5 Undervalued Growth Stocks!

Time To Buy The Dip?

Market Latest

The S&P 500 had it’s worst week since April, and as we can see below it ended the week down 2.34%.

The Magnificent 7 were are all down, with Nvidia leading the drawdown by 8.75%.

There are several reasons that can be pointed to as to why we saw this take place:

On Wednesday we had reports from both Biden’s administration and Trump talking up tighter export restrictions from the US which ramped up geopolitical tensions. (Just to highlight, ASML sources 49% of it’s sales from China). This affected the majority of semiconductor stocks which were all down following this news.

We are seeing rotation coming out of stocks that have performed incredibly well into those that have been previously unloved, especially now with the high chance of several rate cuts in 2024 - meaning investors will likely flock to higher yielding stocks.

On Friday we saw a global outage due to a CrowdStrike update affecting one of their key products.

Earnings This Week

Looking ahead this week, earnings continue with some very big names:

As always we will cover this on our YouTube channel, and for those that aren’t subscribed, we would love to have you in our growing 47k community:

Notable News

On Friday, Activist Elliott has reportedly taken a significant stake in Starbucks and is in talks with management to find ways to improve the performance, of which has been a struggle lately.

Off the back of that news, Starbucks was up 7%, and we now see it trading at around $79.

Undervalued Growth Stocks

Now let us dive into some Undervalued Growth Stocks:

Zoetis (ZTS)

Zoetis develops, manufactures, and markets animal health medicines, vaccines, and diagnostic products.

As you can see above, over the last 10Y this company’s share price has increased by 446%, significantly outperforming the S&P 500.

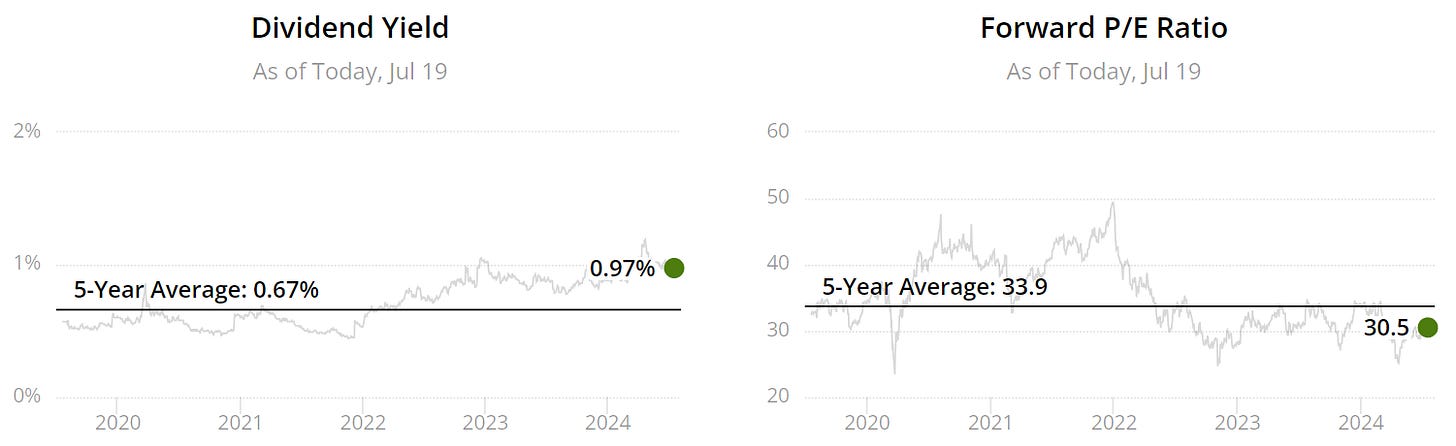

Undervalued per Dividend Yield Theory (DYT), as we can see the current yield is higher than the 5Y average.

We can also note that the Forward P/E of 30.5 is lower than the 5Y average (another undervaluation signal).

