4 Undervalued Stocks Ready to Outperform in 2025

Strong earnings and easing trade tensions set the stage—here’s where smart investors should focus now.

Market Update

Markets were largely driven by two key themes last week: big tech earnings and rising trade tensions.

Earnings season has been stronger than expected, with tech and healthcare leading the way. NVIDIA reported solid numbers, showing resilience despite concerns over export restrictions to China.

On the trade front, the U.S. tariff stance was upheld in court, but legal battles may continue. Ongoing friction with China is adding another layer of uncertainty for investors.

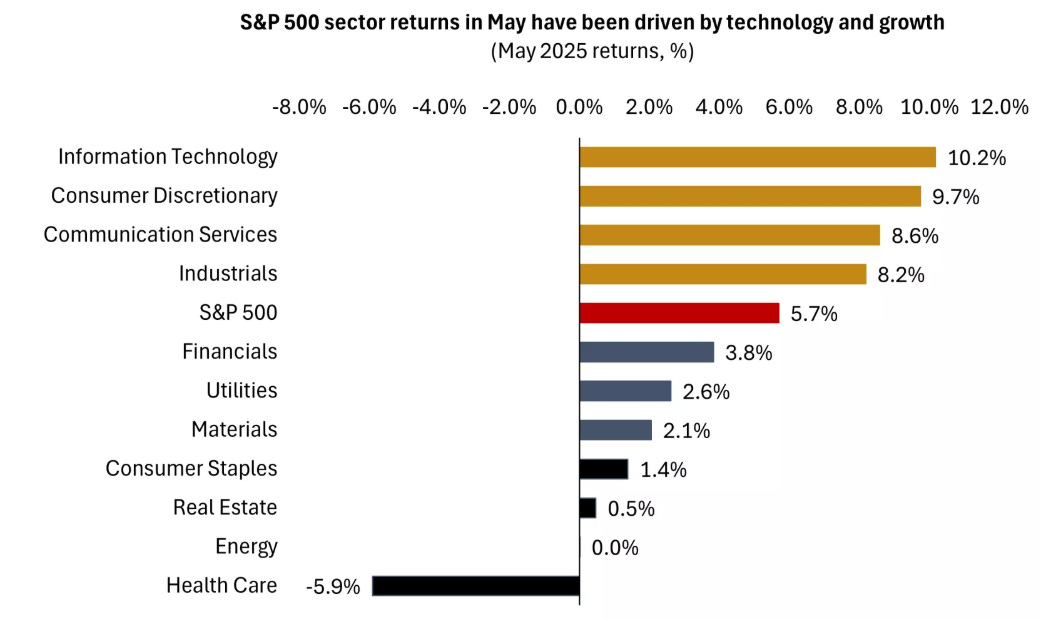

Despite the noise, the S&P 500 gained around 6% in May and has nudged into positive territory for the year.

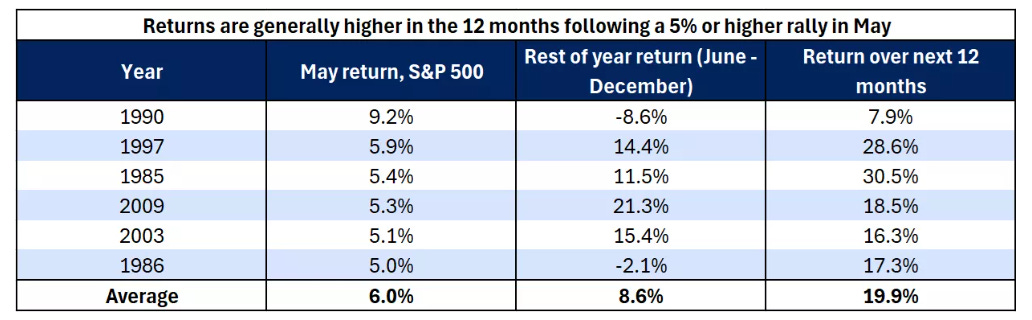

Historically, strong May returns have often been a good sign for the year ahead.

On a granular level, we had some very strong performers just last week.

Biggest winners included:

Intuit (INTU) up 13%

Palantir (PLTR) up 8%

GE Aerospace (GE) up 7%

NextEra Energy (NEE) up 6%

Broadcom (AVGO) up 5%

Notable News

Earnings Still Leading the Market

One of the biggest forces behind stock market gains is earnings growth—and so far in Q1 2025, S&P 500 companies, especially in tech, have delivered.

NVIDIA’s recent earnings were a standout. Despite ongoing trade hurdles with China, the company beat revenue and profit expectations and reported a massive 73% jump in its data center business. Demand remains strong from major players like Microsoft, Amazon, and Meta—all of whom continue to invest heavily in AI infrastructure.

In fact, just four tech giants—Microsoft, Meta, Google, and Amazon—have reaffirmed plans to spend over $330 billion combined this year, underscoring just how committed Big Tech is to AI expansion.

Earnings Growth Holding Steady

Looking ahead, S&P 500 earnings are still on pace to grow in the mid-to-high single digits for 2025.

While some estimates have been trimmed due to trade tensions and tariff uncertainty, the broader picture remains positive—analysts still expect earnings growth in 9 out of 11 sectors.

