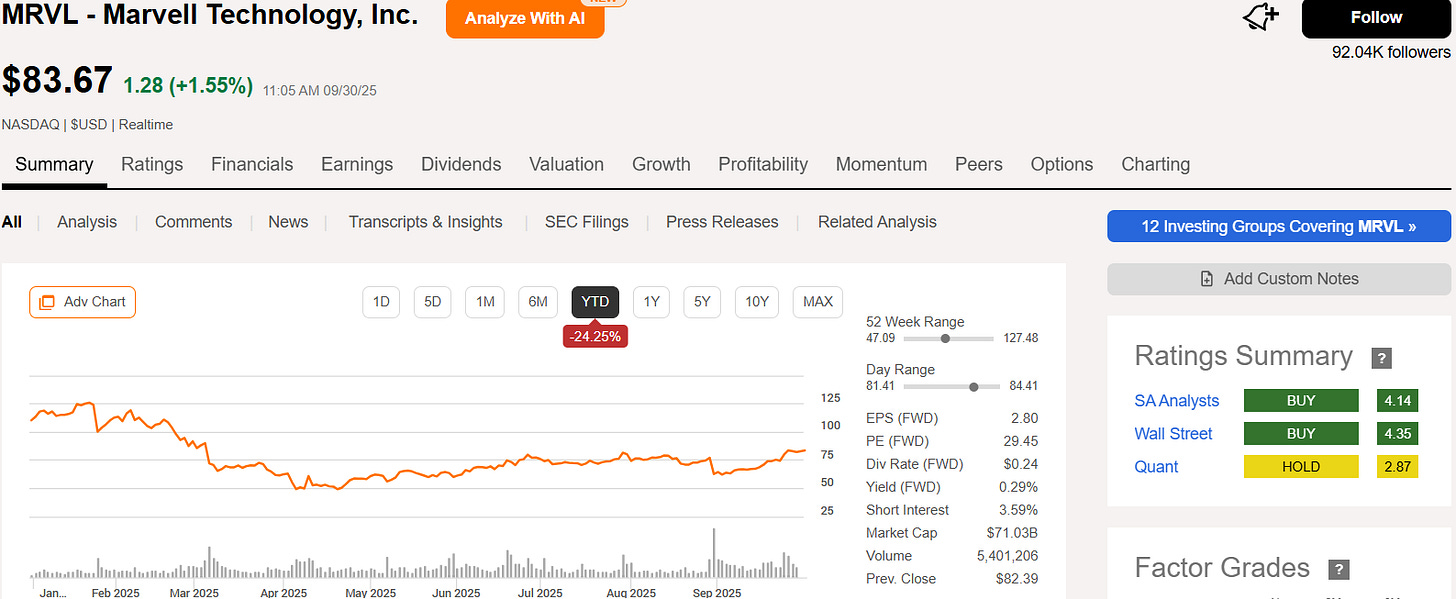

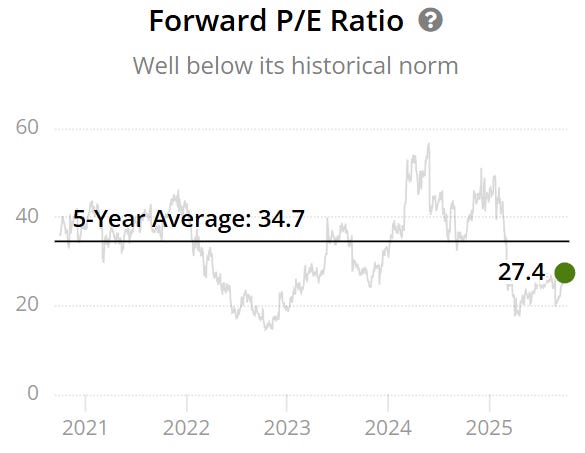

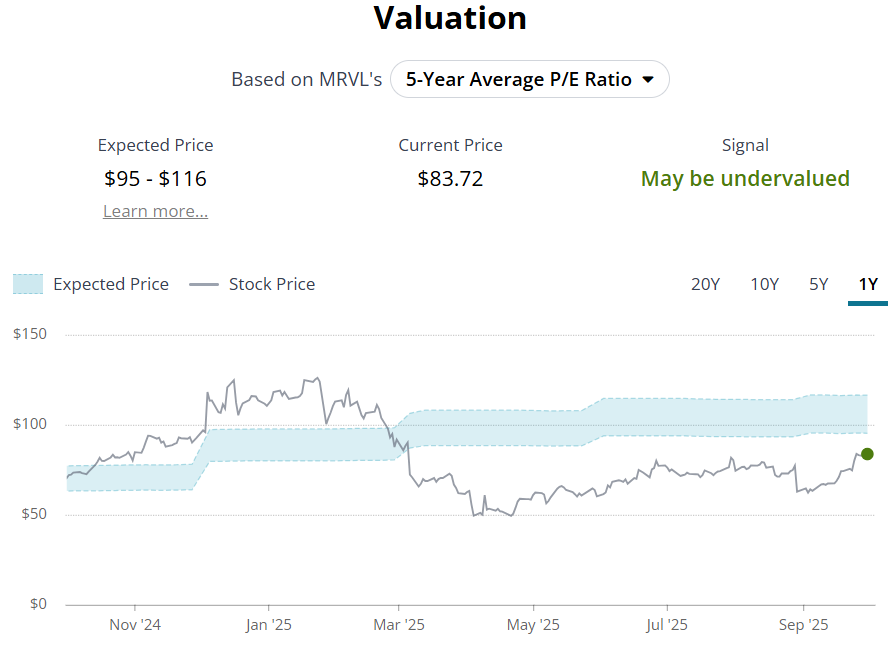

Here lies the paradox: despite this explosive potential, Marvell’s stock has been battered, falling 25% year-to-date, a drop partly fueled by forward guidance that fell slightly short of Wall Street’s expectations. Its current forward Price-to-Earnings (P/E) ratio is 27, well below its 5-year average of 35.

Valuation models suggest a “potential severe undervaluation,” and the stock is trading near the lower end of its 52-week range. This counter-intuitive situation means a company at the heart of the AI revolution is being priced as if it’s on sale.

3. The Growth Story’s Hidden Flaw: Skyrocketing Revenue, Inconsistent Profits