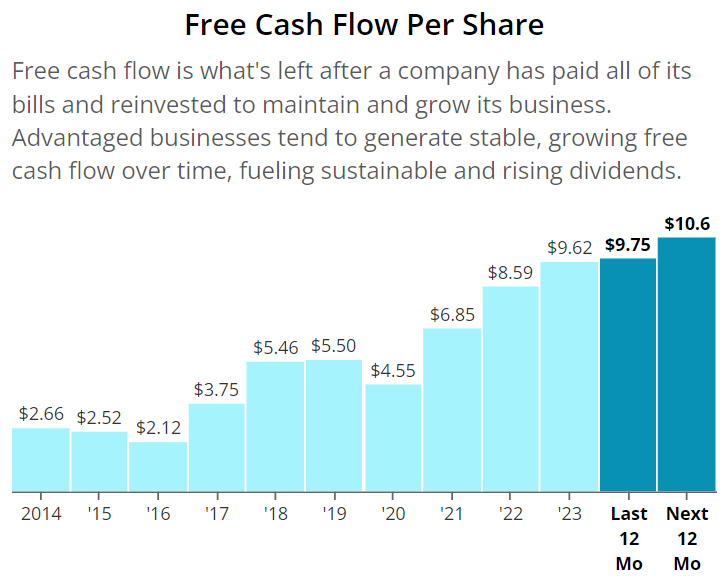

Free cash flows also look good, we want to see consistent increases over time, and we can see over the last 10Y it has increased 4x and expected to continue that trend over the next 12 months.

ROIC is also consistently very strong in the mid 20’s, with our absolute minimum target being 10%.

Remember we use 10% as a baseline to give us confidence that management are able to effectively allocate their capital.

Both operating and free cash flow margins also look very healthy, increasing trend and above the minimums that we want to see for most companies.

Finally, Net Debt to EBITDA for 2023 is 1.27 which is good to see, we also note it is downwards trending and that is expected to continue over the next 12 months.

Remember this correlates to both dividend safety and balance sheet strength.

Happy to report that their dividend’s have been increasing by double digits over the last 10 years as well as in the more recent period too.

Wall Street Target Upside = 20%

ASML Holding (ASML)

ASML designs and manufactures advanced lithography equipment used in the production of semiconductor chips.

Over the last 10Y this company has significantly outperformed the S&P 500, up 988%.

As we mentioned above they did have a pullback last week, in fact they were down 18% just in the last 5 days, so it is back on our radar.

Undervalued per DYT (current yield is higher than the 5Y average).

We also note that the Forward P/E of 32.6 is marginally lower than the 5Y average (another undervaluation signal).

As we can see above, whilst the free cash flow has increased over the 10Y period, it is fairly inconsistent, but then you could argue the semiconductor industry as a whole is cyclical and inconsistency is attached to that.

Very strong ROIC metrics, especially over the last few years in the high 40’s.

Very strong margins too, although we can see more inconsistency within the free cash flow margin, nonetheless it is still above the 5% minimum we target for this sector.

This metric gets a gold star! 0 right across the board, phenomenal balance sheet, and wouldn’t even take them 1 day to pay off all of their debt, net of cash on hand.

Disappointing dividend increase this year of 4.8%, pretty much in line with the historical inflation rate, but over the last 5 and 10 years they have increased it very rapidly.

Wall Street Target Upside = 31%

Broadcom (AVGO)

Broadcom designs, develops, and supplies a wide range of semiconductor and infrastructure software solutions.

Incredible 10Y performance of 2,196%, and just this week it had a 10:1 stock split, as well as recent news of Nancy Pelosi adding a few million shares into her portfolio.

Similar to ASML, on the back of the news this week it is down 8.5%.