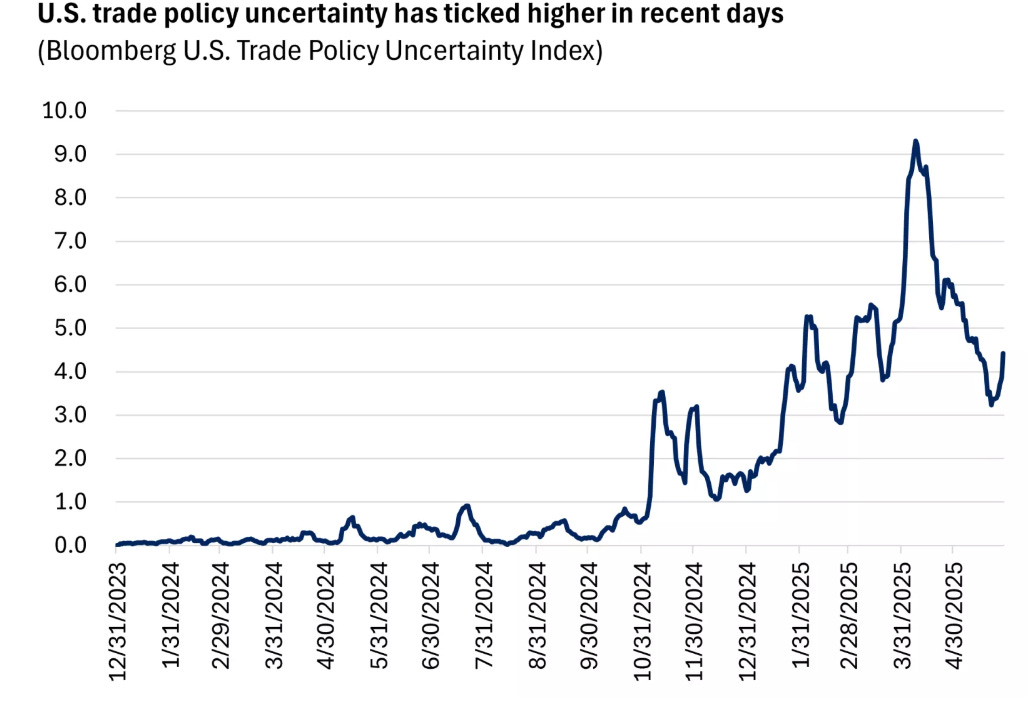

Tariff News Persists, but Investor Fatigue Grows

Last week, markets welcomed strong earnings but also navigated a fresh wave of tariff-related updates.

On trade talks, progress was mixed. The U.S. delayed 50% tariffs on European allies and other partners until July 9, offering some relief. However, negotiations with China remain stalled, with hopes that top leaders may need to intervene to move things forward. The administration also signaled plans to expand restrictions on China’s tech sector, though specifics are still scarce.

Domestically, a federal appeals court reinstated Trump-era tariffs after overturning a lower court’s ruling. These tariffs are back in effect worldwide for now, but more court hearings are set next week. The case could eventually reach the Supreme Court, and the administration might explore alternative ways to enforce its tariff policies if necessary.

No “Sell in May” This Year — Stay Invested and Diversified

The old saying goes, “Sell in May and go away,” but this year investors did the opposite. The S&P 500 gained about 6% in May, rebounding from losses earlier in the year.

Since 1980, there have been six instances where the S&P 500 rose 5% or more in May—and each time, the market went on to gain over the following 12 months. While history doesn’t always repeat, it often offers useful clues.

Morgan Stanley 30 Stocks for 2027

We’re excited to share a FREE PDF listing 30 stocks that Morgan Stanley believes are the best picks for 2027.

This carefully curated list highlights companies with strong growth potential and solid fundamentals, giving you a head start on smart investing for the years ahead.

Download your copy today and stay ahead of the market!

Earnings This week

Join 95,000+ investors on YouTube! 🎥

We dive deeper into earnings (and more) on our channel. Don't miss out - click below to watch now!👇

YouTube Channel 🔔

Click here to subscribe and stay updated!

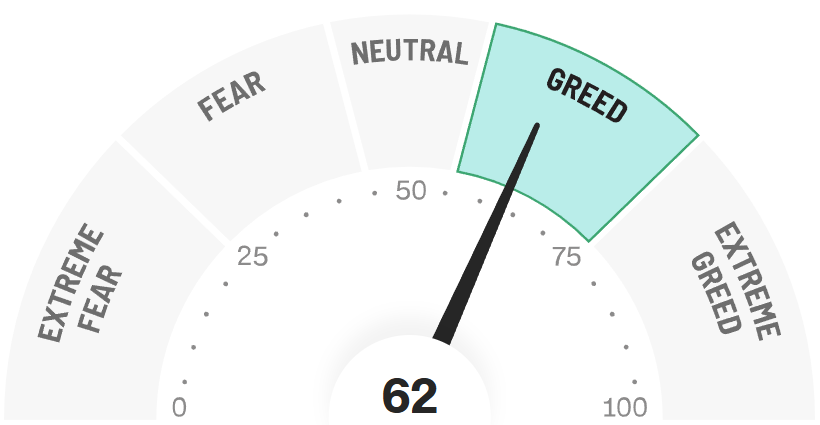

Fear & Greed Index

4 Value Stocks

Let us dive into these 4 Stocks.

I have used the following criteria to help identify these stocks:

