5 Cheap Dividend Aristocrats!

+ Market Update

Market Latest

What a week we’ve had in the stock market! After a turbulent day with rotation from tech and semiconductors on Thursday, notably Nvidia down 6%, they all seemed to have recovered sharply on Friday, ending the week with the S&P 500 up 0.72%.

As we can see from the S&P 500 heat map below, there was a lot of green across the board with the only real losers being the majority of the magnificent 7 (although you could argue they have performed very well year to date and are due a pullback).

We also had PepsiCo (PEP) report their earnings last week, and if you want a deep dive into this you can check out our YouTube episode where we analysed both the stock and the earnings result:

Looking ahead this week, earnings continue with some very big names:

As always we will cover this on our YouTube channel, and for those that aren’t subscribed, we would love to have you in our growing 46k community:

Notable News

Inflation:

Inflation is down 0.1% from May which is very bullish for those that want to see interest rate cuts.

To put this in perspective, the 12-month rate is now at 3% which is the lowest level we have seen in over 3 years.

The Federal Open Market Committee (FOMC) in an ideal world want to see inflation of 2% over the longer run as they believe this number will achieve maximum employment and price stability.

The remaining FOMC meetings for 2024 are:

31st July, 18th Sept, 7th Nov and 18th Dec.

The expectation is now that the first rate cut will take place in September. The Fed-funds futures now see this as an 88.8% chance of taking place.

The Fed-fund futures is a direct reflection of collective marketplace insight regarding the future course of the Federal Reserve's monetary policy.

As per above, we can see that inflation is coming down towards that 2% the Fed wants to see.

REITs:

Following on from the above news, it was no surprise that this led to a massive rally for stocks in the Real Estate industry.

Remember the below, after the Fed has finished hiking rates, REITs have historically outperformed.

The heat map below shows just how strong REITs performed with some standout gains from ARE +7.89%, CCI +7.79% and AMT +7.65%.

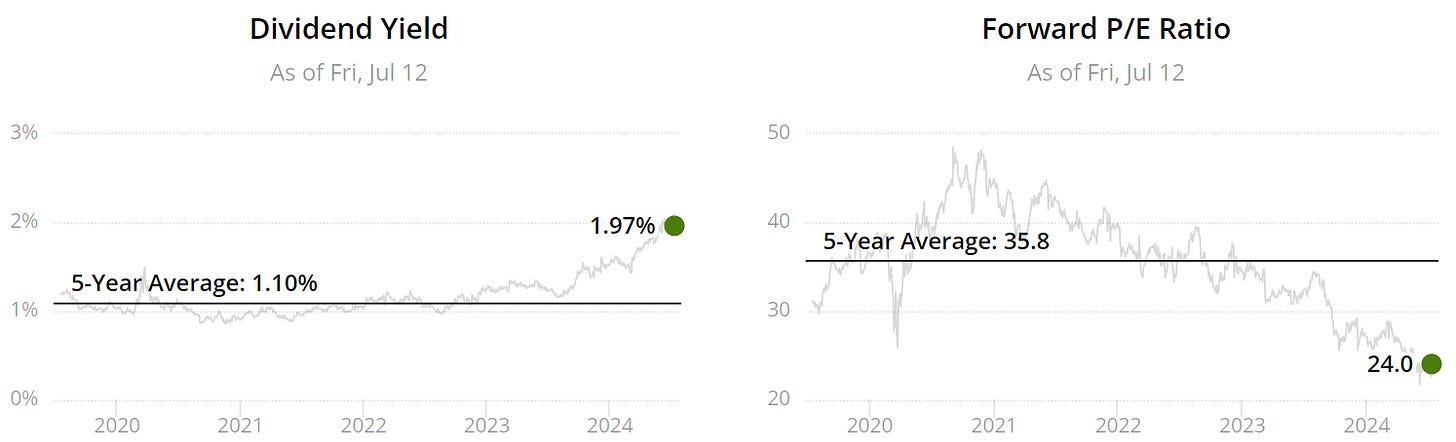

Nvidia:

An interesting week with both an increase to the price target by one Wall Street analyst, and on the other hand a downgrade by another.

Dividend Aristocrat

Before we talk about Dividend Aristocrats, for those that are unfamiliar with this title, it is given to Companies who have consecutively increased their dividend for at least 25 years.