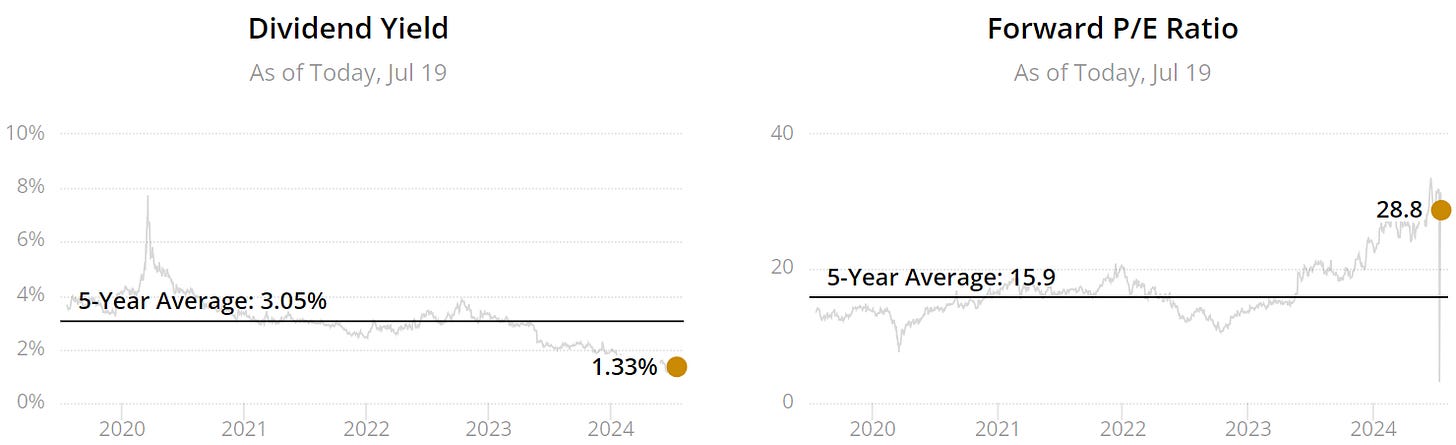

Unlike the previous 2 stocks we get a double overvaluation signal with the yield being lower than the 5Y average and the Forward P/E being higher than the 5Y average.

Absolutely gorgeous free cash flows, they are consistently growing year on year and expected to increase rapidly over the next 12 months.

Sometimes it is worth reminding ourselves that consistency in a Company brings along with it a premium to the valuation.

ROIC is inconsistent across the board, however since the lows of 2020 they have been increasing, and what we would like to see here is that this trend continues into 2024-25.

Margins are fantastic! Operating efficiency as it has been climbing up since 2014’s 21% to 2023’s 46%.

And this is truly a Free Cash Flow MACHINE - 50%+ over the last 4 years is not something we often see in our reviews.

Below 1.5 on this metric for semiconductors and whilst we see that in 2023 at 1.10, it is expected to climb higher in 2024 to around 1.85.

Not a red flag indicator but maybe something to just keep an eye on.

Not many Companies have a better track record than Broadcom in their dividend growth.

Every year (on average) over the last 10Y they have increased the dividend by a whopping 36%!

Wall Street Target Upside = 25%

Visa (V)

Visa facilitates secure and efficient electronic payments worldwide, primarily through its credit, debit, and prepaid card network.

Strong 10Y performance from Visa, up 401%, and like the previous 3 stocks it has outperformed the S&P 500.

We note a double undervaluation signal as per above.

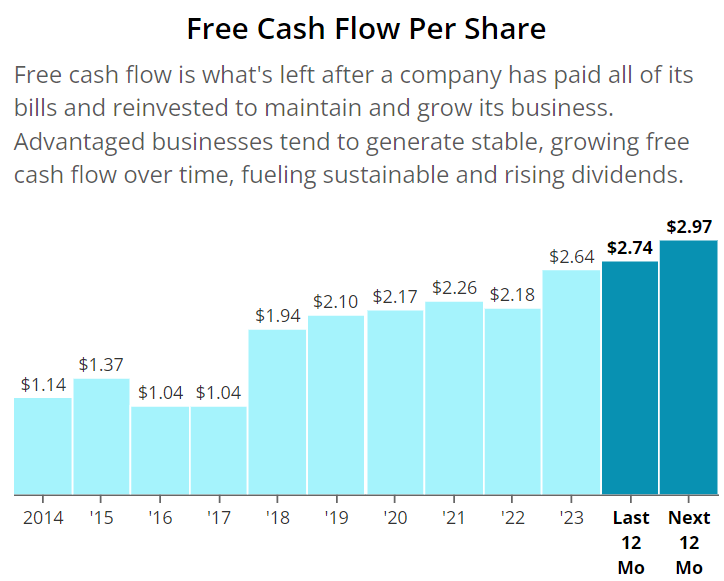

Free cash flow has ticked off everything we look for in stocks, as discussed on the previous 4 above.