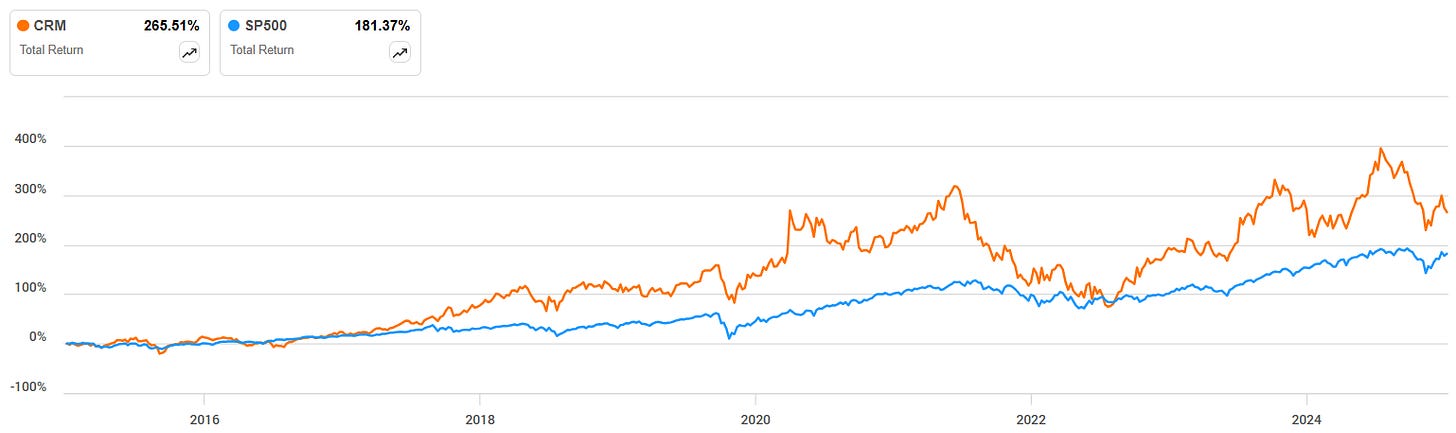

1. Outperformed S&P 500 last 10Y

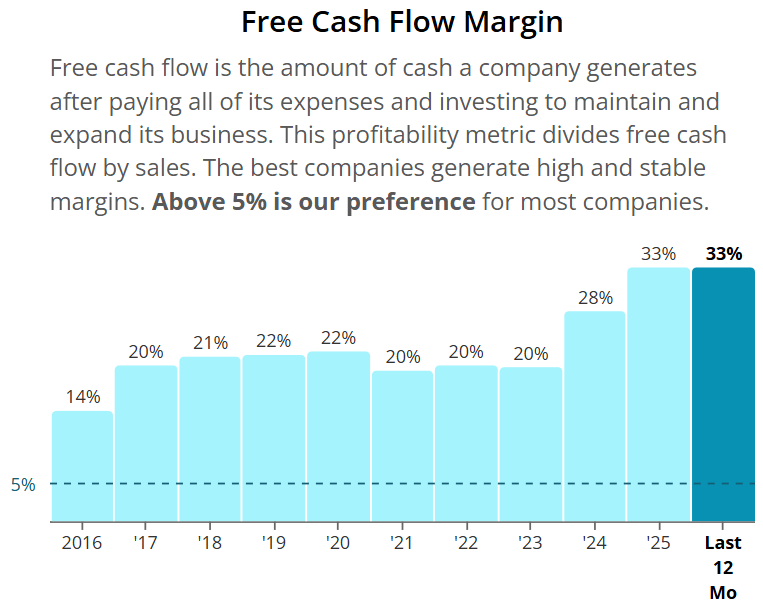

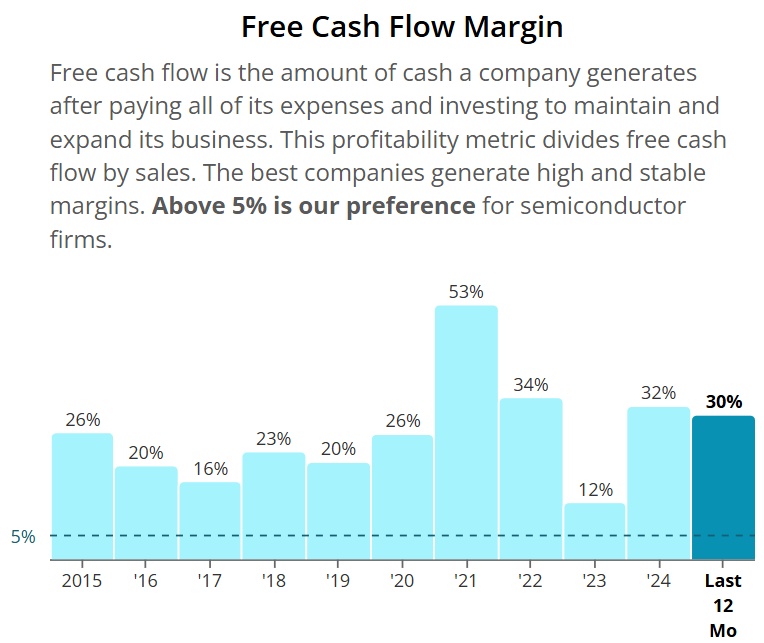

2. Free Cash Flow Margin 20%+

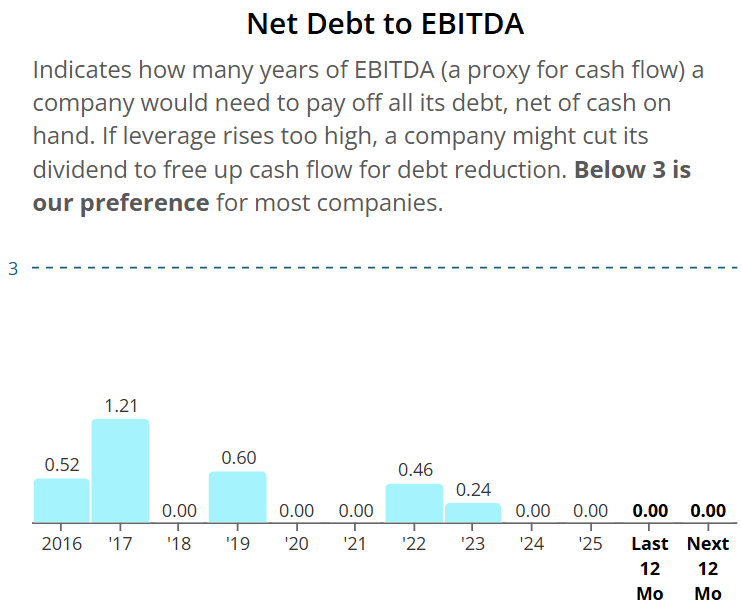

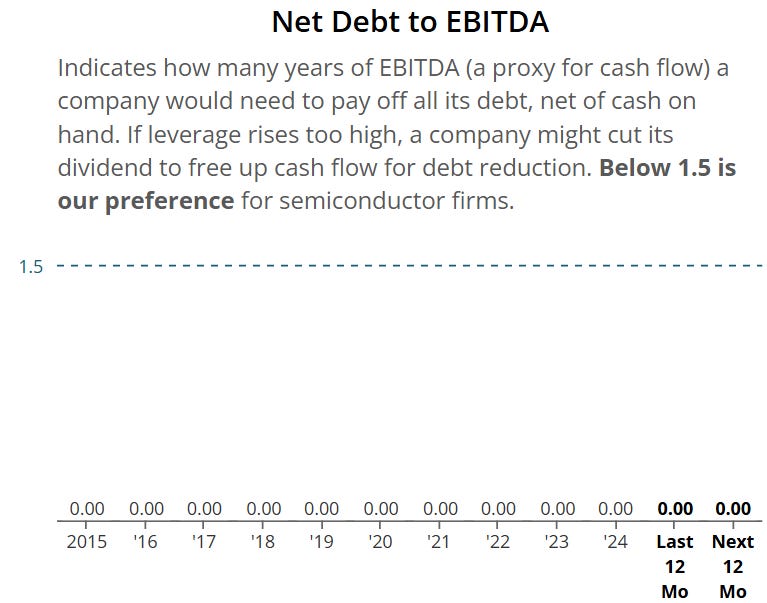

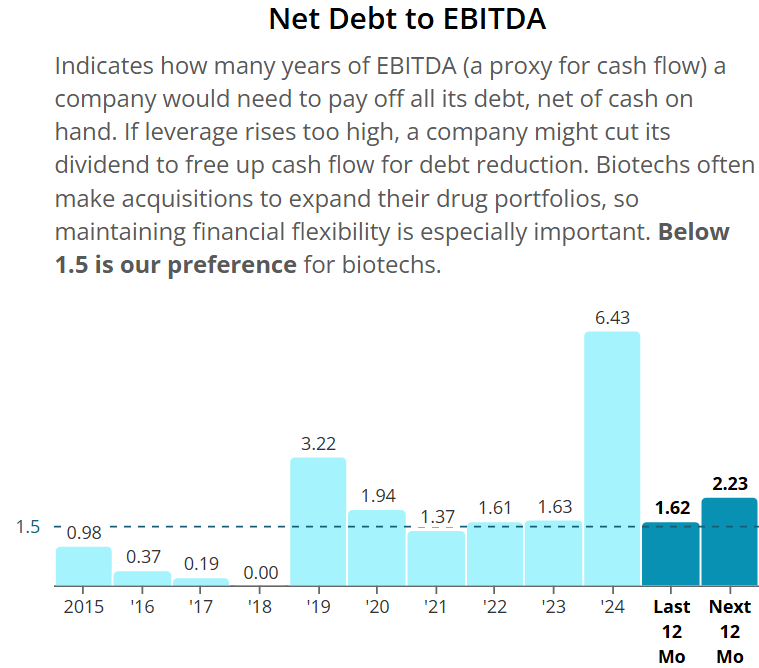

3. Net Debt to EBITDA <1.5

4. Undervaluation signal

5. Margin of Safety 20%+

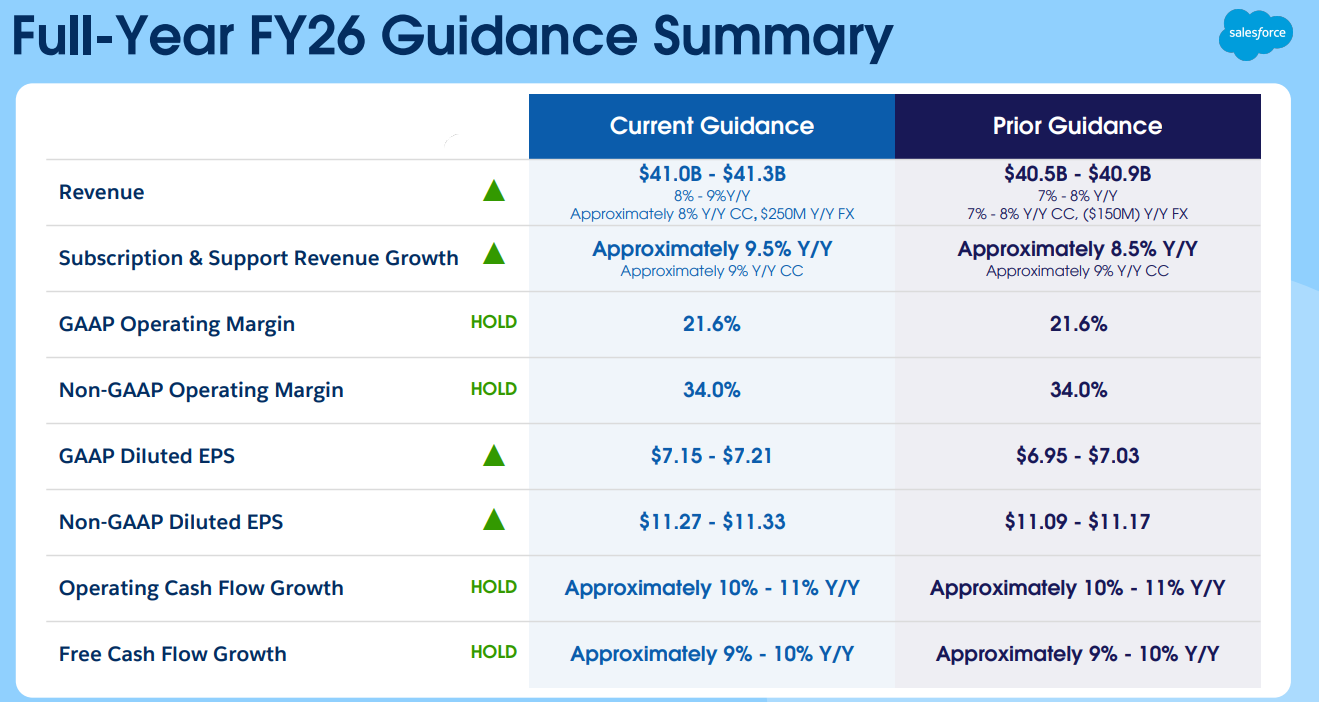

Salesforce (CRM)

Salesforce is a cloud-based software company that provides customer relationship management (CRM) tools.

It helps businesses manage sales, customer service, marketing, and analytics in one platform.

Companies use Salesforce to track customer interactions, automate tasks, and improve customer engagement.

Its platform also supports custom apps and integrations for various business needs.

Outperformed S&P 500

Free Cash Flow Margin 20%+

Net Debt to EBITDA <1.5

Undervaluation signal

Margin of Safety 20%+

CRM is offering a 30% Margin of Safety at $260.

