56 Undervalued Dividend Stocks to Buy in Q4 2025

Exclusive list of dividend bargains I’m tracking this month before the market re-prices them.

Every month, premium subscribers get exclusive access to my full dividend stock spreadsheet — a curated list of undervalued opportunities built on strict, time-tested metrics.

For October, 56 stocks made the cut. Each one screens as undervalued, income-generating, and positioned to deliver strong upside. This is your chance to grab high-quality bargains before the market wakes up — but the full breakdown is reserved for paid members only.

How We Pick Undervalued Stocks

When we talk about “undervalued,” we’re not just guessing - we use a set of proven filters that help us spot opportunities where income and growth come together.

Here’s what we look for:

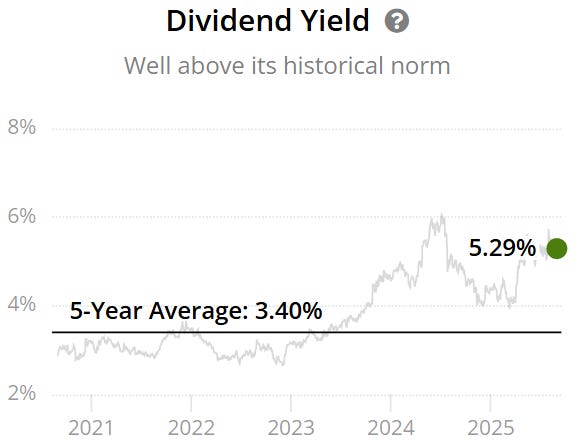

1. Dividend Yield Theory

A stock often looks undervalued when its current yield is higher than its 5-year average.

Example: A company with a 5.29% yield versus a 5-year average of 3.40% signals potential undervaluation.

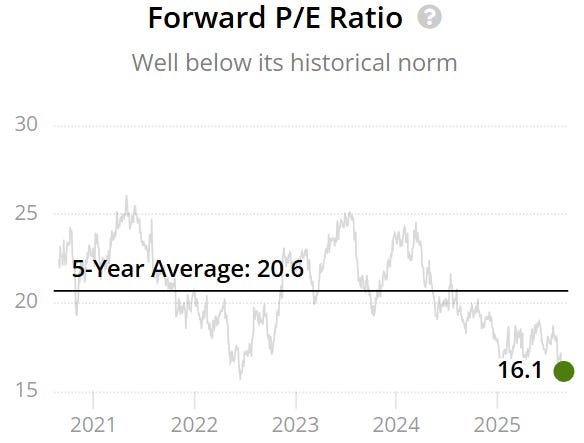

2. Attractive Valuation

We look for forward P/E ratios meaningfully below historical averages.

Example: A forward P/E of 16.1x compared to a 5-year average of 20.6x suggests the stock may be trading at a discount.

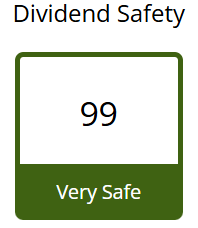

3. Dividend Safety (Score: 60+)

Dividends only matter if they’re sustainable. We focus on companies with strong safety scores to ensure payouts are reliable well into the future.

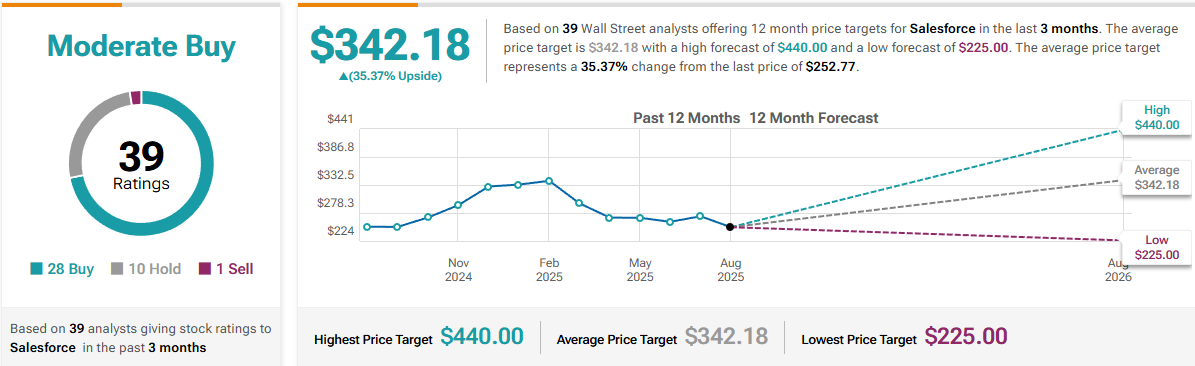

4. Upside Potential (15%+)

Dividends are great, but growth matters too. We look for stocks with at least 15% upside over the medium term, giving us a balance of income and capital appreciation.

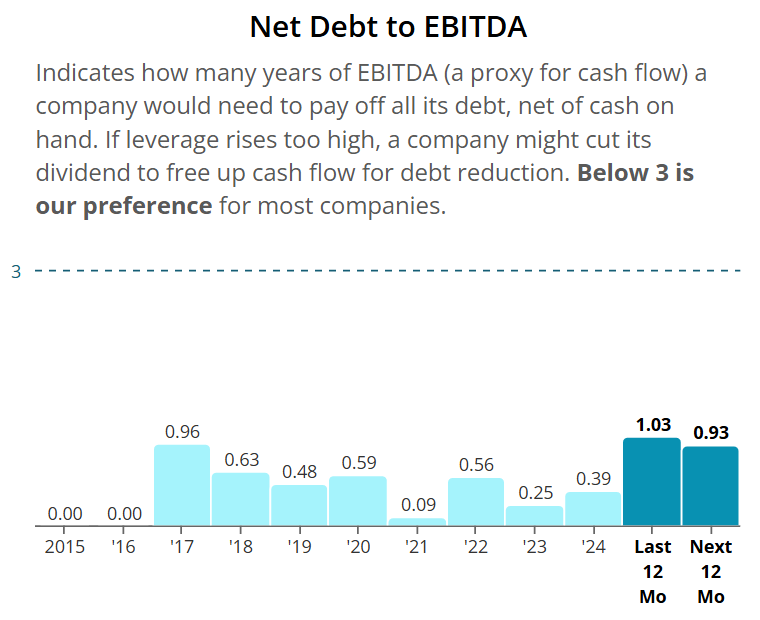

5. Strong Balance Sheets

Healthy financials are non-negotiable. We prefer companies with Net Debt/EBITDA below 3x, and for REITs, a threshold below 5.5x.

This ensures they can manage debt responsibly while still funding growth.

October Spreadsheet Below

Keep reading with a 7-day free trial

Subscribe to Dividend Talks to keep reading this post and get 7 days of free access to the full post archives.