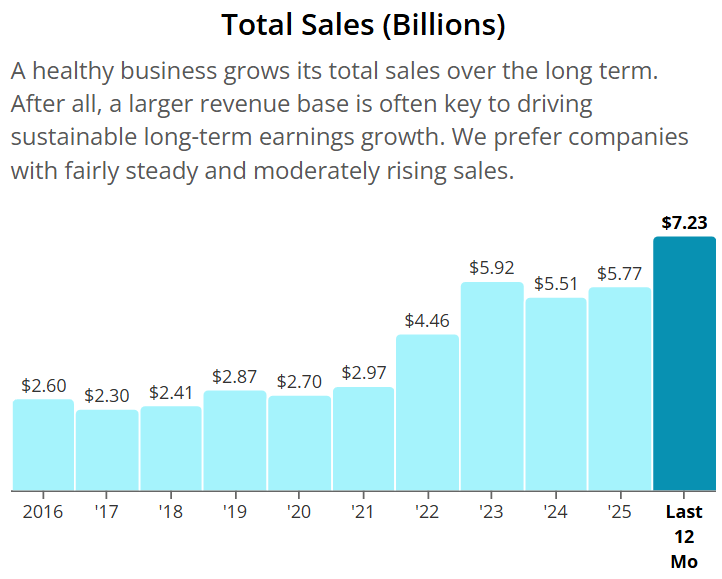

On the surface, Marvell’s growth is impressive. Over the last 10 years, its revenue has more than doubled, growing from $2.6 billion to $5.8 billion. This top-line trajectory tells a story of successful expansion.

Yet, beneath this impressive top-line growth lies a startling lack of profitability. In its most recent accounts, Marvell posted a net loss of $885 million - a figure nearly identical to its $811 million loss from a decade prior, despite having more than doubled its revenue.

This inconsistency reflects the “notoriously very cyclical” nature of the semiconductor industry and serves as a crucial risk factor for investors to consider beneath the exciting AI growth narrative.