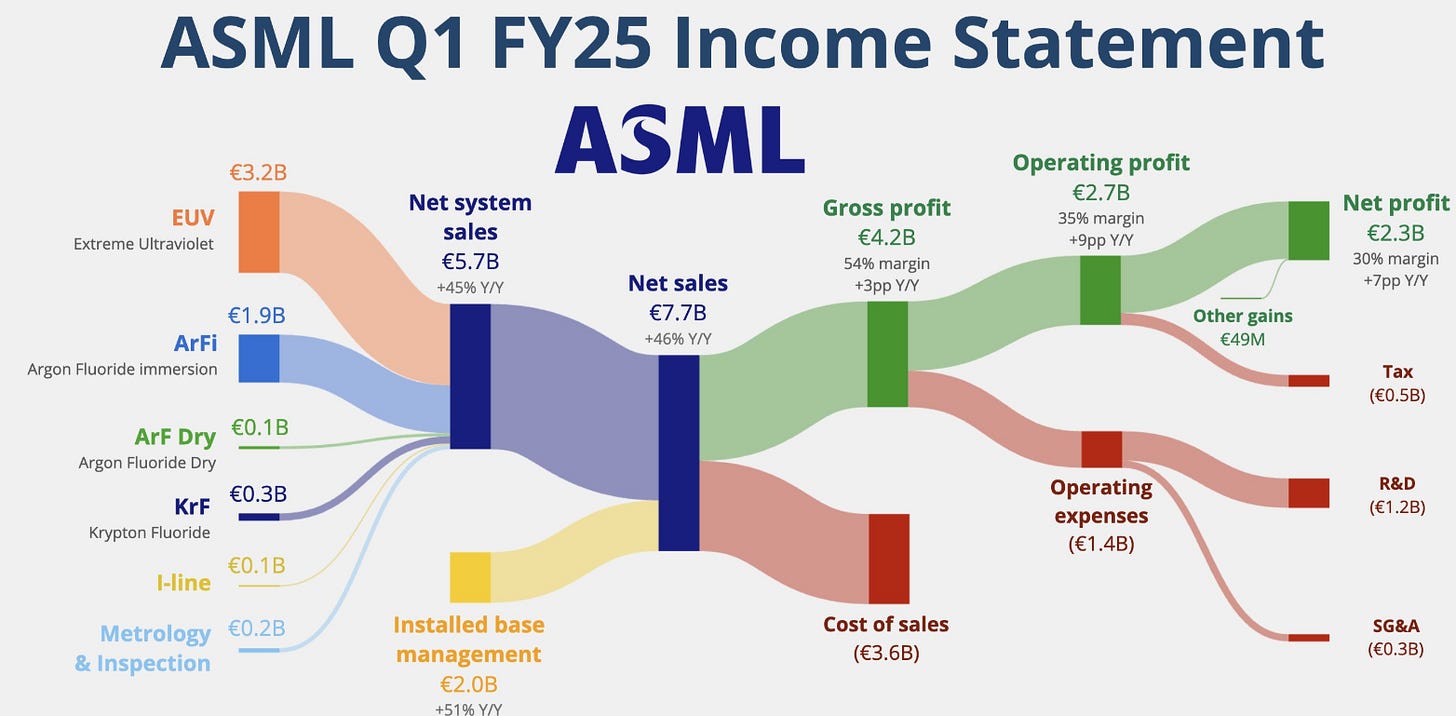

ASML (ASML)

ASML is a Dutch company that makes advanced photolithography machines used to produce computer chips.

It is the only company in the world that manufactures extreme ultraviolet (EUV) lithography systems, essential for making cutting-edge semiconductors.

ASML’s technology enables chipmakers like TSMC, Intel, and Samsung to create smaller, faster, and more efficient chips.