ROIC, not only consistently higher than our 10% minimum, but also increasing and 34% in 2023 is very good.

This will likely be one of the best margins you will come across when analysing stocks, 67% operating margin and 61% free cash flow margin is phenomenal.

Strong balance sheet and therefore very safe dividend, which is no surprise given we can see below that they consistently increase it double digits year on year!

Wall Street Target Upside = 19%

MDLZ

Mondelez International manufactures and markets snack foods and beverages, including brands like Oreo, Cadbury, and Nabisco, across the globe.

Whilst the 10Y performance has been below the S&P 500 some of this relates to the fact that rising cocoa prices over the last few years has affected their sales and margins.

From the above, we can see that this has ultimately peaked in April this year and looks to be on it’s way down which should help Companies like Mondelez (Hershey is another Company in a similar situation).

Double undervaluation signal as above.

Free cash flow has more than doubled over the last 10Y and the upward trend is anticipated to continue over the next 12 months.

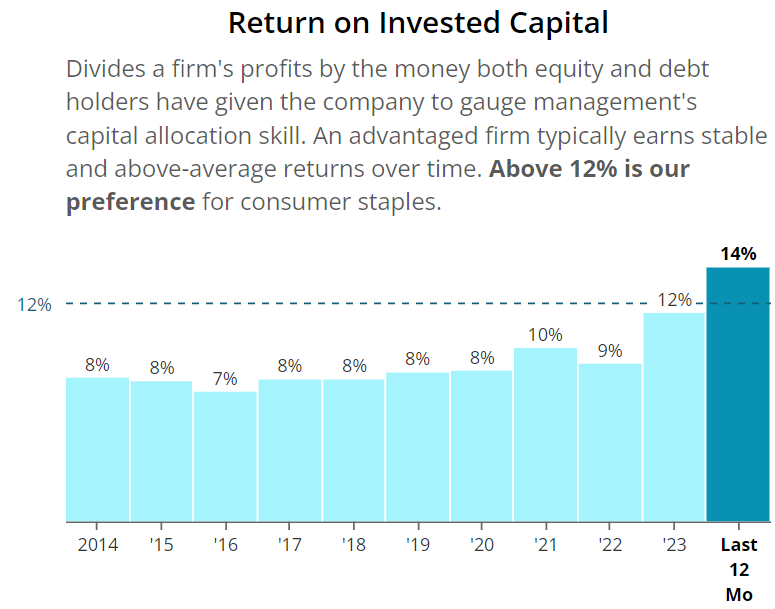

ROIC has struggled to maintain that 10% consistency that we like, but it is positive to note that in 2023 this was 12%.

Margins look very good, with operating efficiency noted and well as consistent free cash flow margins above 7% over the last 6 years.

Extremely positive to see the Net Debt to EBITDA come down from the highs of 2014 at 3.61 to 2023’s 2.33, and on top of that it is expected to drop down to 2.12 over the next 12 months.

Dividend growth also looks very good over the last 5Y, and over the last 20Y they have grown the dividend slightly higher than the 4% average inflation rate.

Wall Street Target Upside = 21%

Latest YouTube Videos!

Some of the videos we have covered below on the YouTube channel:

Perfect Time To Buy These Beaten Down Stocks?

Why Is Nvidia Crashing?

Stock Valuation Model

If you are interested in valuing stocks yourself, we have created a valuation model below which you can pick up, this is the same version we use in our YouTube analysis:

Seeking Alpha

Seeking Alpha, one of the websites that I use when I review stocks on YouTube has a $25 off discount for your first year. This also includes a 7-day free trial for new users too!

Conclusion

We have just gone through 5 Undervalued Dividend Growth Stocks.

However as always do your own due diligence and let us know your thoughts about today’s newsletter in the comments.

I hope you all have a great week ahead!

Thanks For Reading!

If you’d like to support this work feel free to buy me a coffee. The proceeds will contribute to the running costs of the newsletter.

Join the community of investors - subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today’s newsletter helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Note

I am not a financial advisor or licensed professional. Nothing I say or produce anywhere, should be considered as advice. All content is for educational purposes only. I am not responsible for any financial losses or gains. Invest and trade at your own risk.