4. The Shareholder Shift: From Years of Dilution to a $5 Billion Buyback

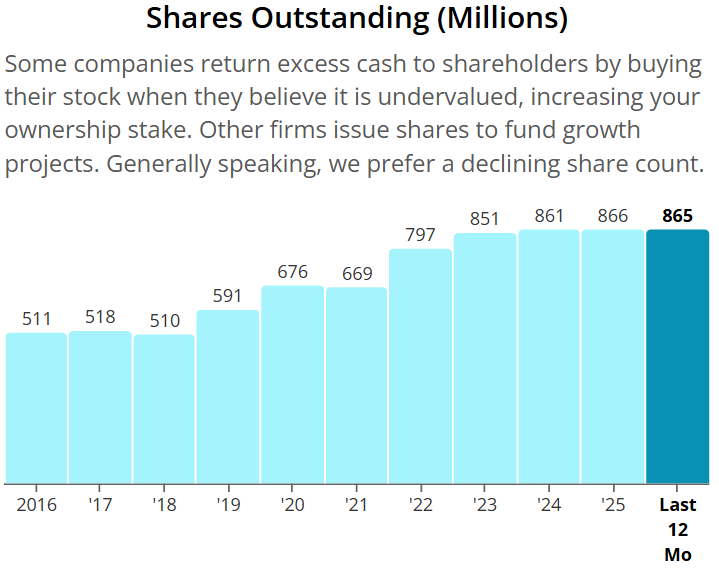

Historically, Marvell has not prioritized returning cash to shareholders through buybacks. In fact, over the last 10 years, the company has actively diluted shareholder positions by issuing more stock.

This makes their latest announcement a dramatic and significant change in strategy. The company has just initiated a new, very large $5 billion stock buyback program.

This represents a major pivot in capital allocation. It not only signals management’s belief that the stock is undervalued but also demonstrates a new commitment to delivering value directly back to shareholders.

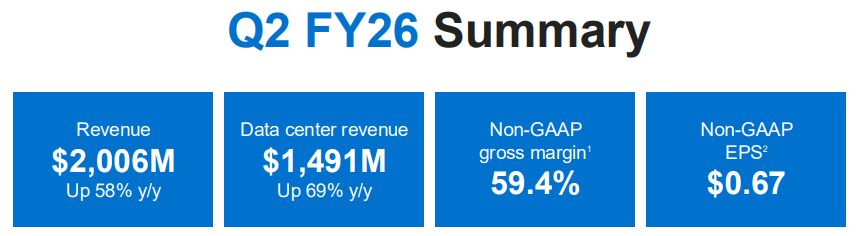

5. The Real Growth Engine: It’s All About the Data Center

While Marvell operates in several segments, one division overwhelmingly drives its growth. The data center segment is the company’s largest and most dominant portion, bringing in $1.5 billion in revenue in the latest quarter alone.

The growth in this area is staggering. Compared to the same quarter last year, data center revenue was up an incredible 69%. However, growth from the previous quarter was a more modest 3%, a crucial detail suggesting potential lumpiness in hyperscaler orders or short-term headwinds that complicate the explosive year-over-year narrative.

Still, this rate of expansion far eclipses the contributions from its other segments. This takeaway is critical for investors, as it shows precisely where Marvell’s AI story lives and breathes. The company’s future success is inextricably tied to its performance in powering the data centers that run the AI revolution.