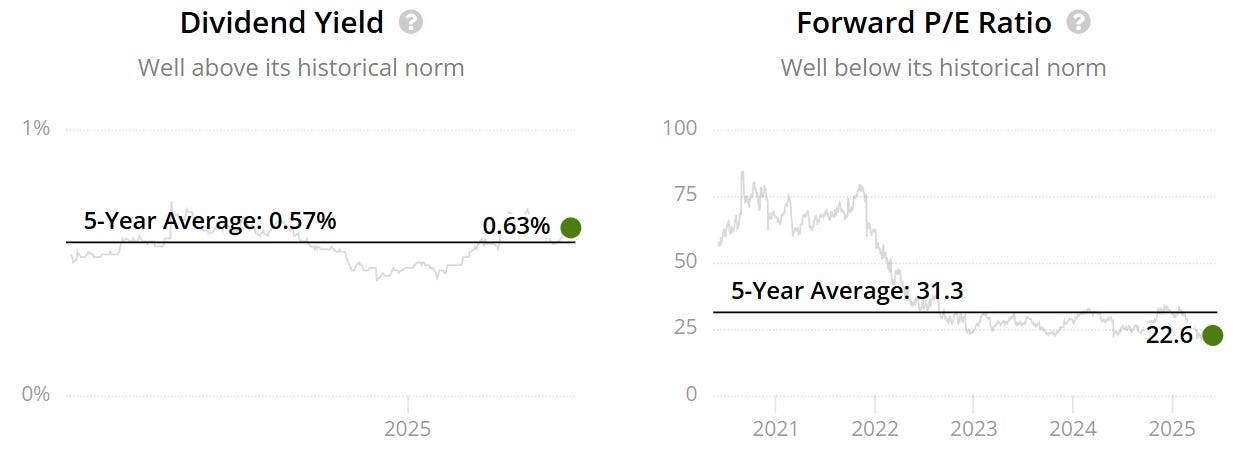

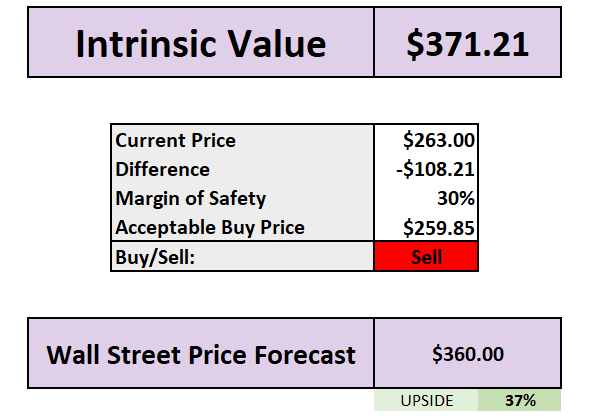

Outperformed S&P 500

Free Cash Flow Margin 20%+

Net Debt to EBITDA <1.5

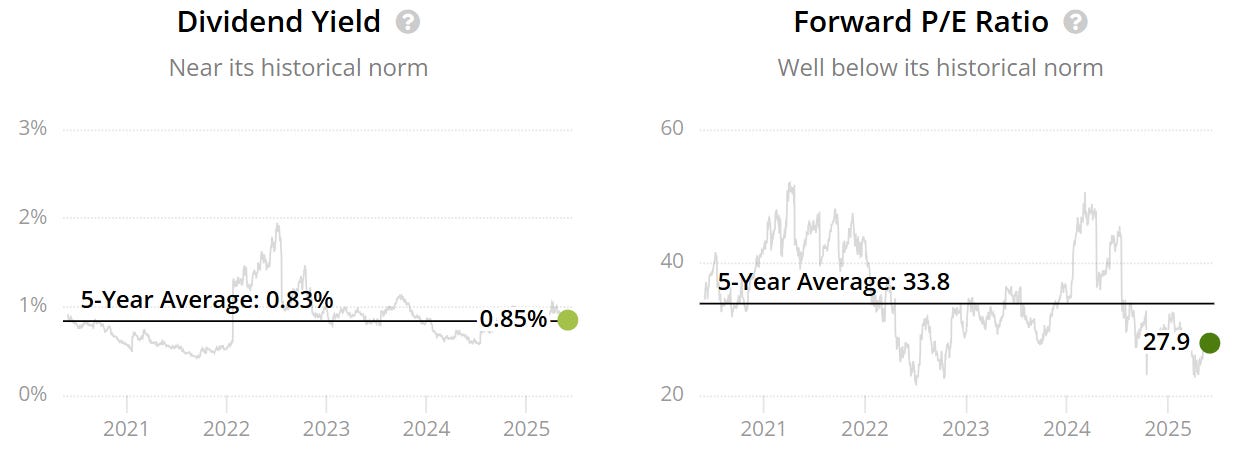

Undervaluation signal

Margin of Safety 20%+

ASML is offering a 30% Margin of Safety at $738.

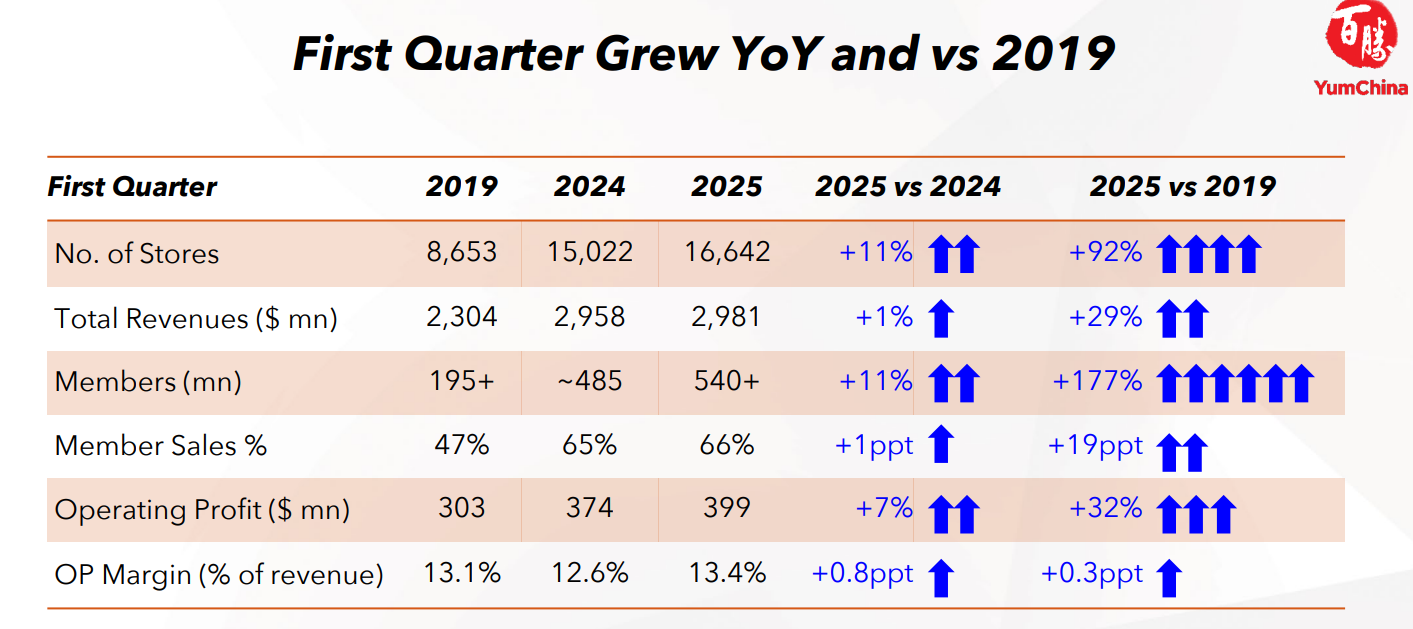

Yum China Holdings (YUMC)

Yum China Holdings is the largest restaurant company in China, operating and franchising over 16,000 restaurants across more than 2,300 cities.

Its portfolio includes well-known brands like KFC, Pizza Hut, Taco Bell, Little Sheep, East Dawning, COFFii & JOY, Lavazza, and Huang Ji Huang .

The company was spun off from Yum! Brands in 2016 and is headquartered in Shanghai.

Yum China focuses on digital innovation, delivery services, and expanding its footprint in China's fast-growing foodservice market.