ETF

Now before we look at individual aristocrats, it is important to understand that some investors would rather have exposure through an ETF.

This has been made possible with this ETF, NOBL.

It focuses exclusively on the S&P 500 Dividend Aristocrats—high-quality companies that have not just paid dividends but grown them for at least 25 consecutive years, with most doing so for 40 years or more

The top 10 holdings consist of the below:

Please note this has an expense ratio of 0.35% and the total return performance over the last 10 years is +163%.

5 Undervalued Dividend Aristocrats

Now let us dive into those that we believe to be Undervalued Dividend Aristocrats.

To select those that we believe to be undervalued and worth a deep dive we have used the following criteria:

P/E below or equal to 25

Dividend Safety to be a minimum safe level (60+)

Upside 15%+

Medtronic (MDT)

Medtronic develops and manufactures medical devices and technologies to improve patient health, including cardiac devices, insulin pumps, and surgical instruments.

P/E = 14.3x

Dividend Safety = 99 (highest score obtainable)

Wall Street Upside = 18%

Undervalued per dividend yield theory too, as both yield is higher than 5Y average and forward p/e is lower than the 5Y rolling.

Balance sheet also looks good as Net Debt to EBITDA is below 3, currently 1.90.

Years of increasing the dividend also looks great at 46 years, in fact they are 4 years away from becoming a Dividend King.

McDonald’s (MCD)

McDonald's operates a global chain of fast-food restaurants, serving burgers, fries, and other quick-service meals.

P/E = 20.6x

Dividend Safety = 77

Wall Street Upside = 21%

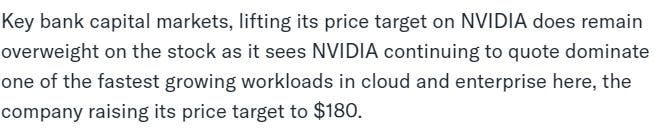

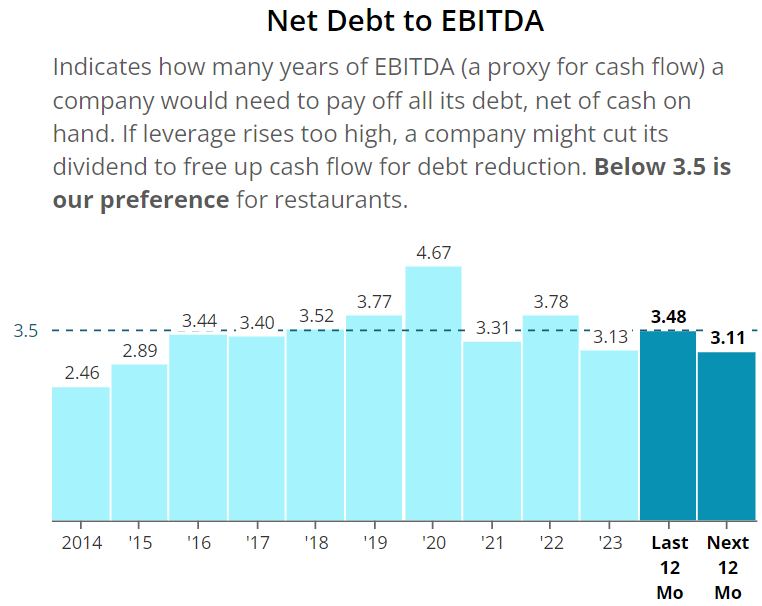

Undervalued per dividend yield theory too, as both yield is higher than 5Y average and forward p/e is lower than the 5Y rolling.

Net Debt to EBITDA sits around 3.13 which is not far off the maximum we want to see of 3.5 for the restaurant industry, so something to consider with this Company.

Years of increasing the dividend looks fantastic at 47 years, in fact they are 3 years away from becoming a Dividend King.

Last week I added more of this stock to my portfolio, feel free to check out the deep dive below:

Chevron (CVX)

Chevron Corporation is an integrated energy company that explores, produces, and refines oil and natural gas, and manufactures chemicals.

P/E = 11.8x

Dividend Safety = 90

Wall Street Upside = 18%

Reasonably valued per dividend yield theory, with both yield and forward p/e not too dissimilar from the 5Y averages.