Our Valuation

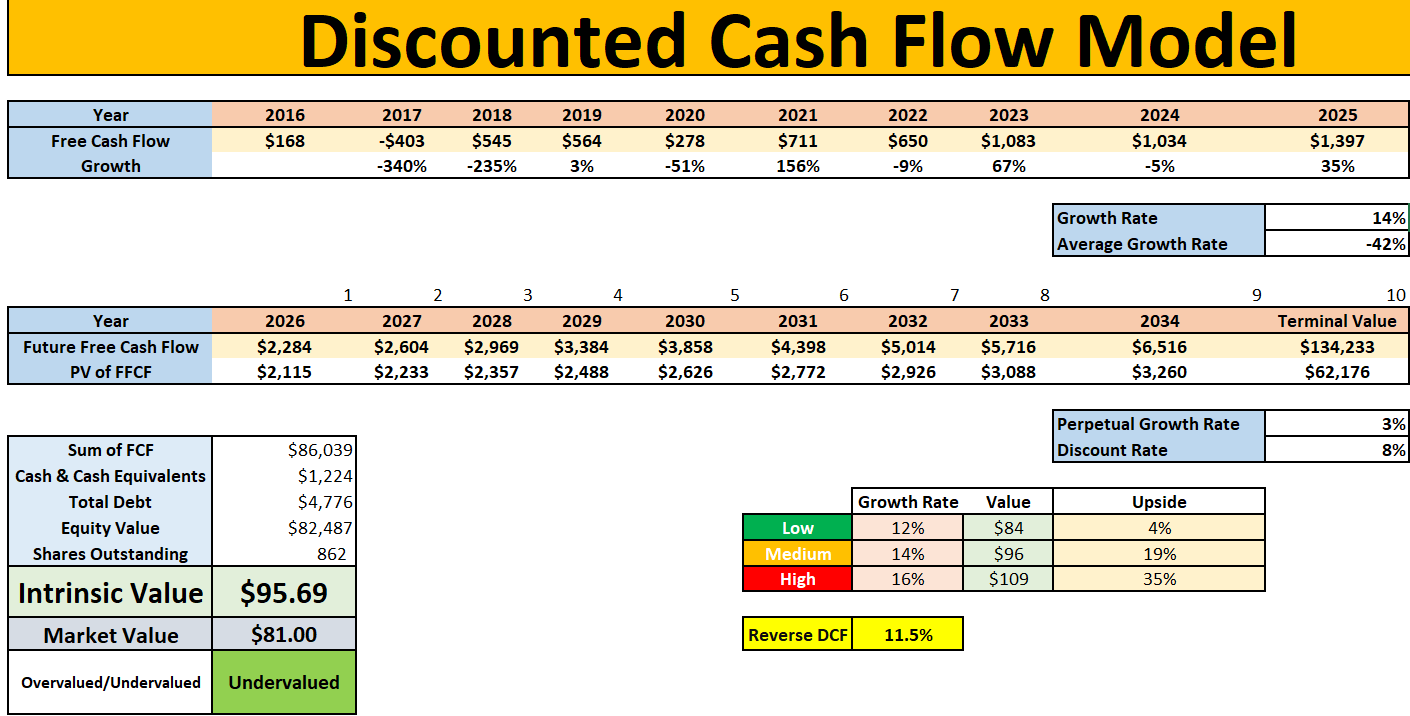

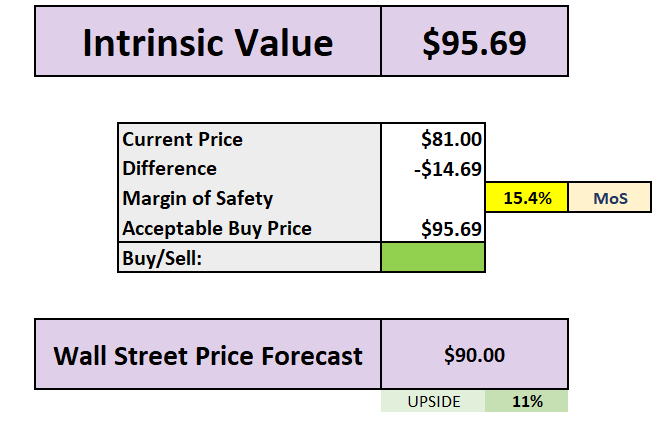

Using a DCF model we can see that baked into future growth is 11.5% to the free cash flow.

Using the middle rate of 14% growth we get a 15.4% margin of safety with Wall Street seeing this at $90 on average into 2026 (11% upside).

If you want to see this in more detail we have just released an in depth look on our YouTube channel:

Conclusion: A Calculated Bet on the Future?

Marvell Technology presents a fascinating and complex picture for investors. On one hand, the case is compelling: top executives are buying in unison, the company plays a central role in the AI build-out, and its data center business is booming. This bullish outlook is reinforced by a recent, dramatic shift in capital allocation: a new $5 billion stock buyback program, which appears to be management’s direct financial response to the stock’s potential severe undervaluation.

On the other hand, this outlook is coupled with the real risks of a notoriously cyclical industry and a history of inconsistent profitability. With top executives placing their own bets, is Marvell Technology a calculated risk worth taking for a piece of the AI future, or do the cyclical headwinds and profitability issues signal a value trap?

Stock Resources

Stock Valuation Model 📊 (Unlock my stock valuation model as seen on YouTube)

Seeking Alpha 💵 ($30 off stock research tools I use daily.)

TipRanks 📈 (40% off expert stock research tools)

YouTube 🎥 (Join 111,000+ investors on YouTube!)

Patreon 👥 (Join my community for exclusive content)

Snowball Analytic (30% off portfolio tracker)

I hope you all have a great week ahead! 🌟

Dividend Talks💰

Note:

I’m not a financial advisor. All content is for educational purposes only. Invest and trade at your own risk—I’m not responsible for any financial outcomes.