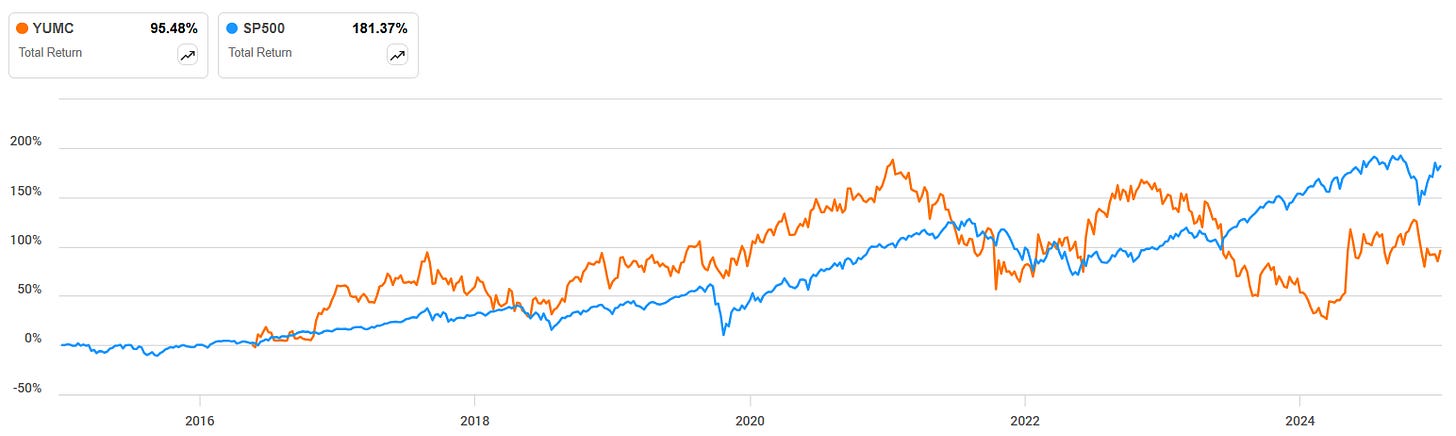

Outperformed S&P 500 (Doesn’t quite match this criteria, although there were times over the last 10Y where it was)

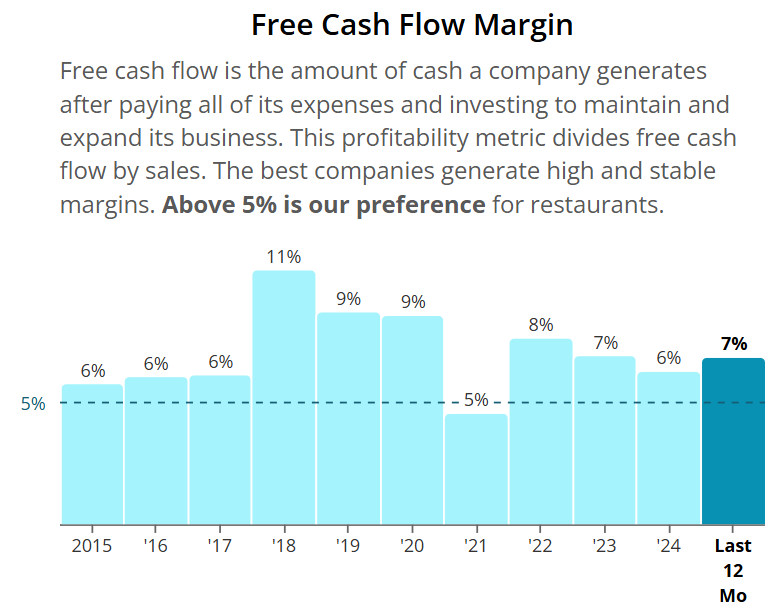

Free Cash Flow Margin 20%+ (not quite 20% but above the minimum expected for the industry)

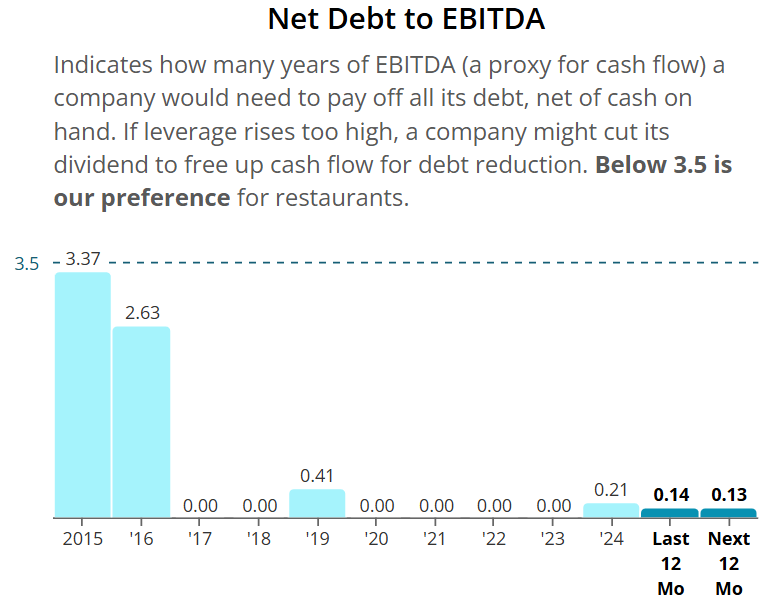

Net Debt to EBITDA <1.5

Undervaluation signal

Margin of Safety 20%+

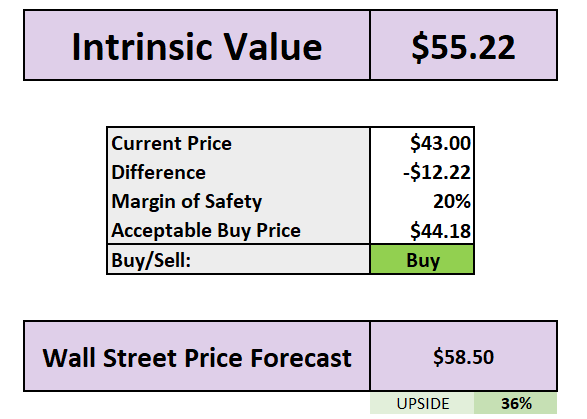

YUMC is offering a 20% Margin of Safety at $44.

Bristol-Myers Squibb (BMY)

Bristol Myers Squibb is a global biopharmaceutical company headquartered in Princeton, New Jersey, dedicated to discovering, developing, and delivering innovative medicines that help patients prevail over serious diseases.

Its core therapeutic areas include oncology, immunology, cardiovascular disease, and neuroscience, with notable products like Opdivo (cancer immunotherapy), Eliquis (blood thinner), and Cobenfy (schizophrenia treatment) .

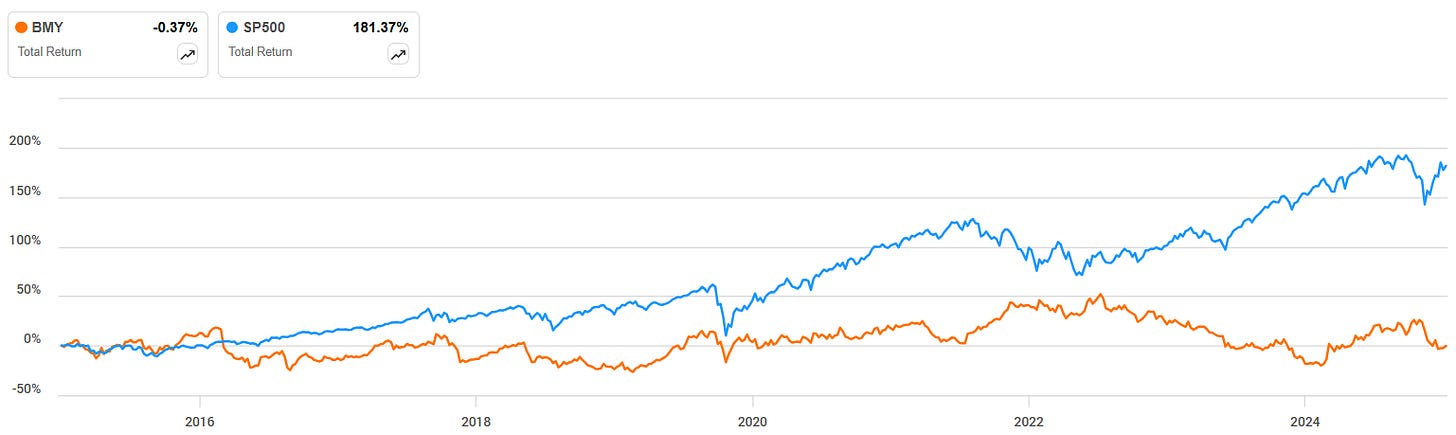

Outperformed S&P 500 (Has not met this criteria)

Free Cash Flow Margin 20%

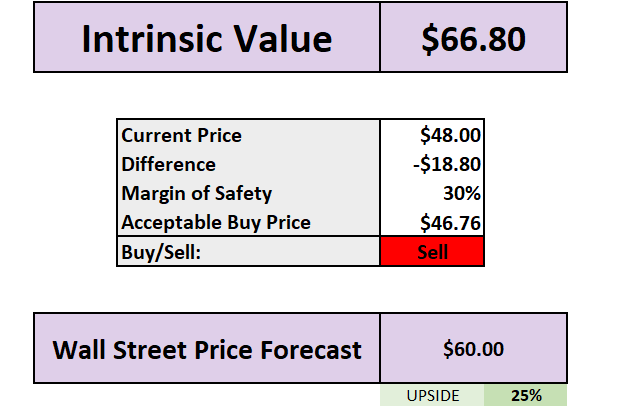

Net Debt to EBITDA <1.5 (1.62 on a trailing twelve-month basis)

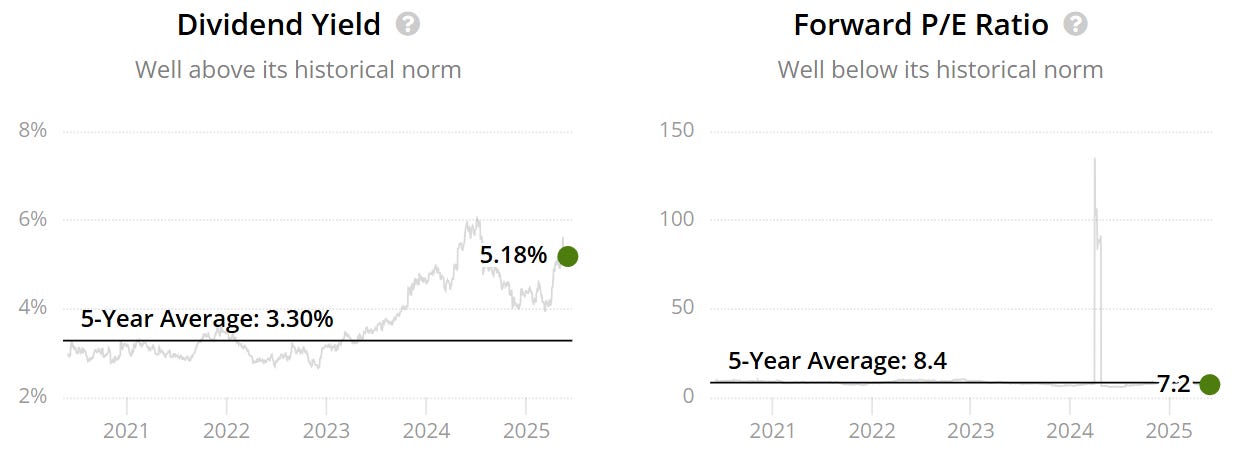

Undervaluation signal

Margin of Safety 20%+

BMY is offering a 30% Margin of Safety at $47.

Stock Resources

Stock Valuation Model 📊 (Unlock my stock valuation model as seen on YouTube)

Seeking Alpha 💵 ($30 off stock research tools I use daily.)

TipRanks 📈 (50% off expert stock research tools)

YouTube 🎥 (Join 94,000+ investors on YouTube!)

Patreon 👥 (Join my community for exclusive content)

Snowball Analytic (30% off portfolio tracker)

Thanks For Reading!

☕ Buy Me A Coffee – Your support helps cover the costs of running the newsletter.

📬 Join the community – Subscribe now to get weekly investment insights delivered straight to your inbox.

💬 Found this helpful? Share it with friends and colleagues! Your support keeps this newsletter FREE.

I hope you all have a great week ahead! 🌟

Dividend Talks💰

Note:

I’m not a financial advisor. All content is for educational purposes only. Invest and trade at your own risk—I'm not responsible for any financial outcomes.