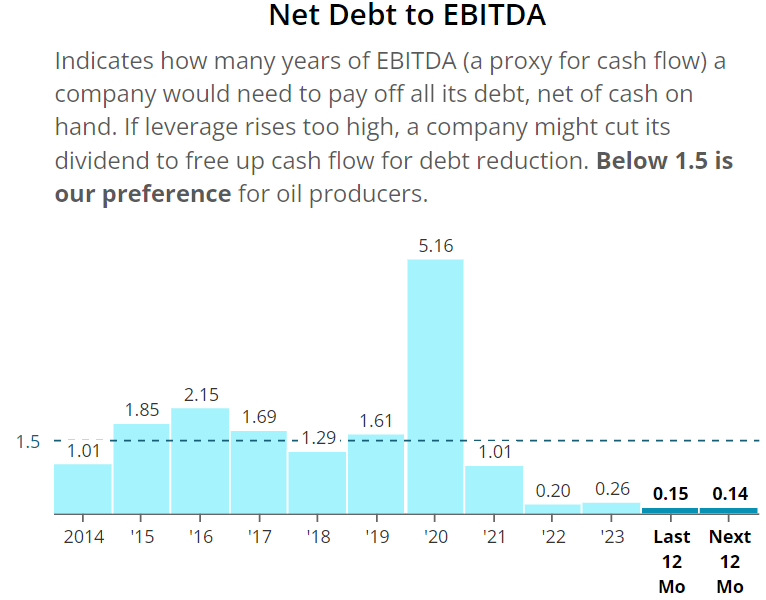

Net Debt to EBITDA looking very good at 0.4. So no surprises why this has a good dividend safety score and also goes to show it has an excellent balance sheet.

36 years of increasing their dividend, however the standout metric is that they have been paying a dividend for the last 112 years without a reduction!

Brown-Forman (BF.B)

Brown-Forman Corporation produces and markets a variety of alcoholic beverages, including well-known brands like Jack Daniel's and Woodford Reserve.

P/E = 24x

Dividend Safety = 99 (highest score)

Wall Street Upside = 15%

Undervalued per dividend yield theory too, as both yield is higher than 5Y average and forward p/e is lower than the 5Y rolling.

Net Debt to EBITDA looking very good, well below the 4 maximum currently sitting at 1.85.

Exxon Mobil (XOM)

Exxon Mobil Corporation is an energy company that explores, produces, refines, and sells oil, natural gas, and petrochemicals globally.

Bear in mind, this industry is cyclical and you ideally want to be buying when they are out of favour.

P/E = 12.7x

Dividend Safety = 80

Wall Street Upside = 20%

Overvalued per dividend yield theory, whilst we note the forward p/e is not too dissimilar from the 5Y rolling average.

Excellent balance sheet as shown above with a Net Debt to EBITDA sitting at 0.26.

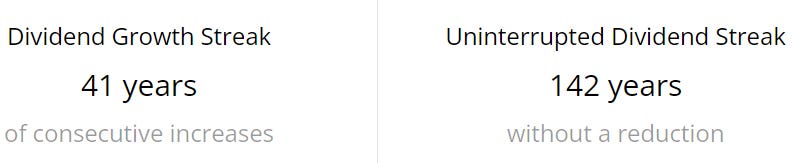

142 years of paying a dividend without a reduction!

Latest YouTube Videos!

Some of the videos we have covered below on the YouTube channel:

8 Dividend Stocks At 52 Week Lows:

5 Best Undervalued Growth Stocks:

4 Stocks Insiders Keep Buying:

Stock Valuation Model

If you are interested in valuing stocks yourself, we have created a valuation model below which you can pick up, this is the same version we use in our YouTube analysis:

Seeking Alpha

Seeking Alpha, one of the websites that I use when I review stocks on YouTube has a $25 off discount for your first year. This also includes a 7-day free trial for new users too!

Conclusion

We have just gone through 5 Undervalued Dividend Aristocrats.

However as always do your own due diligence and let us know your thoughts about today’s newsletter in the comments.

I hope you all have a great week ahead!

Thanks For Reading!

If you’d like to support this work feel free to buy me a coffee. The proceeds will contribute to the running costs of the newsletter.

Join the community of investors - subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today’s newsletter helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Note

I am not a financial advisor or licensed professional. Nothing I say or produce anywhere, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk.